Artificial Intelligence (AI) in Military Market Size, Share and Industry Growth Analysis Report by Offering (Software, Hardware, Services), Technology (Machine Learning, Natural Language Processing), Platform (Airborne, Land, Space), Application, Installation Type, and Region - Global Forecast to 2028

Update: 10/22/2024

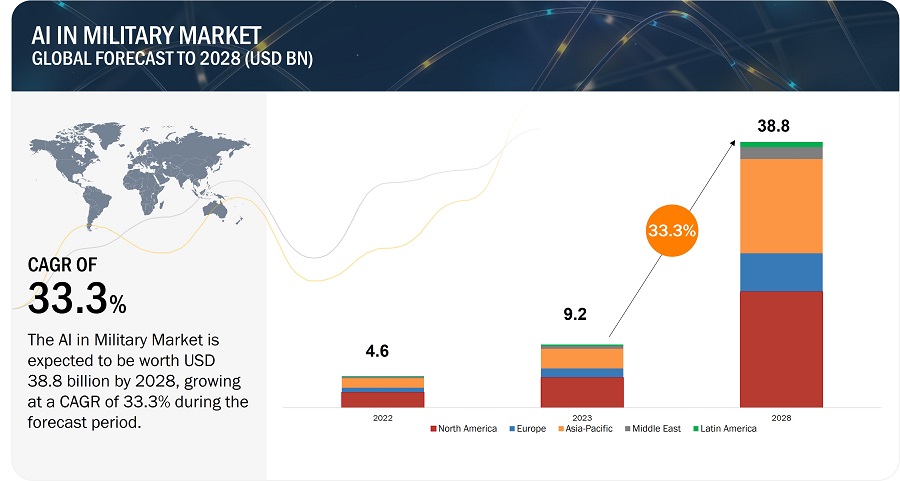

[285 Pages Report] The Artificial Intelligence (AI) in Military Market is estimated to be US$ 9.2 Billion in 2023 and is projected to reach US$ 38.8 Billion by 2028, at a Compound Annual Growth Rate (CAGR) of 33.3% from 2023 to 2028. The Artificial Intelligence (AI) in Military Industry is driven by factors such as rising focus on development of high-precision military laser systems.

Artificial Intelligence (AI) in Military Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Military Market Dynamics:

Drivers: Increase Investments in Development of AI-Enabled Solution to Strengthen Military Capabilities

The development of autonomous military systems drives the adoption of AI in the military market. The modern AI-enabled system helps to enhance the efficiency of military systems and strengthen their capabilities in Warfield. Therefore, the defense forces of leading countries have increased their defense spending to boost the deployment of AI on military platforms. According to a report by Stockholm International Peace Research Institute (SIPRI) in April 2023, the US, Russia, China, India, and Saudi Arabia collectively accounted for 63% of defense expenditure in 2022. Global military spending grew by 3.7% in 2022 and reached UD$ 2,240.0 billion. Nine major international conflicts have occurred in recent years, including the Russia-Ukraine war, the Saudi Arabia-Yemen conflict, the Syrian Civil War, US-Iran tensions, the India-China tensions, and Armenia-Azerbaijan border conflict. Such conflicts result in increased procurement of advanced AI-enabled weapon systems and the incorporation of newer technologies into existing systems to make them more efficient. In addition, in April 2021, eight European North Atlantic Treaty Organization (NATO) members met the 2021 alliance’s goal of allocating at least 2% of their GDP to armed forces. The following table indicates the defense expenditures of major countries during 2020-2022.

Restraints: Lack of Protocols and Standards for Use of AI in Military Applications

The development, management, and successful implementation of AI systems require certain protocols. Presently, since only a few countries are using AI in the military arena, there are very few standards and protocols for their use.

As most AI capabilities are being developed by private companies, there is a lack of co-operation between governments and companies in developing these technologies. This is because companies are reluctant to share their intellectual property with the government, as there are no standard regulations. They also face complexities in defense acquisition processes and the lengthy and complicated legal framework involved, and thus, many companies have refused to do business with the US Department of Defense (DoD). Such factors indicate the lack of proper standards and protocol for the use of AI in military applications, which poses a restraint to market growth.

Opportunities: Incorporation of Quantum Computing in AI

A quantum computer works on phenomena such as “superposition” and “entanglement.” Through these computational advantages, a quantum computer can outperform any modern classical computer. For instance, Google recently reported that it developed a quantum processor, “Sycamore,” that has demonstrated the ability to solve a complex mathematical problem in 200 seconds, while the same results will only be obtained in 10,000 years using the most advanced supercomputer available today.

This power of quantum computing can also be introduced in AI systems. This will supercharge the AI systems that now depend on binary-based classical computing and enhance their capabilities. For instance, AI can crunch through a larger data set and learn from it to give a better model and, thus, more accurate predictions. This can have various applications in the defense industry for security and privacy. Having the ability to process larger datasets, the information can be processed much quicker locally rather than depending on the cloud. For instance, data from all sensors attached in an autonomous Ai-powered tank can be processed quickly, and decisions can be made faster. Quantum computing will play a huge role in cybersecurity, as this will power up the systems for faster detection of threats and take necessary countermeasures. This presents significant opportunities for the AI in military market.

Challenges: Concerns Related to Data Privacy and Security

The integration of AI with warfare systems requires data that can be used for training and building reliable AI programs. This data is crucial to develop and enhance AI systems. However, governments are reluctant to share military data with private companies owing to its sensitive nature as it may jeopardize the security of critical mission-based information. Several AI-enabled autonomous systems require encrypted communication and data transfer links, and as data transmitted from these systems is vulnerable to cyber-attacks, governments are more reluctant. With the number of sophisticated cyberattacks on the rise, governments are even more skeptical about entrusting their sensitive data to AI-enabled systems.

