Building Information Modeling Market by Offering (Software, Services), Deployment Type (On-Premises), Project lifecycle (Pre construction), End User (AEC Professionals), Application (Planning & Modelling) and Region - Global Forecast to 2029

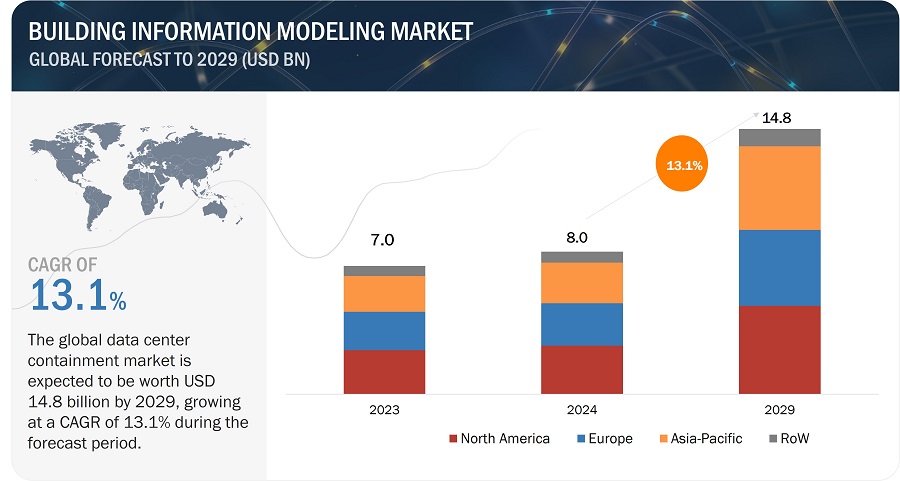

[250 Pages Report] The Building Information Modeling Market is projected to reach from USD 8.0 billion in 2024 to USD 14.8 billion by 2029; it is expected to grow at a CAGR of 13.1% from 2024 to 2029. The increasing demand for BIM software is driven by various factors, including heightened sustainability concerns, expanding construction activities, supportive government policies, and the need for improved collaboration. Additionally, opportunities in emerging markets, advancements in technology integration, and enhanced facility management are expected to further boost the adoption of BIM software.

Building Information Modeling Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Building Information Modeling Market Dynamics

Driver: Enables building management systems and facility management systems

BIM's integration with Building Management Systems (BMS) and Facility Management Systems (FMS) enhances building operations and maintenance by improving efficiency and effectiveness. BIM offers comprehensive data on a building’s design, construction, and performance. This data can be integrated into the BMS to enable improved control and monitoring of building systems such as HVAC, lighting, and security. For FMS, BIM data assists in managing building assets like equipment, furniture, and fixtures. The detailed information from BIM, including asset locations, conditions, and maintenance histories, enables more effective asset management and planning. The integration of sensors within buildings has led to the development of intelligent buildings. These smart buildings not only monitor usage patterns but also detect issues such as pipe leaks, identifying moisture buildup before it can cause mold and health problems.

Restraint: High initial cost of BIM

Implementing BIM software, such as Autodesk Revit and ArchiCAD, involves significant expenses. The cost of licensing, whether through subscriptions or one-time payments, represents a substantial initial investment. Additionally, BIM software demands robust computing power, necessitating high-performance computers and potentially additional servers to manage data processing and storage. Consequently, upgrading existing hardware or acquiring new equipment incurs further costs.

Opportunity: Integration of VR and AR technologies with BIM solutions

Virtual Reality (VR) and Augmented Reality (AR) technologies significantly enhance the visualization of Building Information Modeling (BIM) models by allowing stakeholders to experience designs in immersive 3D environments. This capability improves the understanding of complex architectural and engineering designs, facilitating better communication and collaboration among clients, architects, and construction teams. By enabling interactive design reviews, project stakeholders can explore virtual models in real-time, which aids in receiving immediate feedback and making informed decisions during the design phase. Consequently, potential issues can be identified and addressed more effectively, improving design quality and reducing the likelihood of errors during construction. The modern technique of integrating VR with BIM is highly valuable. It primarily facilitates a thorough analysis of problems and the discussion of alternative solutions. Interacting with the BIM model to visualize the geometry of elements and consult parametric data enhances the collaborative project development process significantly.

Challenge: Complying with BIM standards across multiple geographies

While BIM endeavors to streamline real-time communication and model visualization among stakeholders, ensuring compliance with AEC (Architecture, Engineering, and Construction) and BIM standards presents a significant challenge. This challenge is compounded when multiple stakeholders are involved, each with their own set of compliance requirements. Effectively managing the complex landscape of AEC and BIM standards requires careful attention to detail and a comprehensive grasp of regulatory frameworks. Various regions and industries may impose specific standards, adding layers of complexity to compliance efforts. Additionally, the dynamic nature of these standards requires constant vigilance and adaptation to maintain compliance throughout the project lifecycle.

Building Information Modeling Market Ecosystem

The prominent players in the building information modeling market are Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Trimble Inc. (US), Dassault Systèmes (France). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

Software offering type to account for the largest share of the building information modeling market in 2023.

