Vertical Lift Module Market Overview (2025 - 2035)

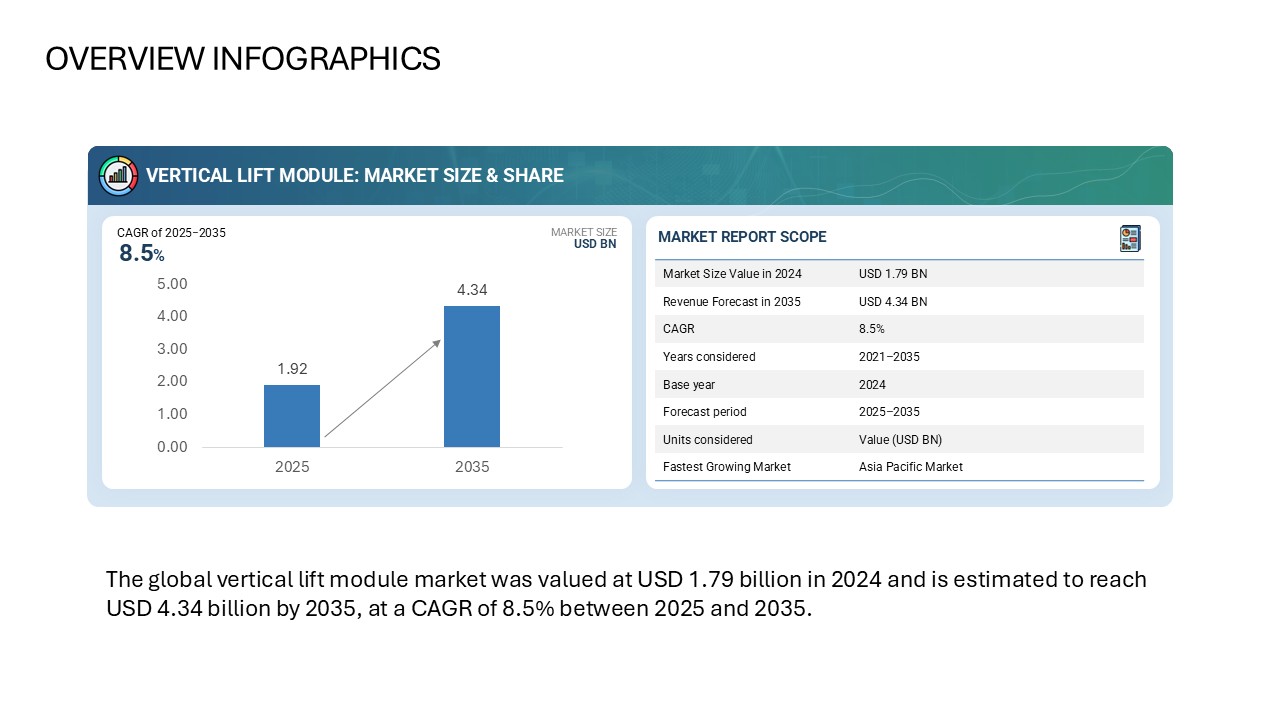

The global vertical lift module market was valued at USD 1.79 billion in 2024 and is estimated to reach USD 4.34 billion by 2035, at a CAGR of 8.5% between 2025 and 2035.

The global vertical lift module market is witnessing strong expansion as industries focus on achieving better space utilization, faster retrieval systems, and higher productivity. A vertical lift module (VLM) is an automated storage and retrieval system that stores goods on trays arranged vertically and delivers them to an access opening through an automatic elevator mechanism. This vertical design allows businesses to store more items in a smaller footprint, improving space efficiency and reducing manual handling. From manufacturing plants to e-commerce warehouses, VLMs are increasingly becoming the preferred choice for streamlining inventory management and enhancing operational flow. Between 2025 and 2035, the market is expected to experience significant growth due to the rising need for automation and smart storage solutions in logistics, production, and healthcare sectors.

Key Market Drivers

The growth of the vertical lift module market is driven by multiple factors. One of the primary drivers is the growing need for space optimization. Industrial real estate costs are rising worldwide, compelling companies to adopt solutions that make better use of available height rather than horizontal space. Automation is another major driver, as VLMs reduce human error, minimize labor dependency, and ensure faster access to stored goods.