This, in effect, creates a vicious cycle: one that prevents AI systems from developing due to the unavailability of data and digital security compromises due to subsequently untrained AI systems. Thus, concerns related to the sharing of sensitive military data are acting as a key challenge to the growth of the AI in military market.

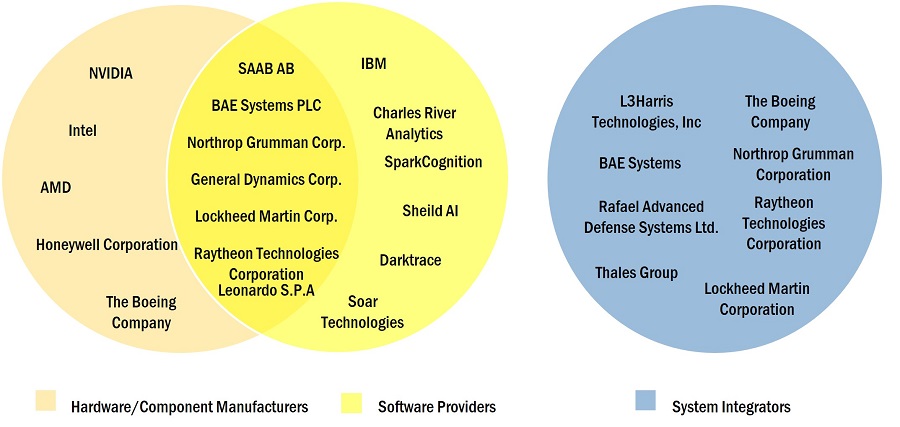

Ai In Military Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of AI solution for military purpose. Major players operating in the AI in military market include Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems plc (US), and Thales Group (France).

Based on the Offering, the Software Segment is Projected to Grow at the Highest CAGR in the AI in Military Market During the Forecast Period

Based on offering, the AI in military market has been segmented into hardware, software, and services. The hardware segment has been classified into processor, memory, and network. The growth of the software segment can be attributed to the significance of AI software in strengthening the IT framework to prevent incidents of a security breach. As data privacy policies and regulatory compliances have become stringent, the demand for cybersecurity solutions using AI is expected to increase in the near future. IBM is the leader in providing software powering AI.

Based on Application, the Information Processing Segment to Held Second Largest Share in the Base Year

Based on application, the market for artificial intelligence in the military has been segmented into warfare platforms, cybersecurity, logistics & transportation, surveillance & situational awareness, command & control, battlefield healthcare, simulation & training, information processing, threat/target monitoring and tracking, and others.

Among these the information processing segment to held second largest share in 2023. AI is used for the processing of a huge cache of data that provides valuable information. It helps in the culling and aggregation of information, which assists military personnel in recognizing patterns and derive correlations in data sets. AI acquires and sums supersets of information from various sources. The processed information is used for further investigation with machine learning or deep learning tools.

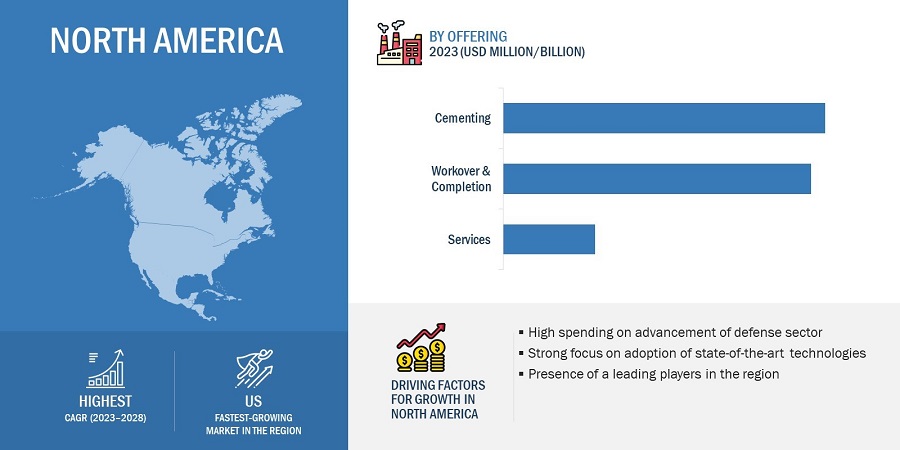

North America Hold Largst Share in 2023

The North America hold the largest share in 2023. This large share is due to the several factors such as, High spending on advancement of defense sector, strong focus on adoption of state-of-the-art technologies, and the presence of a leading players in the region.

Artificial Intelligence (AI) in Military Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Artificial Intelligence (AI) in Military Companies - Key Market Players

Major Artificial Intelligence (AI) in Military Companies include Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems plc (US), and Thales Group (France).

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

$ 9.2 Billion |

|

Projected Market Size |

$ 38.8 Billion |

|

Growth Rate |

33.3% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (US$ Million/Billion) |

|

Segments Covered |

Offering, Application, Technology, Platform, Installation Type, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Lockheed Martin Corporation (US), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), BAE Systems plc (US), and Thales Group (France). L3Harris Technologies Inc. (US), and Rheinmetall AG (Germany) |

Artificial Intelligence (AI) in Military Market Highlights

This research report categorizes the AI in military market based on offering, application, technology, platform, installation type, and region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Application: |

|

|

By Technology: |

|

|

By Platform: |

|

|

By Installation Type: |

|

|

By Region: |

|

Recent Developments

- In April 2023, Raytheon Technologies Corporation launched its new AI-assisted EO/IR system, RAIVEN. This solution allows military pilots to obtain faster and more accurate threat identification.

