Aircraft Electrification Market by Technology (More Electric, Hybrid Electric, Fully Electric), Component, Application, System, Platform (Commercial, Military, Business & General Aviation, UAV, AAM) and Region -Global Forecast to 2030

Update: 11/22/2024

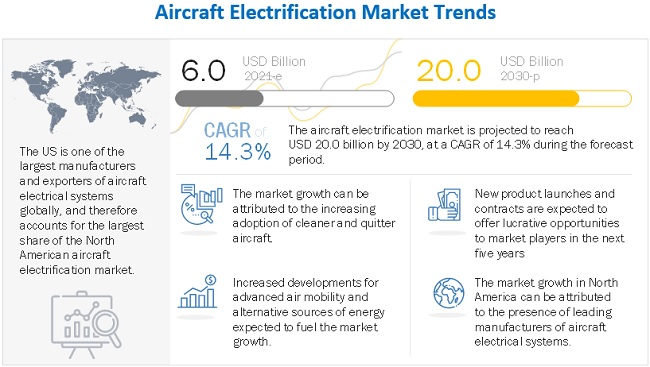

The Global Aircraft Electrification Market Size was valued at USD 6.0 billion in 2021 and is estimated to reach USD 20.0 billion by 2030, growing at a CAGR of 14.3% during the forecast period. The need for cleaner and safer solutions for air travel and the increasing developments in the air mobility platforms to drive demand of the Aircraft Electrification Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft electrification is the utilization for propulsion in aircraft systems traditionally driven by hydraulic, pneumatic, and mechanical systems. It is a market where electrification technology is implemented in progressive stages, from more electric aircraft to fully electric aircraft. Electrification technology is implemented in aircraft at different levels, forming three major segments: more electric aircraft, hybrid electric aircraft and fully electric aircraft.

Aircraft Electrification Market Dynamics

Drivers: Lower cost of maintenance

The installation of conventional systems onboard an aircraft is a complex process, and the maintenance of such systems is both time consuming and labor intensive. Electrification of aircraft helps in the substantial reduction of maintenance costs as it uses fewer moving parts compared to conventional systems. Major aircraft OEMs, such as Airbus and Boeing, are manufacturing more electric aircraft owing to their benefits. Similarly, lower operational costs due to electrification offer a significant opportunity for the development of hybrid as well as fully electric aircraft

Opportunities: Development of lithium-ion batteries

Advanced applications in aircraft tend to consume more power, needing batteries with high power storage, and improved safety features. Despite the potential of lithium-ion batteries, various manufacturers of energy storage systems in Japan, China, South Korea, the US, and Europe believe that the performance of lithium-ion batteries can be improved significantly. Therefore, significant research is carried out to improve the performance of lithium-ion batteries as well as develop other related battery technologies.

Challenges: Battery recharging infrastructure

With a large number of batteries on-board an aircraft, there will be a need for recharging facilities at airports, and existing infrastructure is not sufficiently equipped with such facilities. The electrification of an aircraft adds a layer of complexity to the existing infrastructural growth requirements. Appropriate infrastructural sizing needs to be done in order to understand the overall requirements of recharging facilities, such as estimating the number and type of charging points, their electrical consumption in terms of energy and power, and the economics involved.

The hybrid electric segment is witnessing highest growth during the forecast period

Based on technology, the hybrid electric segment is witnessing the highest growth in the aircraft electrification market during the forecast period. Hybrid electric technology helps aircraft cover larger ranges with much larger MTOW compared to fully electric aircraft. Hybrid electric aircraft also helps reduce emmissions, noise and fule conusmption compared to a conventional aircraft. These factors drive the demand for hybrid electric aircraft.

The business and general aviation segment is witnessing the highest growth during the forecast period

Based on platform, the business jet and general aviation segment is witnessing the highest growth in the aircraft electrification market size during the forecast period. Due to increase in wealth across individuals and corporates, the demand for business jets is gradually increasing. This is because of the need for private and chartered travel options across these individuals and companies.

