Transformer Oil Market by Oil Type (Mineral (Naphthenic, Paraffinic), Silicone, Bio-based), Application (Transformer, Switchgear, Reactor), End-User (Transmission & Distribution, Power Generation, Railways & Metros), Region - Global Forecast to 2030

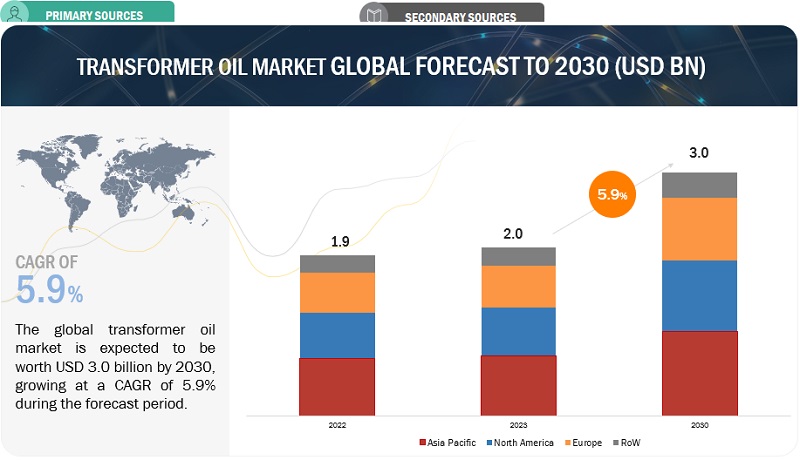

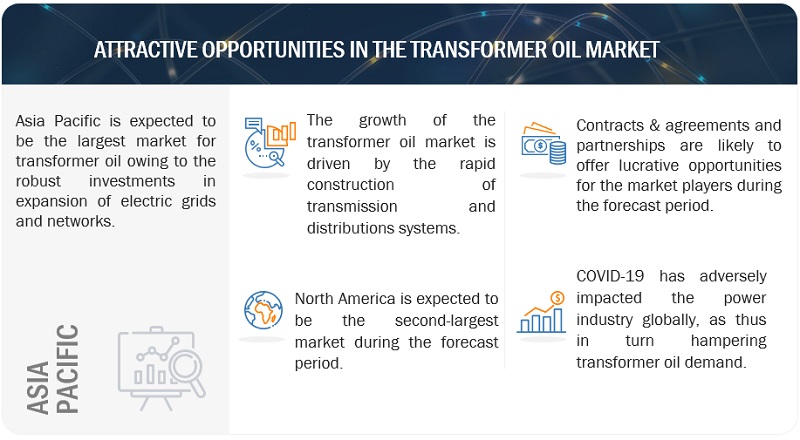

[274 Pages Report] The global Transformer Oil Market size was valued at USD 2.0 billion in 2023 and to reach USD 3.0 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The growth in transformer oil demand in recent years is due to the increased investment in transmission and distribution projects due to growing urbanization. The market for transformer oils is projected to benefit greatly from the rising expansion of smart electricity grids and networks.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Transformer Oil Market Dynamics

Driver: Modernization of electric grids and adoption of smart grids in developed economies

To conduct business without interruption and to reinforce the growth of the global economy, reliable delivery of electricity is critical. The growing energy demand has resulted in the need for a stable and reliable T&D network. The electric grid and the T&D equipment have aged over the years in the US, European regions, and a few parts of APAC. For instance, 70% of the power transformer and transmission lines in the US are over 25 years old. Similarly, as of 2022, one-third of the European Union's grid network is over 42 years old, and this share is projected to surpass 50% by 2030. The aging of the grid network will result in a drop in the efficiency of power delivery and affect the reliability of the electric grid and T&D network. This has led the US and European economies to modernize their electric grids by transitioning towards adopting smart grids. Recently, Western Europe is reportedly to invest USD 133.7 billion in smart grid infrastructure by 2027 to accommodate the rising electricity demand and upgrade aging power assets. Similarly, in the APAC region, India and South Asian participants have agreed to invest USD 25.9 billion to modernize their grid network over 2020–2029.

Restraint: Increasing demand for dry-type transformers

Dry-type transformers are constructed with their windings and the core placed inside a sealed tank pressurized with air, unlike oil-filled transformers where the windings and the core are immersed in an insulating liquid. Further, installing dry-type transformers involves less stringent regulatory requirements for operation and maintenance. Dry-type transformers are less flammable, unlike oil-filled transformers, which are usually filled with flammable liquids such as mineral oil. Due to safety concerns and growing environmental awareness, dry-type transformers are favored over oil-filled transformers. This drives the demand for dry-type transformers, particularly in regions such as Europe and the US. This increase in the demand for dry-type transformers will have a negative impact on the adoption of oil-filled transformers, which will be a restraint for the market.

Opportunities: Increased investment in HVDC transmission systems

The world economies are transitioning towards adopting renewable energy sources such as solar, wind (onshore and offshore), biomass, hydroelectric, and geothermal power. As these resources are often sourced at remote locations far from population centers, companies deploy HVDC transmission systems to connect such remotely located power generation sources and minimize transmission losses. The significance of the HVDC transmission system lies in its efficient bulk power transmission capabilities over long distances. Further, HVDC transmission systems offer enhanced stability, reliability, and transmission capacity. Thus, they become an integral part of the electrical power system.

