Bare Metal Cloud Market by Service Type (Compute, Networking, Database, Security, Storage, Managed), Organization Size (Large, SMEs), Vertical (BFSI, Healthcare & Life Sciences, Manufacturing) and Region - Global Forecast to 2028

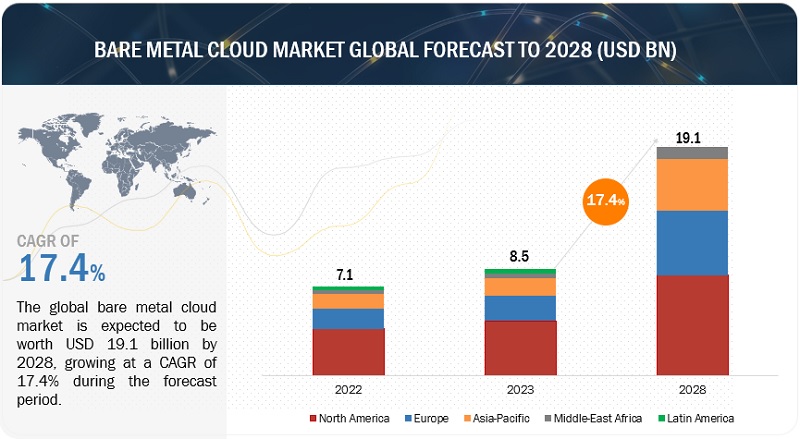

The global bare metal cloud market size accounted for USD 8.5 Billion in 2023 and is estimated to achieve a market size of USD 19.1 Billion by 2028 growing at a CAGR of 17.4% from 2023 to 2028.

The emergence of bare metal cloud services represents a pivotal shift in cloud computing, driven by the evolving demands of businesses and organizations. Unlike traditional virtualized cloud instances, bare metal cloud services provide dedicated physical servers, offering a compelling solution for workloads requiring high performance, low latency, and uncompromising control. This evolution has been spurred by the rising adoption of data-intensive technologies such as AI, IoT, and big data analytics, which demand raw computing power. Bare metal cloud services have become an essential part of the cloud ecosystem, offering an alternative to traditional virtualized cloud instances for businesses with specific performance, security, and control requirements. The evolution of bare metal cloud services reflects the ongoing shift toward more specialized and customizable cloud infrastructure options.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Bare Metal Cloud Market

The global recession caused by factors such as the Russia-Ukraine war, the pandemic, inflation, rising interest rates, and oil prices has reduced organizations’ spending on cloud services, which may impact the demand for bare metal cloud services in the short run. The ongoing recession, the Russia-Ukraine conflict, rising oil prices, and the global COVID-19 pandemic have significantly shaped the bare metal cloud market landscape. These events can influence numerous market aspects, including adoption rates, customer priorities, and vendor strategies. Recessions can drive companies to shift from capital expenditures (CapEx) to operational expenditures (OpEx) to manage costs better. Cloud services, including bare metal cloud, can align with this shift. In addition, the Russia-Ukraine war might impact the supply chains, including the availability of hardware components required for bare metal cloud infrastructure. This could affect the provisioning and expansion of bare metal cloud services.

Bare Metal Cloud Market Dynamics

Driver: Need for high-performance computing to support resource-intensive applications

The surging demand for high-performance computing (HPC) is a driving force behind the rapid expansion of the market, with the adoption of applications such as complex simulations, scientific research, AI/ML model training, and real-time data analytics, demand substantial computational power, memory, and I/O throughput. According to a report by MarketsandMarkets, the global HPC market is projected to grow from USD 37.8 billion in 2020 to USD 49.4 billion by 2025, indicating the escalating need for computational power across industries. Furthermore, the emergence of edge computing, driven by the Internet of Things (IoT), intensifies the requirement for localized, high-performance data processing, pushing the edge computing market. The market is forecasted to grow substantially in response to these trends. High-performance computing is shaping the trajectory of the bare metal cloud market as organizations increasingly seek dedicated and robust hardware solutions to cater to resource-intensive workloads and capitalize on the performance advantages offered by bare metal cloud services.

Restraint: Stringent cloud regulations

The growth trajectory of the market is encountering hurdles due to the prevalence of stringent cloud regulations. While bare metal cloud solutions offer performance advantages, the complex data protection and compliance landscape hinders its wider adoption. In the financial sector, for instance, where regulatory requirements like the European Union’s MiFID II and the Dodd-Frank Act demand robust data controls, 69% of financial firms find it challenging to implement cloud solutions that align with these regulations, as reported by Druva’s 2021 Ransomware and Cloud Data Security Survey. Similarly, the healthcare industry faces obstacles; a survey by HIMSS found that 44% of healthcare IT professionals consider regulatory compliance a barrier to cloud adoption. These statistics depict the impact of stringent regulations on specific industries. As organizations struggle to navigate the intricate network of compliance regulations, the expansion of the bare metal cloud market could be restricted. This situation underscores the necessity for customized solutions that simultaneously cater to performance prerequisites and regulatory obligations.

