Airborne ISR Market by Application (Search and Rescue, Border and Maritime Patrol, Target Acquisition and Tracking, Critical Infrastructure Protection, Tactical Support), Solution, Platform, End-user, and Region- Global Forecast to 2027

Update: 11/22/2024

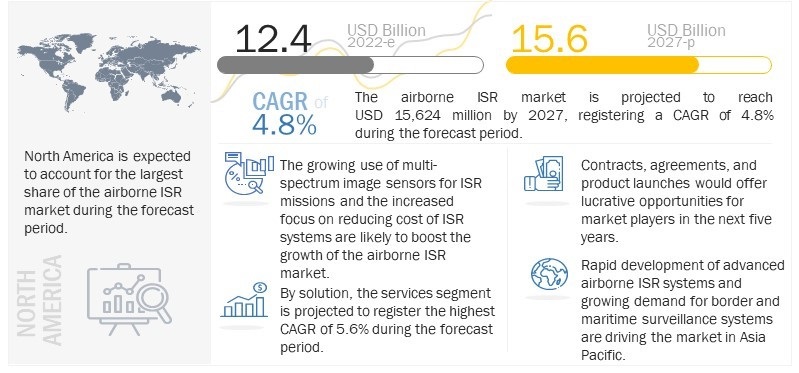

The Global Airborne ISR Market Size was valued at USD 12,700 Million in 2023 and is estimated to reach USD 15,600 Million by 2027, growing at a CAGR of 4.8% during the forecast period.

The Airborne ISR Industry report covers various systems, services, and software related to airborne platform-based intelligence, surveillance, and reconnaissance capabilities. These ISR systems, services, and software are designed to provide access to a global information grid of shared data and information sources for defense and homeland security applications. The market includes information assurance systems, services, software, and various airborne platforms that support the secure exchange of information by ISR systems in digital, voice, and video data.

The development of advanced airborne ISR systems in recent years has strengthened the capabilities of air platforms, making them emerge as a crucial tool in the renewed global air intelligence superiority race, with various countries focusing on developing, manufacturing, and launching these advanced airborne ISR systems and platforms. These airborne ISR systems collect quality intelligence data, increase situational awareness, and offer cutting-edge surveillance and reconnaissance capabilities, resulting in their increasing demand from various organizations and countries.

In terms of size and growth, the market for airborne ISR systems also portrays trends like those witnessed in a disruptive industry. One of the major characteristics of disruptive innovation is that it is adopted by a market that is currently underserved or not served at all. Airborne ISR systems cater to underserved markets wherein consumers mostly include developing countries, research institutions, and commercial players. These consumers utilize airborne ISR systems with specific sensors and radars for technology demonstration, intelligence backhaul, and fulfilling basic surveillance and reconnaissance capabilities.

The airborne ISR market is growing significantly globally, and a similar trend is expected to be observed during the forecast period. Ongoing advancements in airborne ISR systems, the development of small UAVs, and growing investments in ISR missions are fueling the growth of the airborne ISR market is projected to grow from USD 12.4 Billion in 2022 to USD 15.6 Billion by 2027, at a CAGR of 4.8% from 2022 to 2027.

Airborne ISR Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Airborne ISR Market Dynamics:

Driver: Increasing procurement of airborne ISR systems due to growing transnational and regional instability

The frequency of bilateral militarized conflicts among countries is increasing rapidly, leading to the growing need for countries' defense forces to strengthen their security and situational awareness measures. New technologies and reconnaissance systems are being developed to cater to warfare needs. The advent of digital battlefields has propelled the incorporation of airborne ISR systems in defense equipment used during combat missions. These systems have resulted in a change in the procurement priorities of nations to keep pace with emerging warfare needs.

For instance, political instability and terrorism in Iraq and Syria in the Middle East have led to armed conflicts since 2014, with high-end weapon systems increasingly used by various terrorist organizations. Hence, countries in this region are increasing their ISR expenditure to include new airborne ISR systems to monitor and safeguard their borders against these advanced weapons. Countries that have increased their spending on radar and airborne ISR systems in this region include Saudi Arabia, the UAE, and Qatar.

Restraint: High development and maintenance costs

Airborne ISR systems are vital in modern-day warfare. However, high costs need to be incurred in the development and incorporation of these systems into the defense capabilities of any nation. Airborne ISR systems integrate various communication, intelligence, surveillance, and reconnaissance systems into a working multi-domain platform. The development, installation, and maintenance of these systems are expensive. Thus, both the cost and time required for developing and deploying these systems are major factors restraining the growth of the airborne ISR market. In May 2021, the Government of Canada awarded an in-service support and maintenance contract valued at approximately USD 72 million for the upgradation and maintenance of its new manned airborne intelligence, surveillance, and reconnaissance systems for the Canadian Armed Forces

Opportunity: Technological advancements in the ISR ecosystem

Rapid technological developments are breeding disruptive technologies in the defense industry. There is increased adoption of such advanced technologies in small unmanned and manned surveillance systems for ISR missions. Furthermore, the airborne ISR market is expected to grow at a moderate pace as the technologies used for ISR missions constantly evolve. More and more countries are adopting advanced ISR technologies to secure their borders. There has been an increased demand for airborne ISR systems and equipment from the defense sector globally, owing to their growing use in different battlefield functions. They assist ground forces using advanced technologies like AI and big data to analyze collected data.

