Vitamin B3 Market by Type (Feed Grade, Pharmaceutical Grade), Form , Source (Natural, Synthetic), Application (Pharmaceutical, Nutrition, Consumer, Agrochemicals), & Region (North America, Asia Pacific, Europe, RoW) – Global Forecast to 2025

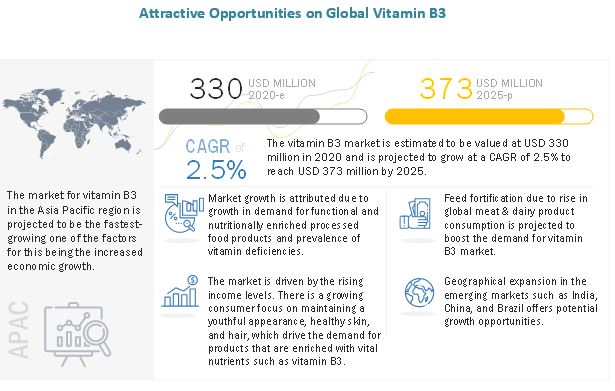

[154 Pages Report] The global Vitamin B3 market size is estimated to be valued USD 330 million in 2020 and is expected to reach a value of USD 373 million by 2025, growing at a CAGR of 2.5% during the forecast period. Factors such growth in demand for functional and nutritionally enriched processed food products, feed fortification due to a rise in global meat & dairy product consumption, Prevalence of vitamin B3 deficiency has driven the market for vitamin B3 into further growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Vitamin B3:

COVID-19 impact on the feed consumption has directly affected the consumption of meat and livestock products and byproducts, such as milk, eggs. There has been as rise in the preference for plant based vitamin suopkement and nutritional alternatives worldwide which has boosted the the market for a plant-based vitamin supplement.

Several vitamin B3 supplements with immunity-enhancing properties are available in the market and are observing more sales post the advent of the novel coronavirus to bring down the risk of the infection. Following the pandemic and the consequent lockdown globally, health consciousness among people has mounted significantly, leading to a higher demand for products that bolster immunity. With the outbreak of COVID-19 across regions, the manufacturing of vitamin B3 is estimated to witness a slowdown in 2020, owing to the lockdowns, closure of the international borders, and delay in cross border transit, which disrupted the supply chain.

Measures such as social distancing by the governments across countries are limiting the number of people who can work together in workplaces. Gradually, as the restrictions of the government measures are likely to relax, the market for vitamin B3 will recover from 2021.

Although the demand for food has been growing, the supply has been significantly impacted by COVID-19. The lockdowns and increased infected cases are resulting in labor shortages and a reduced supply of raw materials. The disruption in supply routes has further led to delays in the food supply. However, the demand for vitamin B3 processing in the milk and dairy industry is increasing presently and is likely to increase in the first and second quarters of the year 2021.

Vitamin B3 Dynamics:

Driver: Growth in demand for functional and nutritionally enriched processed food products

With increased concerns about meeting the daily nutritional value with the consumption of processed food products, the growth in the demand for vitamins is mostly from the food industry. Harsh processing conditions lead to loss of nutrients such as vitamin B3 that are naturally present in foods, which pushes food manufacturers to fortify their food products to restore these losses. With the rise in health consciousness and focus on preventive healthcare, consumers are opting for fortified foods and are willing to pay for nutritionally enriched food products. Food products such as dairy-based beverages, bakery products, and flours are increasingly fortified with different types of B vitamins to enhance their nutritional values. There has been a substantial rise in the number of countries from 2002 till 2017, which administer the mandate for the fortification of wheat flour with iron or folic acid. In 2017, there were 86 countries that had a mandate for wheat flour fortification. There have been many government initiatives addressing malnutrition through the implementation of food fortification programs.

Restraint : Establishment of regulatory control on supplement usage limit

With increased global demand for meat, milk, and eggs, livestock owners carry out unrestricted use of vitamin B3 feed supplements to improve the weight, productivity, and reproductive health of livestock. As vitamin B3 is used to increase disease resistance and yield parameters in livestock, a high dosage of vitamin B3 in these byproducts prove to be detrimental for animal, human, and environmental health.

The FDA regulates both finished dietary supplement products and dietary ingredients. The FDA regulates dietary supplements under a different set of regulations than those covering "conventional" foods and drug products. Under the Dietary Supplement Health and Education Act of 1994 (DSHEA).

