Underwater Lighting Market by Light Source (LED, Halogen, Metal Halide Lamps), Mounting Type (Flush Mounted and Surface Mounted), Installation Type (New Installations and Retrofit Installations), Application, and Region 2025-2036

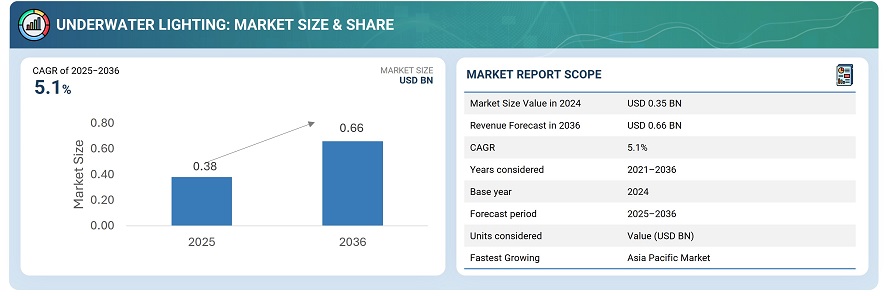

The global underwater lighting market was valued at USD 0.35 billion in 2024 and is projected to reach USD 0.66 billion by 2036, growing at a CAGR of 5.1% between 2025 and 2036.

The primary driving factor for the underwater lighting market is the rising global adoption of smart marine infrastructure and automated vessel systems. This growth is driven by the increasing need among shipbuilders, offshore operators, and aquaculture facilities to enhance operational visibility, energy efficiency, and safety under challenging underwater environments. The integration of Industry 4.0 and maritime digitalization technologies, particularly the use of IoT-enabled lighting networks and intelligent control modules, further boosts the market by enabling real-time monitoring, adaptive brightness control, and predictive maintenance. These systems support seamless data exchange between underwater sensors, lighting units, and surface control platforms. Additionally, growing emphasis on sustainable marine operations and reduced manual intervention encourages end users to adopt automated, energy-efficient LED solutions, positioning smart underwater lighting as a central component of modern marine automation and environmental monitoring systems.

To achieve enhanced operational efficiency and visibility, marine and offshore operators are increasingly adopting advanced underwater lighting systems as part of their automation and modernization initiatives. In a highly competitive maritime environment, growing demands for improved safety, energy efficiency, and reliability under harsh underwater conditions are compelling companies to integrate intelligent and automated lighting solutions. By deploying smart underwater lighting systems equipped with IoT connectivity, adaptive brightness controls, and real-time monitoring, operators can seamlessly transition from traditional manual illumination setups to digitally managed and energy-optimized lighting networks.

Market by Light Source

Light Emitting Diodes (LED)

By light source, LEDs hold the largest share of the underwater lighting market, and it is expected to grow at a significant CAGR during the forecast period, due to their superior performance characteristics and technological versatility. The segment continues to gain momentum as industries increasingly replace traditional halogen and metal halide systems with energy-efficient, long-life, and low-maintenance LED solutions. The ongoing shift toward sustainable illumination technologies is also encouraged by regulatory pressure to reduce carbon emissions and operational costs in marine, aquaculture, and recreational sectors. Furthermore, advancements in smart control systems, color-tunable LEDs, and corrosion-resistant housing are enhancing lighting reliability under harsh underwater conditions, solidifying LED technology as the preferred choice for both new installations and retrofit projects.

Market by Application

Swimming Pools

By application, the swimming pool segment holds the largest share of the underwater lighting market, and it is expected to grow at a significant CAGR during the forecast period, supported by the growing trend of aesthetic enhancement, safety illumination, and energy optimization in both residential and commercial pool projects. The rising number of luxury hotels, resorts, and wellness centers, combined with increasing household spending on outdoor leisure infrastructure, continues to drive demand for high-performance underwater lighting solutions. Manufacturers are focusing on RGB and dynamic color systems, app-controlled lighting networks, and low-voltage designs to deliver efficient and visually appealing pool lighting experiences. Additionally, stringent safety norms related to underwater electrical systems are prompting the use of IP68-rated and thermally protected LED fixtures, ensuring durability and consistent operation across varied climatic conditions.

