Veterinary Antimicrobial Susceptibility Testing Market Size by Product (Disks, Plates, Media, Accessories, Consumables, Automated AST), Animal (Dog, Cat, Horse, Cattle, Pig, Poultry), End User (Veterinary Reference Labs, Universities) & Region - Global Forecast to 2026

Market Growth Outlook Summary

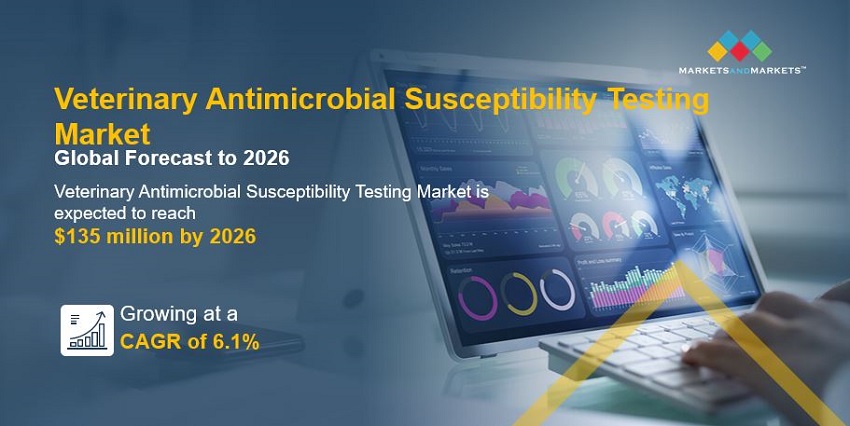

The global veterinary antimicrobial susceptibility testing market growth forecasted to transform from $100 million in 2021 to $135 million by 2026, driven by a CAGR of 6.1%. Growth in the market is largely driven by the growing threat of antimicrobial resistance due to the overuse of antibiotics, rising demand for animal-derived products, the growing prevalence of zoonotic diseases, rising demand for pet insurance, growing animal health expenditure, and the growing number of veterinary practitioners and their rising income levels in developed economies. On the other hand, the high cost of automated veterinary antimicrobial susceptibility testing systems and rising pet care costs are expected to restrain overall market growth to a certain extent.

To know about the assumptions considered for the study, download the pdf brochure

Veterinary Antimicrobial Susceptibility Testing Market Dynamics

Driver: growing threat of antimicrobial resistance due to overuse of antibiotics

The overuse of antimicrobials as growth promoters in food-producing animals (especially in the poultry and swine sectors) is a major concern worldwide. Apart from being used as growth promoters, antimicrobials are also included in animal feed as preventative, prophylactic, and metaphylactic treatment measures. The use of antimicrobials (as growth promoters as well as prophylactic treatment measures) is reportedly higher in healthy animals than in sick animals. According to the WHO, approximately 80% of all antibiotics manufactured worldwide are used on livestock animals. The easy availability of antimicrobials from feed suppliers is a major reason for their overuse. Antimicrobial overuse, however, increases the risk of antimicrobial resistance (AMR), which leads to serious clinical and economic implications. Government and regulatory bodies have also designed antimicrobial stewardship programmes to increase awareness among veterinarians, livestock farmers, and pet owners. These programmes recommend restricting the use of antimicrobials as growth promoters in livestock animals and promoting the adoption of antimicrobial susceptibility tests before prescribing commonly used antibiotics for sick animals.

Restraint: High cost of automated veterinary antimicrobial susceptibility testing systems

One of the main drawbacks of traditional or manual veterinary antimicrobial susceptibility testing methods (such as agar dilution, chromogenic agar method, disc diffusion, and micro-broth dilution) is the time taken to obtain the results, which can vary from 24 to 48 hours. Automated veterinary antimicrobial susceptibility testing systems provide rapid results with better accuracy and fewer chances of human error. However, the adoption of these systems in veterinary laboratories is limited, especially in developing countries, due to their high cost. Moreover, expensive reagents and consumables are used for these systems, along with additional costs incurred for trained personnel. This increases the overall test cost. The high cost of these diagnostic tests is one of the major reasons for their low adoption in both developed and developing countries. Since the volumes of veterinary samples received for testing are generally small, veterinary diagnostic laboratories do not prefer to invest in expensive systems. Most veterinary practises are small or medium-sized, with strict budgetary constraints; the high cost of these systems is, therefore, a major market restraint.

