Aviation Lubricants Market by Type (Engine Oil, Hydraulic Fluid, Special Lubricants & Additives, Grease), Platform (Commercial Aviation, Military Aviation, Business & General Aviation), Technology, Application, End User and Region -Global Forecast to 2027

Update: 11/05/2024

Aviation lubricants are specialized fluids and greases used to minimize friction and wear in various aircraft components, ensuring smooth operation and longevity of critical systems. These lubricants must meet stringent requirements to perform in extreme temperatures, high altitudes, and varying pressures, commonly encountered in aviation. They play a vital role in protecting engines, hydraulic systems, landing gears, and other parts against corrosion, oxidation, and thermal degradation. Key types include oils for engines, hydraulic fluids, and greases, each formulated for specific applications within commercial, military, and general aviation sectors. The demand for aviation lubricants continues to grow as modern aircraft increasingly require advanced lubricants to support efficiency, safety, and performance in diverse operational conditions.

Aviation Lubricants Market Size & Growth

[272 Pages Report] The Global Aviation Lubricant Market Size was valued at USD 804 million in 2022 and is estimated to reach USD 1,082 million by 2027, growing at a CAGR of 6.1% during the forecast period. In the commercial aviation sector, the rise in air passenger traffic has encouraged fleet modernization programs being undertaken by global airline operators, which has driven the demand for new aircraft. Similarly, the increasing number of HNWIs and the increasing defense budget has also benefitted the business & general aviation and military aviation sectors, respectively. Moreover, the need to keep the fleet airworthy has also encouraged MRO activities being conducted on the aircraft, thereby boosting the demand from the MRO sector as well. This will boost Avation Lubricants Industry more in coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Aviation Lubricants Market Trends

Driver: Growing active fleet driving demand from both OEM and MRO sectors

According to Boeing’s commercial outlook, the active commercial fleet is poised to grow at 3.1% between 2021 and 2040, with Asia Pacific registering the highest number of deliveries and the regional fleet growing at a CAGR of 4.2% during the period. Similarly, an increase in defense expenditure by the leading countries such as the US, UK, Russia, and China is expected to drive the supply chain of military aviation, as the funds would be directed to drive both the development and adoption of new aircraft but also drive the MRO activities required to maintain the airworthiness of the existing fleet.

Besides, as more sophisticated aircraft are being developed and inducted, several sophisticated subsystems are being integrated into them that require efficient lubrication to prevent system failures and increase the reliability and component life of the integrated systems. This has encouraged the development of advanced lubricants to support the operational parameters of the different types of aircraft. Shell plc (UK), Exxon Mobil Corporation (US), TotalEnergies Company (France), BP p.l.c. (UK), and PJSC LUKOIL (Russia) are the leading players in the aviation lubricants market.

Please visit 360Quadrants to see the vendor listing of Top Lubricants companies Quadrant

Restraint: High susceptibility to contamination of lubricants

Lubricants are susceptible to contamination through improper storage and faulty maintenance practices. The use of contaminated lubrication can be disastrous to an aircraft, especially for the engine. For instance, the carbon that is formed in the bearing compartments near hot turbine sections breaks off and circulates through the lubricating systems when oil evaporates under high heat conditions. Though, the pieces of carbon are usually not hard enough or large enough to cause failure of the pumps, they may be large enough to clog small filters or nozzles. Furthermore, the presence of sand, dirt, and metallic particles in the lube system is another source of operational contamination.

Improper oil mixing and servicing are some of the prominent faulty maintenance practices that can result in the contamination of lubricating fluid. Other sources of contamination include but are not limited to rust, improper sealing of storage container, which may either induce impurities in the aviation lubricant or deteriorate its mechanical properties, such as viscosity and density.

