Wound Debridement Market by Product (Enzymatic, Autolytic (Gels, Ointments), Mechanical (Medical Gauzes), Surgical, Ultrasonic), Wound Type (Diabetic Foot Ulcers, Venous Leg, Pressure Ulcers, Burns), End User (Hospitals, Clinics) & Region - Global Forecast to 2025

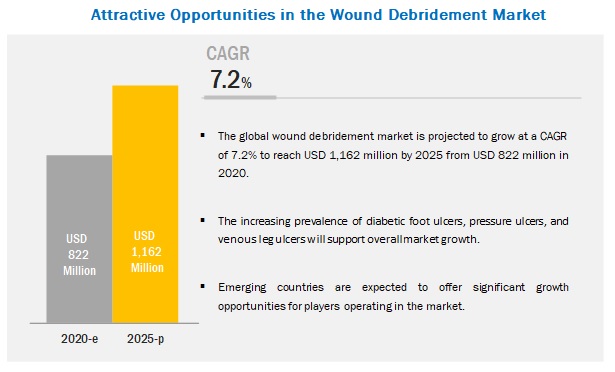

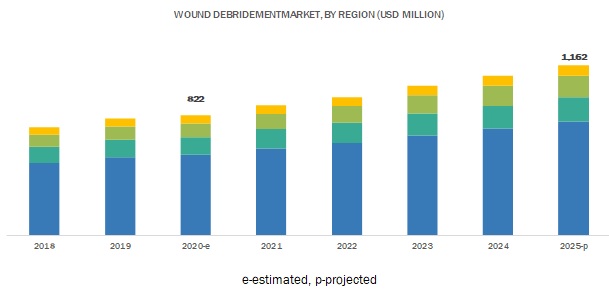

The global wound debridement market in terms of revenue was estimated to be worth $822 million in 2020 and is poised to reach $1,162 million by 2025, growing at a CAGR of 7.2% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Market growth is majorly driven by the high incidence of diabetic foot ulcers and other target wounds, the availability of reimbursement in developed economies, and the rising number of burn cases. However, the high cost of enzymatic products is expected to hamper market growth to a certain extent during the forecast period.

Ultrasonic debridement products segment of the wound debridement industry to witness the highest growth during the forecast period

Based on product, the wound debridement market is categorized into enzymatic, autolytic, mechanical, surgical, ultrasonic, and others. The ultrasonic debridement products segment is expected to grow at the highest growth rate during the forecast period. This is primarily attributed to factors such as their high efficacy in debriding and precision (lack of damage to healthy tissue) during debridement.

Hospitals accounted for the largest share of the wound debridement industry, by end user

Based on end user, the wound debridement market has been segmented into hospitals, clinics, and other end users. In 2019, the hospitals segment accounted for the largest market share. The availability of infrastructure and the presence of skilled professionals in hospitals are the major driving factors for this segment.

North America is the largest regional market for wound debridement industry

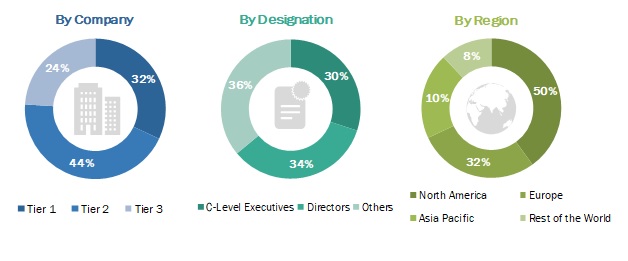

The wound debridement market, by region, has been segmented into North America, Europe, the Asia Pacific, and the Rest of the World (RoW). North America is the largest market for wound debridement, followed by Europe. Growth in the North American market can be attributed to the increasing prevalence of diabetes, high penetration of enzymatic debridement products, and strong market player presence. However, the Asia Pacific is expected to register the highest CAGR during the forecast period. Growth in this region is driven by the presence of a large patient population and increasing awareness regarding advanced healthcare products.

Prominent players in the wound debridement market include Smith & Nephew (UK), B. Braun Melsungen AG (Germany), Coloplast (Denmark), ConvaTec (UK), Mölnlycke Healthcare (Sweden), Lohmann & Rauscher (Germany), Integra Lifesciences (US), Arobella Medical, LLC (US), Advancis Medical (UK), RLS Global (Sweden), DeRoyal Industries (US), Sanara MedTech Inc. (US), and EZ Debride (US).

Smith & Nephew offers a wide range of products in the global wound debridement market, such as surgical devices, gels, and ointments. Due to its well-established product portfolio and good brand image, the company is able to maintain its leading position in the global market. In addition to this, the company has a direct presence in more than 100 countries across the globe. Moreover, the company has well-established distribution channels in developed markets such as the US. It generated ~50% of its revenue from the US alone in 2019.