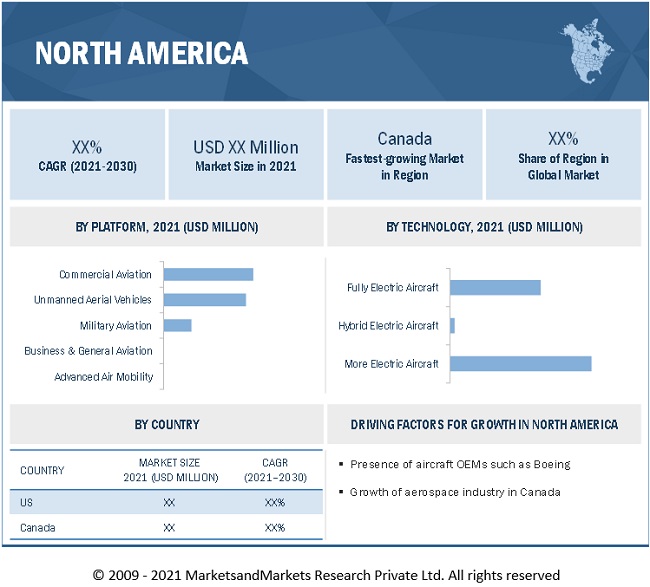

The North American market has the largest market across all regions in the year 2021

The North American market is home to electrification component manufacturers as well as aircraft manufacturers. The growing number of electrification projects and the increasing developments in advanced air mobility platforms are driving the demand for aircraft electrification industry in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Aircraft Electrification Companies are dominated by a few globally established players such as Honeywell International Inc. (US). Safran (France), Raytheon Technologies (US), GE Aviation (US) and Thales Group (France)

Honeywell International Inc. is a design and manufacture company that provides solutions for a wide variety of industries. The company mainly operates through 4 major segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. Honeywell has been providing industry leading solutions along with manufacturing and service for commercial, defense, and space applications.

General Electric Company (Ge) is a technology and manufacture company that operates through 2 main segments: Industrial and Financial Services. The industrial segment provides solutions for power, renewable energy, aviation, and healthcare. Its financial services segment provides services in capital services.

Safran is a multinational company that provide aerospace solutions. The company provides solution in aircraft engines, rocket engine, aerospace components, defense equipment and components, and security solutions. The completely owned subsidiary, Safran Electronics & Defense, offers solutions in electronic systems, and in critical software for both commercial and defense applications.

Raytheon Technologies is the largest aerospace, defense, and intelligence service providers in the world. Raytheon along with its subsidiaries like Collins Aerospace provides electrical solutions across all aerospace platforms. Raytheon provides solutions in aircraft engines, avionics, aerostructures, and security solutions.

Thales Group provides aerospace, defense, transport, and security solutions. In the aerospace segment, the company develops onboard systems, services, and solutions for commercial and defense customers. The company has also heavily invested in the research and development of electrical solution for aerospace and defense applications.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

14.3% |

|

Estimated Market Size in 2021 |

USD 6.0 Billion |

|

Projected Market Size in 2030 |

USD 20.0 Billion |

|

Market size available for years |

2017–2030 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, By Technology, By Application, By Platform, By System |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

Honeywell International Inc. (US), Safran (France), Thales Group (France), Raytheon Technologies (US), GE Aviation (US) |

The study categorizes the aircraft electrification based on component, technology, application, platform, system, and region.

By Component

- Batteries

- Fuel Cells

- Solar Cells

- Electric Actuators

- Electric Pumps

- Generators

- Motors

- Power Electronics

- Distribution Devices

By Technology

- More Electric

- Hybrid Electric

- Fully Electric

By Application

- Power Generation

- Power Distribution

- Power Conversion

- Energy Storage

By Platform

- Fixed Wing

- Rotary Wing

- Unmanned Aerial Vehicles (UAVs)

- Advanced Air Mobility

By System

- Propulsion System

- Environmental Control System

- Landing Gear System

- Ice Protection System

- Flight Control System

- Thrust Reverser System

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

What’s New?

