Biomass Power Generation Market by Technology (Combustion, Gasification, Anaerobic Digestion, Pyrolysis), Feedstock (Agricultural Waste, Forest Waste, Animal Waste, Municipal Waste), Fuel (Solid, Liquid, Gaseous) and Region - Global Forecast to 2028

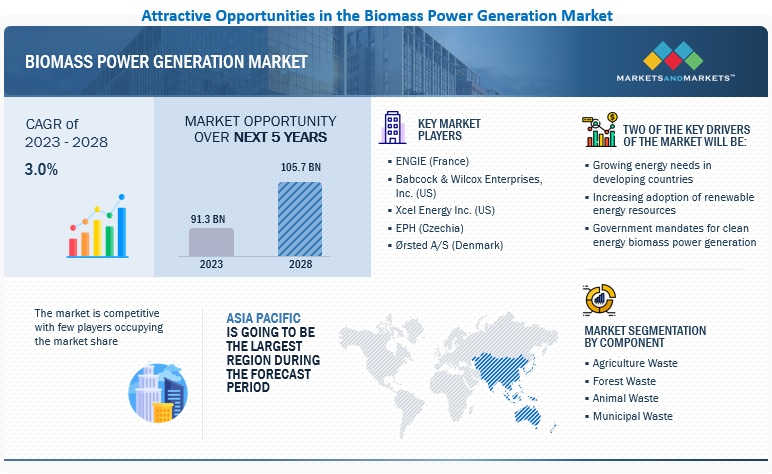

The biomass power generation market size was valued at USD 91.3 billion in 2023 to reach USD 105.7 billion by 2028, it is expected to grow at a CAGR of 3.0 % during forecast period. Recently regions has witnessed a rapid growth in electricity demand in recent years due to the growing population, increase in per capita income, and growth in the use of biomass power with urbanization.

To know about the assumptions considered for the study, Request for Free Sample Report

Biomass Power Generation Market Dynamics

Driver: Government-led initiatives to boost bioenergy production

Government policies and initiatives have played a key role in bioenergy development. In China, ~62 national-level regulations and policies have played a vital role in the country’s biomass power generation between 2006 and 2021. Among these are “The Renewable Energy” Law of 2006, “Regulations on the Implementation of the Enterprise Income Tax Law” of 2007, “11th Five-Year Plan for the Development of Renewable Energy” of 2008, “Notice on Improving the Price Policies for Agroforestry Biomass Power Generation” of 2010, “12th Five-Year Plan for Biomass Energy Development” of 2012, “13th Five-Year Plan for Biomass Energy Development” of 2016, and the “Biomass Power Generation Project Construction Work Plan” of 2021. In August 2021, the National Energy Administration, Ministry of Finance, and National Development and Reform Commission jointly issued the “Biomass Power Generation Project Construction Work Plan.” This initiative led to USD 3.5 billion in financial support on behalf of the local and central governments to facilitate biomass power generation.

Restraint: Fluctuating and high costs of feedstocks

The cost of the feedstock is a significant variable factor in power generation. Consistent feedstock quality is required to achieve high production and the longest possible onstream time. Traditionally, biomass power generation plants receive the raw biomass materials directly and preprocess them into feedstock before turning them into products. A consistent just-in-time supply of raw biomass to the plants is not possible since various types of biomass materials, such as agricultural residues, energy crops, and logging residues, are collected in accordance with their growth cycles and optimal harvesting times. Alternatively, biomass materials are stored and sent to the plant as needed. Based on experience, it appears that this strategy has resulted in several logistical issues, biomass losses due to microbial decomposition or fire, and uneven feedstock quality due to variations in the properties of as-delivered biomass. These factors have led to a high increase in the cost of feedstock, low throughput, and low product yield.

