Aircraft Electrical Systems Market

Aircraft Electrical Systems Market by Solution (Power Generation, Power Distribution, Power Conversion, Power Storage, Power Management, Power Drives), Application (Propulsion & Powertrain, Flight Control & Actuation, Avionics & Mission Systems, Cabin & Passenger Systems, Environmental Control Systems, Aircraft Utilities & Support Systems), Aircraft Type (Commercial Aviation, Business & General Aviation, Military Aviation, Advanced Air Mobility (AAM), Propulsion Technology, Point of Sale, and Region – Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

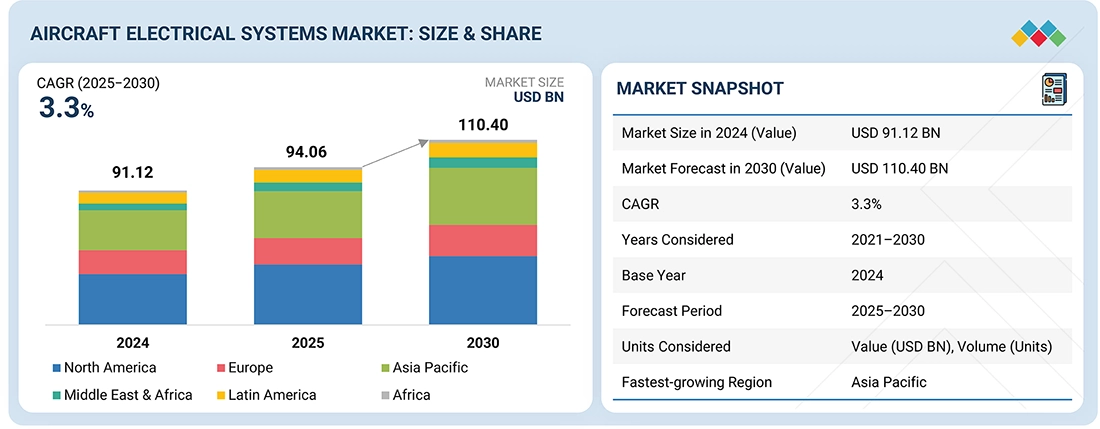

The aircraft electrical systems market is projected to grow from USD 94.06 billion in 2025 to USD 110.40 billion by 2030 at a CAGR of 3.3% from 2025 to 2030. The aircraft electrical systems market has experienced considerable growth recently. This expansion is primarily fueled by the growing shift toward More Electric Aircraft (MEA) and All-Electric Aircraft (AEA) architectures, coupled with rising fleet expansion and aircraft modernization initiatives. Technological advancements in power electronics and energy distribution, are accelerating the adoption of advanced electrical systems in aviation.

KEY TAKEAWAYS

-

By RegionNorth America is estimated to dominate the aircraft electrical systems market, with a share of 38.2%, in 2025.

-

By SolutionBy solution, the power drives segment is projected to register the highest CAGR of 9.8% during the forecast period.

-

By ApplicationBy application, the propulsion & powertrain segment is projected to grow at the highest rate from 2025 to 2030.

-

By Aircraft TypeBy platform, the AAM segment is projected to grow at the highest rate during the forecast period.

-

By Propulsion TechnologyBy propulsion technology, the conventional aircraft segment is estimated to account for the largest share in 2025.