Challenge: Integrating existing systems with new technologies

The integration of existing systems with new systems being deployed poses a major challenge in the adoption of advanced airborne ISR systems. Rapid technological developments and the availability of advanced solutions create a major challenge for integrating these new airborne ISR systems with existing systems. For instance, the efficiency of the perimeter surveillance system requires inputs from all video surveillance devices and others to be integrated with the existing systems. The integration between these systems is difficult, which adversely affects the efficiency of airborne ISR equipment. In some cases, new devices have different protocols, making their adoption difficult. Integrating legacy systems with new technologies is time and effort-consuming and may distract the troops from their core ISR activities.

Based on the platform, the airborne ISR market is segmented into military aircraft, military helicopters, and unmanned aerial systems. Airborne ISR systems are used in tracking land vehicles, aircraft, and enemy ammunition in military applications. Airborne early warning and control (AEW&C) systems use these ISR systems for the command & coordination of the battlefield. These systems enable forces to deal with threats before they can cause harm. The airborne ISR market has been growing significantly globally and is expected to continue to grow during the forecast period. Unmanned systems are projected to grow at the highest CAGR during the forecasted period. The market's growth can be attributed to the rising demand for UAVs for airborne ISR applications and advancements in technologies used in patrol and fighter aircraft.

Based on the solution, the airborne ISR market has been segmented into systems, services, and software. Technological innovations in airborne ISR systems have contributed to developing advanced systems with improved operational efficiency. These systems offer a comprehensive overview of the battlefield that helps military personnel ensure proper operational planning and allocation of resources. The development of various application software and backbone network that support high-bandwidth consuming systems has also influenced the growth of the airborne ISR market. The airborne ISR systems market is projected to lead during the forecasted period owing to the increasing modernization programs in the defense sector.

Regional Insights:

Airborne ISR Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region is projected to Grow at the highest CAGR during the forecast period

The airborne ISR market in the Asia Pacific is projected to grow at the highest CAGR during the forecast period. This regional market analysis covers China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. Countries such as China, India, Japan, South Korea, Taiwan, and Australia are strengthening their combat zone systems by investing in air defense systems to counter threats arising from regional conflicts. South China Sea disputes, North Korea’s increased nuclear arsenal, the border conflict between India and Pakistan, and Afghan unrest are important issues in the region. Border surveillance, intelligence gathering, and critical infrastructure safety require airborne ISR capabilities. Among other factors, the airborne ISR market in the Asia Pacific is expected to be driven by the growing demand for airborne surveillance, scientific research, weather monitoring for commercial aircraft and Business Jets, perimeter surveillance, and battlefield surveillance. The Australian government is focusing on modernizing its airborne surveillance radar for the Royal Australian Navy and Air Force. In 2021, the South Korean government increased its defense budget allocation by 5.4% compared to the previous year. The additional budget would be allocated to the upgradation of surveillance systems, including air defense systems. This is expected to impact the airborne ISR market in the region positively.

Key Market Players:

Some of the major players in the Airborne ISR Companies are Bae Systems PLC (UK), Elbit Systems (Israel), L3Harris Technologies, Inc. (US), Northrop Grumman (US), Teledyne Technologies, Inc. (US), Leonardo S.p.A (Italy), Honeywell International (US), and Raytheon Technologies (US). This is also supported by their growth rates, which are remarkably close to the market.

L3Harris Technologies, Inc.

L3Harris Technologies, Inc. secures the first position in the airborne ISR market. The company offers a wide range of electronic warfare products for various applications, such as CORVUS, Viper Shield AN/ALQ-254(V)1 All-Digital Electronic Warfare Suite, and AN/ALQ-214 (IDECM) F/A-18 Countermeasure System. It has a strong customer base among major defense contractors and a strong reputation among defense organizations. L3Harris Technologies Inc. invested around USD 330 million in 2019 on R&D. In fiscal 2020, the Space and Airborne Systems segment had a diverse portfolio of over 250 programs. Some of this segment's more effective programs in fiscal 2021 included the FTI, F-35, F/A-18, ADS-B, the US Army Modernization of Enterprise Terminals (MET), Data Communications Integrated Services (DataComm), CV-22, B-52, and the F-16. Strong customer relationships, cutting-edge technologies, and strategic partnerships with leading companies in the airborne ISR market drive the company's growth.

BAE Systems PLC

BAE Systems plc is one of the world's leading aerospace, defense, and security companies. It develops, delivers, and supports aerospace & defense systems. The company operates through five business segments: Electronic Systems, Cyber & Intelligence, Platforms & Services (US), Maritime, and Air. It offers ISR systems, electro-optical sensors, electronic warfare systems, next-generation military communication systems, hybrid electric drive systems, and flight controls through its Electronic Systems segment. Target acquisition systems are offered through its electro-optical sensors division

Lockheed Martin Corporation

Lockheed Martin Corporation is ranked fourth in the airborne ISR market. It manufactures various airborne ISR equipment, such as submarine electronic warfare systems, direction finders, automatic threat warning, and situation assessment systems, radio-controlled improvised explosive devices (RCIED), and GPS spatial-temporal anti-jam receivers (GSTAR). The company also provides radars that use electro-optical/infrared sensor systems for advanced precision targeting, navigation, threat detection, and next-generation intelligence, surveillance, and reconnaissance.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate

|

4.8% |

| Estimated Market Size in 2023 |

USD 12,700 Million |

| Projected Market Size in 2027 |

USD 15,600 Million |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

By Solution, application, platform, end-user, and region |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies Covered |

