Angiographic Catheters Market by Application (Coronary, Endovascular, Neurology and Oncology), Geography (North America, Europe, Asia Pacific and Row), End-User Analysis (Reusage Scenario, Purchase Pattern) and Competitive Scenario - Global Forecast to 2022

According to new market research report, angiographic catheters market is expected to reach USD 1,402.8 million by 2022 from USD 922.1 million in 2016 and, at a CAGR of 7.4%. The base year for this study is 2016 and the forecast period is 2017–2022. Increasing number of Cath labs in APAC, incidences of CVDs and preference for minimally invasive surgeries are few of the reasons for the growth of this market.

The objectives of this study are as follows:

- To define, describe, and forecast the market (by value and volume) on the basis of application, and region

- To identify micromarkets and the drivers, restraints, industry-specific challenges, opportunities, and trends affecting the growth of the angiographic catheters market

- To strategically analyze market segments and subsegments with respect to individual growth trends, prospects, and contributions to the overall market

- To understand the re-usage scenario and distribution channel for angiographic catheters in different regions

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as partnerships, agreements, collaborations, and joint ventures; mergers and acquisitions; product launches; and R&D activities in the angiographic catheters market

Research Methodology

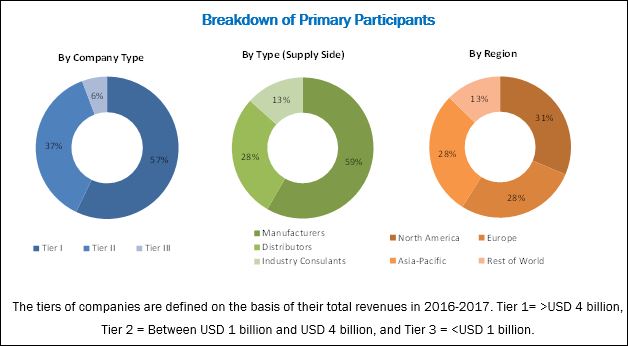

Top-down and bottom-up approaches were used to estimate and validate the size of the market and various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual submarkets (mentioned in the market segmentation—by application and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the angiographic catheters market segment revenues obtained.

Various secondary sources such as the World Health Organization, National Center for Biotechnology Information, National Institutes of Health, Centers for Disease Control and Prevention (CDC), World Heart Federation, Society for Cardiac Angiography and Interventions (SCAI), American College of Cardiology, American Heart Association, European Association of Percutaneous Cardiovascular Interventions (EAPCI), Canadian Association of Interventional Cardiology (CAIC), Asian Pacific Society of Interventional Cardiology (APSIC), PubMed have been used to identify and collect information useful for this extensive commercial study of the market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess the prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The key players in the angiographic catheters market include Boston Scientific (US), Medtronic (US), Terumo Medical (Japan), Cardinal Health (US), and Merit Medical System (US).

Target Audience for this Report:

- Manufacturers and vendors of angiographic catheters

- Market research and consulting firms

- Sepsis diagnostic device suppliers and distributors

- Research institutes and clinical research organizations (CROs)

- Healthcare institutions

Scope of the Report:

This report categorizes the global angiographic catheters market into the following segments:

Angiographic Catheters Market, By Application- Coronary

- Endovascular

- Neurology

- Oncology

- Other Applications (lungs, urology, and gastroenterology)

- North America

- Europe

- Asia Pacific

- Rest of the World

Customization Options:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the angiographic catheters market report:

Company Information:

- Detailed analysis and profiling of additional angiographic catheters market players (up to 5)

Opportunity Assessment:

- Detailed report underlining the various growth opportunities presented in the market.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies in the angiographic catheters market.

End User Perception Analysis:

- Detailed perception analysis of end-user for different products in various region/country can be provided

Detailed Analysis

- Other catheters market such as urinary, angioplasty and diagnostic can also be studied

The angiographic catheters market is expected to reach USD 1,402.8 million by 2022 from USD 980.9 million in 2017, at a CAGR of 7.4%. Market growth is primarily driven by the aging population and increasing incidence of diseases such as CVDs; and demand for angiographic catheter for the diagnosis of arterial blockages. Technological advancements in catheter-based angiography techniques is driving growth of this market.