E-commerce and omnichannel retailing have also accelerated the demand for quick and accurate picking systems, and VLMs meet this need efficiently. Furthermore, global labor shortages, especially in logistics and manufacturing, are pushing industries to invest in automated systems that can work continuously with minimal supervision. Lastly, the increased focus on employee safety and ergonomics by reducing bending, lifting, and walking distances—has made VLMs more attractive to industries seeking long-term operational efficiency.

Market Challenges

Despite the positive outlook, several challenges may restrain the vertical lift module market’s growth. The initial investment cost for installation is relatively high, making it difficult for small and medium enterprises to adopt the technology. Integrating VLMs with existing enterprise software such as warehouse management systems and ERP solutions can also be complex. Moreover, for sectors requiring temperature-controlled storage, the need for customized refrigerated VLMs adds to capital expenditure.

Maintenance and downtime are also concerns, especially in large-scale operations where any system failure can delay production or order fulfillment. In developing regions, lack of skilled technicians and awareness about automation technology further limits adoption. Addressing these barriers will be crucial for sustained market growth through 2035.

Delivery Type Insights

Single-Level Delivery

Single-level delivery VLMs are designed to present one tray at a time to the operator. They are suitable for facilities with moderate throughput requirements and limited space. These systems are commonly used in spare parts storage, maintenance workshops, and low-volume picking environments. Their simple design makes them cost-effective, reliable, and easier to maintain, which appeals to small and medium enterprises that need automation without complex integration.

Dual-Level Delivery

Dual-level delivery VLMs, on the other hand, are engineered for high throughput operations. They have two tray openings that allow one tray to be picked while another is being retrieved, minimizing idle time and improving efficiency. These systems are ideal for e-commerce fulfillment centers, automotive manufacturing, and distribution hubs that handle large order volumes. As the global trend shifts toward faster order processing and lean operations, the dual-level segment is expected to dominate future installations due to its superior productivity and reduced picking time.

Storage Type Insights

Non-Refrigerated VLMs

Non-refrigerated vertical lift modules account for the majority of installations worldwide. They are used in industries such as automotive, electronics, aerospace, and machinery where goods can be stored at ambient temperature. These VLMs provide quick access to components, enhance inventory accuracy, and reduce handling damage. Their relatively low setup cost and wide application scope continue to drive growth in this segment.

Refrigerated VLMs

Refrigerated VLMs are gaining momentum as industries such as food and beverage, healthcare, and pharmaceuticals expand their cold chain logistics. These systems are designed with advanced insulation, temperature sensors, and humidity controls to preserve the integrity of perishable goods. In healthcare, refrigerated VLMs are used to store vaccines, blood samples, and biologics safely. The rising global focus on food safety and healthcare compliance will accelerate the adoption of temperature-controlled VLMs in the coming decade.

Industry Applications

Automotive Industry

The automotive industry heavily relies on vertical lift modules for efficient storage and retrieval of parts, tools, and components. By using VLMs, automotive manufacturers can reduce part retrieval time, improve space utilization, and enhance production flexibility. The systems also support lean manufacturing by ensuring that components are readily available at the point of assembly. As electric vehicles and component diversity increase, automotive plants are expected to further automate their storage processes using advanced VLM systems.

Metals and Machinery

In metals and heavy machinery industries, vertical lift modules are used for storing heavy tools, dies, spare parts, and maintenance equipment. These industries benefit from the high load capacity and rugged design of VLMs. The use of automation helps minimize downtime by ensuring that critical tools and spare parts are always accessible. With a growing emphasis on predictive maintenance and efficient spare part logistics, this sector will continue to invest in intelligent storage systems.

Food and Beverages

The food and beverage sector uses both non-refrigerated and refrigerated VLMs depending on the type of product. Automated storage ensures proper inventory rotation, improved hygiene, and temperature consistency. Supermarkets, food processors, and distribution centers are integrating VLMs to streamline storage of ingredients, packaging materials, and finished products. The increasing adoption of automated systems in cold storage warehouses will boost the growth of this segment through 2035.