-

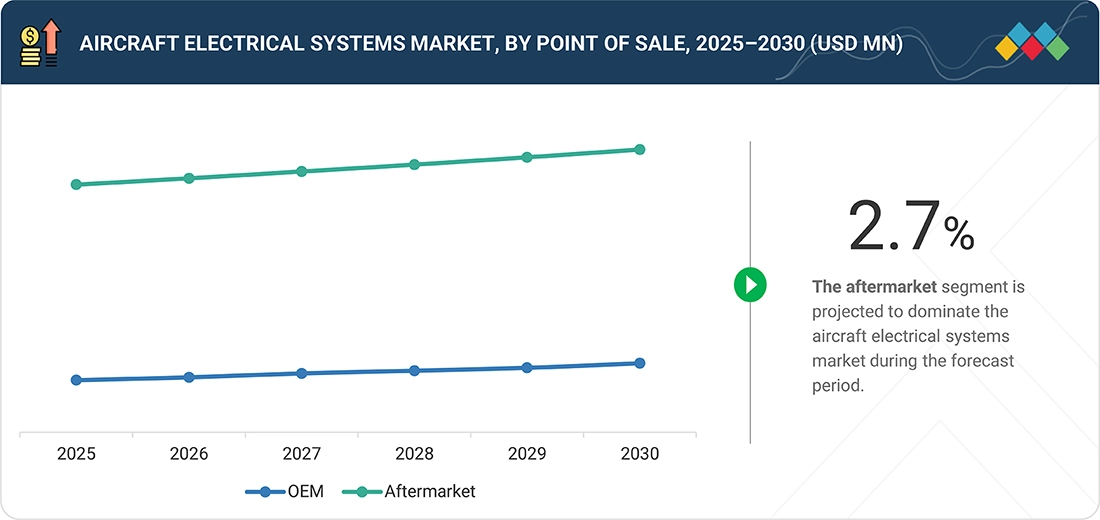

By Point of SaleBy point of sale, the OEM segment is projected to grow at a higher rate than the aftermarket segment during the forecast period.

-

Competitive LandscapeSafran, GE Aviation, and Thales were identified as Star players in the aircraft electrical systems market (global), given their strong product portfolios, extensive global footprint, robust business strategies, and significant market share supported by wide application of their solutions.

-

Competitive LandscapeH3X Technologies Inc., Wright Electric Inc., and Magnix are considered progressive companies in the aircraft electrical systems market. They have distinguished themselves through strong innovation in electric propulsion, advanced power electronics, and their ability to meet rising demand for high-efficiency, lightweight, and reliable electrical systems across commercial, regional, and advanced air mobility sectors.

The aircraft electrical systems market is growing due to the increasing shift toward More Electric Aircraft (MEA), hybrid-electric, and fully Electric Aircraft (EA), which are driving the demand for high-voltage distribution units, advanced converters, batteries, and power management systems. The expansion of hybrid-electric propulsion, urban air mobility platforms, and next-generation commercial and defense aircraft is accelerating the adoption of digitally monitored and intelligent electrical architectures. Future demand will be driven by AI-enabled diagnostics, smart power distribution, and cyber-secure electrical systems capable of supporting high-efficiency, lightweight, and thermally optimized operations. Key players such as Safran, Honeywell, GE Aerospace, RTX, Thales, and Airbus, are actively investing in electrification technologies, enhancing system reliability, efficiency, and sustainability across modern aviation platforms.

