mmWave 5G Market by Component (Hardware, Solutions, Services), Use Case (eMBB, mMTC, URLLC, FWA), Application, Bandwidth, End User (Aerospace and Defense, Telecom, Automotive and Transportation, Public Safety) and Region - Global Forecast to 2027

mmWave 5G Market Size

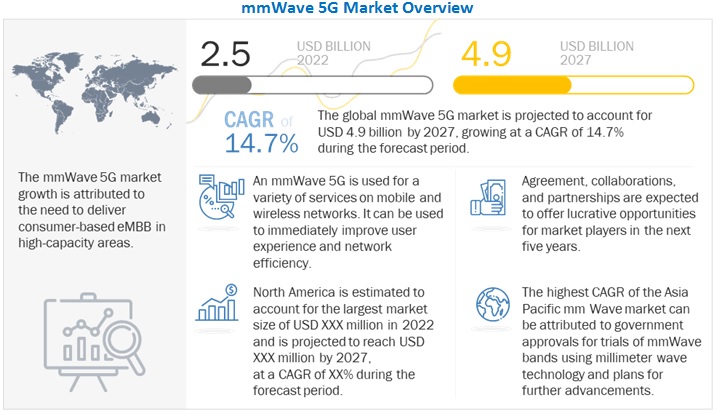

The mmWave 5G market size is predicted to grow at a CAGR of 14.7% over the forecast period, rising from an estimated USD 2.5 billion in 2022 to USD 4.9 billion by 2027. The network performance of mmWave 5G makes it a comparable alternative to fiber-based wired communication, thus opening new opportunities for wireless broadband services for commercial and residential application driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

mmWave 5G Market Dynamics

Driver: Need to deliver consumer-based eMBB in high-capacity areas

The 5G mmWave spectrum deployment will increase the bandwidth available in mobile networks. It will support the 5G FWA service for providing high-speed broadband into homes and offices. Its high bandwidth enables location-specific deployments, such as at airports and train stations, stadiums, music halls, and festivals, where mobile devices generate a vast amount of data. It will also enable operators to dimension capacity to fulfill specific requirements, such as high uplink capacity. 5G eMBB can deliver use cases, such as hotspots, broadband everywhere, public transportation, smart offices, large-scale events, and enhanced multimedia. eMBB will enable new applications, such as 8K video streaming and truly immersive VR and AR.

Restraint: High cost of deployment

To optimize 5G mmWave coverage, carriers need to install numerous small cells in high densities. This increases the cost of deploying mmWave networks at scale. As mmWave witness coverage and Line of Sight (LoS) limitations, it is best suited for dense urban environments. Due to its range limitations, they are not suitable for suburban and rural areas, which are best served by easy and affordable 4G Long Term Evolution (LTE) and sub-6-GHz 5G networks. Widespread deployment of mmWave 5G networks will require extensive underground fiber cable installation. Until this happens, carriers will continue to rely on existing network infrastructure while the market transitions to 5G. While commercial mmWave 5G networks have already been successfully launched in some countries, mmWave 5G solutions need to achieve more scale to reduce deployment costs, increase the choice of affordable devices available, and facilitate greater adoption.

Opportunity: Evolution of wireless data applications and increase in popularity of smart devices to create opportunities for mobile service providers

The evolution of wireless data applications and the popularity of smart devices have led to a rapid increase in mobile data traffic and opportunities for mobile service providers. 5G is expected to enable further economic growth and new use cases, such as smart cities, smart agriculture, smart grids, energy, smart manufacturing, autonomous driving, logistics, public safety, and numerous other verticals. The evolution of IoT has enabled the exchange of information between different electronic devices without the need for direct human interaction. According to Ericsson’s Mobility Report and IoT Forecast, there will be nearly 18 billion IoT devices offered by 2022.

Challenge: mmWave signals have limited signal range and poor building penetration, coverage, and connectivity

Real-world mmWave signals travel relatively short distances, and their network speeds vary greatly depending on range, signal blockers, and proximity to the nearest 5G tower or small cell. Though mmWave 5G networks are ultra-fast, users need to be within a block or two of a 5G tower with no Line-Of-Sight (LOS) obstructions to receive mmWave signals. High-frequency mmWave signals are attenuated by buildings, walls, windows, and foliage, reducing the 5G range. To optimize coverage, carriers are faced with installing numerous small cells in high densities, driving up the cost of deploying mmWave networks at scale. This has led to some concerns about the potential for mmWave 5G in the short term.

Enhanced Mobile Broadband use case are expected account for the largest market share during 2022

eMBB is one of the primary features of 5G services, concentrating on the high speed of the end-user data and system capacity. This will influence the end-user experience by enabling different business uses. In smart offices, eMBB provides high-bandwidth connections to multiple users with heavy data traffic conditions. Also in large-scale events, such as concerts and sporting events, when provided with eMBB, it enables high data rates where a large group of people is present. eMBB can provide continuous, high-definition video streaming, real-time content, and mobile TV driving the mmWave 5G market.

AR/VR end user are expected to account for a higher CAGR during the forecast period

The extensive deployment of 5G mobile networks could speed up the adoption of AR and VR. The devices of AR and VR require to be able to access and process huge amounts of data in real time. 5G permits higher flexibility in use cases like AR, which is commonly used on smartphones or tablets in museums to present additional content for exhibits, also in sporting stadiums, there will be an opportunity to view real-time digital overlays of stats and live camera feedback, enabling the user to select what they want to see and replays of the user's choice.

