Automotive Operating System Market by OS Type (QNX, Android, Linux, Windows), ICE Vehicle Type (PCs, LCVs, and HCVs), EV Application (Battery Management and Charging Management), Application and Region - Global Forecast to 2030

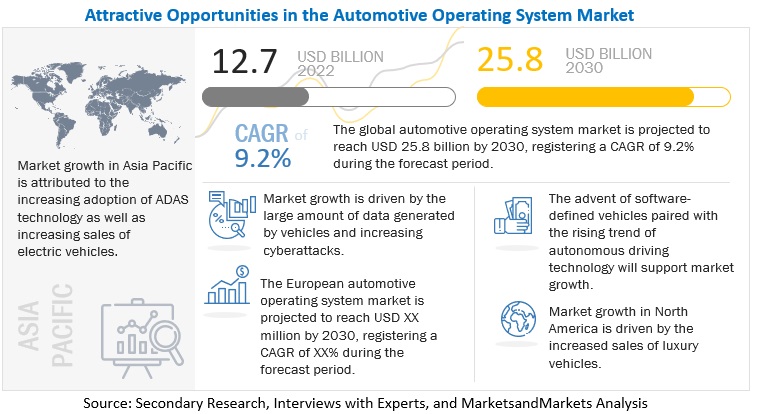

The global automotive operating system market size was valued at USD 12.7 billion in 2022 and is expected to reach USD 25.8 billion by 2030, at a CAGR of 9.2%, during the forecast period 2022-2030. Factors such as growing number of ECUs/domain controllers in vehicles, along with the increase in the penetration of ADAS technology in vehicles will boost the demand for the automotive software such as OS. Increase in developments related to autonomous vehicles, in conjunction with rising penetration of electric vehicles will create new opportunities for this market. Companies operating in the market are focusing on product enhancement in order to gain competitive advantage in the global market.

global

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Operating System Market Dynamics:

Driver: Growing number of ECUs/domain controllers in vehicles

Every vehicle requires electronic-based components in its powertrain and chassis systems, body electronics and connectivity systems, and safety and convenience systems. Some of the increasing applications of electronic-based systems in vehicles are automatic transmission, voice recognition and biometric systems, antilock braking systems, power steering, blind spot detection, lane departure systems, headlights, ADAS, and park assist technologies. These applications are controlled by one or more ECUs. With the addition of advanced and connected technologies in a vehicle, the complexity and number of ECUs have also increased in recent years. This, in turn, will increase the need for automotive operating systems in the near future.

The automotive industry is witnessing a rapid advancement in terms of the number of electronics being used in vehicles. A modern automotive cockpit comprises digital displays for infotainment, instrument cluster, climate control, and others. Thus, the cockpit domain controller has emerged as an important aspect of controlling multiple cockpit functions from a single control unit. The cockpit domain controller gives the cockpit intelligent perception and interaction capabilities. This helps to provide users with an improved interactive experience. In addition, the cockpit domain controller is a single system that ensures multi-display management across the vehicle, thereby reducing the complexity of ECUs in the vehicle. Considering the improving in-vehicle infotainment and increasing penetration of ADAS features, the importance of cockpit domain controllers is expected to continue growing in the future. Domain controllers require Real Time Operating System (RTOS), general-purpose OS (Linux and Android) virtual machines, GPU, and CPU, among others, for the proper functioning of the cockpit domain. This is likely to increase the demand for operating systems. Considering all the mentioned parameters, the automotive operating system market is likely to augment projected revenues during the forecast period.

Restraint: Lack of seamless connectivity

3G is still the predominant connectivity network in some regions. For instance, according to the GSM Association, a significant share of smartphones in Sub-Saharan Africa, the Middle East & North Africa, and Latin America & Caribbean support 3G only. Moreover, emerging countries such as India, Argentina, and Brazil are still facing the challenge of upgrading existing infrastructure for connectivity purposes to 4G/5G due to the predominance of the 3G network. Further, the seamless availability of 4G connectivity is growing at a slow pace mostly in rural and suburban parts of the countries.

A large amount of capital is required to upgrade the necessary infrastructure for telematics, data analytics, and cloud platforms, and this requirement for huge capital will remain a key concern in countries such as India and Brazil while upgrading to 4G/5G. Thus, there arises a need for telecommunication providers to expand network infrastructure to cater to the surge in spectrum usage and data requirements.

The unavailability of uninterrupted 4G/5G networks in developed as well as developing nations is also one of the major concerns. Plus, an unclear picture of the commercialization of 5G technology is hindering the conversion of some conceptual developments to real-time use in developing countries as well as the outskirts areas and major cities within developed countries. Thus, a lack of uninterrupted and seamless connectivity will restrain potential opportunities for infotainment systems, ADAS features, and cockpit domains, among others. For instance, ADAS requires basic infrastructures such as well-organized roads, lane marking, and GPS connectivity for effective functioning. On highways, information such as lane change, object detection, traffic, and the distance between vehicles, apart from services such as navigation and connectivity, is critical. However, vehicles are not connected to each other or to cloud data due to the limited network connectivity on highways. All these factors are likely to restrain the growth opportunities of the automotive operating systems market during the forecast period.

Opportunity: Advent of software-defined vehicles

The automotive industry has started shifting its focus towards software-centric vehicles from hardware-defined vehicles. This transformation has given birth to software-defined vehicles. The features and functions of these vehicles are primarily enabled through automotive software. Today, most premium vehicles have up to 150 million lines of software codes, which are typically proportionate among hundreds of electronic control units (ECUs) and a rising number of cameras, RADAR, and light detection and ranging (LiDAR) devices, among others.

In the past, automotive manufacturers used to differentiate their product offerings with mechanical features such as torque and horsepower. However, in today’s scenario, consumers/buyers are interested in features defined by software such as infotainment innovations, intelligent connectivity solutions, driver assistance features, and V2X communication solutions. The increasing demand for these features will, in turn, increase the need for automotive operating systems, software platforms, etc. All the above factors are expected to bolster the revenue growth of the automotive operating system market during the forecast period.