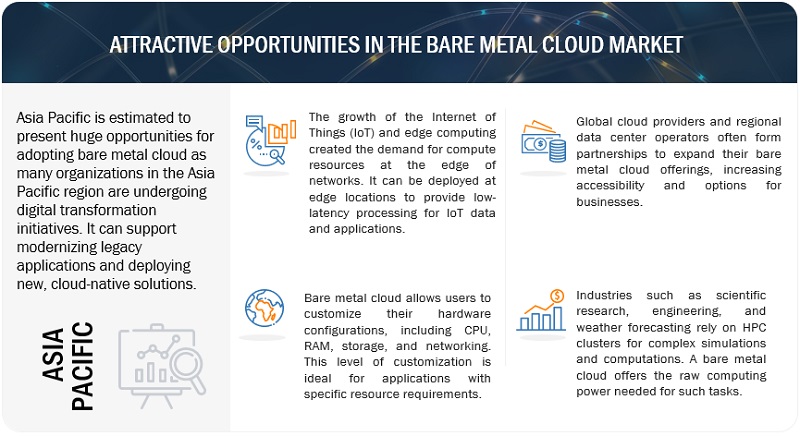

Opportunity: Growing adoption of edge computing infrastructure for real-time data processing

Edge computing presents significant opportunities for adopting bare metal cloud solutions, revolutionizing how organizations process data at the network’s edge. As the Internet of Things (IoT) and real-time applications increase, the need for rapid data processing closer to data sources has become paramount. This is where edge computing comes into play, enabling quicker decision-making, reduced latency, and enhanced user experiences. Bare metal cloud, with its dedicated physical servers and high-performance characteristics, aligns seamlessly with the requirements of edge computing. By offering localized processing power without the virtualization overhead, the bare metal cloud supports the resource-intensive demands of edge applications, ensuring swift data analysis and responses. Industries such as manufacturing, retail, and healthcare, where immediate insights and actions are crucial, stand to benefit immensely from this synergy. The ability of the bare metal cloud to deliver unparalleled performance at the edge while maintaining the scalability and management advantages of cloud services positions it as a powerful enabler for the expanding landscape of edge computing applications.

Challenge: Lack of isolation in multi-tenant environments

The absence of effective isolation in multi-tenant environments poses a significant challenge in adopting bare metal cloud services. The risk of security breaches and unauthorized data access increases substantially in a bare metal cloud setup lacking proper isolation mechanisms. Moreover, the performance predictability of bare metal servers, a key driver for adoption, is compromised, as evidenced by an average 30% degradation in performance due to interference from co-located workloads as per the TechCloud Performance Report, 2020. As industries fight with stringent compliance mandates, the inadequacy of isolation exposes organizations to potential violations. This challenge underscores the pressing need for bare metal cloud providers to implement robust isolation measures that safeguard data, ensure consistent performance, and instill confidence among enterprises considering this technology for their mission-critical workloads.

The Bare Metal Cloud market Ecosystem

The SME segment is projected to witness the highest CAGR during the forecast period based on organization size.

SMEs look forward to adopting the cloud and analytics to improve operations and become more efficient. SMEs often lack the resources for extensive in-house data centers and infrastructure management. Thus, small and medium-sized enterprises (SMEs) increasingly recognize the need for bare metal cloud solutions to address their unique IT requirements. These businesses often face resource-intensive workloads, stringent security demands, and cost constraints. The bare metal cloud offers SMEs dedicated physical servers, ensuring consistent performance without the virtualization overhead, making it ideal for mission-critical applications and data-sensitive tasks. Additionally, the flexibility to scale resources up or down as needed, combined with predictable pricing models, enables SMEs to optimize their IT budgets effectively. In a rapidly evolving digital landscape, the bare metal cloud empowers SMEs to compete effectively, ensuring high performance, reliability, and cost-efficiency for their IT operations.

By Vertical, the retail & consumer goods segment is expected to grow at the second-highest CAGR during the forecast period.

The retail and consumer goods industry is witnessing a substantial uptake of bare metal cloud technology, revolutionizing how businesses operate and serve their customers. Retail giants such as Amazon and Walmart have embraced bare metal cloud solutions to bolster their eCommerce platforms and streamline their supply chain operations. Amazon’s utilization of bare metal cloud servers has allowed them to efficiently handle the surges in web traffic during major sales events, ensuring uninterrupted shopping experiences for millions of customers. Moreover, the enhanced performance and security provided by the bare metal cloud help organizations safeguard customer data and enable personalized shopping experiences. As retailers continue to harness the power of data analytics and AI-driven applications, the bare metal cloud’s flexibility and scalability are essential in delivering the seamless and responsive services that modern consumers expect.