Therefore, livestock producers and food & beverage manufacturers tend to limit their production costs by selecting cheaper feed sources, and the demand for dietary feed supplements is affected.

Opportunity: Increased demand for nutrition supplements for monogastric animals

As monogastric animals cannot synthesize vitamin B complex compounds within their body compared to ruminants, there is a considerable demand for vitamin supplements in this sector. Key players are establishing a market presence in the poultry and swine sectors due to the organized development of these sectors. These sectors are gaining better growth in the developing markets such as the Asia Pacific and Latin American regions. Globally, Asia ranked first in feed production in 2015, according to the USDA. China is a global leader in compound feed with an annual production of 200 kilo tons, according to the Department of Animal Production (China). Due to the increase in the demand for compound feed in these regions, there has been a considerable demand for the use of additives in these developing markets.

Challenge : Environmental impact resulting in changes in regulatory policies

The production process of vitamin B3, mainly synthetic, is considered to have a potentially harmful impact on the environment if proper standard operating procedures are not followed. A majority of synthetic vitamins are manufactured from petroleum extracts and coal tar derivatives, which leave a significant effect on the environment. The production of vitamins is considered to lead to a high amount of environmental pollution, which has pushed vitamin manufacturers to take steps to ensure a low carbon footprint. One of the major challenging factors affecting the vitamins market globally is the change in the environmental policies by the Chinese government. The Chinese government has imposed strict controls to achieve sustainable production and reduce air pollution. The Chinese vitamin manufacturers are facing the challenge where they are required to increase the production of the vitamin to meet the rise in demand, which is, in turn, impacting the global supply of vitamins. Similarly, concerns pertaining to the sustainable production of vitamins in other countries could also lead to similar initiatives being implemented by national governments.

The feed grade segment of the Vitamin B3 is projected to account for the largest share, by type

By type, the feed grade segment accounted for the highest share in Vitamin B3 market.

Vitamin B3 feed grade is a vital part of improved metabolism. It helps the body process fats, carbohydrates, and amino acids in animals. Vitamin B3 is essential for the health of the skin, bones, joints, mucous membranes, digestive system, and central nervous system. It is one of the more frequently supplemented vitamins, particularly in the swine and broiler industries. For feed grade application in broilers, vitamin B3 is used to partly correct leg problems while still maintaining rapid weight gains. Whereas in swine, niacin supplementation before slaughter appears to improve pork quality. Vitamin B3 in dairy cattle has a number of beneficial effects.

The market for dry segment is projected to account for the largest share during the forecast period, by form

By form, dry is the segment which accounted for the highest marlet share as well as the highest growth rate in the Vitamin B3. Global consumption rised in 2019 as dry forms have the ease to get incorporated into various ingredients. Dry forms are easier to transport and travel with for long distances as well.

Vitamin B3 in the market is required for the proper functioning of the body, and each type imparts different health benefits, such as the enhancement of skin health, production of red blood cells and cellular energy, and the proper functioning of the nervous system. Multiple benefits of vitamin B3, such as the increase in metabolism, maintenance of immunity and digestive health, and their application in multiple industries, have led to the dominance of this segment in the vitamin B3 market.

The synthetic segment dominated the market for vitamin B3 by source.

By source, the synthetic segment accounted for the largest market share in 2019. 2019 with a share of 90.0% in 2019, owing to the lower cost of production of synthetic vitamin B3 as compared to natural vitamin B3, coupled with a constrained supply of raw materials for the extraction of natural vitamins. Synthetic vitamin B3 is chemically synthesized and produced largely using coal tar, ammonia, acids, 3-cyanopyridine, and formaldehyde. They are produced on a large scale, and their popularity can be attributed to low manufacturing costs and greater stability than natural vitamins, providing considerable scope for the growth of this segment.

The nutrition segment of the Vitamin B3 is projected to account for the largest share, by application

By application, the nutritionsegmentaccounted for the largest share in 2019. Vitamin b3 is used in majority of the vitamin blends, health suppkements and nutritional food & beverages. It has tremendous benefits for the animal and human body. Vitamin B3lowes LDL cholesterol and treats high cholesterol problems. This proves to be a preventive measure for various heart diseases. Vitamin B3 also improves brain functioning and skin health. In animals vitamin B3 improves bone health and reduces the risks of arthritis.