Software-defined vehicles have several advantages over hardware-defined vehicles. For instance, software upgrades pertaining to vehicle infotainment systems, telematics, vehicle diagnostic systems, etc. will require a trip to the dealership. However, with software-defined vehicles, customers will be able to receive over-the-air (OTA) updates that cover infotainment improvements, security patches, and the monitoring & tuning of core functionalities, such as powertrain and vehicle dynamics. This will increase the demand for software-defined vehicles, in turn driving the market during the forecast period.

Challenge: Risk of cybersecurity

Despite major developments in the automotive sector (ADAS, L2/L3 autonomy, etc.), cybersecurity remains a major challenge. Automotive advanced features are vulnerable to cyberattacks. There are various instances where cybersecurity has created a nuisance. For example, two researchers were able to hack into Chrysler’s Jeep, leading to the company upgrading the software in 1.4 million of its vehicles. Similarly, in Nissan Leaf, the control of the vehicle’s systems, such as HVAC, could be accessed by hackers.

According to a white paper study (Accenture's 2019 Global Survey), data breaches have increased by 67% in past five years, with the US being the most targeted country for cyberattacks. Several automotive OEMs are working on cybersecurity systems in order to make their respective vehicle models safer by integrating cybersecurity as well as threat detection systems with Artificial Intelligence (AI) and data analytics.

Regulators in various countries are preparing minimum standards for vehicle software and cybersecurity. For instance, in April 2018, California’s final regulations on autonomous vehicle testing and deployment came into effect, requiring autonomous vehicles to meet appropriate industry standards for cybersecurity. The World Forum for Harmonization of Vehicle Regulations under the United Nations Economic Commission for Europe (UNECE) also finalized its regulation on cybersecurity and software updates in June 2020. This made cybersecurity a clear requirement for future vehicle sales, and the associated regulations would affect new vehicle-type approvals in more than 60 countries. All these aforementioned factors are likely to hinder the automotive operating system market growth to a certain extent.

Automotive Operating System Market Share

The market share refers to the percentage of the global market owned by specific companies that provide car operating systems. Automotive operating systems are software platforms that manage numerous car operations such as infotainment, navigation, and driver assistance systems. The growing demand for connected and autonomous vehicles, the requirement for increased safety and security features, and the expanding popularity of electric vehicles are driving the automotive operating systems market. A few significant players dominate the worldwide vehicle operating system market, including Google, Apple, and BlackBerry. The market is divided into three sections: vehicle type, application, and geography.

Android segment is estimated to account for significant market during the forecast period (2022-2030)

Android segment is expected to witness significant growth in the automotive operating system market during the forecast period (2022-2030). The adoption of Android-based OS is growing, with its wireless mode already running in more than 100 million vehicles. Google is pulling out the Android smartphone playbook and attracting automakers with a car-specific version of Android, called the "Android Automotive OS". Android Automotive is an open-source platform that runs on other operating systems. It allows access to the Google Play ecosystem and advanced Google Assistant features. This will allow passengers to use the Play Store, Google Maps, Google Assistant, and other Android apps without an Android smartphone. Android Automotive OS supports several applications, such as messaging apps, navigation apps, Point of Interest (POI) apps, Internet of Things (IoT) apps, and video apps. According to primary inputs, the Android OS is likely to gain a significant share by 2028 in the market. All the aforementioned factors are expected to drive the Android-based operating system market during the forecast period.

Light commercial vehicles segment is expected to have significant growth opportunities during the forecast period

The light commercial vehicles segment is estimated to hold the second-largest automotive operating system market share in terms of value in 2022. North America and Asia Pacific are projected to lead the market. There has always been a high demand for vans from the logistics sector. OEMs are also offering an increasing number of LCV models in the Asia Pacific market. In December 2021, Mahindra & Mahindra announced its plan to launch 14 new models in the LCV segment in the Indian market. The upcoming LCVs include 6 new electric LCVs, and among these 6 electric LCVs, 4 will be for last-mile connectivity. These vehicles are expected to be launched in India by 2026. In 2020, United Parcel Services (US) announced that it had ordered 10,000 light-duty electric vans from Arrival for North America and Europe. All these aforementioned factors are anticipated to augment the revenues for autonomous segment of the market during the forecast period.

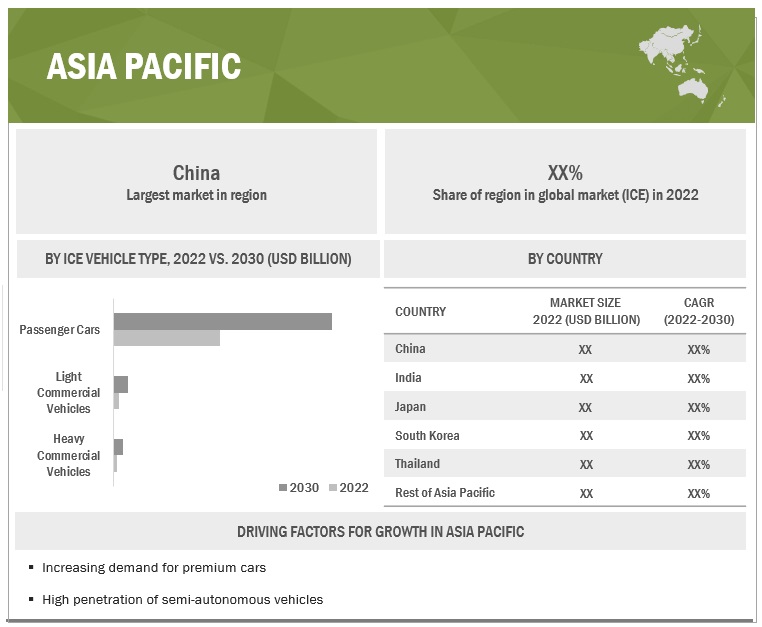

Asia Pacific is estimated to be the largest market during the forecast period.