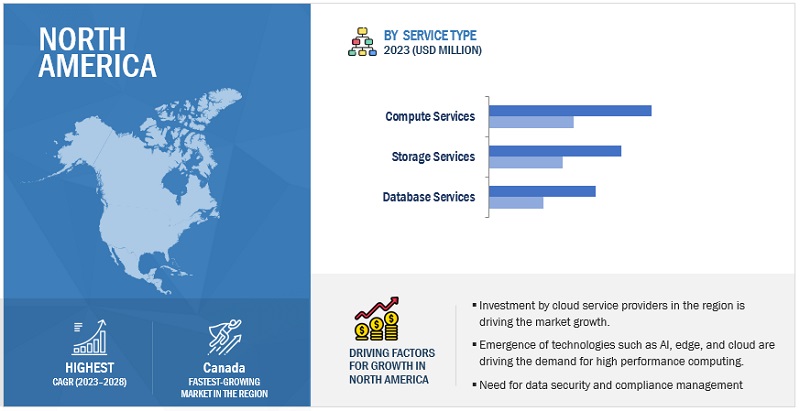

Based on Region, North America is expected to hold the largest market share during the forecast period.

The market in North America is experiencing robust growth driven by a convergence of factors. One key driver is the region’s insatiable appetite for high-performance computing (HPC) resources, as exemplified by research institutions and academic organizations necessitating robust infrastructure for scientific simulations and data analysis. In May 2023, Applied Digital Corporation, a company specializing in creating and managing advanced digital infrastructure tailored for (HPC) applications across North America, unveiled its new AI Cloud offerings. These services are designed to deliver high-performance computing capabilities for a wide range of AI applications, encompassing tasks such as extensive language model training and graphics rendering. Concurrently, the adoption of cutting-edge technologies such as AI and ML is accelerating, with North America accounting for a significant share of global AI software revenue. In addition, Government investments in hybrid and multi-cloud solutions in North America are on the rise, reflecting the public sector’s commitment to modernizing its IT infrastructure, enhancing services, and improving cost efficiency. The Canadian government has implemented a Cloud First policy, promoting the use of cloud solutions, including hybrid and multi-cloud, to enhance the delivery of digital services. This policy has led to investments in hybrid cloud architectures to meet the demands of various government departments. This is expected to drive the bare metal cloud market in the region.

Key Market Players

The bare metal cloud market is dominated by a few globally established players such as IBM (US), Oracle (US), AWS (US), Lumen (US), and Rackspace (US), among others, are the key vendors that secured bare metal cloud contracts in last few years. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the market.

Want to explore hidden markets that can drive new revenue in Bare Metal Cloud Market?

Scope of the Report

Scope of the Report

Want to explore hidden markets that can drive new revenue in Bare Metal Cloud Market?

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Service Type, Organization Size, Vertical, and Region. |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), AWS (US), Lumen (US), Rackspace (US), Internap (US), Dell (US), Equinix (US), Google (US), Microsoft (US), Alibaba Cloud (China), Scaleway (France), Joyent (US), HPE (US), OVHcloud (France), Limestone Networks (US), GoDaddy (US), phoenixNAP (US), Hetzner (Germany), Huawei Cloud (China), Pure Storage (US), DartPoints (US), Bigstep (UK), Oman Data Park (UK), Gcore (Luxembourg), Zenlayer (US), Vultr (US), RedSwitches (US), HostinRaja (India), Cherry Servers (Lithuania), and Cox Edge (US). |

This research report categorizes the bare metal cloud market to forecast revenue and analyze trends in each of the following submarkets:

Based on Service Type:

- Compute Services

- Networking Services

- Database Services

- Security Services

- Storage Services

- Managed Services

- Other Service Type

Based on Organization Size:

- Large Enterprises

- SMEs

Based on Vertical:

- BFSI

- Retail & Consumer Goods

- IT & ITeS

- Telecommunications

- Healthcare & Life Sciences

- Manufacturing

- Media & Entertainment

- Government

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In September 2023, New SmartNIC introduced enhancements to IBM Cloud Bare Metal Servers VPC. It integrated with a customer’s complete IBM Cloud Virtual Private Cloud (VPC) environment. It offered identical networking, storage, and Platform as a Service (PaaS) capabilities as IBM Cloud Virtual Servers within the VPC. Provisioning bare metal servers would be aligned with providing virtual servers, simplifying automation, and enhancing usability.

