Vacuum Contactor Market by Voltage Rating (1-5kV, 5.1-10kV, 10.1-15kV, 15.1-24kV), Configuration (Contactor, Contactor Fuse Combination), Application (Motors, Transformers, Capacitors, Reactors, Resistive Loads), End Users, Region - Global Forecast to 2028

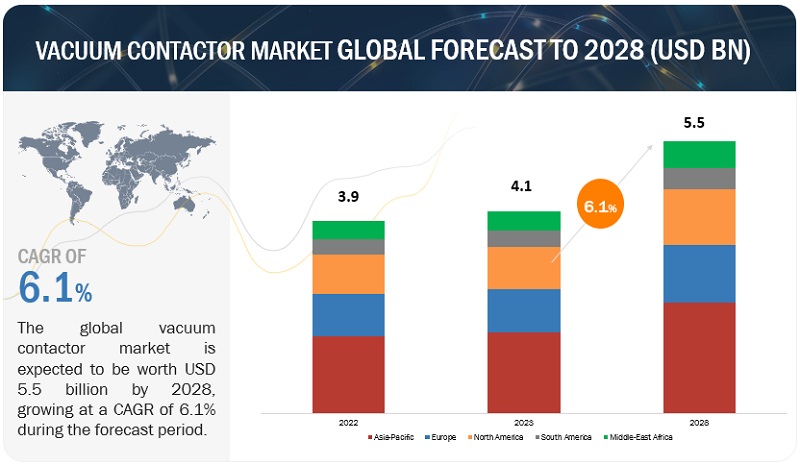

[224 Pages Report] The vacuum contactor market is expected to witness significant growth, with an estimated value of USD 4.1 billion in 2023 and a projected reach of USD 5.5 billion by 2028, exhibiting a Compound Annual Growth Rate (CAGR) of 6.1%. The driving force behind the expansion of the vacuum contactor market is the rising need for dependable and effective electrical control solutions across a wide range of industries and use cases.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Empowering Electrical Control

The rapid progression of industrialization and the concurrent expansion of manufacturing sectors have brought about a heightened necessity for precise motor control and the safeguarding of circuits. This has consequently resulted in an escalated demand for vacuum contactors, which play an instrumental role in meeting these requirements. The surge in urbanization and the ambitious scope of infrastructure projects underscore the significance of streamlined and efficient electrical systems. Within this context, vacuum contactors emerge as crucial components, ensuring the dependable and secure functioning of operations.

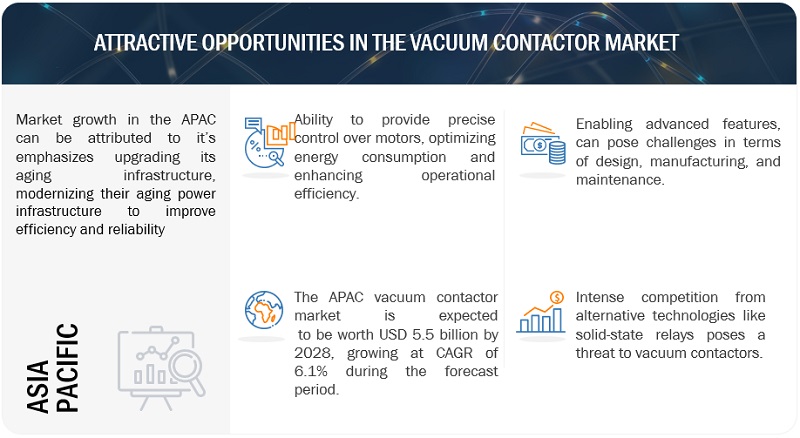

The intrinsic capability of vacuum contactors to enable meticulous control over motors and equipment is pivotal in achieving optimal energy consumption levels while simultaneously curtailing unnecessary wastage. By facilitating such controlled management, vacuum contactors contribute significantly to bolstering energy efficiency, aligning with contemporary sustainability objectives. Moreover, their incorporation serves as a robust defense mechanism, diligently protecting circuits from disruptions and faults, thus elevating the overall safety quotient.