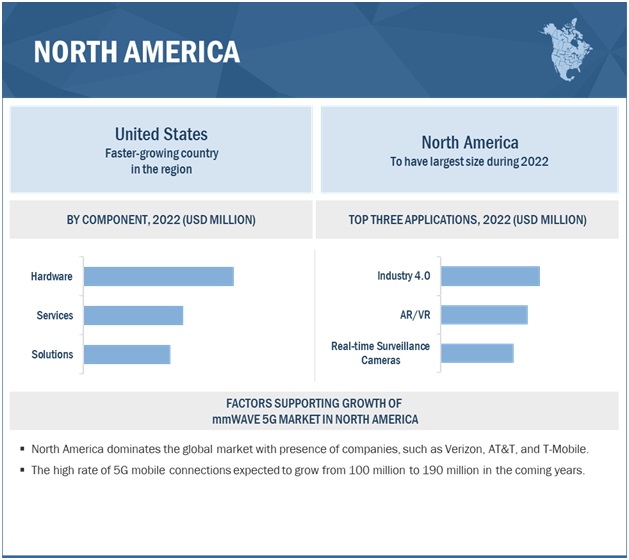

North America to account for the largest market share during the forecast period

North America is estimated to hold the highest market share during the forecast period in the mmWave 5G market, due to the large-scale technological adoption by people, and the presence of key market players in the region. The top countries contributing to the mmWave 5G market in this region include the US and Canada. Many major IT and telecom companies are based in the US and have invested heavily in setting up wireless communication facilities that handle heavy digital traffic across the globe. The top telecom players, such as AT&T, Verizon, T-Mobile, and Sprint, are planning to install the mmWave 5G to offer seamless connectivity to their end users in this region driving the market growth.

To know about the assumptions considered for the study, download the pdf brochure

mmWave 5G Market Players

The mmWave 5G market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global mmWave 5G market are NXP Semiconductors (Netherlands), Airspan Networks (US), AT&T (US), Fastweb (Italy), SoftBank (Japan), Corning (US), Nokia (Finland), Mavenir (US), NTT DOCOMO (Japan), AMD (California), Huawei (China), Qualcomm (US), Ericsson (Sweden), Verizon Communications Inc. (US), Rakuten Mobile (Japan), Singtel (Singapore), Samsung (South Korea), Fujitsu (Japan), Renesas Electronics Corporation (Japan), Keysight Technologies (US), Movandi (US), JMA Wireless (US), Sivers Semiconductors (Sweden), ALCAN systems (Germany), Verana Networks (US), Pivotal Commware (US), Pharrowtech (Belgium). The study includes an in-depth competitive analysis of these key players in the mmWave 5G market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2027 |

USD 4.9 Billion |

|

Market size value in 2022 |

USD 2.5 Billion |

|

Growth rate |

14.7% CAGR |

|

Largest market |

North America |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Segments covered |

By component, use case, bandwidth, application, end user and regions |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

|

Companies covered |

NXP Semiconductors (Netherlands), Airspan Networks (US), AT&T (US), Fastweb (Italy), SoftBank (Japan), Corning (US), Nokia (Finland), Mavenir (US), NTT DOCOMO (Japan), AMD (California), Huawei (China), Qualcomm (US), Ericsson (Sweden), Verizon Communications Inc. (US), Rakuten Mobile (Japan), Singtel (Singapore), Samsung (South Korea), Fujitsu (Japan), Renesas Electronics Corporation (Japan), Keysight Technologies (US), Movandi (US), JMA Wireless (US), Sivers Semiconductors (Sweden), ALCAN systems (Germany), Verana Networks (US), Pivotal Commware (US), Pharrowtech (Belgium). |

This research report categorizes the mmWave 5G market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Hardware

- Antennas and Transceiver Components

- Communication and Networking Components

- Frequency and Sources and Related Components

- RF and Radio Components

- Sensors and Controls

- Power and Battery Components

- Other Hardware

- Solutions

-

Services

-

Professional Services

- Consulting

- Development and Integration

- Support and Maintenance

- Managed Services

-

Professional Services

By Use Case:

- eMBB

- FWA

- mMTC

- URLLC

By Application:

- Real-time Survilliance Cameras

- AR/VR

- Industry 4.0

- Live Streaming

- Transport Connectivity

- Ultra High-defination Video

- Other Applications

By Bandwidth:

- 24GHz to 57GHz

- 57GHz to 95GHz

- 95GHz to 300GHz

By End User:

- Aerospace and Defense

- Telecom

- Media and Entertainment

- Automotive and Transportation

- Public Safety

- Healthcare and Life Sciences

- Other End Users

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- South Korea

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2022, Corning acquired Saint-Gobain’s Shielding and Optics business unit. This acquisition expands Corning’s current radiation shielding business, opens new market opportunities, and enables the manufacturing and supplying of products for nuclear power and medical shielding applications and optical components.

- In February 2022, Fastweb and Qualcomm collaborated to Commercialize 5G Standalone mmWave services in Italy.

- In January 2022, Nokia and SK Telecom collaborated on a new virtualized RAN network in Korea. It successfully completed a Proof-of-Concept (PoC) and demonstration of the world's first 5G 64TRX wireless-based Cloud Radio Access Network (vRAN) in Korea

Frequently Asked Questions (FAQ):

What is the projected market value of the global mmWave 5G market?

The global market of mmWave 5G is projected to reach USD 4.9 billion.

What is the estimated growth rate (CAGR) of the global mmWave 5G market for the next five years?

