Biological Seed Treatment Market by Type (Microbials and Botanicals), Crop (Corn, Wheat, Soybean, Cotton, Sunflower, and Vegetable Crops), Function (Seed Protection and Seed Enhancement), and Region - Global Forecast to 2025

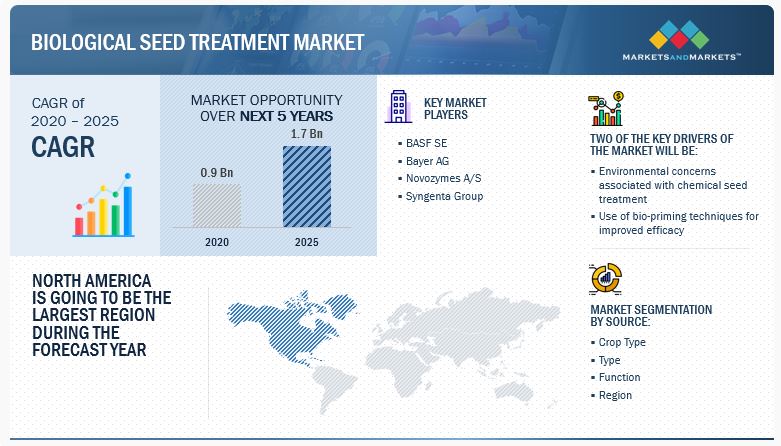

The biological seed treatment market is projected to reach USD 1.7 billion by 2025, and it was valued at USD 0.9 billion in 2020. It is expected to grow with CAGR of 11.9%.

The market is influenced by the adoption of sustainable agricultural practices, along with strong investments being made by major market players in the research and development of these products. The agricultural and environmental benefits associated with these biological seed treatment solutions are the major factors contributing to the growth of this market globally. Beneficial microorganisms and plant extracts are projected to act as important tools that could help reduce the usage of synthetic fertilizers and chemical pesticides, thereby reducing the investments by farmers and environmental risks.

To know about the assumptions considered for the study, Request for Free Sample Report

Biological seed treatment includes microorganisms used for protecting seeds against seed and soil borne diseases, hence this is more effective alternative to the chemical treatments. The high-value industrial crops are those which are high yielding and provide higher net per hectare of product produced. These include crops such as sugarcane, cotton, hybrid maize (corn), soybean, potatoes, spices, vegetables, fruits, flowers, and herbs.

For these high yielding crops, the companies are investing more in R&D activities to design innovative biological products that can align with the requirements of different geographies and soil conditions. These companies include Bayer AG (Germany), Syngenta AG (Switzerland), and other commercial, private companies globally. The Bayer Crop Science R&D team is continuously focusing on converting the industry leading value-driven investment into innovative products that benefit growers, consumers, and the planet.

In 2020, Bayer’s pipeline commercialized ten crop protection formulations; advanced three key biotech products in order to provide farmers around the globe with more than 430 new commercialized hybrids like varieties of corn, soybeans, cotton, and vegetables. Also, Syngenta AG (Switzerland) launched biological seed-applied nematicide for cyst nematodes, which has a high scope for adoption in the US, Brazil, and Canada. These trends projects to impact the growth of biological seed treatment market significantly.

Biological Seed Treatment Market Dynamics

Driver: Environmental concerns associated with chemical seed treatment

The demand for biological seed treatment has significantly increased as a result of high awareness of their potential and the growing attention to the environmental and health risks associated with conventional chemicals. Chemical seed treatments are detrimental to the environment and pose a serious risk to pollinators. The neonicotinoid class of insecticides is considered highly toxic to honeybees. Microorganisms employed as active substances in pest management are recognized as generally safe for the environment and non-target species, in comparison with synthetic chemicals.

Can Government Regulations Boost This Market

The regulatory environment for active biological ingredients differs between countries and regions. Generally, authorities around the world recognize that biological seed treatment products are beneficial but different from chemical plant protection products. Moreover, this recognition has not necessarily led to consistent approaches in regulatory requirements or review processes. In some countries, biologicals are registered under specific legislation or they may be registered in a similar manner as chemical plant protection products. At times, there are reduced data requirements, and other times there may be no well-defined process at all for their registration.

Opportunities: Use of bio-priming techniques for improved efficacy

Bio-priming is a process of a biological seed treatment that refers to a combination of seed hydration and inoculation of the seed with microbes. In most cases, microbial inoculants, such as plant growth-promoting rhizo-microorganisms (bacteria or fungi), are used for the purpose of bio-priming of seeds. It is an environment-friendly ecological approach using selected microorganisms that enhance plant growth by producing plant growth-promoting substances, enhancing nutrient uptake, or protecting seedlings/plants against soil-/seed-borne plant pathogenic organisms.

