Artificial Intelligence in Manufacturing Market Size, Share & Industry Growth Analysis Report by Offering (Hardware, Software, Services), Technology (Machine Learning, Natural Language Processing), Application (Predictive Maintenance & Machinery Inspection, Cybersecurity) - Global Forecast to 2028

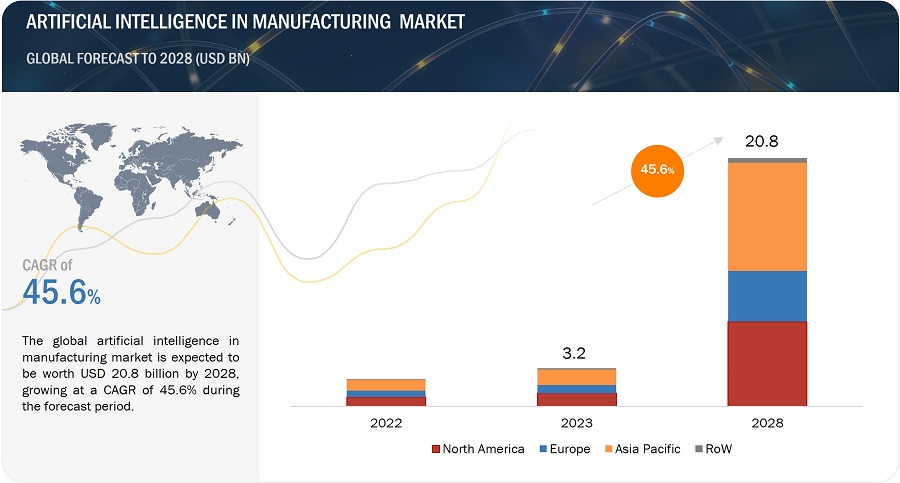

The artificial intelligence in the manufacturing market is estimated to reach USD 20.8 billion by 2028 from 3.2 billion in 2023. The market is expected to grow at a CAGR of 45.6% between 2023 to 2028. Manufacturing is an evolving industry that is continuously developing in terms of the introduction of new technology. Recently, generative artificial intelligence (AI) has been introduced, and this AI has already started impacting industries such as finance, healthcare, and others. Still, it has also begun impacting the manufacturing ecosystem significantly. Most manufacturing companies are trying to explore Generative AI on their production shop floor, and some are also implementing generative AI on a pilot project basis. It has been observed that, as the technology improves, there can be a significant use case for the production shop floor. Still, there are a few typical use cases, such as design & innovation, quality control, predictive maintenance, and optimization. These use cases will revolutionize the manufacturing industry. Factors contributing to the growth of artificial intelligence in the manufacturing ecosystem include the demand to complete the manufacturing activity more digitally. In this ecosystem, Eaton, Bosch, ABB, and Siemens have already started using AI at various levels in their production facilities. . In contrast, a shortage of skilled labor and data security are hindering the growth of AI in the manufacturing market.

Artificial Intelligence in Manufacturing Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Artificial Intelligence in Manufacturing Trends