The global mmWave 5G market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.7 % from 2022 to 2027.

What are the major revenue pockets in the mmWave 5G market currently?

North America is estimated to hold the highest market share during the forecast period in the mmWave 5G market, due to the large-scale technological adoption by people, and the presence of key market players in the region. The top countries contributing to the mmWave 5G market in this region include the US and Canada. Many major IT and telecom companies are based in the US and have invested heavily in setting up wireless communication facilities that handle heavy digital traffic across the globe. The top telecom players, such as AT&T, Verizon, T-Mobile, and Sprint, are planning to install the mmWave 5G to offer seamless connectivity to their end users in this region driving the market growth.

Who are the major vendors in the mmWave 5G market ?

The mmWave 5G market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global mmWave 5G market are NXP Semiconductors (Netherlands), Airspan Networks (US), AT&T (US), Fastweb (Italy), SoftBank (Japan), Corning (US), Nokia (Finland), Mavenir (US), NTT DOCOMO (Japan), AMD (California), Huawei (China), Qualcomm (US), Ericsson (Sweden), Verizon Communications Inc. (US), Rakuten Mobile (Japan), Singtel (Singapore), Samsung (South Korea), Fujitsu (Japan), Renesas Electronics Corporation (Japan), Keysight Technologies (US), Movandi (US), JMA Wireless (US), Sivers Semiconductors (Sweden), ALCAN systems (Germany), Verana Networks (US), Pivotal Commware (US), Pharrowtech (Belgium).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MMWAVE 5G MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

FIGURE 2 MARKET: GEOGRAPHIC SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 3 MMWAVE 5G MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MMWAVE 5G MARKET

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.2.5 GROWTH FORECAST ASSUMPTIONS

TABLE 2 MARKET GROWTH ASSUMPTIONS

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 3 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 4 RISK ASSESSMENT: MMWAVE 5G MARKET

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 10 MARKET, REGIONAL AND COUNTRY-WISE SHARES, 2022

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MMWAVE 5G MARKET OVERVIEW

FIGURE 11 NEED TO DELIVER CONSUMER-BASED ENHANCED MOBILE BROADBAND IN HIGH-CAPACITY AREAS TO DRIVE MARKET

4.2 MARKET, BY COMPONENT

FIGURE 12 MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

4.3 MARKET, BY USE CASE

FIGURE 13 MARKET, BY USE CASE, 2022 VS. 2027 (USD MILLION)

4.4 MARKET, BY BANDWIDTH

FIGURE 14 MARKET, BY BANDWIDTH, 2022 VS. 2027 (USD MILLION)

4.5 MARKET, BY APPLICATION

FIGURE 15 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

4.6 MMWAVE 5G MARKET, BY END USER

FIGURE 16 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

4.7 NORTH AMERICA: MARKET, BY COMPONENT AND END USER

FIGURE 17 HARDWARE AND TELECOM SEGMENTS TO ACCOUNT FOR LARGER MARKET SHARES IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 52)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 18 MMWAVE 5G MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need to deliver consumer-based eMBB in high-capacity areas

5.2.2 RESTRAINTS

5.2.2.1 High cost of deployment

5.2.2.2 Poor backhaul connectivity

5.2.3 OPPORTUNITIES

5.2.3.1 Evolution of wireless data applications and increase in popularity of smart devices

5.2.4 CHALLENGES

5.2.4.1 mmWave signals have limited range and poor building penetration, coverage, and connectivity

5.2.4.2 Implications of government regulations

5.3 VALUE CHAIN

FIGURE 19 MMWAVE 5G MARKET: VALUE CHAIN

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: AIRBUS EXPANDED ITS PRIVATE NETWORK PARTNERSHIP WITH ERICSSON

5.4.2 CASE STUDY 2: UNIVERSITY OF CONNECTICUT LAUNCHED PRIVATE 5G NETWORK WITH AT&T’S SOLUTIONS

5.4.3 CASE STUDY 3: GBL SYSTEMS AND SAMSUNG DEPLOYED 5G TESTBEDS FOR US DEPARTMENT OF DEFENSE

5.4.4 CASE STUDY 4: NTT DOCOMO ATTAINED 5G COMMUNICATION BETWEEN BULLET TRAIN AND BASE STATION

5.4.5 CASE STUDY 5: AT&T DEPLOYED PRIVATE 5G NETWORK AT LAWRENCE J. ELLISON INSTITUTE FOR TRANSFORMATIVE MEDICINE OF USC

5.5 TECHNOLOGY ANALYSIS

5.5.1 INTRODUCTION

5.5.2 5G MASSIVE MIMO

5.5.3 INTERNET OF THINGS

5.5.4 BIG DATA AND ANALYTICS

5.5.5 5G RAN

5.6 ECOSYSTEM

TABLE 5 ECOSYSTEM: MMWAVE 5G MARKET

5.7 AVERAGE SELLING PRICE TREND

5.8 PATENT ANALYSIS

5.8.1 METHODOLOGY

5.8.2 DOCUMENT TYPES OF PATENTS

TABLE 6 PATENTS FILED, 2019–2022

5.8.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 20 ANNUAL NUMBER OF PATENTS GRANTED, 2019–2022

5.8.3.1 Top applicants

FIGURE 21 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019–2022

TABLE 7 TOP TEN PATENT OWNERS IN MARKET, 2019–2022

TABLE 8 LIST OF FEW PATENTS IN MARKET, 2020–2022

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 MMWAVE 5G MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