- In March 2023, Northrop Grumman Corporation, in partnership with Shield AI, has been selected by the U.S. Army for the Future Tactical Unmanned Aircraft System (FTUAS) competition, Increment 2. This competition aims to replace the RQ-7B Shadow tactical unmanned aerial system (UAS) with advanced capabilities.

- In January 2023, Lockheed Martin Corporation introduced its new AI model Aegis. This model is used to improve the operation efficiency of Agis Combat System. The AI enabled Agis combat system offers improved operator decision making, situational awareness, reduced reaction time, and the ability to defend against hypersonic threats. It also predictively determines when parts will need maintenance before they break.

- In July 2022, Raytheon Technologies has chosen the C3 AI Platform to deliver state-of-the-art artificial intelligence (AI) and machine learning (ML) capabilities, presenting a readily available solution for the U.S. Army's Tactical Intelligence Targeting Access Node (TITAN) program.

- In June 2022, Lockheed Martin Corporation introduced new AI/ML technology enable solution. First, a Cognitive Mission Manager, command and control suite of services designed to use AI/ML to deliver accurate, timely, and actionable intelligence to the ground commanders and operators. Second, Cognitive Tip & Cue product to find tanks on a battlefield. Third, AI/ML tools that offer Object Level and Pixel Level Change Detection using time series satellite imagery to deliver automated, rapid change detection. At last, TruthTrail, a prototype gamification application built off a gaming engine which presents a simulated environment that “rewards” labelers for their work.

Frequently Asked Questions (FAQ):

What is the Current Size of the Global AI in Military Market?

The AI in Military Market is projected to grow from US$ 9.2 Billion in 2023 to US$ 38.8 Billion by 2028; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 33.3% from 2023 to 2028.

Who Are the Winners in the Global AI in Military Market?

Companies such as Lockheed Martin Corporation, Raytheon Technologies Corporation, Northrop Grumman Corporation, BAE Systems plc, Thales Group. L3Harris Technologies Inc., and Rheinmetall AG

Which Region is Expected to Hold the Highest Market Share?

The North America hold the largest share in 2023. This large share is due to the several factors such as, High spending on advancement of defense sector, strong focus on adoption of state-of-the-art technologies, and the presence of a leading players in the region.

What Are the Major Drivers and Opportunities Related to the AI in Military Market?

Increase Investments in Development of AI-Enabled Solution to Strengthen Military Capabilities and Incorporation of Quantum Computing in AI are some of the major drivers and opportunities related to the AI in Military Market

What Are the Major Strategies Adopted by Market Players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the AI in Military Market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased investments in development of AI-enabled solutions to strengthen military capabilities- Development of high-end AI chips- Need for advanced surveillance systems and situational awareness- Surge in adoption of intelligent unmanned vehicles- Growing application of AI in cyber security and threat detectionRESTRAINTS- Lack of protocols and standards for use of AI in military applications- Ethical concerns related to deployment of lethal autonomous weapons- High costs associated with development and integration of AI-based systemsOPPORTUNITIES- Incorporation of quantum computing in AI- Increasing adoption of AI in predictive maintenance in military platformsCHALLENGES- Absence of backward analysis- Limited availability of skilled workforce and technical expertise- Concerns related to data privacy and security

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR AI IN MILITARY MANUFACTURERS

-

5.5 AI IN MILITARY MARKET ECOSYSTEM ANALYSIS/MAPPING

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST

- 5.8 TRADE ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN AI IN MILITARY MARKETQUANTUM MACHINE LEARNINGFASTER DATA TRANSFER WITH 5G NETWORKINGSWARM INTELLIGENCEINTERNET OF BATTLEFIELD THINGS (IOBT)ADVANCED ANALYTICSARTIFICIAL NEURAL NETWORK

- 6.3 TECHNOLOGY ROADMAP

-

6.4 USE CASE ANALYSISAI IN MILITARY DRONES FOR AUTONOMOUS SURVEILLANCE AND RECONNAISSANCEIMPROVED AUTONOMOUS MARITIME OPERATIONSDEPLOYMENT OF PICTORIAL TRAINING TOOL TO IMPROVE BATTLEFIELD FIRST-AID SKILLS FROM CHARLES RIVER ANALYTICSC3 AI READINESS: USE OF AI PREDICTIVE MAINTENANCE IN US AIR FORCEHAVE RAIDER: DEPLOYED TO DEMONSTRATE MANNED-UNMANNED TEAMING

- 6.5 TECHNOLOGY ANALYSIS

-

6.6 IMPACT OF MEGATRENDSAIOBT: DIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGS SYSTEMS WITH AI IN MILITARY MARKETNATURAL LANGUAGE PROCESSINGNEW GLOBAL ARMS RACEBIG DATA ANALYTICSBLOCKCHAIN

- 6.7 INNOVATIONS AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 HARDWAREPROCESSOR- Development of specialized chips to pave way for wider application of AI in militaryMEMORY- High-bandwidth parallel file systems to increase efficiency and throughput of memory devicesNETWORK- 5G network to improve connection capabilities

-

7.3 SOFTWAREAI SOLUTIONS- Increasing developing of AI solutions for military applicationsAI PLATFORMS- Demand for intelligent applications and learning algorithms on rise

-

7.4 SERVICESDEPLOYMENT & INTEGRATION- Used to create and deploy custom text analyticsUPGRADES & MAINTENANCE- Use of predictive maintenance tools to boost marketSOFTWARE SUPPORT- Periodic upgrades to improve capabilities to drive software support segmentOTHERS

