Flow Battery Market Size, Share and Trends

Flow Battery Market by Battery Type (Redox, Hybrid), Material (Vanadium, Zinc Bromine, Organic, All-iron, Hydrogen Bromine), Storage (Large Scale & Small Scale), Use Cases (Peak Capacity, Energy Shifting, Frequency Regulation) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

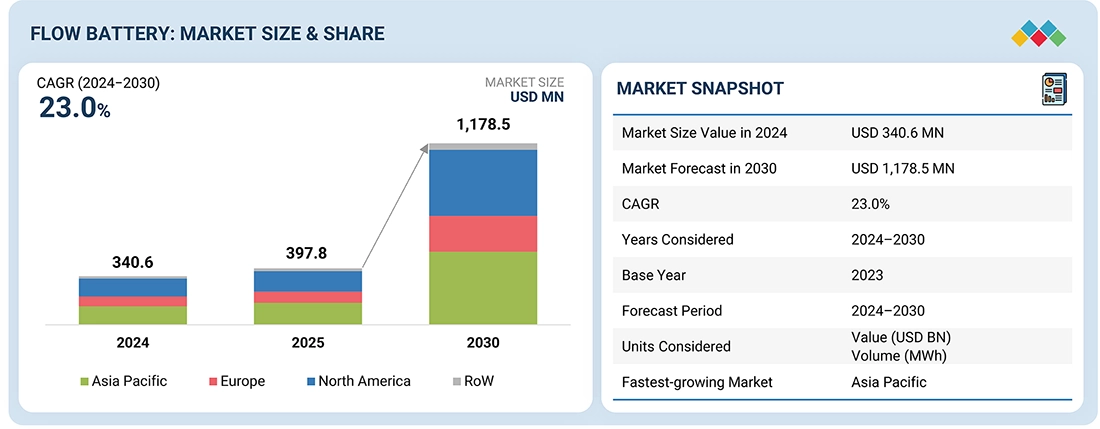

The global flow battery market is anticipated to grow from USD 0.34 billion in 2024 to USD 1.18 billion by 2030, recording a CAGR of 23.0% during 2024–2030. The growing penetration of distributed renewable resources like solar and wind energy sources has created the requirement for an effective storage system. Flow batteries have the ability to fulfill this requirement with ease. The major characteristics associated with flow batteries, such as long cycle life, high energy density, and scalability, make them suitable for energy storage applications in the energy sector. Flow batteries are promising technologies that can provide a solution to the challenges of fluctuating electricity demand and increase the application of renewable energy sources and their storage

KEY TAKEAWAYS

-

BY REGIONNorth America dominated the flow battery market, accounting for a 39.0% share in 2024.

-

BY BATTERY TYPEThe redox flow battery market is projected to grow with the highest CAGR of 24.3% from 2024 to 2030.

-

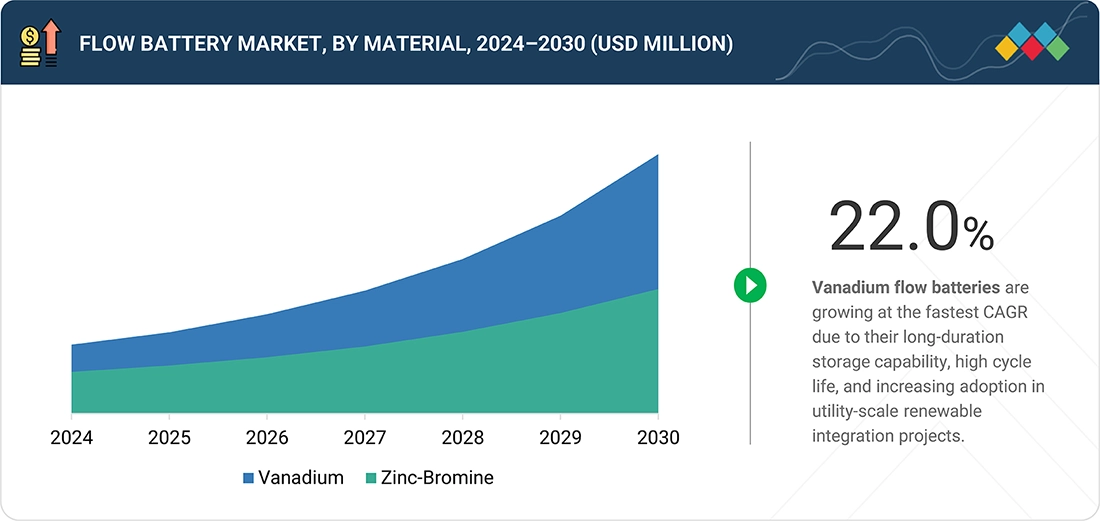

BY MATERIALThe vanadium flow battery market is predicted to gain a significant market share during the forecast period.

