Breathable films Market by Type (Polyethylene, Polypropylene, Polyurethane), End-Use Industry (Hygiene, Medical, Food Packaging, Construction, Fabric), And Region (North America, South America, Europe, APAC, ME&A) - Global Forecast to 2025

Updated on : April 17, 2024

Breathable Films Market

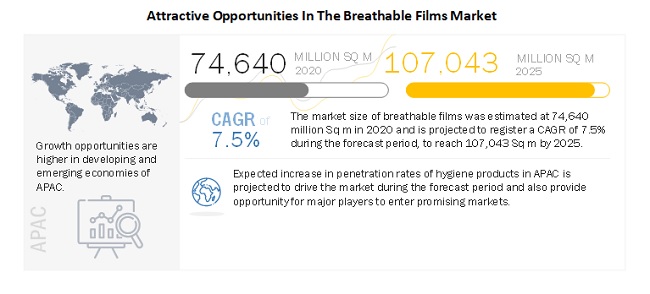

Breathable Films Market was valued at USD 2.6 billion in 2020 and is projected to reach USD 3.9 billion by 2025, growing at 8.2% cagr from 2020 to 2025. Rising awareness of health and hygiene and increasing the purchasing power of consumers are the major drivers of the global market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global breathable films market

Due to the pandemic, demand for personal protective equipment (PPE) kits has grown exponentially from the healthcare workers on the frontline fighting against the virus. Initially, the demand for PPE kit was catered by China, but due to the US-China trade tensions and PPE kits failing quality teste sent by China to India are some factors that led other countries to start local production. This has increased the demand for breathable films as the breathability of PPE kits is one of the critical parameters during quality testing. The breathable films market in 2020 is anticipated to reach USD 2.6 billion, with a growth rate of 7.3%.

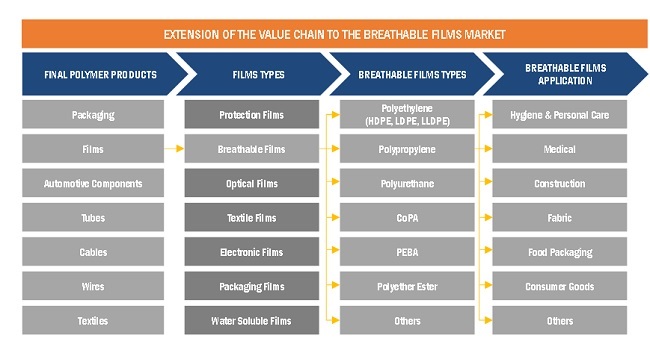

Polyethylene segment is the largest type of breathable films market

Different types of breathable films are polyethylene-based breathable films, polypropylene-based breathable films, polyurethane-based breathable films, and others. The ‘others’ type includes polyether block amide-based breathable films, co-polyamide-based breathable films, and polyether ester-based breathable films. Polyethylene-based breathable films are the most widely used type of breathable films as these are low in cost as compared to any other type of breathable films and have favorable properties such as high absorbency, permeability, and strength.

Medical segment is the fastest-growing application of breathable films market

By application, the breathable films market is classified into six segments, namely hygiene, medical, food packaging, construction, fabric, and others. Hygiene is the largest application industry of breathable films. The growing penetration rate of baby diapers and sanitary napkins in the developing countries is expected to drive the breathable films market in this application. The medical application segment of the breathable films market is expected to be the fastest-growing application during the forecast period. Increased usage of breathable films into surgical drapes and gowns is expected to be the major driver.

Breathable Films Market Dynamics

Driver: Growing awareness regarding health & hygiene

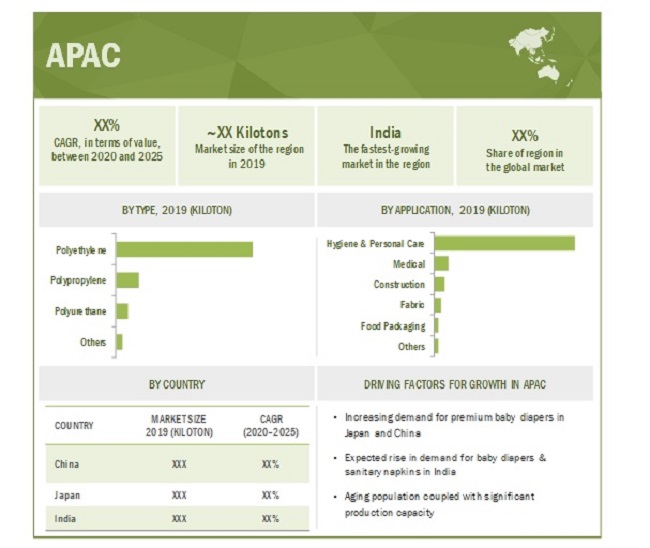

The adoption of hygiene products in developing countries is low as compared to developed countries such as the US, Canada, Japan, and Western European countries such as Germany, France, the UK, and Italy. In APAC, Africa, and Eastern Europe, the adoption is low due to cultural differences (affecting the consumers’ attitude towards these products), unaffordability due to high price and low per capita income. However, with increasing awareness related to health & hygiene and improving per capita income, the adoption of hygiene products is increasing.