Scope of the Wound Debridement Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$822 million |

|

Estimated Value by 2025 |

$1,162 million |

|

Revenue Rate |

Poised to grow at a CAGR of 7.2% |

|

Market Driver |

Growing incidence of diabetes and associated wounds |

|

Market Opportunity |

Growth potential of emerging economies |

This report categorizes the wound debridement market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Enzymatic debridement products

-

Autolytic debridement products

- Gels

- Ointments

-

Mechanical debridement products

- Mechanical debridement pads

- Medical Gauzes

- Surgical debridement products

- Ultrasonic debridement products

- Other debridement products (maggots, irrigation products, and solutions)

By wound type

- Diabetic foot ulcers

- Pressure ulcers

- Venous leg ulcers

- Surgical & trauma wounds

- Burns

- Other wounds (infectious wounds and radiation wounds)

By end user

- Hospitals

- Clinics

- Other end users (long term care facilities and home healthcare)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- India

- Japan

- Australia

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Wound Debridement Industry

- In April 2019, RLS Global (Sweden) received CE approval for ChloraSolv

- In July 2017, Smith & Nephew (UK) opened a new R&D center in Hull, UK

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global wound debridement market?

The global wound debridement market boasts a total revenue value of $1,162 million by 2025.

What is the estimated growth rate (CAGR) of the global wound debridement market?

The global wound debridement market has an estimated compound annual growth rate (CAGR) of 7.2% and a revenue size in the region of $822 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.3 PRIMARY DATA

2.3.1 KEY DATA FROM PRIMARY SOURCES

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 GROWTH FORECAST

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 25)

4 PREMIUM INSIGHTS (Page No. - 28)

4.1 GLOBAL MARKET OVERVIEW

4.2 ASIA PACIFIC WOUND DEBRIDEMENT MARKET, BY PRODUCT & COUNTRY

4.3 GLOBAL MARKET: GEOGRAPHIC SNAPSHOT

5 MARKET OVERVIEW (Page No. - 31)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing incidence of diabetes and associated wounds