Driver: Rising need to handle increasingly large and complex dataset

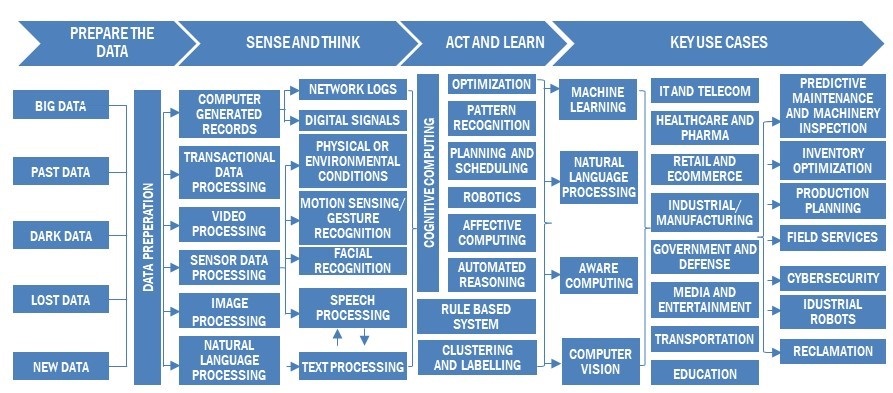

Digitization in the manufacturing industry has increased the capacity to access, analyze, and manage vast volumes of data while rapidly developing the information architecture in the factory. The data obtained from traditional enterprises and supply chains via sensors play a critical role in the successful operation of a manufacturing plant. A strongly coupled digitized system in the manufacturing industry improves the overall quality and reduces costs by improving defect tracking and forecasting abilities. In this process, data is collected from various sensors installed in the plant.

The data is further processed through big data solutions, which analyze and suggest different mechanisms to improve manufacturing efficiency. AI-based systems aid in various actionable solutions, such as predictive maintenance, production planning, field service, and material movement, which are derived from big data technology. Siemens (Germany) uses big data in AI-based smart boxes that are integrated with sensors and a communications interface for data transfer. By analyzing the data, the AI systems can draw conclusions on the machine’s condition and detect irregularities to provide predictive maintenance. These systems also improve the reliability of power grids by making them smarter and providing the devices that control and monitor electrical networks with AI. This enables devices to classify and localize disruptions in the grid.

The increasing demand for Artificial Intelligence (AI) in the Manufacturing Market of the US region is propelled by the imperative to effectively manage the growing volume and intricacy of data. This trend is accentuated by the integration of advanced manufacturing technologies, the adoption of Industry 4.0 principles, and the evolution towards smart factories. The interconnected nature of IoT devices and automated machinery in these environments results in a substantial influx of data, necessitating AI solutions to process and derive actionable insights.

The applications of AI span predictive maintenance, quality control, customization, and supply chain optimization, all of which involve analyzing large and complex datasets. AI's continuous learning capabilities further contribute to ongoing process improvements, while ensuring regulatory compliance and facilitating efficient reporting. In essence, the rising need to handle extensive datasets underscores AI's pivotal role in enhancing efficiency, innovation, and competitiveness in the dynamic landscape of manufacturing in the US.

Restraint: Reluctance among manufacturers to adopt AI-based technologies

AI technologies provide manufacturers with valuable tools to enhance predictive maintenance and machinery inspection processes. Nonetheless, manufacturers exhibit hesitance when it comes to embracing new technologies, especially AI-based solutions, for their expensive machinery and equipment due to the potential risks of mismanagement leading to increased costs. Furthermore, many manufacturers are doubtful about the capabilities of AI-based solutions in terms of the accuracy of the maintenance and inspection processes. Given these circumstances, it can be somewhat challenging to persuade manufacturers and help them grasp the cost-effectiveness, effectiveness, and safety of AI-based solutions. However, manufacturers are now increasingly accepting the potential benefits of AI-based solutions and the spectrum of applications they serve.

Moreover, the lack of adoption among small and medium-sized businesses (SMB) and slow return on investments are further waning the adoption of AI systems, especially among technologically advancing countries such as India and Brazil The substantial deployment expenses associated with AI systems and a lack of widespread awareness contribute to skepticism about this technology within the manufacturing sector. Moreover, the absence of robust domestic infrastructure and relatively lower focus and investment in AI technology and infrastructure are additional factors constraining the adoption of AI among small and medium-sized businesses (SMBs).

Opportunity: Application of AI-driven machine learning and NLP for intelligent enterprise processes

A significant portion of organizational business processes is presently controlled by inflexible, rule-based software, which has limited capabilities when it comes to addressing crucial issues. These processes are often time-consuming and demand employees to engage in repetitive tasks, thereby impeding both employee productivity and the overall organizational performance. Machine Learning and Natural Language Processing tools generated on AI platforms can help enterprises overcome such challenges with self-learning algorithms, which can reveal new patterns and solutions.

