Probiotics Market

Probiotics Market Report by Product Type (Functional Food & Beverages (FnB), Dietary Supplements, and Feed), Ingredient (Bacteria and Yeast), End User (Human and Animal), Distribution Channel, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

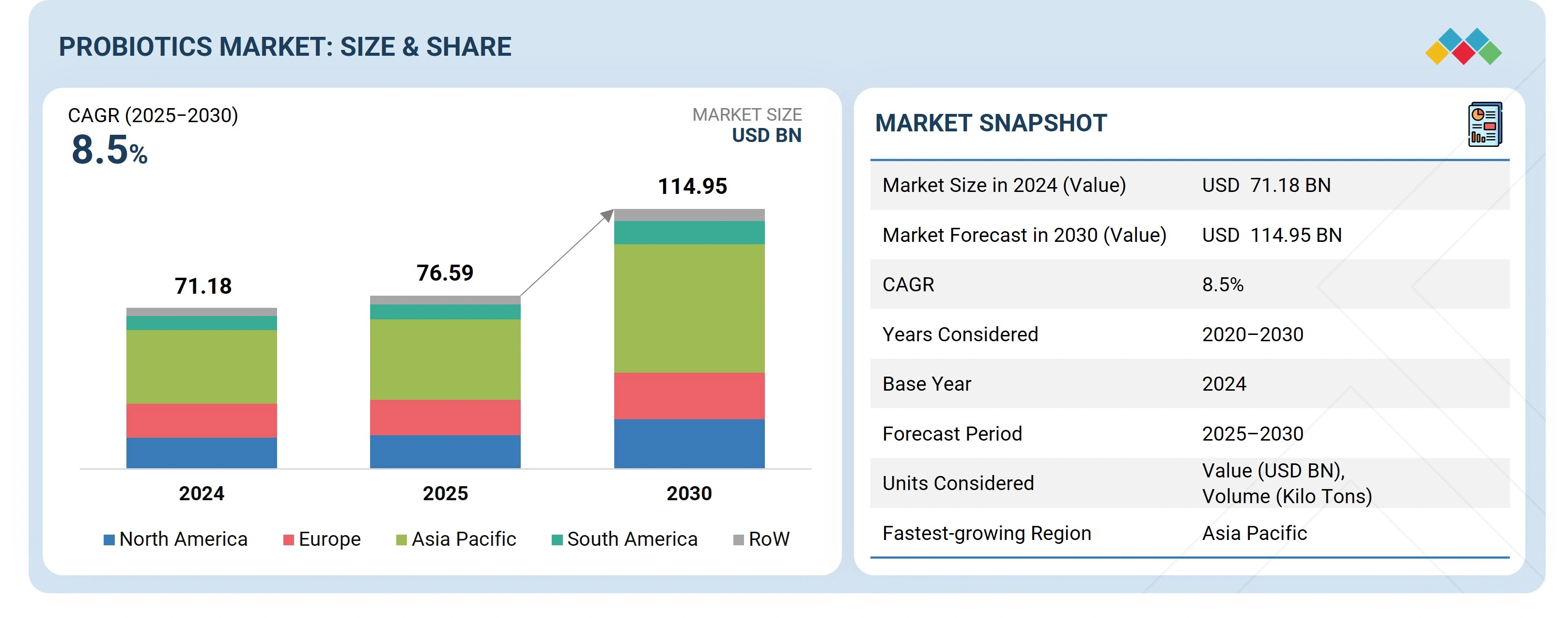

The global probiotics market is estimated to be valued at USD 76.59 billion in 2025 and is projected to reach USD 114.95 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. Consumers are beginning to switch to condition-based segments and go for nutritional products over excessive, self-medicated antibiotics as a way to cope with gastrointestinal disorders and aspects of an unhealthy lifestyle, the very foundation of this group's potential. Regions such as South Asia and the Pacific, including countries such as China, Japan, and India, have witnessed an increase in certain indigenous, locally developed, and probiotic products. These products are now becoming wildly popular, even lifestyle icons, in such countries as a test phase of the ability of probiotics to modify the traditional diet. Since the late '80s, the advent of probiotics and awareness of the need for awareness has shifted from insufficient proof of the benefits toward clear definitions, regulation on consumption, and endorsement.

KEY TAKEAWAYS

-

By RegionAsia Pacific accounted for 45.9% market share in 2024.