5.2.1.2 Rising incidence of burn injuries

5.2.1.3 Awareness programs for wound care and management

5.2.2 OPPORTUNITIES

5.2.2.1 Growth potential of emerging economies

5.2.3 CHALLENGES

5.2.3.1 High cost of enzymatic debridement and surgical devices

5.2.4 TRENDS

5.2.4.1 Focus on autolytic debridement & disposable products

6 WOUND DEBRIDEMENT MARKET, BY PRODUCT (Page No. - 35)

6.1 INTRODUCTION

6.2 ENZYMATIC DEBRIDEMENT PRODUCTS

6.2.1 ENZYMATIC DEBRIDEMENT PRODUCTS DOMINATE THE GLOBAL MARKET

6.3 AUTOLYTIC DEBRIDEMENT PRODUCTS

6.3.1 GELS

6.3.1.1 Gels hold the largest share of the autolytic debridement products market

6.3.2 OINTMENTS

6.3.2.1 North America shows the highest demand for ointments

6.4 MECHANICAL DEBRIDEMENT PRODUCTS

6.4.1 MEDICAL GAUZES

6.4.1.1 North America dominates the medical gauzes market

6.4.2 MECHANICAL DEBRIDEMENT PADS

6.4.2.1 APAC to show the highest growth in the mechanical debridement pads market

6.5 SURGICAL DEBRIDEMENT PRODUCTS

6.5.1 BETTER CLINICAL OUTCOMES ASSOCIATED WITH SURGICAL DEBRIDEMENT PRODUCTS TO SUPPORT THE MARKET GROWTH

6.6 ULTRASONIC DEBRIDEMENT PRODUCTS

6.6.1 ULTRASONIC DEBRIDEMENT PRODUCTS TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

6.7 OTHER DEBRIDEMENT PRODUCTS

7 WOUND DEBRIDEMENT MARKET, BY WOUND TYPE (Page No. - 44)

7.1 INTRODUCTION

7.2 DIABETIC FOOT ULCERS

7.2.1 INCREASING EMPHASIS ON AGGRESSIVE MANAGEMENT OF DIABETIC FOOT ULCERS HAS SUPPORTED MARKET GROWTH

7.3 PRESSURE ULCERS

7.3.1 INCREASING GERIATRIC POPULATION HAS RAISED ULCER PREVALENCE RATE

7.4 VENOUS LEG ULCERS

7.4.1 INCREASING PREVALENCE OF RISK FACTORS DRIVES DEMAND FOR VLU WOUND DEBRIDEMENT PRODUCTS

7.5 SURGICAL & TRAUMATIC WOUNDS

7.5.1 RISING NUMBER OF WOUNDS, CUTS, AND TRAUMA CASES WILL DRIVE MARKET GROWTH

7.6 BURNS

7.6.1 HIGH INCIDENCE OF BURNS DRIVES DEMAND FOR WOUND DEBRIDEMENT PRODUCTS

7.7 OTHER WOUNDS

8 WOUND DEBRIDEMENT MARKET, BY END USER (Page No. - 51)

8.1 INTRODUCTION

8.2 HOSPITALS

8.2.1 HOSPITALS DOMINATE THE GLOBAL MARKET, BY END USER

8.3 CLINICS

8.3.1 CLINICS ARE THE FIRST POINT OF CONTACT FOR PATIENTS AND SHOW HIGH DEMAND FOR DEBRIDEMENT PRODUCTS

8.4 OTHER END USERS

9 WOUND DEBRIDEMENT MARKET, BY REGION (Page No. - 56)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 The US dominates the global market

9.2.2 CANADA

9.2.2.1 Growth in the diabetic patient population will support product demand

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Germany holds the largest share of the European market

9.3.2 FRANCE

9.3.2.1 Increasing diabetes and ulcer prevalence drive the market in France

9.3.3 UK

9.3.3.1 Rising geriatric population in the country to support market growth

9.3.4 ITALY

9.3.4.1 Italy is an emerging market for wound debridement

9.3.5 SPAIN

9.3.5.1 Increasing life expectancy and growing geriatric population will favor wound debridement product demand in Spain

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 China dominates the Asia Pacific market

9.4.2 INDIA

9.4.2.1 High number of burn cases to support market growth

9.4.3 JAPAN

9.4.3.1 Availability of reimbursement to support the growth of the market

9.4.4 AUSTRALIA

9.4.4.1 Awareness of diabetes management has risen, indicating favorable prospects for wound debridement

9.4.5 REST OF APAC

9.5 REST OF THE WORLD

10 COMPETITIVE LANDSCAPE (Page No. - 95)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS, 2019

10.2.1 WOUND DEBRIDEMENT MARKET FOR HOSPITALS

10.3 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.4 VENDOR DIVE

10.4.1 VISIONARY LEADERS

10.4.2 INNOVATORS

10.4.3 DYNAMIC DIFFERENTIATORS

10.4.4 EMERGING COMPANIES

10.5 COMPETITIVE SCENARIO

10.5.1 PRODUCT LAUNCHES & APPROVALS

10.5.2 AGREEMENTS AND COLLABORATIONS

10.5.3 EXPANSIONS

11 COMPANY PROFILES (Page No. - 101)

(Business overview, Products offered, Recent developments, SWOT analysis & MnM View)*

11.1 SMITH & NEPHEW

11.2 B. BRAUN MELSUNGEN AG

11.3 LOHMANN & RAUSCHER

11.4 MÖLNLYCKE HEALTH CARE AB

11.5 CONVATEC

11.6 COLOPLAST CORP

11.7 INTEGRA LIFESCIENCES

11.8 ZIMMER BIOMET

11.9 MISONIX

11.10 MEDLINE INDUSTRIES

11.11 WELCARE INDUSTRIES S.P.A

11.12 MEDAXIS

11.13 PULSECARE MEDICAL

11.14 AROBELLA MEDICAL

11.15 ADVANCIS MEDICAL

11.16 RLS GLOBAL

11.17 DEROYAL INDUSTRIES

11.18 EZ DEBRIDE

11.19 SÖRING

11.20 SUZHOU AND SCIENCE & TECHNOLOGY DEVELOPMENT

*Details on Business overview, Products offered, Recent developments, SWOT analysis & MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 124)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

LIST OF TABLES (115 Tables)

TABLE 1 WOUND CARE AWARENESS INITIATIVES

TABLE 2 COMPANIES OFFERING GEL PRODUCTS

TABLE 3 COMPANIES OFFERING DISPOSABLE DEVICES

TABLE 4 WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 5 ENZYMATIC DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 8 GELS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 OINTMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 MEDICAL GAUZES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 MECHANICAL DEBRIDEMENT PADS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 14 SURGICAL DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 ULTRASONIC DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 OTHER DEBRIDEMENT PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 GLOBAL MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 18 GLOBAL MARKET FOR DIABETIC FOOT ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 GLOBAL MARKET FOR PRESSURE ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 GLOBAL MARKET FOR VENOUS LEG ULCERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 GLOBAL MARKET FOR SURGICAL & TRAUMATIC WOUNDS, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 GLOBAL MARKET FOR BURNS, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 GLOBAL MARKET FOR OTHER WOUNDS, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 GLOBAL MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 25 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 GLOBAL MARKET FOR CLINICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 GMARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 NORTH AMERICA: WOUND DEBRIDEMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: ENZYMATIC DEBRIDEMENT PRODUCTS MARKET, BY COUNTRY, 2018–2025 (UNITS)