- In March 2022, Oracle introduced 11 new computing services, including computing, networking, and storage services and capabilities that enable customers to run their workloads faster and more securely at lower costs. The OCI compute services include container instances, AMD E4, Dense Compute Instances, and Oracle Cloud VMware Solution on AMD. The OCI network services included Flexible Web Application Firewall, Web Application Acceleration, Network Visualizer, and vTAP, and storage services included Flexible Block Volumes with Performance-based Auto-tuning and High Availability ZFS.

- In November 2022, Amazon EC2 M6i and C6i bare metal instances were introduced, powered by 3rd-generation Intel Xeon Scalable processors (code-named Ice Lake). These instances were suitable for various types of workloads. M6i was designed for web and application servers, backend servers supporting enterprise applications, gaming servers, caching fleets, and application development environments. C6i instances are designed for compute-intensive applications like batch processing, distributed analytics, HPC, ad serving, highly scalable multiplayer gaming, and video encoding.

- In February 2021, Lumen partnered with VMware to interconnect the VMware Tanzu Basic edition with the Lumen Edge bare metal service, enabling businesses to create a secure software supply chain to rapidly deploy new edge-native workloads with resilient edge computing solutions to drive the next wave of digital innovation.

Frequently Asked Questions (FAQ):

What is a bare metal cloud?

A bare metal cloud designates a service that can provision bare metal servers with varied capabilities (compute, storage, and network) to customers on demand through a cloud pay-as-you-go model. Bare metal cloud provides the customer access to a dedicated server without virtualization. The absence of virtualization allows access to the server’s direct hardware processing power, with the ability to provision workloads—without the overhead of the virtualization layer.

Which country is the early adopter of bare metal cloud?

The US is at the initial stage of adopting bare metal cloud.

Which are the key vendors exploring the bare metal cloud market?

Some of the major vendors offering bare metal cloud across the globe include IBM (US), Oracle (US), AWS (US), Lumen (US), Rackspace (US), Internap (US), Dell (US), Equinix (US), Google (US), Microsoft (US), Alibaba Cloud (China), Scaleway (France), Joyent (US), HPE (US), OVHcloud (France), Limestone Networks (US), GoDaddy (US), phoenixNAP (US), Hetzner (Germany), Huawei Cloud (China), Pure Storage (US), DartPoints (US), Bigstep (UK), Oman Data Park (UK), Gcore (Luxembourg), Zenlayer (US), Vultr (US), RedSwitches (US), HostinRaja (India), Cherry Servers (Lithuania), and Cox Edge (US).

What is the total CAGR expected to be recorded for the Bare metal cloud market during 2023-2028?

The Bare metal cloud market is expected to record a CAGR of 17.4% from 2023-2028

What is the projected market value of the bare metal cloud market?

The market size is expected to grow from USD 8.5 billion in 2023 to USD 19.1 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.4% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need for high-performance computing to support resource-intensive applications- Growth in demand for delivering high-bandwidth connectivity and scalability- Increase in requirement for enhanced security and compliance to operate in secure environments- Absence of noisy neighbor concern and hypervisor taxRESTRAINTS- High implementation costs- Stringent cloud regulationsOPPORTUNITIES- Rise in adoption of edge computing infrastructure for real-time data processing- Growth in adoption of big data and DevOps applications- Emergence of AI and ML applicationsCHALLENGES- Lack of isolation in multi-tenant environments- Integration with virtualized environments

-

5.3 CASE STUDY ANALYSISRACKSPACE HELPED UNDER ARMOUR HOST HIGH-DEMAND ECOMMERCE AND BRAND EXPERIENCE SITESSOVRN UTILIZED INAP BARE METAL AND NETWORK SOLUTIONS TO POWER LEADING AD TECHNOLOGYSCALEWAY IMPLEMENTED DEDICATED DEDIBOX SERVERS TO ACHIEVE UPTIME AND AVAILABILITY REQUIRED FOR SERVICESGLOBAL GAMING COMPANY UTILIZED ZENLAYER BARE METAL CLOUD TO QUICKLY PROVISION SERVERS AND MEET USER NEEDS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 TECHNOLOGICAL ANALYSISPROVISIONING AND ORCHESTRATIONEDGE COMPUTINGHIGH-PERFORMANCE COMPUTINGBIG DATA AND ANALYTICSSOFTWARE-DEFINED NETWORKINGAI AND MACHINE LEARNING

- 5.7 INDICATIVE PRICING ANALYSIS

- 5.8 BUSINESS MODEL ANALYSIS

-

5.9 PATENT ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES AND EVENTS

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin America

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

5.14 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONSERVICE TYPE: MARKET DRIVERS

