Distribution Transformer Market

Distribution Transformer Market by Mounting (Pad, Pole, Underground), Phase (Three and Single), Power Rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, above 10 MVA), Insulation (Oil-immersed, Dry), End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global distribution transformer market is expected to reach USD 29.57 billion by 2030, up from USD 21.40 billion in 2025, with a CAGR of 6.7%. Major growth drivers include grid modernization efforts, increasing adoption of renewable energy, and the urgent need to replace aging infrastructure with more energy-efficient and intelligent systems. Governments and utilities worldwide are heavily investing in smart grids, decentralized energy generation, and digital monitoring systems, all of which demand advanced transformer technologies capable of supporting real-time analytics, bi-directional power flow, and greater efficiency.

KEY TAKEAWAYS

-

BY MOUNTINGThe key mounting segments include pad, pole, and underground. Pad-mounted distribution transformers dominate the market due to their many benefits. Their compact and affordable design makes them suitable for urban and suburban areas where space is tight and appearance matters.

-

BY PHASEThe key phase segments include single and three. Three-phase distribution transformers dominate the market due to their superior ability to handle higher power loads, making them essential for applications with substantial electricity demand.

-

BY POWER RATINGKey power ratings include up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, and above 10 MVA. The 0.5–2.5 MVA segment commands a leading position in the market due to its broad applicability and operational flexibility.

-

BY INSULATIONKey insulation segments include oil-immersed and dry. Oil-immersed distribution transformers continue to dominate the market owing to their robust design, long operational life, and high thermal efficiency.

-

BY END-USERKey end user segments include utilities, commercial & residential, and industrial. Power utilities hold a commanding position as the leading end users in the distribution transformer market, owing to their central role in planning, operating, and expanding national and regional electricity grids.

-

BY REGIONThe distribution transformer market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is poised for substantial growth driven by rapid urbanization, which significantly increases electricity demand and requires widespread grid expansion and modernization. The region's accelerating industrial development further amplifies the need for efficient and reliable distribution infrastructure.

-

COMPETITIVE LANDSCAPEThe market is moderately competitive, with leading players such as Hitachi Energy, Eaton, Schneider Electric, Siemens, Toshiba Energy Systems & Solutions Corporation, HD Hyundai Electric Co., Ltd., GE Vernova focusing on both organic and inorganic strategies. Strategic partnerships, local manufacturing expansions, and product innovations in eco-friendly insulation materials are being adopted to strengthen market presence and cater to evolving demand.

The distribution transformer market is currently experiencing a substantial transformation influenced by technological progress and the evolving requirements of customers. Developments in data analysis, along with the integration of the Internet of Things (IoT) and Industrial Internet of Things (IIoT), have facilitated the incorporation of sensors within distribution transformers. These sensors gather real-time information regarding transformer health, load conditions, and environmental factors. This data is subject to analysis through advanced algorithms to enable predictive maintenance. Utility providers can thereby prevent unforeseen outages and enhance maintenance scheduling by proactively diagnosing potential issues and advancing asset performance management.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses comes from changing energy demand patterns or technological disruptions. Utilities and industrial users are major clients of distribution transformer manufacturers, while their downstream applications include residential, commercial, and renewable energy sectors. Shifts such as moving toward smart grids, distributed generation, and electrification will affect the revenue of end users. This, in turn, will influence the revenue of utilities and industrial consumers, ultimately impacting the overall growth dynamics of the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Electrification of residential and transportation sectors

-

Aging global grid infrastructure

Level

-

High Initial investment and fluctuating raw material prices

-

Implementation of stringent environmental regulations

Level

-

Shift towards an intelligent and efficient power grid infrastructure

-

Emphasis on offering energy-efficiency transformers

Level

-

Disruptions in supply chain of grid technology

-

Cybersecurity threats

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Electrification of residential and transportation sectors

Global electricity consumption grew by 4.3% in 2024, nearly doubling the 2.5% increase seen in 2023 (IEA). While China, India, and several Southeast Asian nations experienced higher electricity demand, developed economies saw significant declines. This decrease was mainly caused by sluggish economic activity and high inflation, which reduced manufacturing and industrial operations. Over the next three years, global electricity demand is expected to grow rapidly, with an average annual increase of 3.4% projected through 2026. This growth is likely driven by economic expansion, raising electricity demand in both developed and emerging economies. The electrification of residential and transportation sectors, along with the expanding data center industry, are expected to increase electricity use in advanced economies and China. The share of electricity in total final energy consumption rose to 20% in 2023 from 18% in 2015, indicating progress in electrification. However, much faster progress is necessary to meet global decarbonization goals.