Opportunity: Green aviation initiatives driving the adoption of environmentally safe lubricants

The global aviation community is committed to ambitious emissions reduction goals. Hence, Sustainable Aviation Fuel has been identified as one of the key elements in helping achieve these goals. Since, traditional lubricants are toxic, non-biodegradable, and contaminate air and water resources, the demand for sustainable alternatives is increasing due to the adoption of environment-friendly initiatives by the aviation sector. For instance, vegetable-based lubricants are gaining preference in the aviation industry. However, these lubricants are not very stable at high temperatures and pressures and, thus, are used as specialty lubricants or additives. MIL-G-6032 is a vegetable oil-based grease used for the lubrication of specific pump bearings, valves, and fittings in military aircraft. Such lubricants are beneficial for more than just the environment as they can not only save energy, but also enhance operational parameters such as higher operational life and lower consumption.

Challenge: Adherence to stringent regulations

Aviation lubricants are required to possess significantly higher performance parameters than the general lubricants used in other industries. Hence, to target their product offering to a wider customer base, aviation lubricant manufacturers and users need to consult the applicable technical specifications for the grade of oil recommended for use in an engine. In general, the Society of Automotive Engineers (SAE) classifies engine oils by viscosity grades. Oils are classified based on their measured viscosity at high temperatures for single grade oils and at low and high temperatures for multigrade oils. However, the multigrades have a high viscosity index (VI) and may fall into more than one SAE grade classification. For instance, the SAE standard J1966 establishes the requirements for non-dispersant, (straight grade) mineral lubricating oils used in four-stroke cycle piston aircraft engines. It covers the same requirements as the former military specification MIL-L-6082. J1899 establishes the requirements for lubricating oils containing ashless dispersant additives, the same as MIL-L-22851. Stringent emission norms are expected to affect the current product portfolio of the market players, forcing them to spend extensive financial and technical resources to develop high performance aviation lubricants that not only comply with operational standards but also with the emerging emission norms.

Aviation Lubricants Market Ecosystem

Prominent companies that provide aviation lubricants, private and small enterprises, distributors/suppliers/retailers, and end customers (OEMs and MROs) are the key stakeholders in the aviation lubricants market ecosystem. Investors, funders, academic researchers, distributors, service providers, and airport and aerodrome authorities serve as the major influencers in the aviation lubricants market.

To know about the assumptions considered for the study, download the pdf brochure

Aviation Lubricants Market Segments

The commercial aviation segment of the aviation lubricants market is projected to dominate market share between 2022 and 2027

The aviation lubricants market has been segmented based on type, technology, end user, application, platform, and region. Based on platform, the aviation lubricants market has been segmented into commercial aviation, military aviation, and business & general aviation. The commercial aviation segment accounted for 51.5% of the global market in 2022 and is anticipated to occupy a dominant share of the market by the end of 2027 due to factors such as increasing air passenger traffic driving the demand for new generation aircraft and encouraging the OEM segment and the increasing fleet that is required to undergo scheduled maintenance driving MRO demand for lubricants.

The engine segment of the aviation lubricants market is estimated to have the largest share in 2022

Based on application, the aviation lubricants market has been segmented into engine, landing gear, airframe, hydraulic systems, and others. The others segment comprises cockpit systems and cabin interiors. The engine application segment accounted for the largest share of 67.2% of the aviation lubricants market in 2022 and is poised for growth a 6.2% CAGR during the forecast period (2022-2027) on account of the cruciality of lubricants to ensure the smooth operations of aircraft engines.

The aftermarket segment of the aviation lubricants market is estimated to have the highest CAGR during the forecast period

Based on end user, the aviation lubricants market is segmented into OEM (Original Equipment Manufacturer) and aftermarket. The aftermarket end user segment accounted for 98% of the overall aviation lubricants market in 2022 and is projected to grow at a CAGR of 6.2% during the forecast period. The growing fleet of commercial and military aircraft and increasing consumption of lubricants to ensure airworthiness of the fleet are driving the growth in the aftermarket segment.

The synthetic segment of the aviation lubricants market is estimated to dominate market share during the forecast period

Based on technology, the aviation lubricants market is segmented into synthetic and mineral-based lubricants. Owing to their superior performance parameters, as compared to their mineral-based counterparts, the synthetic lubricant segmented accounted for 73% of the total market in 2022 and is projected to hold its dominance in terms of market share during the forecast period.

