Ambulatory EHR Market by Delivery Mode (Cloud-based, On-premise), Application (e-Prescribing, PHM, Health Analytics, Practice, Patient & Referral Management), Practice Size (Large, Small-to-Medium, Solo), End User (Independent) & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global ambulatory EHR market forecasted to transform from $5.7 billion in 2022 to $7.7 billion by 2027, driven by a CAGR of 6.1%. Key drivers include supportive government initiatives, the rise in ambulatory and urgent care centers, and the increasing volume of patient data. Challenges include the high cost of deployment and maintenance, and data security concerns, which may hinder growth. Opportunities exist in the shift towards patient-centered healthcare delivery. The market is dominated by major players such as Epic Systems Corporation, Cerner Corporation, and MEDITECH. Asia Pacific is expected to experience the highest growth, driven by healthcare infrastructure investments in China, digitization in India, and favorable HCIT policies in Japan and Singapore. The market is segmented by delivery mode, application, practice size, end user, and region.

Ambulatory EHR Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Ambulatory EHR Market Dynamics

Driver: Government support for the adoption of EHR solutions

The HCIT industry is one of the fastest-growing industries, which benefits largely from government regulations. EHRs are a central component of HCIT wherein ambulatory EHRs are the digital version of outpatient medical history that store data consisting of patient demographics, progress notes, medications, treatment plans, vital signs, past medical history, immunizations, laboratory data, and radiology reports. Ambulatory EHRs facilitate easy exchange of healthcare information and communication among healthcare providers.

In the present healthcare scenario, the decision to adopt EHRs is greatly affected by incentives and payment adjustments. For instance, the HITECH Act, implemented by the US government in 2009, intended to accelerate the adoption and use of healthcare IT. The Centers for Medicare and Medicaid Services (CMS) was authorized to provide financial incentives to eligible ambulatory care centers, critical access ambulatory care centers (CAHs), and eligible professionals with certified EHR technologies to improve patient care.

The US government provides various incentives to healthcare providers to implement IT infrastructure across their facilities. The HITECH incentives provided eligible professionals nearly USD 44,000–USD 63,000, while eligible hospitals received nearly USD 2–9 million between 2011 and 2018. Such initiatives are currently driving and will continue to drive the demand for ambulatory EHRs.

Restraint: Heavy infrastructure investments and high cost of deployment

Most healthcare providers do not have the required infrastructure (technology, data, and other resources) for the management of complex healthcare cases. Providers are required to invest heavily in infrastructural development to implement ambulatory EHR solutions successfully. Finding the required investments poses a serious challenge to the already-strained financial resources of healthcare providers. Further, the to maintain the digital infrastructure will incur additional investments. Hence, maintenance costs also poses a challenge for the healthcare providers.

Moreover, ambulatory EHR solutions are relatively high-priced software solutions. The maintenance and software update costs of these systems may sometimes be more than the actual price of the software. This recurring expenditure may amount to almost 30% of the total cost of ownership. Moreover, the lack of internal IT expertise in the healthcare industry necessitates training for end users to maximize the efficiency of various HCIT solutions, thereby adding to the cost of ownership of these systems. Hence, factors like budgetary constraints for implementation of ambulatory EHR solutions and the cost for training and maintenance act as a limitation and is expected to restrain the market growth to certain extent.

Opportunity: Shift towards patient-cantered healthcare delivery

New communication technologies support the transition of healthcare delivery from a physician-driven model to a patient-centric care model wherein the entire healthcare system revolves around the patient for virtual meetings, test results, and other health records through electronic modes of communication. HCIT solutions enable patients and healthcare professionals to access relevant health information. The shift towards patient-centric care, coupled with the rising digitization of products and services, enables remote recording and remote sharing of medical records. Owing to the several benefits of patient-centric solutions, their utilization for remote monitoring, consultation, diagnosis, treatment, and prevention is expected to increase in the coming years thereby leading to the increasing adoption of ambulatory EHR solutions.