5.9.1 THREAT FROM NEW ENTRANTS

5.9.2 THREAT FROM SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 DEGREE OF COMPETITION

5.10 REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.1.1 North America

5.10.1.2 Europe

5.10.1.3 Asia Pacific

5.10.1.3.1 China

5.10.1.3.2 India

5.10.1.3.3 Australia

5.10.1.3.4 Japan

5.10.1.4 Middle East & Africa

5.10.1.4.1 United Arab Emirates

5.10.1.4.2 Kingdom of Saudi Arabia

5.10.1.5 Latin America

5.10.1.5.1 Brazil

5.10.1.5.2 Mexico

5.11 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MMWAVE 5G MARKET

FIGURE 22 MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 23 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

TABLE 14 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

5.12.2 BUYING CRITERIA

FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.13 KEY CONFERENCES & EVENTS

TABLE 16 MARKET: DETAILED LIST OF CONFERENCES & EVENTS IN 2022–2023

6 MMWAVE 5G MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

6.2.1 TRANSCEIVER SYSTEM SOFTWARE IS OPEN TO USERS TO MODIFY AS PER NEEDS

6.2.2 HARDWARE: MARKET DRIVERS

TABLE 19 HARDWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 HARDWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 ANTENNAS AND TRANSCEIVER COMPONENTS

6.2.4 COMMUNICATION AND NETWORKING COMPONENTS

6.2.5 FREQUENCY SOURCES AND RELATED COMPONENTS

6.2.6 RF AND RADIO COMPONENTS

6.2.7 SENSORS AND CONTROLS

6.2.8 POWER AND BATTERY COMPONENTS

6.2.9 OTHER HARDWARE

6.3 SOLUTIONS

6.3.1 EXTENSIVE BANDWIDTH AVAILABILITY AT MMWAVE FREQUENCIES COMPARED TO 4G

6.3.2 SOLUTIONS: MMWAVE 5G MARKET DRIVERS

TABLE 21 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 NEED FOR END-TO-END SOLUTIONS TO DRIVE GROWTH OF SERVICES

6.4.2 SERVICES: MARKET DRIVERS

TABLE 23 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 SERVICES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.4.3 PROFESSIONAL SERVICES

TABLE 27 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 PROFESSIONAL SERVICES: MMWAVE 5G MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3.1 Consulting

6.4.3.1.1 Advice and knowledge to clients on critical issues

6.4.3.2 Deployment and integration

6.4.3.2.1 Small cell deployment for mmWave to overcome transmission limitations

6.4.3.3 Support and maintenance

6.4.3.3.1 Performance analysis and management of backhaul capacity

6.4.4 MANAGED SERVICES

6.4.4.1 Outsourcing to third-party service providers to manage efficiently and reduce cost

TABLE 29 MANAGED SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 MMWAVE 5G MARKET, BY USE CASE (Page No. - 85)

7.1 INTRODUCTION

FIGURE 26 ENHANCED MOBILE BROADBAND SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 31 MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 32 MARKET, BY USE CASE, 2022–2027 (USD MILLION)

7.2 FIXED WIRELESS ACCESS

7.2.1 VIABLE ALTERNATIVE AGAINST CABLE AND FIBER OPTIONS

7.2.2 FIXED WIRELESS ACCESS: MARKET DRIVERS

TABLE 33 FIXED WIRELESS ACCESS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 34 FIXED WIRELESS ACCESS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ENHANCED MOBILE BROADBAND

7.3.1 NEED FOR BROADBAND ACCESS IN DENSELY POPULATED AREAS

7.3.2 ENHANCED MOBILE BROADBAND: MMWAVE 5G MARKET DRIVERS

TABLE 35 ENHANCED MOBILE BROADBAND: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 ENHANCED MOBILE BROADBAND: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS

7.4.1 ENSURE DATA TRANSMISSION WITH HIGH RELIABILITY IN 5G SPECTRUM

7.4.2 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS: MARKET DRIVERS

TABLE 37 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 ULTRA-RELIABLE AND LOW-LATENCY COMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 MASSIVE MACHINE-TYPE COMMUNICATIONS

7.5.1 TRANSFORMATIVE POTENTIAL OF MASSIVE MACHINE-TYPE COMMUNICATIONS IN 5G GOES BEYOND MANUFACTURING SYSTEMS

7.5.2 MASSIVE MACHINE-TYPE COMMUNICATIONS: MMWAVE 5G MARKET DRIVERS

TABLE 39 MASSIVE MACHINE-TYPE COMMUNICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 MASSIVE MACHINE-TYPE COMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MMWAVE 5G MARKET, BY BANDWIDTH (Page No. - 93)

8.1 INTRODUCTION

FIGURE 27 95GHZ TO 300GHZ SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 41 MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 42 MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

8.2 24GHZ TO 57GHZ

8.2.1 ABUNDANT BANDWIDTH TO SUPPORT MULTI-GBPS TRANSMISSION SPEEDS PER USER

8.2.2 24GHZ TO 57GHZ: MARKET DRIVERS

TABLE 43 24GHZ TO 57GHZ: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 24GHZ TO 57GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 57GHZ TO 95GHZ

8.3.1 ACCESSIBLE FOR USE IN PRODUCTS AND SERVICES AND HIGH-SPEED

8.3.2 57GHZ TO 95GHZ: MMWAVE 5G MARKET DRIVERS

TABLE 45 57GHZ TO 95GHZ: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 57GHZ TO 95GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 95GHZ TO 300GHZ

