Battery Market for IoT by Type, Rechargeability, End-use Application, and Geography - Global Forecast to 2025

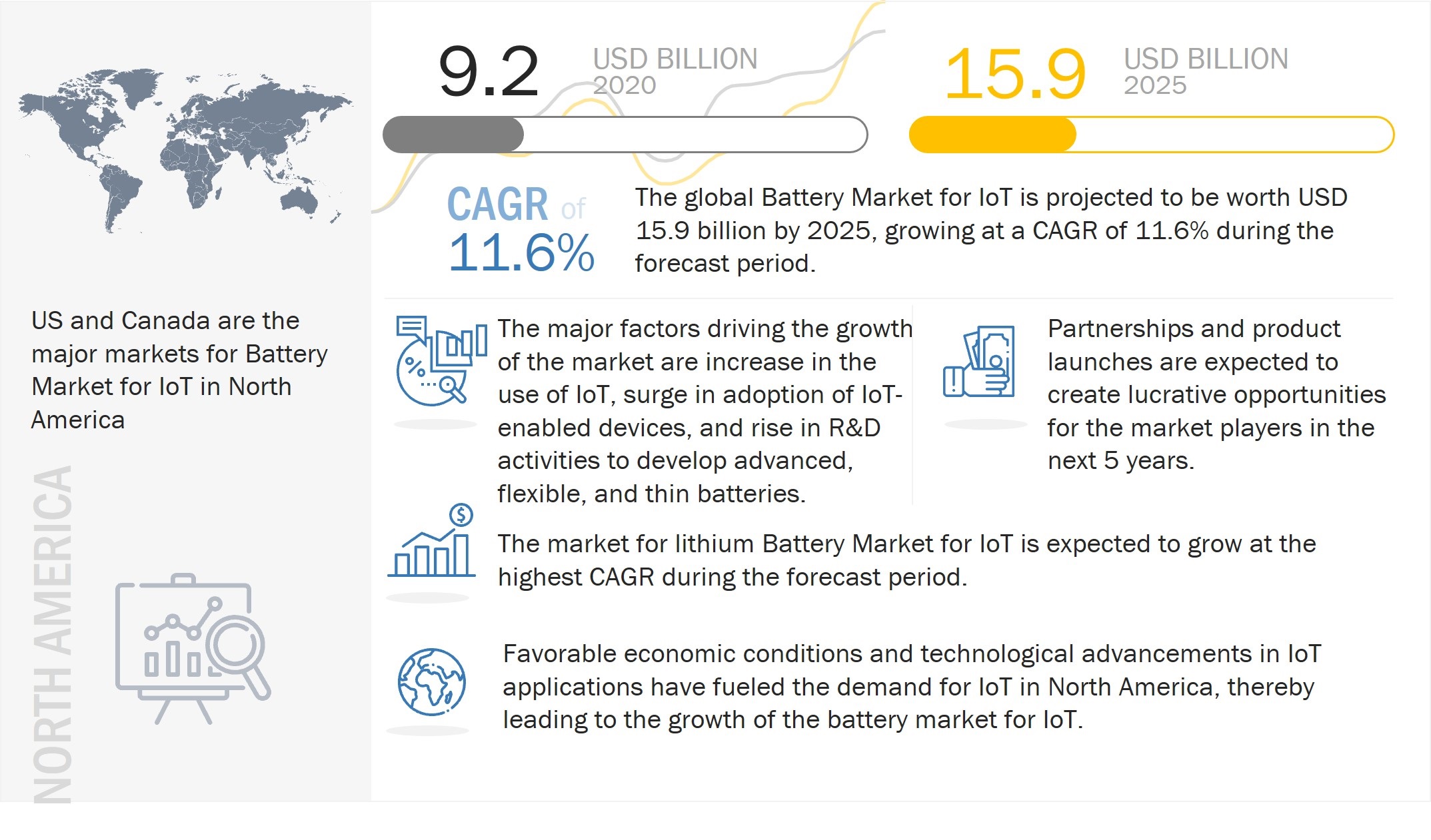

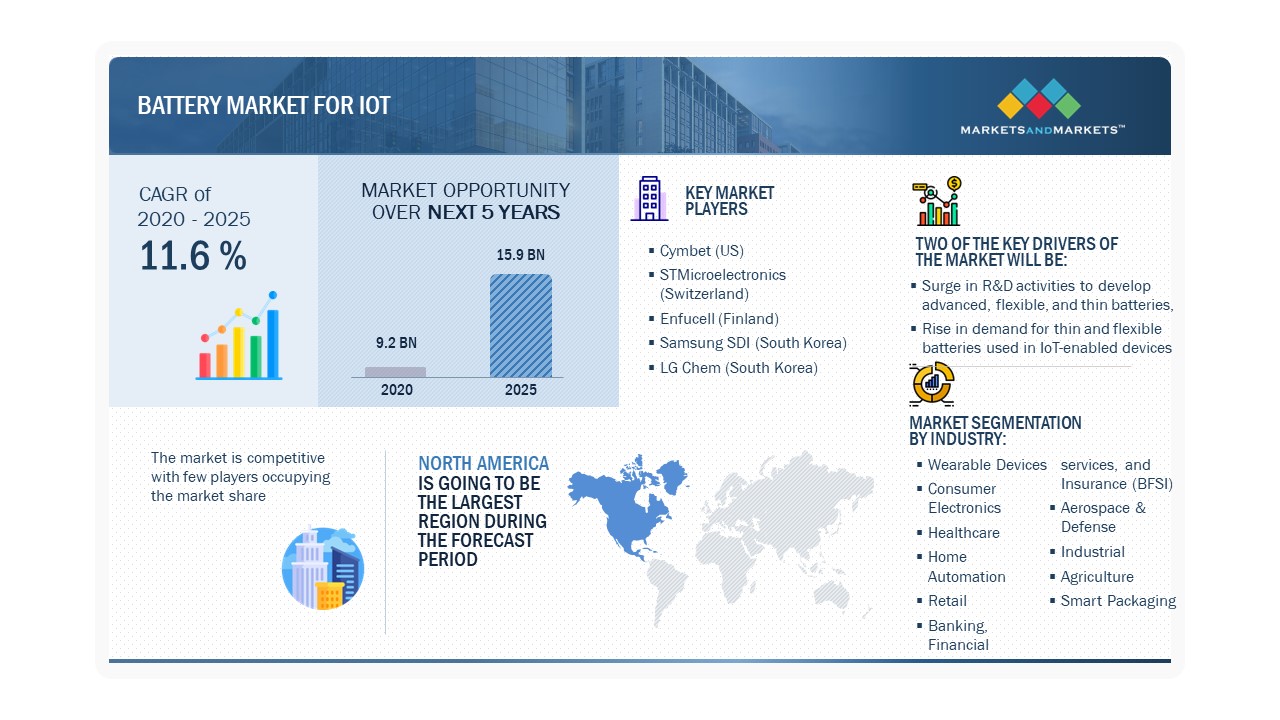

The Battery Market for IoT is projected to grow from USD 9.2 billion in 2020 to USD 15.9 Billion in 2025, growing at a CAGR of 11.6% during the forecast period from 2020 to 2025.

Battery Market for IoT Size & Growth Drivers

The growth of the Battery Market for IoT is driven by the surging adoption of IoT devices across industries such as healthcare, smart homes, industrial automation, and agriculture. As IoT applications increasingly rely on wireless and portable devices, the demand for efficient, long-lasting, and compact batteries has risen significantly. The push for energy-efficient solutions, advancements in battery technologies like lithium-ion and solid-state batteries, and the integration of energy harvesting techniques further boost the market. Additionally, the rise of connected ecosystems, including smart cities and wearable devices, coupled with the growing need for reliable power sources in remote and low-maintenance environments, positions IoT batteries as a critical component for enabling seamless IoT operations.

IoT can be defined as an interconnected system of various devices and sensors that organizations use for different business functions. Most of the IoT end-use applications require devices with miniature characteristics; therefore, these devices use small-sized batteries that are flexible and lightweight. These batteries can be cut, rolled, and customized into different shapes and sizes—without any loss of efficiency to complement the form of the product in which they are to be used. These batteries are used in several IoT applications, including smart cards, wearable devices, and smart monitoring devices.

Impact of AI Battery Market for IoT

The impact of artificial intelligence (AI) on the battery market for the Internet of Things (IoT) is revolutionizing energy management by enhancing battery efficiency, longevity, and smart charging capabilities. AI algorithms enable real-time monitoring and predictive analytics, allowing for optimal battery performance by adjusting power usage based on IoT device requirements. This integration helps in extending battery life, reducing maintenance costs, and ensuring seamless operation in IoT applications, ranging from smart homes and wearable devices to industrial sensors and smart cities. As AI continues to optimize energy consumption, it supports the growth of IoT ecosystems by enabling more sustainable, autonomous, and efficient battery solutions.

Battery Market for IoT Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Battery Market for IoT Dynamics:

Driver: Multifold rise in use of IoT and increase in adoption of IoT-enabled devices

