Augmented and Virtual Reality in Education Market Size, Share, Statistics and Industry Growth Analysis Report by Offering Type (Software, Hardware, Services), Device Type, Deployment (On-Premise, Cloud), Application, End User (Academic Institutions, Corporates) and Region - Global Forecast to 2028

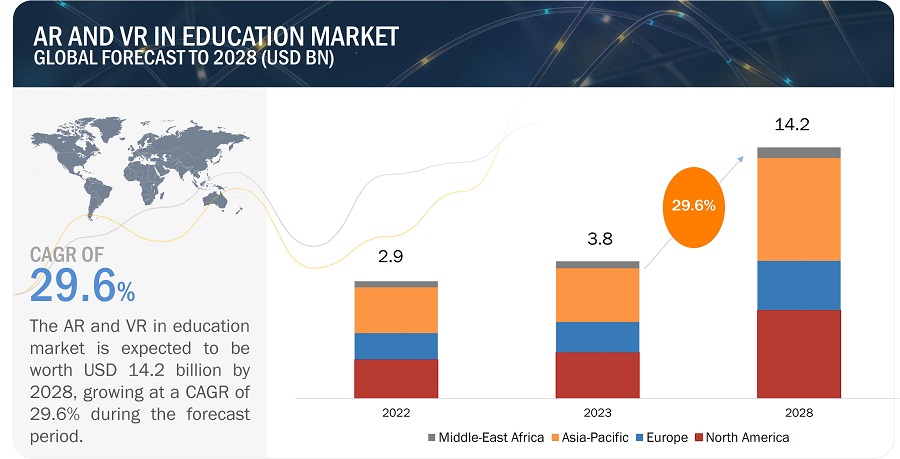

[239 Pages Report] The global AR and VR in Education Market Size was valued at USD 3.8 Billion in 2023 and is projected to reach USD 14.2 Billion by 2028; it is expected to register a CAGR of 29.6% during the forecast period.

Advancing education through ongoing innovation & expansion in AR & VR technology, enhanced understanding through visualization, and real-world application and career readiness are among the factors driving the growth of AR and VR in education industry.

Augmented and Virtual Reality in Education Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Augmented and Virtual Reality in Education Market Dynamics:

Driver: Enhanced understanding through visualization

Visualization of complex concepts serves as a powerful driver for incorporating AR and VR technologies in education. These technologies create immersive and interactive experiences that engage students and promote a deeper understanding of abstract ideas.

The integration of augmented reality (AR) in education has had a significant positive impact, enhancing the learning process in the classroom. One particular area where AR has proven beneficial is in geometry teaching, as it enables the explanation of fundamental operations like perimeters, areas, and diameters. In this section, we will delve into the application of AR in education, exploring its advantages and benefits for students.

Virtual reality (VR) offers immersive experiences in alternate realities that closely resemble the real world. This technology has found applications in education, where it facilitates the learning of complex subjects and fosters cultural connections among students. By leveraging VR, educators can teach the importance of respecting and appreciating cultural diversity, promoting acceptance of differences among students. The interactive nature of virtual reality allows students to engage with diverse environments and experiences, leading to a more inclusive and empathetic learning environment.

For example, in biology, AR and VR can enable students to explore the human body in 3D, allowing them to visualize the intricate systems and organs in a way that traditional textbooks cannot convey. In physics, students can use VR simulations to visualize and interact with abstract concepts like electromagnetic fields or quantum mechanics, helping them grasp these challenging topics more effectively. Moreover, AR and VR can transport students to historical periods, such as ancient civilizations or significant historical events, allowing them to immerse themselves in the context and gain a tangible understanding of the subject matter. By visualizing complex concepts, AR and VR technologies provide a dynamic and engaging learning environment that fosters comprehension and retention, making education more interactive and impactful.