Opportunities: Advancements in biomass power generation techniques

According to the global market for biomass power generation, there have been significant improvements in the methods used to produce biomass energy. The evolution of efficient harvesting and post-harvesting technologies has decreased biomass energy market costs. There are many approaches to technologically advanced biomass energy conversion, such as using improved fuel processing technologies, increasing the effectiveness of biomass energy conversion technologies, and increasing the effectiveness of end-user technologies. In the field of renewable energy, complex operations are becoming mechanized. Automation improves efficiency, reduces waiting time, and boosts output. The operation of biomass power plants is enhanced by a web-based program called biomass co-firing assessment and services (BCAS), which incorporates the fundamental characteristics of combustion and mineral matter transformation. Such technical advancements are anticipated to significantly impact biomass power plant efficiency and propel market growth.

Challenges: Requirement for high initial investments

Although biomass power generation technologies will eventually become more efficient, the initial and equipment costs are expensive. Depending on the technology, location, and feedstock type, biomass power generation equipment might range in price and efficiency. Nearly two-thirds of the capital costs of biomass power generation systems go toward the prime mover, feedstock preparation, feedstock conversion technology, and handling equipment. When operating at full capacity, biomass power plants may provide at least double the plant load factor of solar and wind electricity combined. However, the operational expenditures are higher. The increase in the cost of generating biomass power market can be a significant challenge to the growth of the global biomass power generation market.

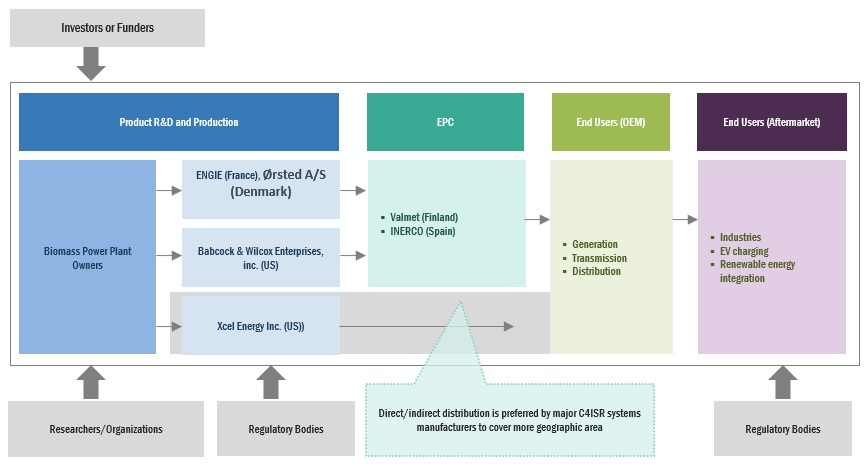

Biomass power generation Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Biomass power generation systems and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ABB (Switzerland), Siemens (Germany), General Electric (US), Prysmian Group (Italy), Nexans (France), and Schneider Electric (France).

To know about the assumptions considered for the study, download the pdf brochure

The agriculture waste segment, by feedstock, is expected to be the second-largest market during the forecast period.

This report segments the biomass market size based on components into four types: agriculture waste, forest waste, animal waste and municipal waste. The agriculture waste segment is expected to be the second largest market during the forecast period. Agricultural wastes such as sugar crops, corn crops etc. have more energy efficiency than other wastes which can be utilized for the electricity generation.

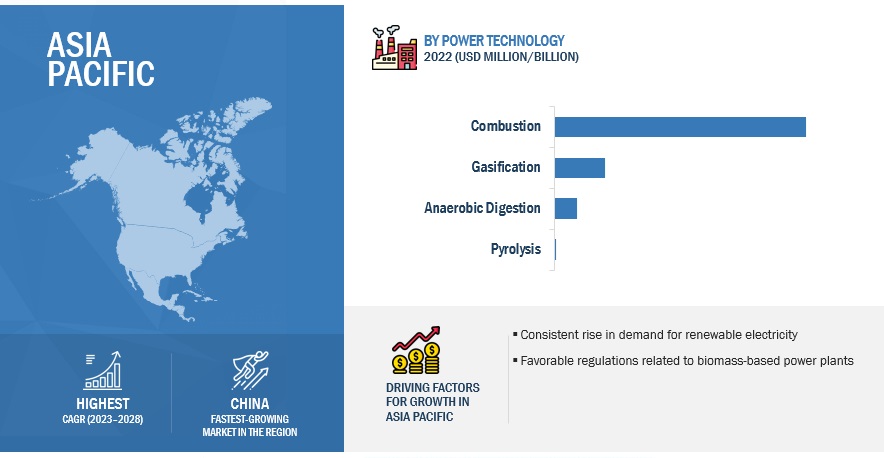

By technology, the combustion segment is expected to be the largest during the forecast period