The increasing adoption of wearable devices is leading the growth of the battery market for IoT. Wearable devices include eyewear, such as smart and virtual reality wearable glasses; footwear, such as athletic, fitness, and sports shoes; and wristwear, such as smartwatches and wristbands. People wear wearable devices to keep track of their daily activities, as well as their body movement and heart rate. Wearable devices are available in different shapes and forms. Most wearable applications require li-ion or li-polymer and ultra-thin durable batteries, creating a significant market demand for micro batteries. The application areas of wearable devices are growing from consumer electronics and medical devices to wireless communication devices.

Restraint: Ecological implications of disposing of battery wastes

A rapidly increasing number of IoT-enabled devices generates colossal volumes of chemical waste. Disposing of these wastes, as well as batteries after use, causes a severe environmental impact. Spent batteries, heavy metals, metal and plastic shells, cathode-anode separators, and other battery components can be hazardous and toxic to the environment if not disposed of properly. Therefore, the sustainable development of batteries has been the most daunting challenge. Though the demand for lithium-ion batteries is increasing globally, developing a real cost-effective, environment-friendly recycling process with high recycling efficiency remains challenging.

Opportunity: Development of new revenue streams for manufacturers of batteries owing to the launch of new IoT-enabled devices

The increasing adoption of IoT technology globally has enabled the development of controls to regulate the use of connected devices through a single, smart interface. There is increasing global penetration of this technology as several IoT-enabled devices are being launched daily. Several manufacturers that, include LG Chemical (South Korea), Samsung SDI (South Korea), and Panasonic (Japan), are scrambling to take advantage of IoT technology and enter the battery market for IoT. That results in developing new revenue streams for these large OEMs and ODMs.

Challenge: Development of cost-effective batteries

Batteries used in IoT-enabled devices are generally costlier than conventional batteries, especially the ones used in industrial applications. The manufacturing process of these batteries requires complex equipment and the cost of fabrication of the cells used by these batteries is high. Moreover, the prices of materials used for developing batteries used by IoT-enabled devices also play an important role in their overall costs. Developing cost-effective electrodes used by these batteries is a challenge for manufacturers to develop economical batteries. Hence, integrating these batteries into consumer electronics, wearable devices, etc., is a costly process.