Bae Systems PLC (UK), Elbit Systems Ltd. (Israel), L3Harris Technologies (US), Northrop Grumman (US), Lockheed Martin Corporation (US), Leonardo Company (Italy), Teledyne Technologies, Inc. (US), Raytheon Technologies (US) and others |

Airborne ISR Market Highlights

This research report categorizes the airborne market based on Solution, application, platform, end-user, and region

|

Aspect |

Details |

|

Airborne ISR Market, By Solution |

|

|

Airborne ISR Market, By Application |

|

|

Airborne ISR Market, By Platform |

|

|

Airborne ISR Market, By End-User |

|

|

Airborne ISR Market, By Region |

|

Recent Developments

- In September 2022, The Royal Thai Navy awarded Elbit Systems a USD 120 million contract to deliver Hermes 900 marine unmanned aerial systems (UAS) and training capabilities. Under the three-year deal, Elbit Systems will offer UAS systems with marine radar, electro-optic payload, satellite communication, droppable inflated life rafts, and other capabilities.

- In September 2022, US Navy awarded Lockheed Martin Corporation a contract to develop advanced electro-optical targeting systems that offer clear resolutions for the F-35.

- In July 2021, Northrop Grumman Corporation developed the active electronically scanned array (AESA) AN/APG-83 Scalable Agile Beam Radar software for the F-16 Viper fighter aircraft.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQs):

What is the current size of the airborne ISR market?

The airborne ISR market is projected to grow from USD 12.4 Billion in 2022 and reach USD 15.6 Billion by 2027, at a CAGR of 4.8% during the forecast period.

Who are the winners in the airborne ISR market?

Bae Systems PLC (UK), Elbit Systems (Israel), L3Harris Technologies, Inc. (US), Northrop Grumman (US), Teledyne Technologies, Inc. (US) Leonardo S.p.A (Italy), Honeywell International (US), and Raytheon Technologies (US)

What are some of the technological advancements in the market?

LiDAR technology resembles radar and sonar in that all three identify objects, their sizes and contours, and their direction over time by sending out waves, timing how long the waves take to bounce back, and reading these reflections. This is referred to as a “time-of-flight” approach, an industry standard. LiDAR uses laser light pulses versus radar radio and sonar sound waves. All 3D LiDAR technologies create three-dimensional point clouds representing shapes and features, such as vehicles, buildings, and people.

Intelligence, reconnaissance, and battlefield surveillance require accurate information and quick data processing. This leads to an increased demand for next-generation sensors from the defense forces of different countries. New sensing techniques with precision data sharing are the prime objectives of these next-generation sensors.

What are the factors driving the growth of the market?

The airborne ISR market has been growing significantly across the globe, and this growth is also expected to continue during the forecast period. The major drivers for the market’s growth include rising demand for UAVs for airborne ISR applications and advancements in artificial intelligence, big data analytics, and robotics used in patrol and fighter aircraft for ISR. Lack of accuracy and operational complexities in airborne ISR technology, regulatory constraints in the transfer of technology, and declining defense budgets of several North American and European countries are expected to restrain the market growth during the forecast period. Technological advancements in the ISR ecosystem and the modernization of reconnaissance equipment by the defense forces of several countries serve as growth opportunities for the airborne ISR market. The main challenges faced by the market include complexity in the design of airborne ISR equipment and the high R&D cost of airborne ISR equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 AIRBORNE ISR MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

TABLE 1 AIRBORNE ISR MARKET: INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH PROCESS FLOW

FIGURE 2 AIRBORNE ISR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Insights from industry experts

