Augmented Reality Market Size, Share & Industry Growth Analysis Report by Product by Device Type (Head-mounted Display, Head-up Display), Offering (Hardware, Software), Application (Consumer, Commercial, Healthcare), Technology, and Geography - Global Forecast to 2026

Updated on : October 23, 2024

Augmented Reality Market Size & Growth

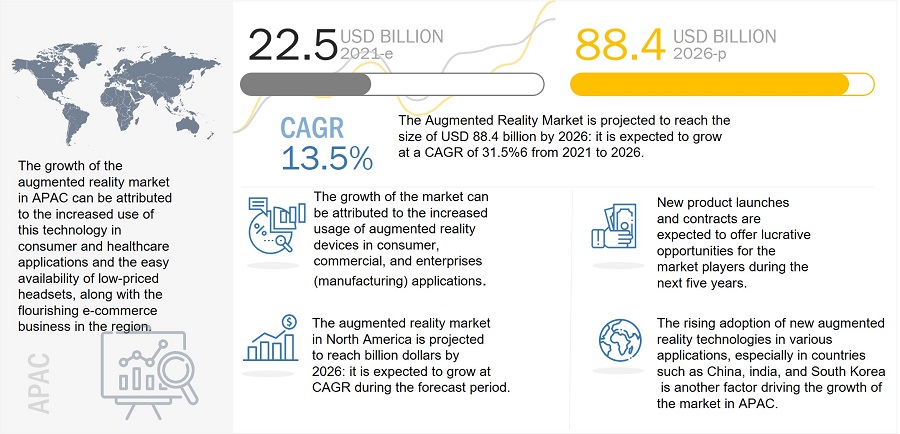

The global augmented reality market size was valued at USD 31.97 billion in 2022 and is projected to reach USD 88.4 billion by 2026, growing at a CAGR of 31.5% between 2023 to 2026. Hardware segment is expected to witness highest CAGR of 60.4%.

The augmented reality market is experiencing remarkable demand, fueled by its transformative applications across various sectors, including gaming, retail, healthcare, and education. As businesses and consumers alike recognize the value of immersive experiences, AR technology is being increasingly adopted to enhance user engagement and improve operational efficiencies. Key trends shaping the augmented reality market include the rapid advancements in AR hardware, such as smart glasses and mobile devices, which are making AR applications more accessible and user-friendly. Additionally, the integration of AR with artificial intelligence and machine learning is enabling more personalized and interactive experiences, driving further interest in the technology. The growing emphasis on remote collaboration and training, particularly in light of recent global challenges, has also accelerated the adoption of AR solutions in professional settings. As industries continue to explore innovative use cases, from virtual try-ons in retail to enhanced training simulations in healthcare, the augmented reality market size is poised for substantial growth, redefining how users interact with the digital and physical worlds.

The key factors fueling the growth of this market include increasing adoption of AR technology in healthcare sector, growing demand for AR in retail and e-commerce sectors due to COVID-19, rising investments in augmented reality (AR) market, and surging demand for Augmented reality industry.

Impact of AI Augmented Reality Market

The impact of AI in the augmented reality (AR) market is transforming user experiences, enhancing real-time data processing, and driving innovation across industries such as retail, healthcare, education, and manufacturing. By integrating artificial intelligence, AR applications can deliver more personalized, adaptive, and interactive experiences, enabling features like intelligent object recognition, real-time language translation, and predictive analytics. This synergy between AI and AR is not only boosting operational efficiency and decision-making but also fueling the development of smart AR wearables and immersive training solutions, ultimately reshaping how businesses and consumers interact with digital content in physical environments.

To know about the assumptions considered for the study, Request for Free Sample Report

Augmented Reality (AR) Market Segment Overview

Software offering was the largest market for augmented reality (AR) in 2022.

The augmented reality market size for the software segment is expected to hold a larger size during the forecast period owing to the growth in the number of apps and platforms in space.

The growing penetration of augmented reality software and its compatibility with existing hardware are expected to drive the growth of the AR market for the software segment during the forecast period. The augmented reality technology is expected to witness increased global adoption owing to the emergence of various projects that will evolve into large-scale projects in the coming years.

The enterprises (manufacturing) to register the highest CAGR during the forecast period

The significant growth of the enterprises sector in countries such as China, Japan, South Korea, and India is expected to contribute to the growth of the augmented reality market.

Moreover, HMD is being used in enterprises to enhance their productivity. AR has a wide range of use cases, mainly in operations for installation and assembly, maintenance and remote assistance, training, quality control, safety management, and design and visualization. It is used in enterprises for training personnel, providing information about the industrial facility, remodeling, and redesigning products, and simulating industrial scenarios.

Traditionally, training was conducted using classroom methods; however, the introduction of AR has helped enhance training methodologies. It has given better visibility to the trainers. AR is cutting-edge technology in the industry 4.0 trend. Using AR helps minimize human errors, improve efficiency, and reduce expenses.