IoT Battery Market Insights and Growth Prospects:

The IoT battery market is witnessing robust growth due to the increasing adoption of Internet of Things (IoT) devices across various industries, such as healthcare, automotive, smart homes, and industrial automation. IoT devices, which require reliable and long-lasting power sources, are driving demand for specialized batteries that offer high energy density, long lifespan, and the ability to operate in diverse environments. As the number of connected devices continues to rise, the need for advanced battery solutions, including lithium-ion, solid-state, and other emerging technologies, is expanding. Moreover, innovations in energy-efficient batteries and wireless charging technologies are enhancing the performance of IoT devices, enabling them to function longer without frequent recharging. The growing demand for autonomous and energy-efficient IoT applications is expected to further propel the growth of the IoT battery market in the coming years.

Battery Market for IoT Segment Insights:

Based on type, the Lithium Batteries segment held the largest share of the market in 2019

By type, lithium batteries held the largest market share. Lithium-ion batteries are majorly used in consumer electronic devices. For IoT applications, small lithium-ion are being produced. Lithium batteries have many applications in IoT devices such as wearables, home automation devices, retail, aerospace, and defense. Moreover, features such as high energy density is key factor completing its growth among other batteries.

Based on rechargeability, the Secondary Batteries segment held the largest share of the market in the forecast period

By rechargeability, the secondary battery segment held a larger share in 2019. Most adopted batteries— lithium, thin film, and solid state chip batteries—are generally secondary batteries. Rechargeable batteries with long lifespans are used in wearable devices, medical devices, wireless sensor nodes, and consumer electronics. With the advancement in technologies used in wearable and medical devices, manufacturers are continuously making efforts to develop innovative designs suitable for their devices. This, in turn, is increasing the need for high-capacity rechargeable batteries that can last long. Therefore, the demand for secondary micro batteries in the applications mentioned above is high and is expected to increase rapidly during the forecast period.

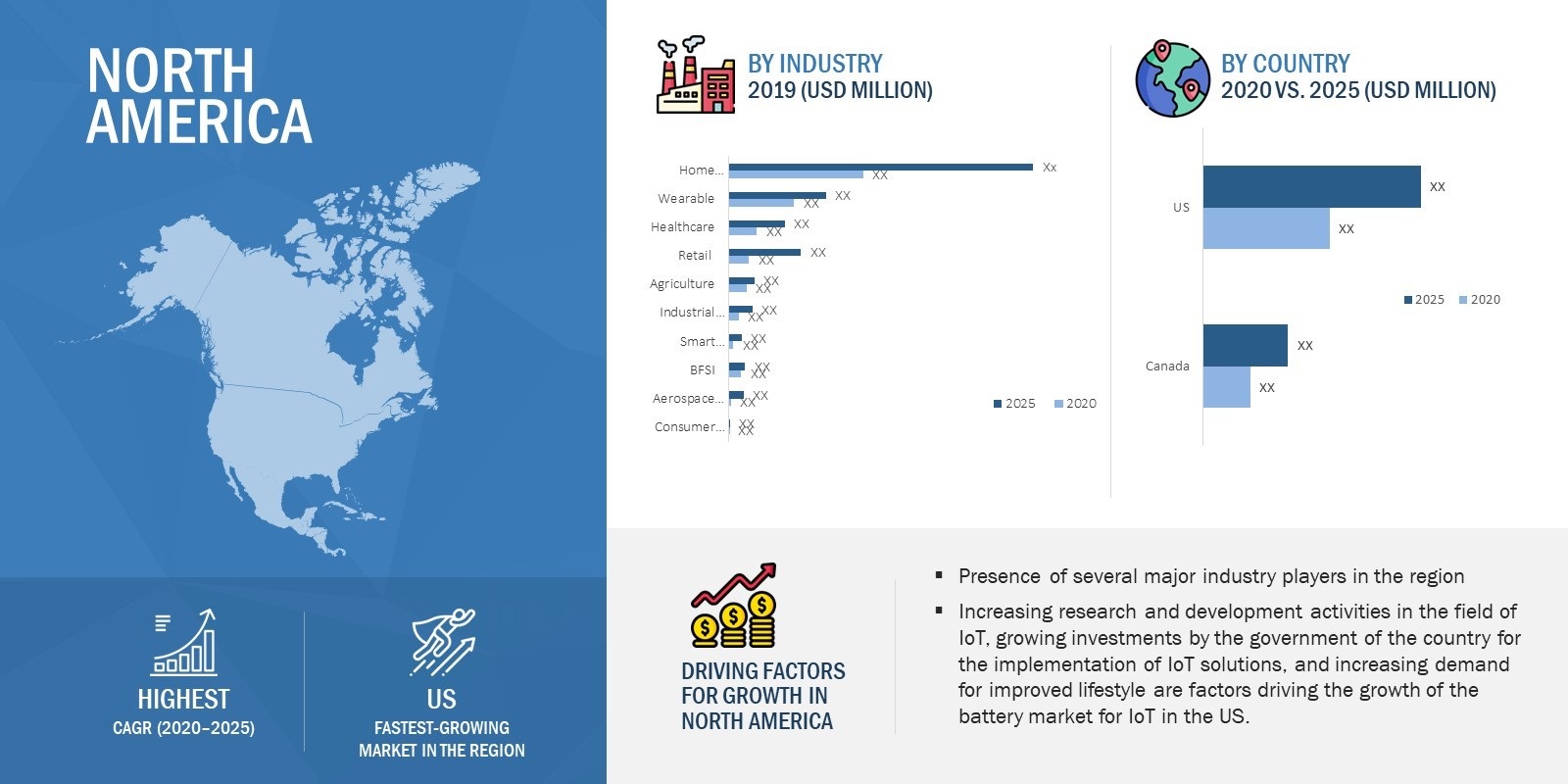

Based on Industry, the home automation segment to dominate the Battery Market for IoT in the year 2019

The demand for energy-efficient solutions, enhanced security, increased venture capital funding, and the constant need to improve the living standards of individuals has led to the development of the battery market for IoT in home automation. Building automation, which started with wired technology, has now entered the era of wireless technology with technologies such as ZigBee, Wi-Fi, and Bluetooth Smart revolutionizing the market. The growing awareness toward energy conservation, stringent legislations and building directives, promotion of numerous smart grid technologies, and the availability of several open protocols are further driving the growth of the building automation market.