Opportunity: Rising focus on veterinary antimicrobial susceptibility testing in emerging markets due to supportive government initiatives

Companion animal ownership has grown significantly across the globe. This is particularly evident in emerging markets in APAC and Latin America due to urbanisation and an increase in disposable incomes, which have expanded access to animal healthcare and enabled owners to spend more on pet care. Emerging countries like India and China have robust livestock markets. According to the Livestock Production Statistics of India 2018, India is one of the world's largest milk producers, followed by the US, China, Brazil, and Pakistan. According to the USDA Foreign Agricultural Service in 2017, China is the fourth-largest beef producer in the world. According to the FAO, China was also the world's largest hog producer and pork consumer. Milk consumption in China is also increasing at a rapid pace. To provide quality animal-derived food products, various animal healthcare products are used to prevent and control diseases in livestock animals. This increasing government focus and efforts to promote the appropriate usage of antibiotics in emerging countries have increased the number of clinical diagnostic procedures carried out, which, in turn, would increase the sales of AST products in these regions. The emerging economies are expected to become a focal point for the growth of the veterinary antimicrobial susceptibility testing market. The Asia Pacific, Middle Eastern, and Latin American regions are relatively untapped markets for companies compared to Europe and North America. Growth in these untapped markets is supported by various initiatives by government organisations to combat veterinary antibiotic resistance.

Challenge: Low awareness about antimicrobial resistance among veterinarians and livestock farmers

The major driver for antibiotic resistance is widespread antibiotic use, including appropriate and inappropriate use. The Centers for Disease Control and Prevention (CDC) report that up to 50% of all antibiotics in outpatient healthcare are unnecessarily or incorrectly prescribed. To reduce the inappropriate use of antibiotics, various associations and regulatory bodies have published guidelines for the use of antimicrobials. For instance, the International Society of Companion Animal Infectious Diseases (ISCAID) has published antibiotic guidelines for three disease syndromes: canine pyoderma, canine and feline urinary tract infections, and canine and feline respiratory diseases. Culture and sensitivity testing is an important diagnostic tool that provides information about infection aetiology and resistance profiles. However, awareness regarding the importance of these diagnostic tests and AMR among veterinarians in both developed and developing countries is very low. According to the 2015 Washington State Study report (a survey of veterinary antimicrobial prescribing practises in Washington State), almost 25% of veterinarians in Washington State (US) are not currently using AST, and the remaining 75% use it less than 75% of the time.

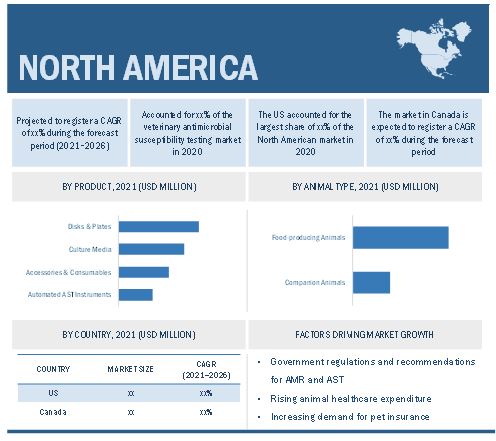

North America is expected to account for the largest share of the veterinary antimicrobial susceptibility testing industry.

The US accounted for the largest share of the North American veterinary antimicrobial susceptibility testing market. The market in North America is characterised by the increasing population of companion and food-producing animals, rising meat and dairy product consumption, the availability of technologically advanced veterinary reference laboratories, strict guidelines for the usage of antimicrobials, rising veterinary healthcare expenditure, and growth in pet insurance coverage.