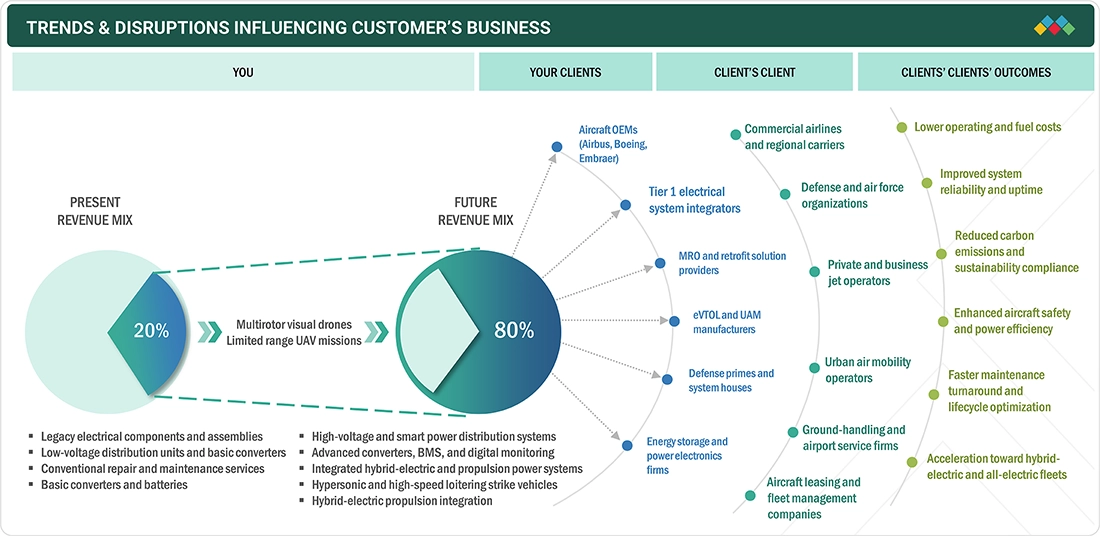

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ business in the aircraft electrical systems market is driven by the shift from legacy low-voltage components to high-voltage, smart, and digitally enabled power distribution and hybrid-electric propulsion systems. Aircraft OEMs, Tier 1 integrators, MRO providers, eVTOL manufacturers, and energy storage firms are adopting advanced converters, battery management systems, and integrated monitoring to improve performance, efficiency, and sustainability. This enables end users, such as airlines, defense forces, private jet operators, and urban air mobility providers to reduce fuel costs, enhance safety and reliability, meet sustainability goals, and accelerate the transition toward hybrid-electric and all-electric fleets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Adoption of More Electric Aircraft (MEA) and All-Electric Aircraft (AEA) architectures

-

Technological advancements in power electronics and energy distribution

Level

-

High development, certification, and lifecycle costs

-

Stringent certification and safety regulations

Level

-

Growing adoption of hybrid-electric and electric propulsion systems

-

Expansion of electrification in emerging markets and urban air mobility

Level

-

Legacy architecture integration and platform compatibility

-

Energy storage and thermal management limitations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of More Electric Aircraft (MEA) and All-Electric Aircraft (AEA) architectures

The shift toward MEA and AEA is fundamentally transforming aircraft propulsion and power systems, replacing hydraulic and pneumatic systems with advanced electrical solutions. This transition is driving significant demand for high-voltage power distribution, electric propulsion subsystems, and advanced converters. It is also accelerating investments in electrification technologies, reshaping OEM strategies and supplier ecosystems.

Restraint: High development, certification, and lifecycle costs

Designing and certifying aviation-grade electrical systems require extensive testing, validation, and regulatory compliance, significantly increasing R&D and time-to-market costs. The high cost of integrating new technologies with safety and performance standards limits adoption among smaller manufacturers and retrofit markets. These financial constraints impact scalability and delay mass-market commercialization of advanced electrical platforms.

Opportunity: Growing adoption of hybrid-electric and electric propulsion systems

Hybrid-electric and fully electric propulsion are emerging as key enablers of sustainable aviation, creating significant opportunities for electrical system suppliers. These systems require advanced power electronics, high-density energy storage, and optimized power conversion architectures. This trend opens new revenue streams in urban air mobility, regional aircraft, and next-generation commercial aviation platforms.

Challenge: Legacy architecture integration and platform compatibility

Integrating advanced high-voltage and digital power systems with existing aircraft platforms presents major compatibility challenges. Legacy architectures limit electrical load capacity, complicating retrofits and delaying hybrid-electric upgrades. Manufacturers must balance innovation with interoperability, making system modularity and redesign essential.