The engine oil segment of the aviation lubricants market is estimated to dominate market share during the forecast period

Based on type, the aviation lubricants market is segmented into engine oil, hydraulic fluid, special lubricants & additives and grease. Engine oil is projected to dominate market share during the forecast period due to their application in the engines to keep them lubricated, cool, and free from external contaminants. Furthermore, the constant replenishment of engine oils as and when required after a flight also boosts their demand as they are required to strictly operate under certain parameters to avoid catastrophic failure.

Aviation Lubricants Market Regions

North America is estimated to have the largest market in 2022 for aviation lubricants

North America is estimated to be the largest market for aviation lubricants in 2022, followed by Asia Pacific and Europe. This is attributed to the low oil prices and improved efficiency of aircraft operations that are fueling the growth of the aviation industry in the North American region. Moreover, several airline operators such as American Airlines, Delta Air Lines, Southwest Airlines, Air Canada, and WestJet are focusing on increasing their profitability by making efficient use of their aircraft fleets. The increase in operating hours of commercial aircraft fleet of various airlines and expansion of aircraft fleet of defense forces of different countries in the region are also driving the growth of the North America aviation lubricants market.

Aviation Lubricants Industry Companies: Top Key Market Players

The Aviation Lubricants Companies are dominated by globally established players such as:

- Shell plc (UK)

- Exxon Mobil Corporation (US)

- TotalEnergies Company (France)

- BP p.l.c. (UK)

- PJSC LUKOIL (Russia)

Shell plc (UK) is the leading player in the aviation lubricants market. The company’s well-established distribution network and brand value serve as an essential factor for its growth. It manufactures products that offer benefits such as low maintenance costs, long equipment life, and reduced energy consumption. The company focuses on inorganic and organic strategies. The company’s strategy for sustainable long-term growth involves expansion in the member countries of the Association of Southeast Asian Nations (ASEAN).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 804 million in 2022 |

|

Projected Market Size |

USD 1,082 million by 2027 |

|

Growth Rate (CAGR) |

6.1% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By type, technology, end user, application, platform, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

|

Companies covered |

Shell plc (UK), Exxon Mobil Corporation (US), TotalEnergies Company (France), BP p.l.c. (UK), and PJSC LUKOIL (Russia), among others |

This research report categorizes the Aviation Lubricants Market based on type, technology, end user, application, platform, and region.

Aviation Lubricants Market, By Type

- Engine Oil

- Hydraulic Fluid

- Special Lubricants and Additives

- Grease

Aviation Lubricants Market, By Technology

- Synthetic

- Mineral-based

Aviation Lubricants Market, By End User

- OEM

- Aftermarket

Aviation Lubricants Market, By Application

- Engine

- Hydraulic Systems

- Landing Gear

- Airframe

- Others

Aviation Lubricants Market, By Platform

- Commercial Aviation

- Military Aviation

- Business & General Aviation

Aviation Lubricants Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2022, Mesa Airlines signed a five-year contract with Boeing Distribution Inc. (formerly Aviall) to procure ExxonMobil aviation lubricants, namely Mobil Jet™ Oil II and Mobil™ HyJet™ IV-Aplus, across its entire fleet comprising over 160 aircraft.

- In February 2022, BP p.l.c. announced the safe and successful start-up of the Herschel Expansion project in the Gulf of Mexico as part of its strategy to invest in focused and resilient hydrocarbons.

- In November 2021, NYCO’s TurboNYCOil 600 was selected by airblue Limited, the second largest airline in Pakistan, for use in its fleet of A320 and A321 aircraft powered by CFM56 and LEAP engines.

- In July 2021, TotalEnergies and Great Wall Motors (GWM) launched a tailor-made fluid, Quartz EV-DHTF2, for GWM’s latest “L.E.M.O.N.” Dedicated Hybrid Transmission (DHT). This highly integrated, high-efficiency, multi-mode gasoline-electric hybrid system features dual-motor hybrid technology, which achieves a perfect balance at all speeds and in all scenarios between high efficiency and high performance.