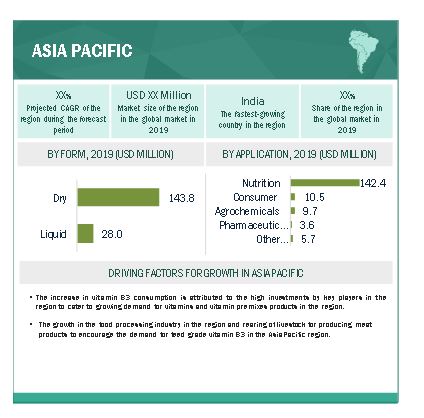

Asia Pacific is the fastest-growing market during the forecast period in the global Vitamin B3

The Asia Pacific region dominated the vitamins market and was valued at USD 171.9 million in 2019 and is also projected to grow at the highest CAGR of 2.9%, in terms of value, during the forecast period.

The key markets in the Asia Pacific region include China, India, Japan, and the Rest of Asia Pacific. The processed food industry in the Asia Pacific region is experiencing growth owing to the changing lifestyles of customers. It is also highly dynamic due to constant changes in consumer preferences, rapid urbanization, diet diversification, and the liberalization of foreign direct investment in the food sector. Furthermore, the rise in income level and significant consumer demand for nutritional & healthy products are expected to provide promising prospects for the growth and diversification of the region’s functional food & beverage products, which is, in turn, leading to growth in the consumption of vitamin-infused products, and thereby driving the market growth.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million), Volume (KiloTons) |

|

Segments covered |

Type, Form, Source, Application, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, RoW |

|

Companies covered |

Lonza Group AG (Switzerland), Jubilant Life Sciences Ltd (India), Shandong Hongda Biotechnology Co., Ltd. (China), Vertellus (US), Jiangsu Brother Vitamin Co. Ltd.(China), DSM (Netherlands), Vanetta (China), Lasons India (China), Zhejiang Lanbo Biotechnology(China), Tianjin Zhongrui Pharmaceutical (China), Foodchem (China), NutraScience Labs (US), Gehring Montgomery, Inc. (US), The Chemical Co. (US), Yuki Gosei Kogyo Co., Ltd.(Japan), Zhejiang Chemvplus Biotech Co. (China), Ltd, Ishita Drugs & Industries Ltd.(India), The Western Drugs Ltd.(India), Spectrum Chemical Mfg. Corp (US), and Glanbia plc (Ireland) |

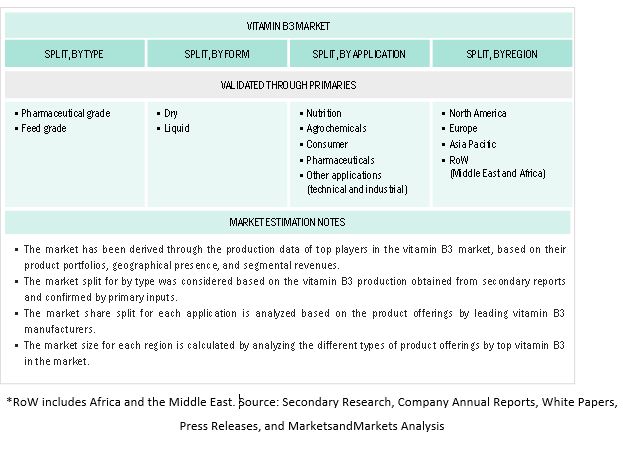

This research report categorizes the Vitamin B3 based on type, application, species, and region.

By Type:

- Feed grade

- Nutrition grade

By source

- natural

- synthetic

By form

- Dry

- Liquid

By application

- Nutrition

- Consumer

- Agrochemicals

- Pharmaceuticals

- Other applications (include industrial and technical applocations )

By region:

- North America

- Europe

- Asia Pacific

- Rest of World (RoW)*

*Rest of the World (RoW) includes Africa and the Middle East

Recent Developments

- In Febrary 2019, DuPont Nutrition & Health and Lonza Specialty Ingredients announced a joint agreement in HMO. Dupont has engaged strategically with Lonza to be able to accelerate commercialization and offer high-quality HMOs to customers. The collaboration with Lonza played a key role in developing a business growth strategy and offering high-quality consumer health and wellness products.