Market by Geography

Geographically, the underwater lighting market is expanding across North America, Europe, the Asia Pacific, and the Rest of the World (ROW), including the Middle East, South America, and Africa. Asia Pacific is expected to grow at the highest CAGR, driven by rapid industrialization and expanding manufacturing bases across countries such as China, India, Japan, and South Korea. The region’s strong demand for automation is propelled by the need to enhance productivity, reduce labor dependency, and improve quality in the automotive, electronics, and food & beverages industries. Additionally, rising operational costs and an evolving regulatory environment are compelling companies to invest in advanced automation and smart infrastructure. The increasing adoption of smart factories, IoT-integrated systems, and digital transformation initiatives, supported by government programs promoting Industry 4.0, further accelerates market growth and cements Asia Pacific’s position as the primary engine of expansion for the global underwater lighting market.

Market Dynamics

Driver: Increased demand for underwater lights in aesthetic water-featured landscaping

The increasing adoption of energy-efficient LED lighting systems and smart illumination technologies is a key growth driver for the underwater lighting market. End users across marine, aquaculture, and recreational applications prioritize sustainability, visibility, and cost-efficiency, encouraging a shift away from traditional halogen and metal halide lights. Advanced underwater lighting solutions enable optimized power consumption, extended operational life, and adaptive brightness control, resulting in reduced maintenance requirements and improved system reliability. Additionally, the growing focus on aesthetic enhancement and safety compliance in underwater installations, such as swimming pools, fountains, harbors, and offshore platforms, is fueling steady market expansion globally.

Restraint: High installation costs of energy-efficient LEDS

Despite technological progress, high upfront investment costs remain a significant restraint, particularly for small and medium-sized enterprises (SMEs) and recreational facilities with limited budgets. The cost of specialized waterproof fixtures, corrosion-resistant materials, and professional installation can be substantial, especially in deep-water or high-pressure environments. Furthermore, the need for skilled maintenance personnel and periodic inspection to prevent water ingress, biofouling, or electrical failures adds to the total cost of ownership. These financial and technical barriers often delay large-scale adoption in developing regions, slowing the pace of market penetration despite the long-term efficiency and reliability benefits of LED-based underwater lighting.

Opportunity: Replacement of traditional lighting with LED underwater lighting

The rapid transition toward smart, IoT-integrated underwater lighting systems presents a major opportunity for market growth. The increasing emphasis on automation, remote monitoring, and real-time control drives demand for intelligent lighting networks capable of adaptive brightness adjustment and predictive maintenance. These systems enhance safety, visibility, and energy optimization, supporting applications in marine vessels, aquaculture farms, offshore energy platforms, and high-end recreational pools. Additionally, the integration of color-tunable and sensor-based LEDs offers new design possibilities for underwater architecture and entertainment, expanding the market into premium aesthetic and experiential applications. As sustainability goals and smart infrastructure initiatives accelerate, the replacement of legacy lighting systems with connected, efficient LEDs is expected to be a key growth enabler.

Challenge: High absorption of light underwater

A major challenge facing the underwater lighting market is the natural absorption and scattering of light in water, which significantly reduces illumination efficiency with increasing depth and turbidity. Water absorbs red and yellow wavelengths faster than blue and green, limiting color accuracy and light penetration. This necessitates the use of high-intensity LEDs, specialized optics, and spectral optimization technologies to maintain visibility in deep or murky environments. Additionally, environmental conditions such as biofouling, salinity, and temperature variations further affect performance consistency and system lifespan. Addressing these optical and environmental challenges through advanced lens coatings, self-cleaning housings, and adaptive wavelength management remains critical for achieving reliable illumination in demanding underwater applications.

Future Outlook

Between 2025 and 2036, the underwater lighting market is projected to grow substantially, driven by rising demand for energy-efficient, durable, and intelligent lighting solutions across marine, aquaculture, oil & gas, and recreational sectors. The growing adoption of LED and IoT-enabled lighting systems is expected to transform underwater illumination through enhanced energy savings, extended lifespan, and superior visibility in deep and turbid environments. The market will continue to benefit from the integration of smart control technologies, allowing real-time monitoring, adaptive color modulation, and predictive maintenance of lighting networks. Advancements in AI, automation, and edge computing are enabling dynamic control systems that optimize illumination based on water depth, clarity, and operational needs. Furthermore, the shift toward sustainable coastal infrastructure, smart ports, and marine tourism will reinforce the adoption of advanced underwater lighting in both new installations and retrofitting projects. In addition, the increasing focus on safety compliance, reduced manual intervention, and digital connectivity is anticipated to drive large-scale implementation of cloud-based lighting management platforms. These developments, supported by ongoing Industry 4.0 and maritime digitalization initiatives, will foster continuous innovation and modernization across underwater environments, positioning smart underwater lighting as a critical enabler of next-generation marine infrastructure and environmental monitoring systems.