2.1.2.2 Breakdown of primary interviews

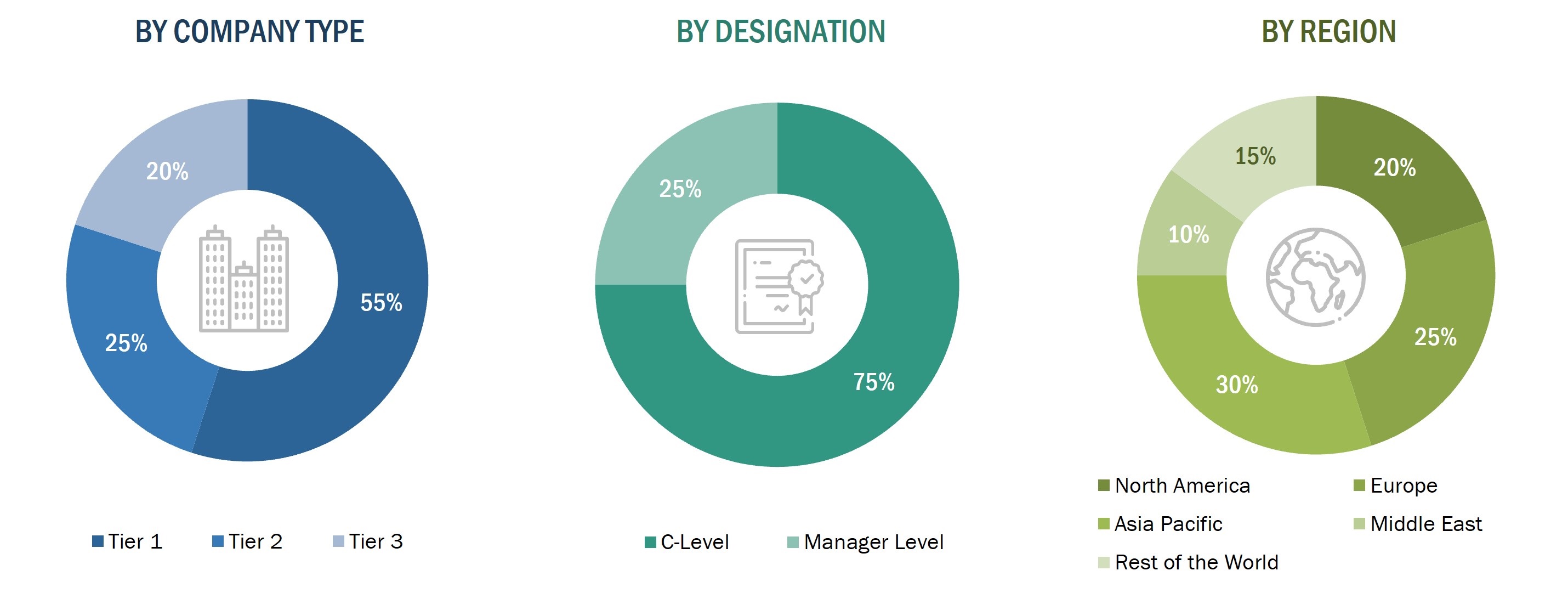

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.3 Key data from primary sources

TABLE 2 KEY PRIMARY SOURCES

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increased military spending of emerging countries

2.2.2.2 Growth of military expenditure on sensor-based autonomous defense systems

2.2.2.3 Rising incidence of regional disputes, terrorism, and political conflicts

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Financial trends of major defense contracts in US

2.3 MARKET SIZE ESTIMATION

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 ASSUMPTIONS

FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY ON AIRBORNE ISR MARKET

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 8 UNMANNED SYSTEMS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 9 NORTH AMERICA DOMINATES AIRBORNE ISR MARKET

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRBORNE ISR MARKET

FIGURE 10 MULTISPECTRAL IMAGE SENSORS TO DRIVE MARKET GROWTH

4.2 AIRBORNE ISR MARKET, BY END USER

FIGURE 11 SYSTEMS SEGMENT TO LEAD AIRBORNE ISR MARKET DURING FORECAST PERIOD

4.3 AIRBORNE ISR MARKET, BY APPLICATION

FIGURE 12 TARGET ACQUISITION AND TRACKING SEGMENT TO FUEL MARKET GROWTH

4.4 AIRBORNE ISR MARKET, BY SOLUTION

FIGURE 13 SYSTEMS SEGMENT PROJECTED TO DOMINATE AIRBORNE ISR MARKET FROM 2022 TO 2027

4.5 AIRBORNE ISR MARKET, BY SOLUTION AND SYSTEM

FIGURE 14 TARGETING AND SURVEILLANCE SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 AIRBORNE ISR MARKET, BY COUNTRY

FIGURE 15 AIRBORNE ISR MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 AIRBORNE ISR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising UAV demand for airborne ISR applications

5.2.1.2 Increasing procurement of airborne ISR systems due to growing transnational and regional instability

5.2.1.3 Growing threats of terror attacks and increasing international border clashes

5.2.1.4 Increasing use of airborne ISR-based geological survey for scientific research

5.2.1.5 Increasing need for missile detection systems

5.2.1.6 Rapid advancements in artificial intelligence, big data analytics, and robotics

5.2.1.7 Increasing preference for modern warfare techniques

5.2.2 RESTRAINTS

5.2.2.1 Lack of accuracy and operational complexities in airborne ISR technology

5.2.2.2 High development and maintenance costs

5.2.2.3 Concerns over error possibilities in complex combat situations

5.2.2.4 Regulatory constraints in technology transfer

5.2.2.5 Declining defense budgets of North American and European countries

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements in ISR ecosystem

5.2.3.2 Modernization of reconnaissance equipment by defense forces of several countries

5.2.4 CHALLENGES

5.2.4.1 Integrating existing systems with new technologies

5.2.4.2 Complexity in designs of airborne ISR systems

5.2.4.3 High system complexity, requiring proper pilot training for optimum usage

5.3 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRBORNE ISR SYSTEM MANUFACTURERS

FIGURE 18 REVENUE SHIFT FOR AIRBORNE ISR MARKET

5.5 AIRBORNE ISR MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

FIGURE 19 AIRBORNE ISR ECOSYSTEM MAPPING

TABLE 3 AIRBORNE ISR: MARKET ECOSYSTEM

5.6 USE CASE ANALYSIS

5.6.1 USE CASE: UAS SENSOR

5.6.2 USE CASE: ELECTRONICALLY SCANNED ARRAY

5.6.3 USE CASE: UAV RADARS

5.7 TECHNOLOGY ANALYSIS

5.7.1 AUTOMATIC DEPENDENT SURVEILLANCE-BROADCAST (ADS-B)

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 AIRBORNE ISR: PORTER’S FIVE FORCE ANALYSIS

FIGURE 20 AIRBORNE ISR MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 THREAT OF NEW ENTRANTS

5.8.2 THREAT OF SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING AIRBORNE ISR SYSTEMS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

5.9.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR AIRBORNE ISR SYSTEMS

TABLE 6 KEY BUYING CRITERIA FOR AIRBORNE ISR

5.10 TRADE ANALYSIS

TABLE 7 IMPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017–2021 (USD MILLION)

TABLE 8 EXPORTED VALUE OF AIRCRAFT AND SPACECRAFT PARTS, 2017–2021 (USD MILLION)

5.11 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE OF AIRBORNE ISR SUBSYSTEMS (USD)