The prominent players in the veterinary antimicrobial susceptibility testing market are BioMérieux SA (France), Thermo Fisher Scientific (US), Bruker Corporation (US), Danaher Corporation (US), Becton, Dickinson and Company (US), Synbiosis (UK), Liofilchem S.r.l. (Italy), and HiMedia Laboratories (India) are the leading players in the veterinary antimicrobial susceptibility testing market. Bio-Rad Laboratories (US), Neogen Corporation (US), Mast Group Ltd. (UK), Condalab (Spain), FASTinov (Portugal), Hardy Diagnostics (US), Bioguard Corporation (Taiwan), and SSI Diagnostica A/S (Denmark).

Scope of the Veterinary Antimicrobial Susceptibility Testing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$100 million |

|

Projected Revenue Size by 2026 |

$135 million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 6.1% |

|

Market Driver |

Growing threat of antimicrobial resistance due to overuse of antibiotics |

|

Market Opportunity |

Rising focus on veterinary antimicrobial susceptibility testing in emerging markets due to supportive government initiatives |

The study categorizes the veterinary antimicrobial susceptibility market to forecast revenue and analyze trends in each of the following submarkets:

By Product Type

- Disks and Plates

- Culture Media

- Accessories & Consumables

- Automated AST Instruments

By Animal Type

- Food-producing Animals

- Cattle

- Pigs

- Poultry

- Other Food-producing Animals

- Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

By End User

- Veterinary Reference Laboratory

- Veterinary Research Institutes and Universities

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments of the Veterinary Antimicrobial Susceptibility Testing Industry

- In 2020, Becton, Dickinson and Company (US) announced collaboration with Fleming Fund Aid Program to help low- and middle-income countries tackle AMR and increase awareness about AST.

- In 2019, Synbiosis (UK) launched AutoCol, an automated colony counter system.

- In 2018, Thermo Fisher Scientific (US) launche AST Plates Zactran to detect respiratory diseases in cattle.

- In 2017, Bruker Corporation (US) accquired Merlin Diagnostika to add selected antibiotic resistance and susceptibility testing products to its MALDI Biotyper Microbial Identification Platform.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the veterinary antimicrobial susceptibility testing market?

The veterinary antimicrobial susceptibility testing market boasts a total revenue value of $135 million by 2026.

What is the estimated growth rate (CAGR) of the veterinary antimicrobial susceptibility testing market?

The global veterinary antimicrobial susceptibility testing market has an estimated compound annual growth rate (CAGR) of 6.1% and a revenue size in the region of $100 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.3.3 CURRENCY

1.3.4 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

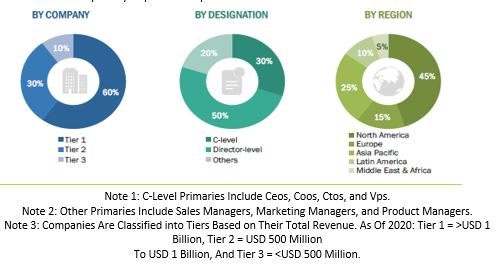

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION: BIOMÉRIEUX

FIGURE 6 REVENUE ANALYSIS OF TOP 5 COMPANIES: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET (2020)

FIGURE 7 DEMAND-SIDE ANALYSIS

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MARKET (2021–2026)

FIGURE 10 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS/RISK ASSESSMENT

2.7 COVID-19 HEALTH ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 12 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 13 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 14 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2021 VS. 2026

FIGURE 15 GLOBAL MARKET, BY ANIMAL TYPE, 2021 VS. 2026

FIGURE 16 GLOBAL MARKET, BY END USER, 2021 VS. 2026

FIGURE 17 GEOGRAPHIC SNAPSHOT: GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 18 GROWING ANIMAL POPULATION AND INCREASING ANIMAL HEALTHCARE EXPENDITURE ARE KEY FACTORS DRIVING MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY PRODUCT

FIGURE 19 DISKS & PLATES COMMANDED THE LARGEST SHARE OF THE GLOBAL MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC MIX

FIGURE 20 CHINA TO WITNESS THE HIGHEST GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Growing threat of antimicrobial resistance due to overuse of antibiotics