- 8.1 INTRODUCTION

-

8.2 WARFARE PLATFORMSRISE OF AI IN EW PLATFORMS TO BOOST MARKET

-

8.3 CYBERSECURITYINCREASING CYBER-ATTACKS AND NEED FOR SECURITY TO DRIVE MARKET

-

8.4 LOGISTICS & TRANSPORTATIONINCREASING TACTICAL AND STRATEGIC MILITARY OPERATIONS TO FUEL MARKET

-

8.5 SURVEILLANCE & SITUATIONAL AWARENESSEFFICIENCY IN GATHERING ACTIONABLE INTELLIGENCE TO DRIVE MARKET

-

8.6 COMMAND & CONTROLIMPROVING ABILITY TO GATHER DATA FOR BETTER DECISION-MAKING TO DRIVE MARKET

-

8.7 BATTLEFIELD HEALTHCARENEW CAPABILITIES THAT REDUCE BATTLEFIELD CAUSALITIES TO DRIVE MARKET

-

8.8 SIMULATION & TRAININGINCREASING INVESTMENTS IN SIMULATION & TRAINING SECTOR TO DRIVE MARKET

-

8.9 THREAT/TARGET MONITORING & TRACKINGADOPTION OF AI IN UAVS TO ASSIST IN THREAT/TARGET MONITORING & TRACKING

-

8.10 INFORMATION PROCESSINGPROCESSING HUGE VOLUMES OF DATA TO GATHER VALUABLE INSIGHTS TO BOOST MARKET

- 8.11 OTHERS

- 9.1 INTRODUCTION

-

9.2 MACHINE LEARNING (ML)DEEP LEARNING- Deep learning increasingly used in facial recognitionSUPERVISED LEARNING- Classification and regression: major segments of supervised learningUNSUPERVISED LEARNING- Unsupervised learning integral to identifying patterns in critical dataREINFORCEMENT LEARNING- Reinforcement learning used for autonomous decision-making in military applicationsGENERATIVE ADVERSARIAL LEARNING- Generative adversarial learning is widely used for surveillance and situational awareness applicationsOTHERS

-

9.3 NATURAL LANGUAGE PROCESSINGHIGH DEMAND FOR PROGRAMMING OF COMPUTERS TO PROCESS NATURAL LANGUAGE DATA

-

9.4 CONTEXT-AWARE COMPUTINGUSED FOR IMPROVEMENT OF RF SIGNALS AND SITUATIONAL AWARENESS

-

9.5 COMPUTER VISIONINVESTMENTS IN DEVELOPMENT OF HIGH-RESOLUTION 3D GEOSPATIAL INFORMATION SYSTEMS BOOST SEGMENT

-

9.6 INTELLIGENT VIRTUAL AGENTDEMAND FOR VIRTUAL IDENTITIES FOR RECRUITMENT, CYBER DEFENSE, AND TRAINING

-

9.7 OTHERSINCREASE IN ADOPTION OF SPEECH RECOGNITION AND EMOTIONAL RECOGNITION

- 10.1 INTRODUCTION

-

10.2 AIRBORNEFIGHTER AIRCRAFT- Military modernization programs to drive marketSPECIAL MISSION AIRCRAFT- Increasing tactical and strategic military operations to drive demandHELICOPTERS- Use of helicopters with advanced capabilities and high operational range to drive marketUNMANNED AERIAL VEHICLES- Increasing adoption of ISR and combat applications to fuel market

-

10.3 LANDMILITARY FIGHTING VEHICLES- Improved capabilities of military vehicles to drive marketUNMANNED GROUND VEHICLES- Increased adoption of advanced ground vehicles to drive marketWEAPONS SYSTEMS- Increased spending to improve defense capabilities to drive marketHEADQUARTERS & COMMAND CENTERS- C5ISR capabilities to boost marketDISMOUNTED SOLDIER SYSTEMS- Enhanced situational awareness capabilities to fuel market

-

10.4 NAVALNAVAL SHIPS- Increasing AI capabilities to contribute to market growthSUBMARINES- Investments to develop advanced submarines to drive demandUNMANNED MARINE VEHICLES- Adoption of UMVs for defense applications to support market growth

-

10.5 SPACENEED TO PREVENT COLLISIONS IN SPACE TO DRIVE MARKETCUBESATSATELLITES

- 11.1 INTRODUCTION

-

11.2 NEW INSTALLATIONGROWING DEFENSE EXPENDITURE ON AI-POWERED TOOLS AND SYSTEMS BOOSTS NEW INSTALLATION SEGMENT

-

11.3 UPGRADEDEMAND FOR ENHANCED MILITARY CAPABILITIES TO DRIVE MARKET

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Modernizing programs and defense policies to drive marketCANADA- Increased investment in defense R&D activities to drive market

-

12.4 EUROPEPESTLE ANALYSIS: EUROPEUK- Defense modernization programs to drive marketFRANCE- Technological advancements to drive marketGERMANY- Increasing investment in R&D activities to fuel marketRUSSIA- Necessity to modernize defense operations with AI capabilities to drive marketITALY- Initiatives aimed at renewing naval fleet to drive demandREST OF EUROPE

-

12.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increase in R&D expenditure for military equipment to boost marketINDIA- Ongoing modernization of Indian defense to fuel marketJAPAN- Need to strengthen combat capabilities to boost marketSOUTH KOREA- Vision to be AI powerhouse to drive marketAUSTRALIA- Demand for modern AI in military radars with advanced technologies to drive marketREST OF ASIA PACIFIC