Most organizations use enterprise software, which uses rule-based processing to automate business processes. This task-based automation has helped organizations in improving their productivity in a few specific processes, but such rule-based software cannot self-learn and improve with experience. Incorporating AI tools like NLP and ML into enterprise software systems enhances their capacity to continuously improve while addressing specific processes. This software can offer ongoing enhancements in performance and productivity to enterprises, rather than delivering just a one-time boost. These factors are seen as driving the demand for intelligent business processes and represent growth opportunities within the AI in manufacturing market.

Challenges: Lack of skilled workforce, especially in developing countries

To create, oversee, and put into practice complex AI systems, businesses necessitate a workforce equipped with specific skill sets. Individuals tasked with handling AI systems should possess knowledge in technologies like cognitive computing, machine learning, artificial intelligence, deep learning, and image recognition. In emerging economies, the shortage of a qualified workforce presents a noteworthy hurdle, especially when juxtaposed with AI-advanced nations like the United States, the United Kingdom, Japan, and Germany. A move toward an AI-enabled factory floor would require manufacturers to reskill their existing workforce and develop, build, and train AI systems. In addition, the integration of AI solutions into existing systems is a difficult task, requiring extensive data processing for replicating a human brain's behavior. Even a minor error can result in system failure or adversely affect the desired result. Furthermore, the absence of professional standards and certifications in AI/ML technologies is restraining the growth of AI. Additionally, AI service providers are facing challenges with regard to deploying/servicing their solutions at their customers’ sites. This is because of the lack of technology awareness and expertise.

Concerns regarding data privacy and cybersecurity regulations

Manufacturing processes generate substantial amounts of proprietary and confidential information, and the integration of AI introduces new security risks such as unauthorized access, data breaches, and intellectual property theft. Compliance with data privacy regulations, both domestic and international, adds complexity, requiring manufacturers to navigate a regulatory landscape that includes GDPR and industry-specific guidelines. Cross-border data transfers and ethical considerations related to transparency and accountability further complicate AI implementations. Manufacturers must prioritize secure connectivity, address data ownership agreements, and enhance employee training to fortify their cybersecurity measures. Ensuring the integration of AI systems with existing security protocols and developing robust incident response plans are essential components in managing this multifaceted challenge and fostering responsible AI adoption in the US manufacturing sector.

Market Ecosystem

Artificial Intelligence in Manufacturing Market: Key Trends

Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric are the top players in the artificial intelligence in manufacturing market. These artificial intelligence in manufacturing companies with advance robotics and AI technology trends with a comprehensive product portfolio and solid geographic footprint.

Software segment accounted for the largest share of artificial intelligence in manufacturing market in 2022

The artificial intelligence in manufacturing market based on offering has been segmented into hardware, software, and services. The market for the software segment has been sub-segmented into AI platforms and AI solutions. Software segment accounted for the largest share of artificial intelligence in manufacturing market in 2022. AI software are capable of performing intelligent functions. The development of intelligent software involves imitating several capabilities, including reasoning, learning, problem-solving, perception, and knowledge representation. The growing adoption of AI solutions and platforms in various industries and the widening application scope of AI in the manufacturing sector are the prime factors driving the growth of the artificial intelligence in manufacturing market for the software segment.

Predictive maintenance & machinery inspection application to account for the largest share in the market during forecast period.

AI technology in predictive maintenance and machinery inspection is used in regular examination, inspection, lubrication, testing, and making equipment adjustments. The Predictive maintenance is a data-driven approach utilizing artificial intelligence to predict when equipment or machinery will fail.

This prevents breakdowns by allowing maintenance to be performed just in time. AI algorithms, such as machine learning and deep learning models, analyze historical data to identify breakdown patterns and trends. By making predictions about equipment failures and performance degradation, these models can help prevent future issues.