- In July 2019, Lonza has acquired a sterile fill manufacturing facility from Novartis (Switzerland). The company plans to manufacture healthcare and nutrition ingredients in the facilities. This enables it to offer products in larger volumes to the customers.

- In July 2020, Jubilant Biosys Limited (“Biosys”), a wholly-owned subsidiary of Jubilant Life Sciences Limited, today announced the completion of the merger with its sister company Jubilant Chemsys Limited, based in Noida, India. The combined entities will now operate as Jubilant Biosys Limited. The merger will simplify operations and provide customers with single brand access for a wide range of discovery, IND and PR&D, and GMP development services. Biosys had earlier announced a significant investment in building new state-of-the-art research facilities in Greater Noida and in Bengaluru, India, to cater to the increasing customer demand for its functional services (medicinal & synthetic chemistry, structural biology, DMPK, Biology & GMP scale-up) and notably integrated drug discovery services.

- In April 2020, DSM has completed the acquisition of Glycom. With this acquisition, DSM aims to add HMOs to its portfolio. The high-growth HMO market is set to deliver novel ingredients for next-generation Early Life Nutrition solutions. Glycom is the only fully-integrated HMO provider in the world with its product development, preclinical and clinical development, regulatory and large-scale production, with an exciting innovation roadmap for next-generation HMOs. As HMOs are believed essential for developing immunity, cognitive and digestive functions, there is significant interest in HMOs for the dietary supplement market and unmet medical nutrition needs, such as irritable bowel syndrome, food & beverage applications, and pet foods..

Frequently Asked Questions (FAQ):

What are the significant trends that are disrupting the Vitamin B3 market?

With the rise in demand for meat and meat products and the increase in the importance of protein-rich diets among consumers across the globe, the demand for feed grade vitamin B3 has been growing in the Asia Pacific, North American, and European countries. The Food and Agriculture Organization (FAO) estimates that by 2050, the demand for food products would grow by 60%, and that of animal protein would grow by 1.7% per year.

What are some of the major regulatory challenges and restraints that the industry faces?

Regulatory bodies such as the European Commission (EU) and the United States Department of Agriculture (USDA) have outlined the regulatory requirements for various feed additives.

Which region is projected to emerge as a global leader by 2025?

The Asia Pacific region is projected to be the fastest growing region owing to the growing demand for vitamins and Vitamin B3 speifically in the making of meat and dairy products. The trend of convenience products is also growing in the region due to which the demand for nutrition rich products.

What are key factors affecting the pricing of the mineral feed ?

Key factors, such as the increase in consumption of feed, rise in demand for animal protein in human diets, the growth of the convenience foods and fortified foods markets, a shift toward natural growth promoters have contributed to the growth of the trace minerals market. However, fluctuations in the prices of raw materials and the lack of awareness in developing countries are projected to act as a factor inhibiting the growth of the market during the forecast period.

What are the technological advancedmenets in the market ?

There have been implementation and advancement of technologies for livestock production, which are enabled by efficient feed formulation methods, to improve meat quality and productivity, that increases demand for feed grade vitamin B3. There has also been advancement and development in technologies for the cultivation of various crops .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 VITAMIN B3: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2017–2019

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key industry insights

2.1.2.2 Key data from primary sources

2.1.2.3 Market data from primary sources

2.1.2.4 Breakdown of primaries

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MACROECONOMIC INDICATORS

2.2.1 INTRODUCTION

2.2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 8 VITAMIN B3 MARKET, BY FORM, 2020 VS. 2025 (USD MILLION)

FIGURE 9 VITAMIN B3 MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 VITAMIN B3 MARKET, BY SOURCE, 2025-P (%)

FIGURE 11 VITAMIN B3 MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 ASIA PACIFIC DOMINATED THE VITAMIN B3 MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 BRIEF OVERVIEW OF THE VITAMIN B3 MARKET

FIGURE 13 INCREASE IN DEMAND FOR NUTRITIONAL FOOD & BEVERAGE PRODUCTS DRIVING THE DEMAND FOR VITAMIN B3

4.2 ASIA PACIFIC: VITAMIN B3 MARKET, BY KEY APPLICATION & COUNTRY

FIGURE 14 ASIA PACIFIC: INDIA ACCOUNTED FOR THE LARGEST MARKET FOR VITAMIN B3 IN 2019

4.3 VITAMIN B3 MARKET, BY APPLICATION

FIGURE 15 VITAMIN B3 IS WIDELY USED IN NUTRITION APPLICATIONS

4.4 VITAMIN B3 MARKET, BY COUNTRY

FIGURE 16 INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR IN THE VITAMIN B3 MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