Challenge: Data Security Concerns

Creating a safe and secure communication platform is a major challenge faced by IT vendors catering to the healthcare industry including the ambulatory EHR software vendors. Approximately one-third of data breaches result in medical identity theft in the healthcare industry, due to poor internal control over patient information, outdated policies and procedures and inadequate personnel training. The HIPAA Journal recorded 712 healthcare data breaches in its 2021 breach list in the US, an increase of 10.9% over the total number of breaches tracked in 2020. In 2020, HIPAA-covered companies and business associates paid around USD 13.6 million for HIPAA violations and around USD 15.3 million in 2019. Therefore, security concerns related to healthcare IT systems may lead to a rise in the sense of insecurity among users and, hence, restrain their adoption until secure HCIT solutions are available.

Large practices accounted for the largest share in the practice size segment of ambulatory EHR industry in 2021

On the basis of practice size, the global ambulatory EHR market has been segmented into large practices, small-to-medium-sized practices, and solo practices. The large practices segment accounted for the largest share of 47.4% of the global market in 2021. The major factors responsible for its largest share include availability of capital investments, the ability to handle productivity challenges that are created by new EHR adoption, and the ability to choose among vendors.

Hospital-owned ambulatory centers is the largest and fastest growing end user segment in the ambulatory EHR industry in 2021

Based on end user, the hospitals segment accounted for the largest share and highest growth rate in the ambulatory EHR market during the forecast period. The large share & high growth of this segment can be attributed to the rising patient emphasis on timely and effective treatment, the rising number of diagnostic and surgical procedures carried out in hospitals.

Asia Pacific is expected to register highest growth rate in the ambulatory EHR industry during the forecast period.

The Asia Pacific region of the ambulatory EHR market is projected to register the highest growth rate of 7.5% during the forecast period. The growth in this region can primarily be attributed to the investments and reforms undertaken for the modernization of China’s healthcare infrastructure; the increasing digitization of healthcare solutions in India; Japan’s favourable outlook for HCIT; the One Singaporean, One Health Record initiative in Singapore; and the implementation of e-Health in Australia.

To know about the assumptions considered for the study, download the pdf brochure

The products and services market is dominated by a few globally established players such as include Epic Systems Corporation (US), Cerner Corporation (US), Allscripts Healthcare Solutions, Inc. (US), Medical Information Technology, Inc. (MEDITECH, US), Computer Programs and Systems, Inc. (CPSI, US).

Scope of the Ambulatory EHR Industry:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$5.7 billion |

|

Projected Revenue by 2027 |

$7.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.1% |

|

Market Driver |

Government support for the adoption of EHR solutions |

|

Market Opportunity |

Shift towards patient-cantered healthcare delivery |

The study categorizes the ambulatory EHR market to forecast revenue and analyze trends in each of the following submarkets:

By Delivery Mode

-

- Introduction

- On-premise

- Cloud-based

By Application

-

- Introduction

- Practice management

- Patient management

- E-prescribing

- Referral Management

- Population Health Management

- Decision Support

- Health Analytics

By Practice Size

-

- Introduction

- Large practices

- Small-to-Medium sized practices

- Solo practices

By End User

-

- Introduction

- Hospital-owned Ambulatory centers

- Independent centers

- Others

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest Of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments:

- In April 2022, MEDITECH (US) partnered with Fraser Health (Canada) to use MEDITECH Expanse to transform care and promote better health outcomes for the more than 1.9 million people it serves throughout 20 diverse communities.

- In March 2022, Cerner Corporation (US) expanded its collaboration with Nuance Communications, Inc. with an aim to integrate Nuance's Dragon Ambient into its Millennium EHR.

- In January 2022, Epic Systems Corporation (US) partnered with Priority Health (US) to implement the EHR vendor’s payer platform to facilitate patient data exchange with providers, lower healthcare costs, and improve care quality for members.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ambulatory EHR market?

The global ambulatory EHR market boasts a total revenue value of $7.7 billion by 2027.

What is the estimated growth rate (CAGR) of the global ambulatory EHR market?