Metals & heavy machinery industry to grow at a highest CAGR during the forecast period.

Metals & heavy machinery comprise the production of different machinery used in construction, infrastructure development, and manufacturing applications. Implementing AI in the metals & heavy machinery industry can help manufacturers analyze machine conditions in advance to avoid unplanned downtime and wastage. Also, AI solutions exhibit predictive maintenance capabilities that help the industry players save time and cost. Field services also play a major role in this industry. Field services are used to collect and sense different data such as heat, sound, light, odor, and eddy current. The collected data is sent to operators to analyze and take action according to the situation in the plant.

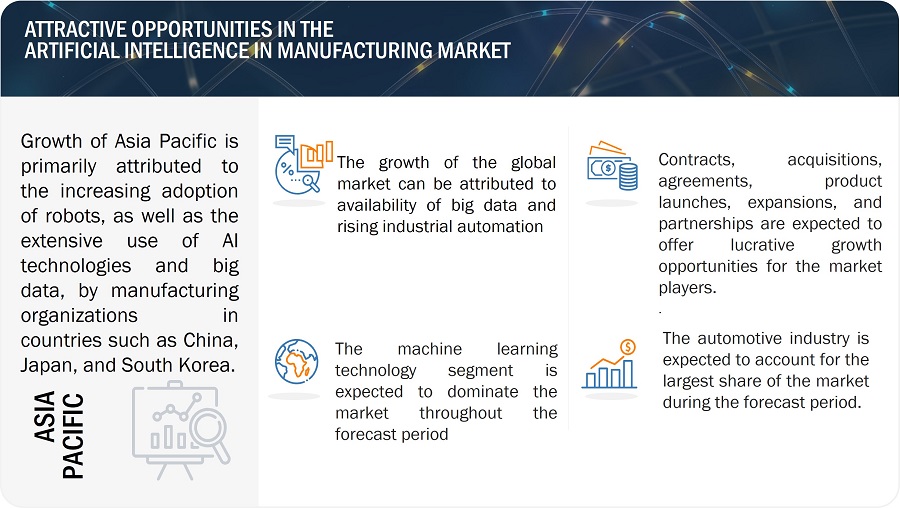

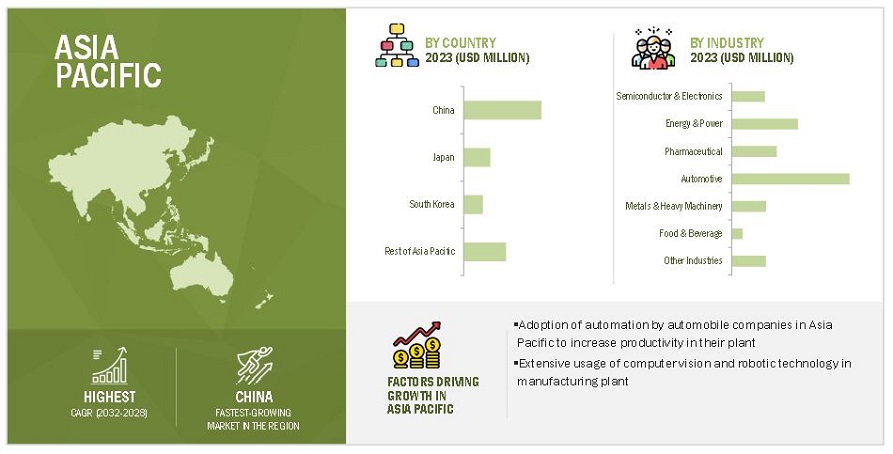

Asia Pacific region to grow at a highest CAGR during the forecast period.

