Breast Reconstruction Market Size, Growth by Product (Breast implant, Tissue Expander, Acellular Dermal Matrix), Procedure (Immediate, Delayed, Revision), Type (Unilateral, Bilateral), End User (Hospitals, Cosmetology Clinics) & Region - Global Forecasts to 2026

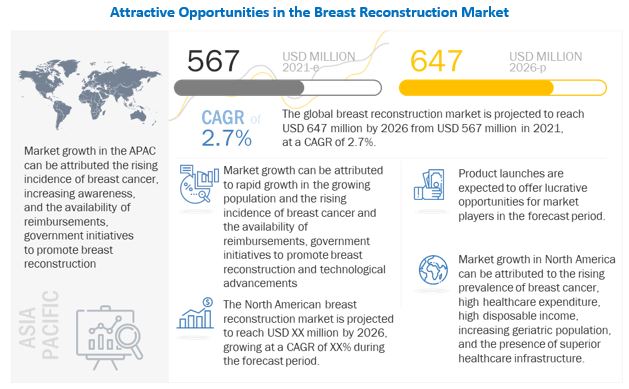

The global breast reconstruction market in terms of revenue was estimated to be worth $567 million in 2021 and is poised to reach $647 million by 2026, growing at a CAGR of 2.7% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. This industry is experiencing significant growth due to rising incidences of breast cancer, increasing awareness, and the availability of reimbursements.

To know about the assumptions considered for the study, Request for Free Sample Report

Breast Reconstruction Market Dynamics

Driver: Increasing awareness regarding breast reconstruction treatment

A number of patients opt for breast reconstruction surgery after mastectomy. This can be primarily attributed to the growing concerns and increasing awareness of the safety and efficacy of reconstructive surgeries. This trend can be observed in both developed and emerging countries that are witnessing improvements in the standard of living.

The rise in awareness can be credited to initiatives taken by market players and stakeholders as well as independent bodies such as the American Society of Plastic Surgeons (ASPS). ASPS, along with the Plastic Surgery Foundation, organized the Breast Reconstruction Awareness campaign to engage and educate women on reconstruction post breast cancer diagnosis. The primary aim of the campaign was to educate women, family members, and the media that the breast cancer loop remains open until a woman is informed of her breast reconstruction options. Other key events include the Association of Breast Surgery Conference 2020 in England and the 36th Annual Breast Surgery Symposium held in Georgia, US. In 2011, Canada launched the first BRA Day (Breast Reconstruction Awareness Day). This year, the American Society of Plastic Surgeons and The Plastic Surgery Foundation have joined forces with the Canadians to initiate BRA Day USA. On February 17, 2022, Tata Memorial Center organized a conference - Reconstruction and Cancer Care: Enhancing Quality Living with and Beyond Cancer to create awareness regarding breast reconstruction. In September 2021, the Journal of the American Society of Plastic Surgeons organized the 8th Secondary optimizing Aesthetic Surgery (SOS) Symposium. In November 2021, a meeting was held on the Experienced Insights in Breast and Body Contouring meeting held in Arlington, Texas. On January 28 through 30, 2022, The 37th Annual Atlanta Breast Surgery Symposium was held, in Atlanta, Ga. The upcoming event such as 23rd ASBrS Annual Meeting will be held at Wynn Las Vegas, from April 6–10, 2022 the meeting will focus on Coding and Reimbursement, High-Risk Clinic, Breast Imaging in 2022, Mitigating Disparities in Medicine, The Surgical Innovation Forum, Pain Management in Breast Surgery.

Restraint: Alternative non-surgical methods

After a mastectomy, some women prefer breast reconstruction surgery. Others do not opt for it due to a lack of awareness or other health issues such as obesity, skinniness, or change in blood flow dynamics. These women can opt for alternatives to breast reconstruction, such as custom breast prosthetics and going flat. Custom breast prosthetics can replicate the woman’s exact shape and create symmetry with the intact breast for single-mastectomy patients. These prosthetics are much cheaper than the breast reconstruction process and are available in the range of under USD 100 to USD 500 for high-quality products. The availability of alternatives, especially non-surgical methods, is a key restraint to the market.