Key Market Players

Top underwater lighting companies Hayward Industries, Inc. (US), Acuity Inc. (Georgia), Signify Holding (Netherlands), T-H Marine Supplies. (US), and Eaton (Ireland).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach Used to Arrive at the Market Size By Bottom-Up Analysis

2.2.1.2 Approach for Capturing Company-Specific Information in the Value Chain of the Underwater Lighting Market

2.2.2 Top-Down Approach

2.2.2.1 Approach Used to Arrive at the Market Size By Top-Down Analysis

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insight (Page No. - 32)

4.1 Attractive Growth Opportunities in Underwater Lighting Market

4.2 Market, By Light Source

4.3 Underwater Lighting Market in Asia Pacific, By Application and Country

4.4 Market, By Mounting Type

4.5 Underwater Lighting Market, By Country, 2019

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand for Underwater Lighting in Swimming Pools

5.2.1.2 Use of Underwater Lights as A Fish Attractor for Night Fishing

5.2.1.3 Increased Demand for Underwater Lights in Aesthetic Water-Featured Landscaping

5.2.1.4 Increased Number of Government Initiatives to Support the Adoption of Energy-Efficient LEDs

5.2.2 Restraints

5.2.2.1 High Installation Costs of Energy-Efficient LEDs

5.2.3 Opportunities

5.2.3.1 Replacement of Traditional Lighting With LED Underwater Lighting

5.2.4 Challenges

5.2.4.1 High Absorption of Light Underwater

5.3 Value Chain Analysis

6 Underwater Lighting Market, By Light Source (Page No. - 40)

6.1 Introduction

6.2 Light Emitting Diode (LED)

6.2.1 Benefits Such as Energy Saving, Less Maintenance Driving the Adoption of LED in Market

6.3 Others

6.3.1 Metal Halides and Xenon Lamps are the Other Light Sources Which Driving Underwater Lighting Market

7 Underwater Lighting Market, By Mounting Type (Page No. - 44)

7.1 Introduction

7.2 Flush Mounted

7.2.1 Swimming Pool is the Major Application Area for Flush Mounted

7.3 Surface Mounted

7.3.1 Surface Mounted is Expected to Hold Larger Share of Market

8 Underwater Lighting Market, By Installation Type (Page No. - 47)

8.1 Introduction

8.2 New Installations

8.2.1 Growth in Construction of Swimming Pools and Fountains Application Driving New Installations Market

8.3 Retrofit Installations

8.3.1 LED Retrofitting Spurs the Growth of Retrofit Installations

9 Underwater Lighting Market By Application (Page No. - 50)

9.1 Introduction

9.2 Boat/Yacht Lighting

9.2.1 to Create Beautiful Environment and to Attract Fishes Creates Need for Underwater Lights in the Boats/Yachts

9.3 Swimming Pools

9.3.1 Swimming Pools is Expected to Hold Largest Share of Market

9.4 Fountains

9.4.1 Growth in Entertainment Industry and Infrastructure Projects Driving the Growth of Fountains in Underwater Lighting Market

9.5 Others

9.5.1 Aquariums and Ponds are the Others Application Driving the Market

10 Regional Analysis (Page No. - 55)

10.1 Introduction

10.2 Americas

10.2.1 North America

10.2.1.1 US

10.2.1.1.1 US is Expected to Hold Largest Share of Underwater Lighting Market in North America

10.2.1.2 Canada

10.2.1.2.1 Canada is Expected to Grow at Highest Rate

10.2.1.3 Mexico

10.2.1.3.1 Longest Underwater Cave and Aquariums Driving the Market in Mexico

10.2.2 South America

10.2.2.1 Brazil

10.2.2.1.1 Infrastructure Development Projects Driving Market in Brazil

10.2.3 Rest of South America

10.3 Europe

10.3.1 Germany

10.3.1.1 Growth in Amusement Parks and Fountains Driving the Underwater Lighting Market in Germany

10.3.2 UK

10.3.2.1 Booming Swimming Pool Industry Spurs the Growth of Market in UK

10.3.3 France

10.3.3.1 France is Expected to Grow at Highest Rate in Europe

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.1.1 China is Expected to Hold Largest Share of Market in APAC