The global ambulatory EHR market has an estimated compound annual growth rate (CAGR) of 6.1% and a revenue size in the region of $5.7 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 MARKETS COVERED – BY REGION

1.3 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

FIGURE 2 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY DATA

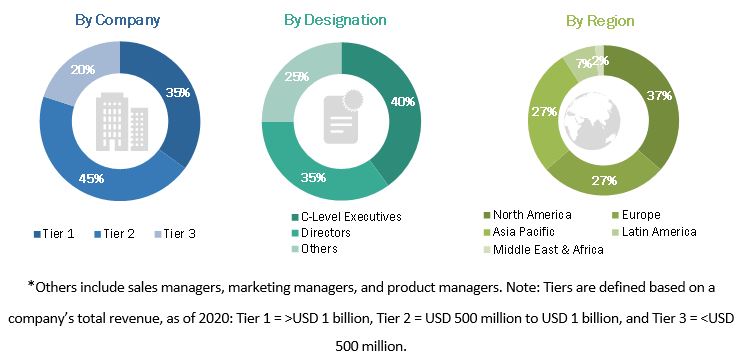

FIGURE 3 PRIMARY SOURCES

FIGURE 4 KEY DATA FROM PRIMARY SOURCES

FIGURE 5 KEY INDUSTRY INSIGHTS

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 9 BOTTOM-UP APPROACH

FIGURE 10 AMBULATORY EHR MARKET: CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 11 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 13 AMBULATORY EHR MARKET, BY DELIVERY MODE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 GLOBAL AMBULATORY EHR INDUSTRY, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 GLOBAL AMBULATORY EMR MARKET, BY PRACTICE SIZE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GLOBAL AMBULATORY EHR INDUSTRY, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 17 GEOGRAPHICAL SNAPSHOT OF GLOBAL AMBULATORY EHR INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 AMBULATORY EHR MARKET OVERVIEW

FIGURE 18 GOVERNMENT SUPPORT FOR HCIT SOLUTIONS ADOPTION TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC MARKET, BY DELIVERY MODE AND END USER (2021)

FIGURE 19 CLOUD-BASED SOLUTIONS AND HOSPITAL-OWNED AMBULATORY CENTERS ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC (2021)

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 ASIA PACIFIC COUNTRIES TO REGISTER HIGH GROWTH RATES DURING FORECAST PERIOD

4.4 GLOBAL AMBULATORY EMR MARKET, BY REGION (2020–2027)

FIGURE 21 NORTH AMERICA TO DOMINATE GLOBAL AMBULATORY EHR INDUSTRY IN 2027

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 AMBULATORY EHR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

TABLE 2 DRIVERS: IMPACT ANALYSIS

5.2.1.1 Government support for the adoption of EHR solutions

TABLE 3 KEY GOVERNMENT INITIATIVES FOR EHR

5.2.1.2 Increasing number of outpatient care centers

5.2.1.3 Growing patient volume due to COVID-19

5.2.1.4 Need to curtail healthcare costs

5.2.2 RESTRAINTS

TABLE 4 RESTRAINTS: IMPACT ANALYSIS

5.2.2.1 Heavy infrastructure investments and high cost of deployment

5.2.2.2 Reluctance to adopt ambulatory EHR solutions in developing countries

5.2.3 OPPORTUNITIES

TABLE 5 OPPORTUNITIES: IMPACT ANALYSIS

5.2.3.1 Increasing demand for cloud-based ambulatory EHR solutions

5.2.3.2 Shift towards patient-centric healthcare delivery

5.2.4 CHALLENGES

TABLE 6 CHALLENGES: IMPACT ANALYSIS

5.2.4.1 Interoperability issues

5.2.4.2 Data security concerns

FIGURE 23 US: NUMBER OF DATA BREACHES (2005–2020)

TABLE 7 LARGEST HEALTHCARE DATA BREACHES IN THE US (2021)

6 INDUSTRY INSIGHTS (Page No. - 58)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON THE GLOBAL AMBULATORY EHR INDUSTRY