-

6.2 COMPUTE SERVICESDEMAND FOR HIGH-PERFORMANCE COMPUTING RESOURCES

-

6.3 NETWORKING SERVICESINCREASE IN REQUIREMENT FOR HIGH-SPEED NETWORK CONNECTIONS

-

6.4 DATABASE SERVICESNEED FOR SCALABLE DATA STORAGE AND MANAGEMENT

-

6.5 SECURITY SERVICESPROTECTION AGAINST THREATS AND VULNERABILITIES

-

6.6 STORAGE SERVICESACCOMMODATION OF RETIREMENT STRUCTURES FOR DIVERSE WORKFORCES AND GLOBAL OPERATIONS, CURRENCIES, AND REGULATIONS

-

6.7 MANAGED SERVICESSIMPLIFIED SERVER MANAGEMENT, SECURITY, AND OPTIMIZED PERFORMANCE

- 6.8 OTHER SERVICE TYPES

-

7.1 INTRODUCTIONORGANIZATION SIZE: BARE METAL CLOUD MARKET DRIVERS

-

7.2 SMALL & MEDIUM-SIZED ENTERPRISESNEED FOR COST-EFFECTIVE INFRASTRUCTURE MANAGEMENT

-

7.3 LARGE ENTERPRISESDEMAND FOR IMPROVED PERFORMANCE AND SECURITY

-

8.1 INTRODUCTIONVERTICAL: MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)DEMAND FOR HIGH PERFORMANCE, SECURITY, AND COMPLIANCE

-

8.3 IT & ITESTECHNOLOGICAL DEMAND FOR HIGH AVAILABILITY AND LOW LATENCY

-

8.4 TELECOMMUNICATIONSGREATER NEED FOR ENHANCING PERFORMANCE AND RELIABILITY

-

8.5 RETAIL & CONSUMER GOODSBENEFITS OF ENHANCED CUSTOMER EXPERIENCES

-

8.6 MANUFACTURINGDIGITALIZATION AND AUTOMATION IN INTEREST OF DRIVING EFFICIENCY, REDUCING COST, AND ENHANCING PERFORMANCE

-

8.7 HEALTHCARE & LIFE SCIENCESTECHNOLOGICAL ADOPTION FOR ENHANCED PATIENT CARE

-

8.8 MEDIA & ENTERTAINMENTRISE IN DEMAND FOR HIGH-PERFORMANCE SERVERS FOR CONTENT DELIVERY AND STREAMING

-

8.9 GOVERNMENTNECESSITY FOR ENHANCED SECURITY, PERFORMANCE, AND CONTROL

- 8.10 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: BARE METAL CLOUD MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Adoption of cloud and edge computing technologiesCANADA- Government initiatives with increase in compute capacity

-

9.3 EUROPEEUROPE: BARE METAL CLOUD MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Increase in presence of major cloud providersGERMANY- Investment in AI research and connected vehiclesFRANCE- Adoption across cloud solutions and presence of research institutions and supercomputing centersREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: BARE METAL CLOUD MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Well-developed technological infrastructureJAPAN- Investment in IoT, Industry 4.0, and Society 5.0INDIA- Developments in IT infrastructure with national strategiesREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Government support for cloud adoption with initiatives such as Saudi Vision 2030UNITED ARAB EMIRATES- Significant investments from cloud service providers with UAE Cloud First PolicyREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: BARE METAL CLOUD MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Investments from hyperscale cloud service providersMEXICO- Major digital transformation in service provision technologiesREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS’ STRATEGIES

- 10.3 MARKET SHARE ANALYSIS

- 10.4 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

-

10.5 KEY COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT FOR KEY PLAYERS

-

10.6 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.7 COMPANY FINANCIAL METRICS

- 10.8 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 10.9 COMPETITIVE SCENARIO

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewLUMEN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRACKSPACE- Business overview- Products/Solutions/Services offered- MnM viewINTERNAP- Business overview- Products/Solutions/Services offeredDELL- Business overview- Products/Solutions/Services offered- Recent developmentsEQUINIX- Business overview- Products/Solutions/Services offered- Recent developmentsGOOGLE- Business overview- Products/Solutions/Services offered- Recent developmentsMICROSOFT- Business overview- Products/Solutions/Services offeredALIBABA CLOUDSCALEWAYJOYENTHPEOVHCLOUDLIMESTONE NETWORKSGO DADDYPHOENIXNAPHETZNERHUAWEI CLOUDPURE STORAGE

-

11.3 STARTUPS/SMESDARTPOINTSBIGSTEPOMAN DATA PARKGCOREZENLAYERVULTRREDSWITCHESHOSTINGRAJACHERRY SERVERSCOX EDGE

- 12.1 INTRODUCTION

- 12.2 INFRASTRUCTURE AS A SERVICE MARKET

- 12.3 CLOUD SERVICES BROKERAGE MARKET

- 12.4 CLOUD COMPUTING MARKET

- 12.5 IDENTITY AND ACCESS MANAGEMENT MARKET

- 12.6 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2015–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RESEARCH ASSUMPTIONS