1. Any major development which can change the business landscape as well as market forecasts

- Low operational costs

- Growing need for cleaner and quieter aircraft

- Advances in batteries, electric motors, and power electronics

- Rise in demand for unmanned aerial vehicles

- Surging demand for electrical systems in aircraft

2. Addition/Refinement in segmentation - Increase in depth or width of segmentation

Aircraft Electrification Market,

- Region

- Platform

- Technology

3.Coverage of new market players, change in market share of existing players

Company Profiles: Company profiles give a glimpse of the key players in the market with respect to business overview, financials, product offerings, SWOT Analysis, MnM View and recent developments.

4. Updated financial information/ product portfolio of players

Newer and improved representation of financial information: This edition of report provides updated financial information in context of aircraft electrification market till 2019/2020 for each listed company in graphical representation in single diagram (instead of multiple tables). This would help to easily analyse the present status of profiled companies in terms of their financial strength,

profitability, key revenue generating region/country, business segment focus in terms of the highest revenue generating segment and investment on research and development activities

5. Updated market developments of profiled players

Recent Market Developments: Recent developments are helpful to know the market trend and growth strategies adopted by players in the market. For instance, the current analysis shows that contracts have become a more popular growth strategy followed by players during 2017-2021.

Recent Developments

- In February 2022, GE Aviation selected Boeing to support flight tests of its hybrid-electric propulsion system using a modified Saab 340B aircraft and CT7-9B turboprop engines. Boeing and its subsidiary Aurora Flight Sciences will provide GE Aviation with airplane modification, system integration, and flight-testing services.

- In February 2022, magniX announced a partnership with Brazilian aeronautical company, DESAER, to develop the ATL-100H, a hybrid electric iteration of the ATL-100 regional aircraft. The ATL-100H is expected to save between 25-40% of fuel depending on the range of the operation, a significant achievement in carbon emission reductions. The innovative design of the hybrid electric ATL-100H is a steppingstone towards an all-electric aircraft from DESAER, supporting the globally recognized need to accelerate sustainable aviation practices.

- In January 2022, Safran is taking a significant role on the H160M Guépard (Leopard) helicopter, developed by Airbus for the French armed forces’ Joint Light Helicopter program (HIL), which will replace five different helicopter types currently in service with French forces: Gazelle, Alouette III, Dauphin, Panther, and Fennec. Safran’s main contribution to these twin-engine helicopters is the Arrano, a new-generation turboshaft engine rated at 1,300 shaft horsepower (SHP) that incorporates the latest aero-engine technologies. Safran will also supply various high-performance flight control systems, including smart electro-mechanical actuators (SEMA) and trim actuators, along with cockpit components and windshield wiper systems and electrical distribution.

- In December 2021, BAE Systems and Embraer Defense & Security have plans to embark on a joint study to explore the development of Eve’s electric Vertical Take-Off and Landing (eVTOL) vehicle for the defense and security market. The joint study builds on Eve’s development for the urban air mobility market and will look at how the aircraft could provide cost-effective, sustainable, and adaptable capability as a defense variant.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the aircraft electrification market?

The aircraft electrification market is expected to grow substantially. The growth of this market is mainly driven by increase in adoption of cleaner and greener aircraft, developments in advanced air mobility and alternative sources of energy.

What are the key sustainability strategies adopted by leading players operating in the aircraft electrification market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft electrification market. The major players include as Honeywell International Inc. (US), Safran (France), Thales Group (France), Raytheon Technologies (US), GE Aviation (US), these players have adopted various strategies, such as acquisitions, contracts, new product launches, and partnerships & agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft electrification market?

The new emerging technologies in the aircraft electrification market are turbogenerators for powering electric motors and batteries, electric actuators and fly by wire.

Who are the key players and innovators in the ecosystem of the aircraft electrification market?

The key players in the aircraft electrification market include Honeywell International Inc. (US), Safran (France), Thales Group (France), Raytheon Technologies (US), GE Aviation (US).

Which region is expected to hold the highest market share in the aircraft electrification market?