Restraint: Standardization and interoperability in AR and VR implementation

The absence of standardized frameworks and guidelines for AR and VR development creates challenges in ensuring compatibility and seamless integration across different platforms, devices, and software applications. This lack of standardization hampers the widespread adoption of AR and VR in education as it limits interoperability between different hardware and software solutions. Educational institutions may face difficulties in finding compatible AR and VR tools and content that align with their specific needs and requirements. Moreover, the absence of industry standards can lead to fragmentation and inconsistency in the quality, functionality, and user experience of AR and VR applications. Establishing industry standards and promoting interoperability would enable educational institutions to have a wider range of choices and options, fostering flexibility and scalability in the implementation of AR and VR technologies. Additionally, industry standards would facilitate collaboration, content sharing, and the development of a robust ecosystem of AR and VR resources, further enhancing the effectiveness and accessibility of these technologies in education.

Opportunity: Immersive Collaboration and Communication

AR and VR technologies provide unique opportunities for collaboration and communication among students, regardless of their physical location. These immersive technologies allow students to interact in shared virtual spaces, enabling them to work together on projects and engage in collaborative problem-solving activities. Through avatars or virtual representations, students can communicate, share ideas, and collaborate on tasks in real-time. This fosters the development of teamwork skills, as students learn to coordinate and cooperate with their peers in a virtual environment. Collaborative activities in AR and VR promote peer learning, as students can exchange knowledge, provide feedback, and learn from each other’s perspectives. By engaging in collaborative experiences facilitated by AR and VR, students gain valuable skills for the future, preparing them to work effectively in collaborative environments in their academic and professional lives.

Challenge: Inadequate infrastructure and technical support

Adequate infrastructure is the requirement for high-performance devices and equipment to run AR and VR applications smoothly. These technologies often rely on powerful computers, smartphones, or specialized headsets, which may not be readily available or accessible in all educational institutions. Limited device availability can hinder the widespread adoption of AR and VR, restricting the number of students who can benefit from these immersive learning experiences. Reliable internet connectivity is another crucial infrastructure requirement for AR and VR implementation. High-quality AR and VR experiences often rely on a stable and fast internet connection to stream content, access online resources, and enable real-time collaboration. Insufficient or unreliable internet connections can lead to lagging experiences, disrupted interactions, and subpar user experience, limiting the effectiveness and usability of AR and VR in education.

Furthermore, technical support plays a crucial role in ensuring the smooth operation of AR and VR technologies. Educators and students may require assistance with setting up devices, troubleshooting technical issues, or understanding the functionalities of AR and VR software. However, inadequate technical support can leave educators feeling unsupported and ill-equipped to effectively integrate AR and VR into their teaching practices.

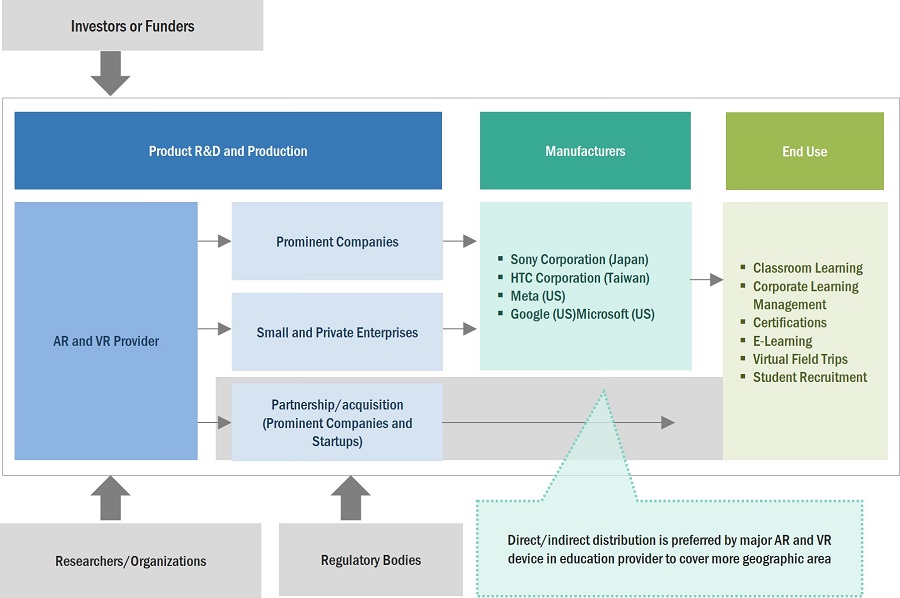

AR and VR In Education Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of AR and VR devices. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Sony Group Corporation (Japan), HTC Corporation (Taiwan), Meta (US), Google (US), Microsoft (US), Panasonic Holdings Corporation (Japan), Hitachi Ltd. (Japan), Barco (Belgium), Lenovo (Hong Kong).