FIGURE 22 SALES AND DISTRIBUTION OF ANTIMICROBIAL DRUGS APPROVED FOR USE IN FOOD-PRODUCING ANIMALS IN THE US (2010–2019)

5.2.1.2 Rising demand for animal-derived food products

TABLE 1 PAST AND PROJECTED TRENDS IN THE CONSUMPTION OF MEAT AND MILK IN DEVELOPED AND DEVELOPING REGIONS

TABLE 2 SIA: COUNTRY-LEVEL CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

TABLE 3 ASIA: COUNTRY-LEVEL PRODUCTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2020 VS. 2030 (THOUSAND METRIC TONS)

FIGURE 23 ASIA WAS THE HIGHEST CONSUMER OF MEAT AND MILK IN THE WORLD 2018

5.2.1.3 Growing prevalence of zoonotic diseases

TABLE 4 ANIMAL DISEASE OUTBREAKS IN ASIA PACIFIC COUNTRIES (2009–2019)

5.2.1.4 Rising demand for pet insurance and growing animal health expenditure

FIGURE 24 US: PET INDUSTRY EXPENDITURE, 2010–2019

5.2.1.5 Growing number of veterinary practitioners & their rising income levels in developed economies

TABLE 5 NUMBER OF VETERINARIANS AND PARA-VETERINARIANS IN DEVELOPED COUNTRIES, 2012–2018

TABLE 6 MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 MARKET RESTRAINTS

5.2.2.1 High cost of automated veterinary antimicrobial susceptibility testing systems

5.2.2.2 Rising pet care costs

TABLE 7 MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Rising focus on veterinary antimicrobial susceptibility testing in emerging markets due to supportive government initiatives

5.2.3.2 Growth in the companion animal population

TABLE 8 PET POPULATION, BY ANIMAL, 2014–2018 (MILLION)

TABLE 9 MARKET OPPORTUNITY: IMPACT ANALYSIS

5.2.4 MARKET CHALLENGES

5.2.4.1 Low awareness about antimicrobial resistance in veterinarians and livestock farmers

5.2.4.2 Limited guidelines for interpretation of veterinary antimicrobial susceptibility test results

5.2.4.3 Shortage of veterinary practitioners and skilled veterinary pathologists in developing markets

TABLE 10 NUMBER OF VETERINARY PROFESSIONALS, BY COUNTRY, 2005 VS. 2014 VS. 2018

TABLE 11 MARKET CHALLENGES: IMPACT ANALYSIS

5.3 TECHNOLOGICAL ANALYSIS

FIGURE 25 TECHNOLOGICAL ADVANCEMENTS ARE A MAJOR TREND IN THE GLOBAL MARKET

5.4 PRICING ANALYSIS

TABLE 12 REGIONAL PRICING ANALYSIS OF AUTOMATED AST INSTRUMENTS, 2019 (USD)

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 GLOBAL MARKET: VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM MARKET MAP

FIGURE 27 VETERINARY ANTIMICROBIAL SENSITIVITY TESTING MARKET: ECOSYSTEM MARKET MAP

FIGURE 28 VETERINARY ANTIMICROBIAL SENSITIVITY TESTING MARKET: ECOSYSTEM MARKET MAP

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 INTENSITY OF COMPETITIVE RIVALRY

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 BARGAINING POWER OF SUPPLIERS

5.7.5 THREAT FROM SUBSTITUTES

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 29 GLOBAL MARKET: SUPPLY CHAIN ANALYSIS

5.9 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.10 REGULATORY ANALYSIS

5.11 PATENT ANALYSIS

5.11.1 PATENT PUBLICATION TRENDS FOR VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING INSTRUMENTS

FIGURE 30 PATENT PUBLICATION TRENDS (2015–2020)

5.11.2 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING INSTRUMENTS

FIGURE 31 TOP APPLICANTS (COMPANIES/INSTITUTIONS) FOR VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING INSTRUMENTS (2015–2021)