FIGURE 17 INCREASING DEMAND FOR FUNCTIONAL AND NUTRITIONALLY ENRICHED PROCESSED FOOD PRODUCTS TO DRIVE THE VITAMIN B3 MARKET

5.1.1 DRIVERS

5.1.1.1 Growth in demand for functional and nutritionally enriched processed food products

5.1.1.2 Feed fortification due to a rise in global meat & dairy product consumption

5.1.1.3 Prevalence of vitamin B3 deficiency

5.1.2 RESTRAINTS

5.1.2.1 Establishment of regulatory control on supplement usage limit

5.1.3 OPPORTUNITIES

5.1.3.1 Increased demand for nutrition supplements for monogastric animals

5.1.4 CHALLENGES

5.1.4.1 Environmental impact resulting in changes in regulatory policies

5.1.4.2 Scarcity of ingredients and price sensitivity

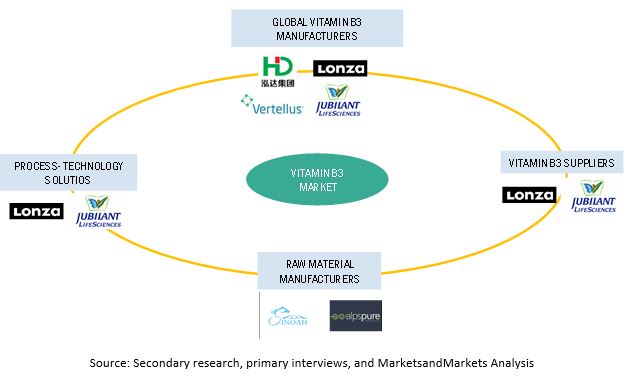

5.2 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

5.3 REGULATORY SCENARIO

5.4 COVID-19 IMPACT

5.5 CASE STUDIES

5.5.1 MNM HELPED A LEADING VITAMIN B3 PROVIDING PARTNER WITH A PROMINENT FEED PRODUCING COMPANY TO TARGET A PROJECTED REVENUE OF USD 200 MILLION OVER THREE YEARS

5.5.2 MNM HELPED A LEADING CONSUMER CARE MANUFACTURER ACQUIRE A VITAMIN B3 PROVIDER TO MEET THE RISING CONSUMER DEMAND

5.6 MARKET ECOSYSTEM

6 VITAMIN B3 MARKET, BY TYPE (Page No. - 50)

6.1 INTRODUCTION

FIGURE 19 NUTRITIONAL GRADE SEGMENT TO EXHIBIT THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 2 VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 3 VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (KILO TONS)

6.1.1 FEED GRADE

6.1.1.1 Benefits associated with feed grade vitamin B3 expected to fuel market demand

TABLE 4 FEED GRADE: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 5 FEED GRADE: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

6.1.2 NUTRITIONAL GRADE

6.1.2.1 Rising demand for nutritionally fortified products to increase the demand for vitamin B3

TABLE 6 NUTRITIONAL GRADE: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 7 NUTRITIONAL GRADE: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

7 VITAMIN B3 MARKET, BY FORM (Page No. - 55)

7.1 INTRODUCTION

FIGURE 20 DRY FORM TO EXHIBIT THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 8 VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 9 VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (KILO TONS)

7.2 DRY

7.2.1 INCREASE IN METABOLISM, MAINTENANCE OF IMMUNITY, AND DIGESTIVE HEALTH LEADING TO THE DOMINANCE OF THE DRY SEGMENT

TABLE 10 DRY: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 11 DRY: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

7.3 LIQUID

7.3.1 OVERALL HEALTH SUPPLEMENTATION AND IMPROVED PHYSICAL CONDITION BOOSTING THE MARKET DEMAND FOR VITAMIN B3

TABLE 12 LIQUID: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 13 LIQUID: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

8 VITAMIN B3 MARKET, BY SOURCE (Page No. - 60)

8.1 INTRODUCTION

FIGURE 21 SYNTHETIC SOURCE SEGMENT TO EXHIBIT THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 14 VITAMIN B3 MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 15 VITAMIN B3 MARKET SIZE, BY SOURCE, 2018–2025 (KILO TONS)