The use of premium hygiene products is increasing significantly, especially in tier-I cities. Hence, the increasing usage of breathable films in premium hygiene products in developing countries is driving the market.

Restraints: stagnant growth in the baby diapers market in the developed countries

The penetration rate of baby diapers is about 95% to 98% in North America, Western Europe, and Japan. The high penetration rate of baby diapers in developed economies is the reason for the slow growth rate of breathable films in the developed economies.

Opportunities: Untapped market with lower penetration

The penetration level of hygiene products in developing countries is still very low. Countries with large populations and high birth rates such as China, India, and Indonesia currently have a very low penetration rate. However, the demand is expected to grow significantly with the increase in per capita income, growing awareness regarding health and hygiene, and changing consumer preference. There is a big prospect for the growth of hygiene products as well as breathable films in emerging countries such as China, India, and Indonesia.

Challenges: Cultural barriers

Although the breathable films market is poised for growth in the next five years, there are certain issues that pose a challenge to market growth. Overcoming these challenges may entail double-digit growth for the breathable films market. The feminine hygiene market in the US and Europe is mature, with a high penetration rate. On the other hand, emerging markets provide an opportunity for growth in this area. Attractive as they may seem, the issue is to overcome the misconceptions surrounding menstruation, which is considered as a disease/taboo in developing countries. The challenge is to educate and uplift women’s social status so that they can have access to hygiene products without difficulty.

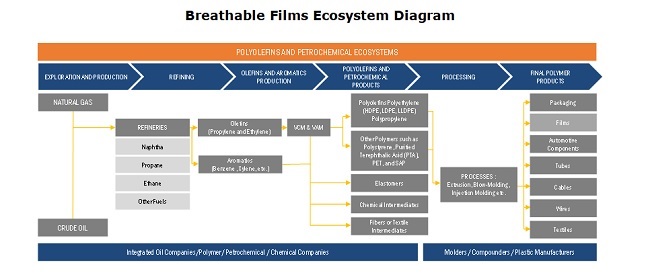

Breathable Films Ecosystem Diagram

To know about the assumptions considered for the study, download the pdf brochure

APAC is estimated to account for the largest market share during the forecast period.

APAC is estimated to be the largest market for breathable films and is also projected to register the fastest CAGR during the forecast period. China is expected to account for the largest share of the market in APAC till 2025. The increasing disposable income & consumption levels and the growing affluence of Chinese consumers will help the hygiene industry to grow stronger in the country. The penetration rate of the disposable baby diaper market in China is lower than in North America and Europe due to reasons such as low awareness, high cost, and social stigma.

Breathable Films Market Players

The key companies profiled in the breathable films market research report are Toray Industries (Japan), Mitsui Chemicals (Japan), Berry Global Group (US), Arkema (France), RKW Group (Germany), and Schweitzer-Mauduit International (US). Other prominent players in the breathable films market are Covestro (Germany), Nitto Denko (Japan), Trioplast Industries AB (Sweden), Rahil Foam Pvt Ltd. (India), Skymark Packaging (UK), Daika Kogyo (Japan), American Polyfilm (US), and Innovia Films (UK).

Breathable Films Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2018–2024 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Unit considered |

Value (USD), Volume (Square Meter) |

|

Segments |

Type, Application, and Region |

|

Regions |

APAC, North America, Europe, South America and Middle East & Africa |

|

Companies |

Toray Industries (Japan), Mitsui Chemicals (Japan), Berry Global Group (US), Arkema (France), RKW Group (Germany), and Schweitzer-Mauduit International (US). Some of the other leading companies in this market are Covestro (Germany), Nitto Denko (Japan), Trioplast Industries AB (Sweden), Rahil Foam Pvt Ltd. (India), Skymark Packaging (UK), Daika Kogyo (Japan), American Polyfilm (US), and Innovia Films (UK). |

This research report categorizes the breathable films market on the basis of type, application, and region.

On the basis of type:

- Polyethylene-based breathable films

- Polypropylene-based breathable films

- Polyurethane-based breathable films

- Others (Polyether block amide, Co-polyamide, and Polyether ester-based breathable films)

On the basis of technology:

- Microporous-based breathable films

- Monolithic-based breathable films

On the basis of application:

- Hygiene & Personal Care

- Medical

- Food Packaging

- Construction

- Fabric (Defence jackets, Protective garments for industrial uses)

- Others (Adventurous sporting goods such as rafts, tents, waterproof camping bags, mattresses, disposable work wear, coverall, jumper, rainwear, and shoe liners)

On the basis of region:

- North America

- South America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

Recent Developments

- In January 2020, Berry Global Group announced that it has planned to expand its health, hygiene & specialties film business in North America. The planned investment is made to address both extrusion and printing capabilities in order to cater to the growing demand for breathable films in the region.