Restraints: Factors Limiting the Market Acceptance of Vacuum Contactors

Vacuum contactors encounter several constraints that can influence their market acceptance and adoption. One significant aspect is the relatively higher initial costs associated with vacuum contactors in comparison to conventional contactors. This financial disparity can act as a deterrent for budget-conscious buyers, potentially steering them towards more economical alternatives. Moreover, the proper installation, maintenance, and operation of vacuum contactors often necessitate a specialized level of technical expertise. This requirement can result in the need for additional training and contribute to operational complexities. This challenge not only affects the initial setup but can also impact the ongoing management of these components within electrical systems. A noteworthy restraint lies in the realm of awareness and understanding. Despite the notable benefits that vacuum contactors offer, a lack of awareness about their advantages and applications persists within specific industries or regions. This limited knowledge can hinder their adoption as potential users may be more inclined to stick with familiar options or technologies.

The presence of alternative technologies poses another constraint. Technologies like solid-state relays or different contactor types may present competitive solutions tailored for certain applications. This technological diversity adds another layer of consideration for potential buyers, potentially diverting demand away from vacuum contactors. Additionally, the adoption and integration of vacuum contactors can be impacted by the regulatory landscape. Different regions may have distinct regulatory requirements or standards that must be met for compliance. Negotiating these varying regulatory frameworks can add intricacy to the process of incorporating vacuum contactors into diverse electrical systems.

In conclusion, while vacuum contactors offer significant advantages, these constraints—ranging from cost considerations and technical expertise demands to awareness gaps, alternative technologies, and regulatory variations—highlight the multifaceted challenges that influence their widespread adoption and integration within the market..

Opportunities: Harnessing the Potential of Vacuum Contactors in Smart Grids, IoT, and Emerging Markets

Vacuum contactors possess a remarkable capacity for achieving precise control over motors, thereby enabling the optimization of energy consumption. Manufacturers can capitalize on this capability to augment the energy efficiency attributes of vacuum contactors, aligning seamlessly with the growing emphasis on sustainability and the reduction of energy waste. In tandem with the progression of electrical systems into more sophisticated and interconnected configurations, there emerges a promising prospect of integrating vacuum contactors into smart grid solutions. This integration would usher in the potential for remote monitoring, control, and diagnostics, thereby elevating operational efficiency and curtailing instances of downtime.

Moreover, the fusion of vacuum contactors with industrial automation systems and the expansive realm of the Internet of Things (IoT) can pave the way for a heightened level of automation, insights derived from data, and anticipatory maintenance practices. Consequently, this convergence holds the promise of bolstering the comprehensive performance and reliability of entire systems. An avenue rife with growth potential for manufacturers of vacuum contactors lies in penetrating burgeoning markets characterized by rapid industrialization and the development of critical infrastructure. Notable examples encompass certain regions within Asia, Africa, and South America, where significant opportunities for expansion are abound.

The trajectory of ongoing research and development endeavors stands poised to yield innovative breakthroughs in the realm of vacuum contactor technology. These advancements are anticipated to yield enhanced levels of performance, bolstered reliability, and a more cost-effective operational landscape.Promoting awareness and understanding of the manifold advantages and applications intrinsic to vacuum contactors is instrumental in stimulating demand and ultimately galvanizing market growth. Through collaborative endeavors with fellow industry stakeholders, including manufacturers of electrical equipment, utility companies, and providers of cutting-edge technologies, the potential to devise synergistic solutions and garner heightened exposure within the market is considerably augmented.

Challenges: Aging of lithium-ion batteries

The intricate nature of vacuum contactor technology poses challenges in design, manufacturing, and maintenance, potentially hindering smooth integration. Specialized expertise is essential throughout the product lifecycle, impacting resource allocation and operational efficiency. Growing demand for low-voltage vacuum contactors is driven by their efficiency and durability in industrial electrical systems. Solid-state relays are emerging as alternatives due to their compactness, resilience, and longer lifespan.

Complex features like integrated protection circuits and digital communication enhance contactor market functionality but raise development and manufacturing costs, requiring a balance between innovation and affordability. As vacuum contactors evolve amidst competition, finding equilibrium between innovation, function, and cost shapes their role in modern industrial systems.