6.2.1 STRATEGIES ADOPTED BY EHR VENDORS DURING COVID-19

6.3 INCREASED ADOPTION OF EHR

6.4 INCREASED PREFERENCE FOR CLOUD-BASED EHR

FIGURE 24 PERCENTAGE OF HEALTHCARE PROFESSIONALS IN AMBULATORY CARE CENTERS THAT USE PUBLIC CLOUDS TO STORE HEALTHCARE DATA, 2018

6.5 SHIFT FROM INPATIENT SURGICAL PROCEDURES TO OUTPATIENT SURGICAL PROCEDURES

6.6 TECHNOLOGICAL ADVANCEMENTS IN EHR SOLUTIONS

TABLE 8 COMPARISON OF VARIOUS TYPES OF EHR SOFTWARE PROVIDED BY SOME KEY PLAYERS

7 AMBULATORY EHR MARKET, BY DELIVERY MODE (Page No. - 65)

7.1 INTRODUCTION

TABLE 9 COMPARISON BETWEEN CLOUD-BASED AND ON-PREMISE EHR SOLUTIONS

TABLE 10 GLOBAL AMBULATORY EMR MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

7.2 CLOUD-BASED SOLUTIONS

7.2.1 LOW COST OF INSTALLATION & MAINTENANCE AND UNLIMITED STORAGE CAPACITY TO DRIVE THE DEMAND FOR CLOUD SOLUTIONS

TABLE 11 CLOUD-BASED AMBULATORY EHR SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 12 GLOBAL AMBULATORY EHR INDUSTRY FOR CLOUD-BASED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 ON-PREMISE SOLUTIONS

7.3.1 LONGER IMPLEMENTATION PROCESS AND PAYMENTS ASSOCIATED WITH HARDWARE LIMIT MARKET GROWTH TO A CERTAIN EXTENT

TABLE 13 ON-PREMISE AMBULATORY EHR SOLUTIONS OFFERED BY KEY MARKET PLAYERS

TABLE 14 GLOBAL MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 AMBULATORY EHR MARKET, BY APPLICATION (Page No. - 71)

8.1 INTRODUCTION

TABLE 15 GLOBAL AMBULATORY EMR MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PRACTICE MANAGEMENT

8.2.1 ADVANTAGES SUCH AS INCREASED EFFICIENCY OF DAY-TO-DAY OPERATIONS TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 16 AMBULATORY EHR SOLUTIONS FOR PRACTICE MANAGEMENT APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 17 GLOBAL MARKET FOR PRACTICE MANAGEMENT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 PATIENT MANAGEMENT

8.3.1 EHR SOLUTIONS FOR PATIENT MANAGEMENT REDUCE ADMINISTRATIVE EXPENSES AND ENSURE EFFICIENCY IN PATIENT CARE

TABLE 18 AMBULATORY EHR SOLUTIONS FOR PATIENT MANAGEMENT APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 19 GLOBAL MARKET FOR PATIENT MANAGEMENT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 E-PRESCRIBING

8.4.1 USE OF E-PRESCRIBING SOLUTIONS HAS INCREASED DUE TO ITS BENEFITS—MEDICATION SAFETY AND COST SAVINGS

TABLE 20 AMBULATORY EHR SOLUTIONS FOR E-PRESCRIBING APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 21 GLOBAL AMBULATORY EHR INDUSTRY FOR E-PRESCRIBING APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 REFERRAL MANAGEMENT

8.5.1 EHR SOLUTIONS FOR REFERRAL MANAGEMENT APPLICATIONS IMPROVE AND STREAMLINE COMMUNICATION AMONG HEALTH PROVIDERS

TABLE 22 AMBULATORY EHR SOLUTIONS FOR REFERRAL MANAGEMENT APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 23 GLOBAL MARKET FOR REFERRAL MANAGEMENT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 POPULATION HEALTH MANAGEMENT

8.6.1 EHRS USED FOR POPULATION HEALTH MANAGEMENT INCORPORATE SERVICES SUCH AS PATIENT IDENTIFICATION AND AUTOMATION OF COMMUNICATION