Opportunity: Development of 3D-printed implants

The emergence of 3D-printed implants can provide significant opportunities for market growth. German companies, BellaSeno and Evonik, have entered into a collaboration to develop 3D breast implant technology. BellaSeno will use Evonik’s Resomer bioresorbable polymer in its Senella breast scaffolds, avoiding the use of silicone implants that have raised major safety concerns.

BellaSeno planned to start the first human clinical trials of the Senella scaffolds with Resomer in Germany in 2019. Evonik has supplied its Resomer polymer for clinical and commercial use. The scaffolds are designed to guide the growth of the natural tissue using the patient's body fat harvested via liposuction. This product is designed to be used after augmentation, reconstruction, and revision surgery. This is progressively reabsorbed by the body and replaced with natural breast tissue. This technology avoids the use of silicone implants and their associated complications & risk, like capsular contracture, rupture, and deflation. Moreover, in December 2021, Bellaseno GmbH reported the publication of first-in-human data for its 3D-printed biodegradable and highly porous Senella scaffold filled with an autologous fat graft to correct a chest deformation in a 22-year-old patient with severe pectus excavatum. The article was published in the European Journal of Plastic Surgery.

Challenge: Product failures and recalls

Product failures due to malfunctioning can have severe or even fatal complications. Over the years, several products have been recalled from the market due to malfunctions or other issues. Such recalls can harm the end-user perception of the safety of these devices and affect their adoption. For instance, in 2019, Allergan (US) recalled its Biocell textured breast implants and tissue expanders after they were linked to anaplastic large-cell lymphoma (ALCL). In 2016, Mentor (US) recalled its Mentor MemoryGel Breast Implant as the box of 300cc MemoryGel Breast Implant was labeled with null manufacturing and expiration dates.

The breast implants segment is expected to dominate the breast reconstruction industry

Based on the product, the breast reconstruction market is segmented into breast implants, tissue expanders, and acellular dermal matrix. The breast implants segment accounted for the largest market share in 2020. This is primarily attributed to the increasing incidences of breast cancer and the rising number of breast reconstruction procedures.

Silicone implants hold the largest share of the breast reconstruction industry

The breast reconstruction market is segmented into silicone and saline implants. Silicone implants accounted for the largest market share in 2020 due to the large number of silicone breast implantation procedures performed across the globe.

To know about the assumptions considered for the study, download the pdf brochure

North America was the largest region for breast reconstruction industry

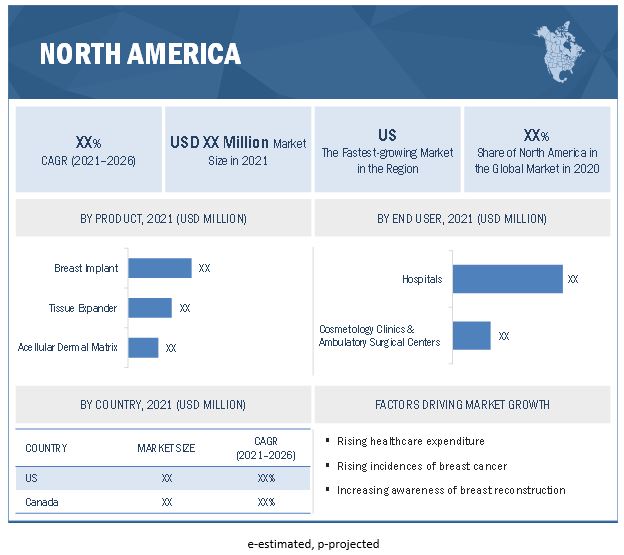

The breast reconstruction market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. In 2020, North America held the largest share of the market, followed by Europe. The rising incidences of breast cancer, increasing awareness of breast reconstruction, and FDA approvals for breast reconstruction products in this region are the major factors driving the growth of the breast reconstruction in North America.

The prominent players operating in this market include Mentor Worldwide LLC (Johnson & Johnson) (US), are Allergan Aesthetics (an Abbvie company) (US), Ideal Implant Incorporated (US), Sebbin (France), GC Aesthetics (Ireland), POLYTECH Health & Aesthetics (Germany), Sientra (US), Integra Lifesciences (US), RTI Surgical Holdings (US), Establishment Labs S.A. (US), Silimed (Brazil), Laboratories Arion (France), and other players are Guangzhou Wanhe Plastic Materials Co. Ltd.(China), CEREPLAS (France), HansBiomed (South Korea), PMT Corporation (US), and Shanghai Kangning Medical Device (China)

Mentor Worldwide LLC (Johnson & Johnson) (US) is one of the leading players in the breast reconstruction market. The company offers a broad product portfolio across the globe. Over the years, the company has maintained its leading position in the market.