This report broadly segments the angiographic catheters market into application and region. The report also contains information on re-usage scenario and distribution channel for angiographic catheters in different regions.

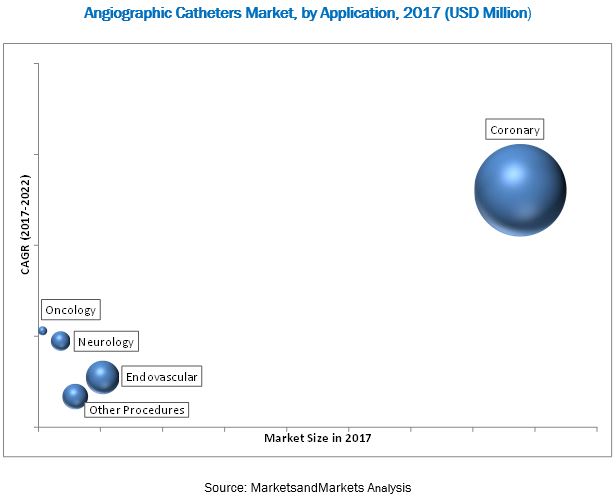

By application, the angiographic catheters market is segmented into coronary, endovascular, neurology, oncology, and other applications. The coronary segment accounted for the largest share of the market in 2017. Factors driving the growth of this segment include the growing incidence of cardiovascular diseases and demand for catheters for angiography procedures. According to OECD, in 2013, PCI contributed around 80% of the total coronary revascularization procedures in Europe and it is anticipated to increase in future.

The global market is dominated by Europe, followed by Asia Pacific. Europe will continue to dominate the market during the forecast period mainly due to the presence of large patient population. However, Asia Pacific is expected to witness the highest CAGR. Factors such as the increasing burden of coronary arterial disease and focus of major players in emerging Asia Pacific countries are driving the growth of the market in this region. However, increasing preference for non-invasive angiography is expected to hinder the growth of market. Additionally, increasing number of Cath labs in the region is witnessing a substantial growth in region that have accentuated the growth of angiographic catheters market.

In Asian countries like India and China, catheter reusage is extensive in Tier 2 and Tier 3 hospitals which helps in reducing the procedural cost and provide affordable treatment to patients. However, due to the reduction in prices of catheters and growing awareness involved with the risk associated with re-used catheters, the preference for re-used catheters is anticipated to decrease in emerging nations.

Major industry players launched innovative products to maintain and improve their position in the angiographic catheters market. Medtronic (US), Boston Scientific (US), Terumo Medical (Japan), Cardinal Health (US), and Merit Medical System (US) have been identified as key players operating in this market. These companies have broad product portfolios with comprehensive features. These players are observed to have a wide distribution network across the globe, which enhances their geographic presence.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Angiographic Catheters Market: Introduction