8.2 SYNTHETIC

TABLE 16 VITAMIN B3 MARKET SIZE FOR SYNTHETIC SOURCES, BY REGION, 2018–2025 (USD MILLIONS)

TABLE 17 VITAMIN B3 MARKET SIZE FOR SYNTHETIC SOURCES, BY REGION, 2018–2025 (KILO TONS)

8.3 NATURAL

TABLE 18 VITAMIN B3 MARKET SIZE FOR NATURAL SOURCES, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 VITAMIN B3 MARKET SIZE FOR NATURAL SOURCES, BY REGION, 2018–2025 (KILO TONS)

9 VITAMIN B3 MARKET, BY APPLICATION (Page No. - 65)

9.1 INTRODUCTION

FIGURE 22 PHARMACEUTICAL APPLICATION SEGMENT TO EXHIBIT THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 20 VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 21 VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (KILO TONS)

9.2 NUTRITION

9.2.1 ANIMAL NUTRITION

9.2.2 HUMAN NUTRITION

TABLE 22 NUTRITION: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 23 NUTRITION: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

9.3 AGROCHEMICALS

TABLE 24 AGROCHEMICALS: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 25 AGROCHEMICALS: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

9.4 CONSUMER

TABLE 26 CONSUMER: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 27 CONSUMER: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

9.5 PHARMACEUTICAL

TABLE 28 PHARMACEUTICAL: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 29 PHARMACEUTICAL: VITAMIN B3 MARKET SIZE, BY REGION,2018-2025 (KILO TONS)

9.6 OTHER APPLICATIONS

TABLE 30 OTHER APPLICATIONS: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 31 OTHER APPLICATIONS: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

10 VITAMIN B3 MARKET, BY REGION (Page No. - 73)

10.1 INTRODUCTION

FIGURE 23 INDIA ACCOUNTED FOR THE MAJOR MARKET SHARE IN THE VITAMIN B3 MARKET

TABLE 32 VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 33 VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILO TONS)

10.2 NORTH AMERICA

FIGURE 24 US TO GROW AT THE HIGHEST CAGR IN THE VITAMIN B3 MARKET

TABLE 34 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY COUNTRY, 2018-2025 (KILO TONS)

TABLE 36 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (KILO TONS)

TABLE 38 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (KILO TONS)

TABLE 40 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 41 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (KILO TONS)

TABLE 42 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY APPLICATIONS, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: VITAMIN B3 MARKET SIZE, BY APPLICATIONS, 2018-2025 (KILO TONS)

10.2.1 US

10.2.1.1 The US market for Vitamin B3 driven by the pharmaceutical and health care applications

TABLE 44 US: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 45 US: VITAMIN B3 MARKET SIZE, SOURCE, 2018-2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Players in the country are investing heavily in R&D, which opens prospects for the growth of Vitamin B3

TABLE 46 CANADA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 47 CANADA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 High consumption of junk food giving rise to health awareness among the consumers

TABLE 48 MEXICO: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 49 MEXICO: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3 EUROPE

FIGURE 25 ITALY TO GROW AT THE HIGHEST CAGR IN THE VITAMIN B3 MARKET

TABLE 50 EUROPE: VITAMIN B3 MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 51 VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

TABLE 52 EUROPE: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (KILO TONS)

TABLE 54 EUROPE: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 55 EUROPE: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (KILO TONS)

TABLE 56 EUROPE: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 57 VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (KILO TONS)

TABLE 58 EUROPE: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 59 EUROPE: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (KILO TONS)

10.3.1 FRANCE

10.3.1.1 Government initiatives benefitting vitamin b3 manufacturers and propelling market growth

TABLE 60 FRANCE: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 61 FRANCE: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Increase in cases of diabetes, high blood pressure, and cholesterol and a rise in the aging population boosting the demand for Vitamin B3

Vitamin B3 88

TABLE 62 GERMANY: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 63 GERMANY: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3.3 UK

10.3.3.1 Increase in the number of nutritional products and health supplement manufacturers

TABLE 64 UK: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 65 UK: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3.4 SPAIN

10.3.4.1 Upsurge in the consumption of meat and poultry fueling the demand for vitamin B3 in the animal feed segment

TABLE 66 SPAIN: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 67 SPAIN: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3.5 ITALY