Breast Reconstruction Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$567 million |

|

Projected Revenue by 2026 |

$647 million |

|

Revenue Rate |

Poised to grow at a CAGR of 2.7% |

|

Market Driver |

Increasing awareness regarding breast reconstruction treatment |

|

Market Opportunity |

Development of 3D-printed implants |

Report categorizes the global breast reconstruction market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Breast Implants

-

By Type

- Silicone Implants

- Saline Implants

-

Shape

- Round Implants

- Anatomical Implants

- Tissue Expanders

- Acellular Dermal Matrix

-

By Type

By Procedure

- Immediate

- Delayed

- Revision

By Type

- Unilateral

- Bilateral

By End User

- Hospitals

- Cosmetology Clinics and Ambulatory Surgical Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Breast Reconstruction Industry

- In 2022, Mentor Worldwide LLC (Johnson & Johnson) received the US FDA approved a new MENTOR Memory Gel boost breast implant

- In 2021, POLYTECH Health & Aesthetics received US FDA approval for the company’s textured breast implants (macrotextured and polyurethane-coated implants)

- In 2020, Sientra received US FDA pre-market approval for its OPUS-branded breast implant products

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the breast reconstruction market?

The breast reconstruction market boasts a total revenue value of $647 million by 2026.

What is the estimated growth rate (CAGR) of the breast reconstruction market?

The global breast reconstruction market has an estimated compound annual growth rate (CAGR) of 2.7% and a revenue size in the region of $567 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews: By company type, designation, and region

2.2 MARKET SIZE ESTIMATION

FIGURE 3 REVENUE SHARE ANALYSIS ILLUSTRATION: SIENTRA.

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF BREAST RECONSTRUCTION PRODUCTS AND SERVICES

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

2.8 COVID-19 HEALTH ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 10 BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 BREAST RECONSTRUCTION MARKET OVERVIEW

FIGURE 15 RISING INCIDENCES OF BREAST CANCER EXPECTED TO DRIVE THE GROWTH OF THE MARKET DURING THE FORECAST PERIOD

4.2 BREAST RECONSTRUCTION BREAST IMPLANTS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 SILICONE IMPLANT SEGMENT TO GROW AT A CAGR DURING HE FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY PRODUCT AND COUNTRY (2020)

FIGURE 17 BREAST IMPLANTS ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4.4 MARKET, BY PROCEDURE, 2021–2026

FIGURE 18 IMMEDIATE PROCEDURE SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD (2021-2026)

4.5 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 THE MARKET IN CHINA EXPECTED TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 BREAST RECONSTRUCTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of breast cancer

TABLE 3 TOP 10 COUNTRIES WITH THE HIGHEST INCIDENCE OF BREAST CANCER, 2020

TABLE 4 INCIDENCE OF BREAST CANCER, 2018 VS. 2020 VS. 2025

5.2.1.2 Growing aging population

5.2.1.3 Increasing awareness regarding breast reconstruction treatment

5.2.1.4 Improving reimbursements for breast reconstruction procedures

TABLE 5 CPT CODES FOR BREAST RECONSTRUCTION

5.2.2 RESTRAINTS

5.2.2.1 Clinical risks and complications of breast reconstruction procedures

5.2.2.2 Alternative non-surgical methods

5.2.3 OPPORTUNITIES

5.2.4 HIGH MARKET GROWTH POTENTIAL IN EMERGING ECONOMIES

5.2.4.1 Development of 3D-printed implants

5.2.4.2 Rise in preference for biological products

5.2.5 CHALLENGES

5.2.5.1 Product failures and recalls

5.2.5.2 Dearth of trained professionals

5.2.6 COVID-19 IMPACT ON THE MARKET

5.3 RANGES/SCENARIOS

5.3.1 MARKET

FIGURE 21 PESSIMISTIC SCENARIO

FIGURE 22 OPTIMISTIC SCENARIO

FIGURE 23 REALISTIC SCENARIO

5.4 TARIFF AND REGULATORY LANDSCAPE

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 6 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 7 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.1.2 Canada