This report segments the biomass power generation market based on components into four segments: combustion, gasification, anaerobic digestion and pyrolysis. The combustion segment is expected to be the largest segment during the forecast period. Combustion is a conventional method used for the generation of electricity. Co-firing policies proposed by the government driving the combustion segment in market.

“Asia Pacific”: The fastest in the biomass power generation market”

Asia Pacific is expected to fastest growing region in the biomass power generation market between 2023–2028, followed by the Middle East and Africa, and Europe. Rising investments in the bioenergy projects to focus on the integration of renewable energy in the national grid are one of the key factors fostering the growth of the market in the Asia Pacific.

Key Market Players

The biomass power generation market is dominated by a few major players that have a wide regional presence. The major players in the market ENGIE (France), Babcock & Wilcox Enterprises, inc. (US), Xcel Energy Inc. (US), EPH (Czechia) and Ørsted A/S (Denmark). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Biomass Power Generation Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2021-2028 |

|

Base year |

2022 |

|

Forecast period |

2023-2028 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Biomass power generation market by feedstock, technology, fuel and region. |

|

Geographic regions covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

ENGIE (France), Babcock & Wilcox Enterprises, Inc. (US), Xcel Energy Inc. (US), Salzburg AG (Austria), Ørsted A/S (Denmark), EPH (Czechia), Drax Group (England), ACCIONA (Spain), EDF (France), Vattenfall (Sweden), Belgian Eco Energy (BEE) (Belgium), D.E.S.I Power (India), Veolia (France), Statkraft (Norway), Greta Energy Limited (India), Lahti Energia Oy (Finland), RENOVA, Inc. (Japan), RWE (Germany), Yonago Biomass Power Generation LLC (Japan) |

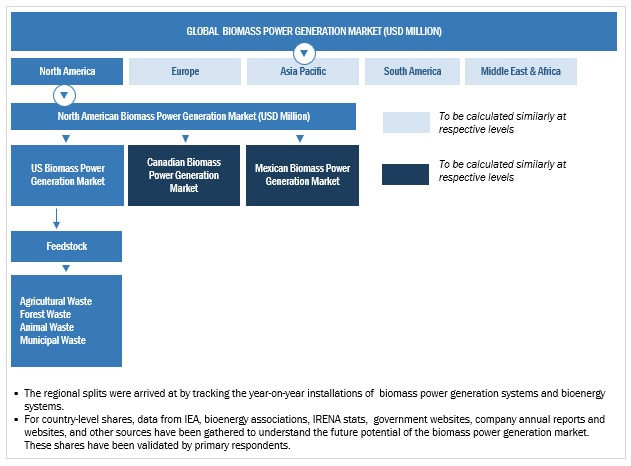

This research report categorizes the biomass power generation market by feedstock, technology, fuel and region.

On the basis of feedstock:

- Agriculture Waste

- Forest Waste

- Animal Waste

- Municipal Waste

On the basis of technology:

- Combustion

- Gasification

- Anaerobic Digestion

- Pyrolysis

On the basis of fuel:

- Solid Fuel

- Liquid Fuel

- Gaseous Fuel

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2022, ENGIE signed an agreement with Alier, a paper recycle specialist, to build and commission a new thermal energy generation plant from sustainable forest management in Roselló’s factory, specializing in manufacturing paper for the construction and packaging industries (Lleida).