The use of such techniques is on the rise as chemicals used for seed treatment mostly act as contact fungicides that are unable to protect the plants from foliar pathogens during the later stages of crop growth.

Challenges: Inconsistent performance and incompatibility with certain pesticides

The features of biological seed treatments that have discouraged investment are their inconsistent results. The most common problems encountered during the usage of such products include desiccation and environmental conditions that discourage their growth. Successful inoculants with one crop may not work as effectively with another crop. For instance, Trichoderma is more effective for the increase in yield in tomatoes than cucumbers. Choosing just one or two microbes is not as effective as loading with an entire community. However, effectiveness can sometimes be increased by a combination of microbes, with various growth requirements. For instance, fungi can be combined with PGPR.

To know about the assumptions considered for the study, download the pdf brochure

Fastest-growing segment by crop type: Soybean

The soybean crop requires significant exposure to nitrogen for growth and development, which can be supplied through biological fixation by seed inoculants. Hence, the market for biological seed treatment in soybean is projected to grow at a fastest rate during the forecast period. Bio-nematicide seed treatments help protect the roots from soybean cyst nematode (SCN) feeding by parasitizing the nematode, inhibiting nerve transmission, or creating a protective barrier around the roots to repel nematodes

Fastest-growing segment by type: Microbials segment

The biological seed treatment market, by type, has been segmented into microbials, botanicals, and others (biofermentation products and natural polymers & derivatives). The microbials industry dominated the market in 2020, due to the increasing demand for microbial seed treatments, in field crops such as soybean and corn.

Many key companies, such as Bayer AG (Germany), Syngenta Group (Switzerland), and Corteva Agriscience (US), offer innovative biological seed treatment solutions for controlling seed and soil-borne diseases in a broad range of crops. This exponential growth in this North America region is attributed to government subsidies, increasing need to improve and protect food production, and rising awareness of biological seed treatment.

Fastest-growing segment by function: Seed protection segment

On the basis of function, the global market has broadly been segmented into seed enhancement and seed protection. Biological seed treatments aimed at seed protection provide targeted control of certain pests and fungal diseases during the early seedling stage. Biological seed treatments are used on multiple crops to control a variety of pests. It ensures uniform stand establishment through defense against numerous soil-borne pathogens and insects.

North America region’s increasing preference for high quality produce

The increasing agricultural practices and requirement of high-quality agricultural produce are factors that are projected to drive the biological seed treatment market growth in this region. The government policies adopted by developed countries for the ban on key active ingredients are the major factors encouraging the growth of this market in North America region. Hence, North America is projected to be the fastest-growing region in the global market. R&D investments for the development of biological seed treatment and installation of new production capacities by key players are projected to drive the market growth in the next five years.

Key Players in Biological Seed Treatment Market:

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Novozymes A/S (Denmark), Syngenta Group (Switzerland), Corteva Agriscience (US), Valent BioSciences (US), Verdesian Life Sciences (US), Plant Health Care (US), Precision Laboratories (US), Koppert Biological Systems (Netherlands), and Italpollina (Italy), These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market demand in 2020 |

US $0.9 billion |

|

Market size value in 2023 |

US $1.3 billion |

|

Growth forecast in 2025 |

US $1.7 billion |

|

Progress Rate |

CAGR of 11.9% from 2020 to 2025 |

|

Base Year for estimation |

2019 |

|

Market Size Available for Years |

2020-2025 |

|

Report Coverage & Deliverables |

Revenue forecast, company ranking, driving factors, Competitive benchmarking, and analysis |

|

Regional scope |

North America, Europe, Asia Pacific, South America, RoW |

|

Fastest Growing Market |

North America |

|

Key Industry Participants Presented |

|

Biological Seed Treatment Market Report Segmentation

This research report categorizes the biological seed treatment market on the basis of crop type, type, function, and region.

|

Aspect |

Details |

|

By Crop Type |

|

|

By Type |

|

|

By Function |

|

|

By Region |

|

Recent Developments in Biological Seed Treatment Market

- In May 2022, FytoSave, a biofungicide co-developed by Biobest Group and FytoFend, was launched in Finland and other Scandinavian countries. This triggered plants’ natural defenses against powdery mildew and downy mildew. The launch of FytoSave in Finland and other Scandinavian countries has helped Biobest expand its geographical offerings to these regions.

- In May 2022, UPL Group acquired OptiCHOS, a naturally derived fungicide from BioCHOS, a spin-off of the Norwegian University of Life Sciences. BioCHOS was formulated as a biodegradable broad-spectrum disease control solution with low environmental and human impact. The product acquisition would help UPL expand its NPP portfolio and target markets suitable to the product to address farmers' needs.