10.4.2 Japan

10.4.2.1 Fountains Application is Expected to Drive the Market in Japan

10.4.3 India

10.4.3.1 India is Expected to Grow at Highest Rate in APAC

10.4.4 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Middle East

10.5.1.1 Middle East is Expected to Hold Larger Share of Market in RoW

10.5.2 Africa

10.5.2.1 Increase in Construction of Swimming Pools Driving the Growth of Africa in RoW

11 Competitive Landscape (Page No. - 82)

11.1 Overview

11.2 Market Ranking Analysis 2018: Underwater Lighting Market

11.3 Competitive Situation and Trends

11.3.1 Product Developments, 2016-2018

11.3.2 Partnerships/Collaborations/Agreements

11.3.3 Mergers & Acquisitions

11.3.4 Expansions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Dynamic Differentiators

11.4.3 Innovators

11.4.4 Emerging Companies

12 Company Profile (Page No. - 88)

12.1 Key Players

12.1.1 Signify (Formerly Philips Lighting)

12.1.1.1 Business Overview

12.1.1.2 Products Offered

12.1.1.3 SWOT Analysis

12.1.1.4 MnM View

12.1.2 Eaton

12.1.2.1 Business Overview

12.1.2.2 Products Offered

12.1.2.3 SWOT Analysis

12.1.2.4 MnM View

12.1.3 Acuity Brands

12.1.3.1 Business Overview

12.1.3.2 Products Offered

12.1.3.3 SWOT Analysis

12.1.3.4 MnM View

12.1.4 Hayward Industries, Inc.

12.1.4.1 Business Overview

12.1.4.2 Products Offered

12.1.4.3 SWOT Analysis

12.1.4.4 MnM View

12.1.5 Lumishore

12.1.5.1 Business Overview

12.1.5.2 Products Offered

12.1.5.3 Recent Developments

12.1.5.4 SWOT Analysis

12.1.5.5 MnM View

12.1.6 T-H Marine

12.1.6.1 Business Overview

12.1.6.2 Products Offered

12.1.6.3 Recent Developments

12.1.6.4 MnM View

12.1.7 Shadow Caster, Inc.

12.1.7.1 Business Overview

12.1.7.2 Products Offered

12.1.7.3 Recent Developments

12.1.7.4 MnM View

12.1.8 Attwood

12.1.8.1 Business Overview

12.1.8.2 Products Offered

12.1.8.3 MnM View

12.1.9 Aqualuma

12.1.9.1 Business Overview

12.1.9.2 Products Offered

12.1.9.3 Recent Developments

12.1.9.4 MnM View

12.1.10 Oceanled

12.1.10.1 Business Overview

12.1.10.2 Products Offered

12.1.10.3 Recent Developments

12.1.10.4 MnM View

12.2 Other Key Players

12.2.1 Dabmar Lighting, Inc.

12.2.2 Lumitec LLC

12.2.3 Perko Inc.

12.2.4 Wibre

12.2.5 Submertec

12.3 Start-Up Ecosystem

12.3.1 G1 Energy Solutions Private Limited

12.3.2 Shenzhen Sanxinbao Semiconductor Lighting Co., Ltd.

12.3.3 Arihant LED Lights

12.3.4 Global Light & Power LLC

12.3.5 Fire Water Marine

13 Appendix (Page No. - 112)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (70 Tables)

Table 1 Underwater Lighting Market, By Light Source, 2016–2024 (USD Million)

Table 2 Market for LED, By Region, 2016–2024 (USD Million)

Table 3 Underwater Lighting for Others, By Region, 2016–2024 (USD Million)

Table 4 Underwater Lighting Market, By Mounting Type, 2016–2024 (USD Million)

Table 5 Market for Flush Mounted, By Region, 2016–2024 (USD Million)

Table 6 Underwater Lighting Market for Surface Mounted, By Region, 2016–2024 (USD Million)

Table 7 Market, By Installation Type, 2016–2024 (USD Million)

Table 8 Underwater Lighting for New Installations, By Region, 2016–2024 (USD Million)

Table 9 Underwater Lighting for Retrofit Installations, By Region, 2016–2024 (USD Million)

Table 10 Market, By Application, 2016–2024 (USD Million)

Table 11 Underwater Lighting Market for Boat/Yacht Lighting, By Region, 2016—2024 (USD Million)