- In March 2021, Salzburg AG signed an agreement with Valmet, a global developer and supplier of technologies, automation, and services for the pulp & paper and energy industries. Salzbrug AG ordered Valmet for the BioPower plant, which is biomass-based for electricity generation in Austria.

- In March 2021, Ørsted, Aker Carbon Capture, and Microsoft have signed a Memorandum of Understanding (MoU) to investigate strategies to help the development of carbon capture and storage at biomass-fired heat and power stations in Denmark.

- In April 2018, The University of Minnesota funds Xcel Energy Inc. to develop gasification for power generation technology from solid wastes.

Frequently Asked Questions (FAQ):

What is the current size of the biomass power generation market?

The current market size of the biomass power generation market is USD 88.6 billion in 2022.

What are the major drivers?

Abundant availability of feedstocks and government led initiatives to boost bioenergy production will be major drivers for the market.

Which is the largest region during the forecasted period?

Asia Pacific is expected to dominate the market between 2022–2027, followed by North America and Europe. Rising urbanization and power demand with increased renewable energy capacity are driving the market for this region.

Which is the largest segment, by technology during the forecasted period?

The combustion segment is expected to be the largest market during the forecast period. This combustion technology are cost effective compared with the other technologies. Direct burying of biomass also emits less carbon.

Which is the fastest segment, by feedstock during the forecasted period?

The forest waste segment is expected to be the fastest market during the forecast period. The forest waste has more energy efficiency, which can be utilized for the power generation. Increasing demand for woody biomass from power sector is driving the growth of market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Abundant availability of biomass feedstocks- Government-led initiatives to boost bioenergy production- Increasing employment in agriculture industry and growing rural development- Rising need to control greenhouse gas (GHG) emissions- Growing use of biomass for power generation by co-firing in coal-based power plantsRESTRAINTS- Improper supply chain management of biomass- Fluctuating and high costs of feedstocksOPPORTUNITIES- High depletion rate of fossil fuels- Advancements in biomass power generation techniquesCHALLENGES- Requirement for high initial investments- Variability in biomass properties

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR BIOMASS POWER GENERATION COMPANIES

-

5.4 VALUE/SUPPLY CHAIN ANALYSISBIOMASS FEEDSTOCK PROVIDERSBIOMASS TRANSPORTATION PROVIDERSENGINEERING PROCUREMENT AND CONSTRUCTION (EPC) CONTRACTORSBIOMASS POWER PLANT OWNERS

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 TECHNOLOGY ANALYSISBIOMASS CO-FIRINGPYRO GASIFICATION

-

5.7 PRICING ANALYSISLEVELIZED COST OF BIOMASS POWER GENERATION, BY TECHNOLOGY

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.9 TARIFF AND REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK

- 5.10 KEY CONFERENCES AND EVENTS, 2023

-

5.11 TRADE ANALYSISHS CODE 2303- Export scenario- Import scenarioHS CODE 382510- Export scenario- Import scenarioHS CODE 382520- Export scenario- Import scenario

-

5.12 CASE STUDY ANALYSISDECENTRALIZED ENERGY SYSTEMS OF INDIA (DESI POWER) HELPED COMMUNITIES IN RURAL AREAS HARNESS POWER FOR ECONOMIC PURPOSES- Problem statement- SolutionVALMET PROVIDED TURNKEY BIOPOWER PLANT TO SALZBURG AG TO GENERATE GREEN ELECTRICITY AND HEAT- Problem statement- Solution