-

By IngredientsThe yeast segment is expected to register the highest CAGR of 9.7% during the forecast period.

-

By Product TypeDietary Supplements segment will grow the fastest during the forecast period.

-

By End UserHuman segment accounted for 93.2% market share in 2024.

-

By Distribution ChannelOnline segment will grow the fastest during the forecast period.

-

Competitive Landscape – Key PlayersKey players in the probiotics market include Novonesis, International Flavors & Fragrances (IFF), Kerry Group, Archer Daniels Midland (ADM), Danone, Nestlé, Yakult Honsha, and BioGaia.

-

Competitive Landscape – StartupsEmerging players in the probiotics market include Probi AB, Winclove Probiotics, UAS Laboratories, AB-Biotics, and Deerland Probiotics & Enzymes.

The global probiotics market is estimated to be valued at USD 76.59 billion in 2025 and is projected to reach USD 114.95 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. Growth is predicted in the probiotics Market, with increasingly less processed food and nutrition industries adopting advanced encapsulation technologies to improve the performance of ingredients, alongside enhancing product stability and shelf life. With action from the nanoencapsulation area, sensitive bioactives, such as vitamins, minerals, omega-3 fatty acids, probiotics, flavors, carotenoids, and polyphenols, would be shielded from heat, humidity, oxygen, and processing stress. With careful release, taste masking, enhanced bioavailability, and nanoencapsulation, this assures so pervasive food and sensory performance that the product can keep up with the developed and packaging industry sector, which includes functional food, fortified beverage, dietary supplement, infant nutrition, and sports nutrition products.

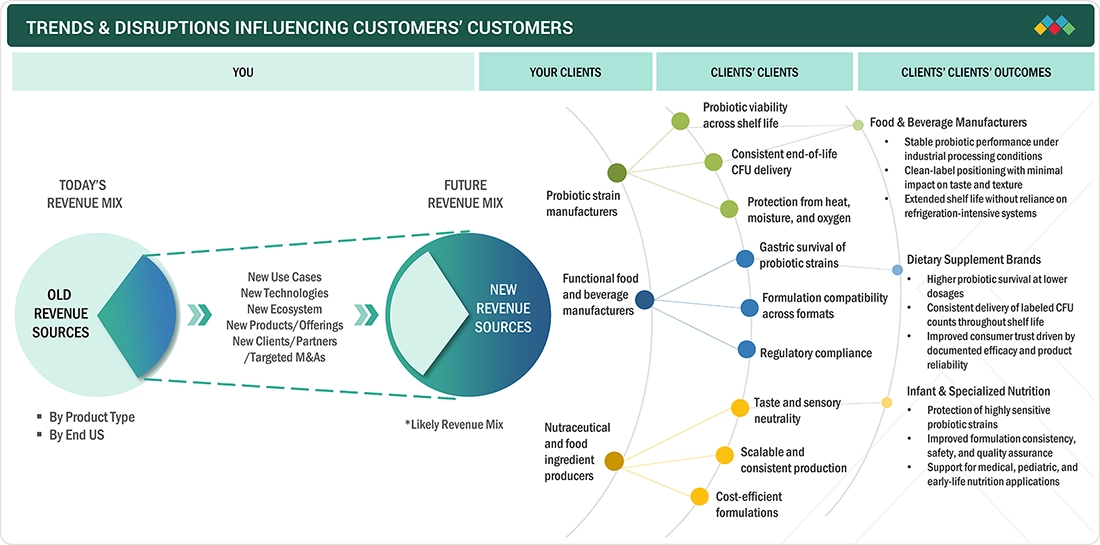

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The probiotics market is being shaped by a shift toward strain-specific, clinically substantiated products, as manufacturers move away from generic formulations to targeted solutions for digestive health, immunity, pediatrics, women’s health, and metabolic support. There is a clear trend toward non-dairy and shelf-stable formats, driven by lactose intolerance, plant-based diets, and the need for ambient storage. Advances in fermentation, stabilization, and encapsulation technologies are enabling wider application across supplements, beverages, and fortified foods, while e-commerce and direct-to-consumer models are accelerating product launches and consumer reach. Disruption in the market is primarily driven by regulatory tightening around health claims, increasing demand for scientific validation, and rapid innovation by specialized players. Companies lacking strain ownership, clinical data, or formulation capabilities face margin pressure and potential delisting in regulated markets. At the same time, digital health platforms, personalized nutrition, and microbiome testing are beginning to influence product development and consumer expectations. These factors are reshaping competitive dynamics, favoring players with strong R&D capabilities, regulatory expertise, and scalable production infrastructure, while accelerating consolidation across the probiotics value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for digestive health, immunity, and preventive nutrition