8.4.1 SPECTRUM POSSIBLY USED AS A REPLACEMENT FOR OR SUPPLEMENT TO FIBER OPTICS

8.4.2 95GHZ TO 300GHZ: MARKET DRIVERS

TABLE 47 95GHZ TO 300GHZ: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 95GHZ TO 300GHZ: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MMWAVE 5G MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 28 INDUSTRY 4.0 SEGMENT TO GROW AT LARGEST MARKET SIZE CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 REAL-TIME SURVEILLANCE CAMERAS

9.2.1 LOW LATENCY, HIGH BANDWIDTH, AND ULTRA-RELIABILITY THROUGH MMWAVE 5G SOLUTIONS

9.2.2 REAL-TIME SURVEILLANCE CAMERAS: MARKET DRIVERS

TABLE 51 REAL-TIME SURVEILLANCE CAMERAS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 REAL-TIME SURVEILLANCE CAMERAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AUGMENTED REALITY/VIRTUAL REALITY

9.3.1 HIGH SPEED AND ULTRA-LOW LATENCY OF 5G TO PROCESS LARGE VOLUMES OF DATA IN REAL TIME

9.3.2 AUGMENTED REALITY/VIRTUAL REALITY: MMWAVE 5G MARKET DRIVERS

TABLE 53 AUGMENTED REALITY/VIRTUAL REALITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 AUGMENTED REALITY/VIRTUAL REALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 INDUSTRY 4.0

9.4.1 PROVIDES UPGRADES FOR DEPLOYED PIS SOLUTIONS AND RESOLVES ISSUES IN PRODUCTS

9.4.2 INDUSTRY 4.0: MARKET DRIVERS

TABLE 55 INDUSTRY 4.0: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 INDUSTRY 4.0: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 LIVE STREAMING

9.5.1 ULTRA-HIGH BANDWIDTH SUPPORTS BANDWIDTH-INTENSIVE APPLICATIONS

9.5.2 LIVE STREAMING: MMWAVE 5G MARKET DRIVERS

TABLE 57 LIVE STREAMING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 LIVE STREAMING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 ULTRA HIGH-DEFINITION VIDEO

9.6.1 WIDE BANDWIDTHS WITH HIGH-SPEED DATA TO SUPPORT ULTRA HIGH-DEFINITION MULTIMEDIA

9.6.2 ULTRA HIGH-DEFINITION VIDEO: MARKET DRIVERS

TABLE 59 ULTRA HIGH-DEFINITION VIDEO: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 ULTRA HIGH-DEFINITION VIDEO: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 TRANSPORT CONNECTIVITY

9.7.1 NEED FOR MMWAVE SOLUTIONS FOR TRAFFIC CONGESTION AND LONG TRAVEL TIMES

9.7.2 TRANSPORT CONNECTIVITY: MARKET DRIVERS

TABLE 61 TRANSPORT CONNECTIVITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 TRANSPORT CONNECTIVITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 OTHER APPLICATIONS

9.8.1 OTHER APPLICATIONS: MARKET DRIVERS

TABLE 63 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MMWAVE 5G MARKET, BY END USER (Page No. - 108)

10.1 INTRODUCTION

FIGURE 29 TELECOM SEGMENT TO GROW AT LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 65 MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 66 MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 AEROSPACE AND DEFENSE

10.2.1 SIGNAL RELIABILITY CRUCIAL FOR PERFORMANCE OF PRODUCTS IN 5G, AEROSPACE, AND DEFENSE

10.2.2 AEROSPACE AND DEFENSE: MARKET DRIVERS

TABLE 67 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 AEROSPACE AND DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 TELECOM

10.3.1 5G ENABLES ALLOCATING HIGH BANDS ABOVE 24GHZ FOR TELECOM INFRASTRUCTURE

10.3.2 TELECOM: MMWAVE 5G MARKET DRIVERS

TABLE 69 TELECOM: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 AUTOMOTIVE AND TRANSPORTATION

10.4.1 SUPPORT FOR VEHICLE-TO-EVERYTHING COMMUNICATIONS DRIVE 5G ADOPTION

10.4.2 AUTOMOTIVE AND TRANSPORTATION: MARKET DRIVERS

TABLE 71 AUTOMOTIVE AND TRANSPORTATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 AUTOMOTIVE AND TRANSPORTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 PUBLIC SAFETY

10.5.1 5G NETWORKS: POTENTIAL ENABLERS FOR FUTURE PUBLIC SAFETY COMMUNICATION SYSTEMS

10.5.2 PUBLIC SAFETY: MMWAVE 5G MARKET DRIVERS

TABLE 73 PUBLIC SAFETY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 PUBLIC SAFETY: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 HEALTHCARE AND LIFE SCIENCES

10.6.1 LOW LATENCY AND HIGH BANDWIDTH OF 5G TO INCREASE DEMAND IN HEALTHCARE

10.6.2 HEALTHCARE AND LIFE SCIENCES: MARKET DRIVERS

TABLE 75 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 MEDIA AND ENTERTAINMENT

10.7.1 HIGH-QUALITY, INTERACTIVE VIDEO EXPERIENCES ENHANCED BY 5G

10.7.2 MEDIA AND ENTERTAINMENT: MMWAVE 5G MARKET DRIVERS

TABLE 77 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHER END USERS

10.8.1 OTHER END USERS: MARKET DRIVERS

TABLE 79 OTHER END USERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 OTHER END USERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MMWAVE 5G MARKET, BY REGION (Page No. - 118)