Challenges: Constand Fluctuations in crude oil prices

Crude oil plays a vital role as the primary energy source for conducting economic activities, and the unpredictability surrounding the fluctuations of crude oil prices significantly impacts economic stability. Transformer oil is a by-product of crude oil, which is highly refined, processed, and purified. Thus, the fluctuations in crude oil prices directly impact transformer oil price for manufacturers. In 2017 and 2018, crude oil prices experienced an upward trajectory, increasing demand for production enhancement activities. However, prices subsequently declined in 2019 and 2020, followed by a consistent increase in 2021. These fluctuations in crude oil prices created an environment of uncertainty, making it challenging for transformer oil manufacturers to make informed decisions regarding the purchase of crude oil at favorable prices.

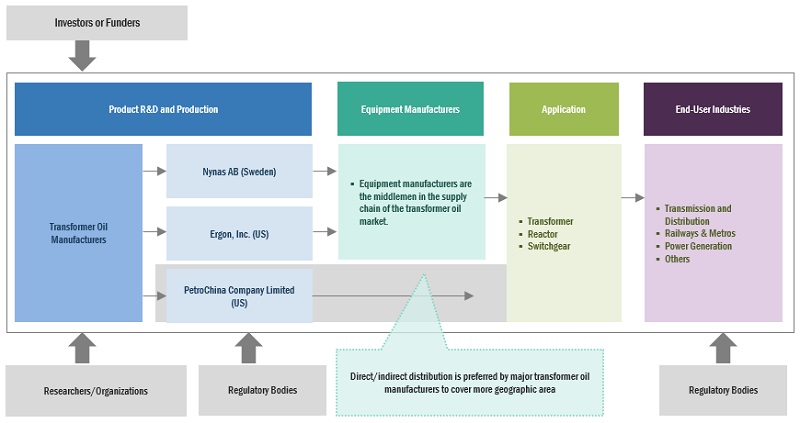

Transformer Oil Market Ecosystem

Prominent companies in this market include well-established, financially stable transformer oil manufacturers. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Nynas AB (Sweden), Ergon, Inc. (US), PetroChina Company Limited (China), Shell (UK), APAR Industries (India), and Calumet specialty products partners, L.P. (US).

The bio-based segment, by oil type, is expected to be the second-fastest growing market during the forecast period.

This report segments the transformer oil market based on type into three types: mineral oil, silicone oil, and bio-based oil. The bio-based oil segment is expected to be the second fastest-growing market during the forecast period. Bio-based transformer oil is derived from various vegetable feedstocks and formulated depending on requirements and market conditions. Bio-based oil is less hazardous than mineral oil or silicone oil; thus, the rising environmental concerns drive the bio-based oil market.

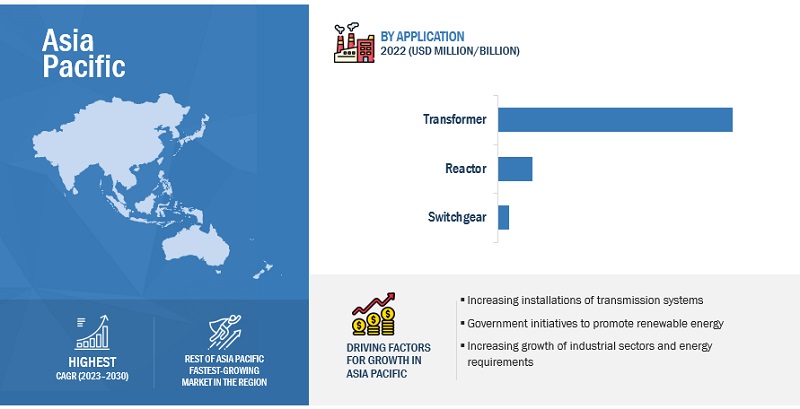

By application, the transformer segment is expected to be the fastest growing during the forecast period

This report segments the transformer oil market based on application into three segments: transformer, reactor, and switchgear. The transformer segment is expected to grow at the fastest rate during the forecast period. Transformer oils are extensively used in power and distribution transformers. Growing power demands and aging transformers will likely lead to installing new transformers, which is anticipated to increase the demand for transformer oils.