TABLE 24 AMBULATORY EHR SOLUTIONS FOR POPULATION HEALTH MANAGEMENT APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 25 GLOBAL MARKET FOR POPULATION HEALTH MANAGEMENT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.7 DECISION SUPPORT

8.7.1 DECISION SUPPORT IS A VITAL PART OF AMBULATORY EHR, AS IT HELPS TO IMPROVE THE QUALITY OF CARE & EFFICIENCY

TABLE 26 AMBULATORY EHR SOLUTIONS FOR DECISION SUPPORT APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 27 GLOBAL MARKET FOR DECISION SUPPORT APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.8 HEALTH ANALYTICS

8.8.1 HEALTH ANALYTICS UTILIZES DATA COLLATED BY AN AMBULATORY EHR TO DRAW INSIGHTS REGARDING THE CLINICAL CONDITIONS OF PATIENTS

TABLE 28 AMBULATORY EHR SOLUTIONS FOR HEALTH ANALYTICS APPLICATIONS OFFERED BY KEY MARKET PLAYERS

TABLE 29 GLOBAL MARKET FOR HEALTH ANALYTICS APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 AMBULATORY EHR MARKET, BY PRACTICE SIZE (Page No. - 83)

9.1 INTRODUCTION

TABLE 30 GLOBAL AMBULATORY EMR MARKET, BY PRACTICE SIZE, 2020–2027 (USD MILLION)

9.2 LARGE PRACTICES

9.2.1 LARGE PRACTICES REQUIRE EFFICIENT ADMINISTRATION AND COORDINATION—A KEY FACTOR DRIVING MARKET GROWTH SINCE EHRS HELP WITH THESE TASKS

TABLE 31 AMBULATORY EHR SOLUTIONS FOR LARGE PRACTICES OFFERED BY KEY MARKET PLAYERS

TABLE 32 GLOBAL MARKET FOR LARGE PRACTICES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 SMALL-TO-MEDIUM-SIZED PRACTICES

9.3.1 AMBULATORY EHRS USED IN SMALL-TO-MEDIUM-SIZED PRACTICES OFFER FLEXIBLE FUNCTIONALITY FOR PRACTICE WORKFLOWS

TABLE 33 AMBULATORY EHR SOLUTIONS FOR SMALL-TO-MEDIUM-SIZED PRACTICES OFFERED BY KEY MARKET PLAYERS

TABLE 34 GLOBAL MARKET FOR SMALL-TO-MEDIUM-SIZED PRACTICES, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 SOLO PRACTICES

9.4.1 USE OF EHRS IN SOLO PRACTICES HAS INCREASED OVER THE YEARS, MAINLY DUE TO THE AVAILABILITY OF CLOUD-BASED EHR PLATFORMS

TABLE 35 AMBULATORY EHR SOLUTIONS FOR SOLO PRACTICES OFFERED BY KEY MARKET PLAYERS

TABLE 36 GLOBAL MARKET FOR SOLO PRACTICES, BY COUNTRY, 2020–2027 (USD MILLION)

10 AMBULATORY EHR MARKET, BY END USER (Page No. - 89)

10.1 INTRODUCTION

TABLE 37 GLOBAL AMBULATORY EMR MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 HOSPITAL-OWNED AMBULATORY CENTERS

10.2.1 BENEFITS OF EHR SOLUTIONS, SUCH AS OPERATIONAL SAVINGS, HAVE DRIVEN THEIR ADOPTION AMONG THESE END USERS

TABLE 38 AMBULATORY EHR SOLUTIONS FOR HOSPITAL-OWNED AMBULATORY CENTERS OFFERED BY KEY MARKET PLAYERS

TABLE 39 GLOBAL MARKET FOR HOSPITAL-OWNED AMBULATORY CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

10.3 INDEPENDENT CENTERS

10.3.1 HIGH COST OF SOFTWARE AND LACK OF HEALTH IT LITERACY AMONG PHYSICIANS ARE THE RESTRAINING FACTORS FOR THIS MARKET

TABLE 40 AMBULATORY EHR SOLUTIONS FOR INDEPENDENT CENTERS OFFERED BY KEY MARKET PLAYERS

TABLE 41 GLOBAL MARKET FOR INDEPENDENT CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