- In April 2021, LANXESS launched an organic lubricant additive for high-performance engine oils. The new Addition RC 3502 has been specifically developed to reduce friction and deliver sustained performance and anti-wear protection.

- In April 2021, NYCO introduced the NYCO Grease GN 3058, which delivers outstanding performances in four key properties for applications such as wheel bearings, propeller bearings and highly loaded landing gear areas: the base oil viscosity, the load wear index, the resistance to water washout and the oil separation.

Frequently Asked Questions (FAQ):

How will the drivers, challenges, and future opportunities for the aviation lubricants market affect its dynamics and the subsequent market analysis of the associated trends?

Aviation lubricants are highly sophisticated fluids that are used to lubricate the different parts of an aircraft, thereby prolonging their service life. Synthetic lubricants are highly effective for the job as they possess superior lubricating capabilities than their mineral-based counterparts and hence are extensively used by commercial, military, and business aviation platforms. The rise in operational fleet is anticipated to drive the demand for aviation lubricants during the forecast period.

What are the key sustainability strategies adopted by leading players operating in the aviation lubricants market?

A benchmarking of the growth strategies adopted by key players were undertaken which offers a comprehensive analysis of new product launches, contracts, partnerships, collaborations, expansions, agreements, new product developments, and acquisitions.

What are the new emerging technologies and use cases disrupting the industry?

The development of Standard Performance Capable (SPC) oils and High-Performance Capable (HPC) oils are anticipated to be widely adopted by different platforms as per their operational scenario during the forecast period. Besides, the introduction and adoption of sustainable aviation fuel and other green initiatives in the aviation sector is envisioned to have a profound disruptive effect on the existing market.

When are the high-growth niche segments expected to have an impact on changing the revenue mix of companies?

An increase in operational flight hours of business, military, and commercial aircraft fleet is envisioned to have a positive impact on the market.

Who are the key players and innovators in the partnership ecosystem?

Shell plc (UK), Exxon Mobil Corporation (US), TotalEnergies Company (France), BP p.l.c. (UK), and PJSC LUKOIL (Russia) are some of the key companies. These key companies are all strong in their home regions and are exploring geographic diversification alternatives to grow their businesses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Exhaustive secondary research was undertaken to collect information on the aviation lubricants market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturers associations; directories; and databases.

Primary Research

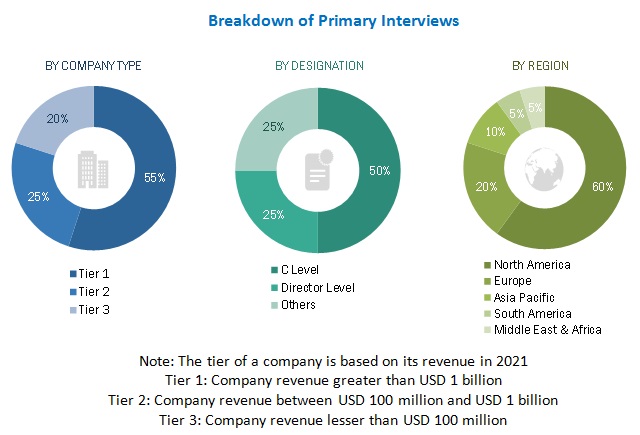

The aviation lubricants market comprises several stakeholders, such as raw material suppliers, processors, and regulatory organizations in the supply chain. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

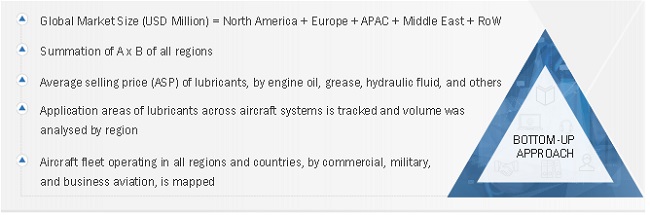

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the aviation lubricants market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size included the following.

- Key players in the market were identified through secondary research, and their market ranking determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

Bottom- Up Approach

The bottom-up approach was employed to arrive at the overall size of the global aviation lubricants market. It was also implemented to extract data from secondary research to validate the revenue of various market segments. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the size of the market and each segment were determined and confirmed.