"Asia Pacific": The fastest in the transformer oil market"

Asia Pacific is expected to fastest growing region in the transformer oil market between 2023–2030, followed by Europe and North America. Urbanization and population growth have resulted in the need for vast infrastructure development, which has propelled the energy demand across the region. This has further resulted in an energy demand-supply gap, resulting in a power supply shortage. Electricity shortage is expected to support market growth as it can be attributed to the increasing demand for power leading to the installation of new substations, increasing the demand for transformers, reactors, and switchgear, and increasing the demand for transformer oil.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the transformer Oil market include Nynas AB (Sweden), Ergon, Inc., Petrochina Company Limited (China), Shell (UK), Calumet specialty products partners, L.P. (US). Between 2018 and 2022, these companies followed strategies such as contracts, agreements, partnerships, mergers, acquisitions, and expansions to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Value (USD Million/USD Billion), Volume (Units) |

|

Segments covered |

Transformer oil market by oil type, application, end-user, and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World. |

|

Companies covered |

Nynas AB (Sweden), Ergon, Inc. (US), Shell (UK), Calumet Specialty Products Partners, L.P. (US), APAR Industries Limited (India), PetroChina Company Limited (China), Exxon Mobil Corporation (US), Repsol (Spain), Sinopec Lubricant Company (China), Savita Oil Technologies Limited (India), Chevron Corporation (US), M&I Materials Limited (UK), Petro-Canada (Canada), Gandhar Oil (India), Lubrita (Netherlands), Phillips 66 Company (US), Gulf Oil International (UK), Dow (US), Cargill, Incorporated. (US), Hydrodec Group plc (UK), Sasol (South Africa), Farabi Petrochemicals Co. (Saudi Arabia), San Joaquin Refining Co (US), and Engen Petroleum Limited (South Africa) |

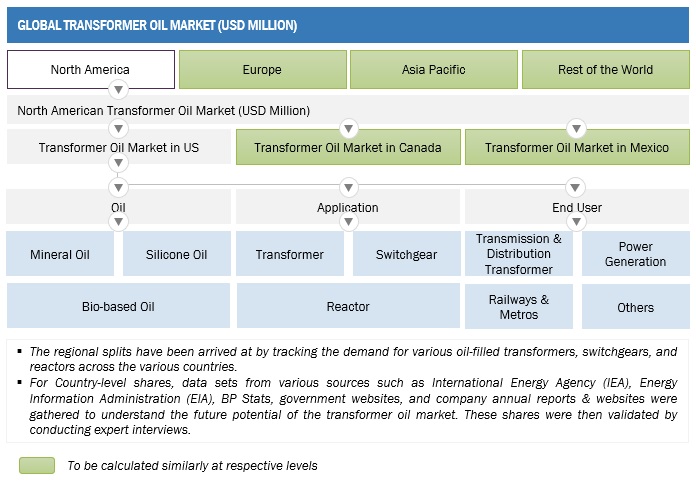

This research report categorizes the market by oil type, application, end-user, and region.

On the basis of oil type, the transformer oil market has been segmented as follows:

-

Mineral Oil

-

Naphthenic Oil

- Inhibited

- Uninhibited

-

Paraffinic Oil

- Inhibited

- Uninhibited

-

Naphthenic Oil

- Silicone Oil

- Bio-based Oil

On the basis of application, the market has been segmented as follows:

-

Transformer

- Power transformer

- Distribution transformer

- Reactor

- Switchgear

On the basis of end-user, the market has been segmented as follows:

- Transmission and Distribution

- Railways & Metros

- Power generation

- Others

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In October 2022, Nynas AB launched the new transformer fluid named NYTRO RR 900X. It is a circular transformer fluid based on refining technology. NYTRO RR 900X is high-grade oil used in various electrical applications, including high voltage and high-power transformers.

- In December 2021, MIDEL, a transformer oil manufacturing brand of M&I Materials Limited, was awarded a three-year contract by First Philec Inc, to supply MIDEL transformer oil for their transformers to minimize the risk of fire and damage

- In May 2021, Calumet Specialty Products Partners, L.P. partnered with Aevitas, Inc. to improve access to exclusive transformer oil products in the Canadian market. The company's new arctic-grade transformer oil will be distributed exclusively by Aevitas, Inc. across Canada, as a result of this partnership.

- In May 2021, Cargill, Incorporated. partnered up with Delta Star, Inc. to provide retro-filling services for its Envirotemp range of dielectric fluids to its consumers in the Western United States. The agreement designates Delta Star, Inc. as a Cargill, Incorporated service center in the Western United States market.

Frequently Asked Questions (FAQ):

What is the current size of the transformer oil market?

The current market size of the transformer oil market is USD 1.9 billion in 2022.

What are the major drivers for the transformer oil market?

Increasing investments in modern electricity grids and networks will be major drivers for the transformer oil market.

Which is the largest region during the forecasted period in the transformer oil market?

Asia Pacific is expected to dominate the transformer oil market between 2023–2030, followed by Europe and North America. The increase in renovation of grid infrastructure activities in recent years is driving the region's market.

Which is the largest segment, by oil type, during the forecasted period in the transformer oil market?

The mineral segment is expected to be the largest market during the forecast period. Increased demand for transformers due to the increasing investments in renewable energy sources and the easy availability of mineral oil are expected to drive the market for the mineral-based transformer oil segment.

Which is the fastest end-user segment during the forecasted period in the transformer oil market?