- In May 2022, A strategic partnership was announced between UPL limited and AgBiTech, a world leader in ag biologicals innovation. Through this collaboration, UPL would distribute AgBiTech’s biosolutions, starting with two bioinsecticides, Heligen and Fawligen. Through this collaboration, UPL would distribute AgBiTech’s biosolutions, starting with two bioinsecticides, Heligen and Fawligen. This would ultimately help UPL expand its bioinsecticides portfolio.

- In April 2022, Biobest acquired a 60% stake in Biopartner sp z.o.o, a Poland-based leading distributor of biological plant protection products, including fertilizers and biopesticides. This investment has benefitted Biobest Group as it can now offer and distribute its products in Poland.

- In April 2022, Vestaron announced a strategic partnership with Berkeley Lights, a leader in digital cell biology, to advance the development of pesticidal peptides as active ingredients to improve the safety and efficacy of crop protection. Vestaron would use Berkeley’s propriety high-throughput, functional screening service to optimize novel peptide-based active ingredients.

- In April 2022, Ginkgo Bioworks announced plans to expand its platform capabilities in agricultural biologicals by acquiring Bayer’s 175,000-square-foot West Sacramento biologics research & development site team.

- In April 2022, Andermatt Biocontrol AG bought a new production facility in Fredericton, NB, Canada, to meet the rising demand for its bioinsecticide, Spodovir Plus. With this addition, the production was expected to increase roughly five times the current production. With this addition, the production is expected to increase roughly five times the current production.

- In March 2022, Marrone Bio Innovations and Bioceres Crop Solutions entered into a definitive agreement to combine the companies in an all-stock transaction. This transaction would combine Bioceres’ expertise in bionutrition with MBI’s leadership in developing biological crop protection and plant health solutions.

- In January 2022, Certis Biologicals announced the launch of MeloCon LC, containing Purpureocilium lilacinum strain 251 as an active ingredient. It can control a wide variety of harmful nematodes at every lifecycle stage. This launch helped the company expand its bionematicide portfolio offering.

Frequently Asked Questions (FAQ):

How big is the biological seed treatment market?

The global biological seed treatment market in terms of revenue was estimated to be worth $0.9 billion in 2020 and is poised to reach $1.7 billion by 2025

What is the estimated growth rate (CAGR) of the global biological seed treatment market for the next five years?

The global biological seed treatment market is expected to grow at a compound annual growth rate (CAGR) of 11.9% from 2020 to 2025

What are the major revenue pockets in the biological seed treatment market?

North America is projected to be the fastest-growing region in the global market. R&D investments for the development of biological seed treatment and installation of new production capacities by key players are projected to drive the market growth in the next five years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 UNIT CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2015–2019

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9 COVID-19 ECONOMIC IMPACT ASSESSMENT: SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 12 BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION, 2020 VS. 2025

FIGURE 13 MARKET FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 14 MARKET FOR BIOLOGICAL SEED TREATMENT, BY CROP TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 15 MARKET FOR BIOLOGICAL SEED TREATMENT: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 16 INCREASE IN COMBINED APPLICATION OF BIOLOGICAL SEED TREATMENT PRODUCTS WITH CHEMICAL SEED TREATMENT PRODUCTS TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET FOR BIOLOGICAL SEED TREATMENT, BY TYPE

FIGURE 17 MICROBIAL IS ESTIMATED TO BE THE MOST PREFERRED TYPE IN THE BIOLOGICAL SEED TREATMENT MARKET IN 2020

4.3 NORTH AMERICA: MARKET FOR BIOLOGICAL SEED TREATMENT, BY KEY COUNTRY AND CROP TYPE

FIGURE 18 CORN & SOYBEAN TO BE A KEY APPLICATION OF BIOLOGICAL SEED TREATMENT PRODUCTS IN THE NORTH AMERICAN REGION IN 2020

4.4 MARKET FOR BIOLOGICAL SEED TREATMENT: MAJOR REGIONAL SUBMARKETS

FIGURE 19 US AND BRAZIL TO ACCOUNT FOR THE LARGEST MARKET SHARE IN 2020

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASED LAND AREA UNDER ORGANIC AGRICULTURE

FIGURE 20 GLOBAL ORGANIC AGRICULTURE, BY REGION (2018)

5.2.2 GROWING AWARENESS PERTAINING TO PESTICIDE RESIDUAL LEVELS

FIGURE 21 TOP 10 COUNTRIES WITH MAXIMUM PESTICIDE USE FOR AGRICULTURE, 2019 (TON)

5.2.3 INCREASE IN DEMAND FOR HIGH-VALUE INDUSTRIAL CROPS

FIGURE 22 PRODUCTION/YIELD QUANTITIES OF FRESH FRUITS IN THE WORLD, 2016–2019

FIGURE 23 PRODUCTION SHARE OF FRESH FRUITS, BY REGION (AVG, 2016–2019)