5.12 DIFFERENCE BETWEEN 96-WELL PLATES AND 384-WELL PLATES

TABLE 14 DIFFERENCE BETWEEN 96-WELL PLATES AND 384-WELL PLATES

5.13 CUSTOMIZED VS. PORTFOLIO PRODUCTS

6 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT (Page No. - 83)

6.1 INTRODUCTION

TABLE 15 GLOBAL MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 DISKS & PLATES

6.2.1 DISKS & PLATES ACCOUNTED FOR THE LARGEST SHARE OF THE VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET IN 2020

TABLE 16 LEADING DISKS & PLATES AVAILABLE IN THE MARKET FOR VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING (2020)

TABLE 17 GLOBAL MARKET FOR DISKS & PLATES, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 CULTURE MEDIA

6.3.1 CONSTANT REQUIREMENT AND REPETITIVE PURCHASE OF CULTURE MEDIA TO DRIVE MARKET GROWTH

TABLE 18 GLOBAL MARKET FOR CULTURE MEDIA, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 ACCESSORIES & CONSUMABLES

6.4.1 WIDE USE OF MANUAL METHODS LIKE DISK DIFFUSION WILL DRIVE THE GROWTH OF THIS SEGMENT

TABLE 19 GLOBAL MARKET FOR ACCESSORIES & CONSUMABLES, BY COUNTRY, 2019–2026 (USD MILLION)

6.5 AUTOMATED AST INSTRUMENTS

6.5.1 ONGOING TREND OF LABORATORY AUTOMATION TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 20 ADVANTAGES OF AUTOMATED AST OVER DISKS & PLATES

TABLE 21 GLOBAL MARKET FOR AUTOMATED AST INSTRUMENTS, BY COUNTRY, 2019–2026 (USD MILLION)

7 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY ANIMAL TYPE (Page No. - 91)

7.1 INTRODUCTION

TABLE 22 GLOBAL MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

7.2 FOOD-PRODUCING ANIMALS

FIGURE 32 MARKET FOR CATTLE TO DOMINATE THE GLOBAL MARKET FOR FOOD-PRODUCING ANIMALS DURING THE FORECAST PERIOD

TABLE 23 GLOBAL MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 24 GLOBAL MARKET FOR FOOD-PRODUCING ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 CATTLE

7.2.1.1 Increasing cattle population and growing consumption of meat to drive growth in the veterinary AST market

TABLE 25 EXAMPLES OF CATTLE-RELATED AMR HUMAN HEALTH THREATS

TABLE 26 CATTLE POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 27 GLOBAL MARKET FOR CATTLE, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 PIGS

7.2.2.1 Growing incidence of infectious diseases will support market growth

TABLE 28 SWINE POPULATION, BY COUNTRY, 2012–2019 (MILLION)

FIGURE 33 PER CAPITA PORK CONSUMPTION, 2006–2018 (POUNDS)

TABLE 29 GLOBAL MARKET FOR PIGS, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 POULTRY

7.2.3.1 Growing infectious disease prevalence in poultry will support the growth of the global market

FIGURE 34 PER CAPITA POULTRY MEAT CONSUMPTION, 2006–2018 (POUNDS)

TABLE 30 POULTRY POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 31 GLOBAL MARKET FOR POULTRY, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 OTHER FOOD-PRODUCING ANIMALS

TABLE 32 GLOBAL MARKET FOR OTHER FOOD-PRODUCING ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 COMPANION ANIMALS

TABLE 33 POPULATION OF DOGS AND CATS, BY COUNTRY, 2012–2019 (MILLION)

FIGURE 35 MARKET FOR DOGS TO REGISTER THE HIGHEST GROWTH IN THE GLOBAL MARKET FOR COMPANION ANIMALS DURING THE FORECAST PERIOD

TABLE 34 GLOBAL MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 GLOBAL MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 DOGS

7.3.1.1 Dogs dominate the global market for companion animals

TABLE 36 DOG POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 37 GLOBAL MARKET FOR DOGS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 CATS

7.3.2.1 Increasing pet cat population to drive market growth

TABLE 38 CAT POPULATION, BY COUNTRY, 2012–2019 (MILLION)