-

5.13 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.15 SUPPLY AND DEMAND ANALYSIS OF BIOMASS FEEDSTOCK

- 6.1 INTRODUCTION

-

6.2 AGRICULTURAL WASTEGROWING NEED TO MEET ENERGY DEMANDS IN RURAL AREAS

-

6.3 FOREST WASTERISING DEMAND FOR WOOD BIOMASS

-

6.4 ANIMAL WASTEGROWING USE OF ANIMAL WASTE TO PRODUCE BIOGAS

-

6.5 MUNICIPAL WASTESTRINGENT GOVERNMENT POLICIES RELATED TO DISPOSAL OF MUNICIPAL WASTE

- 7.1 INTRODUCTION

-

7.2 COMBUSTIONPRESENCE OF FAVORABLE GOVERNMENT POLICIES REGARDING USING BIOMASS BLENDS AND REDUCING COAL USE

-

7.3 GASIFICATIONINCREASING NUMBER OF GASIFICATION PROJECTS

-

7.4 ANAEROBIC DIGESTIONEXCELLENT PROPERTIES OF ANAEROBIC DIGESTION TECHNOLOGY

-

7.5 PYROLYSISHIGH EFFICIENCY OF PYROLYSIS TECHNOLOGY IN ELECTRICITY GENERATION

- 8.1 INTRODUCTION

-

8.2 SOLID FUELRISING PREFERENCE FOR WOOD BIOMASS AS SOLID FUEL FOR POWER GENERATION

-

8.3 LIQUID FUELADVANCEMENTS IN TECHNOLOGIES USED TO PRODUCE LIQUID FUEL

-

8.4 GASEOUS FUELPRESENCE OF STRINGENT REGULATIONS RELATED TO LANDFILLS

- 9.1 INTRODUCTION

-

9.2 EUROPEEUROPE: RECESSION IMPACTGERMANY- Government-led initiatives for energy transitionUK- Advancements in green hydrogen technologiesFINLAND- Increasing renewable electricity generation through forest wasteSWEDEN- Increasing investments in biomass power plantsITALY- Government efforts to decarbonize transportation sectorFRANCE- Rising use of biofuels for power generationNETHERLANDS- Government-led incentives for electricity productionREST OF EUROPE

-

9.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Rising private investments to decarbonize industrial sectorJAPAN- Rising number of waste-to-energy projectsINDIA- Increasing financial assistance from government and rising rural electrification and captive power requirementsINDONESIA- Rising investments in setting up waste-to-energy projectsTHAILAND- Increasing foreign investments and ability to transition to clean energyREST OF ASIA PACIFIC

-

9.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Increasing in-house electricity productionCANADA- Favorable policies promoting installation of power plantsMEXICO- Increasing renewable electricity generation using agricultural residue

-

9.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Increasing investments in power plants to decarbonize industrial sectorARGENTINA- Growing demand for biofuelsCOLOMBIA- Increasing investments in waste-to-energy projects to generate green energyREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTSOUTH AFRICA- Rising number of public–private partnerships (PPPs)TURKEY- Increasing use of forest waste to produce sustainable fuel and electricityEGYPT- Government-led initiatives to increase investments in construction of biomass power plantsISRAEL- Establishment of new greenhouse gas (GHG) emission targetREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS, 2022

- 10.3 MARKET EVALUATION FRAMEWORK, 2018-2021

- 10.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 RECENT DEVELOPMENTSDEALSOTHERS

-

10.6 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 START-UP/SME EVALUATION QUADRANT, 2021PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE BENCHMARKING

-

11.1 KEY PLAYERSENGIE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewXCEL ENERGY INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBABCOCK & WILCOX ENTERPRISES, INC.- Business overview- Products/Services/Solutions offered- MnM viewØRSTED A/S- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEPH- Business overview- Products/Services/Solutions offered- MnM viewRWE- Business overview- Products/Services/Solutions offeredRENOVA INC.- Business overviewVEOLIA ENERGY HUNGARY CO. LTD.- Business overview- Products/Services/Solutions offeredACCIONA- Business overview- Products/Services/Solutions offeredEDF RENEWABLE ENERGY- Business overview- Products/Services/Solutions offeredDRAX GROUP- Business overview- Products/Services/Solutions offeredSALZBURG AG- Business overview- Products/Services/Solutions offered- Recent developmentsLAHTI ENERGIA OY- Business overview- Products/Services/Solutions offeredVATTENFALL- Business overviewSTATKRAFT- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSGRETA ENERGY LIMITEDYONAGO BIOMASS POWER GENERATION LLCBELGIAN ECO ENERGY (BEE)D.E.S.I. POWERENEXOR ENERGY LLC