Aircraft Electrical Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Predictive Health Monitoring for Power Electronics to detect degradation in generators, converters, and wiring systems | Reduces unplanned failures | Extends component lifespan, optimizes maintenance schedules | Lowers operational costs |

|

AI-Assisted Electrical Load Management to optimize real-time power allocation during peak demand phases | Enhances energy efficiency | Improves system reliability | Reduces fuel burn | Ensures stable electrical performance during critical flight conditions |

|

Digital Twin for Electrical Architecture to simulate and validate electrical system behavior under thousands of operating scenarios | Accelerates certification | Reduces testing time and development costs | Enables early fault detection | Enhances design accuracy |

|

Automated Fault Detection & Isolation (AFDI) to rapidly detect voltage anomalies and component failures in high-voltage systems | Improves flight safety | Minimizes cascading failures | Reduces troubleshooting time | Enables precise diagnostic insights |

|

Gen AI–Enhanced Component Design for converters, inverters, and solid-state power controllers (SSPCs) | Optimizes thermal and weight performance | Enhances component efficiency | Shortens development cycles | Improves system reliability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aircraft electrical systems market ecosystem consists of manufacturers, such as GE Aerospace, Honeywell, RTX, Astronics, Amphenol, and AMETEK, supplying core electrical components, high-voltage distribution units, and power conversion systems. Solution providers including Safran, Thales, BAE Systems, ST Engineering, Radiant Power Corp, and Avionic Instruments deliver integrated power management, digital monitoring, and advanced electrical architectures. End users such as Airbus, Boeing, Lockheed Martin, Northrop Grumman, Dassault Systèmes, and NASA deploy these solutions to enhance aircraft electrification, improve safety, reduce fuel consumption, and support hybrid-electric and all-electric aviation programs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aircraft Electrical Systems Market, By Solution

The power generation segment is estimated to account for the largest share in 2025, due to the increasing adoption of more electric aircraft, which rely heavily on advanced electrical power sources to support critical systems. Rising demand for efficient energy generation technologies, such as high-density generators, auxiliary power units, and integrated starter generators, is enhancing system reliability and performance. Additionally, the focus on reducing fuel consumption, improving energy efficiency, and ensuring uninterrupted power supply is driving the integration of innovative power generation solutions in modern aircraft platforms.

Aircraft Electrical Systems Market, By Application

The avionics & mission systems segment is estimated to account for the largest share (22%) in 2025 due to the growing demand for advanced navigation, communication, surveillance, and flight management systems in modern aircraft. Increasing adoption of digital cockpit technologies, real-time data processing, and intelligent monitoring systems is accelerating the need for efficient and reliable electrical architectures. Additionally, rising focus on situational awareness, safety, and compliance with regulatory standards further drives the integration of sophisticated avionics and mission-critical electrical systems.

Aircraft Electrical Systems Market ,By Propulsion Technology

The more electric aircraft segment is projected to grow at the highest CAGR of 13.3% during the forecast period due to the increasing industry focus on full electrification to improve energy efficiency and reduce emissions. Advancements in high-voltage electrical systems, electric propulsion motors, and energy storage technologies are accelerating adoption across regional, commercial, and advanced air mobility platforms. Additionally, growing government incentives, sustainability mandates, and investments in electric aircraft programs are further supporting segment expansion.

Aircraft Electrical Systems Market, By Point of Sale

The aftermarket segment is estimated to account for the largest share in 2025 driven by the growing demand for maintenance, repair, upgrades, and life-cycle support of electrical components across expanding global fleets. Airlines are increasingly investing in retrofitting aging aircraft with advanced, energy-efficient electrical systems to enhance reliability and operational performance. The rise of predictive maintenance and digital monitoring solutions further boosts aftermarket service requirements, reinforcing its strong market position.

REGION

Asia Pacific to be fastest-growing region in global aircraft electrical systems market during forecast period

Asia Pacific is projected to grow at the highest CAGR of 4.1% in the aircraft electrical systems market, driven by rapid expansion in commercial aviation, rising air passenger traffic, and increased aircraft procurement across major economies like China, India, and Japan. Regional airlines are heavily investing in fleet modernization and adopting more electric and fuel-efficient aircraft, boosting the demand for advanced electrical systems. Government initiatives, strengthening domestic aerospace manufacturing and developing aviation infrastructure, support market growth. Additionally, the growing interest in electric and hybrid aircraft technologies enhances future demand in the region.