TABLE 39 GLOBAL MARKET FOR CATS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 HORSES

7.3.3.1 Growing equine health awareness will drive the market growth

TABLE 40 EQUINE POPULATION, BY COUNTRY, 2012–2019 (THOUSAND)

TABLE 41 GLOBAL MARKET FOR HORSES, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 OTHER COMPANION ANIMALS

TABLE 42 GLOBAL MARKET FOR OTHER COMPANION ANIMALS, BY COUNTRY, 2019–2026 (USD MILLION)

8 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER (Page No. - 111)

8.1 INTRODUCTION

TABLE 43 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

8.2 VETERINARY REFERENCE LABORATORIES

8.2.1 VETERINARY REFERENCE LABORATORIES ARE THE LARGEST END USERS OF VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTS

TABLE 44 GLOBAL MARKET FOR VETERINARY REFERENCE LABORATORIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 VETERINARY RESEARCH INSTITUTES AND UNIVERSITIES

8.3.1 INCREASING FUNDING FOR RESEARCH ON ANTIMICROBIAL RESISTANCE AND AST IN UNIVERSITIES TO BOOST MARKET GROWTH

TABLE 45 GLOBAL MARKET FOR VETERINARY RESEARCH INSTITUTES AND UNIVERSITIES, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 OTHER END USERS

TABLE 46 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION (Page No. - 116)

9.1 INTRODUCTION

FIGURE 36 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 47 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 37 EXPECTED GROWTH IN THE NUMBER OF VETERINARIANS IN NORTH AMERICA

FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 The US dominated the North American market in 2020

FIGURE 39 US: EXPENDITURE ON VET VISITS

FIGURE 40 US: NUMBER OF VETERINARIANS, 2014–2019

TABLE 54 US: FOOD-PRODUCING ANIMAL POPULATION, 2001–2019 (MILLION)

FIGURE 41 DOMESTIC SALES AND DISTRIBUTION OF MEDICALLY IMPORTANT ANTIMICROBIAL DRUGS FOR PRODUCTION AND THERAPEUTIC INDICATIONS IN THE US (THOUSAND KG)

TABLE 55 US: NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, 2014 VS. 2019

TABLE 56 US: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 57 US: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 58 US: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 US: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Slow economic growth in Canada severely affects its share in the North American Market

TABLE 61 CANADA: LARGE ANIMAL POPULATION, 2001–2014 (MILLION)

TABLE 62 CANADA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 63 CANADA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 64 CANADA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 65 CANADA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3 EUROPE

TABLE 67 EUROPE: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 70 EUROPE: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 UK

9.3.1.1 The UK is the largest market for veterinary antimicrobial susceptibility testing in Europe

FIGURE 42 SALES OF ANTIBIOTICS FOR FOOD-PRODUCING ANIMALS IN THE UK FROM 2015 TO 2019 (MG/KG)

TABLE 73 UK: PET POPULATION, 2016–2019 (MILLION)

FIGURE 43 NUMBER OF PRACTICING VETERINARIANS IN THE UK, 2013–2017

TABLE 74 UK: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 75 UK: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 76 UK: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 77 UK: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 Strict government regulations for AST to drive market growth in Germany

FIGURE 44 SALES SURVEILLANCE OF ANTIMICROBIALS FOR VETERINARY USE IN GERMANY (2011–2018)

TABLE 79 GERMANY: PET POPULATION, 2012–2019 (MILLION)

TABLE 80 GERMANY: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 82 GERMANY: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 GERMANY: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Mandatory AST before prescribing antibiotics in animals to drive market growth

TABLE 85 FRANCE: COMPANION ANIMAL POPULATION, 2010–2019 (MILLION)

TABLE 86 FRANCE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 88 FRANCE: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 89 FRANCE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Increasing food-producing animal population and growing awareness of AMR will generate high demand for AST in Italy

TABLE 91 ITALY: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 92 ITALY: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 93 ITALY: MARKET,BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 94 ITALY: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 ITALY: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Increasing demand for good quality animal-based food products is a major factor driving market growth

TABLE 97 SPAIN: LARGE ANIMAL POPULATION, 2001–2019 (MILLION)