11 AMBULATORY EHR MARKET, BY REGION (Page No. - 94)

11.1 INTRODUCTION

TABLE 42 GLOBAL AMBULATORY EHR INDUSTRY, BY REGION, 2020–2027(USD MILLION)

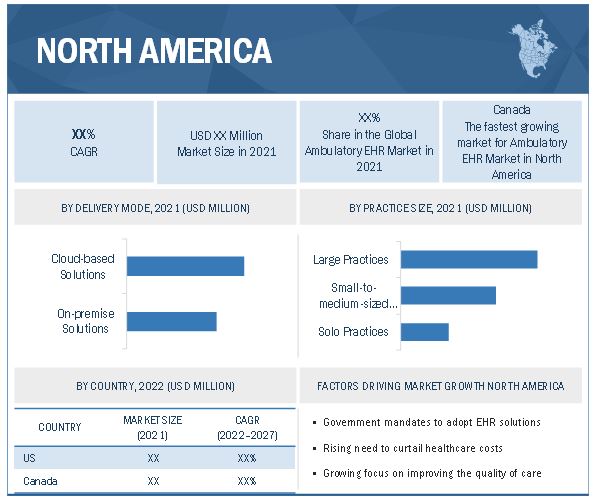

11.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: AMBULATORY EHR MARKET SNAPSHOT

TABLE 43 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027(USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 46 NORTH AMERICA: AMBULATORY EHR INDUSTRY, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 47 NORTH AMERICA: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.2.1 US

11.2.1.1 Federal mandates in US to boost ambulatory EHRs adoption

TABLE 48 US: KEY MACROINDICATORS

TABLE 49 US: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 50 US: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 51 US: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 52 US: MARKET, BY END USER, 2020–2027(USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing efforts to enhance healthcare delivery to drive market growth

TABLE 53 CANADA: KEY MACROINDICATORS

TABLE 54 CANADA: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 55 CANADA: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 56 CANADA: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 57 CANADA: AMBULATORY EHR INDUSTRY, BY END USER, 2020–2027(USD MILLION)

11.3 EUROPE

FIGURE 26 EUROPE: EHEALTH PRIORITIES IN HEALTH FACILITIES, 2019

TABLE 58 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY, 2019

FIGURE 27 EUROPE: EHEALTH CHALLENGES FACED BY HEALTHCARE PROVIDERS IN HEALTH FACILITIES, 2019

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2020–2027(USD MILLION)

TABLE 60 EUROPE: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 61 EUROPE: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 62 EUROPE: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 63 EUROPE: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.3.1 GERMANY

11.3.1.1 Government initiatives to improve EHR solutions adoption to drive market growth

TABLE 64 GERMANY: KEY MACROINDICATORS

TABLE 65 GERMANY: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 66 GERMANY: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 67 GERMANY: AMBULATORY EHR INDUSTRY, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 68 GERMANY: AMBULATORY EMR MARKET, BY END USER, 2020–2027(USD MILLION)

11.3.2 UK

11.3.2.1 Organizational transformation with paperless environment through EHRs to drive market growth

TABLE 69 UK: KEY MACROINDICATORS

TABLE 70 UK: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 71 UK: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 72 UK: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 73 UK: MARKET, BY END USER, 2020–2027(USD MILLION)

11.3.3 FRANCE

11.3.3.1 Upcoming retirement of large number of French doctors to drive effective patient management solutions

TABLE 74 FRANCE: KEY MACROINDICATORS

TABLE 75 FRANCE: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 76 FRANCE: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 77 FRANCE: AMBULATORY EHR INDUSTRY, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 78 FRANCE: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.3.4 ITALY