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MARKET: SNAPSHOT

- TABLE 2 CROPS AND THEIR HARVESTING IN INDIA

- TABLE 3 BIOMASS COLLECTION SYSTEMS AND THEIR COSTS IN DIFFERENT COUNTRIES

- TABLE 4 PROXIMATE ANALYSIS OF BIOMASS MATERIALS

- TABLE 5 COMPANIES AND THEIR ROLE IN BIOMASS POWER GENERATION ECOSYSTEM

- TABLE 6 LEVELIZED COST OF BIOMASS POWER GENERATION

- TABLE 7 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2016–FEBRUARY 2023

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MARKET: REGULATORY FRAMEWORK, BY REGION

- TABLE 14 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 EXPORT SCENARIO FOR HS CODE 2303, BY COUNTRY, 2019–2021 (USD)

- TABLE 16 IMPORT SCENARIO FOR HS CODE 2303, BY COUNTRY, 2019–2021 (USD)

- TABLE 17 EXPORT SCENARIO FOR HS CODE: 382510, BY COUNTRY, 2019–2021 (USD)

- TABLE 18 IMPORT SCENARIO FOR HS CODE: 382510, BY COUNTRY, 2019–2021 (USD)

- TABLE 19 EXPORT SCENARIO FOR HS CODE: 382520, BY COUNTRY, 2019–2021 (USD)

- TABLE 20 IMPORT SCENARIO FOR HS CODE: 382520, BY COUNTRY, 2019–2021 (USD)

- TABLE 21 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP TECHNOLOGIES (%)

- TABLE 23 KEY BUYING CRITERIA, BY TECHNOLOGY

- TABLE 24 MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 25 AGRICULTURAL WASTE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 FOREST WASTE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 ANIMAL WASTE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 MUNICIPAL WASTE: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 30 MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 31 COMBUSTION: MARKET, BY REGION, 2021–2028 (TWH)

- TABLE 32 COMBUSTION: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 GASIFICATION: MARKET, BY REGION, 2021–2028 (TWH)

- TABLE 34 GASIFICATION: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 ANAEROBIC DIGESTION: MARKET, BY REGION, 2021–2028 (TWH)

- TABLE 36 ANAEROBIC DIGESTION: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 PYROLYSIS: MARKET, BY REGION, 2021–2028 (TWH)

- TABLE 38 PYROLYSIS: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 40 SOLID FUEL: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 LIQUID FUEL: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 GASEOUS FUEL: MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 MARKET, BY REGION, 2021–2028 (TWH)

- TABLE 44 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 EUROPE: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 47 EUROPE: MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 48 EUROPE: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 49 EUROPE: MARKET, BY COUNTRY, 2021–2028 (TWH)

- TABLE 50 EUROPE: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 GERMANY: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 52 UK: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 53 FINLAND: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 54 SWEDEN: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 55 ITALY: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 56 FRANCE: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 57 NETHERLANDS: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 58 REST OF EUROPE: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 62 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (TWH)

- TABLE 64 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 CHINA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 66 JAPAN: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 67 INDIA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 68 INDONESIA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 69 THAILAND: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 74 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (TWH)

- TABLE 76 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 US: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 79 MEXICO: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 80 SOUTH AMERICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 81 SOUTH AMERICA: MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 82 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 83 SOUTH AMERICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 84 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (TWH)

- TABLE 85 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 BRAZIL: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 87 ARGENTINA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 88 COLOMBIA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 89 REST OF SOUTH AMERICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY FUEL, 2021–2028 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2021–2028 (TWH)

- TABLE 93 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (TWH)

- TABLE 95 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 SOUTH AFRICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 97 TURKEY: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 98 EGYPT: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 99 ISRAEL: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 100 REST OF MIDDLE EAST & AFRICA: MARKET, BY FEEDSTOCK, 2021–2028 (USD MILLION)