11.1 INTRODUCTION

FIGURE 30 MARKET: REGIONAL SNAPSHOT (2022)

TABLE 81 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: PESTLE ANALYSIS

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Government auction of 24GHz airwaves

TABLE 97 UNITED STATES: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 98 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 99 UNITED STATES: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 100 UNITED STATES: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 101 UNITED STATES: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 102 UNITED STATES: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 103 UNITED STATES: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 104 UNITED STATES: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 105 UNITED STATES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 UNITED STATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 107 UNITED STATES: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 108 UNITED STATES: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Anticipates 5G mmWave bands release for services

TABLE 109 CANADA: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 110 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 111 CANADA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 112 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 113 CANADA: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 114 CANADA: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 115 CANADA: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 116 CANADA: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 117 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 118 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 CANADA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 120 CANADA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: PESTLE ANALYSIS

TABLE 121 EUROPE: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 123 EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 126 EUROPE: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Major networks’ secured spectrum in UK’s second 5G spectrum auction

TABLE 135 UNITED KINGDOM: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 136 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 142 UNITED KINGDOM: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 143 UNITED KINGDOM: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 UNITED KINGDOM: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 145 UNITED KINGDOM: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 146 UNITED KINGDOM: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 German communications regulator released more than 70 licenses to build 5G campus networks

11.3.4 FRANCE

11.3.4.1 Digitization and electronic communication networks

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 147 ASIA PACIFIC: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Early adoption of 5G technology to drive market

TABLE 161 CHINA: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 162 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 163 CHINA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 164 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 165 CHINA: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 166 CHINA: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 167 CHINA: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 168 CHINA: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 169 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 170 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 171 CHINA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 172 CHINA: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.3 SOUTH KOREA

11.4.3.1 Samsung signed contract with all three mobile operators to supply mmWave 5G network

11.4.4 JAPAN

11.4.4.1 All operators deployed commercial 5G mmWave

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST & AFRICA

11.5.1 MIDDLE EAST & AFRICA: PESTLE ANALYSIS

TABLE 173 MIDDLE EAST & AFRICA: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 180 MIDDLE EAST & AFRICA: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.5.2 UNITED ARAB EMIRATES

11.5.2.1 Telco Du successfully deployed first live mmWave 5G site at Yas Island

TABLE 187 UNITED ARAB EMIRATES: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 188 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 189 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 190 UNITED ARAB EMIRATES: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 191 UNITED ARAB EMIRATES: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 192 UNITED ARAB EMIRATES: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 193 UNITED ARAB EMIRATES: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 194 UNITED ARAB EMIRATES: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 195 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 196 UNITED ARAB EMIRATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 197 UNITED ARAB EMIRATES: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 198 UNITED ARAB EMIRATES: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.3 SOUTH AFRICA

11.5.3.1 ICASA provided access to high-demand spectrums

11.5.4 REST OF MIDDLE EAST & AFRICA

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: PESTLE ANALYSIS

TABLE 199 LATIN AMERICA: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 206 LATIN AMERICA: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 207 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Projeto 5G Brasil to deliver an ecosystem to drive 5G in Brazil

TABLE 213 BRAZIL: MMWAVE 5G MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 214 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 215 BRAZIL: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 216 BRAZIL: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 217 BRAZIL: MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

TABLE 218 BRAZIL: MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

TABLE 219 BRAZIL: MARKET, BY USE CASE, 2018–2021 (USD MILLION)

TABLE 220 BRAZIL: MARKET, BY USE CASE, 2022–2027 (USD MILLION)

TABLE 221 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 222 BRAZIL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 223 BRAZIL: MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 224 BRAZIL: MARKET, BY END USER, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 US-Mexico-Canada Agreement (USMCA) trade deal to accelerate deployment of 5G in Mexico

11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 177)

12.1 INTRODUCTION

12.2 KEY PLAYER STRATEGIES

TABLE 225 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MMWAVE 5G MARKET

12.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 226 MARKET: DEGREE OF COMPETITION

12.4 HISTORICAL REVENUE ANALYSIS

FIGURE 33 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

12.5 COMPETITIVE BENCHMARKING

TABLE 227 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 228 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

TABLE 229 MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

12.6 KEY COMPANY EVALUATION QUADRANT

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 34 KEY MMWAVE 5G MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2022

12.7 STARTUP/SME EVALUATION QUADRANT

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 35 STARTUP/SME MMWAVE PLAYERS, COMPANY EVALUATION MATRIX, 2022

12.8 COMPETITIVE SCENARIO

12.8.1 PRODUCT LAUNCHES

TABLE 230 PRODUCT LAUNCHES, 2021–2022

12.8.2 DEALS

TABLE 231 DEALS, 2020–2022

12.8.3 OTHERS

TABLE 232 OTHERS, 2021–2022

13 COMPANY PROFILES (Page No. - 190)

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

13.1 MAJOR PLAYERS

13.1.1 HUAWEI

TABLE 233 HUAWEI: BUSINESS OVERVIEW

FIGURE 36 HUAWEI: COMPANY SNAPSHOT

TABLE 234 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 235 HUAWEI: PRODUCT LAUNCHES

13.1.2 QUALCOMM

TABLE 236 QUALCOMM: BUSINESS OVERVIEW

FIGURE 37 QUALCOMM: COMPANY SNAPSHOT

TABLE 237 QUALCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 QUALCOMM: PRODUCT LAUNCHES