Aircraft electrification market in North America is projected to hold the highest market share during the forecast period. The key factor responsible for North America leading the aircraft electrification market is the high demand for new aircraft in the region. The growing upcoming projects, and the emergence of several startups supporting the electrification in the aviation industry are additional factors influencing the growth of the North American aircraft electrification market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

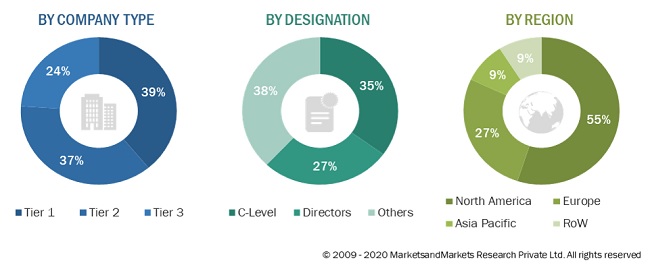

The research study involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg, and Factiva to identify and collect information relevant to the aircraft electrification market. Primary sources include industry experts from the aircraft electrification market as well as suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the aircraft electrification market as well as to assess the growth prospects of the market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as the International Air Transport Association (IATA); the Federal Aviation Administration (FAA); the General Aviation Manufacturers Association (GAMA); corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from aircraft electrification component manufacturers; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, product, end user, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using aircraft electrification components were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aircraft electrification and future outlook of their business which will affect the overall market.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

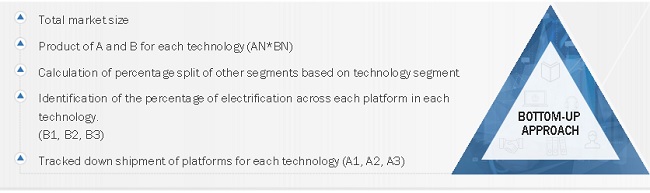

Both top-down and bottom-up approaches were used to estimate and validate the total size of the aircraft electrification market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Aircraft Electrification Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the aircraft electrification market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends. Along with this, the market size was validated using the top-down and bottom-up approaches.

Meeting the Demand for Sustainable Aviation Solutions with Electric Propulsion Systems in the Aviation Electrification Industry

The electric propulsion system offers significant advantages over traditional fuel-based engines. Electric propulsion systems are more efficient, reliable, and environmentally friendly than traditional engines, making them a more attractive option for airlines and aircraft manufacturers. Additionally, the use of electric propulsion systems allows for reduced noise levels and vibrations, resulting in a more comfortable passenger experience.

Advancements in battery technology have made electric propulsion systems a more viable option for aircraft. The development of high-energy-density batteries has enabled electric aircraft to have longer ranges and carry more passengers and cargo, making them a more practical alternative to traditional fuel-based aircraft.

The increasing demand for sustainable and eco-friendly aviation solutions has driven the growth of the electric propulsion system. The aviation industry is under increasing pressure to reduce its environmental impact, and the use of electric propulsion systems is seen as a key way to achieve this goal. As a result, governments, regulatory bodies, and consumers are driving demand for more sustainable aviation solutions, with electric propulsion systems at the forefront of this movement.

The aircraft electric propulsion system is the main growth factor in the aviation electrification industry due to its efficiency, reliability, eco-friendliness, and practicality. As technology continues to advance and the demand for sustainable aviation solutions increases, the use of electric propulsion systems are expected to become even more widespread, driving further growth and innovation in the industry.

Report Objectives

- To define, describe, segment, and forecast the aircraft electrification market based on component, technology, application, platform, system, and region.

- To forecast the size of various segments of the aircraft electrification market based on five regions—North America, Europe, Asia Pacific, Latin America, Middle East and Africa ?along with major countries in each region.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze technological advancements and product launches in the market

- To analyze micromarkets with respect to their growth trends, prospects, and contribution to the overall market

- To provide a detailed competitive landscape of the market, along with market share analysis of key players

- To strategically profile key players and comprehensively analyze their market position in terms of shares and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aircraft electrification market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in aircraft electrification market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Electrification Market