Asia Pacific region is expected to have largest share for automotive operating system market during the forecast period. Asia Pacific comprises emerging countries such as China and India and developed countries such as Japan and South Korea. China, India, Japan, South Korea, Thailand, and the Rest of Asia Pacific have been considered in this study. In recent years, this region has emerged as a hub for automobile production. China, India, Japan, and South Korea, together, are driving the automobile market with the largest share in production and sales globally. This has led to an increase in vehicle production volumes over the years, which caters not only to domestic but also overseas demand. In addition, the increasing purchasing power of the population and rising concerns over vehicle pollution have triggered the demand for electric vehicles and semi-autonomous vehicles in Asia Pacific. One of the key drivers for the Asia Pacific market is the increased demand for connected services, particularly in China, Japan, and South Korea. The tech-savvy population in these countries demands a better and connected driving experience. Moreover, it is the largest market since it has majority of vehicle production, which is further exported to other regions. Although Asia Pacific has a lower penetration of software content in cars/vehicles than North America and Europe currently, the market size is larger due to larger vehicle production. Key automotive manufacturers in this region, along with the software providers and system integrators, are focusing on developing and innovating advanced software solutions to support reliable, safe, and performance-oriented automotive applications. All these factors are expected to bolster the revenue growth of the Asia Pacific market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The automotive operating system market is dominated by major players including BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US). These companies offer automotive operating system and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Operating System Type, ICE Vehicle Type, EV Application, Application, and Region. |

|

Geographies covered |

Asia Pacific, Europe, North America, LATAM, and Rest of the World |

|

Companies Covered |

BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US). |

This research report categorizes the automotive operating system market based on operating system type, ICE vehicle type, EV application, application, and region.

Based on Operating System Type:

- QNX

- Linux

- Windows

- Android

- Others

Based on ICE Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Based on EV Application:

- Charging Management Systems

- Battery Management Systems

Based on Application:

- ADAS & Safety Systems

- Autonomous Driving

- Body Control & Comfort Systems

- Communication Systems

- Connected Services

- Infotainment Systems

- Engine Management & Powertrain

- Vehicle Management & Telematics

Based on the Region:

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Thailand

- Rest of APAC

-

North America (NA)

- US

- Canada

- Mexico

-

Europe (EU)

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Latin America (LATAM)

- Brazil

- Argentina

- Rest of Latin America

-

Rest of the World (RoW)

- Iran

- South Africa

- Others

Recent Developments

- In June 2022, BlackBerry Limited announced an updated version of QNX Advanced Virtualization Frameworks (QAVF) and support for Google’s latest Android Automotive OS (AAOS) reference implementation (Trout 1.0). This new version of QAVF is likely to further enable embedded automotive software developers to simplify development, accelerate time to market, and reduce costs when building Android Automotive OS-based In-Vehicle Infotainment (IVI) systems.

- In June 2022, BMW announced that it will develop its BMW Operating System 8 infotainment software using Alphabet Inc.’s Android Automotive for some vehicle models beginning in March 2023.

- In April 2022, Automotive Grade Linux (AGL) announced IndyKite, Marelli Corporation, and Red Hat as new bronze members. This collaboration is likely to bring together automotive manufacturers, automotive suppliers, and technology companies to accelerate the development as well as the adoption of an open, shared software platform (Linux) for all technology in the vehicle, from infotainment to autonomous driving.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive operating system market?

The global automotive operating system market was valued at $12.7 billion in 2022 and expected to reach $25.8 billion by 2030, at a CAGR of 9.2%.

Who are the winners in the global automotive operating system market?

The automotive operating system market is dominated by major players including BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US).

Which region will have the largest market for automotive operating system?

The Asia Pacific region will the largest market for automotive operating system due to increasing sales of premium vehicles in the region.

Which country will have the significant demand for automotive operating system in APAC region?

China will be the significant market for automotive operating system due to strong government support towards electric vehicles, and increasing ICE vehicle sales.

What are the key market trends impacting the growth of the automotive operating system market?

Software-defined vehicles is the key market trends or technologies which will have major impact on the automotive operating system market in the future.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing advancements in infotainment systems- Increasing demand for rear-seat entertainment- Rising adoption of ADAS features- Growing number of ECUs/domain controllers in vehicles- Rising sales of luxury vehiclesRESTRAINTS- Lack of seamless connectivityOPPORTUNITIES- Advent of software-defined vehicles- Increasing focus on autonomous driving technology- Growing penetration of electric vehiclesCHALLENGES- Cybersecurity riskIMPACT OF MARKET DYNAMICS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING MARKET

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 MARKET ECOSYSTEM

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIESWORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021

-

5.8 PATENT ANALYSISINTRODUCTION

-

5.9 CASE STUDYQNX AND FREESCALE: DRIVING AUTOMOTIVE INFOTAINMENTGREEN HILLS SOFTWARE DELIVERS SAFETY AND SECURITY FOR MAHINDRA RACING’S ALL-ELECTRIC FORMULA E RACE CARGREEN HILLS SOFTWARE’S INTEGRITY MULTI-VISOR POWERS MULTI-OS AUTOMOTIVE COCKPIT FOR MARELLI

-

5.10 REGULATORY OVERVIEW (AUTOMOTIVE SOFTWARE)INTERNATIONAL STANDARDS FOR AUTOMOTIVE SOFTWARE QUALITY- Systems and software engineering: ISO/IEC 12207- Automotive SPICE: ISO/IEC 15504 and ISO/IEC 33001- Software engineering-product quality: ISO/IEC 9126 and ISO/IEC 25010:2011- Functional safety road vehicles: ISO 26262 and IEC 61508LIST OF KEY REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023