Aircraft Electrical Systems Market: COMPANY EVALUATION MATRIX

Safran (Star) leads the market with advanced electrical power generation and distribution systems, offering lightweight, reliable, and highly integrated solutions for next-generation commercial and defense aircraft. GE Aviation (Emerging Leader) strengthens its position with high-efficiency electrical propulsion components, intelligent power conversion technologies, and strong OEM collaborations supporting the shift toward more electric aircraft. Similarly, Amphenol Corporation (Pervasive Player) is rapidly expanding with innovative connectors, wiring harnesses, and lightweight interconnect solutions, meeting growing demand for high-performance, safe, and digitally enabled electrical systems across the aviation sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Safran (France)

- Honeywell International Inc (US)

- Thales (France)

- RTX (US)

- GE Aviation (US)

- Astronics Corporation (US)

- Amphenol Corporation (US)

- AMETEK Inc (US)

- TransDigm Group (US)

- Meggitt PLC (UK)

- BAE Systems (UK)

- EaglePicher Technologies (US)

- Crane Aerospace & Electronics (US)

- PBS Aerospace (Czech Republic)

- ACME Aerospace Inc. & Avionic Instruments, LLC (US)

- Pioneer Magnetics (US)

- Radiant Power Corp (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 91.12 Billion |

| Market Forecast in 2030 (Value) | USD 110.40 Billion |

| Growth Rate | CAGR of 3.3% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Latin America, Africa |

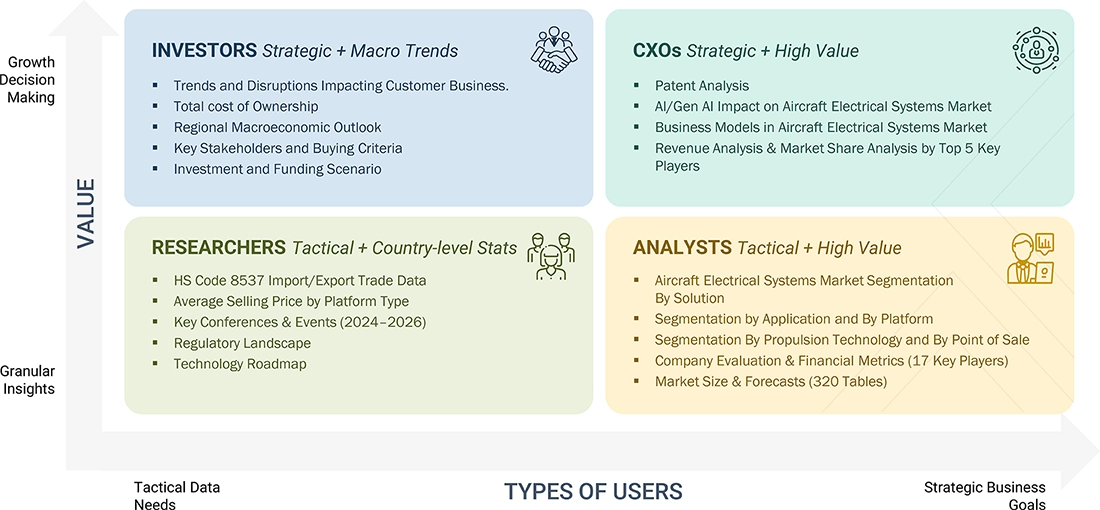

WHAT IS IN IT FOR YOU: Aircraft Electrical Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at regional/global level to gain an understanding on market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding on total addressable market |

RECENT DEVELOPMENTS

- October 2024 : Safran announced the expansion of its electrical power systems facility in France to increase production of high-voltage generators and power conversion units for next-generation electric and hybrid aircraft programs, enhancing manufacturing capacity and supporting OEM partnerships for advanced electrical architectures.