- TABLE 101 MARKET: DEGREE OF COMPETITION

- TABLE 102 MARKET EVALUATION FRAMEWORK, 2018–2021

- TABLE 103 BIOMASS POWER GENERATION: DEALS, 2018–2022

- TABLE 104 MARKET: OTHERS, 2018–2022

- TABLE 105 FEEDSTOCK: COMPANY FOOTPRINT

- TABLE 106 FUEL: COMPANY FOOTPRINT

- TABLE 107 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 108 REGION: COMPANY FOOTPRINT

- TABLE 109 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 110 FEEDSTOCK: COMPANY FOOTPRINT (STARTUPS/SMES)

- TABLE 111 FUEL: COMPANY FOOTPRINT (STARTUPS/SMES)

- TABLE 112 TECHNOLOGY: COMPANY FOOTPRINT (STARTUPS/SMES)

- TABLE 113 REGION: COMPANY FOOTPRINT (STARTUPS/SMES)

- TABLE 114 ENGIE: COMPANY OVERVIEW

- TABLE 115 ENGIE: DEALS

- TABLE 116 XCEL ENERGY INC.: COMPANY OVERVIEW

- TABLE 117 XCEL ENERGY INC.: DEALS

- TABLE 118 BABCOCK & WILCOX ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 119 ØRSTED A/S: COMPANY OVERVIEW

- TABLE 120 ØRSTED A/S: DEALS

- TABLE 121 EPH: COMPANY OVERVIEW

- TABLE 122 RWE: COMPANY OVERVIEW

- TABLE 123 RENOVA INC.: COMPANY OVERVIEW

- TABLE 124 VEOLIA ENERGY HUNGARY CO. LTD.: COMPANY OVERVIEW

- TABLE 125 ACCIONA: COMPANY OVERVIEW

- TABLE 126 EDF RENEWABLE ENERGY: COMPANY OVERVIEW

- TABLE 127 DRAX GROUP: COMPANY OVERVIEW

- TABLE 128 SALZBURG AG: COMPANY OVERVIEW

- TABLE 129 SALZBURG AG: DEALS

- TABLE 130 LAHTI ENERGIA OY: COMPANY OVERVIEW

- TABLE 131 VATTENFALL: COMPANY OVERVIEW

- TABLE 132 STATKRAFT: COMPANY OVERVIEW

- TABLE 133 STATKRAFT: DEALS

- FIGURE 1 MARKET: SEGMENTATION

- FIGURE 2 MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 BREAKDOWN OF PRIMARIES

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 8 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR BIOMASS POWER GENERATION SYSTEMS

- FIGURE 9 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF BIOMASS POWER GENERATION SYSTEMS

- FIGURE 10 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 11 COMPANY ANALYSIS, 2022

- FIGURE 12 ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 13 FOREST WASTE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 COMBUSTION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SOLID FUEL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING NEED TO DECARBONIZE INDUSTRIAL SECTOR

- FIGURE 17 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

- FIGURE 18 FOREST WASTE SEGMENT AND CHINA DOMINATED ASIA PACIFIC MARKET IN 2022

- FIGURE 19 FOREST WASTE SEGMENT TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 20 COMBUSTION SEGMENT DOMINATED MARKET IN 2022

- FIGURE 21 SOLID FUEL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 CUMULATIVE AGRICULTURAL RESIDUE GENERATION IN SELECTED COUNTRIES

- FIGURE 24 MAJOR FOREST RESIDUE-PRODUCING COUNTRIES

- FIGURE 25 NUMBER OF POLICIES ISSUED IN CHINA RELATED TO BIOMASS POWER GENERATION, 2006–2021

- FIGURE 26 EMPLOYMENT RATE IN BIOENERGY INDUSTRY

- FIGURE 27 REVENUE SHIFT FOR BIOMASS POWER BIOMASS POWER GENERATION COMPANIES

- FIGURE 28 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 MARKET MAP

- FIGURE 30 EXPORT DATA FOR HS CODE 2303 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 31 IMPORT DATA FOR HS CODE 2303 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 32 EXPORT DATA FOR HS CODE 382510 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 33 IMPORT DATA FOR HS CODE 382510 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 34 EXPORT DATA FOR HS CODE 382520 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 35 IMPORT DATA FOR HS CODE 382520 OF TOP FIVE COUNTRIES, 2019–2021 (USD)