Augmented Reality (AR) Industry Regional Analysis

Asia Pacific to register the highest CAGR during the forecast period

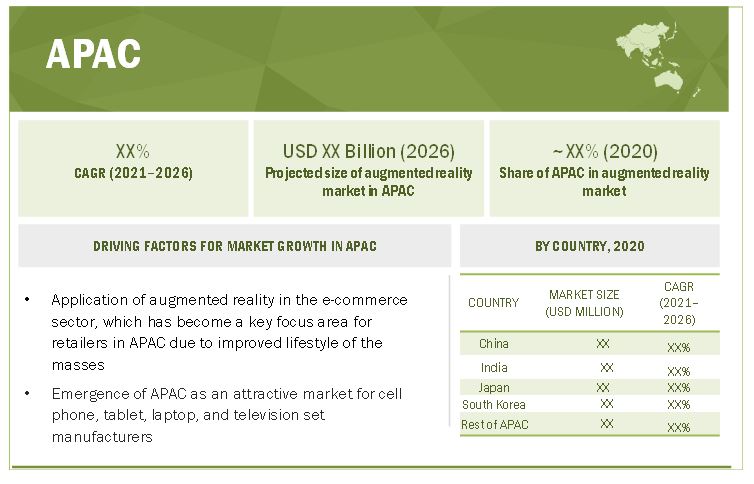

The augmented reality (AR) market in APAC is projected to grow at the highest CAGR during the forecast period. The flourishing enterprises (manufacturing) sector in China and Japan are projected to fuel the growth of the augmented reality market in APAC.

The gaming industry in this region has also witnessed significant growth, thereby contributing to the increased demand for augmented reality technology in APAC. Additionally, rising investments in commercial applications are also expected to contribute to the growth of the augmented reality market in APAC. Moreover, the thriving healthcare and automotive sectors in Japan are also projected to drive the demand for AR technology in the region.

To know about the assumptions considered for the study, download the pdf brochure

Top Augmented Reality (AR) Companies - Key Market Players

- Google, Inc. (US),

- PTC Inc. (US),

- Seiko Epson (Japan),

- Microsoft (US),

- Lenovo (Hong Kong),

- Samsung Electronics (South Korea), and

- Apple (US).

The top players have adopted merger & acquisition, partnership, collaboration, and product launch strategies to grow in the global augmented reality industry.

Augmented Reality Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 22.5 Billion |

| Projected Market Size | USD 88.4 Billion |

| Growth Rate | CAGR of 31.5% |

|

Market size available for years |

2017–2026 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Increased investments in AR market |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Consumer Application and Hardware Segment |

| Highest CAGR Segment | Enterprises (Manufacturing) Segment |

Augmented Reality (AR) Market Dynamics

Driver: Rising investments in AR market

Investments in the augmented reality (AR) market have witnessed huge growth over the past few years. Companies such as Facebook Corporation, Intel Corporation, Qualcomm, Inc., Alphabet, Inc., Comcast Ventures, and Samsung Group are investing heavily in the augmented reality market.

Also, several research institutes are carrying out research in the AR application market for various products and applications. A few research institutes are being funded by private firms and venture capitalists, while governments are funding some. Industries such as consumer, aerospace & defense, healthcare, enterprises, retail, and marketing embrace the benefits of AR. For instance, Boeing Company announced a new setup named HorizonX, to forge a broader external investment fund.

The company would be investing in some companies to start with, including Upskill, a major company in enterprise software for industrial AR devices, and Zunum Aero, an aircraft manufacturer start-up based in Kirkland, Washington.

Restraint: Health issues associated with excessive usage of AR

With the advent of new gaming devices and technologies, AR-related health issues among gamers are increasing. AR games are highly interactive and keep the user engrossed with the game immensely for longer hours, causing issues such as anxiety, eye strain, obesity, and lack of concentration.

The nature of AR technology is immersive and can induce anxiety or stress after wearing the AR headset for longer hours. Apart from stress, AR devices also expose users to harmful electromagnetic frequency radiation, which may cause illness. Researchers from the National Toxicology Program (NTP), a federal inter-agency program under the National Health Institutes (US), experimented on mice.

This experiment demonstrated that subjects exposed to electromagnetic radiation might be more vulnerable to cancer. Therefore, the excessive use of AR devices can cause health issues, limiting the growth of the augmented reality market.

Opportunity: High growth of travel and tourism industry

The tourism market heavily relies on information. The travel & tourism industry is one of the fastest-growing industries worldwide.

The use of AR will play an important role in delivering information to users and enhancing the experience of tourists and travelers. Augmented reality can be used in cultural institutions for engaging visitors and enhancing their experience through real-time navigation.

AR applications can be used for outdoor locations. Tourists can use smartphones or other handheld devices to point toward physical objects in the real world dominate augmented reality market. This will enable them to enhance physical locations and tourist attractions.

This may allow them to point their smartphone at a building or landmark and learn more about it, in real-time. For instance, a user may point their phone at a restaurant and instantly be provided with reviews or menus or aim their tablet at a historic landmark and be presented with information about its history. This can greatly enhance the entire travel experience and allow tourists to get information in one go.

Challenge: Reconfiguration of applications for different platforms

In AR, most of the applications are designed for different purposes with specific configurations. Hence, these applications cannot be used for other purposes.

Therefore, the development of new applications usually requires additional effort and time. In addition, Augmented Reality Applications have limitations pertaining to operating systems, Android versions, and programming languages and platforms.

Moreover, mobile AR has restrictions regarding the size of the devices and processing power for AR applications.

AR Market Categorization

In this research report, the augmented reality market categorizes on the basis of technology, offering, device type, application, and geography.

