This research study on the more electric aircraft market involved the extensive use of secondary sources, directories, and databases such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources considered included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the market and assess its growth prospects.

Secondary Research

The ranking analysis of companies in the more electric aircraft market was determined using secondary data from paid and unpaid sources and analyzing the product portfolios and service offerings of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources for this research study included financial statements of companies offering aircraft electric components for all technology stages, such as more electric aircraft, hybrid electric aircraft, and fully electric aircraft, along with various trade, business, and professional associations. The secondary data was collected and analyzed to determine the market's overall size, which primary respondents validated.

Primary Research

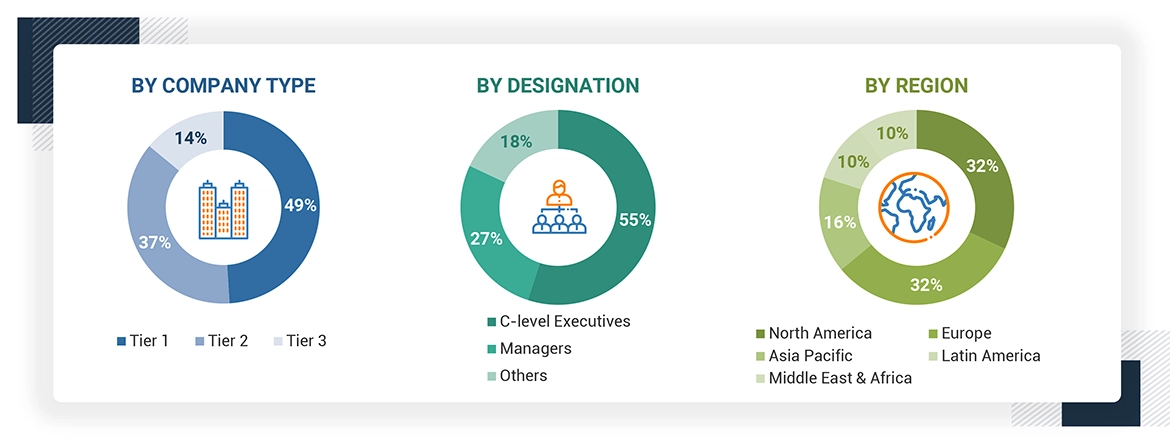

Through secondary research, extensive primary research was conducted after obtaining information about the more electric aircraft market's current scenario. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: C-level Executives include the CEO, COO, and CTO, among others.

*Others include Sales Managers, Marketing Managers, and Product Managers.

The tiers of the companies have been defined based on their total revenue as of 2022.

Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the more electric aircraft market size. The following figure in this subsection represents the overall market size estimation process employed for this study.

The research methodology used to estimate the market size also includes the following details:

-

Key players in the market have been identified through secondary research, and their market shares have been determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

-

All percentage shares split and breakdowns have been determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data has been consolidated, added with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

In the top-down approach, the overall market size has been used to estimate the size of individual subsegments (mentioned in the market segmentation) through percentage splits acquired from secondary and primary research. For the calculation of specific market segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The bottom-up approach has been implemented to validate the market segment revenues obtained.

Market shares have been estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation and validation of data through primaries, the overall parent market size and each market size have been determined and confirmed in this study. The data triangulation used for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market has been split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, data triangulation and market breakdown procedures explained below have been implemented, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

More electric aircraft (MEA) is a concept that involves the use of electric power (as opposed to pneumatic and hydraulic sources of power) for all non-propulsive systems in an aircraft. The use of electric power helps reduce the overall weight, fuel consumption, and greenhouse emissions of an aircraft. Electrical systems also help cut down the assembly and maintenance costs of aircraft and facilitate faster manufacturing.

Stakeholders

-

Airport developers

-

Software developers

-

Research bodies.

-

Governmental bodies

-

More electric aircraft system manufacturers

-

More electric aircraft regulators

-

Investors and financial community professionals

-

Ministry of Defense of relevant nations

-

Technology support providers

-

Software/hardware/service and solution providers

Report Objectives

-

To define, describe, segment, and forecast the size of the more electric aircraft market based on system, component, application, platform, end user, and region.

-

To forecast the size of various segments of the market with respect to five major regions, namely North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with major countries in each of these regions.

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe.

-

To identify industry trends, market trends, and technology trends currently prevailing in the market.

-

To provide an overview of the regulatory landscape with respect to more electric aircraft regulations across regions

-

To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

-

To analyze opportunities in the market for stakeholders by identifying key market trends

-

To profile key market players and comprehensively analyze their market share and core competencies2.

-

To analyze the degree of competition in the market by identifying key growth strategies, such as, agreements, acquisitions, contracts, and partnerships, adopted by leading market players.

-

To identify detailed financial positions, key products, and unique selling points of leading companies in the market

-

To provide a detailed competitive landscape of the market, along with market ranking analysis, market share analysis, and revenue analysis of key players

Growth opportunities and latent adjacency in More Electric Aircraft Market