Aircraft Communication System Market by Connectivity (SATCOM, VHF/UHF/L-Band, HF and Data Link), Fit (Line Fit, Retrofit), Platform (Fixed-wing, Rotary-wing, UAVs and eVTOL/eSTOL), Component and Region - Global Forecast to 2027

The Aircraft Communication System Market Size is projected to grow from USD 8.2 billion in 2022 to USD 12.8 billion by 2027, at a CAGR of 9.2% from 2022 to 2027. Increased focus on next generation technologies such as IP version 6, UAV communication and use of commercial off-the-shelf (COTS) technology are driving the Aircraft Communication System Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Communication System Markets Trends

Drivers: Rise in adoption of software-defined radio for satellite communication

Technical challenges faced by aircraft manufacturers include achieving payload flexibility and minimizing the complexity and cost associated with system integration. Flexibility features are required to develop satellite systems that are interconnected with the global communications infrastructure and can function in emergency situations. Satellite communication involves the integration of a wide range of network technologies. It facilitates high-speed voice and data communication between passengers and flight crew. Software-defined Radio (SDR) technologies provide flexibility in the operation of satellite communication devices. In addition, as a part of the onboard communication satellite systems in aircraft, they help cater to the need for reconfigurable, flexible payloads. They include onboard hardware and software technologies to reconfigure satellite payloads for multiple communication scenarios. These devices have enhanced capabilities and innovative features and form an important component of the aircraft communications architecture.

In June 2022, Lockheed Martin (US) received the 1000th AN/ARC-238 Software-defined Radio (SDR) from Rohde & Schwarz (Germany) for installation on F-16 aircraft. The R&S MR6000R/L radios from the SOVERON radio family include two airborne radios that constitute the AN/ARC-238, which is fully qualified for use on the F-16 and satisfies the standards for secure communication. In April 2021, the E-3A Airborne Warning and Control System (AWACS) fleet of NATO aircraft was to be equipped with Leonardo's (Italy) new software-defined radio, the SWave Airborne SDR SRT-800, according to an agreement between Boeing (US) and Leonardo (Italy). The AWACS fleet, one of the few military assets owned and controlled directly by NATO, is being updated by Boeing as part of the Final Lifetime Extension Programme (FLEP) to ensure its operational viability through 2035.

Restraints: Issues due to limited availability of radio spectrum

One of the issues of the radio spectrum is radio-frequency interference (RFI), i.e., the interference from other radio services impacting the performance of active science sensors. Active science systems are frequently required to share a band with other services, in contrast to passive science systems, where regulatory efforts are made to keep the allocated band free of other emitters. As a result, signals from other radio services are frequently present to varying degrees in active science systems. To reduce the effects of this interference, many mitigation strategies may be used.

Competing users present a rising danger of interference, making the radio spectrum a highly sought-after and limited resource. To prevent future expenses, aviation must act now to improve how it uses its limited spectrum, but the industry's existing commercial structures are intrinsically incapable of providing incentives to do so.

- Enhanced adjacent band filtering

- Improved aviation equipment maintenance standards maintenance for legacy systems

- Balance between coordinated deployments of new CNS radio systems, including 'settling for less' if it helps with worldwide adoption

Every country has a governing authority that allocates a specific operating frequency for a small satellite mission. The International Telecommunication Union (ITU) Radio Regulations regulate the utilization of radio frequencies and the law of nations scale radio-communication services. However, the process of obtaining licenses to launch and deploy a satellite in high band frequencies is both, time- and cost-intensive. It involves documentation and payment for band allotment. Thus, limited radio spectrum availability acts as a restraint to the growth of the aircraft communication system market.

Opportunities: Increased demand for next-generation IP systems

The demand for next-generation IP systems is growing in the aviation sector, owing to the ability of these systems to enable air-to-ground data communication. In addition, the increasing applicability of next-generation IP systems has resulted in increasing the profitability of IP network providers. Next-generation IP systems, such as AeroMACS communications, are used to ensure safe and secure flight operations. Moreover, communication service providers are shifting their preference from the high-power single line of contact method to a low-power mesh system, wherein operators are linked together by means of a multi-node mesh system. The low-power mesh system is less prone to single points of failure and can enable communication packets to determine the best route to the destination based on traffic levels and available system bandwidth.