Augmented Reality Market, by Technology

- Marker-Based AR Technology

- Markerless AR Technology

- Anchor-Based AR Technology

Augmented Reality Market, by Offering

- Hardware

- Software

Augmented Reality (AR) Market, by Device Type

- HUDs

- HMDs

Augmented Reality Market, by Application

- Consumer

- Commercial

- Enterprise (Manufacturing)

- Healthcare

- Aerospace & Defense

- Energy

- Automotive

- Others

Augmented Reality Market Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments in Augmented Reality (AR) Industry:

- In March 2021, Microsoft launched its new app called Microsoft Mesh that gives users across AR/VR meeting space to interact with other users and 3D content, handling all of the technical hard parts of sharing spatial multi-player experiences over the web.

- In March 2021, Microsoft won a contract from the US Army to supply HoloLens technology. The deal is worth about USD 22 billion, lasting for 10 years where Microsoft will provide the military with 120,000 AR headsets.

- In January 2021, Lenovo announced its new ThinkReality A3 augmented reality AR glasses ahead of CES 2021 aimed at the enterprise market. The ThinkReality A3 AR smart glasses look like a pair of sunglasses and can be easily folded. The glasses that superimpose computer graphics over real-world views require a tethered connection to a PC or Motorola smartphone. It will also give users the option to view multiple screens at once.

- In January 2021,Magic Leap partnered with Google Cloud to deliver Magic Leap enterprise solutions on the Google Cloud Marketplace and explore potential new cloud-based, spatial computing solutions running on Google Cloud.

- In September 2020, Seiko Epson Corporation developed its fourth generation of optical engines for smart glasses. These optical engines boast the most advanced optical technology for Epson's next generation of smart glasses in the Moverio series.

Frequently Asked Questions (FAQ):

What is the size of the augmented reality market ?

The Augmented Reality market refers to the global industry that develops and sells AR products and services. The size of the AR market is anticipated to increase $88.4 billion by 2026, growing at a CAGR of 31.5%.

Who are the main players in the augmented reality (AR) market share ?

The AR market has a number of players, including technology giants such as Apple, Google, and Microsoft, as well as smaller startups and niche players.

What are the main drivers of augmented reality market share growth ?

The main drivers of AR market growth include increasing demand for AR applications in various industries, advancements in AR technology, and growing investment in AR research and development.

What are the main challenges facing the augmented reality market share?

The main challenges facing the AR market include the high cost of AR devices, privacy and security concerns, and the need for standardized AR technologies.

How is the augmented reality (AR) market expected to evolve in the future ?

The AR market is expected to continue growing in the future, driven by increasing demand for AR applications and advancements in AR technology. The market is likely to consolidate, with a few dominant players emerging, and AR is expected to become a ubiquitous technology in many industries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AUGMENTED REALITY MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.1.2 List of key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews with experts

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 AR MARKET SIZE ESTIMATION

FIGURE 3 AR AUGMENTED REALITY (AR) MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF KEY PLAYERS

FIGURE 4 AR MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIZE): BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF AUGMENTED REALITY (AR) MARKET

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 AR MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

FIGURE 6 AR MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 8 ASSUMPTIONS OF RESEARCH STUDY : AUGMENTED REALITY MARKET

2.5 RISK ASSESSMENT

TABLE 1 ANALYSIS OF RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 9 AR MARKET: OPTIMISTIC, REALISTIC, AND PESSIMISTIC SCENARIO ANALYSIS, 2017–2026

3.1 MARKET: REALISTIC SCENARIO (POST-COVID-19)

3.2 AUGMENTED REALITY (AR) MARKET: OPTIMISTIC SCENARIO (POST-COVID-19)

3.3 MARKET: PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SOFTWARE SEGMENT TO HOLD LARGER SIZE OF MARKET FROM 2021 TO 2026

FIGURE 11 HMD TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 12 CONSUMER APPLICATION SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2021 TO 2026

FIGURE 13 NORTH AMERICA HELD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 KEY OPPORTUNITIES IN MARKET

FIGURE 14 AUGMENTED REALITY (AR) MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4.2 MARKET, BY OFFERING

FIGURE 15 SOFTWARE SEGMENT TO HOLD LARGER SIZE OF MARKET FROM 2021 TO 2026

4.3 MARKET, BY APPLICATION AND REGION

FIGURE 16 CONSUMER SEGMENT HELD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET, BY COUNTRY

FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.5 MARKET, BY DEVICE TYPE

FIGURE 18 HMD TO DOMINATE AUGMENTED REALITY (AR) MARKET FROM 2021 TO 2026

5 AUGMENTED REALITY MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS FOR AR MARKET

FIGURE 19 INCREASING ADOPTION OF AR TECHNOLOGY IN HEALTHCARE AND RETAIL SECTORS TO DRIVE MARKET GROWTH

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of AR technology in healthcare sector

5.2.1.2 Growing demand for AR in retail and e-commerce sectors due to COVID-19

5.2.1.3 Rising investments in AR market

5.2.1.4 Surging demand for AR devices and technology in global automotive industry

FIGURE 20 IMPACT ANALYSIS OF DRIVERS ON AUGMENTED REALITY (AR) MARKET

5.2.2 RESTRAINTS

5.2.2.1 Trade war between US and China

5.2.2.2 Security and privacy issues associated with AR

5.2.2.3 Health issues associated with excessive usage of AR

FIGURE 21 IMPACT ANALYSIS OF RESTRAINTS ON MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Continuous developments in 5G technology