-

Integration of probiotics into daily-consumption foods and beverages

Level

-

Regulatory restrictions on probiotic health claims

-

Stability and viability issues across processing and storage

Level

-

Expansion of condition-specific and strain-specific probiotics

-

Growth of non-dairy and shelf-stable probiotic formats

Level

-

High cost of strain development and clinical validation

-

Maintaining viability across large-scale manufacturing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for digestive health and preventive nutrition

Demand for probiotics is being driven by increasing diagnosis of gastrointestinal disorders, higher antibiotic usage impacting gut microbiota, and growing acceptance of preventive nutrition across age groups. Probiotics are increasingly positioned as daily-consumption products through foods, beverages, and supplements, supporting repeat purchase behavior. Healthcare professionals are also recommending probiotics as adjuncts to antibiotic therapy and pediatric nutrition, strengthening demand in clinical and pharmacy-led channels.

Restraint: Regulatory restrictions on probiotic health claims

Probiotic commercialization is constrained by strict regulations governing health and functional claims, particularly in the US and Europe. Authorities require clear strain identification, stability throughout shelf life, and scientific substantiation for any claimed benefit. These requirements increase development timelines, limit on-pack communication, and create uncertainty for food-based probiotic launches, especially for small and mid-sized manufacturers operating across multiple regions.

Opportunity: Expansion of strain-specific and targeted probiotic products

Advances in microbiome science are enabling manufacturers to develop strain-specific probiotics targeted at defined health outcomes such as infant gut health, women’s health, immunity, and metabolic support. This shift supports premium pricing, differentiation, and stronger engagement with healthcare professionals. Targeted formulations also enable entry into medical nutrition and hospital channels, expanding the addressable market beyond traditional consumer wellness segments.

Challenge: High cost of strain development and clinical validation

Developing commercially viable probiotic strains requires significant investment in screening, fermentation optimization, stability testing, and human clinical studies. Scaling production while maintaining consistent viability and regulatory compliance adds further complexity. These factors increase entry barriers and favor established players with dedicated R&D infrastructure, regulatory expertise, and global manufacturing capabilities.

PROBIOTICS MARKET TRENDS, GROWTH, AND FORECAST [LATEST]: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development and large-scale fermentation of clinically documented probiotic strains for dietary supplements, functional foods, infant nutrition, and medical nutrition applications, with focus on strain stability and regulatory compliance | Ensures consistent strain performance, improves shelf-life stability, supports regulatory acceptance, and enables scalable supply across multiple end-use segments |

|

Production of probiotic ingredients and formulation support for supplements and functional foods, including stability optimization and application-specific blends | Improves probiotic viability during processing and storage, supports targeted formulations, and enables integration into diverse food and supplement matrices |

|

Delivery systems and formulation technologies for probiotics in supplements and functional beverages, designed to enhance survival through processing and digestion | Enhances gastrointestinal survival, supports controlled release, and maintains probiotic efficacy throughout product shelf life |

|

Application-focused probiotic solutions for functional foods, beverages, and nutrition products, including multi-strain blends and stability-enhancing technologies | Enables incorporation of probiotics into everyday foods, improves taste and formulation compatibility, and supports clean-label positioning |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The probiotics market ecosystem functions through an integrated flow connecting ingredient innovation, product manufacturing, regulation, and distribution. At the upstream level, ingredient and technology providers develop probiotic strains, fermentation processes, and stabilization solutions that ensure viability, safety, and consistency. Their role includes strain discovery, scale-up fermentation, drying or coating technologies, and technical support to enable use across food, supplement, and clinical applications. Food and functional nutrition manufacturers sit at the core of the ecosystem, converting probiotic ingredients into finished products such as fermented foods, beverages, dietary supplements, infant nutrition, and medical nutrition. This stage involves formulation design, dosage optimization, shelf-life validation, sensory compatibility, and compliance with market-specific requirements. Product portfolios are shaped by consumer health needs, application feasibility, and channel strategy. Regulatory and standards authorities define the framework within which probiotics are commercialized. They govern strain approval, safety assessments, labeling norms, and permissible claims. Regulatory compliance directly impacts product positioning, launch timelines, and cross-border scalability. Downstream, distribution and end-use channels—including ingredient distributors, retail chains, pharmacies, direct-selling networks, and online platforms—connect products to end consumers. Market feedback from sales performance, healthcare recommendations, and consumer adoption flows back into portfolio optimization, creating a continuous improvement loop across the ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