- TABLE 4 PRICING ANALYSIS OF VENDORS IN BARE METAL CLOUD MARKET, BY SERVICE TYPE

- TABLE 5 US: TOP TEN PATENT APPLICANTS, 2022

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES

- TABLE 7 MARKET: KEY CONFERENCES AND EVENTS, 2023 & 2024

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATIONS

- TABLE 13 EUROPE: REGULATIONS

- TABLE 14 ASIA PACIFIC: REGULATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATIONS

- TABLE 16 LATIN AMERICA: REGULATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END USERS

- TABLE 18 KEY BUYING CRITERIA FOR END USERS

- TABLE 19 MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 20 MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 21 BARE METAL CLOUD COMPUTE SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 BARE METAL CLOUD COMPUTE SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 BARE METAL CLOUD NETWORKING SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 BARE METAL CLOUD NETWORKING SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 BARE METAL CLOUD DATABASE SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 BARE METAL CLOUD DATABASE SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 BARE METAL CLOUD SECURITY SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 BARE METAL CLOUD SECURITY SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 BARE METAL CLOUD STORAGE SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 BARE METAL CLOUD STORAGE SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 BARE METAL CLOUD MANAGED SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 BARE METAL CLOUD MANAGED SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 OTHER BARE METAL CLOUD SERVICE TYPES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 OTHER BARE METAL CLOUD SERVICE TYPES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 36 MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 37 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 SMALL & MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 LARGE ENTERPRISES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 LARGE ENTERPRISES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 BARE METAL CLOUD MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 42 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 43 MARKET IN BFSI VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 MARKET IN BFSI VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MARKET IN IT & ITES VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 MARKET IN IT & ITES VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 MARKET IN TELECOMMUNICATIONS VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 MARKET IN TELECOMMUNICATIONS VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 MARKET IN RETAIL & CONSUMER GOODS VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 MARKET IN RETAIL & CONSUMER GOODS VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MARKET IN MANUFACTURING VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 MARKET IN MANUFACTURING VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MARKET IN GOVERNMENT VERTICAL, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 MARKET IN GOVERNMENT VERTICAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MARKET IN OTHER VERTICALS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 MARKET IN OTHER VERTICALS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: BARE METAL CLOUD MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 US: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 72 US: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 80 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 82 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 UK: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 84 UK: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 86 GERMANY: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 87 FRANCE: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 88 FRANCE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 100 CHINA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 101 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 102 JAPAN: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 103 INDIA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 104 INDIA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 KSA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 116 KSA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 117 UAE: BARE METAL CLOUD MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 118 UAE: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 119 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 120 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 122 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 123 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 124 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 125 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 126 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 128 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 129 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 130 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 131 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 132 MEXICO: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 133 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 134 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 MARKET: DEGREE OF COMPETITION

- TABLE 136 COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 137 COMPANY FOOTPRINT FOR STARTUP/SMES

- TABLE 138 DETAILS OF KEY STARTUPS/SMES

- TABLE 139 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 140 MARKET: DEALS, 2020–2023

- TABLE 141 IBM: BUSINESS OVERVIEW

- TABLE 142 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 144 IBM: DEALS

- TABLE 145 ORACLE: BUSINESS OVERVIEW

- TABLE 146 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 148 ORACLE: DEALS

- TABLE 149 AWS: BUSINESS OVERVIEW

- TABLE 150 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 152 AWS: DEALS

- TABLE 153 LUMEN: BUSINESS OVERVIEW

- TABLE 154 LUMEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 LUMEN: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 156 LUMEN: DEALS

- TABLE 157 RACKSPACE: BUSINESS OVERVIEW

- TABLE 158 RACKSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 INTERNAP: BUSINESS OVERVIEW

- TABLE 160 INTERNAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 DELL: BUSINESS OVERVIEW

- TABLE 162 DELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 DELL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 164 EQUINIX: BUSINESS OVERVIEW

- TABLE 165 EQUINIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 EQUINIX: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 167 EQUINIX: DEALS

- TABLE 168 GOOGLE: BUSINESS OVERVIEW

- TABLE 169 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 171 MICROSOFT: BUSINESS OVERVIEW

- TABLE 172 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 RELATED MARKETS

- TABLE 174 IAAS MARKET, BY SOLUTION, 2013–2020 (USD MILLION)

- TABLE 175 IAAS MARKET, BY END USER, 2013–2020 (USD MILLION)

- TABLE 176 IAAS MARKET, BY DEPLOYMENT TYPE, 2013–2020 (USD BILLION)

- TABLE 177 IAAS MARKET, BY VERTICAL, 2013–2020 (USD MILLION)

- TABLE 178 IAAS MARKET, BY REGION, 2013–2020 (USD MILLION)

- TABLE 179 CLOUD SERVICES BROKERAGE MARKET, BY SERVICE TYPE, 2016–2019 (USD MILLION)