5.3 MARKET DYNAMICS

FIGURE 24 MARKET FOR BIOLOGICAL SEED TREATMENT: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Environmental concerns associated with chemical seed treatment

TABLE 2 KEY MICROBIAL BIOCONTROL AGENTS USED IN BIOLOGICAL SEED TREATMENT

5.3.1.2 Rising prices of high-quality seeds

5.3.2 RESTRAINTS

5.3.2.1 Government regulatory barriers

5.3.2.2 Safety concerns regarding the use of microbial

5.3.3 OPPORTUNITIES

5.3.3.1 Advent of innovative combination products

5.3.3.2 Use of bio-priming techniques for improved efficacy

5.3.4 CHALLENGES

5.3.4.1 Inconsistent performance and incompatibility with certain pesticides

5.3.4.2 Limited microbial shelf life

5.4 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED FOR BIOLOGICAL SEED TREATMENT, 2015–2020

FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED IN THE MARKET, 2015–2020

TABLE 3 LIST OF A FEW PATENTS IN THIS MARKET, 2015–2020

5.6 AVERAGE PRICE ANALYSIS

FIGURE 28 AVERAGE PRICE TRENDS FOR ACTIVE INGREDIENTS OF BIOLOGICAL SEED TREATMENT, 2018-2020, (USD/KG)

5.7 CASE STUDIES

5.7.1 USE OF BACILLUS STRAINS FOR THE PRODUCTION OF BIOFUNGICIDES FOR LONGER SHELF LIFE

TABLE 4 IDENTIFICATION OF MARKET OPPORTUNITIES FOR BIOFUNGICIDES IN EUROPE

5.7.2 USE OF NUTRIENT TECHNOLOGY IN CONJUNCTION WITH BIOLOGICAL SEED TREATMENT FOR IMPROVED CROP YIELDS

TABLE 5 IMPROVED CROP QUALITY THROUGH THE APPLICATION OF NUTRIENT TECHNOLOGY BASED PRODUCT IN BIOLOGICAL SEED TREATMENT

5.8 YC–YCC SHIFTS IN THE BIOLOGICAL SEED TREATMENT MARKET

FIGURE 29 DEMAND FOR HIGHLY-EFFICIENT CROP PROTECTION PRODUCTS IS A NEW HOT BET IN THE MARKET

5.9 COVID-19 IMPACT ON THE GLOBAL MARKET

5.10 MARKET ECOSYSTEM

FIGURE 30 MARKET ECOSYSTEM

5.10.1 PRODUCT MANUFACTURERS

5.10.2 REGULATORY BODIES

5.11 IMPACT OF COVID-19 ON GLOBAL MARKET

FIGURE 31 IMPACT OF COVID-19 ON GLOBAL MARKET, PRE COVID-19 V/S POST COVID-19, 2020-2025 (USD MILLION)

TABLE 6 MARKET SIZE, PRE-COVID-19 V/S POST-COVID-19, 2020–2025 (USD MILLION)

6 BIOLOGICAL SEED TREATMENT MARKET, BY TYPE (Page No. - 77)

6.1 INTRODUCTION

FIGURE 32 MICROBIAL SEGMENT PROJECTED TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 7 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

6.2 COVID-19 IMPACT ON THE GLOBAL MARKET, BY TYPE

TABLE 8 PRE-COVID-19: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2020–2025 (USD MILLION)

TABLE 9 POST-COVID-19: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2020–2025 (USD MILLION)

6.3 MICROBIAL

6.3.1 BACTERIAL

6.3.1.1 Eradication of pathogens and increase in the speed of germination driving the market for bacterial seed treatment

6.3.2 FUNGAL

6.3.2.1 Fungal seed treatment helps overcome the limitations of salinity and alkalinity on crop growth

TABLE 10 MICROBIAL MARKET SIZE, BY SUBTYPE, 2018–2025 (USD MILLION)

TABLE 11 MICROBIAL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.4 BOTANICALS & OTHERS

6.4.1 ECONOMICAL PRICE, ECO-FRIENDLY BENEFITS, AND NON-TOXICITY TO ANIMALS AND HUMANS DRIVING THE DEMAND

TABLE 12 BOTANICALS & OTHERS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 BIOLOGICAL SEED TREATMENT MARKET, BY CROP (Page No. - 84)

7.1 INTRODUCTION

FIGURE 33 CORN SEGMENT PROJECTED TO DOMINATE THE MARKET THROUGHOUT THE FORECAST PERIOD

TABLE 13 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP TYPE, 2018–2025 (USD MILLION)