probiotics Market, By Product Type

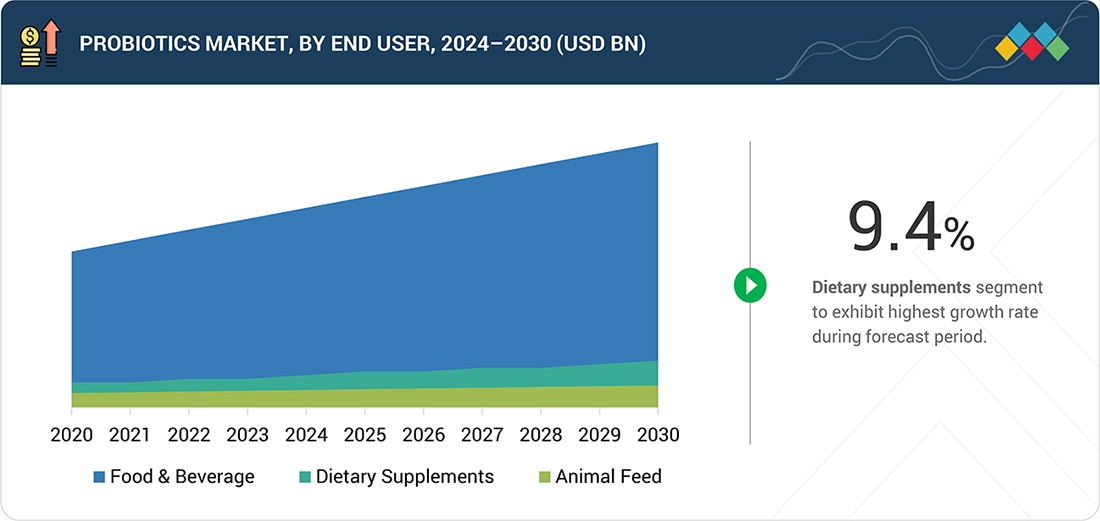

By product type, food and beverages represent the largest share of the probiotics market, supported by high consumption frequency and integration into everyday diets. Probiotic dairy products, fermented milk drinks, yogurts, and increasingly non-dairy beverages enable routine intake, which drives higher volume sales compared to episodic supplement use. Consumers perceive probiotic foods as natural and preventive, lowering adoption barriers across age groups, including children and elderly populations. Established cold-chain infrastructure, brand familiarity, and wide retail availability have further supported large-scale commercialization of probiotic foods. Dietary supplements constitute a fast-growing subsegment, particularly capsules, powders, and sachets, due to targeted health positioning and dosage convenience. However, supplements typically generate higher value per unit but lower volume compared to food-based formats. Feed-grade probiotics represent a smaller but structurally important segment, driven by livestock gut health management and reduced reliance on antibiotic growth promoters. Overall, food and beverages continue to dominate due to repeat purchase behavior, broader consumer reach, and ease of integration into daily nutrition. Continuous innovation in flavors, formats, and non-dairy matrices is further expanding the product type segment’s contribution to overall market growth.

probiotics Market, By End User

The human end-user segment dominates the probiotics market, accounting for the majority of consumption and value generation. Demand is driven by widespread use of probiotics in dietary supplements, functional foods, infant nutrition, and medical nutrition products targeting digestive health, immunity, and overall wellness. Rising healthcare awareness, increasing gastrointestinal issues, and growing use of probiotics as adjuncts to antibiotic therapy are reinforcing adoption across multiple age groups. Human probiotics benefit from strong distribution infrastructure, including pharmacies, supermarkets, specialty health stores, and online platforms. This segment also supports higher product differentiation through strain-specific formulations, clinical substantiation, and targeted health claims, enabling premium pricing and brand loyalty. Infant and pediatric applications remain particularly significant due to strong involvement of healthcare professionals and caregivers in purchase decisions. The animal end-user segment, while growing, remains smaller in value terms and is primarily driven by feed efficiency, gut health, and disease prevention in livestock and aquaculture. Although regulatory pressure to reduce antibiotic usage supports long-term adoption, animal probiotics are more price-sensitive and volume-driven. As a result, human consumption continues to anchor investment priorities and innovation activity within the probiotics market.