By end user, the Academic Institutions segment is expected to grow with the highest CAGR from 2023 to 2028

The AR and VR in education market for academic institutions is expected to grow at the highest CAGR from 2023 to 2028. The academic users of virtual classroom solutions facilitate the process of learning and teaching through the sharing of data, voice, and video for effective collaboration and communication. This helps in the rationalization of the education process by enabling mobility, interaction, and real-time teaching. Virtual classroom solutions in the academic sector also open up new doors for knowledge sharing without the restrictions of time and distance. The academic institutions category is further segmented into 2 broad sections, namely, K-12 and higher education. This segmentation is based on the nature or level of education provided by these institutions. The academic institution type is expected to have a larger market size, as schools, colleges, and universities have been implementing and leveraging educational platforms and eLearning technologies for a more flexible and innovative learning experience.

By application, the classroom learning segment is expected to grow with a higher CAGR during the forecast period.

The classroom learning segment expected to exhibit a higher CAGR in the AR and VR in education market, by wafer size, from 2023 to 2028. Advancements in AR and VR technology have made it more accessible and cost-effective for educational institutions. The cost of hardware and software has decreased over time, making AR and VR more affordable for classrooms. Additionally, the technology has become more user-friendly, making it easier for teachers and students to integrate AR and VR into their learning environments.

By devices, AR HMD segment is expected to grow with a higher CAGR during the forecast period.

The augmented reality head-mounted display (AR HMD) segment is expected to grow at the highest CAGR from 2023 to 2028. It is a device that allows users to see a computer-generated image superimposed on their real-world view. AR HMDs are used in a variety of applications, including education, gaming, and training. AR HMD devices offer the ability to integrate virtual content seamlessly into the real-world context, enabling students to learn in a more authentic and meaningful way. Students can explore and understand abstract concepts by visualizing and interacting with virtual objects and information within their physical surroundings. This real-world contextual learning approach enhances knowledge retention and the application of learned concepts

In 2028, Asia Pacific is projected to hold the highest CAGR of the overall AR and VR in education market

Augmented and Virtual Reality in Education Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

In 2028, Asia Pacific region can be attributed to factors such as technological advancements, investment and government support, a large and diverse student population, demand for high-quality education, e-learning and remote education, cultural preservation and heritage education, industry collaboration and partnerships, rising digital literacy, market competitiveness, and research and development initiatives. These factors collectively contribute to the increasing integration of AR and VR technologies in educational practices, transforming the learning experiences of students in the Asia Pacific region.

Key Market Players

Sony Group Corporation (Japan), HTC Corporation (Taiwan), Meta (US), Google (US), Microsoft (US), Panasonic Holdings Corporation (Japan), Vuzix (US), Cornerstone OnDemand, Inc. (US), Anthology Inc. (US), Lenovo (Hong Kong) are some of the key players in the AR and VR in education companies

Augmented and Virtual Reality in Education Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 3.8 Billion |

|

Projected Market Size in 2028 |

USD 14.2 Billion |

|

Growth Rate |

CAGR of 29.6% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Forecast Units |

USD Millions/USD Billions and Million Units |

|

Segments Covered |

By offering type, device type, deployment, application, end-use, and region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Sony Group Corporation (Japan), HTC Corporation (Taiwan), Meta (US), Google (US), Microsoft (US), Panasonic Holdings Corporation (Japan), Vuzix (US), Cornerstone OnDemand, Inc. (US), Anthology Inc. (US), Lenovo (Hong Kong). |