TABLE 8 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

TABLE 9 BREAST LESION LOCALIZATION DEVICES CLASSIFICATION ACCORDING TO THE GOVERNMENT OF CANADA

5.4.2 EUROPE

FIGURE 24 EUROPE: CLASS III MEDICAL DEVICES

5.4.3 ASIA PACIFIC

5.4.3.1 Japan

TABLE 10 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

5.4.3.2 China

TABLE 11 NMPA MEDICAL DEVICES CLASSIFICATION

5.4.3.3 India

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 INTENSITY OF COMPETITIVE RIVALRY

5.5.2 BARGAINING POWER OF SUPPLIERS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 THREAT OF SUBSTITUTES

5.5.5 THREAT OF NEW ENTRANTS

5.6 TECHNOLOGY ANALYSIS

5.7 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS FOR THE MARKET

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 26 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

5.9 PATENT ANALYSIS

5.9.1 PATENT GRANTED TRENDS FOR BREAST RECONSTRUCTION

FIGURE 27 PATENT GRANTED TRENDS OF BREAST IMPLANTS, JANUARY 2011–FEBRUARY 2022

FIGURE 28 PATENT GRANTED TRENDS OF ACELLULAR DERMAL MATRIX, JANUARY 2011– FEBRUARY 2022

5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR BREAST IMPLANTS PATENTS, JANUARY 2011—FEBRUARY 2022

FIGURE 30 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR ACELLULAR DERMAL MATRIX, JANUARY 2011—FEBRUARY 2022

5.10 TRADE ANALYSIS

TABLE 13 IMPORT DATA FOR HS CODE 902190 - ARTICLES AND APPLIANCES, WHICH ARE WORN OR CARRIED, OR IMPLANTED IN THE BODY, TO COMPENSATE FOR A DEFECT OR DISABILITY (EXCLUDING ARTIFICIAL PARTS OF THE BODY, COMPLETE HEARING AIDS, AND COMPLETE PACEMAKERS FOR STIMULATING HEART MUSCLES), BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 14 EXPORT DATA FOR HS CODE 902190 - ARTICLES AND APPLIANCES, WHICH ARE WORN OR CARRIED, OR IMPLANTED IN THE BODY, TO COMPENSATE FOR A DEFECT OR DISABILITY (EXCLUDING ARTIFICIAL PARTS OF THE BODY, COMPLETE HEARING AIDS, AND COMPLETE PACEMAKERS FOR STIMULATING HEART MUSCLES), BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PRICING ANALYSIS

TABLE 15 PRICE OF BREAST RECONSTRUCTION PRODUCTS (USD)

TABLE 16 AVERAGE COST OF BREAST RECONSTRUCTION SURGERY USING IMPLANTS (USD)

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 17 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 ECOSYSTEM ANALYSIS

FIGURE 31 ECOSYSTEM OF THE BREAST HEALTH INDUSTRY

5.13.1 ROLE IN THE ECOSYSTEM

FIGURE 32 KEY PLAYERS IN THE BREAST RECONSTRUCTION ECOSYSTEM

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SHIFT & REVENUE POCKETS FOR BREAST RECONSTRUCTION PRODUCTS MANUFACTURERS OR SERVICE PROVIDERS

FIGURE 33 REVENUE SHIFT FOR BREAST RECONSTRUCTION PRODUCTS

6 BREAST RECONSTRUCTION MARKET, BY PRODUCT (Page No. - 95)

6.1 INTRODUCTION

TABLE 18 US: PRODUCTS USED FOR BREAST RECONSTRUCTION PROCEDURES, 2020

TABLE 19 MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 20 MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

6.2 BREAST IMPLANT

TABLE 21 US: TYPES OF BREAST IMPLANTS USED FOR BREAST RECONSTRUCTION PROCEDURES, 2020

TABLE 22 MARKET FOR BREAST IMPLANT, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 MARKET FOR BREAST IMPLANT, BY REGION, 2021–2026 (USD MILLION)