Software solutions used for Building Information Modeling (BIM) are expected to capture largest market share during the forecast period. These solutions offer various features such as interoperability between applications, intuitive visualization capabilities, and cost-effectiveness. BIM software suites typically encompass tools tailored for different project objectives across the lifecycle, including architecture, sustainability, structural design, mechanical, electrical, and plumbing (MEP), construction management, and facility maintenance. 3D BIM software is increasingly adopted by architecture, engineering, and construction (AEC) professionals due to its ability to provide comprehensive 3D visualization of projects.

Pre construction project lifecycle to dominate building information modeling market during the forecast period.

Using BIM in the pre-construction phase ensures designs comply with local building codes and regulations, facilitating the permit approval process and reducing associated delays. Additionally, BIM helps identify and resolve clashes between different building systems (such as structural, mechanical, electrical, and plumbing) early in the design process. This early detection minimizes the risk of costly rework and construction delays.

On-premises deployment type to register the largest share building information modeling market during the forecast period.

The on-premise segment is expected to witness the largest share during the forecast period. Larger firms in the AEC industry, such as Autodesk and Nemetschek, offer on-premise software solutions for customers in industrial, healthcare, and residential sectors. One of the primary reasons for adopting on-premise BIM software is that organizations maintain complete control over their data, as it is physically stored on their premises. This control over data flow is particularly appealing to many firms. Additionally, on-premise deployment is feasible for small- and medium-sized enterprises because it simplifies data management, allowing them to handle their data more efficiently and securely within their own infrastructure.

AEC professionals to grow at highest CAGR during the forecast period.

BIM software offers AEC professionals robust project management features, including cost estimation, scheduling, and clash detection. These capabilities enhance project outcomes and help ensure deadlines are met. Additionally, BIM aids in designing and constructing more sustainable and energy-efficient buildings, a growing priority in the industry. This focus on sustainability is increasing the demand for BIM tools among environmentally-conscious professionals.

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

The Asia Pacific region is rapidly adopting digital technologies, including Building Information Modeling (BIM), as construction companies aim to enhance efficiency, productivity, and collaboration. This surge in adoption is driven by a construction boom in the region, fueled by population growth, urbanization, and economic development, which in turn is increasing the demand for BIM software. The favorable economic conditions and the expanding construction activities in the Asia Pacific are expected to sustain the high growth rate of the BIM market. As construction firms continue to embrace digital solutions to meet the demands of large-scale projects, BIM adoption is likely to grow even further.

Building Information Modeling Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the building information modeling companies include Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Trimble Inc. (US), Dassault Systèmes (France), Schneider Electric (France), Asite (UK), Procore Technologies, Inc. (US), Hexagon AB (Sweden), Archidata Inc. (Canada). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Offering Type, By Deployment Type, By Project Phase, By Vertical, By Application, By End User |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Trimble Inc. (US), Dassault Systèmes (France), Schneider Electric (France), Asite (UK), Procore Technologies, Inc. (US), Hexagon AB (Sweden), Archidata Inc. (Canada), ACCA software (Italy), pinnacleinfotech.com (US), Concora (US), AFRY AB (Sweden), Beck Technology (US), Computers and Structures, Inc. (US), Robert McNeel & Associates (TLM, Inc.) (US), SierraSoft (Italy), Safe Software Inc (Canada), FARO (US), 4M S.A. (Greece), Geo-Plus (Canada), CYPE (Spain), MagiCAD Group (Finland) and Revizto SA (Switzerland) |

Building Information Modeling Market Highlights

This research report categorizes the building information modeling market based on offering type, deployment type, project phase, vertical, application, end user, and region.

|

Segment |

Subsegment |

|

By Offering Type |

|

|

By Deployment Type |

|

|

By Project Phase |

|

|

By Vertical |

|

|

By Application |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In March 2024, Autodesk has introduced several new features in Autodesk Construction Cloud (ACC) designed to help project leaders and teams prevent costly mistakes. These features, including Specifications, Work Planning capabilities, and Model-Based Progress Tracking, provide teams with critical project insights drawn from data, enabling them to make informed decisions. The updated Model Viewer also enhances field collaboration by enabling teams to concentrate on construction rather than spending time searching for essential information.

- In January 2024, ALLPLAN, a leading global provider of BIM solutions for the AEC industry, has revealed that users of Allplan Subscription will now enjoy enhanced functionality for interconnected 2D and 3D workflows. A new addition to Allplan Subscription is Allplan Cloud, a comprehensive solution that seamlessly integrates Allplan desktop and cloud applications, enabling users to maximize their data utilization. Allplan Cloud incorporates a robust cloud-based BIM collaboration platform, which now features the latest addition: Bimplus Overlay functionality.

- In August 2023, Bentley Systems, Incorporated, a leader in infrastructure engineering software, announced its acquisition of Blyncsy, a company known for its innovative AI services tailored for transportation departments to enhance operations and maintenance. This acquisition strengthens Bentley’s iTwin Ventures portfolio by advancing the creation and dissemination of comprehensive infrastructure asset analytics within the digital twin ecosystem.