Restraint: High initial investment and fluctuating raw material prices

The high initial investment can significantly limit the growth of the global distribution transformer market. Modern distribution transformers, especially those with smart grid features or designed for renewable energy integration, often include advanced technologies. While enhancing efficiency and functionality, these upgrades come at a higher cost than basic models. According to a report by the International Energy Agency (IEA), smart grid technologies can raise the overall cost of a distribution transformer by 20–30% (IEA - Smart Grid Cost-Effectiveness). Distribution transformers depend on various raw materials, such as copper, steel, and silicon steel.

Opportunity: Shift toward intelligent and efficient power grid infrastructure

Smart grids mark a major shift towards an intelligent and efficient power grid system, with distribution transformers playing a key role in this change. Much of the current grid infrastructure is aging and inefficient, causing energy losses and reliability problems. The world's growing population and increasing electrification are driving a steady rise in electricity demand. Incorporating renewable energy sources like solar and wind power is essential for sustainability, but these sources are variable and need advanced grid management techniques.

Challenge: Cybersecurity threats

Global supply chains for grid technology continue to face significant pressure due to increasing demand for electrification and renewable energy integration. The rise in infrastructure projects—such as utility-scale solar and wind farms, electric vehicle charging networks, and smart grid upgrades—has strained the availability of essential components like transformers, switchgear, and semiconductor-based control systems. Furthermore, competition for critical minerals such as lithium, cobalt, and rare earth elements has intensified, fueled by the rapid expansion of clean energy technologies. These factors have resulted in longer lead times and higher costs; for example, the procurement time for 20 MVA distribution transformers now exceeds 18 months, mainly because of manufacturing bottlenecks and shortages of skilled labor.

Distribution Transformer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

EasyDry up to 550 kV transformer bushings: Paperless, oil-free, dry-type, pluggable bushings for transmission applications | Eliminates moisture ingress, fire, and oil leak risks; reduces maintenance; high seismic resistance; customizable; supports sustainability |

|

TXpert Hub: Digital transformer management platform integrating advanced sensor and analytics technology | Enables predictive maintenance, remote monitoring, operational optimization, and extends transformer lifespan for grid modernization |

|

TVP (Transient Voltage Protection): Network-agnostic varistor technology safeguarding transformers against voltage spikes | Prevents insulation damage, minimizes downtime, requires no additional space, and is maintenance-free—boosts reliability and efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The distribution transformer market ecosystem consists of a well-connected network of raw material suppliers, manufacturers, distributors, and end users. Leading manufacturers like GE, Hitachi Energy, and Schneider Electric design and produce transformers using materials supplied by companies such as Nippon Steel, Baosteel, Nexans, and Prysmian. These products are distributed through major channels including Wesco, Sonepar, and Graybar to reach key end users like utilities and industrial operators, including National Grid and Con Edison. The ecosystem is driven by increasing power demand, grid modernization, and renewable energy integration, which together create a strong interdependence among stakeholders to deliver efficient, reliable, and sustainable power distribution solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Distribution transformer Market, By Mounting

The pad-mounted segment had the largest market revenue share in 2024. Pad-mounted distribution transformers remain dominant in the market because of their many benefits. Their compact, cost-effective design makes them perfect for urban and suburban areas where space is limited and aesthetics matter. These transformers are housed in secure, tamper-resistant cabinets, which improve safety and lower the risk of unauthorized access or vandalism.

Distribution transformer Market, By Phase

The three-phase segment led the distribution transformer market in 2024. These transformers are the top choice for powering industrial facilities, large commercial complexes, and densely populated urban areas, where a reliable and continuous power supply is essential. Their ability to provide a complete three-phase power system ensures higher efficiency, smoother operation of heavy machinery, and balanced load distribution, which lowers energy losses and improves overall grid stability.

Distribution Transformer Market, By Power Rating

The 0.5–2.5 MVA segment held the largest share in 2024. This power rating range effectively addresses the intermediate energy needs between the lower demands of residential areas and the higher capacity requirements of heavy industrial facilities. Its ability to serve a wide variety of end-users, including commercial complexes, educational institutions, small- to medium-sized manufacturing plants, and urban infrastructure, makes it a versatile and widely used solution across both developed and emerging power networks.

Distribution Transformer Market, By Insulation

The oil-immersed segment held the largest market share in 2024. These transformers are popular across utility, industrial, and commercial sectors because of their proven reliability in handling variable load conditions and operating in various environmental settings. The insulating oil not only provides effective cooling but also improves dielectric strength, facilitating better heat dissipation and extending equipment lifespan even with continuous use.