6.2.1 BREAST IMPLANTS MARKET, BY TYPE

TABLE 24 MARKET FOR BREAST IMPLANT, BY TYPE, 2018–2020 (USD MILLION)

TABLE 25 MARKET FOR BREAST IMPLANT, BY TYPE, 2021–2026 (USD MILLION)

6.2.1.1 Silicone implants

6.2.1.1.1 Silicone breast implants expected to dominate the breast implants market due to their benefits

TABLE 26 SILICONE BREAST IMPLANTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 SILICONE BREAST IMPLANTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.1.2 Saline Implants

6.2.1.2.1 Low cost of implants to drive market growth

TABLE 28 SALINE IMPLANTS MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 SALINE IMPLANTS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 BREAST IMPLANTS MARKET, BY SHAPE

TABLE 30 MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 31 MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

6.2.2.1 Round implants

6.2.2.1.1 Round implants show the highest end-user demand and market growth

TABLE 32 ROUND BREAST IMPLANT MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 ROUND BREAST IMPLANT MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2 Anatomical implants

6.2.2.2.1 Increasing implant-based breast reconstruction procedures will support the market growth

TABLE 34 ANATOMICAL BREAST IMPLANT MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 ANATOMICAL BREAST IMPLANT MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 TISSUE EXPANDER

6.3.1 RISING NUMBER OF BREAST RECONSTRUCTION PROCEDURES WILL SUPPORT MARKET GROWTH

TABLE 36 MARKET FOR TISSUE EXPANDER, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 MARKET FOR TISSUE EXPANDER, BY REGION, 2021–2026 (USD MILLION)

6.4 ACELLULAR DERMAL MATRIX

6.4.1 RISING NUMBER OF ACELLULAR DERMAL MATRIX BREAST RECONSTRUCTION PROCEDURES WILL SUPPORT MARKET GROWTH

TABLE 38 MARKET FOR ACELLULAR DERMAL MATRIX, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 MARKET FOR ACELLULAR DERMAL MATRIX, BY REGION, 2021–2026 (USD MILLION)

7 BREAST RECONSTRUCTION MARKET, BY PROCEDURE (Page No. - 106)

7.1 INTRODUCTION

TABLE 40 US: IMMEDIATE AND DELAYED BREAST RECONSTRUCTION PROCEDURES PERFORMED, 2020

TABLE 41 MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 42 MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

7.2 IMMEDIATE PROCEDURES

7.2.1 IMMEDIATE PROCEDURES WAS THE LARGEST MARKET SEGMENT

TABLE 43 IMMEDIATE BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 44 IMMEDIATE BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 DELAYED PROCEDURES

7.3.1 RISING AWARENESS WILL SUPPORT MARKET GROWTH

TABLE 45 DELAYED BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 46 DELAYED BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2021–2026 (USD MILLION)

7.4 REVISION PROCEDURES

7.4.1 DISSATISFACTION AND AESTHETIC ISSUES DRIVE DEMAND FOR REVISION

TABLE 47 REVISION BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 48 REVISION BREAST RECONSTRUCTION PROCEDURES MARKET, BY REGION, 2021–2026 (USD MILLION)

8 BREAST RECONSTRUCTION MARKET, BY TYPE (Page No. - 112)

8.1 INTRODUCTION

TABLE 49 US: UNILATERAL AND BILATERAL BREAST RECONSTRUCTION PROCEDURES PERFORMED, 2020

TABLE 50 MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 51 MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2 UNILATERAL BREAST RECONSTRUCTION

8.2.1 UNILATERAL RECONSTRUCTION DOMINATES THE MARKET, BY TYPE

TABLE 52 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 BILATERAL

8.3.1 APAC TO SHOW HIGHEST GROWTH IN THE MARKET FOR BILATERAL BREAST RECONSTRUCTION

TABLE 54 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 55 MARKET, BY REGION, 2021–2026 (USD MILLION)

9 BREAST RECONSTRUCTION MARKET, BY END USER (Page No. - 116)

9.1 INTRODUCTION

TABLE 56 MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 57 MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2 HOSPITALS

9.2.1 HOSPITALS TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 58 MARKET FOR HOSPITALS, BY REGION, 2018–2020 (USD MILLION)

TABLE 59 MARKET FOR HOSPITALS, BY REGION, 2021–2026 (USD MILLION)