This market in Asia Pacific is further divided into China, Japan, South Korea, and Rest of Asia Pacific. the Asia Pacific, led by China, Japan, and South Korea, is considered the largest market for industrial robots. Industrial robots generate a huge amount of data. This data is used in deep learning algorithms to further train the robots. Rapid industrialization in Asia Pacific has boosted the manufacturing sector. Furthermore, Many small and mid-sized enterprises (SMEs) are present in the countries in Asia Pacific considered in this study.

AI implementation can make robots smarter, reduce the downtime of machines, and increase productivity. Such high adoption rate of industrial robots in manufacturing plants is expected to drive the growth of the artificial intelligence in manufacturing market in Asia Pacific.

Artificial Intelligence in Manufacturing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Artificial Intelligence in Manufacturing Companies - Key Market Players:

The major companies in the artificial intelligence in manufacturing companies are Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric, Microsoft Corporation, Google, Amazon Web Services are among others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the artificial intelligence in manufacturing market.

Artificial Intelligence in Manufacturing Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.2 billion in 2023 |

| Projected Market Size | USD 20.8 billion by 2028 |

| Growth Rate | CAGR of 45.6% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Offering, Technology, Application, Industry, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

NVIDIA Corporation (US), IBM (US), Intel Corporation (US), Siemens (Germany), General Electric (US). |

Artificial Intelligence in Manufacturing Market Highlights

In this report, the overall artificial intelligence in manufacturing market has been segmented based on Offering, Technology, Application, Industry, and Region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology |

|

|

By Application |

|

|

BY Industry |

|

|

By Region |

|

Recent Developments in Artificial Intelligence in Manufacturing Industry

- In August 2023, NVIDIA Corporation announced NVIDIA OVX Servers featuring the new NVIDIA® L40S GPU, a powerful, universal data center processor designed to accelerate the most compute-intensive, complex applications, including AI training and inference, 3D design and visualization, video processing and industrial digitalization with the NVIDIA Omniverse platform.

- In January 2023, Intel Corporation Launched 4th Gen Xeon Scalable Processors, Max Series CPUs and GPUs. These processors are Intel’s most sustainable data center processors, delivering a range of features for optimizing power and performance, making optimal use of CPU resources to help achieve customers’ sustainability goals.

- In november 2022, IBM announced new software designed to help enterprises break down data and analytics silos so they can make data-driven decisions quickly and navigate unpredictable disruptions. IBM Business Analytics Enterprise is a suite of business intelligence planning, budgeting, reporting, forecasting, and dashboard capabilities that provides users with a robust view of data sources across their entire business.

Frequently Asked Questions:

What will be the global artificial intelligence in manufacturing market size in 2023?

The artificial intelligence in manufacturing market is expected to be valued USD 3.2 billion in 2023.

Who are the global artificial intelligence in manufacturing market winners?

Companies such as Siemens, IBM, Intel Corporation, NVIDIA Corporation, and General Electric fall under the winners’ category.

Which region is expected to hold the highest global artificial intelligence in manufacturing market share?

Asia Pacific will dominate the global artificial intelligence in manufacturing market in 2023.

What are the major drivers of the artificial intelligence in manufacturing market?

Rising need to handle increasingly large and complex dataset and emerging industrial IoT and automation technology.

What are the major strategies adopted by artificial intelligence in manufacturing companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