Distribution transformer Market, By Application

The power utilities segment accounted for the largest market share in 2024. Power utilities hold a dominant position as the primary end users in the distribution transformer market, due to their central role in planning, operating, and expanding national and regional electricity grids. Responsible for ensuring consistent and reliable electricity delivery across residential, commercial, and industrial sectors, utilities generate significant demand for a wide range of transformer capacities and technologies.

REGION

Asia Pacific to be largest and fastest-growing region in global distribution transformer market during forecast period

Asia Pacific is expected to be the largest and fastest-growing region in the global distribution transformer market during the forecast period, driven by rapid urbanization, strong industrial growth, and increasing investments in power infrastructure. Countries such as China, India, Japan, and South Korea are experiencing surging electricity demand due to expanding manufacturing sectors, rising residential and commercial developments, and the growing integration of renewable energy sources into national grids. Additionally, the region’s ambitious electrification and smart grid initiatives, along with the expansion of transmission and distribution networks, are creating significant opportunities for advanced and energy-efficient distribution transformers.

Distribution Transformer Market: COMPANY EVALUATION MATRIX

In the distribution transformer market matrix, Schneider Electric (Star) leads with its extensive global presence, advanced smart grid-compatible transformer solutions, and strong partnerships with utilities and renewable energy developers, enabling large-scale adoption across industrial, commercial, and residential sectors. Siemens Energy (Emerging Leader) is rapidly strengthening its position through innovation in eco-efficient and digital monitoring transformer technologies, supported by increasing investments in grid modernization and sustainable power infrastructure across Europe and Asia Pacific.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.32 Billion |

| Market Forecast in 2030 (Value) | USD 29.57 Billion |

| Growth Rate | CAGR of 6.7% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Distribution Transformer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End User & Application Segmentation | Comprehensive list of distribution transformer customers segmented by utilities, industrial, and residential & commercial end user | Insights into demand/growth trends and addressable market size across each segment |

| US Specific Market | US-specific market sizing | Supports strategic decisions for market entry, resource allocation, and sales focus based on US demand and growth trends |

RECENT DEVELOPMENTS

- April 2024 : Hitachi Industrial Equipment Systems Co., Ltd. (Japan) formed an agreement with Mitsubishi Electric Corporation (Japan) to acquire Mitsubishi Electric’s distribution transformer business, which is part of its Nagoya Works, which develops and manufactures factory automation (FA) equipment. This acquisition will result in the integration of the two companies' operations in this sector, strengthening Hitachi Industrial Equipment Systems’ capabilities in the distribution transformer market.

- April 2023 : Eaton acquired a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a Chinese power distribution and sub-transmission transformers manufacturer.

- April 2023 : Siemens Energy and Spain’s Dragados Offshore signed a framework agreement with German Dutch transmission system operator TenneT to supply high-voltage direct current (HVDC) transmission technology for three grid connections in the German North Sea.

- June 2022 : Hitachi Energy Ltd. and Schneider Electric collaborated to provide sustainable and smart energy management solutions.

Table of Contents

Methodology

The study involved major activities in estimating the current size of the distribution transformer market. Exhaustive secondary research was done to collect information on the peer markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The primary research for this report involved interviews with sources from both the supply and demand sides to gather qualitative and quantitative insights. Supply-side sources included industry experts such as CEOs, VPs, and marketing directors from companies in the distribution transformer market.