-

6.1 TECHNOLOGYINTRODUCTIONAUTOMOTIVE SOFTWARE DEVELOPMENT- Requirements analysis- System design- Component design- Implementation- Unit testing- Integration testing- System testingCONSOLIDATION OF ECU AND DOMAIN-CONTROLLER FUNCTIONALITYOVER-THE-AIR (OTA) UPDATESAI IN AUTOMOTIVECYBERSECURITY FOR IN-VEHICLE SOFTWARENEED FOR SOFTWARE IN AUTONOMOUS DRIVINGCHANGING AUTOMOTIVE INDUSTRY WITH APPLICATION PROGRAM INTERFACE (API)USE OF OPEN SOURCE SOFTWARE (OSS) IN AUTOMOTIVE

-

6.2 AUTOMOTIVE SOFTWARE CONSORTIUMSAUTOSAR- Basic software (BSW)- AUTOSAR runtime environment (RTE)- Application layer

-

6.3 AUTOMOTIVE OPERATING SYSTEM MARKET SCENARIOS (2022–2030)MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

-

6.4 RECESSION IMPACT ON MARKET – SCENARIO ANALYSISINTRODUCTIONREGIONAL MACRO-ECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

-

6.5 IMPACT ON AUTOMOTIVE SECTORANALYSIS OF AUTOMOTIVE VEHICLE SALES- Europe- Asia Pacific- AmericasAUTOMOTIVE SALES OUTLOOK

-

7.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

7.2 QNXINCREASED ADOPTION OF QNX SOFTWARE BY OEMS TO SUPPORT MARKET GROWTH

-

7.3 LINUXOPEN SOURCE, EASY AVAILABILITY, AND COST-SAVING FEATURES TO DRIVE SEGMENT

-

7.4 ANDROIDEASY AVAILABILITY AND ACCESS TO APPLICATIONS TO DRIVE SEGMENT

-

7.5 WINDOWSGROWING LINUX AND ANDROID OS PENETRATION EXPECTED TO LIMIT SEGMENT GROWTH

- 7.6 OTHERS

- 7.7 KEY PRIMARY INSIGHTS

-

8.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

8.2 PASSENGER CARSINCREASED INVESTMENT IN ADVANCED TECHNOLOGY TO AID GROWTH

-

8.3 LIGHT COMMERCIAL VEHICLESGROWING SALES OF HIGH-END LCVS TO DRIVE MARKET

-

8.4 HEAVY COMMERCIAL VEHICLESGROWING DEMAND FOR INFOTAINMENT SYSTEMS TO SUPPORT SEGMENT GROWTH

- 8.5 KEY PRIMARY INSIGHTS

-

9.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

9.2 CHARGING MANAGEMENT SYSTEMSGROWING NUMBER OF BEVS TO DRIVE SEGMENT

-

9.3 BATTERY MANAGEMENT SYSTEMSNEED TO MAINTAIN RELIABILITY AND SAFETY TO DRIVE SEGMENT

-

9.4 V2GEMERGING TECHNOLOGY AND INCREASED EFFICIENCY TO DRIVE SEGMENT

- 9.5 KEY PRIMARY INSIGHTS

-

10.1 INTRODUCTIONOPERATIONAL DATAASSUMPTIONSRESEARCH METHODOLOGY

-

10.2 ADAS & SAFETY SYSTEMSGOVERNMENT FOCUS ON VEHICLE SAFETY TO DRIVE MARKET

-

10.3 BODY CONTROL & COMFORT SYSTEMSFOCUS ON PROVIDING COMFORT AND CONVENIENCE TO CONSUMERS TO BOOST MARKET

-

10.4 ENGINE MANAGEMENT & POWERTRAININCREASING EMISSION CONCERNS TO FUEL MARKET

-

10.5 INFOTAINMENT SYSTEMSGROWING ADOPTION OF INFOTAINMENT SYSTEMS IN PASSENGER AND COMMERCIAL VEHICLES

-

10.6 COMMUNICATION SYSTEMSINCREASING DEMAND FOR HIGH-END COMMUNICATION PLATFORMS TO RAISE MARKET GROWTH

-

10.7 VEHICLE MANAGEMENT & TELEMATICSINCREASING DEMAND FOR FLEET MANAGEMENT AND VEHICLE MONITORING TO DRIVE MARKET

-

10.8 AUTONOMOUS DRIVINGRISING DEMAND FOR SELF-DRIVING CARS TO DRIVE MARKET

-

10.9 CONNECTED SERVICESOPTIMIZING VEHICLE MANAGEMENT AND FOCUS ON REAL-TIME SAFETY TO AMPLIFY MARKET

- 10.10 KEY PRIMARY INSIGHTS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICCHINA- Developed V2X networking to drive marketJAPAN- Standardization of ADAS features by Japanese OEMs to drive marketSOUTH KOREA- Increasing adoption of L2 autonomous vehicles to support market growthINDIA- Increasing demand for connected services to support market growthTHAILAND- Increasing focus on ADAS to support market growthREST OF ASIA PACIFIC

-

11.3 EUROPEGERMANY- Strong demand for premium cars to drive marketITALY- Focus on deployment of ADAS features by OEMs to drive marketFRANCE- Investments on autonomous mobility to support market growthUK- Government focus on connected and autonomous vehicles to drive marketSPAIN- Growing traffic and safety concerns to drive market growthREST OF EUROPE

-

11.4 NORTH AMERICAUS- Developments in autonomous driving to drive marketCANADA- Focus on autonomous driving to support market growthMEXICO- Increasing production of light trucks with telematics to drive market

-

11.5 LATIN AMERICABRAZIL- Adoption of advanced technologies to drive market growthARGENTINA- Rise in internet infrastructure to support market growthREST OF LATIN AMERICA