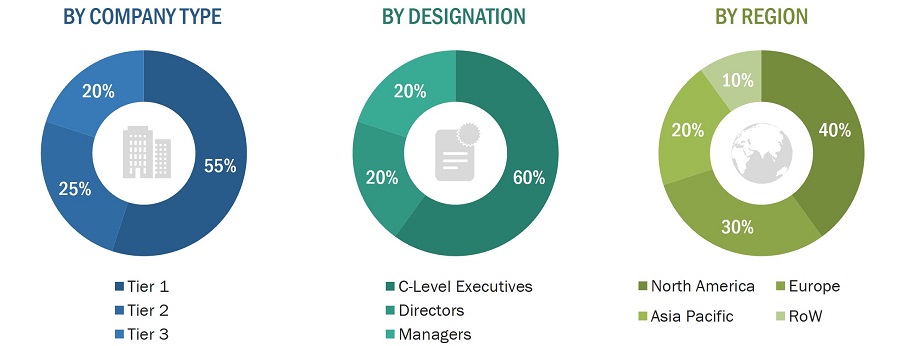

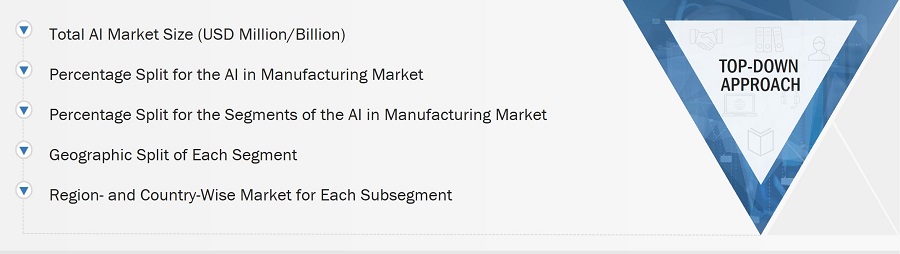

The study involves four major activities that estimate the size of the artificial intelligence in manufacturing market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the artificial intelligence in manufacturing market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply-side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from artificial intelligence in manufacturing providers, (such as Siemens, NVIDIA Corporation, IBM, Intel Corporation, General Electric) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

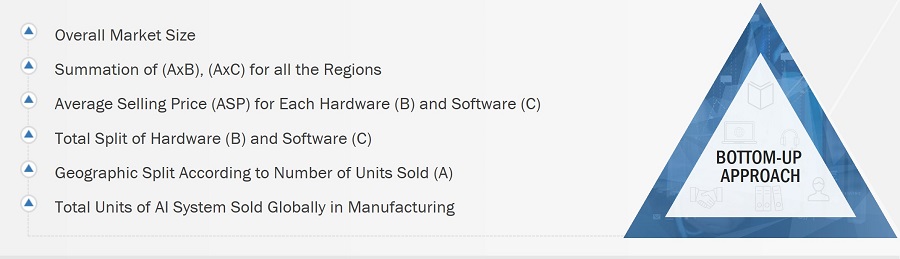

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the artificial intelligence in manufacturing market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Market Size Estimation Methodology-Bottom-up approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Artificial intelligence (AI) in manufacturing is defined as the replication of human intelligence used to communicate with machines, extract data from fields, analyze the extracted data, and perform required tasks. Tasks ranging from material movement to machinery inspection and self-diagnostics, which are usually performed by human labor or robots with the help of human intelligence, can be performed by AI-based systems in less time, at lower cost, and without human intervention.

Stakeholders

- Semiconductor companies

- Technology providers

- Universities and research organizations

- System integrators

- AI solution providers

- AI platform providers

- Cloud service providers

- AI system providers

- AI service providers

- Energy and power companies

- Automobile companies

- Aircraft companies

- Textile companies

- Heavy metal companies

- Food and beverage companies

- Packaging companies

- Pharmaceutical companies

- Manufacturing consulting companies

- Investors and venture capitalists

- Manufacturers implementing AI technology

- Government bodies, venture capitalists, and private equity firms

The main objectives of this study are as follows:

- To define, describe and forecast the artificial intelligence (AI) in manufacturing market, in terms of value, based on offering, technology, application, and industry

- To describe and forecast the artificial intelligence in manufacturing market, in terms of value, based on region—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the probable impact of the recession on the market in the future

- To study the complete value chain of the artificial intelligence in manufacturing ecosystem, along with market trends and use cases

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product launches, and research and development (R&D) in the Artificial Intelligence in manufacturing market

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence in Manufacturing Market

To understand potential of AI in manufacturing Industry.