- September 2024 : GE Aerospace completed successful ground testing of its 270V DC high-voltage electrical power distribution system designed for hybrid-electric commercial aircraft, marking a key milestone in integrating electric propulsion components into future platforms.

- August 2024 : Amphenol introduced a compact, high-temperature-resistant wiring harness solution for electric aircraft and urban air mobility platforms, enhancing electrical connectivity performance while reducing weight and improving safety compliance.

- June 2024 : Honeywell launched a digital power management unit (DPMU) to optimize energy distribution, monitor electrical health, and reduce energy losses in more electric aircraft systems, targeting both commercial and regional fleets.

- May 2024 : Thales unveiled a next-generation electrical distribution and management system with real-time monitoring and AI-driven fault detection to improve electrical safety and system reliability in electric, hybrid-electric, and advanced air mobility platforms.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the aircraft electrical systems market. Exhaustive secondary research was conducted to collect information on the aircraft electrical systems market, its adjacent markets, and its parent aerospace systems market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain, including OEMs, Tier 1 suppliers, electrical component manufacturers, and MRO providers, through primary research. Demand-side analysis was conducted to estimate the overall market size based on fleet expansion, electrical content per aircraft, and electrification trends. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the aircraft electrical systems market, covering power generation, distribution, conversion, storage, management, and platform adoption.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. The secondary sources included government and regulatory bodies such as FAA, EASA, and ICAO; corporate filings, including annual reports, press releases, and investor presentations from key market players; white papers, journals, and certified publications on aircraft electrification, power management, and aerospace component technologies; and articles from recognized aerospace research agencies, directories, and databases, such as IATA, Airbus Global Market Outlook, Boeing Commercial Market Outlook, and industry associations.

Primary Research

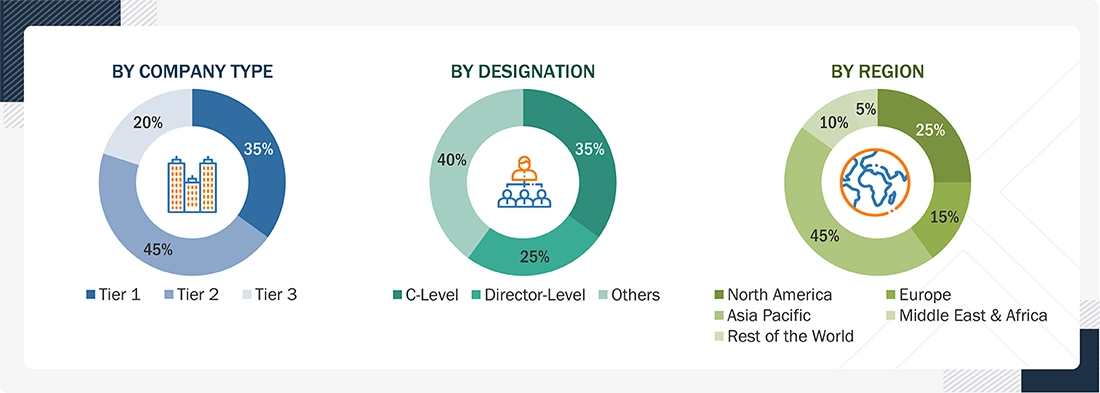

Extensive primary research was conducted after gathering key insights regarding the aircraft electrical systems market through secondary research. Several primary interviews were conducted with industry experts from demand and supply sides, including OEMs, Tier 1 suppliers, electrical component manufacturers, aviation consultants, and MRO service providers across major regions, such as North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. Primary data was collected through structured questionnaires, emails, and telephonic discussions to validate market assumptions, segment sizing, growth drivers, and future adoption trends.