- TABLE 180 CLOUD SERVICES BROKERAGE MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

- TABLE 181 CLOUD SERVICES BROKERAGE MARKET, BY PLATFORM, 2016–2019 (USD MILLION)

- TABLE 182 CLOUD SERVICES BROKERAGE MARKET, BY PLATFORM, 2020–2025 (USD MILLION)

- TABLE 183 CLOUD SERVICES BROKERAGE MARKET, BY DEPLOYMENT MODEL, 2016–2019 (USD MILLION)

- TABLE 184 CLOUD SERVICES BROKERAGE MARKET, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

- TABLE 185 CLOUD SERVICES BROKERAGE MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

- TABLE 186 CLOUD SERVICES BROKERAGE MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD MILLION)

- TABLE 187 CLOUD SERVICES BROKERAGE MARKET, BY VERTICAL, 2016–2019 (USD MILLION)

- TABLE 188 CLOUD SERVICES BROKERAGE MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 189 CLOUD SERVICES BROKERAGE MARKET, BY REGION, 2020–2025 (USD MILLION)

- TABLE 190 CLOUD SERVICES BROKERAGE MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

- TABLE 191 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 192 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 193 CLOUD COMPUTING MARKET, BY IAAS, 2017–2021 (USD BILLION)

- TABLE 194 CLOUD COMPUTING MARKET, BY IAAS, 2022–2027 (USD BILLION)

- TABLE 195 CLOUD COMPUTING MARKET, BY PAAS, 2017–2021 (USD BILLION)

- TABLE 196 CLOUD COMPUTING MARKET, BY PAAS, 2022–2027 (USD BILLION)

- TABLE 197 CLOUD COMPUTING MARKET, BY SAAS, 2017–2021 (USD BILLION)

- TABLE 198 CLOUD COMPUTING MARKET, BY SAAS, 2022–2027 (USD BILLION)

- TABLE 199 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2017–2021 (USD BILLION)

- TABLE 200 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2022–2027 (USD BILLION)

- TABLE 201 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 202 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 203 CLOUD COMPUTING MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 204 CLOUD COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 205 CLOUD COMPUTING MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 206 CLOUD COMPUTING MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 207 IDENTITY AND ACCESS MANAGEMENT MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 208 IDENTITY AND ACCESS MANAGEMENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 209 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 210 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 211 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 212 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 213 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 214 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 215 IDENTITY AND ACCESS MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 216 IDENTITY AND ACCESS MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 217 IDENTITY AND ACCESS MANAGEMENT MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 218 IDENTITY AND ACCESS MANAGEMENT MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 219 IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 220 IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 221 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET, BY SERVICE TYPE, 2013–2020 (USD MILLION)

- TABLE 222 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET, BY DEPLOYMENT TYPE, 2013–2020 (USD MILLION)

- TABLE 223 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET, BY END USER, 2013–2020 (USD MILLION)

- TABLE 224 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET, BY VERTICAL, 2013–2020 (USD MILLION)

- TABLE 225 NORTH AFRICA: CLOUD MANAGED SERVICES MARKET, BY COUNTRY, 2013–2020 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 APPROACH 1 (SUPPLY-SIDE): REVENUE OF BARE METAL CLOUD FROM VENDORS

- FIGURE 5 BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE OF BARE METAL CLOUD VENDORS

- FIGURE 6 APPROACH 2 (SUPPLY-SIDE): CAGR PROJECTIONS

- FIGURE 7 APPROACH 2 (DEMAND-SIDE): REVENUE GENERATED FROM BARE METAL CLOUD COMPONENT

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FASTEST-GROWING SEGMENTS IN MARKET, 2023–2028

- FIGURE 10 BARE METAL CLOUD COMPUTE SERVICES TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 11 LARGE ENTERPRISES TO ACCOUNT FOR HIGHER ADOPTION OF MARKET DURING FORECAST PERIOD

- FIGURE 12 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 MARKET: REGIONAL SNAPSHOT, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 NEED FOR SUPERIOR PERFORMANCE FOR WORKLOADS REQUIRING HIGH COMPUTATIONAL POWER, LOW LATENCY, AND RESOURCE ISOLATION TO DRIVE MARKET

- FIGURE 15 COMPUTE SERVICES TO ACCOUNT FOR LARGEST SERVICE TYPE MARKET DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 19 MARKET DYNAMICS: MARKET

- FIGURE 20 COST OF DATA BREACH, 2017–2023 (USD MILLION)

- FIGURE 21 ORGANIZATION FUNCTIONS IMPACTED BY IOT AND EDGE SOLUTIONS, 2022

- FIGURE 22 MARKET: SUPPLY CHAIN

- FIGURE 23 BARE METAL CLOUD MARKET: ECOSYSTEM

- FIGURE 24 MARKET: BUSINESS MODEL

- FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2012–2022

- FIGURE 26 TOP FIVE PATENT OWNERS (GLOBAL), 2022

- FIGURE 27 BARE METAL CLOUD MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 28 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR END USERS