-

12.6 MIDDLE EAST & AFRICAPESTLE ANALYSIS: MIDDLE EAST & AFRICAISRAEL- Rising focus on development of state-of-the-art military solutions to drive marketTURKEY- Increased investment to strengthen defense capability to drive marketSAUDI ARABIA- Need for cyber-defense to boost marketSOUTH AFRICA- Need for new military equipment to boost market

-

12.7 LATIN AMERICAPESTLE ANALYSIS: LATIN AMERICAMEXICO- Focus on strengthening ISR capabilities to drive marketBRAZIL- Modernization of armed forces to propel market

-

13.1 INTRODUCTIONKEY GROWTH STRATEGIES OF LEADING PLAYERS IN AI IN MILITARY MARKET

- 13.2 RANKING ANALYSIS OF KEY PLAYERS IN AI IN MILITARY MARKET, 2022

- 13.3 REVENUE ANALYSIS, 2022

- 13.4 MARKET SHARE ANALYSIS, 2022

-

13.5 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 COMPETITIVE BENCHMARKING

-

13.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products offered- Recent developments- MnM viewTHE BOEING COMPANY- Business overview- Products offered- Recent developmentsGENERAL DYNAMICS CORPORATION- Business overview- Products offered- Recent developmentsRHEINMETALL AG- Business overview- Products offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products offered- Recent developmentsSAFRAN SA- Business overview- Products offered- Recent developmentsINTERNATIONAL BUSINESS MACHINES CORP. (IBM)- Business overview- Products offered- Recent developmentsNVIDIA CORPORATION- Business overview- Products offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products offered- Recent developmentsSAAB AB- Business overview- Products offered- Recent developments

-

14.3 OTHER PLAYERSSHIELD AIRAFAEL ADVANCED DEFENSE SYSTEMS LTD.DARKTRACE HOLDINGS LIMITEDSPARKCOGNITION INC.SOAR TECHNOLOGY, INC.CHARLES RIVER ANALYTICSANDURIL INDUSTRIES, INC.C3.AI, INC.HENSOLDT ANALYTICS GMBHBLUEHALO

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 AI IN MILITARY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION), 2020–2022

- TABLE 4 DEVELOPMENTS IN AI-POWERED CYBERSECURITY

- TABLE 5 AI IN MILITARY MARKET: ECOSYSTEM

- TABLE 6 AI IN MILITARY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 STORAGE UNITS FOR AUTOMATIC DATA-PROCESSING MACHINES: COUNTRY-WISE IMPORTS, 2021–2022 (USD MILLION)

- TABLE 8 STORAGE UNITS FOR AUTOMATIC DATA-PROCESSING MACHINES: COUNTRY-WISE EXPORTS, 2021–2022 (USD MILLION)

- TABLE 9 ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS: COUNTRY-WISE IMPORTS, 2021–2022 (USD MILLION)

- TABLE 10 ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS: COUNTRY-WISE EXPORTS, 2021–2022 (USD MILLION)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE TECHNOLOGIES

- TABLE 13 AI IN MILITARY MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 INNOVATIONS AND PATENT REGISTRATIONS (2020–2022)

- TABLE 15 AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 16 AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 17 HARDWARE: AI IN MILITARY MARKET, BY COMPONENT, 2020–2022 (USD MILLION)

- TABLE 18 HARDWARE: AI IN MILITARY MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 19 SOFTWARE: AI IN MILITARY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 20 SOFTWARE: AI IN MILITARY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 21 SOFTWARE SOLUTIONS: AI IN MILITARY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 22 SOFTWARE SOLUTIONS: AI IN MILITARY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 23 SERVICES: AI IN MILITARY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 24 SERVICES: AI IN MILITARY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 25 AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 26 AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 AI IN MILITARY MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 28 AI IN MILITARY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 29 MACHINE LEARNING: AI IN MILITARY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 30 MACHINE LEARNING: AI IN MILITARY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 AI IN MILITARY PLATFORMS: RECENT DEVELOPMENTS

- TABLE 32 AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 33 AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 34 AIRBORNE PLATFORM: AI IN MILITARY MARKET, BY AIRCRAFT TYPE, 2020–2022 (USD MILLION)

- TABLE 35 AIRBORNE PLATFORM: AI IN MILITARY MARKET, BY AIRCRAFT TYPE, 2023–2028 (USD MILLION)

- TABLE 36 LAND PLATFORM: AI IN MILITARY MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 37 LAND PLATFORM: AI IN MILITARY MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 NAVAL PLATFORM: AI IN MILITARY MARKET, BY VESSEL TYPE, 2020–2022 (USD MILLION)

- TABLE 39 NAVAL PLATFORM: AI IN MILITARY MARKET, BY VESSEL TYPE, 2023–2028 (USD MILLION)

- TABLE 40 AI IN MILITARY MARKET, BY INSTALLATION TYPE, 2020–2022 (USD MILLION)

- TABLE 41 AI IN MILITARY MARKET, BY INSTALLATION TYPE, 2023–2028 (USD MILLION)