5.2.3.2 Opportunities in enterprise applications

5.2.3.3 High growth of travel & tourism industry

FIGURE 22 IMPACT ANALYSIS OF OPPORTUNITIES ON AUGMENTED REALITY (AR) MARKET

5.2.4 CHALLENGES

5.2.4.1 Global economic slowdown owing to COVID-19

5.2.4.2 Reluctance of users in accepting AR products due to health concerns

5.2.4.3 Reconfiguration of applications for different platforms

FIGURE 23 IMPACT ANALYSIS OF CHALLENGES ON AR MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: AR MARKET

5.3.1 RESEARCH AND PRODUCT DEVELOPMENT

5.3.2 MANUFACTURING

5.3.3 ASSEMBLY

5.3.4 DISTRIBUTION

5.3.5 END USER

FIGURE 25 AR SOFTWARE MARKET VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED THROUGH PRIMARY ACTIVITIES

5.4 REGULATORY LANDSCAPE

5.5 ECOSYSTEM ANALYSIS

TABLE 2 AUGMENTED REALITY MARKET: ECOSYSTEM

FIGURE 26 KEY MARKETS RELATED TO ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS, 2020

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 INTENSITY OF COMPETITIVE RIVALRY

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 THREAT OF NEW ENTRANTS

5.7 TECHNOLOGY ANALYSIS

5.7.1 MOBILE AUGMENTED REALITY

5.7.2 MONITOR-BASED AR TECHNOLOGY

5.7.3 NEAR-EYE-BASED TECHNOLOGY

5.7.4 LIDAR TECHNOLOGY

5.7.5 WEB AR

TABLE 4 USE CASE FOR WEB AR

5.8 CASE STUDY ANALYSIS : AUGMENTED REALITY MARKET

5.8.1 PROVIDING DYNAMIC SALES TRAINING TO TEAMS OF ROYAL ENFIELD DURING PANDEMIC USING VUFORIA STUDIO

5.8.2 TRANSFORMING DENTAL SURGERIES WITH MOVERIO SMART GLASSES

5.8.3 FIRST MICROSOFT HOLOLENS SURGERY IN LATIN AMERICA: HOW AR CAN CHANGE SURGICAL EXPERIENCE FOR DOCTORS AND PATIENTS

5.9 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

5.10 AVERAGE SELLING PRICE (ASP) TREND

TABLE 5 AVERAGE PRICES OF AR HMD

TABLE 6 COMPARISON OF SDK PRICES

5.11 PATENT ANALYSIS

FIGURE 28 NUMBER OF PATENTS RELATED TO AUGMENTED REALITY PUBLISHED FROM 2012 TO 2020

FIGURE 29 SHARE OF TOP 10 COMPANIES IN PATENT APPLICATIONS FROM 2012 TO 2020

TABLE 7 KEY PATENTS FROM 2019 TO 2020

5.12 TRADE ANALYSIS

FIGURE 30 IMPORT DATA OF SPECTACLES, GOGGLES, AND THE LIKE, CORRECTIVE, PROTECTIVE, OR OTHER (EXCLUDING SPECTACLES FOR EYESIGHT TESTING, CONTACT LENSES, AND SPECTACLE LENSES, FRAMES, AND MOUNTINGS), BY COUNTRY, 2016–2019 (USD THOUSAND)

FIGURE 31 EXPORT DATA OF SPECTACLES, GOGGLES, AND THE LIKE, CORRECTIVE, PROTECTIVE, OR OTHER (EXCLUDING SPECTACLES FOR EYESIGHT TESTING, CONTACT LENSES, AND SPECTACLE LENSES, FRAMES, AND MOUNTINGS), BY COUNTRY, 2016–2019 (USD THOUSAND)

6 AUGMENTED REALITY MARKET, BY DEVICE TYPE (Page No. - 79)

6.1 INTRODUCTION

FIGURE 32 AR MARKET, BY DEVICE TYPE

FIGURE 33 HMD EXPECTED TO DOMINATE AR MARKET DURING FORECAST PERIOD

TABLE 8 AR MARKET, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 9 AR MARKET, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 10 AR MARKET, BY DEVICE TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 11 AUGMENTED REALITY MARKET, BY DEVICE TYPE, 2021–2026 (THOUSAND UNITS)

6.2 HEAD-MOUNTED DISPLAYS

6.2.1 AR SMART GLASSES

6.2.1.1 Adoption of AR smart glasses by companies to improve their work efficiency

6.2.2 SMART HELMETS

6.2.2.1 Use of smart helmets in the construction sector to optimize workflow

TABLE 12 AR MARKET FOR HMD, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 13 AR MARKET FOR HMD, BY APPLICATION, 2021–2026 (USD MILLION)

6.3 HEAD-UP DISPLAYS

6.3.1 AR HUD EXPECTED TO BE ADOPTED WIDELY IN DIFFERENT APPLICATIONS IN NEAR FUTURE

TABLE 14 AR MARKET FOR HUD, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 15 MARKET FOR HUD, BY APPLICATION, 2021–2026 (USD MILLION)

7 AUGMENTED REALITY (AR) MARKET, BY OFFERING (Page No. - 86)

7.1 INTRODUCTION

FIGURE 34 AR MARKET, BY OFFERING

FIGURE 35 SOFTWARE SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 16 AR MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 17 AUGMENTED REALITY MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 SENSORS