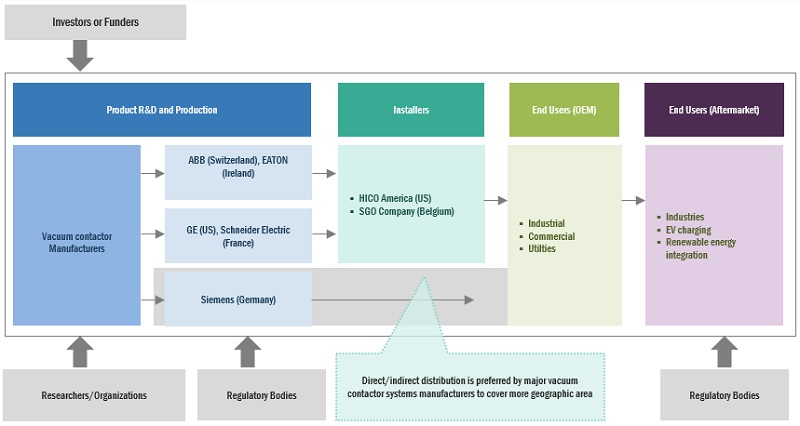

Vacuum Contactor Market Ecosystem

Dominant players in this sector comprise established and financially robust vacuum contactor manufacturers and component providers. These firms boast extensive market experience, diverse product ranges, cutting-edge technologies, and robust worldwide sales and marketing networks. Notable entities encompass Eaton (Ireland), ABB (Switzerland), Siemens (Germany), GE (US), and Schneider Electric (France).

By application, the capacitors is expected to grow at the fastest rate during the forecast period.

From 2023 to 2028, the capacitors are projected to exhibit the highest growth rate compared to other applications. Rising infrastructure development, automation, stability enhancement, and energy savings in power systems are driving capacitor demand. The vacuum contactors market for capacitors is growing due to increased usage, reliable switching for capacitor banks, and specialized vacuum contactor designs for capacitors.

By power rating, the 1-5 kV segment is expected to hold the largest share during the forecast period.

Throughout the forecast period, the 1-5 kV segment is anticipated to maintain its leading position in terms of market share. Market growth for vacuum contactors is propelled by expanding infrastructure, transmission loss reduction, and industrial distribution advancements. Increasing awareness about harmonics, power factor correction, and commutation failure prevention is boosting demand for 1KV-5KV vacuum contactors in residential and commercial applications.

By End User, utilities segment is expected to grow the fastest, during the forecast period.

The vacuum contactor market is segmented based on end user, which includes utilities, industrial, oil & gas, commercial, mining and others. Among these segments, the utilities segment is experiencing significant growth. The utilities sector encompasses power generation and transmission in wind, solar, and hydropower industries. Growing demand for electricity and services, along with new electrical devices, drives this sector. Vacuum contactors play a vital role by providing dependable power switching and motor starting solutions for reliable electricity supply in power plants. Vacuum contactors find applications in blowers, water pumping, conveyors, capacitor switching, and various power switching tasks within the utilities sector.

Asia Pacific is expected to be the largest market during the forecast period.

During the forecast time frame, Asia Pacific is anticipated to be the largest and fastest-growing regional market for vacuum contactor. The Asia-Pacific region is experiencing rapid industrialization, urbanization, and infrastructure development, driving increased energy demand. This surge in activity necessitates efficient power distribution and control, leading to a higher demand for vacuum contactors. Additionally, emerging markets, favorable government policies, and growing awareness of energy efficiency contribute to the region's significant growth in the vacuum contactor market.

Key Market Players

The vacuum contactor market is primarily led by prominent entities including Eaton (Ireland), ABB (Switzerland), Schneider Electric (France), Siemens (Germany), and GE (US). During the period spanning 2018 to 2022, these companies have strategically employed tactics such as introducing new products, forging contracts, establishing agreements, entering partnerships, facilitating collaborations, pursuing acquisitions, and expanding operations to bolster their market presence within the vacuum contactor industry.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Configuration, application, voltage rating, end-user, and region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America and Middle East & Africa. |

|

Companies covered |

ABB Ltd (Switzerland), Siemens AG (Germany), Eaton Corporation plc (Dublin, Ireland), Toshiba Corporation (Japan), Mitsubishi Electric Corporation (Japan), Schneider Electric SE (France), Larsen & Toubro Limited (India), Rockwell Automation, Inc. (US), Crompton Greaves Limited (India), LS Industrial Systems Co., Ltd (South Korea), Joslyn Clark (US), Meidensha Corporation (Japan), Ampcontrol Pty Ltd (Australia), ARTECHE Group (Spain), Yueqing Liyond Electric Co., Ltd. (China), Fuji Electric (Japan), Xiamen Huadian Switchgear Co., Ltd. (China), TDK Electronics AG (Germany), ZHIYUE GROUP CO., LTD (China), Wuxi Haibang Mechanical & Electrical Manufacturing Co., Ltd (China). |

This research report categorizes the vacuum contactor market by configuration, application, voltage rating, end-user, and region.