- TABLE 42 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 43 AI IN MILITARY MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 44 AI IN MILITARY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: AI IN MILITARY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: AI IN MILITARY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 53 US: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 54 US: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 55 US: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 56 US: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 US: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 58 US: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 59 CANADA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 60 CANADA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 61 CANADA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 62 CANADA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 CANADA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 64 CANADA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 65 EUROPE: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 66 EUROPE: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 67 EUROPE: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 68 EUROPE: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 70 EUROPE: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 71 EUROPE: AI IN MILITARY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 72 EUROPE: AI IN MILITARY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 UK: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 74 UK: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 UK: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 76 UK: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 UK: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 78 UK: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 79 FRANCE: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 80 FRANCE: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 81 FRANCE: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 82 FRANCE: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 FRANCE: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 84 FRANCE: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 86 GERMANY: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 87 GERMANY: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 88 GERMANY: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 GERMANY: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 90 GERMANY: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 91 RUSSIA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 92 RUSSIA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 93 RUSSIA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 94 RUSSIA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 RUSSIA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 96 RUSSIA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 97 ITALY: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 98 ITALY: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 99 ITALY: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 100 ITALY: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 ITALY: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 102 ITALY: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 103 REST OF EUROPE: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 104 REST OF EUROPE: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 105 REST OF EUROPE: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AI IN MILITARY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AI IN MILITARY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 CHINA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 118 CHINA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 120 CHINA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 122 CHINA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 123 INDIA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 124 INDIA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 125 INDIA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 126 INDIA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 INDIA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 128 INDIA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 129 JAPAN: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 130 JAPAN: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 131 JAPAN: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 132 JAPAN: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 JAPAN: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 134 JAPAN: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 135 SOUTH KOREA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 136 SOUTH KOREA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH KOREA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 138 SOUTH KOREA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH KOREA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 140 SOUTH KOREA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 141 AUSTRALIA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 142 AUSTRALIA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 AUSTRALIA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 144 AUSTRALIA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 AUSTRALIA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 146 AUSTRALIA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 161 ISRAEL: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 162 ISRAEL: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 163 ISRAEL: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 164 ISRAEL: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 ISRAEL: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 166 ISRAEL: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 167 TURKEY: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 168 TURKEY: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 169 TURKEY: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 170 TURKEY: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 TURKEY: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 172 TURKEY: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 173 SAUDI ARABIA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 174 SAUDI ARABIA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 SAUDI ARABIA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 176 SAUDI ARABIA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 177 SAUDI ARABIA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 178 SAUDI ARABIA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 179 SOUTH AFRICA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 180 SOUTH AFRICA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 181 SOUTH AFRICA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 182 SOUTH AFRICA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH AFRICA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 184 SOUTH AFRICA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 187 LATIN AMERICA: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 188 LATIN AMERICA: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: AI IN MILITARY MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: AI IN MILITARY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 193 MEXICO: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 194 MEXICO: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 195 MEXICO: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 196 MEXICO: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 MEXICO: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 198 MEXICO: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 199 BRAZIL: AI IN MILITARY MARKET, BY OFFERING, 2020–2022 (USD MILLION)

- TABLE 200 BRAZIL: AI IN MILITARY MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 201 BRAZIL: AI IN MILITARY MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 202 BRAZIL: AI IN MILITARY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 203 BRAZIL: AI IN MILITARY MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 204 BRAZIL: AI IN MILITARY MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 205 AI IN MILITARY MARKET: DEGREE OF COMPETITION

- TABLE 206 COMPANY FOOTPRINT

- TABLE 207 COMPANY PLATFORM FOOTPRINT

- TABLE 208 COMPANY REGION FOOTPRINT

- TABLE 209 AI IN MILITARY MARKET: PRODUCT LAUNCHES, FEBRUARY 2019–MAY 2023

- TABLE 210 AI IN MILITARY MARKET: DEALS, JULY 2019–MAY 2023

- TABLE 211 AI IN MILITARY MARKET: EXPANSIONS, MARCH 2019–FEBRUARY 2023

- TABLE 212 AI IN MILITARY MARKET: OTHER DEVELOPMENTS, MARCH 2019–FEBRUARY 2023

- TABLE 213 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 214 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 215 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 216 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 217 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 218 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 219 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 220 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 221 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 222 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 223 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 224 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 225 THALES GROUP: COMPANY OVERVIEW

- TABLE 226 THALES GROUP: PRODUCTS OFFERED

- TABLE 227 THALES GROUP: PRODUCT LAUNCHES

- TABLE 228 THALES GROUP: DEALS

- TABLE 229 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 230 BAE SYSTEMS PLC: PRODUCTS OFFERED

- TABLE 231 BAE SYSTEMS PLC: DEALS

- TABLE 232 THE BOEING COMPANY: COMPANY OVERVIEW

- TABLE 233 THE BOEING COMPANY: PRODUCTS OFFERED

- TABLE 234 THE BOEING COMPANY: PRODUCT LAUNCHES

- TABLE 235 THE BOEING COMPANY: DEALS

- TABLE 236 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 237 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 238 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 239 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 240 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 241 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 242 RHEINMETALL AG: PRODUCTS OFFERED

- TABLE 243 RHEINMETALL AG: DEALS

- TABLE 244 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 245 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 246 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 247 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 248 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 249 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 250 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 251 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 252 LEONARDO S.P.A.: OTHERS

- TABLE 253 SAFRAN SA: COMPANY OVERVIEW

- TABLE 254 SAFRAN SA: PRODUCTS OFFERED

- TABLE 255 SAFRAN SA: PRODUCT LAUNCHES

- TABLE 256 SAFRAN SA: DEALS

- TABLE 257 INTERNATIONAL BUSINESS MACHINES CORP. (IBM): COMPANY OVERVIEW

- TABLE 258 INTERNATIONAL BUSINESS MACHINES CORP. (IBM): PRODUCTS OFFERED

- TABLE 259 INTERNATIONAL BUSINESS MACHINES CORP. (IBM): PRODUCT LAUNCHES

- TABLE 260 INTERNATIONAL BUSINESS MACHINES CORP. (IBM): DEALS

- TABLE 261 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 262 NVIDIA CORPORATION: PRODUCTS OFFERED

- TABLE 263 NVIDIA CORPORATION: PRODUCT LAUNCHES

- TABLE 264 NVIDIA CORPORATION: DEALS

- TABLE 265 NVIDIA CORPORATION: OTHERS

- TABLE 266 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 267 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 268 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 269 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 270 SAAB AB: COMPANY OVERVIEW