The transmission and distribution segment is expected to be the fastest market during the forecast period. The increasing investment in modernizing transmission & distribution infrastructure to meet the electricity demand would drive the demand for transformer oils used in transformers, reactors, and switchgear.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Expansion of electric grid network in Asia Pacific- Modernization of electric grids and adoption of smart grids in developed economiesRESTRAINTS- Environmental concerns over use of mineral transformer oil- Increasing demand for dry-type transformers- Competition from players in unorganized sectorOPPORTUNITIES- Growing demand for bio-based transformer oil due to environmental concerns- Increase in cross-border electricity trade- Increasing investments in HVDC transmission systemsCHALLENGES- Constant fluctuations in crude oil prices

- 5.3 IMPACT OF DEVELOPMENTS IN RENEWABLE ENERGY & TRANSITION TOWARD CLEAN ENERGY ON MARKET

- 5.4 IMPACT OF EV ADOPTION & EV INFRASTRUCTURE DEVELOPMENTS ON MARKET

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS & NEW REVENUE POCKETS IN MARKET

-

5.6 AVERAGE SELLING PRICING ANALYSISAVERAGE SELLING PRICING ANALYSIS, BY OIL TYPE

-

5.7 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSTRANSFORMER OIL PRODUCERSEQUIPMENT MANUFACTURERSDISTRIBUTORSEND USERS

- 5.8 MARKET MAP

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.11 CASE STUDY ANALYSISTATA POWER INSTALLS DISTRIBUTION TRANSFORMERS IN MUMBAI TO ADDRESS SPACE- AND SAFETY-RELATED CONCERNS AND REDUCE COST AND ENVIRONMENTAL IMPACT

- 6.1 INTRODUCTION

-

6.2 MINERAL OILEASY AVAILABILITY AND LOW-PRICE INDEX TO INCREASE DEMAND FOR MINERAL TRANSFORMER OILNAPHTHENIC OIL- Naphthenic mineral oil, by inhibition typePARAFFINIC OIL- Paraffinic mineral oil, by inhibition type

-

6.3 BIO-BASED OILRISING ENVIRONMENTAL CONCERNS TO DRIVE DEMAND FOR BIO-BASED OIL

-

6.4 SILICONE OILNON-REACTIVE AND NON-TOXIC PROPERTIES TO FUEL NEED FOR SILICONE TRANSFORMER OIL

- 7.1 INTRODUCTION

-

7.2 TRANSMISSION & DISTRIBUTION UTILITIESRISING FOCUS ON UPGRADING AGING T&D INFRASTRUCTURE TO FUEL MARKET GROWTH

-

7.3 RAILWAYS & METROSGROWING INVESTMENTS IN RAILWAYS & METROS TO PROPEL DEMAND FOR TRANSFORMER OIL

-

7.4 POWER GENERATION UTILITIESINCREASING NEED FOR POWER GENERATION TO DRIVE MARKET

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 TRANSFORMERINCREASING INVESTMENTS IN T&D SECTOR TO CREATE DEMAND FOR TRANSFORMERSPOWER TRANSFORMERDISTRIBUTION TRANSFORMER

-

8.3 REACTORLONG-TERM INDUSTRIAL GROWTH AND INCREASED DEMAND FOR ENERGY TO BOOST SEGMENTAL GROWTH

-

8.4 SWITCHGEARINVESTMENTS IN T&D NETWORK EXPANSION TO PROPEL DEMAND FOR OIL-FILLED SWITCHGEAR

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTBY OIL TYPE- Mineral oil - by sub-oil type- Mineral oil - by inhibition typeBY APPLICATION- Transformer - by sub-applicationBY END USERBY COUNTRY- China- India- Japan- Australia- South Korea- Rest of Asia Pacific

-

9.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTBY OIL TYPE- Mineral oil - by sub-oil type- Mineral oil - by inhibition typeBY APPLICATION- Transformer - by sub-applicationBY END USERBY COUNTRY- US- Canada- Mexico

-

9.4 EUROPEEUROPE: RECESSION IMPACTBY OIL TYPE- Mineral oil - by sub-oil type- Mineral oil - by inhibition typeBY APPLICATION- Transformer - by sub-applicationBY END USERBY COUNTRY- UK- Germany- Russia- France- Rest of Europe

-

9.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACTBY OIL TYPE- Mineral oil - by sub-oil type- Mineral oil - by inhibition typeBY APPLICATION- Transformer - by sub-applicationBY END USERBY REGION- Middle East- Africa- South America

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 10.3 MARKET EVALUATION FRAMEWORK

- 10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2018–2022

-

10.5 COMPETITIVE SCENARIOS & TRENDSDEALSPRODUCT LAUNCHES & DEVELOPMENTS

-

10.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.1 KEY PLAYERSNYNAS AB- Business overview- Products offered- Recent developments- MnM viewERGON, INC.- Business overview- Products offered- Recent developments- MnM viewPETROCHINA COMPANY LIMITED- Business overview- Products offered- Recent developments- MnM viewAPAR INDUSTRIES LIMITED- Business overview- Products offered- MnM viewSHELL- Business overview- Products offered- Recent developments- MnM viewCALUMET SPECIALTY PRODUCTS PARTNERS, L.P.- Business overview- Products offered- Recent developments- MnM viewSINOPEC LUBRICANT COMPANY- Business overview- Products offered- Recent developmentsCARGILL, INCORPORATED.- Business overview- Products offered- Recent developmentsEXXON MOBIL CORPORATION- Business overview- Products offered- Recent developmentsGULF OIL INTERNATIONAL LTD- Business overview- Products offered- Recent developmentsM&I MATERIALS LTD- Business overview- Products offered- Recent developmentsPHILLIPS 66 COMPANY- Business overview- Products offered- Recent developmentsDOW- Business overview- Products offeredREPSOL- Business overview- Products offered- Recent developmentsCHEVRON CORPORATION- Business overview- Products offered- Recent developments