7.2.1.1 Accelerometers

7.2.1.1.1 Accelerometers are electromechanical devices used for measuring acceleration

7.2.1.2 Gyroscopes

7.2.1.2.1 Gyroscopes are used to measure angular velocity of 3D mouse, games, and athlete-training applications

7.2.1.3 Magnetometers

7.2.1.3.1 Magnetometers measure magnetic field and electric currents using one or more sensors

7.2.1.4 Proximity sensors

7.2.1.4.1 Proximity sensors prevent unintentional touch during active calls on mobile phones

7.2.2 SEMICONDUCTOR COMPONENTS : AUGMENTED REALITY MARKET

7.2.2.1 Controllers and processors

7.2.2.1.1 Increased demand for controllers and processors in devices

7.2.2.2 Integrated circuits

7.2.2.2.1 Integrated circuit ensures large volume of data storage for high-resolution image processing

7.2.3 DISPLAYS AND PROJECTORS

7.2.3.1 Displays and projectors hold significant share of augmented reality hardware market

7.2.4 POSITION TRACKERS

7.2.4.1 Increased use of position trackers to maintain position accuracy in augmented reality devices

7.2.5 CAMERAS

7.2.5.1 Cameras form crucial components to measure depth and amplitude of objects

7.2.6 OTHERS

TABLE 18 AR MARKET FOR HARDWARE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 19 AR MARKET FOR HARDWARE, BY COMPONENT, 2021–2026 (USD MILLION)

7.3 SOFTWARE

7.3.1 SOFTWARE DEVELOPMENT KITS

7.3.1.1 SDKs provide tools to design, build, and test AR experiences

7.3.2 CLOUD-BASED SERVICES

7.3.2.1 AR cloud offers abstracted medium for physical spaces, objects, and humans for tailoring digital contents and experiences

8 TYPES OF TECHNOLOGIES IN AUGMENTED REALITY (AR) MARKET (Page No. - 94)

8.1 INTRODUCTION

8.2 MARKER-BASED AR TECHNOLOGY

8.2.1 PASSIVE MARKERS

8.2.1.1 Passive markers are used at large scale worldwide

8.2.2 ACTIVE MARKERS

8.2.2.1 Active markers use LED to track objects

8.3 MARKERLESS AR TECHNOLOGY

8.3.1 MODEL-BASED TRACKING

8.3.1.1 Model-based tracking depends on camera movements

8.3.2 IMAGE PROCESSING-BASED TRACKING

8.3.2.1 Image processing-based tracking requires optical scanners or cameras for processing images

8.4 ANCHOR-BASED AR TECHNOLOGY

8.4.1 ANCHOR-BASED AR TECHNOLOGY IS USED TO OVERLAY VIRTUAL IMAGES IN REAL SPACE

9 AUGMENTED REALITY MARKET, BY APPLICATION (Page No. - 96)

9.1 INTRODUCTION

FIGURE 36 MARKET, BY APPLICATION

FIGURE 37 ENTERPRISES (MANUFACTURING) APPLICATION OF AR MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 20 AUGMENTED REALITY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 21 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 CONSUMER

9.2.1 GAMING

9.2.1.1 Augmented reality (AR) enhances interactivity in gaming and provides more immersive experience to gamers

9.2.2 SPORTS & ENTERTAINMENT

9.2.2.1 Sports

9.2.2.1.1 AR is used for real-time augmentation of broadcast videos, primarily to enhance sporting events

9.2.2.2 Entertainment

9.2.2.2.1 Museums (Archaeology)

9.2.2.2.1.1 Augmented reality enhances viewing experience of visitors in archaeological monuments and museums

9.2.2.3 Theme parks

9.2.2.3.1 Augmented reality enhances interactivity of theme parks

9.2.2.4 Art galleries and exhibitions

9.2.2.4.1 AR enhances artistic visualization and provides immersive experience to visitors

TABLE 22 AUGMENTED REALITY MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 23 AR MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 24 AR AUGMENTED REALITY (AR) MARKET FOR CONSUMER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MARKET FOR CONSUMER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 MARKET IN NORTH AMERICA FOR CONSUMER APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 27 MARKET IN NORTH AMERICA FOR CONSUMER APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 28 AR MARKET IN EUROPE FOR CONSUMER APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 29 MARKET IN EUROPE FOR CONSUMER APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 30 MARKET IN APAC FOR CONSUMER APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 31 MARKET IN APAC FOR CONSUMER APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 32 AR MARKET IN ROW FOR CONSUMER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 AUGMENTED REALITY MARKET IN ROW FOR CONSUMER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.3 COMMERCIAL

9.3.1 RETAIL & E-COMMERCE : AR MARKET

9.3.1.1 Jewelry

9.3.1.1.1 Augmented reality enables consumers to try before they buy and improves consumer buying experience

9.3.1.2 Beauty and cosmetics

9.3.1.2.1 Virtual testing of cosmetic products is key driver for market in beauty and cosmetics

9.3.1.3 Apparel fitting

9.3.1.3.1 Virtual trial rooms are gaining consumer attention

9.3.1.4 Grocery shopping

9.3.1.4.1 AR provides personalized product tips in grocery application

9.3.1.5 Footwear

9.3.1.5.1 Virtual try before you buy feature drives growth of ar market in footwear

9.3.1.6 Furniture & lighting design

9.3.1.6.1 Reduced product exchange rates owing to use of augmented reality in furniture & lighting design

9.3.2 TRAVEL & TOURISM

9.3.2.1 AR plays crucial role in enhancing traveling experience

9.3.3 E-LEARNING

9.3.3.1 Augmented reality increases students’ interactions and enhances learning experience

TABLE 34 AUGMENTED REALITY (AR) MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 35 AR MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 36 AR MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 38 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 39 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 41 MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 42 MARKET IN APAC FOR COMMERCIAL APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 43 MARKET IN APAC FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 44 AR MARKET IN ROW FOR COMMERCIAL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 AUGMENTED REALITY (AR) MARKET IN ROW FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.4 ENTERPRISES (MANUFACTURING)