TABLE 239 QUALCOMM: DEALS

13.1.3 ERICSSON

TABLE 240 ERICSSON: BUSINESS OVERVIEW

FIGURE 38 ERICSSON: COMPANY SNAPSHOT

TABLE 241 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 242 ERICSSON: PRODUCT LAUNCHES

TABLE 243 ERICSSON: DEALS

13.1.4 VERIZON

TABLE 244 VERIZON: BUSINESS OVERVIEW

FIGURE 39 VERIZON: COMPANY SNAPSHOT

TABLE 245 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 246 VERIZON: PRODUCT LAUNCHES

TABLE 247 VERIZON: DEALS

TABLE 248 VERIZON: OTHERS

13.1.5 NOKIA

TABLE 249 NOKIA: BUSINESS OVERVIEW

FIGURE 40 NOKIA: COMPANY SNAPSHOT

TABLE 250 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 251 NOKIA: PRODUCT LAUNCHES

TABLE 252 NOKIA: DEALS

TABLE 253 NOKIA: OTHERS

13.1.6 NXP SEMICONDUCTORS

TABLE 254 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

FIGURE 41 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

TABLE 255 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

TABLE 257 NXP SEMICONDUCTORS: DEALS

13.1.7 AIRSPAN NETWORKS

TABLE 258 AIRSPAN NETWORKS: BUSINESS OVERVIEW

FIGURE 42 AIRSPAN NETWORKS: COMPANY SNAPSHOT

TABLE 259 AIRSPAN NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 260 AIRSPAN NETWORKS: DEALS

13.1.8 AT&T

TABLE 261 AT&T: BUSINESS OVERVIEW

FIGURE 43 AT&T: COMPANY SNAPSHOT

TABLE 262 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 263 AT&T: DEALS

13.1.9 FASTWEB

TABLE 264 FASTWEB: BUSINESS OVERVIEW

TABLE 265 FASTWEB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 266 FASTWEB: DEALS

13.1.10 SOFTBANK

TABLE 267 SOFTBANK: BUSINESS OVERVIEW

FIGURE 44 SOFTBANK: COMPANY SNAPSHOT

TABLE 268 SOFTBANK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 269 SOFTBANK: DEALS

13.1.11 CORNING

TABLE 270 CORNING: BUSINESS OVERVIEW

FIGURE 45 CORNING: COMPANY SNAPSHOT

TABLE 271 CORNING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272 CORNING: DEALS

13.1.12 MAVENIR

TABLE 273 MAVENIR: BUSINESS OVERVIEW

TABLE 274 MAVENIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 275 MAVENIR: PRODUCT LAUNCHES

TABLE 276 MAVENIR: DEALS

13.1.13 NTT DOCOMO

TABLE 277 NTT DOCOMO: BUSINESS OVERVIEW

FIGURE 46 NTT DOCOMO: COMPANY SNAPSHOT

TABLE 278 NTT DOCOMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 279 NTT DOCOMO: DEALS

13.1.14 AMD

TABLE 280 AMD: BUSINESS OVERVIEW

FIGURE 47 AMD: COMPANY SNAPSHOT

TABLE 281 AMD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 282 AMD: DEALS

13.1.15 RAKUTEN MOBILE

TABLE 283 RAKUTEN MOBILE: BUSINESS OVERVIEW

FIGURE 48 RAKUTEN MOBILE: COMPANY SNAPSHOT

TABLE 284 RAKUTEN MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 285 RAKUTEN MOBILE: PRODUCT LAUNCHES

TABLE 286 RAKUTEN MOBILE: DEALS

13.1.16 SINGTEL

TABLE 287 SINGTEL: BUSINESS OVERVIEW

FIGURE 49 SINGTEL: COMPANY SNAPSHOT

TABLE 288 SINGTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 289 SINGTEL: PRODUCT LAUNCHES

TABLE 290 SINGTEL: DEALS

13.1.17 SAMSUNG

TABLE 291 SAMSUNG: BUSINESS OVERVIEW

FIGURE 50 SAMSUNG: COMPANY SNAPSHOT

TABLE 292 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 293 SAMSUNG: PRODUCT LAUNCHES

TABLE 294 SAMSUNG: DEALS

13.1.18 FUJITSU

TABLE 295 FUJITSU: BUSINESS OVERVIEW

FIGURE 51 FUJITSU: COMPANY SNAPSHOT

TABLE 296 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 297 FUJITSU: PRODUCT LAUNCHES

TABLE 298 FUJITSU: DEALS

13.1.19 RENESAS

TABLE 299 RENESAS: BUSINESS OVERVIEW

FIGURE 52 RENESAS: COMPANY SNAPSHOT

TABLE 300 RENESAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 301 RENESAS: PRODUCT LAUNCHES

TABLE 302 RENESAS: DEALS

13.1.20 KEYSIGHT TECHNOLOGIES

TABLE 303 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 53 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 304 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 305 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 306 KEYSIGHT TECHNOLOGIES: DEALS

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 STARTUP/SMES

13.2.1 MOVANDI

13.2.2 JMA WIRELESS

13.2.3 SIVERS SEMICONDUCTOR

13.2.4 ALCAN SYSTEMS

13.2.5 VERANA NETWORKS

13.2.6 PIVOTAL COMMWARE

13.2.7 MICROAMP SOLUTIONS

13.2.8 PHARROWTECH

14 ADJACENT/RELATED MARKETS (Page No. - 264)

14.1 INTRODUCTION

14.2 SMALL CELL 5G NETWORK MARKET

14.2.1 MARKET OVERVIEW

14.2.2 SMALL CELL 5G NETWORK MARKET, BY COMPONENT

TABLE 307 SMALL CELL 5G NETWORK MARKET, BY COMPONENT, 2019–2025 (USD MILLION)