Table 12 Market for Swimming Pools, By Region, 2016—2024 (USD Million)

Table 13 Market for Fountains, By Region, 2016—2024 (USD Million)

Table 14 Underwater Lighting Market for Other Applications, By Region, 2016—2024 (USD Million)

Table 15 Market, By Region, 2016–2024 (USD Million)

Table 16 Americas Market, By Region, 2016–2024 (USD Million)

Table 17 Americas Market, By Light Source, 2016–2024 (USD Million)

Table 18 Americas Market, By Application, 2016–2024 (USD Million)

Table 19 Americas Market, By Mounting Type, 2016–2024 (USD Million)

Table 20 Americas Underwater Lighting Market, By Installation Type, 2016–2024 (USD Million)

Table 21 North America Market, By Country, 2016–2024 (USD Million)

Table 22 North America Underwater Lighting Market , By Light Source, 2016–2024 (USD Million)

Table 23 North America Market, By Application, 2016–2024 (USD Million)

Table 24 North America Market, By Mounting Type, 2016–2024 (USD Million)

Table 25 North America Market, By Installation Type, 2016–2024 (USD Million)

Table 26 US Market, By Light Source, 2016–2024 (USD Million)

Table 27 Canada Market, By Light Source, 2016–2024 (USD Million)

Table 28 Mexico Underwater Lighting Market, By Light Source, 2016–2024 (USD Million)

Table 29 South America Market, By Country, 2016–2024 (USD Million)

Table 30 South America Market, By Light Source, 2016–2024 (USD Million)

Table 31 South America Underwater Lighting Market, By Application, 2016–2024 (USD Million)

Table 32 South America Market, By Mounting Type, 2016–2024 (USD Million)

Table 33 South America Market, By Installation Type, 2016–2024 (USD Million)

Table 34 Brazil Underwater Lighting Market, By Light Source, 2016–2024 (USD Million)

Table 35 Rest of South America Market, By Light Source, 2016–2024 (USD Million)

Table 36 Europe Market, By Country, 2016–2024 (USD Million)

Table 37 Europe Market, By Light Source, 2016–2024 (USD Million)

Table 38 Europe Market, By Application, 2016–2024 (USD Million)

Table 39 Europe Market, By Mounting Type, 2016–2024 (USD Million)

Table 40 Europe Market, By Installation Type, 2016–2024 (USD Million)

Table 41 Germany Market, By Light Source, 2016–2024 (USD Million)

Table 42 UK Market, By Light Source, 2016–2024 (USD Million)

Table 43 France Market, By Light Source, 2016–2024 (USD Million)

Table 44 Rest of Europe Market, By Light Source, 2016–2024 (USD Million)

Table 45 Asia Pacific Market, By Country, 2016–2024 (USD Million)

Table 46 Asia Pacific Market, By Light Source, 2016–2024 (USD Million)

Table 47 Asia Pacific Market, By Application, 2016–2024 (USD Million)

Table 48 Asia Pacific Underwater Lighting Market, By Mounting Type, 2016–2024 (USD Million)

Table 49 Asia Pacific Market, By Installation Type, 2016–2024 (USD Million)

Table 50 China Market, By Light Source, 2016–2024 (USD Million)

Table 51 Japan Market, By Light Source, 2016–2024 (USD Million)

Table 52 India Market, By Light Source, 2016–2024 (USD Million)

Table 53 Rest of Asia Pacific Market, By Light Source, 2016–2024 (USD Million)

Table 54 RoW Market, By Region, 2016–2024 (USD Million)

Table 55 RoW Market, By Light Source, 2016–2024 (USD Million)

Table 56 RoW Underwater Lighting Market, By Application, 2016–2024 (USD Million)

Table 57 RoW Market, By Mounting Type, 2016–2024 (USD Million)

Table 58 RoW Market, By Installation Type, 2016–2024 (USD Million)

Table 59 Middle East Market, By Light Source, 2016–2024 (USD Million)

Table 60 Middle East Market, By Application, 2016–2024 (USD Million)

Table 61 Middle East Underwater Lighting Market, By Mounting Type, 2016–2024 (USD Million)

Table 62 Middle East Market, By Installation Type, 2016–2024 (USD Million)

Table 63 Africa Market, By Light Source, 2016–2024 (USD Million)

Table 64 Africa Market, By Application, 2016–2024 (USD Million)