-

BY APPLICATIONThe flow battery market for the utilities segment is estimated to grow with the fastest CAGR of 23.6% from 2024 to 2030.

-

COMPETITIVE LANDSCAPESumitomo Electric Industries, Ltd. (Japan), Invinity Energy Systems (UK), and VRB Energy (Canada),were identified as Star players in the flow battery market. These players are known for their technologically advanced long-duration storage systems, proven large-scale deployments, and robust VRFB solutions that deliver high reliability, long cycle life, and scalable performance for utility, commercial, and industrial energy applications.

-

COMPETITIVE LANDSCAPEVFlowTech Pte Ltd. (Singapore),and VoltStorage GmbH (Germany) have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy.

The Flow Battery is an energy storage system that has varying applications from utility, telecoms, commercial, industrial and military. It has recently gained widespread use in residential and electric vehicle charging applications because of the technical superiority over the lithium-ion and lead-acid batteries. In conventional batteries, energy is embodied in the electrode material; whereas, in flow batteries, the energy is stored in external tanks containing liquid electrolytes which are circulated through cells to create the electrochemical reaction

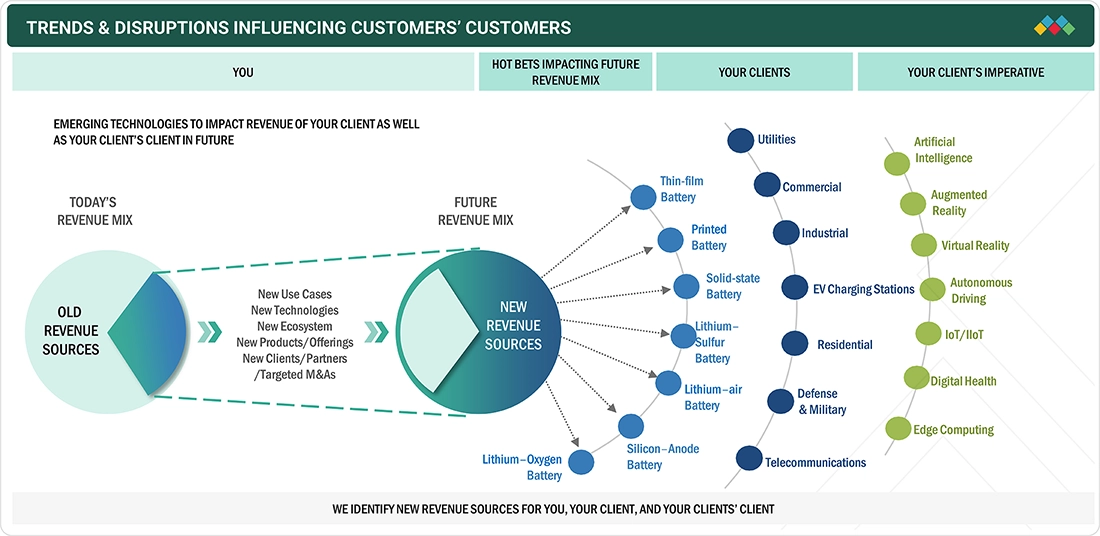

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The flow battery market is evolving rapidly as new battery technologies and shifting customer needs reshape the energy-storage landscape. Unlike traditional lithium-ion systems, which face limits in safety and scalability, flow batteries provide a strong option for large-scale storage. Alongside technologies like solid-state and lithium–sulfur batteries, they are expected to disrupt current market dynamics by offering safer, more flexible, and longer-lasting solutions, especially for renewable energy integration and grid stability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surging use of flow batteries in utility and smart grid applications