-

11.2 OTHER PLAYERSGANDHAR OIL REFINERY (INDIA) LIMITEDHYDRODEC GROUP PLCENGEN PETROLEUM LIMITEDLUBRITAPETRO-CANADA

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 TRANSFORMER OIL MARKET SNAPSHOT

- TABLE 2 MARKET: PRICING ANALYSIS

- TABLE 3 MARKET: VALUE CHAIN ANALYSIS

- TABLE 4 MARKET: REGULATIONS

- TABLE 5 TRANSFORMER OIL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 7 MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 8 MARKET, BY OIL TYPE, 2018–2022 (MILLION LITERS)

- TABLE 9 TRANSFORMER OIL MARKET, BY OIL TYPE, 2023–2030 (MILLION LITERS)

- TABLE 10 MINERAL OIL: TRANSFORMER OIL MARKET, BY SUB-OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 11 MINERAL OIL: MARKET, BY SUB-OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 12 MINERAL OIL: MARKET, BY SUB-OIL TYPE, 2018–2022 (MILLION LITERS)

- TABLE 13 MINERAL OIL: MARKET, BY SUB-OIL TYPE, 2023–2030 (MILLION LITERS)

- TABLE 14 MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (USD MILLION)

- TABLE 15 MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (USD MILLION)

- TABLE 16 MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (MILLION LITERS)

- TABLE 17 MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (MILLION LITERS)

- TABLE 18 MINERAL OIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 20 NAPHTHENIC MINERAL OIL: TRANSFORMERS OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 NAPHTHENIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 22 NAPHTHENIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (USD MILLION)

- TABLE 23 NAPHTHENIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (USD MILLION)

- TABLE 24 NAPHTHENIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (MILLION LITERS)

- TABLE 25 NAPHTHENIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (MILLION LITERS)

- TABLE 26 INHIBITED NAPHTHENIC MINERAL OIL: TRANSFORMERS OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 INHIBITED NAPHTHENIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 28 UNINHIBITED NAPHTHENIC MINERAL OIL: TRANSFORMERS OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 UNINHIBITED NAPHTHENIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 30 PARAFFINIC MINERAL OIL: TRANSFORMERS OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 PARAFFINIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 32 PARAFFINIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (USD MILLION)

- TABLE 33 PARAFFINIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (USD MILLION)

- TABLE 34 PARAFFINIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2018–2022 (MILLION LITERS)

- TABLE 35 PARAFFINIC MINERAL OIL: MARKET, BY INHIBITION TYPE, 2023–2030 (MILLION LITERS)

- TABLE 36 INHIBITED PARAFFINIC MINERAL OIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 INHIBITED PARAFFINIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 38 UNINHIBITED PARAFFINIC MINERAL OIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 UNINHIBITED PARAFFINIC MINERAL OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 40 BIO-BASED OIL: TRANSFORMER OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 BIO-BASED OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 42 SILICONE OIL: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 SILICONE OIL: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 44 MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 45 MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 46 MARKET, BY END USER, 2018–2022 (MILLION LITERS)

- TABLE 47 TRANSFORMER OIL MARKET, BY END USER, 2023–2030 (MILLION LITERS)

- TABLE 48 TRANSMISSION & DISTRIBUTION UTILITIES: TRANSFORMER OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 TRANSMISSION & DISTRIBUTION UTILITIES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 50 RAILWAYS & METROS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 RAILWAYS & METROS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 52 POWER GENERATION UTILITIES: TRANSFORMER OIL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 POWER GENERATION UTILITIES: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 54 OTHERS: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 OTHERS: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 56 MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 57 MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 58 MARKET, BY APPLICATION, 2018–2022 (MILLION LITERS)

- TABLE 59 TRANSFORMER OIL MARKET, BY APPLICATION, 2023–2030 (MILLION LITERS)

- TABLE 60 TRANSFORMER: MARKET, BY SUB-APPLICATION, 2018–2022 (USD MILLION)

- TABLE 61 TRANSFORMER: MARKET, BY SUB-APPLICATION, 2023–2030 (USD MILLION)

- TABLE 62 TRANSFORMER: MARKET, BY SUB-APPLICATION, 2018–2022 (MILLION LITERS)

- TABLE 63 TRANSFORMER: MARKET, BY SUB-APPLICATION, 2023–2030 (MILLION LITERS)

- TABLE 64 TRANSFORMER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 TRANSFORMER: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 66 POWER TRANSFORMER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 POWER TRANSFORMER: TRANSFORMER OIL MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 68 DISTRIBUTION TRANSFORMER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 DISTRIBUTION TRANSFORMER: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 70 REACTOR: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 REACTOR: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 72 SWITCHGEAR: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 SWITCHGEAR: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 76 MARKET, BY REGION, 2018–2022 (MILLION LITERS)