Regional Insights:

North America to hold the largest market share during the forecast period

North America held the largest IoT battery market share in 2019. Favorable economic conditions and technological advancements in IoT applications have fueled the demand for IoT in North America, thereby leading to the battery market growth for IoT. Demand for smart packaging is expected to drive the development of the thin-film and printed batteries segments of the battery market for IoT in North America. The increased penetration of IoT in medical devices and the miniaturization of wireless devices are expected to increase the demand for thin-film and printed batteries in North America.

Battery Market for IoT by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players:

Some of the Major players in the Battery Market for IoT are Cymbet (US), STMicroelectronics (Switzerland), Enfucell (Finland), Samsung SDI (South Korea), and LG Chem (South Korea). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the Battery Market for IoT.

Cymbet manufactures and provides solid-state energy storage technologies. The company offers its products under the brand name EnerChip. It offers solid-state thin-film rechargeable batteries with integrated power management capabilities that can be configured with integrated circuits (ICs), sensors, industrial controls, RFID tags, communication systems, medical devices, and portable electronic devices. Besides, the company also provides products under its EnerChip RTC (real-time clock) family and EnerChip Evaluation Kit, which provides access to EnerChip RTC through a USB stick. Cymbet was among the first companies to offer surface-mounted packaged energy storage solutions for embedded systems.

STMicroelectronics designs, develop, manufactures, and markets a wide range of semiconductor integrated circuits and discrete devices. The company operates through 3 segments: Automotive and Discrete Group (ADG), Analog MEMS and Sensors Group (AMS), Microcontrollers and Digital ICs Group (MDG), and Others. The company offers dedicated automotive ICs (both digital and analog) and discrete and power transistor products through its ADG. It provides low-power, high-end analog ICs both customized and general purpose) for all markets, smart power products for the industrial, computer, and personal electronics markets through its AMS segment. STMicroelectronics offers general purpose and secure microcontrollers, electrically erasable programmable read-only memory (EEPROM) solutions, digital application-specific integrated circuits (ASICs), and aerospace and defense products, including components for microwave and millimeter wave through its MDG segment.

Report of the Scope

|

Report Metric |

Details |

| Market size availability years | 2018–2025 |

| Base year | 2019 |

| Forecast period | 2020–2025 |

| Forecast units | Value (USD million/thousand) |

| Covered segments | Type, rechargeability, end-use application, and geography |

| Covered regions | North America, Europe, APAC, and RoW |

| Covered companies | Duracell Inc (Duracell) (US), Energizer Holdings Inc (Energizer) (US), Panasonic Corporation (Panasonic) (Japan), LG Chem Ltd (LG Chem) (South Korea), Samsung SDI Co (Samsung SDI) (South Korea), STmicroelectronics N.V (STmicroelectronics) (Switzerland), Cymbet Corporation Inc (Cymbet) (US), Ultralife Corporation (Ultralife) (US), Ilika Plc (Ilika) (UK), Imprint Energy Inc (Imprint Energy) (US), Blue Spark Technologies Inc (Blue Spark Technologies) (US), Enfucell Oy (Enfucell) (Finland), BrightVolt Inc (BrightVolt) (US), SAFT Groupe SA (SAFT) (France), Power Paper Ltd (Power Paper) (Israel), Jenax Inc (Jenax) (South Korea), Front Edge Technology Inc (Front Edge Technology) (US), Rocket Electric Co. Ltd (Rocket Electric) (South Korea), Guangzhou Fullriver Battery New Technology Co Ltd (Guangzhou Fullriver Battery New Technology) (China), and ITEN SA (ITEN) (France). |

Battery Market for IoT Segmentation:

In this report, the battery market for IoT has been segmented into the following categories:

Battery Market for IoT based on type:

-

Chemical Batteries

- Lithium Batteries

- Alkaline Batteries

- Others

- Thin-film Batteries

- Printed Batteries

- Solid-state Chip Batteries

Battery Market for IoT based on rechargeability:

- Primary Batteries

- Secondary Batteries

Battery Market for IoT based on end-use application:

- Wearable Devices

- Consumer Electronics

- Healthcare

- Home Automation

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Aerospace & Defense

- Industrial

- Agriculture

- Smart Packaging

Battery Market for IoT based on region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Battery Market for IoT Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

The Battery Market for the IoT industry has witnessed numerous technological advancements in materials and types. Substantial investments have been made in the Battery Market for IoT research & development and upgrades. The value chain of the Battery Market for the IoT ecosystem starts with research and development (R&D), which comprises system requirements analysis, comparison of electronics specifications, and prototype development, followed by manufacturing and system integration phases.

-

Emerging Technology Trends

- Internet of Things (IoT)

- Cloud-based BMS

- 5G

- Addition/refinement in segmentation–Increase the depth or width of market segmentation.

-

Battery Market for IoT, by Type

-

Chemical Batteries

- Lithium Batteries

- Alkaline Batteries

- Others

- Thin-Film Batteries

- Printed Batteries

- Solid-state Chip Batteries

-

Chemical Batteries

-

Battery Market for IoT, by Rechargeability

- Primary Batteries

- Secondary Batteries

-

Battery Market for IoT, by End-Use Application

- Wearable Devices

- Consumer Electronics

- Healthcare

- Home Automation

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Aerospace & Defense

- Industrial

- Agriculture

- Smart Packaging

- Inclusion of new players and change in the market share of existing players - Battery Market for IoT

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have a total of 25 players (15 major, 10 Startups/SME). Moreover, we have also provided the share of companies operating in the ‘Battery Market for IoT’ and brief details of the start-up matrix.