Challenges: Lack of proper air traffic management system during peak hours

One of the most complex challenges for the future of aviation is to ensure a safe increase in air traffic demand. In 20 years, the increase in air traffic operations is predicted to nearly treble its current value. Such a tremendous rise in air traffic generally requires the development, validation, and implementation of new strategic ideas that must address demands in the future. Air traffic management (ATM) systems are used for the guidance, separation, control, and coordination of aircraft movement. Air traffic controllers use ATM systems to monitor air traffic on a regular basis. Lack of proper ATM systems affects aircraft communication systems, which results in collision or crashing of aircraft.

According to a risk assessment, risk in ATM is due to the lack of a widely accepted methodology and safety criteria in the aviation industry. A number of ATM factors are considered; these are often grouped into three categories—navigation, intervention capability, and exposure to risk. These aspects, however, cannot be separated from the regulatory framework that sets acceptable levels for the many stakeholders, including airports, airlines, manufacturers, pilots, air traffic controllers, and others. ATM systems struggle to manage air traffic during peak periods that include daily peak hours, weekly peak days, and seasonal peaks. Challenges faced by airport authorities include allocation of runaways for landing and take-off, reduction in the time gap between two aircraft movements, gate allocation, taxiway allocation, aircraft turnaround time, and emergency landings. Addressing these issues to maintain safe and efficient air traffic management during peak hours is a major challenge.

The failure of ATM systems is also brought on by the aging of systems and lack of regular maintenance. For instance, in June 2022, the automation system that helps Mumbai air traffic control handle a large number of flights land, take-off, and overfly safely and efficiently presented a high number of glitches and failures. Recently, the automation system faced more than 70 subsystem problems. This is due to the aging of the systems; the current hardware automation system was over 16 years old, while its lifespan is ~10 years.

Aircraft Communication System Market Segments

Based on connectivity, the VHF/UHF/L-Band segment has second largest share in 2022

Based on connectivity, the VHF/UHF/L-Band segment is expected to lead the market from 2022 to 2027. The increasing investments in VHF/UHF/L-Band communication are expected to drive this segment.

Based on Platform, the UAV segment is expected to have second highest CAGR and second largest market share in the forecasted period.

Based on Platform, the UAV segment is projected to grow from USD 1,272 million in 2022 to USD 2,620 million in 2027 at CAGR of 15.6%. The increased availability of UAV for several military applications and increased technological innovations and advancements is expected to drive the aircraft communication system market growth.

Aircraft Communication System Market Regional Analysis

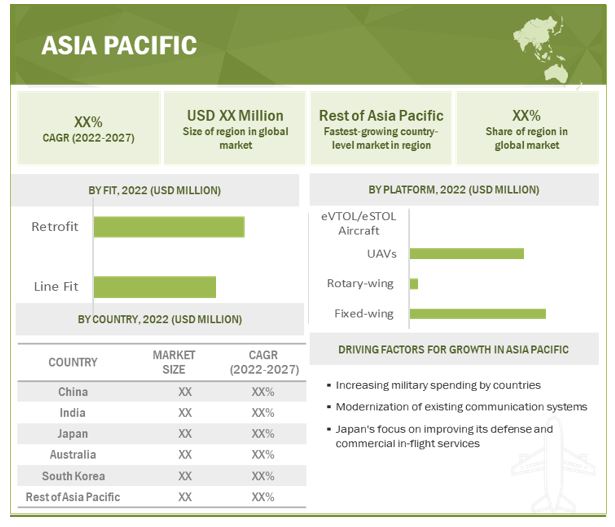

The Asia Pacific market is projected to contribute the highest CAGR from 2022 to 2027

The Asia Pacific is projected to grow at highest CAGR of 13.1% in 2022-2027. Changes in regulatory norms, modernization of legacy systems and Collaboration among leading players for aircraft communication system are driving this market

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Communication System Companies: Top Key Market Players

The Aircraft Communication System Companies is dominated by globally established players such as:

- Elbit Systems (Israel)

- L3Harris Technologies (US)

- Thales Group (France)

- Collins Aerospace (US)

- Northrop Grumman (US)

- Raytheon Intelligence and Space (US)

The report covers various industry trends and new technological innovations in the aircraft communication system market for the period, 2018-2027.