On the basis of configuration:

- Contactor

- Contactor fuse combination

On the basis of application:

- Motors

- Transformers

- Capacitors

- Reactors

- Resistive loads

- Other medium voltage equipment

On the basis of voltage rating:

- 1KV–5KV

- 5.1KV–10KV

- 10.1KV–15KV

- 15.1KV–24KV

On the basis of end user:

- Utilities

- Industrial

- Oil & gas

- Commercial

- Mining

- Others

On the basis of region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In July 2022, TDK collaborates with students across diverse universities to cultivate innovative and sustainable mobility visions for the future. Through its sponsorship initiatives, TDK is championing the advancement of concepts encompassing Hyperloop technology, solar-powered solutions, and electric vehicles. TDK's involvement extends beyond mere support, encompassing the provision of components, expertise, and financial backing. Presently, teams at prestigious institutions like ETH Zurich in Switzerland, Leuven University of Technology in Belgium, and Aalen University of Applied Sciences in Germany are reaping the benefits of this comprehensive engagement.

- In January 2023, TDK has revealed its acquisition of Qeexo, Co., a notable pioneer in the realm of automated machine learning (ML) platforms, particularly focusing on tinyML models tailored for low-power, persistent intelligent devices. This strategic acquisition underscores TDK's ambition to fortify its ML prowess and optimize the process of ML application development, positioning the company as a front-runner in furnishing intelligent edge solution.

- In May 2023, Ampcontrol, now under full ownership of investment firm Washington H. Soul Pattinson since 2022, has marked its inaugural acquisition by procuring Androck Engineering & Mining Pty Limited, a Hunter-based enterprise. This deliberate acquisition harmonizes seamlessly with Ampcontrol's strategic trajectory for amplifying its presence and influence in the renewable energy manufacturing arena. It serves as a tangible manifestation of Ampcontrol's dedication to facilitating the worldwide shift toward a low-carbon economy.

Frequently Asked Questions (FAQ):

What is the current size of the vacuum contactor market?

The current market size of the global vacuum contactor market is estimated at USD 4,091 million in 2023.

What are the major drivers for vacuum contactor market?

A prominent catalyst propelling the vacuum contactor market is the escalating demand for efficient energy distribution and control solutions within rapidly advancing industrial and infrastructure sectors.

Which is the fastest-growing region during the forecasted period in the vacuum contactor market?

The Asia Pacific vacuum contactor market is estimated to be the largest and the fastest growing region, during the forecast period.

What is the fastest-growing segment by end user during the forecast period in the vacuum contactor market?

The utilities is estimated to be the largest and the fastest growing end user in the vacuum contactor market.

Which is the fastest-growing segment by application during the forecasted period in the vacuum contactor market?

The capacitors is estimated to be the largest and the fastest growing application in the vacuum contactor market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

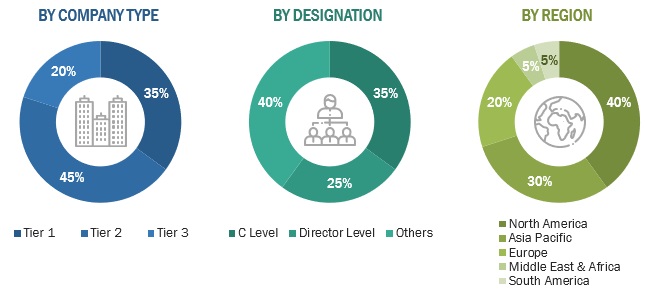

This study involved four major activities in estimating the current size of the vacuum contactor market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and UNESCO Institute of Statistics to identify and collect information useful for a technical, market-oriented, and commercial study of the utility communication market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all the segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global vacuum contactor market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Vacuum Contactor Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the vacuum contactor market.

Objectives of the Study

- To forecast and describe the vacuum contactor market size, by by configuration, application, voltage rating, end-user, and region, in terms of value and volume

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value and volume

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the recession on the overall market and value chain

- To forecast the growth of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America and Middle East & Africa

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the vacuum contactor market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Vacuum Contactor Market