Chemicals and Healthcare

Both the chemical and healthcare sectors demand strict control over product storage conditions. In chemical plants, VLMs help manage hazardous or sensitive materials with controlled access and proper documentation. In healthcare, hospitals, pharmacies, and laboratories use VLMs for storing surgical tools, medical devices, and pharmaceuticals. These systems support traceability, regulatory compliance, and protection against contamination. The global rise in healthcare infrastructure investment is expected to further fuel demand for these systems.

The major players in the VLM market are Kardex (Switzerland), Haenel (Germany), System Spa (Italy), Ferretto (Italy), and ICAM S.r.l. (Italy).

Regional Analysis

North America

North America represents one of the largest markets for vertical lift modules due to advanced manufacturing practices and strong adoption of automation technologies. The United States, in particular, leads in e-commerce fulfillment and warehouse automation. High labor costs, coupled with an emphasis on operational efficiency, continue to drive installations across industries such as automotive, healthcare, and logistics.

Europe

Europe has been a pioneer in adopting automated storage solutions, driven by high space costs and strict safety regulations. Countries like Germany, France, and Italy have well-established manufacturing sectors that rely on vertical storage for optimizing production and maintenance operations. The presence of key automation companies and integrators further strengthens the regional market.

Asia Pacific

Asia Pacific is the fastest-growing regional market, led by countries such as China, Japan, India, and South Korea. Rapid industrialization, booming e-commerce, and government incentives for smart manufacturing have accelerated VLM adoption. As more factories modernize their operations and warehouse automation gains traction, Asia Pacific will become a key contributor to global market revenue by 2035.

Middle East, Africa, and Latin America

These regions are emerging markets for vertical lift modules. Industrial growth, new logistics hubs, and infrastructure development in the Middle East and Latin America are creating opportunities for automated storage systems. However, high initial costs and limited local manufacturing still pose challenges to large-scale adoption. As awareness and investment in automation increase, gradual growth is expected.

Technological Advancements

The future of vertical lift modules is closely tied to digital transformation. Integration with artificial intelligence, Internet of Things, and predictive analytics allows real-time monitoring, remote diagnostics, and predictive maintenance. Smart sensors enhance accuracy, while machine vision ensures correct tray retrieval and placement.

In addition, cloud-based software and advanced warehouse management systems are enabling centralized control of multiple VLM units across locations. Collaborative robots and automated guided vehicles are being combined with VLMs for seamless goods movement, further enhancing automation levels in warehouses and manufacturing floors. Energy-efficient motors and regenerative drives are also being introduced to reduce power consumption and support sustainability goals.

Market Outlook from 2025 to 2035

The global vertical lift module market is expected to grow steadily between 2025 and 2035, driven by industrial automation, digitalization, and the shift toward smart warehouses. Dual-level systems will see faster adoption due to their higher throughput capacity, while refrigerated systems will grow rapidly in healthcare and food sectors.

As companies move toward Industry 4.0, the integration of VLMs with robotics, digital twins, and AI-driven analytics will become a standard practice. Investments in warehouse modernization, particularly in Asia and North America, will keep market growth strong. The focus on energy efficiency, system scalability, and cloud connectivity will define competitive differentiation among manufacturers.

Competitive Landscape

The market is moderately fragmented, with several global and regional players offering customized VLM solutions. Leading manufacturers are focusing on product innovation, modular designs, and user-friendly software interfaces. Strategic partnerships with system integrators and logistics firms are helping companies expand their global reach. After-sales services, predictive maintenance capabilities, and customer training programs are increasingly becoming important differentiators in vendor selection.

As demand grows, new entrants are likely to emerge, particularly in emerging economies, offering cost-effective and localized solutions. The trend toward flexible financing options such as leasing and subscription-based models is also expected to make advanced automation accessible to mid-sized enterprises.

The vertical lift module market is poised for long-term growth, supported by global trends in automation, digitalization, and sustainability. By addressing challenges related to cost and integration, manufacturers and system providers can unlock significant opportunities in both developed and developing markets.

From automotive to healthcare, every major industry is recognizing the advantages of compact, automated storage solutions that enhance efficiency and safety. With continued innovation and the adoption of smart technologies, the vertical lift module market will play a central role in shaping the future of intelligent warehousing and industrial automation through 2035.

Growth opportunities and latent adjacency in Vertical Lift Module Market