9.4.1 AUGMENTED REALITY AIDS ENTERPRISES IN PROVIDING BETTER TRAINING BY VISUALIZING CONTENT

TABLE 46 AR MARKET FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 48 MARKET FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 MARKET IN NORTH AMERICA FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 MARKET IN EUROPE FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN EUROPE FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MARKET IN APAC FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN APAC FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 MARKET IN ROW FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 AR MARKET IN ROW FOR ENTERPRISES (MANUFACTURING) APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.5 HEALTHCARE

9.5.1 SURGERY

9.5.1.1 Augmented healthcare apps can help save lives and treat patients seamlessly irrespective of severity of issues

9.5.2 FITNESS MANAGEMENT

9.5.2.1 Augmented reality adds interactivity and fun to workouts

9.5.3 PATIENT CARE MANAGEMENT

9.5.3.1 Remote consulting feature drives growth of augmented reality market for patient care management

9.5.4 PHARMACY MANAGEMENT

9.5.4.1 Requirement for better scheduling flow of medicines boosts adoption of augmented reality in pharmacy management

9.5.5 MEDICAL TRAINING AND EDUCATION

9.5.5.1 Augmented reality enriches learning experience and amplifies interactivity

9.5.6 OTHERS

TABLE 58 AUGMENTED REALITY (AR) MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 59 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 60 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 MARKET IN NORTH AMERICA FOR HEALTHCARE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 63 AR MARKET IN NORTH AMERICA FOR HEALTHCARE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 MARKET IN EUROPE FOR HEALTHCARE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN EUROPE FOR HEALTHCARE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 MARKET IN APAC FOR HEALTHCARE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 MARKET IN APAC FOR HEALTHCARE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 MARKET IN ROW FOR HEALTHCARE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 AUGMENTED REALITY MARKET IN ROW FOR HEALTHCARE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.6 AEROSPACE & DEFENSE

9.6.1 AR IS BEING USED TO GAIN COMPETITIVE ADVANTAGE OVER ENEMIES

TABLE 70 AR MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 71 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 72 AUGMENTED REALITY (AR) MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 74 MARKET IN NORTH AMERICA FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 75 MARKET IN NORTH AMERICA FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 76 MARKET IN EUROPE FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 77 AUGMENTED REALITY MARKET IN EUROPE FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 78 MARKET IN APAC FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 79 MARKET IN APAC FOR AEROSPACE & DEFENSE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 80 MARKET IN ROW FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 AUGMENTED REALITY MARKET IN ROW FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.7 ENERGY

9.7.1 GROWING NEED TO IMPROVE SAFETY IN OIL & GAS SECTOR DRIVES AR MARKET FOR ENERGY APPLICATIONS

TABLE 82 AUGMENTED REALITY (AR) MARKET FOR ENERGY APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 83 MARKET FOR ENERGY APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 84 MARKET FOR ENERGY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MARKET FOR ENERGY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 86 AUGMENTED REALITY MARKET IN NORTH AMERICA FOR ENERGY APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA FOR ENERGY APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 88 MARKET IN EUROPE FOR ENERGY APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN EUROPE FOR ENERGY APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 90 AUGMENTED REALITY MARKET IN APAC FOR ENERGY APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN APAC FOR ENERGY APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 92 MARKET IN ROW FOR ENERGY APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 AR MARKET IN ROW FOR ENERGY APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.8 AUTOMOTIVE

9.8.1 EMERGENCE OF ADAS DRIVES DEMAND FOR AR-BASED HUD TECHNOLOGY

TABLE 94 MARKET FOR AUTOMOTIVE APPLICATION, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 95 AR MARKET FOR AUTOMOTIVE APPLICATION, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 96 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 MARKET FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN NORTH AMERICA FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN NORTH AMERICA FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 100 AUGMENTED REALITY MARKET IN EUROPE FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN EUROPE FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 102 AUGMENTED REALITY (AR) MARKET IN APAC FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 103 AR MARKET IN APAC FOR AUTOMOTIVE APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 104 MARKET IN ROW FOR AUTOMOTIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 105 AR MARKET IN ROW FOR AUTOMOTIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHERS

9.9.1 AGRICULTURE

9.9.1.1 Augmented reality assists farmers in implementing new techniques with better learning experience

9.9.2 CONSTRUCTION

9.9.2.1 3D models required for construction projects can be better illustrated with augmented reality

9.9.3 TRANSPORTATION & LOGISTICS

9.9.3.1 AR technology is widely adopted in transportation & logistics sector to document trading activities

9.9.4 PUBLIC SAFETY

9.9.4.1 Augmented reality-based 3D maps aid police personnel to enhance public safety

9.9.5 TELECOM/IT DATA CENTERS

9.9.5.1 Requirement for advanced network infrastructure in telecom/IT data centers would help drive AR software market for this vertical

TABLE 106 AUGMENTED REALITY (AR) MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2017–2020 (USD MILLION)