-

Increasing investments in renewable energy projects

Level

-

Need for substantial upfront capital investments

-

Standardization challenges associated with flow batteries

Level

-

Rising use of flow battery-integrated residential energy storage solutions

-

Rising use of advanced battery technologies

Level

-

Availability of alternative battery technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging use of flow batteries in utility and smart grid applications

Flow batteries have emerged as a major component of substantial value in utilities applications due to the growing integration of renewable resources into the grid. These systems are also essential during calamities for storing generated electricity as well as maintaining power stability. As a part of grid-integrated energy storage systems, flow batteries are gradually finding their application in supplying ancillary services to electricity networks and advancement of smart grids

Restraint: Need for substantial upfront capital investments

Flow batteries have turned out to be potential challengers to other conventional batteries, such as lithium-ion, lead-acid, and sodium batteries. In their current state, flow batteries face drawbacks due to their expensive manufacturing process. The upfront costs of setting up flow batteries in the vicinity can be subdivided into components, materials, installation, repair, and maintenance, which may be expensive for small and medium businesses

Opportunity: Rising use of flow battery-integrated residential energy storage solutions

Over the past decade, residential solar photovoltaic (PV) systems have expanded significantly, driven by their ability to reduce electricity costs and lower greenhouse gas emissions. Nonetheless, the variable nature of solar generation presents challenges for grid integration. Flow batteries address this issue by enabling the storage of substantial amounts of energy, thereby stabilizing supply, reducing operational costs, and minimizing the risk of power outages. Owing to their long cycle life, modular architecture, and adaptable storage capacity, flow batteries are well suited for both residential and commercial applications.

Challenge: Availability of alternative battery technologies

Competition from other large-scale energy storage technologies, including lithium-ion, fuel cells, and nickel-metal hydride systems poses a significant challenge to the adoption of flow batteries. Lithium-ion batteries, in particular, are widely preferred due to their high energy density and rapid charge–discharge capability. Sodium-sulfur batteries also offer long service life, while lead-acid batteries remain inexpensive and simple to maintain. As a result, manufacturers of flow batteries compete directly with established suppliers of these conventional battery technologies.

FLOW BATTERY MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Sumitomo deploys large-scale vanadium redox flow battery (VRFB) systems for renewable energy integration, grid stabilization, and long-duration peak-shifting, with installations supporting solar and wind plants, microgrids, and utility transmission networks. | Improves grid reliability, enables high renewable penetration, reduces curtailment, and provides long-duration, safe, and scalable storage with decades-long cycle life. |

|

Invinity delivers modular VRFB units for commercial, industrial, and utility customers, supporting demand charge reduction, behind-the-meter storage, microgrids, and hybrid renewable systems requiring continuous cycling. | Lowers energy costs through peak shaving, enables high-frequency cycling without degradation, enhances energy resilience, and supports stable microgrid operation. |

|

VRB Energy provides containerized VRFB solutions for solar-plus-storage projects, renewable integration, and grid services, with a focus on large-scale installations in industrial parks and utility zones. | Delivers long-duration discharge, supports grid balancing and frequency regulation, extends asset life for renewable plants, and minimizes operational downtime due to robust, low-maintenance design. |

|

ESS Tech manufactures iron flow batteries for commercial facilities, microgrids, and utility-scale deployments requiring long-duration, environmentally safe, and fire-risk-free energy storage. | Provides cost-efficient long-hour storage, eliminates thermal runaway risk, supports 20,000+ cycle operation with minimal capacity fade, and improves renewable dispatch reliability. |

|

Elestor BV develops hydrogen–bromine flow battery systems designed for long-duration and low-cost energy storage, targeting renewable energy parks, industrial facilities, and utility grids that require high-efficiency, multi-hour storage with minimal degradation. | Offers exceptionally low levelized cost of storage through durable chemistry, enables large-scale renewable integration and peak shifting, reduces dependence on natural gas-based balancing power, and provides a robust, long-life system suitable for continuous deep cycling. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