7.2 CORN

7.2.1 CORN SEEDS ARE TREATED TO PREVENT SEED DECAY AND SEEDLING BLIGHTS CAUSED DUE TO FUNGI

TABLE 14 MARKET SIZE FOR CORN, BY REGION, 2018–2025 (USD MILLION)

7.3 WHEAT

7.3.1 WHEAT SEEDS ARE TREATED TO BOOST THEIR RESISTANCE AGAINST FUNGI AND BACTERIA

TABLE 15 MARKET SIZE FOR WHEAT, BY REGION, 2018–2025 (USD MILLION)

7.4 SOYBEAN

7.4.1 BIO-NEMATICIDE SEED TREATMENTS PROTECT THE ROOTS FROM SOYBEAN FROM NEMATODE

TABLE 16 MARKET SIZE FOR SOYBEAN, BY REGION, 2018–2025 (USD MILLION)

7.5 COTTON

7.5.1 BIOLOGICAL SEED TREATMENT HELPS ACCELERATE SEED GERMINATION AND PREVENTS DISEASES

8 BIOLOGICAL SEED TREATMENT MARKET, BY FUNCTION (Page No. - 90)

8.1 INTRODUCTION

FIGURE 34 SEED ENHANCEMENT SEGMENT PROJECTED TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 18 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

8.2 SEED ENHANCEMENT

TABLE 19 BIOLOGICAL SEED ENHANCEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 BIOLOGICAL SEED ENHANCEMENT MARKET SIZE, BY REGION, 2018–2025 (KT)

8.2.1 BIOFERTILIZER

8.2.1.1 Developing countries witness high adoption of biofertilizers as they are cost-effective

8.2.2 BIOSTIMULANT

8.2.2.1 Biostimulants applied as seed treatment provide growth stimulation and enhanced germination

TABLE 21 BIOLOGICAL SEED ENHANCEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 22 BIOLOGICAL SEED ENHANCEMENT MARKET SIZE, BY TYPE, 2018–2025 (KT)

8.3 SEED PROTECTION

TABLE 23 BIOLOGICAL SEED PROTECTION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 BIOLOGICAL SEED PROTECTION MARKET SIZE, BY REGION, 2018–2025 (KT)

8.3.1 BIOINSECTICIDES

8.3.1.1 Bioinsecticides have reduced the reliance on synthetic agrochemical seed treatments

8.3.2 BIOFUNGICIDES

8.3.2.1 Biofungicides offer resistance to a variety of biotic and abiotic stresses

8.3.3 OTHER FUNCTIONS

TABLE 25 BIOLOGICAL SEED PROTECTION MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 26 BIOLOGICAL SEED PROTECTION MARKET SIZE, BY TYPE, 2018–2025 (KT)

9 BIOLOGICAL SEED TREATMENT MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 35 THE NETHERLANDS RECORDED THE HIGHEST GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

9.2 COVID-19 IMPACT ON BIOLOGICAL SEED TREATMENT MARKET, BY REGION

TABLE 27 PRE-COVID-19: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 28 POST-COVID-19: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 31 MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY REGION, 2018–2025 (KT)

9.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 32 NORTH AMERICA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 33 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (KT)

TABLE 35 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

TABLE 37 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP, 2018–2025 (USD MILLION)

9.3.1 REGULATIONS

9.3.1.1 US

9.3.1.2 Canada

9.3.2 TRADE ANALYSIS

9.3.2.1 Export scenario of insecticides and fungicides

FIGURE 37 NORTH AMERICA: INSECTICIDES AND FUNGICIDES EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.3.2.2 Import scenario of insecticides and fungicides

FIGURE 38 NORTH AMERICA: INSECTICIDES AND FUNGICIDES IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.3.3 US

9.3.3.1 Established players in the market are focusing on developing innovative seed enhancement products

TABLE 39 US: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 40 US: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.3.4 CANADA

9.3.4.1 Increase in demand for better quality crop products driving the demand for seed enhancement products

TABLE 41 CANADA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 42 CANADA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.3.5 MEXICO

9.3.5.1 Rise in the export of fruits & vegetables to the US increasing the adoption of biological seed treatment among small organic producers

TABLE 43 MEXICO: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 44 MEXICO: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4 EUROPE

TABLE 45 EUROPE: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 46 EUROPE:MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 47 EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (KT)

TABLE 48 EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

TABLE 50 EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP, 2018–2025 (USD MILLION)

FIGURE 39 EUROPE: MARKET SNAPSHOT

9.4.1 REGULATIONS

9.4.2 TRADE ANALYSIS

9.4.2.1 Export scenario of insecticides and fungicides

FIGURE 40 EUROPE: INSECTICIDES AND FUNGICIDES EXPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.4.2.2 Import scenario of insecticides and fungicides