- Updated financial information and product portfolios of players operating in the Battery Market for IoT

Newer and improved representation of financial information: The latest edition of the report provides updated financial information on the Battery Market for IoT till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Recent market developments of the profiled players

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new product launches, investments, funding, and certification have been mapped for 2020 to 2022.

- New data points/analysis which was not present in the previous version of the report

- Competitive benchmarking of startups/SMEs covers employee details, financial status, the latest funding round, and total funding (if available).

- Inclusion of the impact of megatrends on the Battery Market for IoT includes a shift in global climate change and disruptive technologies.

- Technology analysis and case studies are added in this report edition to give the technological perspective and the significance of the advancements in the Battery Market for IoT.

- We have included brief patent information for the overall market of Battery Market for IoTs.

- The startup evaluation matrix is added in this edition of the report, covering startups.

The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand Battery Market for IoT's market dynamics.

Recent Developments

- In June 2022, Wiliot launched breakthrough battery-assisted IoT Pixel tags; Wiliot is now disrupting the battery-powered tag market by introducing its new business card-sized Battery-Assisted IoT Pixel tag. The new Battery-Assisted IoT Pixel tag leverages the same ultra-power-efficient cloud and chip technology.

- In May 2022, Powermat Technologies launched the new Powermat PMT 100 Wireless Power Solution, designed to meet the needs of small medical, lifestyle, and smart home internet of things (IoT) devices.

Frequently Asked Questions (FAQ’s)

What is the current size of the Battery Market for IoT?

The Battery Market for IoT is projected to grow from USD 9.2 billion in 2020 to USD 15.9 Billion by 2025, at a CAGR of 11.6% between 2020-2025.

Who are the winners in the Battery Market for IoT?

Cymbet (US), STMicroelectronics (Switzerland), Enfucell (Finland), Samsung SDI (South Korea), and LG Chem (South Korea).

What are some of the technological advancements in the market?

A battery that can operate within the ambient temperature range of its location is crucial for long-term sustainability and reliability. If the battery can no longer efficiently deliver energy, it could render the IoT device obsolete. Rechargeable lithium-ion batteries are prevalent in IoT devices, especially smartphones and smartwatches. In general, lithium-ion batteries have a high energy density and low self-discharge.

What are the factors driving the growth of the market?

Multifold rise in use of IoT and adoption of IoT-enabled devices, increase in global demand for wireless communication, Surge in R&D activities to develop advanced, flexible, and thin batteries, Rise in demand for thin and flexible batteries used in IoT-enabled devices.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary Sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP

2.2.2 TOP-DOWN

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 INTERNET OF THINGS MARKET - START-UP SCENARIO

5.1 START-UP COMPANY ANALYSIS BY

5.1.1 GLOBAL FOOTPRINT

5.1.2 REVENUE

5.1.3 MARKET RANKING/SHARE INTERVAL

5.1.4 VENTURE CAPITAL AND FUNDING SCENARIO

6 MARKET OVERVIEW AND INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 MARKET DYNAMICS

6.2.1 DRIVERS

6.2.2 RESTRAINTS

6.2.3 OPPORTUNITIES

6.2.4 CHALLENGES

6.3 USE CASES

6.3.1 SMART RETAIL

6.3.2 CONNECTED HEALTH

6.3.3 BUILDING AND HOME AUTOMATION

6.3.4 SMART LOGISTICS

6.3.5 SMART MOBILITY AND TRANSPORTATION

6.3.6 SMART GRID AND UTILITIES

6.3.7 SMART MANUFACTURING

6.3.8 SMART HOME

6.3.9 OTHERS

6.4 REGULATORY FRAMEWORK (FOR IOT BATTERY)

6.4.1 GENERAL

6.4.2 PRESENT STATUS

6.4.3 STANDARDIZATION NEEDS AND OUTLOOK

6.4.4 CHALLENGES AND FUTURE STANDARDIZATION NEEDS

6.5 IMPACT OF OTHER DISRUPTIVE TECHNOLOGIES

6.5.1 ARTIFICIAL INTELLIGENCE (AI)

6.5.2 5G

6.5.3 SMART TRANSPORTATION

6.5.4 SMART ENERGY

6.6 IOT CHARACTERISTICS

6.7 VALUE CHAIN ANALYSIS

6.8 PRICE TRENDS ANALYSIS

6.9 TRENDS IN BATTERY-LESS IOT TECHNOLOGY

6.9.1 AMBIENT ENERGY HARVESTING

6.9.1.1 Piezoelectric

6.9.1.2 Thermoelectric (PV)

6.9.1.3 Kinetic

6.9.1.4 Photoelectric

6.9.2 BATTERY-FREE BLUETOOTH TAGS

6.1 EMERGING BATTERY TECHNOLOGY: ZINC-AIR BATTERIES

6.11 IMPACT OF COVID-19 ON BATTERY MARKET FOR IOT

7 BATTERY MARKET FOR IOT, BY TYPE (USD MILLION AND MILLION UNITS)

7.1 INTRODUCTION

7.2 CHEMICAL BATTERIES

7.2.1 LITHIUM BATTERIES

7.2.2 ALKALINE BATTERIES

7.2.3 OTHERS

7.3 THIN-FILM BATTERIES

7.4 PRINTED BATTERIES

7.5 SOLID-STATE CHIP BATTERIES

8 BATTERY MARKET FOR IOT, BY RECHARGEABILITY (USD MILLION)

8.1 PRIMARY BATTERIES

8.2 SECONDARY BATTERIES

9 BATTERY MARKET FOR IOT, BY END-USE APPLICATION (USD MILLION AND MILLION UNITS)

9.1 WEARABLE DEVICES

9.1.1 ACTIVITY MONITORS

9.1.2 SMART WATCHES

9.1.3 SMART GLASSES

9.1.4 BODY-WORN CAMERAS

9.1.5 HEARABLES

9.2 CONSUMER ELECTRONICS

9.3 HEALTHCARE

9.3.1 FITNESS AND HEART RATE MONITORS

9.3.2 BLOOD PRESSURE MONITORS

9.3.3 BLOOD GLUCOSE METERS

9.3.4 FALL DETECTORS

9.3.5 OTHERS

9.4 HOME AUTOMATION

9.4.1 SMART LOCKS

9.4.2 SECURITY CAMERAS

9.4.3 SMART METERS

9.4.4 WIRELESS ALARMS AND THEFT DETECTION SYSTEMS

9.4.5 OCCUPANCY SENSORS

9.4.6 SMOKE DETECTORS

9.4.7 GARAGE DOOR SENSORS

9.4.8 WINDOW SENSORS

9.4.9 WATER LEAK DETECTION SENSORS

9.5 RETAIL

9.5.1 CONTACTLESS POINT OF SALES (POS)

9.5.2 WIRELESS BEACONS

9.5.3 SMART TAGS

9.6 BFSI

9.6.1 MOBILE POINT OF SALES (MPOS)

9.7 AEROSPACE AND DEFENSE

9.7.1 SMART BEACONS

9.7.2 DRONES/ UNMANNED AERIAL VEHICLES (UAV)

9.7.3 SMART BAGGAGE TAGS

9.8 INDUSTRIAL

9.9 AGRICULTURE

9.9.1 AGRICULTURE DRONES

9.9.2 AGRICULTURE ROBOTS

9.9.3 SOIL MOISTURE SENSORS

9.9.4 LIVE STOCK RFID TAGS

9.10 SMART PACKAGING

10 BATTERY MARKET FOR IOT, BY GEOGRAPHY (USD MILLION)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 UK

10.3.2 GERMANY

10.3.3 FRANCE

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 JAPAN

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 REST OF APAC

10.5 REST OF THE WORLD

10.5.1 MIDDLE EAST & AFRICA (MEA)

10.5.2 LATIN AMERICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 KEY PLAYERS IN BATTERY MARKET FOR IOT

11.3 COMPETITIVE BENCHMARKING AND LANDSCAPE

11.3.1 NEW PRODUCT LAUNCHED AND DEVELOPMENTS

11.3.2 PARTNERSHIPS, COLLABORATIONS, AGREEMENTS, AND ACQUISITIONS

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 VISIONARY LEADERS

11.4.2 INNOVATORS

11.4.3 DYNAMIC DIFFERENTIATORS

11.4.4 EMERGING COMPANIES

12 COMPANY PROFILES

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1.1 DURACELL

12.1.2 ENERGIZER

12.1.3 PANASONIC

12.1.4 LG CHEM

12.1.5 SAMSUNG SDI

12.1.6 STMICROELECTRONICS

12.1.7 CYMBET

12.1.8 ULTRALIFE

12.1.9 IMPRINT ENERGY

12.1.10 ILIKA

12.1.11 BLUE SPARK TECHNOLOGIES

12.1.12 ENFUCELL

12.1.13 BRIGHTVOLT

12.1.14 SAFT

12.1.15 POWER PAPER

12.1.16 JENAX

12.2 RIGHT TO WIN

12.3 OTHER KEY PLAYERS

12.3.1 FRONT EDGE TECHNOLOGY

12.3.2 ROCKET ELECTRIC

12.3.3 GUANGZHOU FULLRIVER BATTERY NEW TECHNOLOGY

12.3.4 ITEN

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 APPENDIX

13.1 KNOWLEDGE STORE

13.2 RELATED REPORTS

LIST OF TABLES (62 TABLES)

TABLE 1 BATTERY MARKET FOR IOT, BY TYPE, 2018–2025, (USD MILLION)

TABLE 2 MARKET FOR IOT, BY TYPE, 2018–2025, (MILLION UNITS)

TABLE 3 MARKET FOR IOT, BY RECHARGEABILITY, 2018–2025, (USD MILLION)

TABLE 4 MARKET FOR IOT, BY END-USE APPLICATION, 2018–2025, (USD MILLION)

TABLE 5 MARKET FOR IOT, BY END-USE APPLICATION, 2018–2025, (MILLION UNITS)

TABLE 6 MARKET FOR IOT IN WEARABLE DEVICES, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 7 MARKET FOR IOT IN WEARABLE DEVICES, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 8 MARKET FOR IOT IN WEARABLE DEVICES, BY BATTERY TYPE, 2018–2025 (MILLION UNITS)

TABLE 9 MARKET FOR IOT IN WEARABLE DEVICES, BY BATTERY TYPE, 2018–2025 (USD MILLION)

TABLE 10 MARKET FOR IOT FOR WEARABLE DEVICES, BY RECHARGEABILITY, 2018–2025, (USD MILLION)

TABLE 11 BATTERY MARKET FOR IOT FOR WEARABLE DEVICES, BY REGION, 2018–2025, (USD MILLION)

TABLE 12 MARKET FOR IOT FOR CONSUMER ELECTRONICS, BY REGION, 2018–2025, (USD THOUSAND)

TABLE 13 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 14 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2018–2025 (USD THOUSAND)

TABLE 15 MARKET FOR IOT FOR CONSUMER ELECTRONICS, BY RECHARGEABILITY, 2018–2025, (USD THOUSAND)