-

11.6 REST OF THE WORLDIRAN- Penetration of ADAS and safety features to drive marketSOUTH AFRICA- Focus on autonomous driving to support market growthOTHERS

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS

-

12.3 COMPETITIVE SCENARIODEALSEXPANSIONS

-

12.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPETITIVE LEADERSHIP MAPPING (OEMS)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.1 KEY PLAYERSBLACKBERRY LIMITED- Business overview- Products/Solutions offered- Recent developments- MnM viewAUTOMOTIVE GRADE LINUX- Business overview- Products/Solutions offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products/Solutions offered- Recent developments- MnM viewAPPLE INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewALPHABET INC.- Business overview- Products/Solutions offered- Recent developments- MnM viewGREEN HILLS SOFTWARE- Business overview- Products/Solutions offered- Recent developmentsNVIDIA CORPORATION- Business overview- Products/Solutions offered- Recent developmentsSIEMENS- Business overview- Products/Solutions offeredRED HAT, INC.- Business overview- Products/Solutions offered- Recent developmentsWIND RIVER SYSTEMS, INC.- Business overview- Products/Solutions offered- Recent developments

-

13.2 OTHER PLAYERSFORD MOTOR COMPANYTOYOTA MOTOR CORPORATIONMERCEDES-BENZ GROUP AGVOLKSWAGEN AGBMW AGHONDA MOTOR CO., LTD.GENERAL MOTORSNISSAN MOTOR CO., LTD.TESLA, INC.TATA MOTORSSUZUKI MOTOR CORPORATIONMAHINDRA & MAHINDRA LTD.STELLANTIS N.V.SAIC MOTOR CORPORATION LTD.VOLVO GROUP

- 14.1 ASIA PACIFIC TO BE SIGNIFICANT MARKET FOR AUTOMOTIVE OPERATING SYSTEMS

- 14.2 ANDROID EXPECTED TO BE PROMISING SEGMENT

- 14.3 AUTONOMOUS DRIVING TO EMERGE AS KEY APPLICATION SEGMENT

- 14.4 CONCLUSION

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 AUTOMOTIVE OPERATING SYSTEM MARKET DEFINITION, BY OPERATING SYSTEM TYPE

- TABLE 2 MARKET DEFINITION, BY ICE VEHICLE TYPE

- TABLE 3 MARKET DEFINITION, BY APPLICATION

- TABLE 4 MARKET DEFINITION, BY EV APPLICATION

- TABLE 5 MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 6 USD EXCHANGE RATES

- TABLE 7 VEHICLES WITH ADAS FEATURES IN INDIA

- TABLE 8 REQUIREMENT FOR AUTOMOTIVE OS

- TABLE 9 TOP 25 COUNTRIES WITH HIGHEST LUXURY CAR DENSITY

- TABLE 10 LUXURY CAR SALES WORLDWIDE (THOUSAND UNITS) BY GERMAN BRANDS IN 2018, 2019, AND 2020

- TABLE 11 TOP 20 LUXURY CARS IN INDIA

- TABLE 12 AUTONOMOUS DRIVING ATTEMPTS BY AUTOMAKERS

- TABLE 13 VEHICLES WITH LEVEL-2 & LEVEL-3 AUTONOMY (2017–2022)

- TABLE 14 BATTERY ELECTRIC VEHICLE SALES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 15 MAJOR AUTOMAKER ANNOUNCEMENTS ON ELECTRIFICATION, 2021–2022

- TABLE 16 PLUG-IN HYBRID ELECTRIC VEHICLE SALES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 17 TESLA EV PRICES FOR 2023 (NEW PRICES)

- TABLE 18 MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 19 MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 20 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 21 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 22 WORLD MOTOR VEHICLE PRODUCTION STATISTICS IN 2021 (THOUSAND UNITS)

- TABLE 23 IMPORTANT PATENT REGISTRATIONS RELATED TO AUTOMOTIVE OPERATING SYSTEMS

- TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 28 BENEFITS OF AUTOSAR FOR CONSORTIUMS

- TABLE 29 MOST LIKELY SCENARIO, BY REGION, 2022–2030 (USD MILLION)

- TABLE 30 OPTIMISTIC SCENARIO, BY REGION, 2022–2030 (USD MILLION)

- TABLE 31 PESSIMISTIC SCENARIO, BY REGION, 2022–2030 (USD MILLION)

- TABLE 32 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 33 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 34 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 35 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 36 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 37 MARKET, BY OPERATING SYSTEM TYPE, 2018–2021 (USD MILLION)

- TABLE 38 MARKET, BY OPERATING SYSTEM TYPE, 2022–2030 (USD MILLION)

- TABLE 39 ASSUMPTIONS: OPERATING SYSTEM TYPE

- TABLE 40 QNX OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 41 QNX OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 42 LINUX OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 43 LINUX OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 44 ANDROID OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 45 ANDROID OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 46 WINDOWS OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 47 WINDOWS OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 48 OTHER OPERATING SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 49 OTHER OPERATING SYSTEMS MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 50 MARKET, BY ICE VEHICLE TYPE, 2018–2021 (USD MILLION)

- TABLE 51 MARKET, BY ICE VEHICLE TYPE, 2022–2030 (USD MILLION)

- TABLE 52 ASSUMPTIONS: ICE VEHICLE TYPE

- TABLE 53 PASSENGER CARS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 PASSENGER CARS: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 55 L2: LAUNCH OF NEW SELF-DRIVING CARS, 2021–2022

- TABLE 56 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 57 LIGHT COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 58 HEAVY COMMERCIAL VEHICLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 59 HEAVY COMMERCIAL VEHICLES: MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 60 MARKET, BY EV APPLICATION, 2018–2021 (USD MILLION)

- TABLE 61 MARKET, BY EV APPLICATION, 2022–2030 (USD MILLION)