- In February 2020, RKW Group launched RoofTopGuard breather, a synthetic roofing underlayment that is breathable and optionally self-adhesive. The new products offer higher permeability and water resistance compared to other breathable products.

- In July 2019, Schweitzer-Mauduit International added a TPU film line at its manufacturing site in Suzhou, China, to support the demand for protective film in China and APAC region.

- In July 2019, Arkema acquired Prochimir SAS, a French company that specializes in high-performance thermobonding adhesive films. Prochimir develops high-performance thermobonding films and breathable membranes that are environmentally friendly.

Key Questions addressed by the report

- What was the market size of breathable films and the estimated share of each region in 2020, in terms of volume and value?

- What will be the CAGR of the breathable films market in all the key regions during the forecast period?

- What are the new revenue streams for the breathable films market?

- Which type of breathable sheet is preferred most?

- What is the estimated demand for polyethylene breathable films in various applications?

- Who are the major players in the market?

- What is the impact of the COVID-19 pandemic on the breathable films market?

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the breathable films market?

The major drivers influencing the growth of breathable films are the growing awareness regarding health & hygiene and the increasing usage of breathable films in premium hygiene products in the developing countries

What are the different types of breathable films?

The different types of breathable films are polyethylene, polypropylene, polyurethane, and others.

How are the breathable films segmented in terms of technology?

The breathable films are segmented into microporous and monolithic breathable films

What is the difference between microporous and monolithic breathable films?

The breathability of microporous films depends on the formation of a tortuous path inside the films, which has billions of tiny holes per square centimetre. The size of these holes is smaller than the smallest raindrops and bigger than the largest water molecules. The breathability of monolithic films on the other hand, utilizes continuous hydrophilic laminates with membranes in between which absorb gases and water molecules on one surface, transferring the molecules through the film to release it on the other side.

What are the major end-use applications for breathable films?

The major end-use applications are hygiene & personal care, medical, construction, fabric, food packaging, and others.

What are the biggest restraints for breathable films?

The biggest restraints in the breathable films market are the developed countries seeing stagnant growth in the baby diapers markets.

What are the new opportunities in the breathable films market?

The untapped markets with low penetration rates in hygiene products present new opportunities for the breathable film market. The report answers the untapped markets with both qualitative as well as quantitative information.

Who are the major manufacturers of breathable films?

The major manufacturers of breathable films are Mitsui Chemicals (Japan), Toray Industries (Japan), Covestro (France), and Nitto Denko (Japan).

What are the emerging applications for breathable films?

In the medical industry, breathable films are finding increasing usage due to its characteristics such as permeability, elastics, processability, and strength. The report also answers which technology will see the highest growth in the medical application.

How is the hygiene & personal care market aligned?

The market is expected to see above moderate growth during the forecast period. In the personal & hygiene market, the disposable baby diapers and disposable sanitary napkins will grow at a faster pace in developing economies while the adult diapers will grow in both developed as well as developing economies. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1.1 Breathable Films Market, By Technology

1.3.1.2 Breathable Films Market, By Type

1.3.1.3 Breathable Films Market, By Application

1.3.1.4 Breathable Films Market, By Region

1.4 Years Considered for the Study

1.5 Currency

1.6 Package size

1.7 Limitations

1.8 Stakeholders

1.9 Summary of Changes (Vs previous version of the report)

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.2.4 Data Triangulation

2.2 Market Size Estimation

2.2.1 Market Size Estimation - Demand Side

2.2.2 Market Size Estimation - Based on Backsheet Estimation

2.3 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities in breathable films Market