TABLE 16 MARKET FOR IOT IN HEALTHCARE, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 17 MARKET FOR IOT IN HEALTHCARE, BY DEVICE TYPE, 2018–2025, (USD MILLION)

TABLE 18 MARKET FOR IOT IN HEALTHCARE, BY BATTERY TYPE, 2018–2025, (MILLION UNITS)

TABLE 19 MARKET FOR IOT IN HEALTHCARE, BY BATTERY TYPE, 2018–2025, (USD MILLION)

TABLE 20 MARKET FOR IOT IN HEALTHCARE, BY RECHARGEABILITY, 2018–2025, (USD MILLION)

TABLE 21 MARKET FOR IOT FOR HEALTHCARE, BY REGION, 2018–2025, (USD MILLION)

TABLE 22 MARKET FOR IOT IN HOME AUTOMATION, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 23 BATTERY MARKET FOR IOT IN HOME AUTOMATION, BY DEVICE TYPE, 2018–2025, (USD MILLION)

TABLE 24 MARKET FOR IOT IN HOME AUTOMATION, BY BATTERY TYPE, 2018–2025, (USD MILLION)

TABLE 25 MARKET FOR IOT IN HOME AUTOMATION, BY RECHARGEABILITY, 2018–2025, (USD MILLION)

TABLE 26 MARKET FOR IOT IN HOME AUTOMATION, BY BATTERY TYPE, 2018–2025, (MILLION UNITS)

TABLE 27 MARKET FOR IOT FOR HOME AUTOMATION, BY REGION, 2018–2025, (USD MILLION)

TABLE 28 MARKET FOR IOT IN RETAIL, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 29 MARKET FOR IOT IN RETAIL, BY DEVICE TYPE, 2018–2025, (USD MILLION)

TABLE 30 MARKET FOR IOT IN RETAIL, BY BATTERY TYPE, 2018–2025, (MILLION UNITS)

TABLE 31 MARKET FOR IOT IN RETAIL, BY BATTERY TYPE, 2018–2025, (USD MILLION)

TABLE 32 MARKET FOR IOT IN HOME AUTOMATION, BY RECHARGEABILITY, 2018–2025, (USD MILLION)

TABLE 33 MARKET FOR IOT FOR RETAIL, BY REGION, 2018–2025, (USD MILLION)

TABLE 34 MARKET FOR IOT IN BFSI, BY DEVICE TYPE, 2018–2025

TABLE 35 BATTERY MARKET FOR IOT FOR BFSI, BY REGION, 2018–2025, (USD MILLION)

TABLE 36 MARKET FOR IOT IN BFSI, BY BATTERY TYPE, 2018–2025

TABLE 37 MARKET FOR IOT IN AEROSPACE AND DEFENSE, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 38 MARKET FOR IOT IN AEROSPACE AND DEFENSE, BY DEVICE TYPE, 2018–2025, (USD MILLION)

TABLE 39 MARKET FOR IOT IN AEROSPACE AND DEFENSE, BY BATTERY TYPE, 2018–2025, (MILLION UNITS)

TABLE 40 MARKET FOR IOT IN AEROSPACE & DEFENSE, BY BATTERY TYPE, 2018–2025

TABLE 41 MARKET FOR IOT IN AEROSPACE & DEFENSE, BY RECHARGEABILITY, 2018–2025

TABLE 42 BATTERY MARKET FOR IOT FOR AEROSPACE AND DEFENSE, BY REGION, 2018–2025, (USD MILLION)

TABLE 43 MARKET FOR IOT IN INDUSTRIAL, BY DEVICE TYPE, 2018–2025

TABLE 44 MARKET FOR IOT FOR INDUSTRIAL, BY REGION, 2018–2025, (USD MILLION)

TABLE 45 MARKET FOR IOT IN INDUSTRIAL, BY BATTERY TYPE, 2018–2025

TABLE 46 MARKET FOR IOT IN AGRICULTURE, BY DEVICE TYPE, 2018–2025, (MILLION UNITS)

TABLE 47 MARKET FOR IOT IN AGRICULTURE, BY DEVICE TYPE, 2018–2025, (USD MILLION)

TABLE 48 MARKET FOR IOT IN AGRICULTURE, BY BATTERY TYPE, 2018–2025, (MILLION UNITS)

TABLE 49 MARKET FOR IOT FOR AGRICULTURE, BY REGION, 2018–2025, (USD MILLION)

TABLE 50 BATTERY MARKET FOR IOT IN AGRICULTURE, BY BATTERY TYPE, 2018–2025

TABLE 51 MARKET FOR IOT IN AGRICULTURE, BY RECHARGEABILITY, 2018–2025

TABLE 52 BATTERY MARKET FOR SMART PACKAGING, BY TYPE, 2018–2025 (MILLION UNITS)

TABLE 53 BATTERY MARKET FOR SMART PACKAGING, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 MARKET FOR IOT FOR SMART PACKAGING, BY REGION, 2018–2025, (USD MILLION)

TABLE 55 MARKET FOR IOT IN SMART PACKAGING, BY RECHARGEABILITY, 2018–2025

TABLE 56 BATTERY MARKET FOR IOT, BY REGION, 2018–2025, (USD MILLION)

TABLE 57 MARKET OF IOT IN NORTH AMERICA, BY COUNTRY, 2018–2025, (USD MILLION)

TABLE 58 MARKET OF IOT IN EUROPE, BY COUNTRY, 2018–2025, (USD MILLION)

TABLE 59 MARKET OF IOT IN APAC, BY COUNTRY, 2018–2025, (USD MILLION)

TABLE 60 MARKET OF IOT IN ROW, BY REGION, 2018–2025, (USD MILLION)