1.1 Objectives of the Study

1.2 Definition & Exclusions

1.3 Markets Covered

1.4 Years Considered for the Study

1.5 Currency

1.6 Assumptions & Limitations

2 Angiographic Catheters Market: Research Methodology

2.1 angiographic catheters market Breakdown and Data Triangulation

2.2 Market Size Estimation

2.3 Forecast Model Steps

3 Executive Summary

4 Angiographic Catheters Market Overview

5 Angiographic Catheters Market, By Application

5.1 Coronary

5.2 Endovascular

5.3 Neurology

5.4 Oncology

5.5 Other

6 Angiographic Catheters Market, By Region

6.1 Region Snapshot

6.2 North America

6.2.1 Respondent Profiles

6.2.2 Coronary Market

6.2.3 Endovascular Market

6.2.4 Neurology Market

6.2.5 Oncology Market

6.2.6 Other Angiographic Procedures Catheters Market

6.3 Europe

6.3.1 Respondent Profiles

6.3.2 Coronary Market

6.3.3 Endovascular Market

6.3.4 Neurology Market

6.3.5 Oncology Market

6.3.6 Other Angiographic Procedures Catheters Market

6.4 Asia-Pacific

6.4.1 Respondent Profiles

6.4.2 Coronary Market

6.4.3 Endovascular Market

6.4.4 Neurology Market

6.4.5 Oncology Market

6.4.6 Other Angiographic Procedures Catheters Market

6.5 Rest of the World

6.5.1 Respondent Profiles

6.5.2 Coronary Market

6.5.3 Endovascular Market

6.5.4 Neurology Market

6.5.5 Oncology Market

6.5.6 Other Angiographic Procedures Catheters Market

7 Purchase Pattern

8 Reusage Scenario

9 Angiographic Catheters Market Share Analysis

10 Company Profiles

10.1 Boston Scientific Corporation

10.2 Medtronic PLC.

10.3 Terumo Medical Corporation

10.4 Merit Medical System Inc

10.5 B. Braun Melsungen AG

10.6 Angiodynamics Inc

10.7 Cardinal Health, Inc.

10.8 C.R. Bard, Inc. (A Part of Becton, Dickinson and Company)

10.9 Cook Medical LLC

10.10 Alvimedica Medical Devices Inc.

11 Appendix

List of Tables (76 Tables)

Table 1 Global Market, By Application - Volume (No. of Units), 2015-2022

Table 2 Global Market, By Application – Value (USD Mn), 2015-2022

Table 3 Angiographic Catheters Market, By Region- Volume (No. of Units), 2015-2022

Table 4 Market, By Region– Value (USD Mn), 2015-2022

Table 5 Number of Angiographic Procedures in North America, By Application, 2015 - 2022

Table 6 North American Market, By Application - Volume (No. of Units), 2015-2022

Table 7 North American Market, By Application - Value (USD Mn), 2015-2022

Table 8 Number of Coronary Angiographic Procedures in North America, 2015 - 2022

Table 9 North American Coronary Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 10 North American Coronary Market, By Value (USD Mn), 2015-2022

Table 11 Number of Endovascular Angiographic Procedures in North America, 2015 - 2022

Table 12 North American Endovascular Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 13 North American Endovascular Market, By Value (USD Mn), 2015-2022

Table 14 Number of Neurology Angiographic Procedures in North America, 2015 – 2022

Table 15 North American Neurology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 16 North American Neurology Market, By Value (USD Mn), 2015-2022

Table 17 Number of Oncology Angiographic Procedures in North America, 2015 - 2022

Table 18 North American Oncology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 19 North American Oncology Market, By Value (USD Mn), 2015-2022

Table 20 Number of Other Angiographic Procedures in North America, 2015 - 2022

Table 21 North American Other Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 22 North American Other Market, By Value (USD Mn), 2015-2022

Table 23 Number of Angiographic Procedures in Europe, By Application, 2015 - 2022

Table 24 European Market for Angiographic Catheters, By Application - Volume (No. of Units), 2015-2022

Table 25 European Angiographic Catheters Market, By Application - Value (USD Mn), 2015-2022

Table 26 Number of Coronary Angiographic Procedures in Europe, 2015 - 2022

Table 27 European Coronary Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 28 European Coronary Market, By Value (USD Mn), 2015-2022

Table 29 Number of Endovascular Angiographic Procedures in Europe, 2015 - 2022

Table 30 European Endovascular Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 31 European Endovascular Market for Angiographic Catheters, By Value (USD Mn), 2015-2022

Table 32 Number of Neurology Angiographic Procedures in Europe, 2015 - 2022

Table 33 European Neurology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 34 European Neurology Market, By Value (USD Mn), 2015-2022

Table 35 Number of Oncology Angiographic Procedures in Europe, 2015 - 2022

Table 36 European Oncology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 37 European Oncology Market, By Value (USD Mn), 2015-2022

Table 38 Number of Other Angiographic Procedures in Europe, 2015 - 2022

Table 39 European Other Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 40 European Other Market, By Value (USD Mn), 2015-2022

Table 41 Number of Angiographic Procedures in Asia Pacific ,By Application, 2015 - 2022

Table 42 Asia Pacific Angiographic Catheters Market for Angiographic Catheters, By Application - Volume (No. of Units), 2015-2022

Table 43 Asia Pacific Market for Angiographic Catheters, By Application - Value (USD Mn), 2015-2022

Table 44 Number of Coronary Angiographic Procedures in Asia Pacific, 2015 - 2022

Table 45 Asia Pacific Coronary Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 46 Asia Pacific Coronary Market for Angiographic Catheters, By Value (USD Mn), 2015-2022

Table 47 Number of Endovascular Angiographic Procedures in Asia Pacific, 2015 – 2022