14.2.2.1 Solutions

TABLE 308 SOLUTIONS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

14.2.2.2 Services

TABLE 309 SERVICES: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 310 SERVICES: SMALL CELL 5G NETWORK MARKET, BY TYPE, 2019–2025 (USD MILLION)

TABLE 311 CONSULTING MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 312 INTEGRATION AND DEPLOYMENT MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 313 TRAINING AND SUPPORT MARKET, BY REGION, 2019–2025 (USD MILLION)

14.2.3 SMALL CELL 5G NETWORK MARKET, BY CELL TYPE

TABLE 314 SMALL CELL 5G NETWORK MARKET, BY CELL TYPE, 2019–2025 (USD MILLION)

TABLE 315 PICOCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 316 FEMTOCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

TABLE 317 MICROCELLS: SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

14.2.4 SMALL CELL 5G NETWORK MARKET, BY DEPLOYMENT MODE

TABLE 318 SMALL CELL 5G NETWORK MARKET, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

14.2.5 SMALL CELL 5G NETWORK MARKET, BY RADIO TECHNOLOGY

TABLE 319 SMALL CELL 5G NETWORK MARKET, BY RADIO TECHNOLOGY, 2019–2025 (USD MILLION)

14.2.6 SMALL CELL 5G NETWORK MARKET, BY END USER

TABLE 320 SMALL CELL 5G NETWORK MARKET, BY END USER, 2019–2025 (USD MILLION)

14.2.7 SMALL CELL 5G NETWORK MARKET, BY REGION

TABLE 321 SMALL CELL 5G NETWORK MARKET, BY REGION, 2019–2025 (USD MILLION)

14.3 5G SERVICES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 5G SERVICES MARKET, BY END USER

TABLE 322 5G SERVICES MARKET, BY END USER, 2020–2026 (USD BILLION)

TABLE 323 CONSUMERS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 324 ENTERPRISES: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

14.3.4 5G SERVICES MARKET, BY COMMUNICATION TYPE

TABLE 325 5G SERVICES MARKET, BY COMMUNICATION TYPE, 2020–2026 (USD BILLION)

TABLE 326 FIXED WIRELESS ACCESS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 327 ENHANCED MOBILE BROADBAND: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 328 MASSIVE MACHINE-TYPE COMMUNICATIONS: 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

TABLE 329 ULTRA-RELIABLE, LOW-LATENCY: 5G SERVICES MARKE, BY REGION, 2020–2026 (USD BILLION)

14.3.5 5G SERVICES MARKET, BY ENTERPRISE

TABLE 330 5G SERVICES MARKET, BY ENTERPRISE, 2020–2026 (USD BILLION)

14.3.6 5G SERVICES MARKET, BY REGION

TABLE 331 5G SERVICES MARKET, BY REGION, 2020–2026 (USD BILLION)

15 APPENDIX (Page No. - 277)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

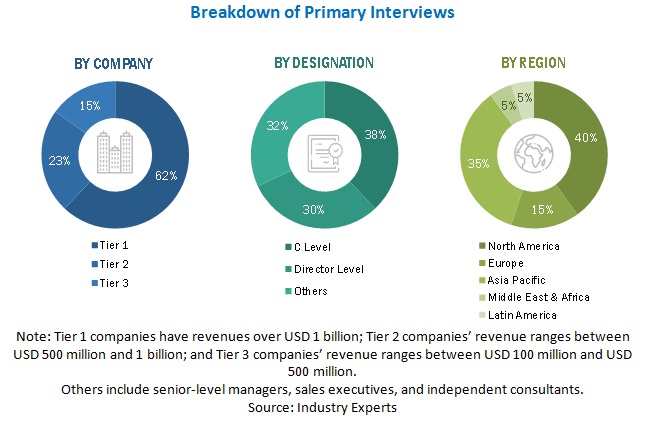

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global mmWave 5G market . The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers (SPs), technology developers, alliances, and organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the global mmWave 5G market .

Secondary Research

The market size of the companies offering mmWave 5G hardware, solutions and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports of Qualcomm; press releases of various companies Nokia, Ericsson, and AT&T; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases, such as 5G Americas and GSM Association.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

The secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply-side included industry experts, chief experience officers (CXOs), vice presidents (VPs), and directors from business development, marketing, product development/innovation teams, and related key executives from mmWave 5G solution vendors, system integrators, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the solutions and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand-side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of the governments/end users who are using mmWave 5G hardware, solutions and services were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of mmWave 5G solutions, which is projected to impact the overall mmWave 5G market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation of the mmWave 5G market . The first approach involves the estimation of the market size by summation of the company’s revenues generated through the different types of hardware, solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the global mmWave 5G market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players are limited to NXP Semiconductors, Airspan Networks, AT&T, Fastweb, SoftBank, Nokia, NTT DOCOMO, Huawei, Qualcomm, Ericsson; other players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

MmWave 5G market : Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global mmWave 5G market based on component, use case, bandwidth, application, end user, and regions from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market .

- To analyze the impact of COVID-19 on the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total mmWave 5G market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, a new product launched and product developments, partnerships, agreements, and collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in mmWave 5G Market