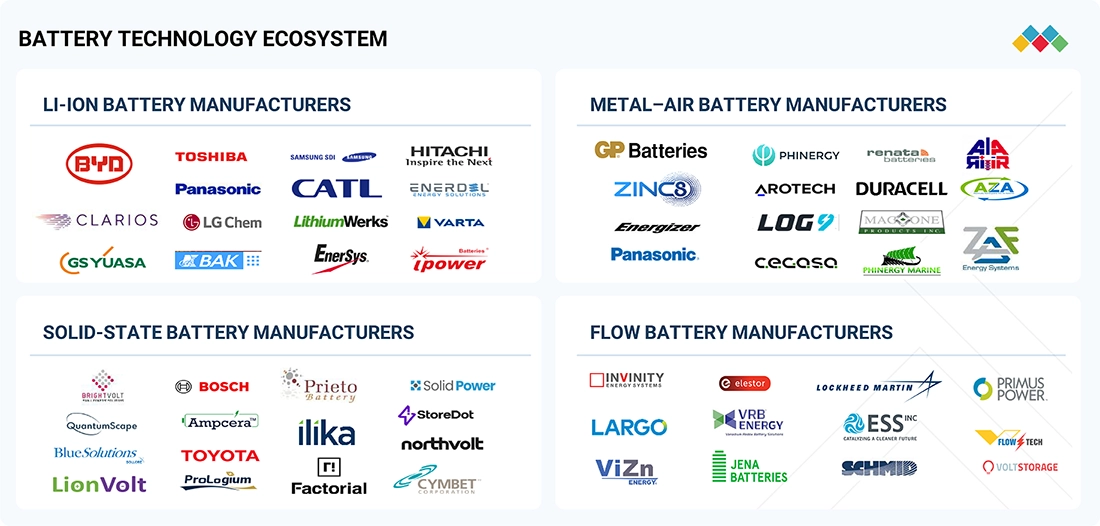

MARKET ECOSYSTEM

The adoption of flow batteries is increasing due to their scalability, safety, and long cycle life. Companies that manufacture flow batteries, particularly vanadium flow batteries, offer long-duration energy storage solutions for utilities, commercial, and industrial applications. Component suppliers provide essential materials, while system integrators help integrate flow battery systems into various applications. The growing demand for energy storage, coupled with advancements in flow battery technology, is driving the growth of this market

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Flow Battery Market, By Battery Type

As of 2024, redox flow batteries held the largest share of the flow battery market due to long operational life and low electrode and electrolyte degradation. Vanadium redox flow batteries are the most widely used type, gaining traction for long-duration, large-scale energy storage at lower cost than hybrid flow batteries. Their ability to provide reliable power backup makes them suitable for grid-scale and other applications

Flow Battery Market, By Application

As of 2024, redox flow batteries held the largest share of the flow battery market due to long operational life and low electrode and electrolyte degradation. Vanadium redox flow batteries are the most widely used type, gaining traction for long-duration, large-scale energy storage at lower cost than hybrid flow batteries. Their ability to provide reliable power backup makes them suitable for grid-scale and other applications

Flow Battery Market, By Storage

Large-scale flow batteries are projected to grow at the highest CAGR due to their durability and efficiency. Although bulky and space-intensive because of large electrolyte tanks, they support reversible chemical reactions and scalable storage. Initially developed for utilities, these batteries are increasingly being adopted in military, industrial, commercial, and telecommunications applications.

REGION

China to be fastest-growing country in Asia Pacific Flow Battery Market during forecast period

Asia Pacific is expected to register the highest CAGR in the flow battery market, driven by rapid renewable energy expansion, large-scale solar and wind projects, and strong government support for long-duration energy storage across major economies. Grid modernization, rising demand for safe multi-hour storage, supportive non-lithium policies, expanding utility-scale projects, and growing industrial microgrids are positioning the region as a key hub for next-generation long-duration energy storage deployment.

FLOW BATTERY MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

Sumitomo Electric Industries leads the flow battery market with a well-established vanadium redox flow battery portfolio, backed by decades of electrolyte innovation, large-scale deployments, and proven reliability in utility and industrial applications. Elestor BV is rapidly emerging with its next-generation hydrogen–bromine flow battery technology, leveraging low storage costs, multi-hour discharge capability, and expanding pilot projects to move toward a leadership position.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Invinity Energy Systems (UK)

- Sumitomo Electric Industries, Ltd. (Japan)

- VRB Energy (Canada)

- Enerox GmbH (Austria)

- Elestor (Netherlands)

- ESS Tech, Inc. (US)

- Largo Inc. (Canada)

- Lockheed Martin Corporation (US)

- Primus Power (US).