- FIGURE 31 SECURITY SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 LARGE ENTERPRISES SEGMENT TO BE LARGER ADOPTERS DURING FORECAST PERIOD

- FIGURE 33 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 34 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 37 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- FIGURE 38 BARE METAL CLOUD MARKET SHARE ANALYSIS, 2022

- FIGURE 39 HISTORICAL REVENUE ANALYSIS, 2018–2022 (USD BILLION)

- FIGURE 40 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 41 KEY COMPANY EVALUATION MATRIX, 2022

- FIGURE 42 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- FIGURE 43 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 44 COMPANY FINANCIAL METRICS, 2022

- FIGURE 45 BARE METAL CLOUD MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- FIGURE 46 IBM: COMPANY SNAPSHOT

- FIGURE 47 ORACLE: COMPANY SNAPSHOT

- FIGURE 48 AWS: COMPANY SNAPSHOT

- FIGURE 49 LUMEN: COMPANY SNAPSHOT

- FIGURE 50 RACKSPACE: COMPANY SNAPSHOT

- FIGURE 51 DELL: COMPANY SNAPSHOT

- FIGURE 52 EQUINIX: COMPANY SNAPSHOT

- FIGURE 53 GOOGLE: COMPANY SNAPSHOT

- FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

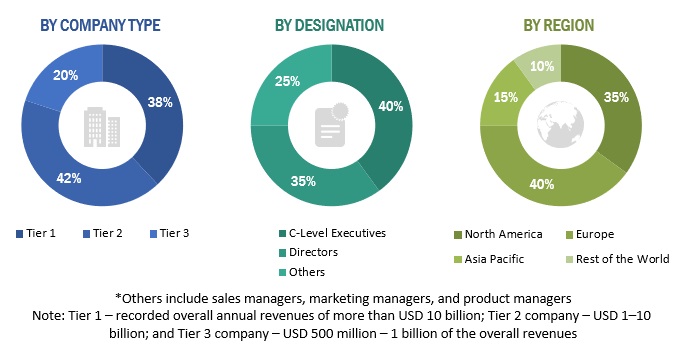

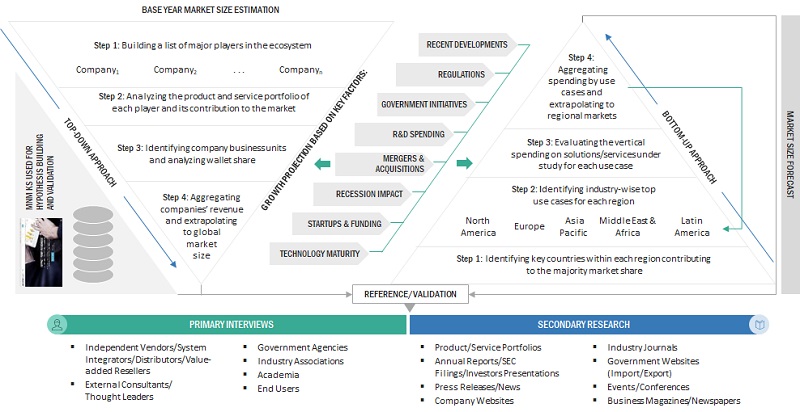

The study involved four major activities in estimating the current market size of the bare metal cloud market. Did extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting valuable information for this technical, market-oriented, and commercial study of the bare metal cloud market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using bare metal cloud services, and digital initiatives project teams were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of services, which would affect the overall bare metal cloud market.

Breakup of Primary Profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down and bottom-up approaches were used to estimate and validate the bare metal cloud market size and various other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included studying top market players’ annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Bare metal cloud market: Top-down and bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the bare metal cloud market.

Market Definition

According to MarketsandMarkets, a bare metal cloud designates a service that can provision bare metal servers with varied capabilities (compute, storage, and network) to customers on demand through a cloud pay-as-you-go model. Bare metal cloud provides the customer access to a dedicated server without virtualization. The absence of virtualization allows access to the server’s direct hardware processing power, with the ability to provision workloads—without the overhead of the virtualization layer.

Key Stakeholders

- Technology service providers

- Bare metal cloud vendors

- Colocation providers

- Government organizations

- Networking companies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information technology (IT) infrastructure providers

- System Integrators (SIs)

- Regional associations

- Independent software vendors (ISVs)

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the bare metal cloud market by service type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as partnerships, acquisitions, and product/solution launches and enhancements, in the market

- To analyze the impact of the recession on the global bare metal cloud market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Bare Metal Cloud Market