- TABLE 62 ASSUMPTIONS: EV APPLICATION

- TABLE 63 LEVEL 2 BEV CAR LAUNCHES, 2020-2022

- TABLE 64 CHARGING MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 65 CHARGING MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 66 BATTERY MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 67 BATTERY MANAGEMENT OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 68 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 69 MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 70 EUROPEAN COMMISSION NEW SAFETY FEATURES IN CARS

- TABLE 71 ASSUMPTIONS: APPLICATION

- TABLE 72 ADAS & SAFETY OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 73 ADAS & SAFETY OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 74 BODY CONTROL & COMFORT OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 75 BODY CONTROL & COMFORT OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 76 ENGINE MANAGEMENT & POWERTRAIN OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 77 ENGINE MANAGEMENT & POWERTRAIN OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 78 INFOTAINMENT OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 79 INFOTAINMENT OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 80 COMMUNICATION OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 81 COMMUNICATION OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 82 VEHICLE MANAGEMENT & TELEMATICS OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 83 VEHICLE MANAGEMENT & TELEMATICS OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 84 AUTONOMOUS DRIVING OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 85 AUTONOMOUS DRIVING OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 86 CONNECTED SERVICES OPERATING SYSTEM MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 87 CONNECTED SERVICES OPERATING SYSTEM MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 88 MARKET (ICE), BY REGION, 2018–2021 (USD MILLION)

- TABLE 89 MARKET (ICE), BY REGION, 2022–2030 (USD MILLION)

- TABLE 90 MARKET (EV), BY REGION, 2018–2021 (USD MILLION)

- TABLE 91 MARKET (EV), BY REGION, 2022–2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 94 C-V2X EQUIPPED VEHICLES LAUNCHED IN CHINA

- TABLE 95 NEW L2 LAUNCHES IN CHINA, 2021–2022

- TABLE 96 CHINA: VEHICLE LAUNCHES WITH ADAS FEATURES (2021–2022)

- TABLE 97 CHINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 98 CHINA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 99 NEW L2 LAUNCHES IN JAPAN, 2021–2022

- TABLE 100 JAPAN: VEHICLE LAUNCHES WITH ADAS FEATURES (2021–2022)

- TABLE 101 JAPAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 JAPAN: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 103 NEW L2 LAUNCHES IN SOUTH KOREA, 2020–2022

- TABLE 104 SOUTH KOREA: VEHICLE LAUNCHES WITH ADAS FEATURES (2021–2022)

- TABLE 105 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 106 SOUTH KOREA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 107 INDIA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 108 INDIA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 109 THAILAND: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 110 THAILAND: AUTOMOTIVE OPERATING SYSTEM MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 113 EUROPE:MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 115 LAUNCH/UNDERDEVELOPMENT OF SEMI-AUTONOMOUS CARS, 2021–2022

- TABLE 116 GERMANY: VEHICLE LAUNCHES WITH ADAS FEATURES (2021–2022)

- TABLE 117 GERMANY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 119 ITALY: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 120 ITALY: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 121 LAUNCH/UNDERDEVELOPMENT OF SEMI-AUTONOMOUS CARS, 2021–2023

- TABLE 122 FRANCE: VEHICLE LAUNCHES WITH ADAS FEATURES (2021–2022)

- TABLE 123 FRANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 124 FRANCE: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 125 UK: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 126 UK: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 127 UK: VEHICLE LAUNCHES WITH ADAS FEATURES (2020–2022)

- TABLE 128 SPAIN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 129 SPAIN: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 133 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: AUTONOMOUS VEHICLE EFFORTS

- TABLE 135 LAUNCH OF SEMI-AUTONOMOUS CARS, 2021–2023

- TABLE 136 US: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 137 US: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 138 CANADA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 139 CANADA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 140 MEXICO: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 141 MEXICO: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 142 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 143 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 144 BRAZIL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 145 BRAZIL: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 146 ARGENTINA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 147 ARGENTINA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 148 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 149 REST OF LATIN AMERICA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 150 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 151 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 152 IRAN: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 153 IRAN: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 154 SOUTH AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 155 SOUTH AFRICA: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 156 OTHERS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 157 OTHERS: MARKET, BY APPLICATION, 2022–2030 (USD MILLION)