- EverFlow (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 397.8 Million |

| Market Forecast in 2030 (Value) | USD 1,178.5 Million |

| Growth Rate | CAGR of 23.0% from 2024–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2023 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (In GWh) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, South America, and Africa |

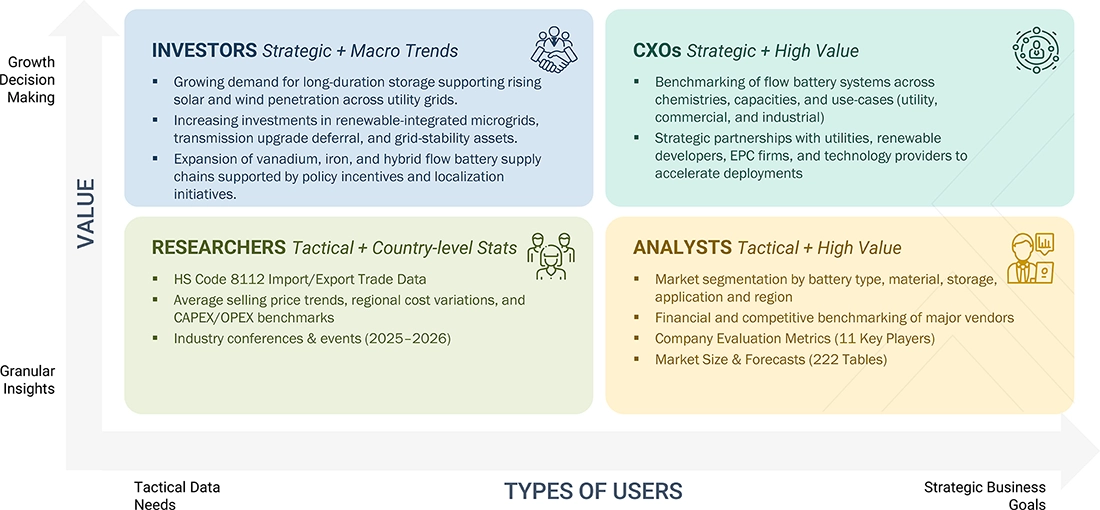

WHAT IS IN IT FOR YOU: FLOW BATTERY MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Flow Battery Manufacturer |

|

|

| Industrial End User (Data Centers, Mines, Manufacturing) | Evaluation of AGV demand across warehouses, distribution centers, and e-commerce hubs ¦ Assessment of integration readiness with WMS and ERP ¦ Roadmap for transitioning to automated intralogistics and real-time fleet coordination |

|

| System Integrator / EPC Partner |

|

|

RECENT DEVELOPMENTS

- October 2024 : Enerox GmbH was awarded investment in combined funding by the US Department of Defense Innovation Unit (DIU) to deploy its advanced megawatt-scale vanadium flow battery (VFB) and management system.

- September 2024 : VRB Energy secured a USD 55 million investment, with USD 20 million earmarked for establishing Arizona's US-based grid-scale vanadium redox flow battery manufacturing facility.

- June 2024 : Invinity Energy Systems secured a 4 MWh battery sale to PowerFlex for a California Energy Commission-funded solar microgrid project with the Rincon Band of Luiseño Indians. This project will integrate 18 Invinity VS3 batteries with a solar array expansion at Harrah’s Resort Southern California, enabling on-demand, low-carbon power to support the site's sustainable energy needs.