10.3.5.1 The vitamin B3 market is driven by the demand for nutritional supplements and nutraceutical products in the form of functional foods

TABLE 68 ITALY: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 ITALY: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 70 REST OF EUROPE: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 71 REST OF EUROPE: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 26 INDIA TO GROW AT THE HIGHEST CAGR IN THE VITAMIN B3 MARKET

TABLE 72 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY COUNTRY, 2018-2025 (KILO TONS)

TABLE 74 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (KILO TONS)

TABLE 76 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 77 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (KILO TONS)

TABLE 78 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 79 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (KILO TONS)

TABLE 80 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.4.1 INDIA

10.4.1.1 Rising demand for vitamin b3 owing to the growing demand for healthier food & beverages and preventive healthcare products

TABLE 82 INDIA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 83 INDIA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increased demand for high-quality functional foods fueling the demand for vitamin B3

TABLE 84 CHINA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 85 CHINA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Significant demand for nutrient-enriched products

TABLE 86 JAPAN: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 87 JAPAN: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

10.4.4.1 Increased spending by consumers on healthcare and food & beverage products to compensate for vitamin deficiencies

TABLE 88 REST OF ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.5 ROW

TABLE 90 ROW: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 91 ROW: VITAMIN B3 MARKET SIZE, BY REGION, 2018-2025 (KILOTONS)

TABLE 92 ROW: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (USD MILLION)

TABLE 93 ROW: VITAMIN B3 MARKET SIZE, BY FORM, 2018-2025 (KILO TONS)

TABLE 94 ROW: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 95 ROW: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (KILOTONS)

TABLE 96 ROW: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 97 ROW: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (KILOTONS)

TABLE 98 ROW: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 99 ROW: VITAMIN B3 MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTONS)

10.5.1 MIDDLE EAST

10.5.1.1 Growth opportunities for domestic as well as international food & beverage processing players

TABLE 100 MIDDLE EAST: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 101 MIDDLE EAST: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

10.5.2 AFRICA

10.5.2.1 Westernization of diets leading to health concerns

TABLE 102 AFRICA: VITAMIN B3 MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 103 AFRICA: VITAMIN B3 MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 106)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 27 MARKET EVALUATION FRAMEWORK, 2018–2020

11.3 MARKET SHARE OF KEY PLAYERS, 2019

FIGURE 28 LONZA GROUP AG LED THE NATURAL FOOD COLORS MARKET IN 2019

FIGURE 29 VITAMIN B3, MARKET SHARE ANALYSIS, 2019

11.4 KEY MARKET DEVELOPMENTS

11.4.1 AGREEMENTS & COLLABORATIONS

TABLE 104 AGREEMENTS & COLLABORATIONS, 2019–2020

11.4.2 MERGERS & ACQUISITIONS

TABLE 105 MERGERS & ACQUISITIONS, 2019-2020

11.4.3 JOINT VENTURES, AGREEMENTS, AND PARTNERSHIPS

TABLE 106 JOINT VENTURES, COLLABORATIONS, AND PARTNERSHIPS, 2019-2020

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 113)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STAR

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE

12.2.4 EMERGING COMPANIES

FIGURE 30 VITAMIN B3 MARKET COMPETITIVE LEADERSHIP MAPPING, 2019 (OVERALL MARKET)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.3 LONZA GROUP AG