TABLE 98 SPAIN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 SPAIN: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 100 SPAIN: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 SPAIN: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.6 REST OF EUROPE (ROE)

TABLE 103 COMPANION ANIMAL OWNERSHIP IN THE REST OF EUROPE, 2018 (MILLION)

TABLE 104 REST OF EUROPE: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4 ASIA PACIFIC (APAC)

TABLE 109 APAC: FOOD-PRODUCING ANIMAL POPULATION, 2010–2018 (MILLION)

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 110 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China dominated the APAC market in 2020

TABLE 116 CHINA: FOOD-PRODUCING ANIMAL POPULATION, 2012–2019 (MILLION)

TABLE 117 CHINA: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 118 CHINA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 119 CHINA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 CHINA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Increasing risk of AMR due to high use of antimicrobial feed additives drives the market growth in Japan

FIGURE 46 VOLUME OF VETERINARY ANTIMICROBIALS SOLD BY PHARMACEUTICAL COMPANIES IN JAPAN, 2001–2017 (IN TONS OF ACTIVE INGREDIENT)

FIGURE 47 AMOUNT OF ANTIMICROBIAL FEED ADDITIVES MANUFACTURED IN JAPAN, 2003–2017 (IN TONS OF ACTIVE INGREDIENT)

TABLE 122 JAPAN: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 124 JAPAN: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 JAPAN: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Rising food-producing animal population and growing awareness about animal health will contribute to market growth during the forecast period

TABLE 127 INDIA: FOOD-PRODUCING ANIMAL POPULATION, 2010–2019 (MILLION)

TABLE 128 INDIA: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 129 INDIA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 130 INDIA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 INDIA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 132 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.4 ROAPAC

TABLE 133 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 134 REST OF ASIA PACIFIC: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 135 REST OF ASIA PACIFIC: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 REST OF ASIA PACIFIC: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 INCREASING BEEF AND POULTRY MEAT EXPORTS SUPPORTS THE MARKET GROWTH

TABLE 138 LATIN AMERICA: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 AVAILABILITY OF FUNDING TO PROMOTE ANIMAL HEALTHCARE IN THIS REGION SUPPORTS OVERALL MARKET GROWTH

TABLE 143 MIDDLE EAST: NUMBER OF VETERINARIANS AND PARAVETERINARIANS, BY COUNTRY (2016 VS. 2018)

TABLE 144 AFRICA: NUMBER OF VETERINARIANS, 2010 VS. 2014 VS. 2016

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY ANIMAL TYPE, 2019–2026 (USD MILLION)

TABLE 147 MIDDLE EAST & AFRICA: MARKET FOR FOOD-PRODUCING ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET FOR COMPANION ANIMALS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 173)

10.1 KEY PLAYER STRATEGIES

FIGURE 48 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN 2017 AND 2021 (JANUARY)

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 49 MARKET EVALUATION FRAMEWORK: MARKET CONSOLIDATION THROUGH PARTNERSHIPS, COLLABORATIONS, ACQUISITIONS, AND AGREEMENTS

10.3 REVENUE ANALYSIS

FIGURE 50 REVENUE ANALYSIS: VETERINARY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, 2020

10.4 MARKET SHARE ANALYSIS

FIGURE 51 GLOBAL MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

TABLE 150 COMPETITION ANALYSIS: GLOBAL MARKET, 2020

10.5 COMPANY EVALUATION QUADRANT/DIVE MATRIX

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 52 COMPANY EVALUATION QUADRANT/DIVE MATRIX: GLOBAL MARKET

FIGURE 53 COMPANY PRODUCT FOOTPRINT: GLOBAL MARKET

10.6 GLOBAL MARKET: GEOGRAPHICAL ASSESSMENT

FIGURE 54 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN THE GLOBAL MARKET (2020)

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 PRODUCT LAUNCHES & ENHANCEMENTS

TABLE 151 PRODUCT LAUNCHES & ENHANCEMENTS (2017 – JANUARY 2021)