Breakdown of Primary Respondents:

To know about the assumptions considered for the study, download the pdf brochure

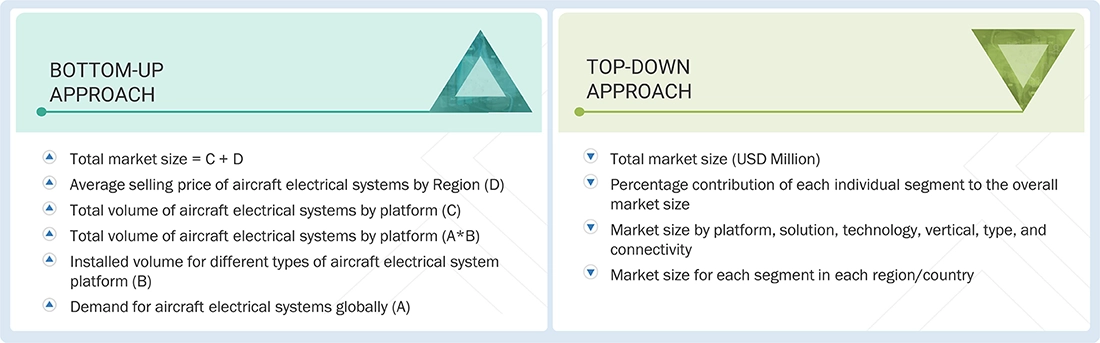

Market Size Estimation

Top-Down and Bottom-Up Approaches

The top-down and bottom-up approaches were used to estimate and validate the size of the aircraft electrical systems market. The research methodology used to estimate the size of the market included the following details:

- Key players in the aircraft electrical systems market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, electrical system architects, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the aircraft electrical systems market. This data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

An aircraft electrical system includes four main functionalities: Power generation, power conversion, power distribution, and energy storage. The system mainly consists of power sources, such as batteries and generators; components, such as conversion devices, control devices, and protection devices; and power distribution systems, such as cables and wires.

The system provides energy to the main electric loads, which include motors & actuators, subsystem controllers, lighting, avionics systems, and heating devices. Aircraft equipment that commonly uses the electrical system as a source of energy includes fuel gauges, air conditioning, ice protection, flight control systems, utilities, and landing gear, among others.

Stakeholders

- Raw Material Suppliers (Copper, aluminum, composites, insulation materials)

- Electrical Component Manufacturers (generators, converters, inverters, batteries, EWIS)

- Aircraft Electrical System Manufacturers

- Power Electronics and Energy Storage Providers

- System Integrators (Tier 1 and Tier 2 Suppliers)

- Avionics and Mission System Suppliers

- Distributors and Component Supply Partners

- Maintenance, Repair, and Overhaul (MRO) Companies

- Aircraft OEMs (Commercial, Business, Military, AAM, UAV)

- Government and Regulatory Agencies (FAA, EASA, ICAO, DoD)

- Research and Development Organizations and Testing Laboratories

Report Objectives

- To define, describe, and forecast the size of the aircraft electrical systems by solution, application, aircraft type, propulsion technology, point of sale, and region

- To forecast the sizes of market segments with respect to key countries in the following regions: North America, Europe, Asia Pacific, Middle East, Latin America, and Africa

- To identify and analyze drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To provide an overview of the regulatory landscape with respect to global aircraft electrical system regulations

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies

- To analyze the degree of competition in the market by identifying growth strategies, such as agreements, acquisitions, partnerships, collaborations, and product launches, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading market players.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aircraft Electrical Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Aircraft Electrical Systems Market

Ray

Nov, 2019

Interested in procuring this report to analyze the industry. Want to review a sample for content and scope of analysis..

Ian

Nov, 2019

I am a product marketing manager supporting the elements of GE Aviation covered by this market report. I am requesting the brochure and an understanding of the methodology deployed to develop it to see if this report will help me build out / refresh my own internal market analysis. I also have a concern that the report is now two years old and based on 2015 market data, is there a plan to refresh the analysis? If yes, then when will that new report be published and available? Thanks. .