11.3.4.1 Increasing focus on ensuring interoperability of patient health records to drive market growth

TABLE 79 ITALY: KEY MACROINDICATORS

TABLE 80 ITALY: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 81 ITALY: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 82 ITALY: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 83 ITALY: MARKET, BY END USER, 2020–2027(USD MILLION)

11.3.5 SPAIN

11.3.5.1 Large number of COVID-19 patients to promote EHR solutions adoption among physicians

TABLE 84 SPAIN: KEY MACROINDICATORS

TABLE 85 SPAIN: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 86 SPAIN: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 87 SPAIN: AMBULATORY EHR INDUSTRY, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 88 SPAIN: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.3.6 REST OF EUROPE

TABLE 89 REST OF EUROPE: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 90 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 91 REST OF EUROPE: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 92 REST OF EUROPE: MARKET, BY END USER, 2020–2027(USD MILLION)

11.4 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC: AMBULATORY EHR MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027(USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 96 ASIA PACIFIC: AMBULATORY EHR INDUSTRY, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 97 ASIA PACIFIC: AMBULATORY EMR MARKET, BY END USER, 2020–2027(USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan to be largest ambulatory EHR market in Asia Pacific region

TABLE 98 JAPAN: KEY MACROINDICATORS

TABLE 99 JAPAN: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 100 JAPAN: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 101 JAPAN: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 102 JAPAN: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.4.2 CHINA

11.4.2.1 Government investments and reforms to modernize healthcare infrastructure to boost EHR solutions adoption

TABLE 103 CHINA: KEY MACROINDICATORS

TABLE 104 CHINA: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 105 CHINA: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 106 CHINA: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 107 CHINA: AMBULATORY EHR INDUSTRY, BY END USER, 2020–2027(USD MILLION)

11.4.3 INDIA

11.4.3.1 High adoption of digital healthcare solutions to increase EHR implementation

TABLE 108 INDIA: KEY MACROINDICATORS

TABLE 109 INDIA: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 110 INDIA: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 111 INDIA: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 112 INDIA: AMBULATORY EMR MARKET SHARE, BY END USER, 2020–2027(USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 113 REST OF ASIA PACIFIC: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 115 REST OF ASIA PACIFIC: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 116 REST OF ASIA PACIFIC: AMBULATORY EHR INDUSTRY, BY END USER, 2020–2027(USD MILLION)

11.5 LATIN AMERICA

11.5.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

TABLE 117 LATIN AMERICA: AMBULATORY EHR MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 118 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 119 LATIN AMERICA: MARKET, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 120 LATIN AMERICA: MARKET, BY END USER, 2020–2027(USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 GROWING MEDICAL TOURISM TO SUPPORT MARKET GROWTH

TABLE 121 MIDDLE EAST & AFRICA: MARKET, BY DELIVERY MODE, 2020–2027(USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: AMBULATORY EHR INDUSTRY, BY APPLICATION, 2020–2027(USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: AMBULATORY EMR MARKET SHARE, BY PRACTICE SIZE, 2020–2027(USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: AMBULATORY EMR MARKET, BY END USER, 2020–2027(USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 138)

12.1 OVERVIEW

FIGURE 29 KEY STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2019 TO MAY 2022

12.2 MARKET SHARE ANALYSIS

FIGURE 30 GLOBAL AMBULATORY EHR MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

12.3 COMPANY EVALUATION MATRIX

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE PLAYERS

12.3.4 PARTICIPANTS

FIGURE 31 GLOBAL AMBULATORY EHR INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2022

12.3.5 PRODUCT FOOTPRINT

TABLE 125 PRODUCT MATRIX, BY COMPANY

12.4 COMPETITIVE SITUATIONS & TRENDS

12.4.1 PRODUCT/SERVICE LAUNCHES & UPGRADES

TABLE 126 KEY PRODUCT/SERVICE LAUNCHES & UPGRADES (2019−2022)

12.4.2 DEALS

TABLE 127 KEY DEALS (2019−2022)