probiotics Market, By Ingredient

The ingredient segment of the probiotics market is dominated by bacterial probiotics, particularly strains belonging to Lactobacillus and Bifidobacterium. These bacteria account for the majority of commercial applications due to their established safety profiles, extensive clinical documentation, and broad regulatory acceptance. Their proven efficacy in digestive health, immune support, and pediatric nutrition has made them the preferred choice for food, supplement, and medical nutrition manufacturers. Bacterial probiotics benefit from mature fermentation technologies, scalable production processes, and compatibility with multiple delivery formats, including capsules, sachets, dairy products, and beverages. Advances in stabilization, freeze-drying, and protective coating techniques have further improved their viability during processing and storage, supporting expansion into shelf-stable products. Yeast-based probiotics, such as Saccharomyces boulardii, represent a smaller but specialized segment. These ingredients are mainly used in clinical and therapeutic applications due to their resistance to antibiotics and gastric conditions. However, their narrower application scope and higher formulation complexity limit widespread use. As a result, bacterial probiotics continue to dominate the ingredient segment, supported by manufacturing scalability, scientific validation, and broad end-use applicability.

probiotics Market, By Distribution Channel

Hypermarkets and supermarkets account for the largest share of probiotic product distribution, driven by their role as primary retail outlets for food, beverages, and daily health products. Probiotic foods and drinks benefit significantly from shelf placement in dairy and beverage aisles, where high footfall and impulse purchasing support volume sales. Centralized procurement and nationwide distribution networks allow manufacturers to scale rapidly through this channel. Pharmacies and drugstores represent a key channel for probiotic supplements and pediatric formulations, where professional recommendation influences purchasing decisions. These outlets support higher-value products and reinforce credibility, particularly for clinically positioned probiotics. Specialty health stores cater to premium and niche formulations, while online channels are gaining momentum due to convenience, subscription models, and access to detailed product information. Despite rapid growth in e-commerce, supermarkets remain dominant due to frequent shopping cycles, cold-chain availability, and consumer trust in established food retailers. The coexistence of mass retail for volume growth and pharmacy/online channels for value growth continues to define the distribution landscape of the probiotics market.

REGION

Asia Pacific is the largest and fastest-growing region probiotics market

Asia Pacific leads the probiotics market, supported by long-standing consumption habits, high awareness of gut health, and strong participation from regional and multinational companies. Japan remains a foundational market, led by Yakult Honsha Co., Ltd., which has continued to expand localized production and distribution across Southeast Asia through the 2020s. In China, multinational players such as Danone S.A. expanded specialized nutrition and fermented dairy capacity between 2021 and 2023 to address rising demand for digestive and pediatric nutrition. India has emerged as a high-growth market, with Nestlé S.A. strengthening its probiotic dairy and nutrition portfolio through product launches and localized sourcing initiatives since 2022. Regional ingredient suppliers and domestic brands are also increasing investments in fermentation capacity and formulation capabilities. These developments, combined with rising urbanization and modern retail expansion, continue to position Asia Pacific as the central growth engine of the global probiotics market.

PROBIOTICS MARKET TRENDS, GROWTH, AND FORECAST [LATEST]: COMPANY EVALUATION MATRIX

The market quadrant analysis of the probiotics market highlights clear differentiation among players based on product footprint and market reach. Companies positioned in the Stars quadrant demonstrate strong global presence combined with broad and well-established probiotic portfolios. These players benefit from high brand recognition, extensive distribution networks, and consistent demand driven by routine consumption patterns. Their positioning reflects sustained investment in product expansion, geographic scale, and consumer engagement, enabling them to maintain leadership across multiple regions and applications. The Emerging Leaders quadrant captures companies that show strong growth momentum and expanding probiotic offerings but with comparatively narrower global penetration. These players are actively strengthening their portfolios through innovation, regional expansion, and targeted positioning in functional foods and nutrition segments. The Pervasive Players category includes companies with wide geographic presence but relatively limited product breadth, often focusing on select formats or regions. Meanwhile, Participants represent companies with localized operations or narrower portfolios, typically addressing specific consumer segments or regional markets. Overall, the quadrant illustrates a market where scale, portfolio depth, and consumption frequency are key determinants of competitive positioning, with clear pathways for upward movement through portfolio diversification and geographic expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Novonesis A/S (Denmark)