- TABLE 271 SAAB AB: PRODUCTS OFFERED

- TABLE 272 SAAB AB: OTHERS

- TABLE 273 SHIELD AI: COMPANY OVERVIEW

- TABLE 274 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 275 DARKTRACE HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 276 SPARKCOGNITION INC.: COMPANY OVERVIEW

- TABLE 277 SOAR TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 278 CHARLES RIVER ANALYTICS: COMPANY OVERVIEW

- TABLE 279 ANDURIL INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 280 C3.AI, INC.: COMPANY OVERVIEW

- TABLE 281 HENSOLDT ANALYTICS GMBH: COMPANY OVERVIEW

- TABLE 282 BLUEHALO: COMPANY OVERVIEW

- FIGURE 1 AI IN MILITARY MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 AI IN MILITARY MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MILITARY EXPENDITURE (USD BILLION), 2022

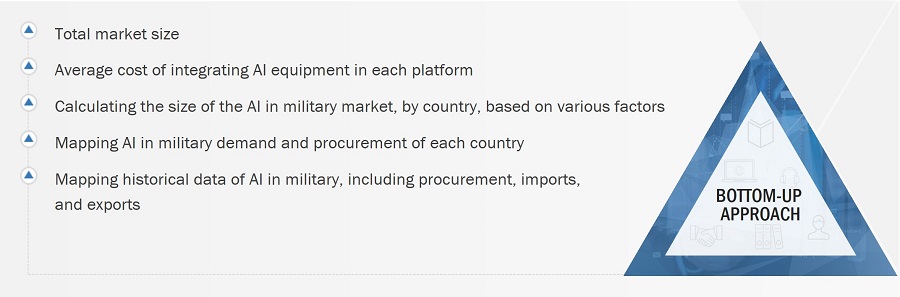

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

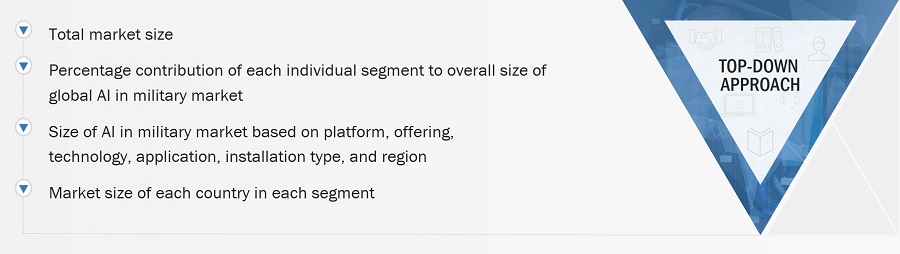

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 RESEARCH ASSUMPTIONS

- FIGURE 10 HARDWARE WEAPONS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 11 MACHINE LEARNING SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 12 WARFARE PLATFORMS SEGMENT TO REGISTER HIGHEST CAGR DURING 2023-2028

- FIGURE 13 INCREASING INVESTMENT BY DEVELOPED AND EMERGING ECONOMIES IN AI-ENABLED MILITARY SOLUTIONS TO DRIVE MARKET

- FIGURE 14 DEEP LEARNING SEGMENT HELD LARGEST MARKET SHARE IN 2022

- FIGURE 15 AIRBORNE SEGMENT IS PROJECTED TO HOLD MAJOR MARKET SHARE DURING 2023-2028

- FIGURE 16 NEW INSTALLATION SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 17 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 18 AI IN MILITARY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DEFENSE EXPENDITURE OF MAJOR COUNTRIES IN PERCENTAGE, 2022

- FIGURE 20 AI IN MILITARY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 REVENUE SHIFT IN AI IN MILITARY MARKET

- FIGURE 22 AI IN MILITARY MARKET: ECOSYSTEM MAPPING/ANALYSIS

- FIGURE 23 MARKET ECOSYSTEM MAP: AI IN MILITARY MARKET

- FIGURE 24 AI IN MILITARY MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- FIGURE 26 KEY BUYING CRITERIA FOR AI IN MILITARY MARKET, BY TOP THREE TECHNOLOGIES

- FIGURE 27 TECHNOLOGICAL TRENDS IN AI IN MILITARY MARKET

- FIGURE 28 HARDWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 WARFARE PLATFORMS SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 30 MACHINE LEARNING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 31 LAND PLATFORM TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 32 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 33 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2023–2028

- FIGURE 34 NORTH AMERICA: AI IN MILITARY MARKET SNAPSHOT

- FIGURE 35 EUROPE: AI IN MILITARY MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: AI IN MILITARY MARKET SNAPSHOT

- FIGURE 37 MIDDLE EAST & AFRICA: AI IN MILITARY MARKET SNAPSHOT

- FIGURE 38 LATIN AMERICA: AI IN MILITARY MARKET SNAPSHOT

- FIGURE 39 RANKING OF KEY PLAYERS IN AI IN MILITARY MARKET, 2022

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES IN AI IN MILITARY MARKET, 2019–2022

- FIGURE 41 AI IN MILITARY MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- FIGURE 42 AI IN MILITARY MARKET: COMPETITIVE LEADERSHIP MAPPING (KEY PLAYERS), 2022

- FIGURE 43 AI IN MILITARY MARKET: COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES), 2022