- TABLE 158 MARKET: NEW PRODUCT LAUNCHES, 2022

- TABLE 159 MARKET: DEALS, 2021–2022

- TABLE 160 MARKET: EXPANSIONS, 2018

- TABLE 161 MARKET: COMPANY FOOTPRINT, 2022

- TABLE 162 MARKET: ICE VEHICLE TYPE FOOTPRINT, 2022

- TABLE 163 MARKET: REGIONAL FOOTPRINT, 2022

- TABLE 164 BLACKBERRY LIMITED: BUSINESS OVERVIEW

- TABLE 165 BLACKBERRY LIMITED: PRODUCTS OFFERED

- TABLE 166 BLACKBERRY LIMITED: KEY CUSTOMERS

- TABLE 167 BLACKBERRY LIMITED: NEW PRODUCT DEVELOPMENTS

- TABLE 168 BLACKBERRY LIMITED: DEALS

- TABLE 169 AUTOMOTIVE GRADE LINUX: BUSINESS OVERVIEW

- TABLE 170 AUTOMOTIVE GRADE LINUX: PRODUCTS OFFERED

- TABLE 171 AUTOMOTIVE GRADE LINUX: KEY CUSTOMERS

- TABLE 172 AUTOMOTIVE GRADE LINUX: DEALS

- TABLE 173 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 174 MICROSOFT CORPORATION: PRODUCTS OFFERED

- TABLE 175 MICROSOFT CORPORATION: KEY CUSTOMERS/PARTNERS

- TABLE 176 MICROSOFT CORPORATION: DEALS

- TABLE 177 APPLE INC.: BUSINESS OVERVIEW

- TABLE 178 APPLE INC.: PRODUCTS OFFERED

- TABLE 179 APPLE INC.: KEY CUSTOMERS

- TABLE 180 APPLE INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 181 ALPHABET INC.: BUSINESS OVERVIEW

- TABLE 182 ALPHABET INC.: KEY AUTOMOTIVE CUSTOMERS

- TABLE 183 ALPHABET INC.: PRODUCTS OFFERED

- TABLE 184 ALPHABET INC.: DEALS

- TABLE 185 GREEN HILLS SOFTWARE: BUSINESS OVERVIEW

- TABLE 186 GREEN HILLS SOFTWARE: PRODUCTS OFFERED

- TABLE 187 GREEN HILLS SOFTWARE: THIRD-PARTY PARTNERS

- TABLE 188 GREEN HILLS SOFTWARE: NEW PRODUCT DEVELOPMENTS

- TABLE 189 GREEN HILLS SOFTWARE: DEALS

- TABLE 190 GREEN HILLS SOFTWARE: OTHERS

- TABLE 191 NVIDIA CORPORATION: BUSINESS OVERVIEW

- TABLE 192 NVIDIA CORPORATION: KEY AUTOMOTIVE CUSTOMERS

- TABLE 193 NVIDIA CORPORATION: PRODUCTS OFFERED

- TABLE 194 NVIDIA CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 195 NVIDIA CORPORATION: DEALS

- TABLE 196 SIEMENS: BUSINESS OVERVIEW

- TABLE 197 SIEMENS: PRODUCTS OFFERED

- TABLE 198 RED HAT, INC.: BUSINESS OVERVIEW

- TABLE 199 RED HAT, INC.: PRODUCTS OFFERED

- TABLE 200 RED HAT, INC.: DEALS

- TABLE 201 WIND RIVER SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 202 WIND RIVER SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 203 WIND RIVER SYSTEMS, INC.: DEALS

- TABLE 204 FORD MOTOR COMPANY: BUSINESS OVERVIEW

- TABLE 205 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

- TABLE 206 MERCEDES-BENZ GROUP AG: BUSINESS OVERVIEW

- TABLE 207 VOLKSWAGEN AG: BUSINESS OVERVIEW

- TABLE 208 BMW AG: BUSINESS OVERVIEW

- TABLE 209 HONDA MOTOR CO., LTD.: BUSINESS OVERVIEW

- TABLE 210 GENERAL MOTORS: BUSINESS OVERVIEW

- TABLE 211 NISSAN MOTOR CO., LTD.: BUSINESS OVERVIEW

- TABLE 212 TESLA, INC.: BUSINESS OVERVIEW

- TABLE 213 TATA MOTORS: BUSINESS OVERVIEW

- TABLE 214 SUZUKI MOTOR CORPORATION: BUSINESS OVERVIEW

- TABLE 215 MAHINDRA & MAHINDRA LTD.: BUSINESS OVERVIEW

- TABLE 216 STELLANTIS N.V.: BUSINESS OVERVIEW

- TABLE 217 SAIC MOTOR CORPORATION LTD.: BUSINESS OVERVIEW

- TABLE 218 VOLVO GROUP: BUSINESS OVERVIEW

- FIGURE 1 AUTOMOTIVE OPERATING SYSTEM MARKETS COVERED

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE: BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH: MARKET

- FIGURE 8 MARKET ESTIMATION NOTES

- FIGURE 9 MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ICE VEHICLES – DEMAND SIDE

- FIGURE 10 MARKET: RESEARCH DESIGN AND METHODOLOGY FOR ELECTRIC VEHICLES – DEMAND SIDE

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 FACTOR ANALYSIS: MARKET

- FIGURE 13 MARKET OVERVIEW

- FIGURE 14 MARKET, BY REGION, 2022–2030

- FIGURE 15 MARKET, BY OPERATING SYSTEM, 2022–2030

- FIGURE 16 KEY PLAYERS INAUTOMOTIVE OPERATING SYSTEM MARKET

- FIGURE 17 INCREASING INCLINATION TOWARD ADAS TECHNOLOGY AND AUTONOMOUS MOBILITY TO DRIVE MARKET GROWTH

- FIGURE 18 ASIA PACIFIC PROJECTED TO BE LEADING MARKET (USD MILLION)

- FIGURE 19 QNX ESTIMATED TO BE DOMINANT SEGMENT (USD MILLION)

- FIGURE 20 ADAS & SAFETY SYSTEMS TO BE LARGEST SEGMENT (USD MILLION)

- FIGURE 21 BATTERY MANAGEMENT SYSTEMS TO REMAIN DOMINANT SEGMENT (USD MILLION)

- FIGURE 22 PASSENGER CARS TO HOLD MAJOR SHARE, 2022 VS. 2030 (USD MILLION)

- FIGURE 23 MARKET DYNAMICS

- FIGURE 24 ROAD TRAFFIC DEATHS FACT

- FIGURE 25 AUTONOMOUS LEVELS WITH REQUIRED ADAS FEATURES

- FIGURE 26 DOMAIN CONTROLLER FUNCTIONALITY

- FIGURE 27 HNWI AND UHNWI, BY GEOGRAPHY

- FIGURE 28 LUXURY CAR MARKET GROWTH

- FIGURE 29 DOMAIN EXPANSION IN AUTOMOTIVE SECTOR

- FIGURE 30 CONVENTIONAL VEHICLES VS SOFTWARE-DEFINED VEHICLES

- FIGURE 31 LEVELS OF AUTONOMOUS DRIVING

- FIGURE 32 GLOBAL PHEV CAR STOCK, 2017–2021, BY REGION/COUNTRY

- FIGURE 33 REVENUE SHIFT DRIVING MARKET

- FIGURE 34 PORTER’S FIVE FORCES: MARKET

- FIGURE 35 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 36 SUPPLY CHAIN ANALYSIS OF MARKET FOR AUTOMOTIVE OS

- FIGURE 37 V-MODEL OF AUTOMOTIVE SOFTWARE DEVELOPMENT

- FIGURE 38 EVOLUTION OF DOMAIN CENTRALIZATION ARCHITECTURE

- FIGURE 39 ECU CONSOLIDATION AND RESULTING IMPLICATIONS

- FIGURE 40 DATA FROM AN AUTONOMOUS VEHICLE

- FIGURE 41 SOCIETY OF AUTOMOTIVE ENGINEERS AUTOMATION LEVELS

- FIGURE 42 3-LAYERED AUTOSAR SOFTWARE ARCHITECTURE

- FIGURE 43 MARKET – FUTURE TRENDS AND SCENARIOS, 2022–2030 (USD MILLION)