FIGURE 31 LONZA GROUP AG.: COMPANY SNAPSHOT

FIGURE 32 LONZA GROUP AG.: SWOT ANALYSIS

12.4 JUBILANT LIFE SCIENCES LIMITED.

FIGURE 33 JUBILANT LIFE SCIENCES LIMITED.: COMPANY SNAPSHOT

FIGURE 34 JUBILANT LIFE SCIENCES LIMITED.: SWOT ANALYSIS

12.5 SHANDONG HONGDA BIOTECHNOLOGY CO., LTD.

FIGURE 35 SHANDONG HONGDA BIOTECHNOLOGY CO., LTD.: SWOT ANALYSIS

12.6 VERTELLUS

FIGURE 36 VERTELLUS: SWOT ANALYSIS

12.7 JIANGSU BROTHER VITAMIN CO. LTD.

FIGURE 37 JIANGSU BROTHER VITAMIN CO.: SWOT ANALYSIS

12.8 DSM

FIGURE 38 DSM.: COMPANY SNAPSHOT

12.9 VANETTA LTD.

12.10 LASONS INDIA

12.11 ZHEJIANG LANBO BIOTECHNOLOGY

12.12 TIANJIN ZHONGRUI PHARMACEUTICAL

12.13 FOODCHEM

12.14 NUTRASCIENCE LABS

12.15 GEHRING MONTGOMERY, INC.

12.16 THE CHEMICAL CO.

12.17 YUKI GOSEI KOGYO CO., LTD.

FIGURE 39 YUKI GOSEI KOGYO CO., LTD: COMPANY SNAPSHOT

12.18 ZHEJIANG CHEMVPLUS BIOTECH CO., LTD.

12.19 ISHITA DRUGS & INDUSTRIES

FIGURE 40 ISHITA DRUGS & INDUSTRIES: COMPANY SNAPSHOT

12.20 THE WESTERN DRUGS LTD.

12.21 SPECTRUM CHEMICAL MFG. CORP

12.22 GLNBIA PLC

FIGURE 41 GLANBIA PLC.: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 146)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

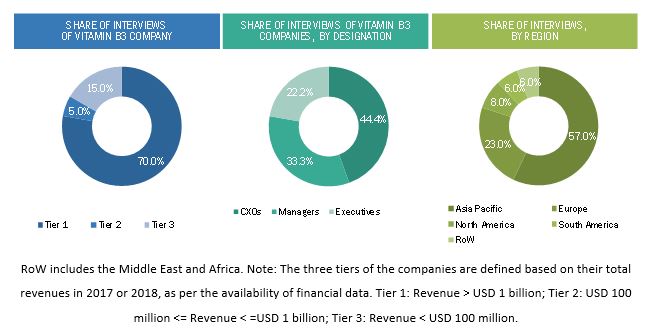

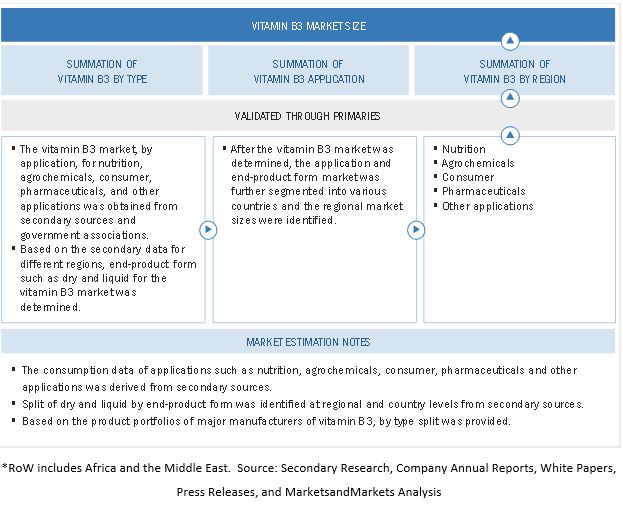

The study involves four major activities to estimate the current market size of the Vitamin B3 market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The Vitamin B3 market comprises several stakeholders such vitamins manufacturers, commercial research organisations/agencies/laboratories, intermediary suppliers, wholesalers, traders, research institutes and organization, and regulatory bodies such as Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), Health Food Manufacturers' Association (HFMA), Food Safety Authority of Ireland (FSAI), The Organic Trade Association (OTA), The Association of American Feed Control Officials (AAFCO), Compound Feed Manufacturers Association (CLFMA), EU Association of Specialty Feed Ingredients and their Mixtures (FEFANA), International Feed Industry Federation (IFIF), Food and Agriculture Organisation (FAO) and Animal Feed Manufacturers Association (AFMA)

The demand side is comprised of strong demand from the various enduser markets, nutritional supplements producers, and feed manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Vitamin B3 market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Vitamin B3 Market Size: Top-Down Approach

Vitamin B3 Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Vitamin B3 market.

Report Objectives

- To define, segment, and estimate the size of the Vitamin B3 market with respect to its type, source, form, application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the Vitamin B3 market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for Vitamin B3 which includes countries such as Poland, Ukraine, Hungary and Denmark

- Further breakdown of the Rest of Asia Pacific market for Vitamin B3 , which includes countries such as Malaysia,Australia, Vietnam and Philippines.

- Further breakdown of the Rest of South America market for Vitamin B3 which includes countries such as Peru, Uruguay and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Vitamin B3 Market