- FIGURE 44 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 48 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 49 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 50 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 52 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 54 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 55 INTERNATIONAL BUSINESS MACHINES CORP. (IBM): COMPANY SNAPSHOT

- FIGURE 56 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 58 SAAB AB: COMPANY SNAPSHOT

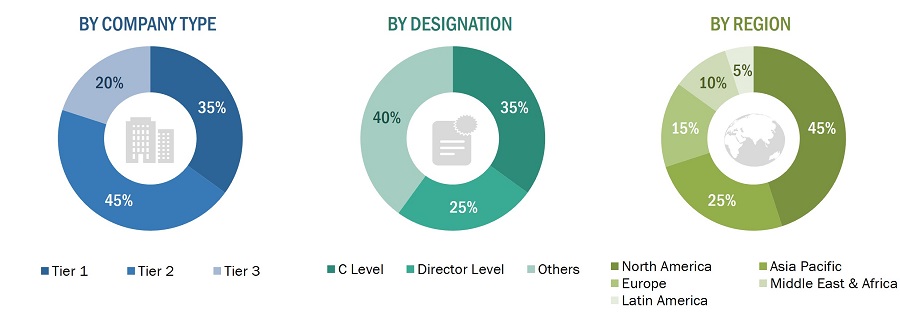

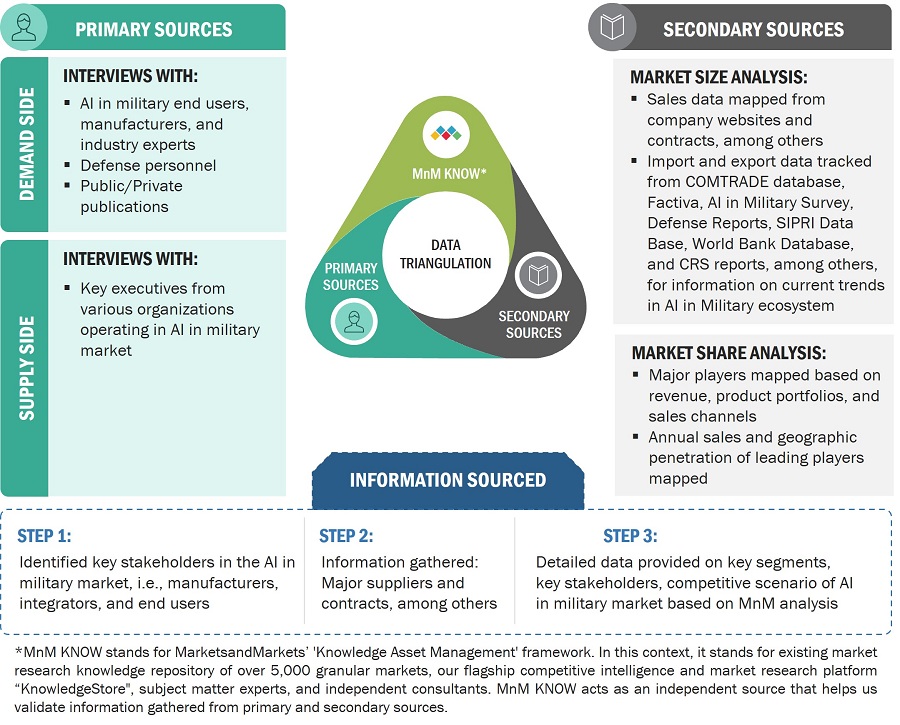

The research study conducted on the AI in military market involved extensive use of secondary sources, including directories, databases of articles, journals on AI in military, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the AI in military market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the AI in military market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the AI in military market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the AI in military industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the AI in military market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the AI in military market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Extensive research into AI in military sources and the concurrent advances in machine learning technology have pushed technology to the level where fully configured AI in military are now being designed and tested for imminent deployment. Advances in AI/ML technology and its global demand propelling the demand for AI in military.

The top-down and bottom-up approaches were used to estimate and validate the size of the AI in military market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

The research methodology used to estimate the market size also included the following details:

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

- Market growth trends were defined based on approaches such as the product revenues of the major 10-15 companies from 2019 to 2022, military expenditure, exports/imports of AI in military parts and equipment by different countries from 2019 to 2022, historic procurement patterns between 2019 to 2022, among others.

Market size estimation methodology: Bottom-Up Approach

Market size estimation methodology: Top Down Approach

Data Triangulation

After arriving at the overall size of the AI in military market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

AI (Artificial Intelligence) in the military refers to the utilization of AI technologies and applications in various aspects of defense and military operations. AI has the potential to revolutionize the way military forces operate, enabling enhanced decision-making, improved efficiency, and increased effectiveness in a range of defense-related activities.

Key Stakeholders

- AI Technology Providers

- System Integrators

- AI Solution Providers

- AI Platform Providers

- Cloud Service Providers

- AI System Providers

- Investors and Venture Capitalists

- Component Manufacturers

- Distributors and Suppliers

- Universities, Research Organizations, Forums, Alliances, and Associations

- Ministries of Defense

- Original Equipment Manufacturers (OEMs)

- Regulatory Bodies

- R&D Companies

Report Objectives

- To define, describe, and forecast the size of the market based on offering, application, technology, platform, and installation type, along with a regional analysis

- To forecast the size of different segments of the market with respect to four key regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to AI in military across different regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To analyze the impact of the recession on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as constant innovation, high R&D investment, new product and service launch, collaborations & expansions, contracts, acquisitions, partnerships, and agreements, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the AI in military market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Micromarkets refer to further segments and subsegments of the AI in military market included in the report.

Core competencies of companies were captured in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence (AI) in Military Market