Augmented and Virtual Reality in Education Market Highlights

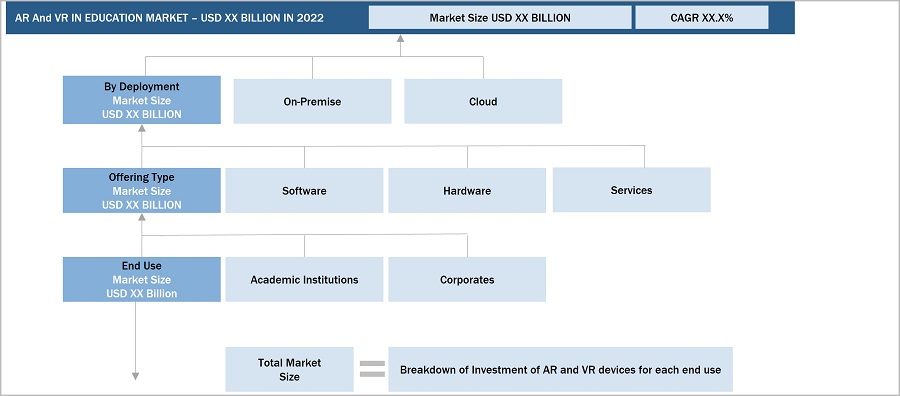

This research report categorizes the AR and VR in education market based on by offering type, device type, deployment, application, end-use, and region.

|

Segment |

Subsegment |

|

By Offerings |

|

|

By Devices Type |

|

|

By Service |

|

|

By Deployment |

|

|

By Application |

|

|

By End Use |

|

|

By Geography |

|

Recent Developments

- In January 2023, HTC Corporation launched VIVE XR Elite headset combines Mixed Reality (MR) and Virtual Reality (VR) capabilities into one compact, lightweight, powerful and highly versatile device – perfect for gaming, fitness, productivity and more.

- In January 2023, Panasonic partnered with Biel Glasses (Spain), it develops smart glasses to solve the mobility problems of visually impaired people, enabling a strong increase in their autonomy. With this partnership both the companies are developing smart glasses that support the visually impaired. It includes Panasonic's lightweight VR goggles with 5.2K HDR capabilities and Biel Glasses' technology designed for individuals with low vision.

- In March 2022, Google acquired Raxium (US), an innovator in single panel MicroLED display technologies. The acquisition added to Google’s AR hardware portfolio as Raxium develops AR display technology (micro-LED). With this acquisition, Google focuses on developing AR glasses and headsets.

- In April 2022, Google introduces multisearch in Lens, allowing users to search using both text and images simultaneously. This feature helps users find information about objects, refine searches by color or brand, and ask questions about visual attributes..

Frequently Asked Questions (FAQ):

Which are the major companies in the AR and VR in education market? What are their major strategies to strengthen their market presence?

The major companies in the AR and VR in education market are – Sony Group Corporation (Japan), HTC Corporation (Taiwan), Meta (US), Google (US), Microsoft (US), Panasonic Holdings Corporation (Japan), Vuzix (US), Cornerstone OnDemand, Inc. (US), Anthology Inc. (US), Lenovo (Hong Kong). The major strategies adopted by these players are product launches and developments.

What is the potential market for AR and VR in education in terms of the region?

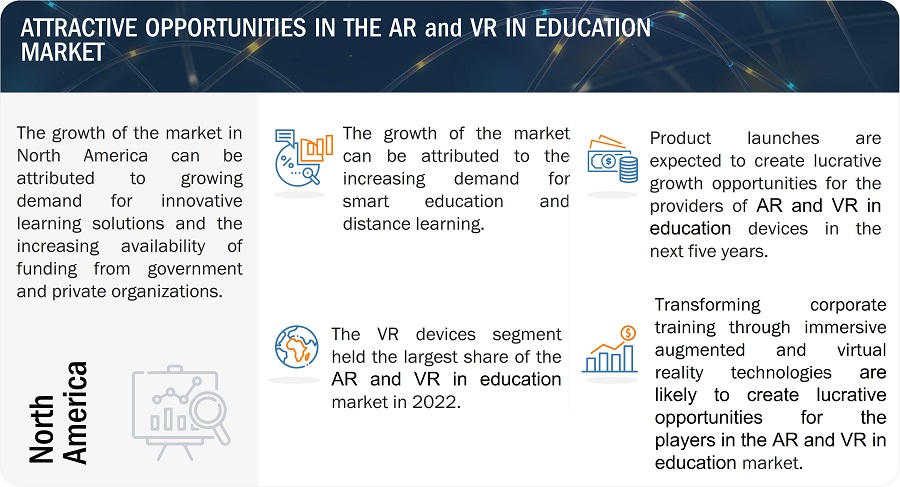

North America region is expected to dominate the AR and VR in education market owing to the demand for smart connectivity.