- FIGURE 44 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- FIGURE 45 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- FIGURE 46 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- FIGURE 47 PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 (UNITS)

- FIGURE 48 QNX SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- FIGURE 49 PASSENGER CARS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- FIGURE 50 BATTERY MANAGEMENT SYSTEMS SEGMENT ESTIMATED TO HOLD LARGER MARKET SHARE, BY VALUE, IN 2022

- FIGURE 51 ADAS & SAFETY SYSTEMS SEGMENT ESTIMATED TO HOLD LARGEST MARKET SHARE, BY VALUE, IN 2022

- FIGURE 52 ADAS FEATURE OFFERING BY VEHICLE HARDWARE

- FIGURE 53 MARKET, BY REGION, 2022 VS. 2030

- FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 55 EUROPE: MARKET, 2022 VS. 2030 (USD MILLION)

- FIGURE 56 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 57 LATIN AMERICA: MARKET SNAPSHOT

- FIGURE 58 REST OF THE WORLD: MARKET SNAPSHOT

- FIGURE 59 MARKET: MARKET RANKING 2022

- FIGURE 60 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 61 MARKET: OEM EVALUATION QUADRANT, 2022

- FIGURE 62 BLACKBERRY LIMITED: COMPANY SNAPSHOT

- FIGURE 63 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 APPLE INC.: COMPANY SNAPSHOT

- FIGURE 65 ALPHABET INC.: COMPANY SNAPSHOT

- FIGURE 66 GOOGLE SERVICES REVENUE SHARE, BY TYPE (2021)

- FIGURE 67 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 NVIDIA CORPORATION’S REVENUE SHARE, BY SPECIALIZED MARKETS (2020)

- FIGURE 69 NVIDIA DRIVE PARTNER ECOSYSTEM

- FIGURE 70 SIEMENS: COMPANY SNAPSHOT

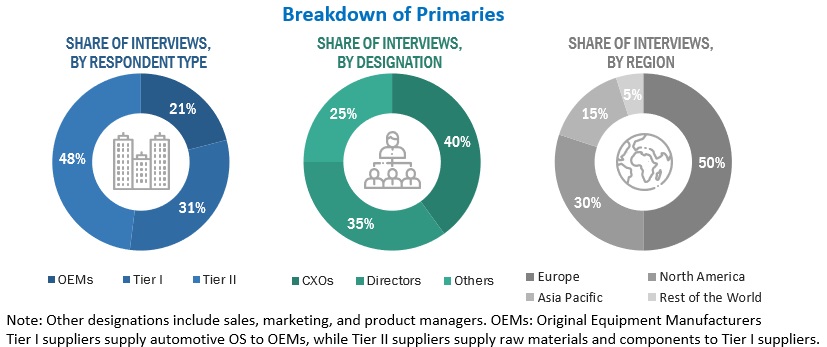

The study involves 4 main activities to estimate the current size of the automotive operating system market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size of different segments considered in this study. Market breakdown and data triangulation were then used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications [for example, International Organization of Motor Vehicle Manufacturers (OICA), National Highway Traffic Safety Administration (NHTSA), International Energy Association (IEA)], articles, directories, technical handbooks, trade websites, technical articles, and databases (for example, Marklines, and Factiva) have been used to identify and collect information useful for an extensive commercial study of the global automotive operating system market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive operating system market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (automotive OEMs) and supply (automotive operating system providers, Tier I suppliers, software providers, and technology providers) sides across major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 30% and 70% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing, were covered to provide a holistic viewpoint in the report. After interacting with industry experts, brief sessions were also conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches were used to estimate and validate the size of the automotive operating system market. The market size, by application, in terms of value, was derived by applying the penetration rate to passenger car and commercial vehicle production data for different applications such as ADAS & safety systems, control & comfort systems, connected services, autonomous driving, and communication systems, among others. Post that, multiplying the derived penetration rates with the number of ECUs and cost of OS from overall license per ECUs with vehicle production led to the value of the market by country level. Further, the summation of all countries leads to the regional level market in terms of value.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

-

To analyze the automotive operating system market and forecast its size, in terms of value (USD million), from 2018 to 2030

- To analyze the market and forecast its size in terms of value (USD million) based on operating system type (Android, Linux, QNX, Windows, and others)

- To forecast the market size, in terms of value (USD million), based on ICE vehicle type (passenger cars, light commercial vehicles, and heavy commercial vehicles)

- To analyze the market and forecast its size in terms of value (USD million) based on EV application (charging management system and battery management system)

- To analyze the market and provide forecasts based on application (ADAS & safety systems, body control & comfort system, engine management & powertrain, infotainment system, communication system, vehicle management & telematics, autonomous driving, and connected services)

- To analyze the market and forecast its size in terms of value (USD million) based on region (Asia Pacific, Europe, North America, Latin America, and RoW)

- To provide detailed information about the factors influencing the market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies

- To analyze the opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze the competitive developments such as joint ventures, mergers & acquisitions, product enhancement, expansions, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

- Automotive operating system market, By ICE vehicle type, at the country level (For countries covered in the report)

-

Company Information

- Profiling of Additional Market Players (Up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive Operating System Market