4.2 Regional Breathable films Market, By Resin Type and Country

4.3 Breathable films Market, By Type

4.4 Breathable films Market, By Technology

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Porter’s Five Forces

5.4 Ecosystem/market map

5.5 Value Chain Analysis

5.6 Trade Analysis

5.7 Average Selling Price Analysis

5.8 Technology Analysis

5.9 Region wise Regulatory Mandates

5.9.1 North America

5.9.2 Europe

5.9.3 APAC

5.9.4 Middle East & Africa

5.9.5 South America

5.10 Forecast Factors Impacting the Growth

5.11 Patent Analysis

5.12 YC, YCC Drivers (analyzing customer’s customers’ impact)

5.13 Macroeconomic Overview

5.14 COVID-19 Impact Analysis

6 Breathable films Market, By Technology- Forecast till 2025 (in Tons and USD Million)

6.1 Micro Porous Film

6.2 Monolithic Film

7 Breathable films Market, By Type- Forecast till 2025 (in Tons and USD Million)

7.1 Introduction

7.2 Polyethylene

7.2.1 Hygiene & Personal Care

7.2.2 Packaging

7.2.3 Others

7.3 Polypropylene

7.4 Polyurethane

7.5 Others (polyether block amide, thermoplastic polyester elastomers (polyether ester), and co-polyamide)

8 Breathable films Market, By Application- Forecast till 2025 (in Tons and USD Million)

8.1 Introduction

8.2 Hygiene & Personal Care

8.2.1 Disposable baby diapers

8.2.2 Disposable incontinency adult diapers

8.2.3 Disposable sanitary napkins

8.2.4 Protective Clothes

8.2.5 Others

8.2.6 Impact of megatrend in the hygiene & personal care segment

8.3 Medical

8.3.1 Impact of megatrend in the medical segment

8.4 Construction

8.4.1 Impact of megatrend in the construction segment

8.5 Fabric

8.5.1 Impact of megatrend in the fabric trend segment

8.6 Food Packaging

8.6.1 Impact of megatrend in the food packaging segment

8.7 Others (Sporting goods and automotive mats)

9 Breathable films Market, By Region – Forecast till 2025 (in Tons and USD Million)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Italy

9.3.5 Rest of the Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 South Korea

9.4.5 Taiwan

9.4.6 Others

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 UAE

9.5.3 Saudi Arabia

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape

10.1 Introduction

10.2 Company Evaluation Matrix Definition And Technology

10.2.1 Market Share & Industry Tier Structure Analysis

10.2.2 Product Footprint

10.2.3 Star

10.2.4 Emerging Leader

10.2.5 Pervasive

10.3 Company Evaluation Matrix 2019

10.4 Competitive Scenario

10.4.1 Expansions

10.4.2 Acquisitions

10.4.3 New Product launches

10.4.4 Market Strategy Analysis

10.4.5 Revenue Analysis of Top Players

11 Company Profiles

Business Overview, Financials, Impact of Covid-19 on Business Segment, Products & Services, MNM View, Key strength/Right to win, Strategic choices made, weaknesses and competitive threats)*

11.1 Introduction

11.1.1 Clopay Plastic Products

11.1.2 RKW Group

11.1.3 Arkema

11.1.4 Mitsui Chemicals

11.1.5 Toray Industries

11.1.6 Covestro

11.1.7 Nitto Denko

11.1.8 Fatra, a.s.

11.1.9 Schweitzer-Mauduit International

11.2 Startup/SME Evaluation Matrix, 2019

11.3 Startup/New Entrant Profiles

11.3.1 Trioplast Industries AB

11.3.2 Celanese

11.3.3 Rahil Foam Pvt. Ltd

11.3.4 Skymark Packaging

11.3.5 American Polyfilm

11.3.6 Innovia Films

11.3.7 DSM Engineering Plastics

11.3.8 Agiplast

11.3.9 Teknor Apex Company

11.3.10 Daika Kogyo

11.3.11 Sunplac Corporation

The study involved four major activities for estimating the current size of the global breathable films market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of breathable films through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the breathable films market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, edana.org, associations were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The breathable films market comprises several stakeholders such as raw material suppliers, technology developers, breathable films companies, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the hygiene applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Note: The tiers of the companies are defined on the basis of their total revenue, as of 2019: Tier 1 = >USD 5 billion, Tier 2 = USD 1 billion to USD 5 billion and Tier 3 = < USD 1 billion.

*Others include sales managers, marketing managers, and product managers.

**Others include South America and the Middle East & Africa

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global breathable films market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

The overall market size has been used in the top-down approach to estimate the sizes of other individual markets mentioned in the segmentation through percentage splits derived using secondary and primary sources.

For calculating each type of specific market segment, the size of the most appropriate immediate parent market has been considered for implementing the top-down approach. The bottom-up approach has also been implemented for data extracted from secondary research to validate the market sizes, in terms of value and volume, obtained for each segment.

The exact values of the overall parent and individual markets have been determined and confirmed through the data triangulation procedure and validation of data through primary interviews. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and sub-segments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the global breathable films market on the basis of type, technology application, and region

- To forecast the market size, in terms of value and volume, of the five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their key developments such as new product launches, capacity expansions, mergers & acquisitions, and partnerships in the breathable films market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information:

- Breathable films market analysis for additional countries

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Pricing Analysis:

- Detailed pricing analysis for each type of breathable film products

Growth opportunities and latent adjacency in Breathable films Market

Information on PE breathable textile backsheet line for baby and adult diapers

looking for the details of medical and hygiene breathable film market and type of technology used for manufacturing

Looking for report on indian and african breathable film market (market size, CAGR,applications, and key players)

General information on breathable films market

Polyethylene based breathable film market insights