- Yakult Honsha Co., Ltd. (Japan)

- Danone S.A. (France)

- Nestlé S.A. (Switzerland)

- BioGaia AB (Sweden)

- Probi AB (Sweden)

- Archer Daniels Midland Company – ADM (US)

- International Flavors & Fragrances – IFF (US)

- Kerry Group plc (Ireland)

- Lallemand Inc. (Canada)

- Morinaga Milk Industry Co., Ltd. (Japan)

- Meiji Holdings Co., Ltd. (Japan)

- Lifeway Foods, Inc. (US)

- UAS Laboratories LLC (US)

- Reckitt Benckiser Group plc (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 71.18 BN |

| Market Forecast in 2030 (Value) | USD 114.95 BN |

| CAGR | 8.50% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN), Volume (Kilo Tons) |

| Fastest-growing Region | Asia Pacific |

| Segments Covered |

|

| Region Covered | North America, Europe, Asia Pacific, South America, RoW |

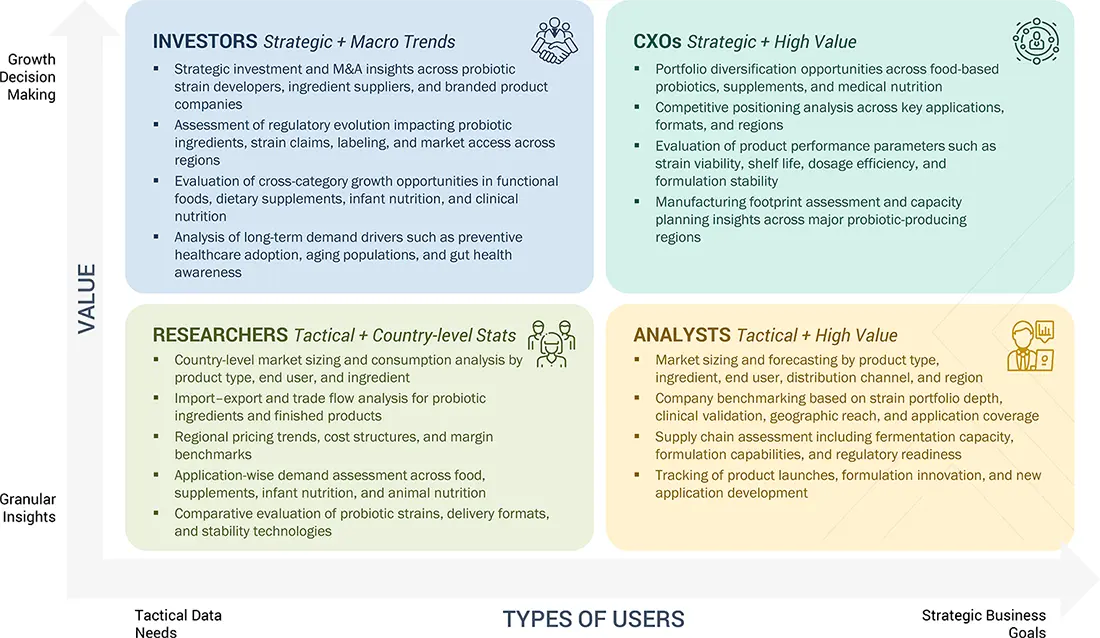

WHAT IS IN IT FOR YOU: PROBIOTICS MARKET TRENDS, GROWTH, AND FORECAST [LATEST] REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Probiotics Market |

|

|

| Functional & Probiotic Foods Market |

|

|

| Dietary Supplements Probiotics Market |

|

|

| Infant & Clinical Nutrition Probiotics Market |

|

|

RECENT DEVELOPMENTS

- March 2025 : Lallemand Health Solutions launched Cerenity™, a clinically studied probiotic blend targeting the gut-muscle axis to support mobility, strength, and quality of life in healthy aging.?