TABLE 32 NORTH AMERICA: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 36 CURRENT PROCEDURAL TERMINOLOGY CODES FOR THE REIMBURSEMENT OF DEBRIDEMENT PROCEDURES

TABLE 37 US: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 38 US: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 US: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 40 US: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 41 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 42 CANADA: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 43 CANADA: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 CANADA: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 CANADA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 46 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 53 GERMANY: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 54 GERMANY: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 55 GERMANY: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 GERMANY: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 58 FRANCE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 59 FRANCE: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 FRANCE: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 FRANCE: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 62 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 63 UK: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 64 UK: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 UK: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 UK: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 67 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 68 ITALY: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 69 ITALY: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 ITALY: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 ITALY: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 72 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 73 SPAIN: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 74 SPAIN: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 75 SPAIN: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 SPAIN: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 77 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 78 ROE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 79 ROE: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 ROE: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 ROE: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 82 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: WOUND DEBRIDEMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 ASIA PACIFIC: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 88 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 89 CHINA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 90 CHINA: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 CHINA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 92 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 93 INDIA: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 94 INDIA: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 INDIA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 96 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 97 JAPAN: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 98 JAPAN: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 JAPAN: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 100 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 101 AUSTRALIA: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 102 AUSTRALIA: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 AUSTRALIA: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 AUSTRALIA: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 105 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 106 ROAPAC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 107 ROAPAC: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 ROAPAC: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 109 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 110 ROW: DIABETIC PATIENT POPULATION, BY REGION

TABLE 111 ROW: WOUND DEBRIDEMENT MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 112 ROW: AUTOLYTIC DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 ROW: MECHANICAL DEBRIDEMENT PRODUCTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 ROW: MARKET, BY WOUND TYPE, 2018–2025 (USD MILLION)

TABLE 115 ROW: MARKET, BY END USER, 2018–2025 (USD MILLION)

LIST OF FIGURES (32 Figures)

FIGURE 1 WOUND DEBRIDEMENT MARKET SCOPE

FIGURE 2 RESEARCH DESIGN

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION FROM THE PARENT MARKET

FIGURE 6 DATA TRIANGULATION METHODOLOGY

FIGURE 7 GLOBAL MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY WOUND TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY END USER, 2020 TO 2025 (USD MILLION)

FIGURE 10 GEOGRAPHIC SNAPSHOT OF THE GLOBAL MARKET

FIGURE 11 INCREASING PREVALENCE OF DIABETES TO DRIVE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 12 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2019

FIGURE 13 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 14 GLOBAL MARKET: DRIVERS, OPPORTUNITIES, TRENDS, AND CHALLENGES

FIGURE 15 GLOBAL INCIDENCE OF DIABETES, BY REGION, 2019 VS. 2030 VS. 2045

FIGURE 16 DIABETIC FOOT ULCERS SEGMENT WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 17 HOSPITALS SEGMENT WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 18 NORTH AMERICA WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 19 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 21 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE GLOBAL MARKET

FIGURE 22 GLOBAL MARKET SHARE, BY KEY PLAYER, 2018

FIGURE 23 GLOBAL MARKET SHARE FOR HOSPITALS, BY KEY PLAYER, 2019

FIGURE 24 WOUND DEBRIDEMENT MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2018

FIGURE 25 SMITH & NEPHEW: COMPANY SNAPSHOT

FIGURE 26 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT

FIGURE 27 MÖLNLYCKE HEALTH CARE AB: COMPANY SNAPSHOT

FIGURE 28 CONVATEC: COMPANY SNAPSHOT

FIGURE 29 COLOPLAST CORP: COMPANY SNAPSHOT

FIGURE 30 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT

FIGURE 31 ZIMMER BIOMET: COMPANY SNAPSHOT

FIGURE 32 MISONIX: COMPANY SNAPSHOT

This study involved four major activities in estimating the current size of the wound debridement market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the wound debridement market. The secondary sources used for this study include the International Diabetes Federation (IDF), National Institutes of Health (NIH), the Wound Healing Society, European Wound Management Association (EWMA), American Professional Wound Care Association (APWCA), World Health Organization (WHO), American Burn Association, Organisation for Economic Co-operation and Development, Annual Reports, Press Releases, SEC Filings, and Investor Presentations. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the wound debridement market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the wound debridement market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global wound debridement market on the basis of product, wound type, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, challenges, trends, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall wound debridement market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the sizes of market segments with respect to four main regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To strategically profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, collaborations, and R&D activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Wound debridement market size and growth rate estimates for counties in Rest of Europe

Company profiles

- Additional profiles of players operating in the wound debridement market (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wound Debridement Market