TABLE 107 AR MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 108 MARKET FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

TABLE 110 AR MARKET IN NORTH AMERICA FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN NORTH AMERICA FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 112 MARKET IN EUROPE FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 113 AUGMENTED REALITY MARKET IN EUROPE FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN APAC FOR OTHER APPLICATIONS, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 115 AR MARKET IN APAC FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 116 MARKET IN ROW FOR OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 117 AUGMENTED REALITY MARKET IN ROW FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHICAL ANALYSIS (Page No. - 136)

10.1 INTRODUCTION

FIGURE 38 MARKET, BY REGION

TABLE 118 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 119 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 39 MARKET IN NORTH AMERICA, BY COUNTRY

FIGURE 40 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 120 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 121 AUGMENTED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 41 ANALYSIS OF MARKET IN NORTH AMERICA: PRE- AND POST-COVID-19 SCENARIOS

10.2.2 US

10.2.2.1 Surging use of augmented reality technology in US defense applications to contribute to market growth

10.2.3 CANADA

10.2.3.1 Increasing investments in cutting-edge technologies to fuel market growth in Canada

10.2.4 MEXICO

10.2.4.1 Evolving industries in Mexico to drive market growth

10.3 EUROPE

FIGURE 42 MARKET IN EUROPE, BY COUNTRY

FIGURE 43 SNAPSHOT OF MARKET IN EUROPE

TABLE 122 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 44 ANALYSIS OF MARKET IN EUROPE: PRE- AND POST-COVID-19 SCENARIOS

10.3.2 GERMANY

10.3.2.1 Surging adoption of new technologies in healthcare sector to contribute to market growth in Germany

10.3.3 UK

10.3.3.1 Increasing focus on digitization in UK to drive market growth

10.3.4 FRANCE

10.3.4.1 Surging adoption of augmented reality in retail sector to enhance market growth in France

10.3.5 REST OF EUROPE

10.4 APAC

FIGURE 45 AUGMENTED REALITY MARKET IN APAC, BY COUNTRY

FIGURE 46 SNAPSHOT OF MARKET IN APAC

TABLE 124 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 IMPACT OF COVID-19 ON MARKET IN APAC

FIGURE 47 ANALYSIS OF MARKET IN APAC: PRE- AND POST-COVID-19 SCENARIOS

10.4.2 CHINA

10.4.2.1 Rising number of local players producing augmented reality devices to drive market growth in China

10.4.3 JAPAN

10.4.3.1 Flourishing healthcare sector to fuel market growth in Japan

10.4.4 SOUTH KOREA

10.4.4.1 Ongoing digital revolution in industrial sector of South Korea to drive market growth in country

10.4.5 INDIA

10.4.5.1 Increasing awareness related to advanced technologies in India to play crucial role in market growth in country

10.4.6 REST OF APAC

10.5 ROW

FIGURE 48 MARKET IN ROW, BY REGION

TABLE 126 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 AR MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 IMPACT OF COVID-19 ON MARKET IN ROW

FIGURE 49 ANALYSIS OF MARKET IN ROW: PRE- AND POST-COVID-19 SCENARIOS

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Flourishing tourism sector to fuel demand for augmented reality devices in Middle East and Africa

10.5.3 SOUTH AMERICA

10.5.3.1 Growing consumer sector to drive market growth in South America

11 COMPETITIVE LANDSCAPE (Page No. - 156)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AR MARKET

11.3 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 50 5-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET, 2016–2020

11.4 MARKET SHARE ANALYSIS OF KEY PLAYERS IN 2020

FIGURE 51 AUGMENTED REALITY (AR) MARKET SHARE ANALYSIS OF KEY PLAYERS IN MARKET IN 2020

TABLE 128 AUGMENTED REALITY MARKET: DEGREE OF COMPETITION

TABLE 129 MARKET: RANKING ANALYSIS

11.5 COMPANY EVALUATION QUADRANT, 2020

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 52 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2020

11.6 COMPETITIVE BENCHMARKING

11.6.1 COMPANY FOOTPRINT, BY APPLICATION

11.6.2 COMPANY FOOTPRINT, BY REGION

11.6.3 TOTAL SCORE

11.7 STARTUP/SME EVALUATION QUADRANT, 2020

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 53 MARKET (GLOBAL) STARTUP/SME EVALUATION QUADRANT, 2020

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 130 PRODUCT LAUNCHES/DEVELOPMENTS, 2019–2021

11.8.2 DEALS : AUGMENTED REALITY MARKET

TABLE 131 DEALS, 2019–2021

12 COMPANY PROFILES (Page No. - 169)

12.1 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View)*

12.1.1 GOOGLE, INC.

TABLE 132 GOOGLE, INC.: BUSINESS OVERVIEW

FIGURE 54 GOOGLE, INC.: COMPANY SNAPSHOT

TABLE 133 GOOGLE, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 134 GOOGLE, INC.: PRODUCT LAUNCHES

TABLE 135 GOOGLE, INC.: DEALS

12.1.2 PTC INC.

TABLE 136 PTC INC.: BUSINESS OVERVIEW

FIGURE 55 PTC INC.: COMPANY SNAPSHOT

TABLE 137 PTC INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 138 PTC INC.: PRODUCT LAUNCHES