5.12 VOLUME DATA IN UNITS

TABLE 10 MILITARY UAV, BY COUNTRY

TABLE 11 MILITARY UAV, BY TYPE

5.13 REGULATORY LANDSCAPE

5.13.1 NORTH AMERICA

5.13.2 EUROPE

5.14 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 12 AIRBORNE ISR MARKET: CONFERENCES AND EVENTS

6 INDUSTRY TRENDS (Page No. - 79)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS OF AIRBORNE ISR MARKET

6.3 TECHNOLOGY TRENDS

6.3.1 SOFTWARE-DEFINED AIRBORNE ISR SYSTEM

6.3.2 MULTIPLE-INPUTS/MULTIPLE-OUTPUTS (MIMO)

6.3.3 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

6.3.4 LIDAR TECHNOLOGY

6.3.5 NEXT-GENERATION SENSOR SYSTEMS

6.3.6 TERRAIN AWARENESS AND WARNING SYSTEMS (TAWS)

6.3.7 ENHANCED VISION SYSTEMS (EVS)

6.4 IMPACT OF MEGATRENDS

6.4.1 ARTIFICIAL INTELLIGENCE AND COGNITIVE APPLICATIONS

6.4.2 MACHINE LEARNING

6.4.3 DEEP LEARNING

6.4.4 BIG DATA

6.5 INNOVATIONS AND PATENT REGISTRATIONS

7 AIRBORNE ISR MARKET, BY APPLICATION (Page No. - 87)

7.1 INTRODUCTION

FIGURE 24 AIRBORNE ISR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 13 AIRBORNE ISR MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 14 AIRBORNE ISR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 SEARCH AND RESCUE OPERATIONS

7.2.1 NEED TO ACESS ISOLATED AREAS DURING SEARCH AND RESCUE OPERATIONS TO STIMULATE DEMAND

7.3 BORDER AND MARITIME PATROL

7.3.1 URGENCY TO SECURE BORDERS FROM UNLAWFUL ACTIVITIES TO DRIVE MARKET

7.4 TARGET ACQUISITION AND TRACKING

7.4.1 PRECISE TARGETING BY UNMANNED COMBAT AERIAL VEHICLES TO FUEL GLOBAL DEMAND

7.5 CRITICAL INFRASTRUCTURE PROTECTION

7.5.1 QUICK INSPECTIONS AND MONITORING ACTIVITIES

7.6 TACTICAL SUPPORT

7.6.1 NECESSITY TO ACCESS MISSION-CRITICAL DATA TO SUPPORT MARKET GROWTH

7.7 OTHERS

8 AIRBORNE ISR MARKET, BY SOLUTION (Page No. - 92)

8.1 INTRODUCTION

FIGURE 25 AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 15 AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 16 AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

8.2 SYSTEMS

TABLE 17 AIRBORNE ISR SYSTEMS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 18 AIRBORNE ISR SYSTEMS MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2.1 TARGETING AND SURVEILLANCE SYSTEMS

8.2.1.1 Day and night sensors, radar sensors, and laser rangefinders/designators

TABLE 19 AIRBORNE ISR MARKET FOR TARGETING AND SURVEILLANCE SYSTEMS, BY SUBSYSTEM, 2019–2021 (USD MILLION)

TABLE 20 AIRBORNE ISR MARKET FOR TARGETING AND SURVEILLANCE SYSTEMS, BY SUBSYSTEM, 2022–2027 (USD MILLION)

8.2.1.2 Electro-optical infrared (EO/IR) full-motion video (FMV)

8.2.1.3 Imagery sensors (multispectral, hyperspectral imaging)

8.2.1.4 Radar sensors

8.2.1.5 Spectrum systems

8.2.1.6 LiDAR

8.2.1.7 Others

8.2.2 COMMUNICATION SYSTEMS

8.2.2.1 Use of wireless communication devices to transmit information to command and control centers

TABLE 21 AIRBORNE ISR MARKET FOR COMMUNICATION SYSTEMS, BY TYPE, 2019–2021 (USD MILLION)

TABLE 22 AIRBORNE ISR MARKET FOR COMMUNICATION SYSTEMS, BY TYPE, 2022–2027 (USD MILLION)

8.2.2.2 Datalinks

8.2.2.3 SATCOM

8.2.2.4 Antenna

8.2.3 RECONNAISSANCE AND INTELLIGENCE SYSTEMS

8.2.3.1 Reconnaissance and intelligence systems for aerial reconnaissance activities

8.2.3.2 Signals intelligence

8.2.3.3 Electronic intelligence

8.2.3.4 Communications intelligence

8.2.4 OTHERS

8.3 SERVICES

8.3.1 MANAGED SERVICE/ISR AS A SERVICE

8.3.1.1 Need for managed services to reduce cost and requirement for tailor systems for specific applications

8.3.2 SUPPORT SERVICE

8.3.2.1 Requirement of support service to optimize ISR systems

8.3.2.2 Maintenance

8.3.2.3 Simulation and training

8.3.2.4 Technical support

8.3.3 OPERATIONAL SERVICE

8.3.3.1 Operational service to support flight operations for ISR aircraft

8.4 SOFTWARE

8.4.1 MISSION CONTROL SOFTWARE

8.4.1.1 Mission control software to offer centralized venue for managing airborne ISR operations

8.4.2 SIGINT SOFTWARE SUITE

8.4.2.1 SIGINT used by government and defense sectors for ISR operations

8.4.3 THREAT DETECTION SOFTWARE

8.4.3.1 Threat detection software to provide timely, accurate view of threats in RF spectrum

8.4.4 OTHERS

8.4.4.1 Improving data feed quality

9 AIRBORNE ISR MARKET, BY PLATFORM (Page No. - 103)

9.1 INTRODUCTION

FIGURE 26 AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 23 AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 24 AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