9.3 COSMETOLOGY CLINICS & AMBULATORY SURGICAL CENTERS

9.3.1 GROWING PREFERENCE FOR OUTPATIENT TREATMENT AND PROCEDURES OVER HOSPITAL CARE DRIVES MARKET GROWTH

TABLE 60 MARKET FOR COSMETOLOGY CLINICS & AMBULATORY SURGICAL CENTERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 61 MARKET FOR COSMETOLOGY CLINICS & AMBULATORY SURGICAL CENTERS, BY REGION, 2021–2026 (USD MILLION)

9.4 COVID-19 ANALYSIS

10 BREAST RECONSTRUCTION MARKET, BY REGION (Page No. - 121)

10.1 INTRODUCTION

TABLE 62 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 63 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the North American breast reconstruction market

TABLE 78 US: BREAST RECONSTRUCTIVE PROCEDURES PERFORMED IN 2020, BY TYPE

TABLE 79 US: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 80 US: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 81 US: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 82 US: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 US: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 84 US: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 85 US: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 86 US: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 87 US: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 88 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 89 US: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 90 US: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing incidence of breast cancer will drive market growth in Canada

TABLE 91 CANADA: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 92 CANADA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 93 CANADA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 94 CANADA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 CANADA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 96 CANADA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 97 CANADA: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 98 CANADA: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 99 CANADA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 100 CANADA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 CANADA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 102 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3 EUROPE

TABLE 103 INCIDENCE OF BREAST CANCER IN EUROPEAN COUNTRIES, 2020 VS. 2040

TABLE 104 MASTECTOMY SURGERIES PERFORMED IN EUROPE, BY COUNTRY, 2019

TABLE 105 EUROPE: BREAST RECONSTRUCTION MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany dominates the European breast reconstruction market

TABLE 119 GERMANY: BREAST CANCER INCIDENCE, 2018 VS. 2025

TABLE 120 GERMANY: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 121 GERMANY: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 122 GERMANY: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 123 GERMANY: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 124 GERMANY: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 125 GERMANY: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 127 GERMANY: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 128 GERMANY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 129 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 130 GERMANY: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 131 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Rising geriatric population will drive market growth

TABLE 132 FRANCE: BREAST CANCER INCIDENCE, 2018 VS. 2025

TABLE 133 FRANCE: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 134 FRANCE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 135 FRANCE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 136 FRANCE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 FRANCE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 138 FRANCE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 139 FRANCE: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 140 FRANCE: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 141 FRANCE: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 142 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 143 FRANCE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 144 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Rising incidences of breast cancer will support market growth

TABLE 145 UK: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 146 UK: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 147 UK: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 148 UK: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 149 UK: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 150 UK: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 151 UK: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 152 UK: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 153 UK: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 154 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 155 UK: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 156 UK: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Rising geriatric population in Italy to drive the market

TABLE 157 ITALY: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 158 ITALY: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 159 ITALY: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 160 ITALY: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 161 ITALY: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 162 ITALY: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 163 ITALY: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 164 ITALY: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 165 ITALY: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 166 ITALY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 167 ITALY: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 168 ITALY: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Silicone implants show high acceptance in Spain

TABLE 169 SPAIN: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 170 SPAIN: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 171 SPAIN: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 172 SPAIN: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 SPAIN: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 174 SPAIN: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 175 SPAIN: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 176 SPAIN: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 177 SPAIN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 178 SPAIN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 179 SPAIN: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 180 SPAIN: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 181 ROE: BREAST CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 182 ROE: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 183 ROE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 184 ROE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 185 ROE: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 186 ROE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 187 ROE: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 188 ROE: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 189 ROE: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 190 ROE: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 191 ROE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 192 ROE: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 193 ROE: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: BREAST RECONSTRUCTION MARKET SNAPSHOT

TABLE 194 APAC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 195 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 196 APAC: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 197 APAC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 198 APAC: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 199 APAC: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 200 APAC: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 201 APAC: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 202 APAC: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 203 APAC: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 204 APAC: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 205 APAC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 206 APAC: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 207 APAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China accounts for the largest share of the APAC market