Table 65 Africa Market, By Mounting Type, 2016–2024 (USD Million)

Table 66 Africa Market, By Installation Type, 2016–2024 (USD Million)

Table 67 Product Developments, 2016–2018

Table 68 Partnerships/Collaborations/Agreements, 2016–2018

Table 69 Mergers & Acquisitions, 2016–2018

Table 70 Expansions, 2016–2018

List of Figures (27 Figures)

Figure 1 Market Segmentation

Figure 2 Underwater Lighting Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Surface Mounted Segment to Lead Market From 2019 to 2024

Figure 7 LED Segment to Lead Market From 2019 to 2024

Figure 8 New Installations Segment of Market to Grow at A Higher CAGR Than Retrofit Installations Segment From 2019 to 2024

Figure 9 Swimming Pools Segment of Market Projected to Grow at Highest CAGR From 2019 to 2024

Figure 10 Asia Pacific Accounted for the Largest Share of Market in 2018

Figure 11 Increasing Demand for Installation of Lights in Swimming Pools is Driving Growth of Market

Figure 12 LED Segment Projected to Lead Market From 2019 to 2024

Figure 13 Swimming Pools Segment and China to Account for the Largest Share of Market in Asia Pacific By 2024

Figure 14 Surface Mounted Segment to Lead Market From 2019 to 2024

Figure 15 China to Lead Market in 2019

Figure 16 Increased Demand for Underwater Lighting in Swimming Pools is Driving the Growth of Market

Figure 17 Major Value Added By Original Equipment Manufacturers and Software Providers

Figure 18 Market, By Light Source

Figure 19 Market: Geographic Snapshot

Figure 20 Americas Market Snapshot

Figure 21 Europe Market Snapshot

Figure 22 Asia Pacific Market Snapshot

Figure 23 Companies Adopted Partnerships and Product Developments as Key Growth Strategies Between 2016 and 2018

Figure 24 Ranking of Key Players in Market, 2018

Figure 25 Competitive Leadership Mapping of Market, 2018

Figure 26 Signify: Company Snapshot

Figure 27 Acuity Brands: Company Snapshot

The study involved 4 major activities to estimate the current size of the underwater lighting market. Exhaustive secondary research was carried out to collect information on the market as well as its peer markets and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the underwater lighting market. Thereafter, market breakdown and data triangulation were used to estimate sizes of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, underwater lighting-related journals such as SAGE journals; certified publications; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size estimations, which were further validated by primary research.

Primary Research

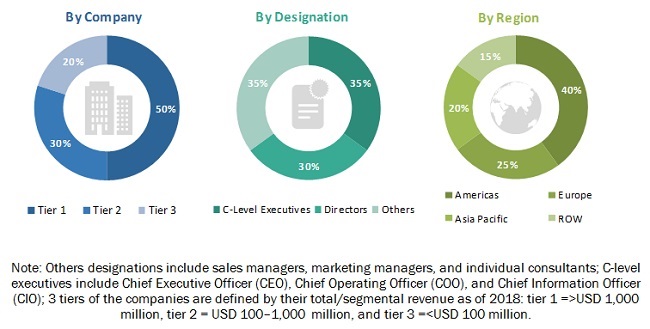

In the primary research process, various primary sources from both, supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report on the underwater lighting market. Extensive primary research was conducted after understanding and analyzing the underwater lighting market through secondary research. Several primary interviews were conducted with key opinion leaders from both, demand- and supply-side vendors across 4 regions: the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). The market in RoW was studied for the Middle East and Africa. Approximately 25% of the primary interviews were conducted with the demand side, while 75% with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Besides, questionnaires and emails were also used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were implemented to estimate and validate the total size of the underwater lighting market. These methods were also used extensively to estimate the size of various segments and subsegments. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The supply chain of the industry and the market size in terms of value were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, demand and supply sides across different end-use applications.

Study Objectives

- To define, describe, and forecast the size of the underwater lighting market, in terms of value, based on light source, mounting type, installation type, application, and region

- To forecast the size of the market and its segments with respect to 4 main regions, namely, the Americas, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product launches/developments, collaborations, and Research & Development (R&D) activities carried out in the underwater lighting market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

- Country-wise breakdown of the market in various regions such as the Americas, Europe, Asia Pacific, and RoW

- Further segmentation of the application segments of the underwater lighting market

Growth opportunities and latent adjacency in Underwater Lighting Market