9.2 MILITARY AIRCRAFT

9.2.1 FIGHTER AIRCRAFT

9.2.1.1 Radar in fighter aircraft to acquire targets

9.2.2 TRANSPORT AIRCRAFT

9.2.2.1 ISR systems in transport aircraft to enhance situational awareness

9.2.3 TRAINER AIRCRAFT

9.2.3.1 Trainer aircraft fitted with ISR systems to offer student pilots hands-on experience

9.2.4 SPECIAL MISSION AIRCRAFT

9.2.4.1 Increasing need to detect cross-border infiltrations to fuel market growth

9.3 MILITARY HELICOPTERS

9.3.1 USE OF MILITARY HELICOPTERS FOR AIR-TO-AIR AND AIR-TO-GROUND SURVEILLANCE

9.4 UNMANNED SYSTEMS

9.4.1 SMALL UAV

9.4.1.1 Adoption of small UAVs to monitor hard-to-reach areas by humans

9.4.2 TACTICAL UAV

9.4.2.1 Technological advancement in unmanned battlefield surveillance systems to fuel market

9.4.3 STRATEGIC UAV

9.4.3.1 Strategic UAVs to offer ISR and combat capabilities

9.4.3.2 Medium-altitude long-endurance (MALE) UAVs

9.4.3.3 High-altitude long-endurance (HALE) UAVs

9.4.4 SPECIAL-PURPOSE UAV

9.4.4.1 Special purpose UAVs in reconnaissance, operations, and battle damage assessment

9.4.5 AEROSTATS

9.4.5.1 Surveillance monitoring border disputes and drug trafficking to fuel market

10 AIRBORNE ISR MARKET, BY END USER (Page No. - 109)

10.1 INTRODUCTION

FIGURE 27 AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

TABLE 25 AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 26 AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

10.2 DEFENSE

TABLE 27 DEFENSE: AIRBORNE ISR MARKET, BY AGENCY, 2019–2021 (USD MILLION)

TABLE 28 DEFENSE: AIRBORNE ISR MARKET, BY AGENCY, 2022–2027 (USD MILLION)

10.2.1 DEPARTMENT OF DEFENSE

10.2.1.1 Advanced airborne ISR capabilities to offer better situational awareness and safety

10.2.2 INTELLIGENCE ORGANIZATIONS

10.2.2.1 Real-time critical military intelligence to fuel market growth

10.2.3 OTHERS

10.3 HOMELAND SECURITY

10.3.1 HOMELAND SECURITY AGENCIES TO EMPLOY ADVANCED AIRBORNE ISR SYSTEMS

11 REGIONAL ANALYSIS (Page No. - 113)

11.1 INTRODUCTION

FIGURE 28 AIRBORNE ISR MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 AIRBORNE ISR MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 AIRBORNE ISR MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 29 NORTH AMERICA: AIRBORNE ISR MARKET SNAPSHOT

TABLE 31 NORTH AMERICA: AIRBORNE ISR MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 32 NORTH AMERICA: AIRBORNE ISR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 33 NORTH AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 34 NORTH AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 36 NORTH AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 38 NORTH AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.2.2 US

11.2.2.1 Development programs related to unmanned systems to increase airborne ISR demand

TABLE 39 US: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 40 US: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 41 US: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 42 US: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.2.3 CANADA

11.2.3.1 Increasing R&D investments to drive market

TABLE 43 CANADA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 44 CANADA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 45 CANADA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 46 CANADA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3 EUROPE

11.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 30 EUROPE: AIRBORNE ISR MARKET SNAPSHOT

TABLE 47 EUROPE: AIRBORNE ISR MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 48 EUROPE: AIRBORNE ISR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 49 EUROPE: AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 50 EUROPE: AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 51 EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 52 EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 53 EUROPE: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 54 EUROPE: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Upgrading existing fleets to fuel market

TABLE 55 UK: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 56 UK: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 57 UK: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 58 UK: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Technological advancements in unmanned aerial vehicle platforms to trigger market growth

TABLE 59 FRANCE: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 60 FRANCE: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 61 FRANCE: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 62 FRANCE: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Integration of airborne platform with ISR system to drive market

TABLE 63 GERMANY: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 64 GERMANY: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 65 GERMANY: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 66 GERMANY: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.5 RUSSIA

11.3.5.1 Growing investments in digitizing VHF and UHF radar systems to improve counter-stealth capability

TABLE 67 RUSSIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 68 RUSSIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 69 RUSSIA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 70 RUSSIA AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Airborne fleet renewal to propel market

TABLE 71 ITALY: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 72 ITALY: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 73 ITALY: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 74 ITALY: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Rising procurement of military helicopters to fuel market growth

TABLE 75 REST OF EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 76 REST OF EUROPE: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 77 REST OF EUROPE: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 78 REST OF EUROPE: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: AIRBORNE ISR MARKET SNAPSHOT

TABLE 79 ASIA PACIFIC: AIRBORNE ISR MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 80 ASIA PACIFIC: AIRBORNE ISR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 82 ASIA PACIFIC: AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 83 ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 84 ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 86 ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Increasing R&D expenditure for airborne early warning and related airborne ISR systems