TABLE 208 CHINA: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 209 CHINA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 210 CHINA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 211 CHINA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 212 CHINA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 213 CHINA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 214 CHINA: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 215 CHINA: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 216 CHINA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 217 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 218 CHINA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 219 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Growing awareness of cosmetic surgery to drive the market in Japan

TABLE 220 JAPAN: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 221 JAPAN: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 222 JAPAN: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 223 JAPAN: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 224 JAPAN: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 225 JAPAN: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 226 JAPAN: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 227 JAPAN: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 228 JAPAN: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 229 JAPAN: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 230 JAPAN: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 231 JAPAN: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Market growth in India is primarily driven by the rising incidence of breast cancer

TABLE 232 INDIA: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 233 INDIA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 234 INDIA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 235 INDIA: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 236 INDIA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 237 INDIA: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 238 INDIA: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 239 INDIA: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 240 INDIA: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 241 INDIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 242 INDIA: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 243 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 244 ROAPAC: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 245 ROAPAC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 246 ROAPAC: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 247 ROAPAC: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 248 ROAPAC: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 249 ROAPAC: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 250 ROAPAC: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 251 ROAPAC: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 252 ROAPAC: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 253 ROAPAC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 254 ROAPAC: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 255 ROAPAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 256 ROW: BREAST CANCER INCIDENCE, BY COUNTRY, 2020 VS. 2040

TABLE 257 ROW: BREAST RECONSTRUCTION MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 258 ROW: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 259 ROW: MARKET FOR BREAST IMPLANTS, BY TYPE, 2018–2020 (USD MILLION)

TABLE 260 ROW: MARKET FOR BREAST IMPLANTS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 261 ROW: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2018–2020 (USD MILLION)

TABLE 262 ROW: MARKET FOR BREAST IMPLANTS, BY SHAPE, 2021–2026 (USD MILLION)

TABLE 263 ROW: MARKET, BY PROCEDURE, 2018–2020 (USD MILLION)

TABLE 264 ROW: MARKET, BY PROCEDURE, 2021–2026 (USD MILLION)

TABLE 265 ROW: MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 266 ROW: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 267 ROW: MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 268 ROW: MARKET, BY END USER, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 196)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 269 OVERVIEW OF THE STRATEGIES ADOPTED BY KEY PLAYERS IN THE BREAST RECONSTRUCTION MARKET

11.3 REVENUE SHARE ANALYSIS

FIGURE 36 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN THE BREAST RECONSTRUCTION MARKET

11.4 MARKET SHARE ANALYSIS

FIGURE 37 MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

TABLE 270 MARKET: DEGREE OF COMPETITION

11.5 COMPETITIVE LEADERSHIP MAPPING

FIGURE 38 MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

11.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS

FIGURE 39 BREAST RECONSTRUCTION MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES & START-UPS (2020)

11.7 COMPANY FOOTPRINT

TABLE 271 COMPANY FOOTPRINT

TABLE 272 COMPANY PRODUCT FOOTPRINT

TABLE 273 COMPANY REGIONAL FOOTPRINT

11.8 COMPETITIVE BENCHMARKING

TABLE 274 BREAST RECONSTRUCTION MARKET: DETAILED LIST OF KEY START-UPS/SMES

11.9 COMPETITIVE SCENARIO

TABLE 275 KEY PRODUCT LAUNCHES & APPROVALS, JANUARY 2018– FEBRUARY 2022

TABLE 276 KEY DEALS, JANUARY 2018– FEBRUARY 2022

TABLE 277 OTHER KEY DEVELOPMENTS, JANUARY 2018– FEBRUARY 2022

12 COMPANY PROFILES (Page No. - 211)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 MENTOR WORLDWIDE LLC (JOHNSON & JOHNSON)

TABLE 278 MENTOR WORLDWIDE LLC (JOHNSON & JOHNSON): BUSINESS OVERVIEW

FIGURE 40 MENTOR WORLDWIDE LLC (JOHNSON & JOHNSON): COMPANY SNAPSHOT (2020)

12.1.2 ALLERGAN AESTHETICS (AN ABBVIE COMPANY)

TABLE 279 ALLERGAN AESTHETICS (AN ABBVIE COMPANY): BUSINESS OVERVIEW

FIGURE 41 ALLERGAN AESTHETICS (AN ABBVIE COMPANY): COMPANY SNAPSHOT (2020)