Scope of the Aircraft Communication System Market Report

|

Report Metric |

Details |

|

Expected Market Size |

USD 8.2 billion in 2022 |

|

Projected Market Size |

USD 12.8 billion by 2027 |

|

Growth Rate (CAGR) |

9.2% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Monetary Unit |

Value (USD) |

|

Segments Covered |

Platform, Component, System, Fit, and Connectivity |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies Covered |

L3Harris Technologies (US), Honeywell International Inc (US), Thales Group (France), Collins Aerospace (US), Elbit System (Israel), General Dynamics Mission Systems (US) and Cobham Aerospace communications (France) are some of the leading companies covered in the report. The report covers top 25 companies globally. |

This research report categorizes the aircraft communication system market based on platform, component, system, connectivity, fit and region.

Based on Platform:

- Fixed Wing

- Commercial Aircraft

- Narrow Body Aircraft (NBA)

- Wide Body Aircraft (WBA)

- Regional Transport Aircraft (RTA)

-

Military Aircraft

- Fighter Aircraft

- Transport Aircraft

- Special Mission Aircraft

-

Business Aviation & General Aviation

- Business Jets

- Light Aircraft

-

Rotary Wing

- Commercial Helicopter

- Military Helicopter

-

Unmanned Aerial Vehicles (UAV)

- Fixed Wing UAVs

- Fixed Wing Hybrid VTOL UAVs

- Rotary Wing UAVs

- eVTOL/eSTOL

Based on System

-

Radio Communication

- VHF Communication System

- HF Communication System

- SATCOM System

- Interphone Communication System

- Passenger Address System

- Digital Radio & Audio Integrating Management System

- Aircraft Communications Addressing and Reporting System (ACARS)

Based on Component:

- Transponders

- Transceivers

- Receivers

- Transmitters

- Antenna

- Software Defined Radio (SDR)

- Radio Tuning Unit

- Communication Management Unit

- Audio Management Unit

- Others

Based on Fit:

- Line Fit

- Retrofit

Based on Connectivity:

- SATCOM

- VHF/UHF/L-Band

- HF

- Data Link

Based on Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In May 2022, Under the US Army's Combat Net Radio (CNR) upgrade program, Thales was one of two vendors chosen to receive an Indefinite Delivery, Indefinite Quantity (IDIQ) contract to supply cutting-edge tactical radios. A five-year basic ordering period and an additional five-year optional ordering period are both part of the competitive 10-year contract for the Combat Net Radio (CNR) program. This contract was issued in an effort to replace its obsolete Single Channel Ground and Airborne Radio System (SINCGARS).

- In April 2022, A contract for hardware design services and manufacturing of Secure Communications Solution (SCS) devices was signed by Northrop Grumman Australia and Australian electronics engineering business IntelliDesign.

- In April 2022, L3Harris Technologies (US) expanded its global aircraft-on-ground (AOG) logistics support supplier contract with OEM Services to include the Aviation Communication & Surveillance Systems (ACSS) surveillance products line to provide faster and more localized customer services.

- In March 2022, The US Special Operations Command received the ALQ-251 radio frequency countermeasure (RFCM) system from Northrop Grumman Corporation as part of an AC-130J aircraft upgrade. In disputed and crowded electromagnetic spectrum conditions, the ALQ-251 will offer enhanced situational awareness and defense against electronic warfare systems and radar-guided munitions. The integrator for the AC-130J and MC-130J RFCM program is Sierra Nevada Corporation.

- In January 2022, For the US Army's Enduring and Future Vertical Lift (FVL) fleet, Collins Aerospace successfully demonstrated a ready-now mission systems solution to support the operation of air launched effects (ALE). These ALE, which consist of an air vehicle, a number of payloads, and a mission system, are an essential component of the FVL aircraft's capacity to increase the natural reach, lethality, and survivability of manned platforms with operator-in-the-loop autonomy.

Frequently Asked Questions (FAQ):

What is the current size of the aircraft communication system market?

The market size of aircraft communication system market is increases from USD 8.2 billion in 2022 to USD 12.8 billion in 2027 at a CAGR of 9.2%.

What are key dynamics such as drivers and opportunities that govern the market?

The ongoing technological advancements, rise in adoption of software defined radio for satellite communications, use of commercial off-the-shelf (COTS) technology and increased demand for next-generation IP systems are few drivers and opportunities that govern the market.

What are the key sustainability strategies adopted by the leading players operating in the aircraft communication system market?

Some of the techniques used by the top manufacturers of aircraft communication system include long-term contracts with airlines, aircraft manufacturers, and integrators for specific aircraft fleets.