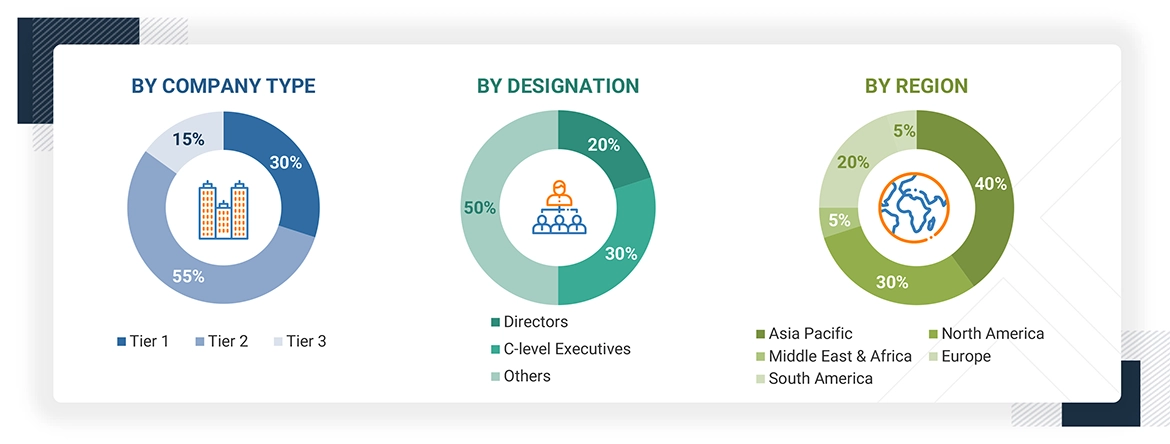

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. The following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2024: Tier 1 = > USD 1 billion, Tier 2 =

From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the distribution transformer market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Distribution Transformer Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

Across the dynamic power distribution ecosystem, distribution transformers enable the efficient supply of electricity to end users. These static electrical devices are the critical link connecting the power transmission grid to the distribution network. Distribution transformers primarily serve the purpose of reducing high-voltage electricity from transmission lines to more usable, lower voltages for consumption in various sectors. Distribution transformers are classified based on various parameters. Capacity ranges from ~0.5 MVA for localized grid systems to greater than 10 MVA for the capacity to power large-scale infrastructure projects and future renewable energy users.

Stakeholders

- Banks, venture capitalists, financial institutions, and other investors

- Companies related to electric power generation, transmission, and distribution

- Energy associations

- Environmental associations

- Energy efficiency consultants

- Government and industry associations

- Government and research organizations

- Manufacturing industry

- Public & private power generation, transmission & distribution companies (utilities)

- Smart grid project developers

- State and national regulatory authorities

- Sub-station equipment manufacturing companies

- Venture capital firms

Report Objectives

- To describe and forecast the distribution transformer market in terms of value based on mounting, phase, power rating, insulation, end user, and region

- To forecast the distribution transformer market size, in terms of volume, by region

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the distribution transformer market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the distribution transformer market

- To analyze the opportunities for various stakeholders by identifying the high-growth segments of the distribution transformer market

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments, such as contracts, agreements, expansions, product launches, investments, and acquisitions, in the distribution transformer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Key Questions Addressed by the Report

What is the size of the distribution transformer market in 2024?

The distribution transformer market is valued at USD 20.3 billion in 2024.

What are the major drivers for the distribution transformer market?

The major drivers for the distribution transformer market include the rising global demand for electricity due to rapid urbanization, industrialization, and the growing population, especially in developing nations. The accelerating integration of renewable energy sources such as solar and wind into the power grid is also propelling demand for efficient and resilient distribution transformers to manage variable loads. Additionally, government initiatives to modernize aging grid infrastructure, improve energy efficiency, and enhance rural electrification programs are further supporting market growth. The expansion of smart grids and increasing adoption of digital monitoring and automation technologies are also key factors encouraging the deployment of advanced distribution transformers across utility, commercial, and industrial sectors.

What is the largest distribution transformer market during the forecast period?

Asia Pacific is expected to dominate the global distribution transformer market during the forecast period due to rapid industrialization, urban expansion, and extensive rural electrification programs, particularly in countries like China, India, and Southeast Asian nations. The region is witnessing large-scale investments in grid modernization, renewable energy integration, and infrastructure development to meet surging electricity demand. Additionally, government-backed initiatives and public-private partnerships are driving transformer installations across both utility and industrial sectors, further strengthening Asia Pacific's leading position in the global market.

Which insulation type is expected to hold the largest market share during the forecast period and why?

The oil-immersed insulation type is expected to hold the largest market share in the distribution transformer market during the forecast period due to its superior cooling efficiency, cost-effectiveness, and high reliability in handling heavy load applications. These transformers are widely adopted in utility and industrial sectors where durability and performance under extreme environmental and electrical stress are crucial. Their long operational life, ease of maintenance, and established use in outdoor installations further solidify their preference over dry-type alternatives, especially in developing and emerging markets.

Which end user will account for the largest market share in the coming years?

Power utilities are expected to hold the largest market share in the distribution transformer market in the coming years, fueled by growing demand for grid modernization, rural electrification, and renewable energy integration. Utilities are continually investing in expanding and upgrading distribution networks to improve reliability and efficiency, particularly in developing areas. Moreover, the shift to smart grids and the rising load from electric vehicles and distributed energy resources are further increasing the demand for advanced distribution transformers in utility infrastructure.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Distribution Transformer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Distribution Transformer Market