TABLE 87 CHINA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 88 CHINA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 89 CHINA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 90 CHINA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Ongoing modernization of defense capabilities to fuel market growth

TABLE 91 INDIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 92 INDIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 93 INDIA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 94 INDIA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Uplifting of self-imposed defense equipment export ban to trigger growth opportunities

TABLE 95 JAPAN: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 96 JAPAN: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 97 JAPAN: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 98 JAPAN: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA

11.4.5.1 High demand for advanced technologies in military equipment to create opportunities

TABLE 99 AUSTRALIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 100 AUSTRALIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 101 AUSTRALIA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 102 AUSTRALIA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.6 SOUTH KOREA

11.4.6.1 Need for stronger ISR activities to drive market

TABLE 103 SOUTH KOREA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 104 SOUTH KOREA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 105 SOUTH KOREA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 106 SOUTH KOREA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.4.7.1 Increased demand for border surveillance to fuel market

TABLE 107 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 108 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 109 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

11.5.1 PESTLE ANALYSIS

FIGURE 32 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET SNAPSHOT

TABLE 111 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 113 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 115 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 116 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 117 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 118 MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.2 ISRAEL

11.5.2.1 Strong bilateral relationship with US to help technology transfer and sale

TABLE 119 ISRAEL: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 120 ISRAEL: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 121 ISRAEL: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 122 ISRAEL: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.3 UAE

11.5.3.1 Focus on strengthening defense capability to fuel market growth

TABLE 123 UAE: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 124 UAE: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 125 UAE: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 126 UAE: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.4 SAUDI ARABIA

11.5.4.1 Increased military expenditure to fuel market

TABLE 127 SAUDI ARABIA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 128 SAUDI ARABIA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 129 SAUDI ARABIA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 130 SAUDI ARABIA AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Need for enhanced military organization to fuel demand

TABLE 131 SOUTH AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 132 SOUTH AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 133 SOUTH AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 134 SOUTH AFRICA AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.5.6 REST OF THE MIDDLE EAST & AFRICA

11.5.6.1 Strengthening combat capabilities

TABLE 135 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 136 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 137 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 138 REST OF MIDDLE EAST & AFRICA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 33 LATIN AMERICA: AIRBORNE ISR MARKET SNAPSHOT

TABLE 139 LATIN AMERICA: AIRBORNE ISR MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 140 LATIN AMERICA: AIRBORNE ISR MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 141 LATIN AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2019–2021 (USD MILLION)

TABLE 142 LATIN AMERICA: AIRBORNE ISR MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 143 LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 144 LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 145 LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 146 LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.6.2 BRAZIL

11.6.2.1 Modernization of armed forces to propel market

TABLE 147 BRAZIL: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 148 BRAZIL: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 149 BRAZIL: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 150 BRAZIL: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.6.3 MEXICO

11.6.3.1 Strengthening ISR capabilities to fuel market growth

TABLE 151 MEXICO: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 152 MEXICO: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 153 MEXICO: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 154 MEXICO: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

11.6.4 REST OF LATIN AMERICA

11.6.4.1 Digital transformation of defense sector to boost market

TABLE 155 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

TABLE 156 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

TABLE 157 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 158 REST OF LATIN AMERICA: AIRBORNE ISR MARKET, BY END USER, 2022–2027 (USD MILLION)

This research study on the airborne ISR market involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources considered included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the market and assess its growth prospects.

Secondary Research

The ranking analysis of companies in the airborne ISR market was determined using secondary data from paid and unpaid sources and analyzing the product portfolios and service offerings of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources for this research study on the airborne ISR market included government sources, such as the Federal Aviation Administration (FAA); corporate filings, including annual reports, investor presentations, and financial statements of companies offering aircraft ISR; and trade, business, and professional associations.

Primary Research

Extensive primary research was conducted after obtaining information about the airborne ISR market’s current scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