Table of Contents

Methodology

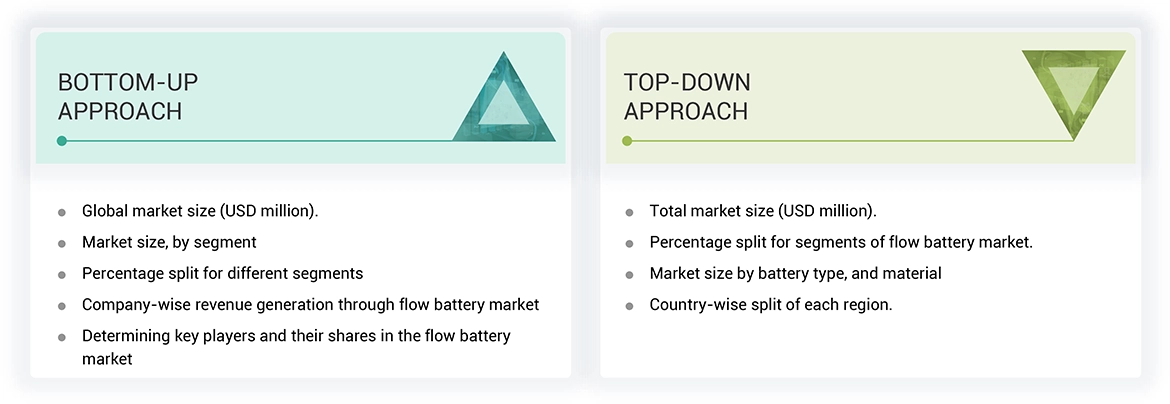

The study involved major activities in estimating the current market size for the flow battery market. Exhaustive secondary research was done to collect information on the flow battery industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the flow battery market.

Secondary Research

The market for the companies offering flow batteries is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of blockchain vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

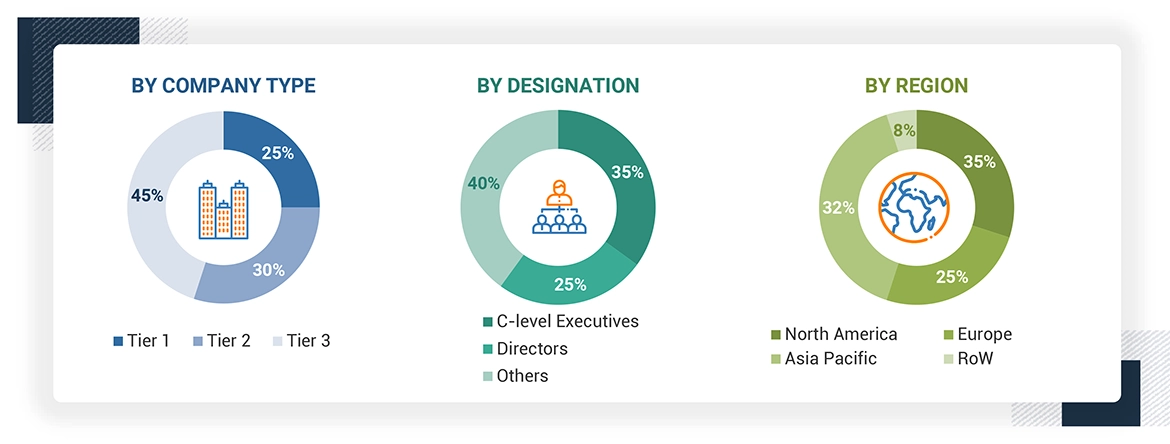

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the flow battery market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the flow battery market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Flow Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

A flow battery is a rechargeable battery in which the electrolyte flows through various electrochemical cells from one or more tanks. The electrochemical cells used in flow batteries can be electrically connected in series or parallel, determining the overall power of a flow battery system. Flow batteries are considered safer than most commonly used lithium-ion batteries as they are resistant to high temperatures and exhibit a longer operational life, making them suitable for storing and releasing renewable energy from solar and wind sources. The scalability of flow batteries, wherein the battery’s energy storage capacity can be increased by increasing the quantity of electrolytes stored in the tanks, is another advantage driving the demand for flow batteries in large-scale energy storage applications.

Key Stakeholders

- Flow Battery Manufacturers

- Government Bodies and Policymakers

- Standards Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Material and Technology Providers

- Testing, Inspection, and Certification Providers

- End Users

- Distributors and System Integrators

Report Objectives

- To describe and forecast the flow battery market, in terms of value, based on battery type, storage, material, application, and vertical

- To forecast the size of the market in terms of volume

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the RoW (Rest of the World)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the flow battery ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as agreements, acquisitions, product launches, expansions, and partnerships

- To study the impact of AI on the market under study, along with macroeconomic outlook for each region

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Flow Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Flow Battery Market