- TABLE 77 TRANSFORMER OIL MARKET, BY REGION, 2023–2030 (MILLION LITTERS)

- TABLE 78 ASIA PACIFIC: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (MILLION LITTERS)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (MILLION LITTERS)

- TABLE 98 CHINA: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 100 CHINA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 101 CHINA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 103 CHINA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 104 CHINA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 105 CHINA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 106 CHINA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 107 CHINA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 108 INDIA: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 109 INDIA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 110 INDIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 111 INDIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 112 INDIA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 113 INDIA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 114 INDIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 115 INDIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 116 INDIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 117 INDIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 118 JAPAN: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 119 JAPAN: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 120 JAPAN: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 121 JAPAN: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 122 JAPAN: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 123 JAPAN: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 124 JAPAN: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 125 JAPAN: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 126 JAPAN: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 127 JAPAN: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 128 AUSTRALIA: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 129 AUSTRALIA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 130 AUSTRALIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 131 AUSTRALIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 132 AUSTRALIA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 133 AUSTRALIA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 134 AUSTRALIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 135 AUSTRALIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 136 AUSTRALIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 137 AUSTRALIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 140 SOUTH KOREA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 141 SOUTH KOREA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 142 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 143 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 144 SOUTH KOREA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 145 SOUTH KOREA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 146 SOUTH KOREA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 147 SOUTH KOREA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 158 NORTH AMERICA: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 159 NORTH AMERICA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 160 NORTH AMERICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 161 NORTH AMERICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 162 NORTH AMERICA: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 163 NORTH AMERICA: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 164 NORTH AMERICA: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 165 NORTH AMERICA: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 166 NORTH AMERICA: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 167 NORTH AMERICA: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 168 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 169 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 170 NORTH AMERICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 171 NORTH AMERICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 172 NORTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 173 NORTH AMERICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 174 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 175 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 176 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (MILLION LITERS)

- TABLE 177 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (MILLION LITERS)

- TABLE 178 US: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 179 US: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 180 US: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 181 US: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 182 US: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 183 US: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 184 US: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 185 US: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 186 US: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 187 US: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 188 CANADA: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 189 CANADA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 190 CANADA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 191 CANADA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 192 CANADA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 193 CANADA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 194 CANADA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 195 CANADA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 196 CANADA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 197 CANADA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 198 MEXICO: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 199 MEXICO: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 200 MEXICO: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 201 MEXICO: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 202 MEXICO: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 203 MEXICO: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 204 MEXICO: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 205 MEXICO: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 206 MEXICO: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 207 MEXICO: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 208 EUROPE: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 209 EUROPE: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 210 EUROPE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 211 EUROPE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 212 EUROPE: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 213 EUROPE: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 214 EUROPE: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 215 EUROPE: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 216 EUROPE: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 217 EUROPE: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 218 EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 219 EUROPE: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 220 EUROPE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 221 EUROPE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 222 EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 223 EUROPE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 224 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 225 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 226 EUROPE: MARKET, BY COUNTRY, 2018–2022 (MILLION LITERS)

- TABLE 227 EUROPE: MARKET, BY COUNTRY, 2023–2030 (MILLION LITERS)

- TABLE 228 UK: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 229 UK: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 230 UK: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 231 UK: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 232 UK: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 233 UK: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 234 UK: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 235 UK: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 236 UK: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 237 UK: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 238 GERMANY: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 239 GERMANY: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 240 GERMANY: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 241 GERMANY: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 242 GERMANY: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 243 GERMANY: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 244 GERMANY: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 245 GERMANY: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 246 GERMANY: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 247 GERMANY: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 248 RUSSIA: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 249 RUSSIA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 250 RUSSIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 251 RUSSIA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 252 RUSSIA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 253 RUSSIA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 254 RUSSIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 255 RUSSIA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 256 RUSSIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 257 RUSSIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 258 FRANCE: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 259 FRANCE: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 260 FRANCE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 261 FRANCE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 262 FRANCE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 263 FRANCE: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 264 FRANCE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 265 FRANCE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 266 FRANCE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 267 FRANCE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 268 REST OF EUROPE: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 269 REST OF EUROPE: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 270 REST OF EUROPE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 271 REST OF EUROPE: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 272 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 273 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 274 REST OF EUROPE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 275 REST OF EUROPE: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 276 REST OF EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 277 REST OF EUROPE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 278 REST OF THE WORLD: MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 279 REST OF THE WORLD: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 280 REST OF THE WORLD: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 281 REST OF THE WORLD: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 282 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 283 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 284 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 285 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (NAPHTHENIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 286 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 287 REST OF THE WORLD: MARKET, BY INHIBITION TYPE (PARAFFINIC MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 288 REST OF THE WORLD: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 289 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 290 REST OF THE WORLD: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 291 REST OF THE WORLD: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 292 REST OF THE WORLD: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 293 REST OF THE WORLD: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 294 REST OF THE WORLD: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 295 REST OF THE WORLD: MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 296 REST OF THE WORLD: MARKET, BY REGION, 2018–2022 (MILLION LITTERS)