12.1.3 RECENT DEVELOPMENTS

12.1.4 SIENTRA

TABLE 280 SIENTRA: BUSINESS OVERVIEW

FIGURE 42 SIENTRA: COMPANY SNAPSHOT (2020)

12.1.5 POLYTECH HEALTH & AESTHETICS GMBH

TABLE 281 POLYTECH HEALTH & AESTHETICS: BUSINESS OVERVIEW

12.1.6 RECENT DEVELOPMENTS

12.1.7 GC AESTHETICS

TABLE 282 GC AESTHETICS: BUSINESS OVERVIEW

12.1.8 SEBBIN

TABLE 283 SEBBIN: BUSINESS OVERVIEW

12.1.9 ESTABLISHMENT LABS S.A.

TABLE 284 ESTABLISHMENT LABS HOLDINGS: BUSINESS OVERVIEW

FIGURE 43 ESTABLISHMENT LABS HOLDINGS: COMPANY SNAPSHOT (2020)

12.1.10 INTEGRA LIFESCIENCES

TABLE 285 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 44 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2020)

12.1.11 RTI SURGICAL HOLDINGS

TABLE 286 RTI SURGICAL HOLDINGS: BUSINESS OVERVIEW

FIGURE 45 RTI SURGICAL HOLDINGS: COMPANY SNAPSHOT (2018)

12.1.12 IDEAL IMPLANT INCORPORATED

TABLE 287 IDEAL IMPLANT INCORPORATED: BUSINESS OVERVIEW

12.1.13 LABORATORIES ARION

TABLE 288 LABORATORIES ARION: BUSINESS OVERVIEW

12.1.14 SILIMED

TABLE 289 SILIMED: BUSINESS OVERVIEW

12.1.15 GUANGZHOU WANHE PLASTIC MATERIALS CO. LTD.

TABLE 290 GUANGZHOU WANHE PLASTIC MATERIALS CO. LTD.: BUSINESS OVERVIEW

12.1.16 CEREPLAS

TABLE 291 CEREPLAS: BUSINESS OVERVIEW

12.1.17 HANSBIOMED

TABLE 292 HANSBIOMED: BUSINESS OVERVIEW

12.1.18 PRODUCTS OFFERED

12.2 OTHER PLAYERS

12.2.1 SHANGHAI KANGNING MEDICAL DEVICE

12.2.2 PMT CORPORATION

12.2.3 PFM MEDICAL

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 244)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the breast reconstruction market. Exhaustive secondary research was conducted to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Then, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to for this research study on the breast reconstruction market include publications from government sources such as white papers; articles from recognized authors; gold standard and silver standard websites, directories, and databases; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations.

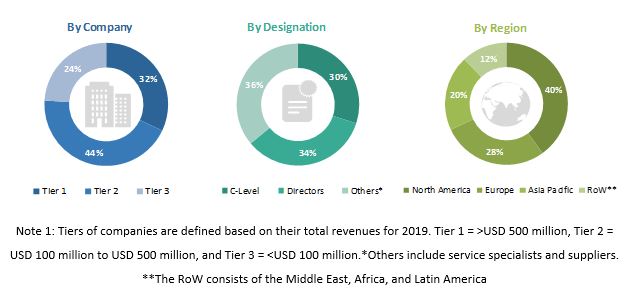

Primary Research

The breast reconstruction market comprises several stakeholders, such as breast reconstruction product manufacturers and distributors. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the breast reconstruction market. These methods were also used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall breast reconstruction market size-using the market size estimation processes explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the breast reconstruction industry.

Report Objectives

- To define, describe, segment, and forecast the breast reconstruction market

- To forecast the size of the market with respect to the main regional segments—North America, Europe, the Asia Pacific, and the Rest of the World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players and comprehensively analyze their market shares and core competencies in terms of market developments and growth strategies

- To track and analyze competitive developments such as collaborations, regulatory approvals, partnerships, acquisitions, and product launches in the breast reconstruction market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the breast reconstruction market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of each company

Company Information:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Breast Reconstruction Market

How emerging markets offering revenue expansion opportunities in Breast Reconstruction Market?

Which are the most innovative companies in Breast Reconstruction Market?

Which market segment is expected to shape the future of the Breast Reconstruction Market?