Steps involved in the bottom-up approach:

Step – 1

Initially, the parent aviation market demand was estimated for military, commercial, and business & general aviation platforms using the bottom-up approach for each region. Independent demand for each vertical was identified, and market numbers for each vertical were identified.

Global Market = North America + Europe + APAC + Middle East & Africa + Latin America

Estimating the market size for the military aviation platform was carried out by considering several parameters such as the percentage annual defense spending on the procurement and maintenance of aircraft, new contracts, current or future programs, defense budget analysis, and current aircraft fleet. These parameters were studied for each country considered. The country-level market size was arrived at, the other summation of which led to the global numbers by adding all country-wise market sizes.

The estimation of the market size for the commercial aviation platform was triangulated using the sales data of commercial aircraft, which was estimated and multiplied by the average contribution of lubricants to aircraft cost to arrive at the final numbers. Also, for estimating aftermarket demand, current fleet data was used, and the annual flight hours were factored in to estimate the number of times that an aircraft undergoes lubricant replenishment or replacement. A similar approach was used even for the business & general aviation platform.

Step – 2

The breakdown of the global aviation lubricants market was carried out from the parent aviation market based on different pointers such as products offered by different manufacturers, pricing, and contracts and new product developments.

Step – 3

An independent analysis of each lubricant type was carried out based on different applications; for example, the engine oil is considered to be used only to lubricate the engines while grease can be applied to other mechanical parts located all over the aircraft. Each type was analyzed using matrix modeling based on the chosen parameters to arrive at a percentage adoption of aviation lubricants in the aircraft fleet by country. A similar methodology was repeated for the other type of lubricants.

Step – 4

Data triangulation was carried out using the three steps mentioned above to arrive at the final size of the aviation lubricants market.

Market Size Estimation: Bottom-Up

To know about the assumptions considered for the study, Request for Free Sample Report

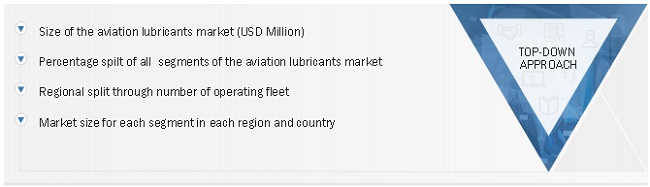

Top-Down Approach

In the top-down approach, the size of the aviation lubricants market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. To calculate the size of specific market segments, the size of the most appropriate immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented to validate the revenue obtained for various market segments.

Market share was estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the size of the parent market and each segment was determined and confirmed in this study.

Market Size Estimation: Top-Down

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides in the aviation lubricants industry.

Collaboration in Developing Specialized Lubricants

The aircraft lubricants industry and aviation oils industry are closely related and provide essential lubrication solutions for aircraft. Aviation oils are a type of aircraft lubricant specifically designed to meet the needs of the aviation industry. Both industries serve to ensure the safe and efficient operation of aircraft, primarily serving the aviation industry, including commercial airlines, military organizations, and private aircraft operators. They are also subject to strict regulatory requirements and work together to provide essential lubrication solutions for the aviation industry.

Continuous Growth and Innovation in the Aviation Lubricant Market

The positive impact of aircraft engine lubricants and aviation oils on the aviation lubricant market is significant, as the demand for these products directly contributes to the growth and expansion of the aviation lubricant market. The aviation industry's constant evolution and advancement create opportunities for manufacturers to develop new and innovative products that meet changing industry needs, driving growth and innovation. Additionally, strict regulatory requirements and standards create demand for reputable manufacturers that provide reliable and safe lubrication solutions, further contributing to the growth and expansion of the aviation lubricant market.

Report Objectives

- To define, segment, and project the global market size for aviation lubricants

- To understand the structure of the aviation lubricants market by identifying the subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, challenges, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze competitive developments such as new product launches, contracts, agreements, acquisition, collaboration, and joint ventures in the aviation lubricants market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aviation Lubricants Market