Who are the winners in the global AR and VR in education market?

Companies such as Sony Group Corporation (Japan), HTC Corporation (Taiwan), Meta (US), Google (US), Microsoft (US) fall under the winner’s category. These companies cater to the requirements of their customers by providing AR and VR devices. Moreover, these companies are highly adopting organic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the AR and VR in education market?

Advancing education through ongoing innovation and expansion in AR & VR technology is the driver and augmented Collaboration in AR and VR Education is the opportunity in the AR and VR in education market

What are the restraints and challenges for the AR and VR in education market?

Technical limitations in AR and VR for enhanced education experiences and Technical limitations in AR and VR for enhanced education experiences are restraints and challenges in the AR and VR in education market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

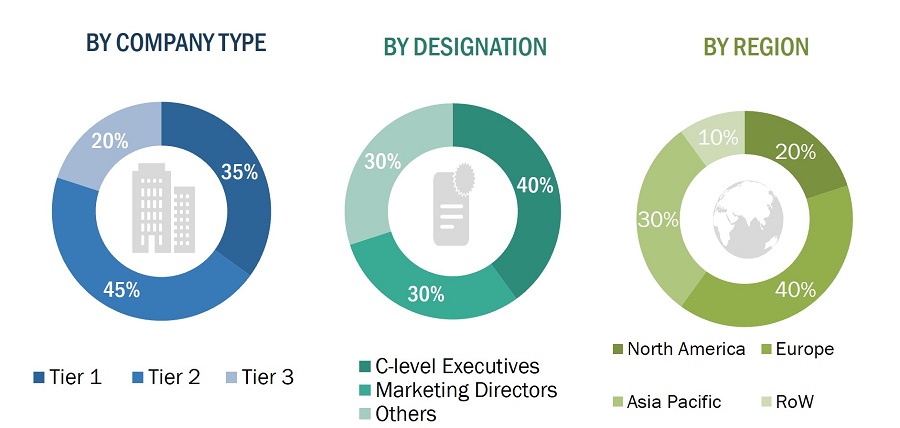

The study involved four major activities in estimating the size of AR and VR in education market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering AR and VR devices have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the AR and VR in education market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of AR and VR devices to identify key players based on their products and prevailing industry trends in the AR and VR in education market by offering type, device type, deployment, application, end-use, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of AR and VR in education market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the AR and VR in education market.

- Identifying approximate revenues of companies involved in AR and VR in education ecosystem

- Identifying different offerings of players in the AR and VR in education market

- Analyzing the global penetration of each AR and VR in education offering through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the AR and VR devices and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then, finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the AR and VR in education market

The top-down approach has been used to estimate and validate the total size of the AR and VR in education market.

- Focusing initially on the top-line investments and expenditures made in the AR and VR in education ecosystem; further splitting into offering and listing key developments in key market areas

- Identifying all major players offering a variety of AR and VR devices, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence for which all identified players offer AR and VR devices to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the AR and VR in education market.

Market Definition

Augmented reality (AR) and virtual reality (VR) are two emerging technologies that are being used in a variety of industries, including education. AR adds digital information to a user’s view of the real world, while VR creates a simulated environment that users can interact with. AR and VR in education refer to the use of these technologies to enhance the learning experience. AR can be used to provide students with interactive learning experiences, while VR can be used to create immersive learning environments.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM)

- Research institutes

- AR and VR device provider

- Forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the size of the AR and VR in education market, in terms of by device type, application, and end user

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of World (RoW), in terms of value

- To describe and forecast the size of the AR and VR in education market by device type in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the AR and VR in education market

- To provide an overview of the value chain pertaining to the AR and VR in education ecosystem, along with the average selling prices of AR and VR devices

- To strategically analyze the ecosystem, tariff and regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies, such as product launches and development, acquisition, partnership, agreement, collaboration, agreement, and expansion adopted by players in the AR and VR education market

- To profile key players in the AR and VR education market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

- Updated market developments of profiled players: The current report includes the market developments from March 2020 and May 2023.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in Augmented and Virtual Reality in Education Market