TABLE 61 NEW PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 62 PARTNERSHIPS, COLLABORATIONS, AGREEMENTS, AND ACQUISITIONS

LIST OF FIGURES (41 FIGURES)

FIGURE 1 BATTERY MARKET FOR IOT - SEGMENTATION

FIGURE 2 BATTERY MARKET FOR IOT: RESEARCH DESIGN

FIGURE 3 SECONDARY SOURCES

FIGURE 4 PRIMARY SOURCES

FIGURE 5 BATTERY MARKET FOR IOT: RESEARCH DESIGN

FIGURE 6 BOTTOM-UP APPROACH

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 DATA TRIANGULATION

FIGURE 9 BATTERY MARKET FOR IOT: RESEARCH DESIGN

FIGURE 10 MICRO-BATTERY SEGMENT TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 11 MARKET FOR IOT IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 12 RISING NEED FOR THIN AND FLEXIBLE BATTERIES IN IOT AND MEDICAL DEVICES DRIVE MARKET GROWTH

FIGURE 13 SECONDARY BATTERY SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR IOT DURING FORECAST PERIOD

FIGURE 14 HOME AUTOMATION SEGMENT IS EXPECTED TO HOLD LARGEST SIZE OF MARKET FOR IOT, IN TERMS OF VOLUME, FROM 2020 TO 2025

FIGURE 15 BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 16 BATTERY MARKET FOR IOT

FIGURE 17 LITHIUM PRICE TREND

FIGURE 18 LITHIUM BATTERIES SEGMENT ACCOUNTED FOR A LARGEST SIZE OF MARKET FOR IOT FROM 2020 TO 2025

FIGURE 19 SECONDARY BATTERIES SEGMENT TO LEAD MARKET FOR IOT FROM 2020 TO 2025

FIGURE 20 MARKET FOR IOT IN AEROSPACE AND DEFENSE PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 21 BLOOD PRESSURE MONITORS SEGMENT EXPECTED TO ACCOUNT FOR LARGEST SHARE OF MARKET (IN TERMS OF UNITS SHIPPED) IN 2020

FIGURE 22 BATTERY MARKET IN APAC IS EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

FIGURE 23 NORTH AMERICA SNAPSHOT

FIGURE 24 EUROPE SNAPSHOT

FIGURE 25 APAC SNAPSHOT

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING

FIGURE 27 DURACELL: COMPANY SNAPSHOT

FIGURE 28 ENERGIZER: COMPANY SNAPSHOT

FIGURE 29 PANASONIC CORPORATION: COMPANY SNAPSHOT

FIGURE 30 LG CHEM: COMPANY SNAPSHOT

FIGURE 31 SAMSUNG SDI: COMPANY SNAPSHOT

FIGURE 32 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 33 CYMBET: COMPANY SNAPSHOT

FIGURE 34 ULTRALIFE: COMPANY SNAPSHOT

FIGURE 35 IMPRINT ENERGY: COMPANY SNAPSHOT

FIGURE 36 ILIKA: COMPANY SNAPSHOT

FIGURE 37 BLUE SPARK TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 38 ENFUCELL: COMPANY SNAPSHOT

FIGURE 39 BRIGHTVOLT: COMPANY SNAPSHOT

FIGURE 40 SAFT: COMPANY SNAPSHOT

FIGURE 41 POWER PAPER: COMPANY SNAPSHOT

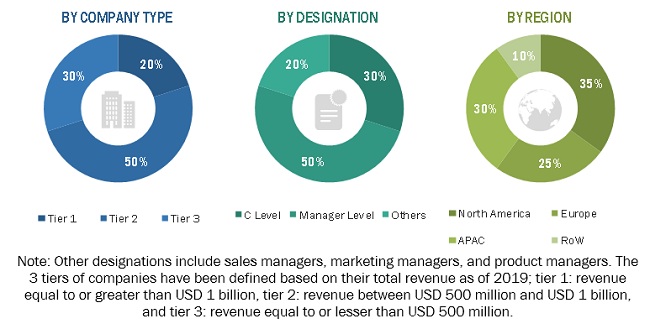

The study involved the estimation of the current size of the battery market for IoT. Exhaustive secondary research was conducted to collect information on the market, its peer markets, and its parent market. This was followed by the validation of these findings, assumptions, and sizing with the industry experts identified across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. This was followed by market breakdown and data triangulation procedures, which were used to estimate the size of the market based on different segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study on the battery market for IoT. Secondary sources included annual reports, press releases, and the investor presentations of companies; white papers; journals and certified publications; and articles by recognized authors, websites, directories, and databases. Secondary research was conducted to obtain the key information regarding the supply chain and the value chain of the industry, the total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from market- and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall size of the battery market for IoT, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Several primary interviews were conducted with the market experts from both demand (the manufacturers of batteries for IoT used in different industries) and supply sides. The primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources included industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the battery market for IoT.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were implemented to estimate and validate the total size of the battery market for IoT. These methods were used extensively to estimate the size of the market based on various segments and subsegments. The research methodology used to estimate the market size included the following steps:

- Key players in the industry were identified through extensive secondary research.

- The industry’s supply chain was identified, and the market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall size of the battery market for IoT—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides across different applications.

Study Objectives

- To describe and forecast the battery market for IoT, in terms of value and volume, based on type, rechargeability, and end-use application

- To describe and forecast the market size for 4 major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze opportunities in the battery market for IoT for stakeholders and provide a detailed competitive landscape of the market for the leading players

- To strategically profile the key players operating in the market and comprehensively analyze their core competencies

- To map the competitive intelligence based on the company profiles, as well as key growth strategies adopted and game-changing developments such as product developments, collaborations, and acquisitions undertaken in the market

Growth opportunities and latent adjacency in Battery Market