FIGURE 41 EUROPE: INSECTICIDES AND FUNGICIDES IMPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Favorable regulatory framework to support the use of biological seed treatment methods

TABLE 52 FRANCE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 53 FRANCE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.4 SPAIN

9.4.4.1 Rise in the organic production of fruits & vegetables driving the need for biological seed treatment

TABLE 54 SPAIN: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 55 SPAIN: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.5 GERMANY

9.4.5.1 Rising pest resistance to chemical pesticides driving the demand for biological seed treatment

TABLE 56 GERMANY: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 57 GERMANY: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.6 RUSSIA

9.4.6.1 High crop losses to boost the adoption of biological control products

TABLE 58 RUSSIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 59 RUSSIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.7 ITALY

9.4.7.1 Government initiatives toward organic farming boosting the market growth

TABLE 60 ITALY: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 61 ITALY: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.8 NETHERLANDS

9.4.8.1 Greenhouse cultivation of vegetables is increasing the adoption of biological seed treatment

TABLE 62 NETHERLANDS: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 63 NETHERLANDS: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.4.9 REST OF EUROPE

9.4.9.1 Need for sustainable agriculture practices to increase the application of biological seed treatment

TABLE 64 REST OF EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.5 ASIA PACIFIC

TABLE 66 ASIA PACIFIC: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (TON)

TABLE 69 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

TABLE 71 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP, 2018–2025 (USD MILLION)

9.5.1 REGULATIONS

9.5.1.1 Australia

9.5.1.2 China

9.5.1.3 India

9.5.2 TRADE ANALYSIS

9.5.2.1 Export scenario of insecticides and fungicides

FIGURE 42 ASIA PACIFIC: INSECTICIDES AND FUNGICIDES EXPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.5.2.2 Import scenario of insecticides and fungicides

FIGURE 43 ASIA PACIFIC: INSECTICIDES AND FUNGICIDES IMPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.5.3 AUSTRALIA

9.5.3.1 Dependency on pollinating insects is driving the demand for biological seed treatment

FIGURE 44 AUSTRALIA: CANOLA EXPORTS, 2012–18 (TONNES)

TABLE 73 AUSTRALIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 74 AUSTRALIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.5.4 CHINA

9.5.4.1 Increasing trend of utilizing biological seed treatment products to meet high-quality export requirements

TABLE 75 CHINA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 76 CHINA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.5.5 INDIA

9.5.5.1 Rising awareness and market penetration of biologicals to drive the adoption of biological seed treatment solutions

FIGURE 45 PRODUCTION QUANTITY OF OILSEEDS IN INDIA, 2015-2019 (MILLION TONNES)

TABLE 77 INDIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 78 INDIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.5.6 JAPAN

9.5.6.1 Collaborative research projects to encourage the adoption of biological seed treatment

TABLE 79 JAPAN: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 80 JAPAN: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.5.7 THAILAND

9.5.7.1 Export of organic fruits & vegetables and increase in sustainable rice cultivation practices to drive the market growth for biological seed treatment

TABLE 81 THAILAND: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 82 THAILAND: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.5.8 REST OF ASIA PACIFIC

9.5.8.1 Increase in government initiatives to support exports driving the market growth

TABLE 83 REST OF ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.6 SOUTH AMERICA

TABLE 85 SOUTH AMERICA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (KT)

TABLE 88 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 89 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

TABLE 90 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP, 2018–2025 (USD MILLION)

9.6.1 REGULATIONS

9.6.1.1 Brazil

9.7 TRADE ANALYSIS

9.7.1 EXPORT SCENARIO OF INSECTICIDES AND FUNGICIDES

FIGURE 46 SOUTH AMERICA: INSECTICIDES AND FUNGICIDES EXPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.7.2 IMPORT SCENARIO OF INSECTICIDES AND FUNGICIDES

FIGURE 47 SOUTH AMERICA: INSECTICIDES AND FUNGICIDES IMPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.7.3 BRAZIL

9.7.3.1 Increase in exports and research activities is a significant boost for the market growth

TABLE 92 BRAZIL: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 93 BRAZIL: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.7.4 ARGENTINA

9.7.4.1 High adoption of biologicals to improve the agro-industrial productivity drives the market growth for biological seed treatment

TABLE 94 ARGENTINA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 95 ARGENTINA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.7.5 CHILE

9.7.5.1 New product offerings by companies are increasing the use of biological seed treatment

TABLE 96 CHILE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 97 CHILE: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.7.6 REST OF SOUTH AMERICA

9.7.6.1 Application of biological seed treatment on key export crops to witness an increase

TABLE 98 REST OF SOUTH AMERICA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 99 REST OF SOUTH AMERICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (KT)