- April 2025 : Lallemand launched the Innov’Biome challenge seeking new probiotic strains, postbiotics, and microbiome applications for human health impacts through May 2025.?

- June 2025 : Danone acquired The Akkermansia Company to bolster its gut health portfolio with the pasteurized Akkermansia muciniphila MucT strain, targeting obesity, diabetes, and inflammation management.?

- October 2025 : PharmExtracta unveiled Colipral® capsules with E. coli 5C (ECP24®) strain for ulcerative colitis remission, prostatitis prevention, and post-colonoscopy balance, plus Brevicillin® Drops using Bifidobacterium breve PRL2020 for antibiotic-resistant child probiotics at CPHI 2025.?

- November 2025 : Probi expanded its probiotic offering with Sports & Active Nutrition by Probi (L. plantarum 299V for human performance), Pets by Probi (LP6595 and S. salivarius for pet digestive/oral health), and Bimuno GOS combined with Probi Defendum/Digestis for synbiotics in digestive and immune support.?

Table of Contents

Methodology

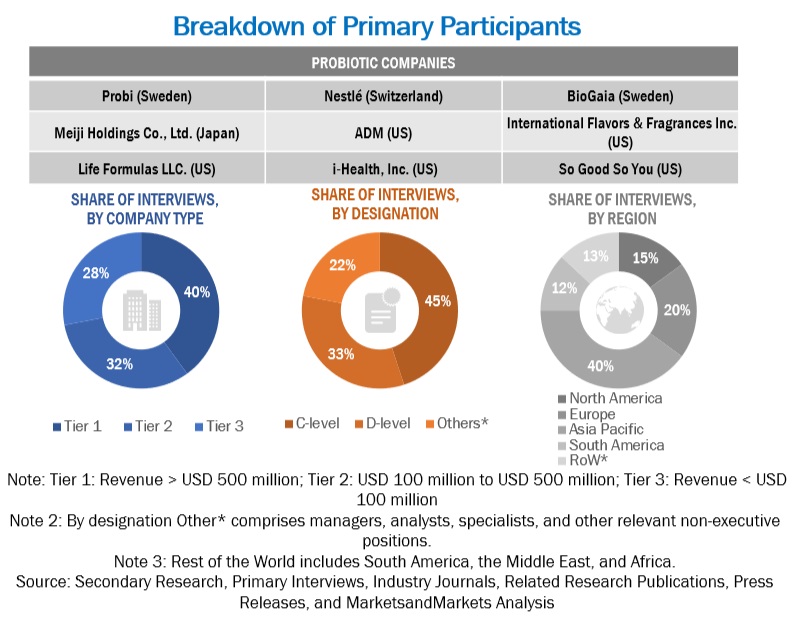

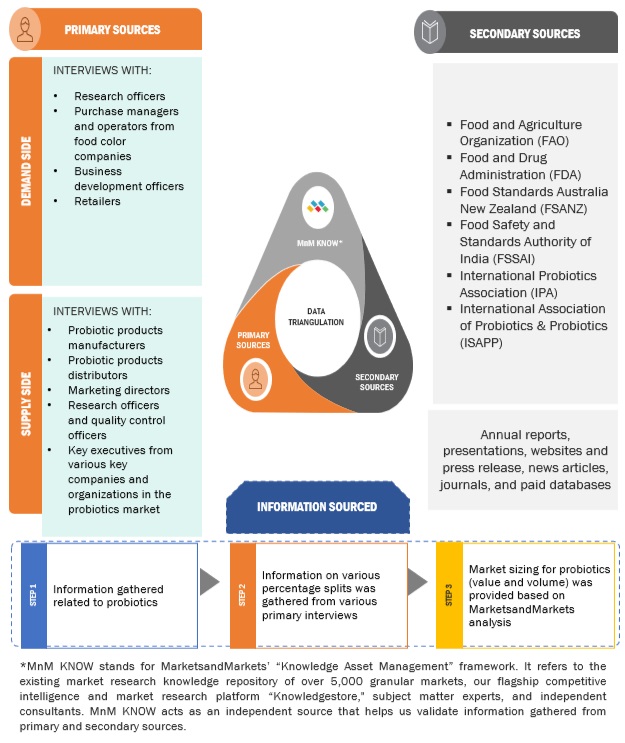

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the global Probiotics market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The global Probiotics market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Probiotics. On the demand side, key opinion leaders, executives, and CEOs of companies in the Probiotics industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Probiotics market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