Table 48 Asia Pacific Endovascular Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 49 Asia Pacific Endovascular Market for Angiographic Catheters, By Value (USD Mn), 2015-2022

Table 50 Number of Neurology Angiographic Procedures in Asia Pacific, 2015 - 2022

Table 51 Asia Pacific Neurology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 52 Asia Pacific Neurology Market, By Value (USD Mn), 2015-2022

Table 53 Number of Oncology Angiographic Procedures in Asia Pacific, 2015 - 2022

Table 54 Asia Pacific Oncology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 55 Asia Pacific Oncology Market, By Value (USD Mn), 2015-2022

Table 56 Number of Other Angiographic Procedures in Asia Pacific, 2015 – 2022

Table 57 Asia Pacific Other Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 58 Asia Pacific Other Market, By Value (USD Mn), 2015-2022

Table 59 Number of Angiographic Procedures in RoW, By Type, 2015 – 2022

Table 60 RoW Market for Angiographic Catheters, By Application - Volume (No. of Units), 2015-2022

Table 61 RoW Angiographic Catheters Market, By Application - Value (USD Mn), 2015-2022

Table 62 Number of Coronary Angiographic Procedures in RoW, 2015 - 2022

Table 63 RoW Coronary Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 64 RoW Coronary Market, By Value (USD Mn), 2015-2022

Table 65 Number of Endovascular Angiographic Procedures in RoW, 2015 - 2022

Table 66 RoW Endovascular Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 67 RoW Endovascular Market for Angiographic Catheters, By Value (USD Mn), 2015-2022

Table 68 Number of Coronary Angiographic Procedures in RoW, 2015 - 2022

Table 69 RoW Neurology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 70 RoW Neurology Market for Angiographic Catheters, By Value (USD Mn), 2015-2022

Table 71 Number of Oncology Angiographic Procedures in RoW, 2015 - 2022

Table 72 RoW Oncology Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 73 RoW Oncology Market, By Value (USD Mn), 2015-2022

Table 74 Number of Other Angiographic Procedures in RoW, 2015 - 2022

Table 75 RoW Other Market for Angiographic Catheters, By Volume (No. of Units), 2015-2022

Table 76 RoW Other Market, By Value (USD Mn), 2015-2022

List of Figures (34 Figures)

Figure 1 Global Angiographic Catheters Market, By Volume (No. of Units, Millions), 2015-2022

Figure 2 Global Market, By Value (USD Mn), 2015-2022

Figure 3 Global Market: Volume vs Value, 2016

Figure 4 Number of Angiographic Procedures (MN), Global, 2015-2022

Figure 5 Global Market: Purchase Pattern By Medical Facilities

Figure 6 Global Market: Market Share Analysis

Figure 7 Medical Professionals: Preference for Reused Catheters

Figure 8 Geographical Snapshot: Percentage Revenue Contribution and Market Growth Opportunity

Figure 9 Common Conditions for Vascular Blockages

Figure 10 Number of Respondents, By Type

Figure 11 Number of Respondents, By Country

Figure 12 Demand Side Respondents, By Designation

Figure 13 Supply Side Respondents, By Type

Figure 14 Number of Respondents, By Type

Figure 15 Number of Respondents, By Country

Figure 16 Demand Side Respondents, By Designation

Figure 17 Supply Side Respondents, By Type

Figure 18 Number of Respondents, By Type

Figure 19 Number of Respondents, By Country

Figure 20 Demand Side Respondents, By Designation

Figure 21 Supply Side Respondents, By Type

Figure 22 Number of Respondents, By Type

Figure 23 Number of Respondents, By Country

Figure 24 Demand Side Respondents, By Designation

Figure 25 Supply Side Respondents, By Type

Figure 26 North America : Purchase Pattern

Figure 27 Europe : Purchase Pattern

Figure 28 Asia Pacific : Purchase Pattern

Figure 29 Rest of the World : Purchase Pattern

Figure 30 Medical Professionals: Preference for Reused Catheters, North America

Figure 31 Medical Professionals: Preference for Reused Catheters, Europe

Figure 32 Medical Professionals: Preference for Reused Catheters, Asia-Pacific

Figure 33 Medical Professionals: Preference for Reused Catheters, Rest of the World

Figure 34 Angiographic Catheters Market Share Analysis, By Player, 2016

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Angiographic Catheters Market