9.8 REST OF THE WORLD

TABLE 100 ROW: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 101 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 102 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY COUNTRY, 2018–2025 (KT)

TABLE 103 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 105 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

TABLE 106 ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY CROP, 2018–2025 (USD MILLION)

9.8.1 REGULATIONS

9.8.1.1 South Africa

9.8.1.2 Kenya

9.8.2 IMPORT-EXPORT

9.8.2.1 Export scenario of insecticides and fungicides

FIGURE 48 ROW: INSECTICIDES AND FUNGICIDES EXPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.8.2.2 Import scenario of insecticides and fungicides

FIGURE 49 ROW: INSECTICIDES AND FUNGICIDES IMPORT, BY KEY COUNTRY, 2012–2019 (USD MILLION)

9.8.3 SOUTH AFRICA

9.8.3.1 Increase in the production of corn in a sustainable way to drive the market growth for biological seed treatment

FIGURE 50 PRODUCTION QUANTITY OF MAIZE, SUNFLOWER SEEDS, AND SOYBEANS IN SOUTH AFRICA, 2017-2019 (TON)

TABLE 107 SOUTH AFRICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 108 SOUTH AFRICA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.8.4 ETHIOPIA

9.8.4.1 Expansion of edible oil processing plants and decrease in the use of chemical pesticides to encourage the adoption of biological seed treatment

FIGURE 51 PRODUCTION QUANTITY OF OILSEEDS IN ETHIOPIA, 2017-2019 (TONS)

TABLE 109 ETHIOPIA: BIOLOGICAL SEED TREATMENT MARKET SIZE, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 110 ETHIOPIA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.8.5 KENYA

9.8.5.1 To protect seeds from bad weather condition, seed treatment is being adapted

TABLE 111 KENYA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 112 KENYA: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

9.8.6 OTHER COUNTRIES IN ROW

9.8.6.1 Biological seed treatment can help seeds survive inhospitable climate in these regions

TABLE 113 OTHER COUNTRIES IN ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (USD MILLION)

TABLE 114 OTHER COUNTRIES IN ROW: MARKET SIZE FOR BIOLOGICAL SEED TREATMENT, BY FUNCTION, 2018–2025 (TON)

10 COMPETITIVE LANDSCAPE (Page No. - 173)

10.1 OVERVIEW

10.2 MARKET RANKING ANALYSIS, 2019

FIGURE 52 BASF SE DOMINATED THE BIOLOGICAL SEED TREATMENT MARKET IN 2019

10.3 COMPANY REVENUE ANALYSIS

FIGURE 53 REVENUE ANALYSIS OF KEY PLAYERS IN THE BIOLOGICAL SEED TREATMENT MARKET, 2017–2019 (USD MILLION)

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 EMERGING COMPANIES

FIGURE 54 BIOLOGICAL SEED TREATMENT, COMPANY EVALUATION QUADRANT, 2019 (OVERALL MARKET)

10.5 START-UPS/SME EVALUATION MATRIX

10.5.1 PROGRESSIVE COMPANIES

10.5.2 STARTING BLOCKS

10.5.3 RESPONSIVE COMPANIES

10.5.4 DYNAMIC COMPANIES

10.6 PRODUCT FOOTPRINT

TABLE 115 COMPANY TYPE FOOTPRINT

TABLE 116 COMPANY CROP FOOTPRINT

TABLE 117 COMPANY REGION FOOTPRINT

TABLE 118 PRODUCT FOOTPRINT (OVERALL)

FIGURE 55 BIOLOGICAL SEED TREATMENT, START-UPS/SME EVALUATION QUADRANT, 2019

10.7 COMPETITIVE SCENARIO

FIGURE 56 MARKET EVALUATION FRAMEWORK

FIGURE 57 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE BIOLOGICAL SEED TREATMENT MARKET, 2018–2020

10.7.1 NEW PRODUCT LAUNCHES

TABLE 119 NEW PRODUCT LAUNCHES, 2018–2020

10.7.2 EXPANSIONS & INVESTMENTS

TABLE 120 EXPANSIONS & INVESTMENTS, 2018-2020

10.7.3 ACQUISITIONS

TABLE 121 ACQUISITIONS, 2018–2020

10.7.4 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 122 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019–2020