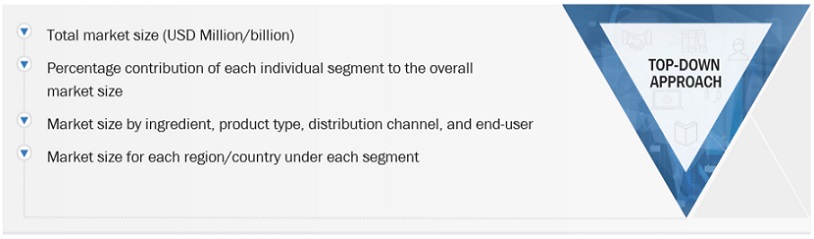

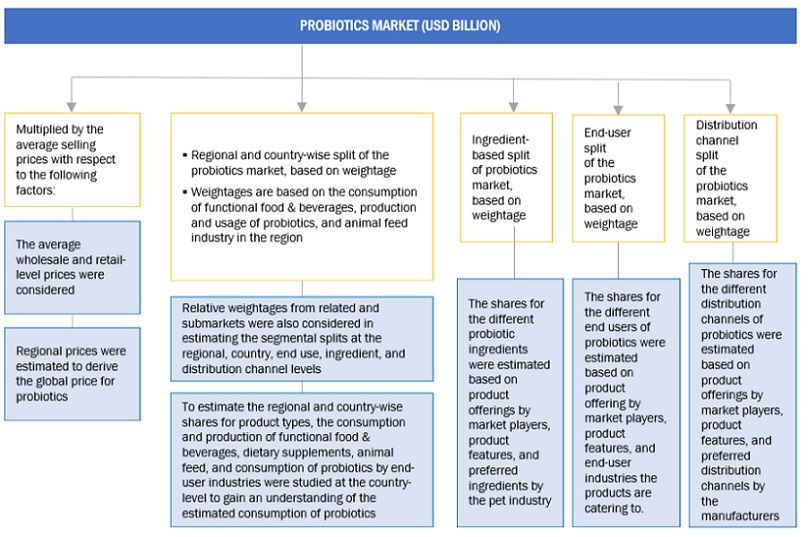

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Probiotics Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Probiotics Market: Data Triangluation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The joint Food and Agriculture Organization (FAO)/World Health Organization (WHO) working group defines probiotics as “live micro-organisms, which when administered in adequate amounts confer a health benefit on the host” (FAO/ WHO, 2001).

Probiotics are living microorganisms that have been shown to provide specific health benefits to consumers. They are known to support gut health and help in running the digestive system smoothly. Yogurt is one of the prime natural sources of probiotics.

According to the National Center for Complementary and Integrative Health, “Probiotics are live microorganisms that are intended to have health benefits when consumed or applied to the body.” The major function of probiotics is to maintain a healthy balance in the body. Several types of microorganisms are present in probiotics, and they may have different effects on the body. The most common bacteria belong to the group called Lactobacillus and Bifidobacterium.

Key Stakeholders

- Manufacturers, Importers and Exporters, Traders, Distributors, and Suppliers of Probiotics

- Nutraceutical Manufacturers

- Food Processors and Manufacturers

- Government and Research Organizations

- Trade Associations and Industry Bodies

-

Regulatory bodies and associations are as follows:

- Food Agriculture Organization (FAO)

- World Health Organization (WHO)

- International Dairy Federation (IDF)

- European Food & Feed Cultures Association (EFFCA)

- National Yogurt Association (NYA)

- International Scientific Association for Probiotics and Prebiotics (ISAPP)

- International Probiotics Association (IPA)

- Council for Responsible Nutrition (CRN)

- National Yogurt Association (NYA)

- International Frozen Yogurt Association (IFYA)

- American Nutrition Association (ANA)

Report Objectives

- To define, segment, and project the global market for Probiotics on the basis of product type, ingredient, distribution channel, end user, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the Probiotics market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Probiotics market, by key country

- Further breakdown of the Rest of the Asia Pacific Probiotics market, by key country

- Further breakdown of the Rest of South America Probiotics market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Probiotics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Probiotics Market