What are the new emerging technologies and use cases disrupting the aircraft communication system market?

The major emerging technologies and use cases disrupting the aircraft communication system market are laser communication, L-Band Digital Aeronautical Communication System (L-DACS), 5G Communication, Wireless communication technologies and Internet Protocol (IP) version 6.

Who are the key players and innovators in the ecosystem of the aircraft communication systems?

Few key players and innovators in the ecosystem of the aircraft communication system market are L3Harris Technologies (US), Collins Aerospace (US), Honeywell International Inc. (US), Collins Aerospace (US), and Elbit Systems (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The global study involved four major activities for estimating the size of the aircraft communication system market. Exhaustive secondary research has been conducted to collect information on the market, peer market and parent market. The next step involved has been validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall market size. Furthermore, market breakdown and data triangulation techniques have been used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as Statista, Boeing and Airbus Outlook, World Bank, Global Firepower, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the aircraft communication system market.

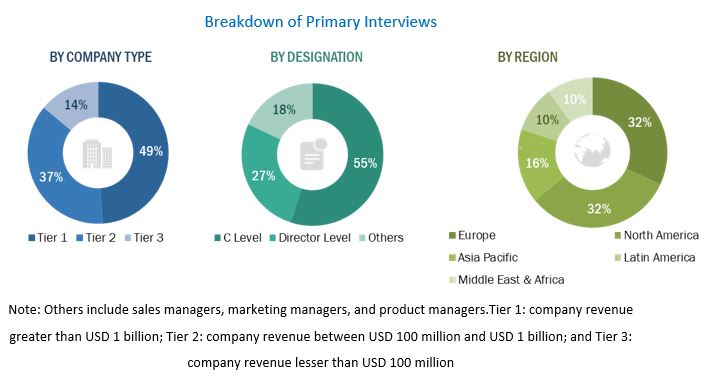

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), and directors, from business development, marketing, and product development/innovation teams, and related key executives from aircraft communication system vendors, independent aviation consultants and importers, distributors, and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, platform, and region. Stakeholders from the demand side, such as CXOs, production managers, engineers, and installation teams of end users of aircraft communication system, were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage and outlook of their business, which could affect the overall aircraft communication system market.

To know about the assumptions considered for the study, download the pdf brochure

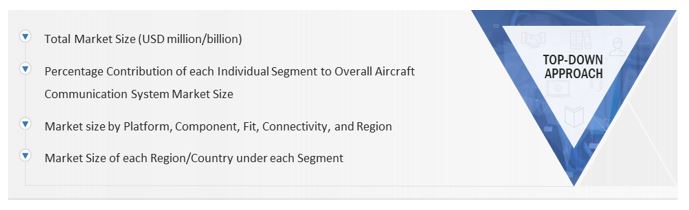

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the aircraft communication system market.

The research methodology used to estimate the market size also includes the following details:

- Key players in the industry and market were identified through extensive secondary research. This included a study of annual and financial reports of top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

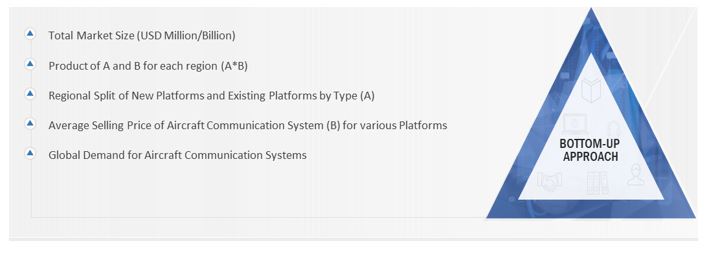

Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the aircraft communication system market from the revenues of key players and their shares in the market. Calculations based on the revenue of key players identified led to the overall market size.

The bottom-up approach was also implemented for data extracted from secondary research to validate the market segment revenue obtained. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each individual market size were determined and confirmed in this study.

Global Aircraft Communication System Market Size: Bottom-Up Approach

Global Aircraft Communication System Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition, the market size was validated using both, top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft communication system market based on component, platform, system, fit, connectivity, and region

- To analyze the degree of competition in the market by mapping the recent developments, products, and services of key market players

- To understand the structure of the aircraft communication system market by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the market

- To forecast the size of market segments across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, along with major countries in each region

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and new product developments adopted by players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations

With the market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Communication System Market