- TABLE 297 REST OF THE WORLD: MARKET, BY REGION, 2023–2030 (MILLION LITTERS)

- TABLE 298 MIDDLE EAST: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 299 MIDDLE EAST: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 300 MIDDLE EAST: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 301 MIDDLE EAST: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 302 MIDDLE EAST: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 303 MIDDLE EAST: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 304 MIDDLE EAST: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 305 MIDDLE EAST: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 306 MIDDLE EAST: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 307 MIDDLE EAST: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 308 AFRICA: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 309 AFRICA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 310 AFRICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 311 AFRICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 312 AFRICA: MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 313 AFRICA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 314 AFRICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 315 AFRICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 316 AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 317 AFRICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 318 SOUTH AMERICA: TRANSFORMER OIL MARKET, BY OIL TYPE, 2018–2022 (USD MILLION)

- TABLE 319 SOUTH AMERICA: MARKET, BY OIL TYPE, 2023–2030 (USD MILLION)

- TABLE 320 SOUTH AMERICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2018–2022 (USD MILLION)

- TABLE 321 SOUTH AMERICA: MARKET, BY SUB-OIL TYPE (MINERAL OIL), 2023–2030 (USD MILLION)

- TABLE 322 SOUTH AMERICA: MARKET, BY APPLICATION, 2018–2022(USD MILLION)

- TABLE 323 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2030 (USD MILLION)

- TABLE 324 SOUTH AMERICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2018–2022 (USD MILLION)

- TABLE 325 SOUTH AMERICA: MARKET, BY SUB-APPLICATION (TRANSFORMER), 2023–2030 (USD MILLION)

- TABLE 326 SOUTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 327 SOUTH AMERICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 328 KEY DEVELOPMENTS IN MARKET, 2018–2023

- TABLE 329 TRANSFORMER OIL MARKET: COMPETITIVE ANALYSIS

- TABLE 330 MARKET EVALUATION FRAMEWORK, 2018–2023

- TABLE 331 MARKET: DEALS, 2018–2023

- TABLE 332 MARKET: PRODUCT LAUNCHES & DEVELOPMENTS, 2018–2023

- TABLE 333 COMPANY OIL-TYPE FOOTPRINT

- TABLE 334 COMPANY REGION FOOTPRINT

- TABLE 335 NYNAS AB: BUSINESS OVERVIEW

- TABLE 336 NYNAS AB: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 337 NYNAS AB: OTHERS

- TABLE 338 ERGON, INC.: BUSINESS OVERVIEW

- TABLE 339 ERGON, INC.: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 340 ERGON, INC.: DEALS

- TABLE 341 ERGON, INC.: OTHERS

- TABLE 342 PETROCHINA COMPANY LIMITED: BUSINESS OVERVIEW

- TABLE 343 PETROCHINA COMPANY LIMITED: OTHERS

- TABLE 344 APAR INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 345 SHELL: BUSINESS OVERVIEW

- TABLE 346 SHELL: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 347 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.: BUSINESS OVERVIEW

- TABLE 348 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.: DEALS

- TABLE 349 SINOPEC LUBRICANT COMPANY: BUSINESS OVERVIEW

- TABLE 350 SINOPEC LUBRICANT COMPANY: OTHERS

- TABLE 351 CARGILL, INCORPORATED.: BUSINESS OVERVIEW

- TABLE 352 CARGILL, INCORPORATED.: DEALS

- TABLE 353 EXXON MOBIL CORPORATION: BUSINESS OVERVIEW

- TABLE 354 EXXON MOBIL CORPORATION: OTHERS

- TABLE 355 GULF OIL INTERNATIONAL LTD: BUSINESS OVERVIEW

- TABLE 356 GULF OIL INTERNATIONAL LTD: DEALS

- TABLE 357 GULF OIL INTERNATIONAL LTD: OTHERS

- TABLE 358 M&I MATERIALS LTD: BUSINESS OVERVIEW

- TABLE 359 M&I MATERIALS LTD: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 360 M&I MATERIALS LTD: DEALS

- TABLE 361 M&I MATERIALS LTD: OTHERS

- TABLE 362 PHILLIPS 66 COMPANY: BUSINESS OVERVIEW

- TABLE 363 PHILLIPS 66 COMPANY: DEALS

- TABLE 364 DOW: BUSINESS OVERVIEW

- TABLE 365 REPSOL: BUSINESS OVERVIEW

- TABLE 366 REPSOL: DEALS

- TABLE 367 CHEVRON CORPORATION: BUSINESS OVERVIEW

- TABLE 368 CHEVRON CORPORATION: DEALS

- FIGURE 1 TRANSFORMER OIL MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