TABLE 139 PTC INC.: DEALS

12.1.3 SEIKO EPSON

TABLE 140 SEIKO EPSON: BUSINESS OVERVIEW

FIGURE 56 SEIKO EPSON: COMPANY SNAPSHOT

TABLE 141 SEIKO EPSON: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 142 SEIKO EPSON: PRODUCT LAUNCHES

TABLE 143 SEIKO EPSON: DEALS

12.1.4 MICROSOFT

TABLE 144 MICROSOFT: BUSINESS OVERVIEW

FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

TABLE 145 MICROSOFT: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 146 MICROSOFT: PRODUCT LAUNCHES

TABLE 147 MICROSOFT: DEALS

12.1.5 LENOVO

TABLE 148 LENOVO: BUSINESS OVERVIEW

FIGURE 58 LENOVO: COMPANY SNAPSHOT

TABLE 149 LENOVO: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 150 LENOVO: PRODUCT LAUNCHES

TABLE 151 LENOVO: DEALS

12.1.6 SAMSUNG ELECTRONICS

TABLE 152 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 59 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

TABLE 153 SAMSUNG ELECTRONICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 154 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES

TABLE 155 SAMSUNG ELECTRONICS: DEALS

12.1.7 APPLE

TABLE 156 APPLE: BUSINESS OVERVIEW

FIGURE 60 APPLE: COMPANY SNAPSHOT

TABLE 157 APPLE: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 158 APPLE: PRODUCT LAUNCHES

12.1.8 WIKITUDE GMBH

TABLE 159 WIKITUDE GMBH: BUSINESS OVERVIEW

TABLE 160 WIKITUDE GMBH: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 161 WIKITUDE GMBH: PRODUCT LAUNCHES

TABLE 162 WIKITUDE GMBH: DEALS

12.1.9 MAXST CO., LTD.

TABLE 163 MAXST CO., LTD.: BUSINESS OVERVIEW

TABLE 164 MAXST CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 165 MAXST: PRODUCT LAUNCHES

12.1.10 QUALCOMM

TABLE 166 QUALCOMM: BUSINESS OVERVIEW

FIGURE 61 QUALCOMM: COMPANY SNAPSHOT

TABLE 167 QUALCOMM: PRODUCT/SOLUTION/SERVICE OFFERINGS

TABLE 168 QUALCOMM: PRODUCT LAUNCHES

TABLE 169 QUALCOMM: DEALS

* Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 TOSHIBA CORPORATION

12.2.2 INTEL CORPORATION

12.2.3 UPSKILL

12.2.4 BLIPPAR

12.2.5 CONTINENTAL

12.2.6 VISTEON CORPORATION

12.2.7 INGLOBE TECHNOLOGIES

12.2.8 OPTINVENT

12.2.9 MAGIC LEAP, INC.

12.2.10 MARXENT LABS, LLC

12.2.11 SCOPE AR

12.2.12 NIANTIC INC.

12.2.13 ATHEER INC.

12.2.14 VUZIX

12.2.15 META COMPANY

13 APPENDIX (Page No. - 210)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

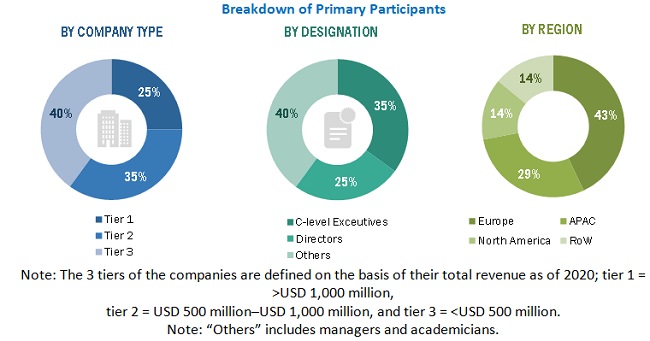

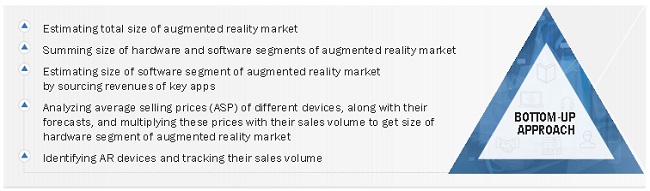

The study involved four major activities in estimating the size of the augmented reality market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Digital Olfaction Society (DOS), Tokyo Institute of Technology, National Institute of Information and Communications Technology, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the augmented reality market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (consumer, commercial, healthcare, automotive) and supply-side (OEM/ODM, system integrators, solution providers) players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the augmented reality market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Augmented reality Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the augmented reality market in terms of value based on technology, offering, device type, and application

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different augmented reality devices

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the augmented reality market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the augmented reality market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches/developments, contracts/collaborations/agreements/acquisitions in the augmented reality market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Augmented Reality Market

Our point of view is from a hardware side, I am not so interested at that point in braking down of AR technology on the software standpoint.We have an optical engine (integrated optics with off-the-shelf micro-display) for HMD that offer wide field of view (Very much interested in paragraph 5.3.4.1!!). We would like to know what companies would be interested in buying this hardware element, so as to integrate it in glasses or helmet. What geographical area should be prioritized? What price could we secure?As we are a European based company, I’d like to make sure that your report includes companies in the USA, Europe as well as Asia.Our technology competes with that of companies like Waveoptics, LetinAR, (…) but also full HMD makers with proprietary optics like Microsoft, North or Trioptics (…).Do you have quantitative sale figures for these companies?