- FIGURE 36 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- FIGURE 38 KEY BUYING CRITERIA FOR TOP TECHNOLOGY-BASED BIOMASS POWER GENERATION SYSTEMS

- FIGURE 39 FOREST WASTE SEGMENT DOMINATED MARKET IN 2022

- FIGURE 40 COMBUSTION SEGMENT LED MARKET IN 2022

- FIGURE 41 SOLID FUEL SEGMENT HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 42 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 43 ASIA PACIFIC MARKET TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 EUROPE: SNAPSHOT OF MARKET

- FIGURE 45 ASIA PACIFIC: SNAPSHOT OF MARKET

- FIGURE 46 KEY DEVELOPMENTS IN MARKET, 2018–2022

- FIGURE 47 INDUSTRY CONCENTRATION OF TOP PLAYERS IN MARKET, 2022

- FIGURE 48 SEGMENTAL REVENUE ANALYSIS, 2018–2021

- FIGURE 49 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 50 MARKET: START-UP/SME EVALUATION QUADRANT, 2022

- FIGURE 51 ENGIE: COMPANY SNAPSHOT

- FIGURE 52 XCEL ENERGY INC.: COMPANY SNAPSHOT

- FIGURE 55 EPH: COMPANY SNAPSHOT

- FIGURE 58 ACCIONA: COMPANY SNAPSHOT

- FIGURE 59 DRAX GROUP: COMPANY SNAPSHOT

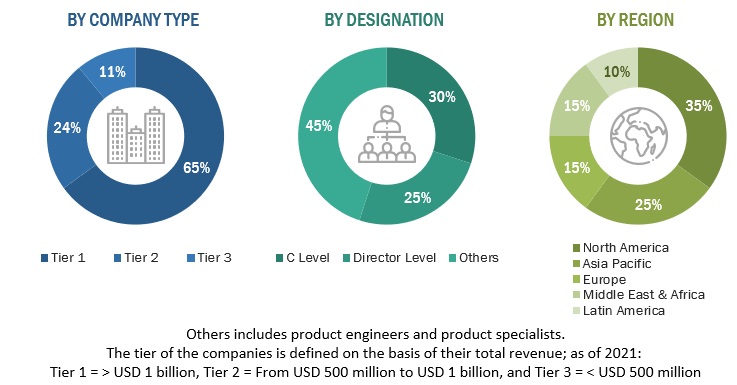

The study involved major activities in estimating the current size of the biomass power generation market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the biomass power generation market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The biomass power generation market comprises several stakeholders such as biomass power generation manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for biomass power generation in, generation, transmission, and distribution application. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biomass power generation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Biomass power generation Market Size: Tow-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Defenition

The biomass power generation is the physical system that delivers (transmits) electricity from where it is generated to the site where it is used (end-use, demand). The electricity leaving the generating station enters a substation with a step-up transformer that raises the voltage extremely high for long-distance transmission.

The growth of the biomass power generation market during the forecast period can be attributed to the planned rollout of green corridor programs across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- Analytics Vendors

- Communication Vendors

- Consulting Companies In The Energy And Power Sector

- Electric Utilities

- Energy & Power Sector Consulting Companies

- Energy Regulators

- Government & Research Organizations

- Government Utility Providers

- Independent Power Producers

Objectives of the Study

- To describe, segment, and forecast the biomass power generation market based on feedstock, fuel, technology, and region, in terms of value

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, South America, the Middle East & Africa, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the market

- To analyze opportunities for stakeholders and draw a competitive landscape of the biomass power generation market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contribution to the overall market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biomass Power Generation Market