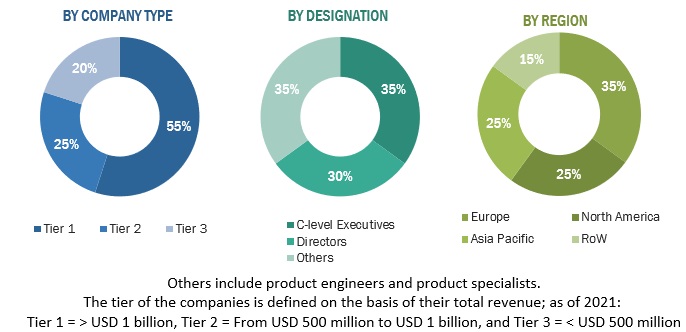

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR TRANSFORMER OIL

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF TRANSFORMER OIL

- FIGURE 8 TRANSFORMERS OIL MARKET: SUPPLY-SIDE ANALYSIS, 2022

- FIGURE 9 COMPANY REVENUE ANALYSIS, 2022

- FIGURE 10 MINERAL OIL SEGMENT TO DOMINATE TRANSFORMER OIL MARKET DURING FORECAST PERIOD

- FIGURE 11 TRANSFORMER SEGMENT TO LEAD TRANSFORMER OIL MARKET DURING FORECAST PERIOD

- FIGURE 12 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT TO LEAD TRANSFORMER OIL MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC DOMINATED TRANSFORMERS OIL MARKET IN 2022

- FIGURE 14 GROWING DEMAND FOR BIO-BASED TRANSFORMER OIL DUE TO ENVIRONMENTAL CONCERNS TO DRIVE MARKET DURING 2023–2030

- FIGURE 15 TRANSFORMER OIL MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 MINERAL OIL SEGMENT DOMINATED TRANSFORMERS OIL MARKET IN 2022

- FIGURE 17 TRANSFORMER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 18 TRANSMISSION & DISTRIBUTION UTILITIES SEGMENT CAPTURED LARGEST SHARE OF TRANSFORMERS OIL MARKET IN 2022

- FIGURE 19 MINERAL OIL AND CHINA HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2022

- FIGURE 20 TRANSFORMER OIL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 GLOBAL T&D INVESTMENT PROJECTION, 2020–2040

- FIGURE 22 WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL PRICES, JANUARY 2018–MARCH 2023

- FIGURE 23 GLOBAL EV SALES VOLUME, 2021–2022

- FIGURE 24 REVENUE SHIFTS FOR TRANSFORMER OIL PROVIDERS

- FIGURE 25 TRANSFORMERS OIL MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 TRANSFORMER OIL: MARKET MAP

- FIGURE 27 TRANSFORMER OIL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 MARKET, BY OIL TYPE, 2022 (USD MILLION)

- FIGURE 29 MARKET, BY END USER, 2022 (USD MILLION)

- FIGURE 30 MARKET, BY APPLICATION, 2022 (USD MILLION)

- FIGURE 31 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 TRANSFORMER OIL MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 33 ASIA PACIFIC: TRANSFORMER OIL MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: TRANSFORMER OIL MARKET SNAPSHOT

- FIGURE 35 MARKET SHARE ANALYSIS OF TOP PLAYERS IN TRANSFORMER OIL MARKET, 2022

- FIGURE 36 SEGMENTAL REVENUE ANALYSIS, 2018–2022

- FIGURE 37 TRANSFORMER OIL MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 38 NYNAS AB: COMPANY SNAPSHOT

- FIGURE 39 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 40 APAR INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 41 SHELL: COMPANY SNAPSHOT

- FIGURE 42 CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.: COMPANY SNAPSHOT

- FIGURE 43 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 PHILLIPS 66 COMPANY: COMPANY SNAPSHOT

- FIGURE 45 DOW: COMPANY SNAPSHOT

- FIGURE 46 REPSOL: COMPANY SNAPSHOT

- FIGURE 47 CHEVRON CORPORATION: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the transformer oil market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the transformer oil market involved the use of extensive secondary sources, directories, and databases, such as Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the transformers oil market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The transformer oil market comprises several stakeholders, such as transformer oil manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for transformer oil in generation, transmission, and distribution applications. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the transformer oil market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Transformer Oil Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Transformer oil is a dielectric fluid used in power transmission systems, mainly for cooling, insulation, stop arcing, and corona discharge, and for heat dispersion in oil-filled electrical equipment, such as transformers, reactors, and switchgear. Transformer oil is also used to preserve a transformer’s core and windings and acts as a barrier between the atmospheric oxygen and transformer components to avoid direct contact, thereby minimizing oxidation

The growth of the transformer oil market during the forecast period can be attributed to the robust investments in the expansion of electric grids across major countries in North America, Europe, Asia Pacific, and the Rest of the World.

Key Stakeholders

- Transformer oil manufacturers

- Technicians and repair personnel

- T&D utilities

- Companies in the railways & metro industry

- Industrial sector end users

- Commercial sector end users

- Power generation plants

- Power and energy associations

- Government and research organizations

- State and national regulatory authorities

- Switchgear component manufacturers

Objectives of the Study

- To define and describe the transformer oil market based on oil type, application, end-user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the transformer oil market with respect to individual growth trends, future expansions, and their contributions to the overall transformers oil market

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the transformer oil market with respect to four main regions: North America, Asia Pacific (APAC), Europe, and the Rest of the World (RoW)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, new product launches, contracts & agreements, and joint ventures & collaborations in the transformers oil market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Transformer Oil Market