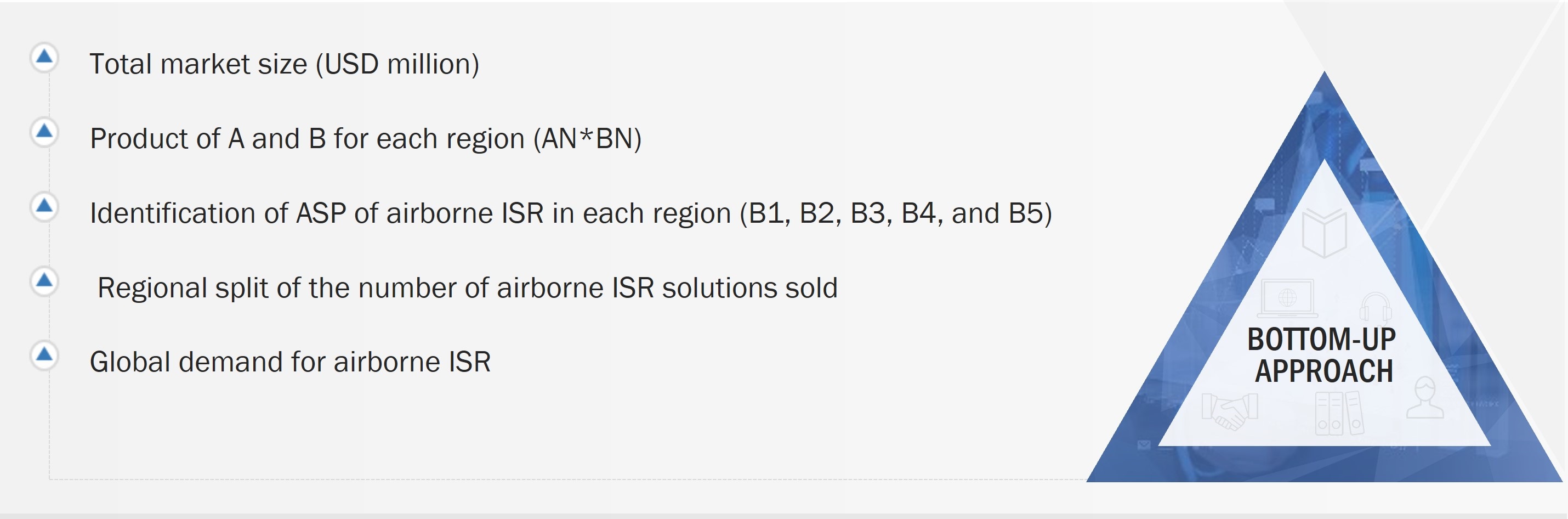

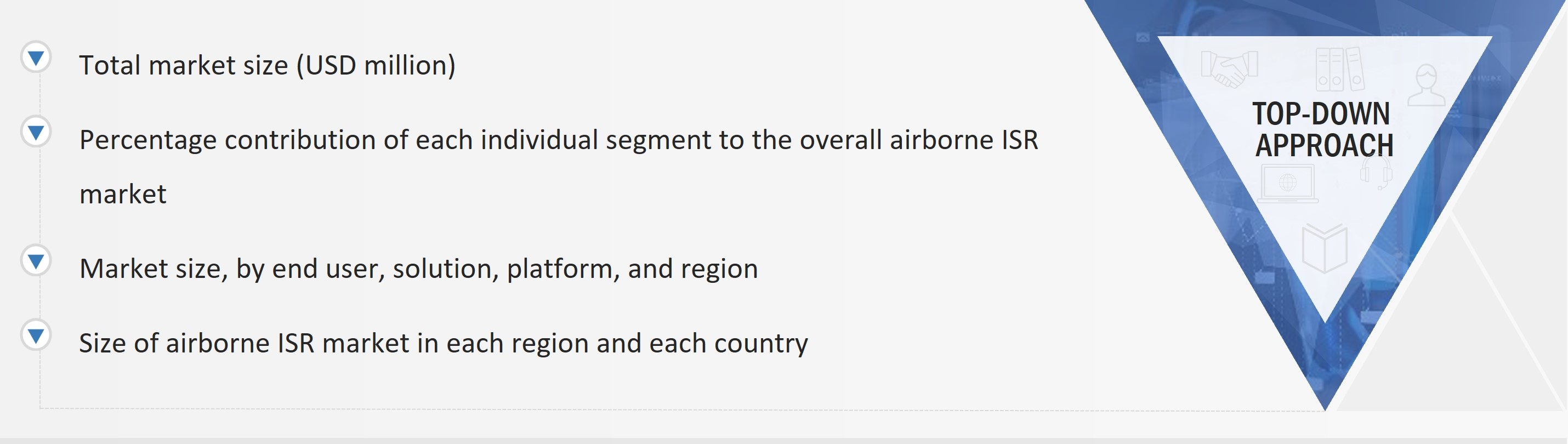

Both top-down and bottom-up approaches were used to estimate and validate the size of the airborne ISR market. The research methodology used to estimate the market size includes the following details.

Key players in the airborne ISR market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as chief executive officers, directors, and marketing executives of leading companies operating in the airborne ISR market.

All percentage shares split and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the airborne ISR market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

The following figures represent the complete market size estimation process used in this study on the airborne ISR market.

Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the airborne ISR market by estimating the revenues and shares of key market players. Calculations based on the revenues of key players identified in the market led to the estimation of the overall market size.

The bottom-up approach was also implemented for data extraction from secondary research to validate the market segment revenues. Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study.

Market Size Estimation Methodology: Bottom-Up Approach

Top-Down Approach

In the top-down approach, the size of the airborne ISR market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate immediate parent market was used to implement the top-down approach.

Different platforms, such as airborne, land, naval, space, and munitions, were considered for the airborne ISR market. The size of each of these platform segments was cross-checked and validated to arrive at the overall size. Similar methodologies were adopted to determine the sizes of other segments and subsegments of the airborne ISR market.

|

Step |

Description |

|

Step 1 |

In this step, all the countries investing heavily in procuring airborne ISR solutions were shortlisted based on secondary research and the SIPRI database. |

|

Step 2 |

From the respective defense budget of the countries, the total procurement of platforms was determined. These platforms were primarily categorized into military aircraft, military helicopters, and unmanned systems for defense and homeland security end-users. |

|

Step 3 |

Market size = m procurement x percentage of application rate + n procurement * percentage of application rate) |

Data Triangulation

After arriving at the overall size of the airborne ISR market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various segments and sub-segments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

In the bottom-up approach, the size of the airborne ISR market was obtained by calculating country-level data. In the top-down approach, the market size was derived by estimating the revenues of key players operating in the market and validating the data acquired from primary research.

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the airborne ISR market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for five regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, as well as significant nations within each of these areas.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders

Available customizations

MarketsandMarkets provides customizations in addition to market data to meet the individual demands of businesses. The following report customization options are available:

Product Evaluation

- The product matrix provides a thorough comparison of each company's product portfolio.

Regional Examination

- Further segmentation of the market at the national level

Information About the Company

- Additional market participants will be thoroughly examined and profiled (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airborne ISR Market