11 COMPANY PROFILES (Page No. - 191)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 KEY PLAYERS

11.1.1 BASF SE

FIGURE 58 BASF SE: COMPANY SNAPSHOT

FIGURE 59 SWOT ANALYSIS

11.1.2 BAYER

FIGURE 60 BAYER: COMPANY SNAPSHOT

FIGURE 61 SWOT ANALYSIS

11.1.3 SYNGENTA GROUP

FIGURE 62 SYNGENTA GROUP: COMPANY SNAPSHOT

FIGURE 63 SWOT ANALYSIS

11.1.4 CORVETA AGRISCIENCE

FIGURE 64 CORVETA AGRISCIENCE: COMPANY SNAPSHOT

11.1.5 NOVOZYMES A/S

FIGURE 65 NOVOZYMES A/S: COMPANY SNAPSHOT

11.1.6 UPL

FIGURE 66 UPL: COMPANY SNAPSHOT

FIGURE 67 SWOT ANALYSIS

11.1.7 MARRONE BIO INNOVATIONS

FIGURE 68 MARRONE BIO INNOVATION: COMPANY SNAPSHOT

11.1.8 CERTIS EUROPE

11.1.9 KOPPERT BIOLOGICAL SYSTEMS

11.1.10 VALENT

11.1.11 RIZOBACTER

11.2 OTHER PLAYERS

11.2.1 PLANT HEALTH CARE

FIGURE 69 PLANT HEALTH CARE: COMPANY SNAPSHOT

FIGURE 70 SWOT ANALYSIS

11.2.2 ITALPOLLINA

11.2.3 PRECISION LABORATORIES LLC

11.2.4 VERDESIAN LIFE SCIENCES

11.2.5 INCOTEC

11.2.6 BIOWORKS INC

11.2.7 ADVANCED BIOLOGICAL MARKETING

11.2.8 IPL BIOLOGICALS

11.2.9 KAN BIOSYS

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 228)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

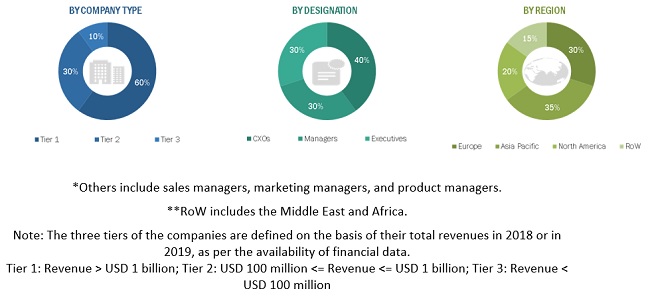

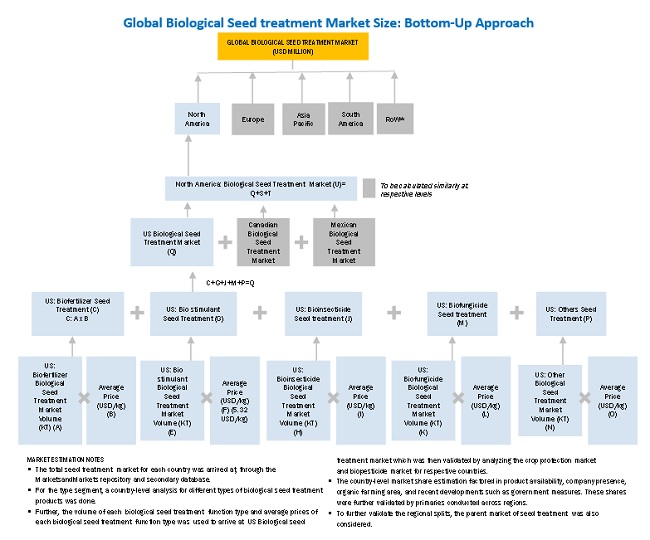

The study involves four major activities to estimate the current size of the biological seed treatment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Biological Seed Treatment Market Primary Research

The market comprises several stakeholders, such as manufacturers, importers and exporters, traders, distributors and suppliers of Biopesticides, biofertilizers, biostimulants and government & research organizations. It also includes manufacturers of inoculants, biologicals and seed companies. The demand-side of this market is characterized by the rising demand for biological seed treatment in seed industries. The supply-side is characterized by the supply of raw materials in the biological seed treatment market from various suppliers in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Biological Seed Treatment Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the seed treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- Major regions were identified, along with countries contributing to the maximum share.

- The industry’s supply chain and market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the seed treatment market.

To know about the assumptions considered for the study, Request for Free Sample Report

Biological Seed Treatment Market Report Objectives

- To define, segment, and project the global market size of the biological seed treatment market .

- To understand the biological seed treatment market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies.

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions.

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, collaborations, divestments, disinvestments, and agreements.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe biological seed treatment market into UK, Greece and Ukraine.

- Further breakdown of the Rest of Asia Pacific biological seed treatment market into Vietnam, the Philippines and Indonesia.

- Further breakdown of South America biological seed treatment market into Colombia and Peru.

- Further breakdown of the others in the RoW biological seed treatment market into other African countries and the Middle East.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biological Seed Treatment Market