13 COMPANY PROFILES (Page No. - 146)

(Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats)*

13.1 EPIC SYSTEMS CORPORATION

13.2 CERNER CORPORATION

TABLE 129 CERNER CORPORATION: BUSINESS OVERVIEW

FIGURE 32 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

13.3 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

FIGURE 130 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 33 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2021)

13.4 MEDICAL INFORMATION TECHNOLOGY, INC. (MEDITECH)

TABLE 131 MEDICAL INFORMATION TECHNOLOGY, INC.: BUSINESS OVERVIEW

13.5 COMPUTER PROGRAMS AND SYSTEMS, INC. (CPSI)

TABLE 132 COMPUTER PROGRAMS AND SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 34 CPSI: COMPANY SNAPSHOT (2021)

13.6 NEXTGEN HEALTHCARE INFORMATION SYSTEMS, LLC.

TABLE 133 NEXTGEN HEALTHCARE INFORMATION SYSTEMS, LLC.: BUSINESS OVERVIEW

FIGURE 35 NEXTGEN HEALTHCARE INFORMATION SYSTEMS, LLC: COMPANY SNAPSHOT (2021)

13.7 ATHENAHEALTH, INC. (A VERITAS CAPITAL COMPANY)

TABLE 134 ATHENAHEALTH, INC.: BUSINESS OVERVIEW

13.8 ECLINICALWORKS

TABLE 135 ECLINICALWORKS: BUSINESS OVERVIEW

13.9 COMPUGROUP MEDICAL SE & CO. KGAA (EMDS, INC.)

TABLE 136 COMPUGROUP MEDICAL SE & CO. KGAA: BUSINESS OVERVIEW

FIGURE 36 COMPUGROUP MEDICAL SE & CO. KGAA: COMPANY SNAPSHOT (2021)

13.10 AMAZING CHARTS, LLC

TABLE 137 AMAZING CHARTS, LLC: BUSINESS OVERVIEW

13.11 GREENWAY HEALTH, LLC

TABLE 138 GREENAWAY HEALTH, LLC.: BUSINESS OVERVIEW

13.12 CUREMD

TABLE 139 CUREMD: BUSINESS OVERVIEW

13.13 CARECLOUD, INC. (MTBC)

TABLE 140 CARECLOUD, INC.: BUSINESS OVERVIEW

FIGURE 37 CARECLOUD, INC.: COMPANY SNAPSHOT (2021)

13.14 NETSMART TECHNOLOGIES, INC.

TABLE 141 NETSMART TECHNOLOGIES, INC.: BUSINESS OVERVIEW

13.15 MODERNIZING MEDICINE

TABLE 142 MODERNIZING MEDICINE: BUSINESS OVERVIEW

13.16 ADVANCEDMD

13.17 KAREO, INC.

13.18 DRCHRONO

13.19 ADVANCED DATA SYSTEMS CORPORATION

13.20 EYEFINITY (OFFICEMATE/EXAMWRITER)

13.21 ICANOTES

13.22 HARRIS HEALTHCARE

13.23 NEXTECH SYSTEMS, LLC

13.24 IPATIENTCARE LLC

13.25 AZALEA HEALTH INNOVATIONS, INC.

*Details on Business Overview, Products Offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 186)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global Ambulatory EHR Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology & innovation directors of ambulatory care centers, key opinion leaders, and suppliers & distributors. Primary sources from the demand side include personnel from ambulatory care centers of all sizes.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by delivery mode, practice size, application, end user, and region).

Data Triangulation

After arriving at the market size, the total Ambulatory EHR Market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Global Ambulatory EHR Market Size: Top-Down Approach

Objectives of the Study

- To define, describe, and forecast the global ambulatory EHR market on the basis of delivery mode, application, end user, practice size, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their product portfolios, market shares, and core competencies2 in the global ambulatory EHR market

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; expansions; and product launches in the global ambulatory EHR market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific ambulatory EHR market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe's ambulatory EHR market into Belgium, Russia, the Netherlands, Switzerland, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ambulatory EHR Market