10.7.2 DEALS

TABLE 152 DEALS (2017–JANUARY 2021)

11 COMPANY PROFILES (Page No. - 182)

11.1 SUPPLY-SIDE PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 153 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 55 COMPANY SNAPSHOT: THERMO FISHER SCIENTIFIC (2019)

11.1.2 BECTON, DICKINSON AND COMPANY

TABLE 154 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 56 COMPANY SNAPSHOT: BECTON, DICKINSON AND COMPANY (2020)

11.1.3 BRUKER CORPORATION

TABLE 155 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 57 COMPANY SNAPSHOT: BRUKER CORPORATION (2019)

11.1.4 BIOMÉRIEUX SA.

TABLE 156 BIOMÉRIEUX: BUSINESS OVERVIEW

FIGURE 58 COMPANY SNAPSHOT: BIOMÉRIEUX S.A. (2019)

11.1.5 DANAHER CORPORATION

TABLE 157 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 59 COMPANY SNAPSHOT: DANAHER CORPORATION (2019)

11.1.6 BIO-RAD LABORATORIES, INC.

TABLE 158 BIO-RAD LABORATORIES: BUSINESS OVERVIEW

FIGURE 60 COMPANY SNAPSHOT: BIO-RAD LABORATORIES, INC. (2020)

11.1.7 NEOGEN CORPORATION

TABLE 159 NEOGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 61 COMPANY SNAPSHOT: NEOGEN CORPORATION (2020)

11.1.8 HIMEDIA LABORATORIES

TABLE 160 HIMEDIA LABORATORIES: BUSINESS OVERVIEW

11.1.9 MAST GROUP LTD.

TABLE 161 MAST GROUP LTD.: BUSINESS OVERVIEW

11.1.10 BIOGUARD CORPORATION

TABLE 162 BIOGUARD CORPORATION: BUSINESS OVERVIEW

11.1.11 SSI DIAGNOSTICA A/S

TABLE 163 SSI DIAGNOSTICA A/S: BUSINESS OVERVIEW

11.1.12 CONDALAB

TABLE 164 CONDALAB: BUSINESS OVERVIEW

11.1.13 FASTINOV SA

TABLE 165 FASTINOV SA: BUSINESS OVERVIEW

11.1.14 SYNBIOSIS

TABLE 166 SYNBIOSIS: BUSINESS OVERVIEW

11.1.15 HARDY DIAGNOSTICS

TABLE 167 HARDY DIAGNOSTICS: BUSINESS OVERVIEW

11.1.16 LIOFILCHEM SRL.

TABLE 168 LIOFILCHEM SRL: BUSINESS OVERVIEW

11.2 DEMAND-SIDE PLAYERS

11.2.1 IDEXX REFERENCE LABORATORIES

TABLE 169 IDEXX LABORATORIES, INC.: BUSINESS OVERVIEW

FIGURE 62 COMPANY SNAPSHOT: IDEXX LABORATORIES, INC. (2020)

11.2.2 UNIVERSITY OF MINNESOTA (VETERINARY DIAGNOSTIC LABORATORY)

11.2.3 IOWA STATE UNIVERSITY (VETERINARY DIAGNOSTIC LABORATORY)

11.2.4 CORNELL UNIVERSITY (ANIMAL HEALTH DIAGNOSTIC CENTER)

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 219)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the veterinary antimicrobial susceptibility testing market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the veterinary antimicrobial susceptibility testing market was arrived at after data triangulation from four different approaches (Supply-side Analysis (Revenue Share Analysis), Parent Market Approach, Company Presentations, Primary Interviews and Demand-side Analysis). After each approach, the weighted average of the four approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Objectives of the Study

- To define, describe, and forecast the global market based on product, animal type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyse micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyse the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the global market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile the key players in the global market and comprehensively analyse their core competencies and market shares

- To track and analyse competitive developments such as product launches, acquisitions, and partnerships in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe market into Belgium, Russia, the Netherlands, Switzerland, and others

- Further breakdown of the Latin American market into Brazil, Mexico, and the Rest of Latin America

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Antimicrobial Susceptibility Testing Market