- In January 2023, Trimble acquired Ryvit, a provider of Integration Platform-as-a-Service (iPaaS) solutions for the construction sector. Ryvit creates connections between widely used applications and data sources, facilitating information sharing both within and across organizations. This enables project teams to access accurate information promptly for informed decision-making. The acquisition enhances Trimble Construction One, Trimble's connected, cloud-based construction management platform, which improves speed, efficiency, and accuracy throughout the construction project lifecycle. With Trimble Construction One, customers gain better visibility into real-time project status and cash flow, resulting in more confident and reliable project delivery.

- In December 2022, Dassault Systèmes, Egis, and B4 partnered for a project to rebuild cities in Ukraine. The French government supports the project with a grant from the French Treasury. The project will combine Dassault Systèmes' 3DEXPERIENCE platform and Egis' and B4's construction engineering expertise in a two-phase approach: a damage assessment and reconstruction cost analysis in the Chernihiv Oblast, followed by a strategic master planning for reconstruction in the city of Chernihiv.

Frequently Asked Questions (FAQs):

What is the current size of the Global Building Information Modeling Market?

The building information modeling market is projected to reach from USD 8.0 billion in 2024 to USD 14.8 billion by 2029; it is expected to grow at a CAGR of 13.1% from 2024 to 2029.

Who are the winners in the Global Building Information Modeling Market?

Companies such as Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Trimble Inc. (US), Dassault Systèmes (France).

Which region is expected to hold the highest market share?

North America is expected to dominate the building information modeling market during the forecast period. Market growth is driven by investments in digital infrastructure, the adoption of advanced technologies such as AR and VR, and the growing reliance on digitalization in construction sector.

What are the major drivers and opportunities related to the building information modeling market?

Enables building management systems and facility management systems, Promotes sustainability through low carbon emissions during construction and Integration of VR and AR technologies with BIM solutionsare some of the major drivers and opportunities related to the building information modeling market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their building information modeling market position.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

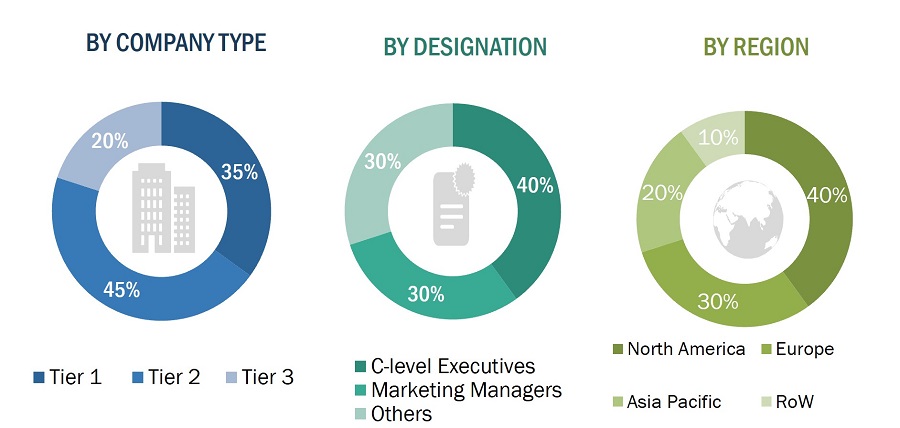

The study involved four major activities in estimating the size of the building information modeling market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering building information modeling solutions have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the building information modeling market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the building information modeling market.

- Identifying approximate revenues of companies involved in the building information modeling ecosystem

- Identifying different offerings of players in the building information modeling market

- Analyzing the global penetration of each building information modeling offering through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the building information modeling solutions and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then, finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information, such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the building information modeling market

The top-down approach has been used to estimate and validate the total size of the building information modeling market.

- Focusing initially on the top-line investments and expenditures made in the building information modeling ecosystem, further splitting into offering and listing key developments in key market areas

- Identifying all major players offering a variety of building information modeling solutions, which have been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence for which all identified players offer building information modeling products to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall size of the building information modeling market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

BIM is a digital representation of the physical and functional characteristics of a building or infrastructure project. BIM integrates various aspects of the design, construction, and operation phases, facilitating collaboration among architects, engineers, contractors, and other stakeholders. It enables the creation, management, and sharing of accurate and reliable project data throughout its lifecycle. It involves creating and managing a 3D model that contains detailed information about the project’s geometry, spatial relationships, materials, quantities, and other relevant data. BIM software goes beyond traditional 2D drafting by incorporating intelligent 3D models that contain detailed information about the project’s components and their interactions. BIM improves collaboration, enhances visualization and analysis, optimizes project planning, supports sustainability, and facilitates efficient facility management. Its adoption has revolutionized the construction industry, driving better project outcomes and increased productivity.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM)

- Research institutes

- Building information modeling solution provider

- Forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the size of the building information modeling (BIM) market, in terms of offering type, deployment type, project lifecycle, application, and end user, in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the building information modeling market

- To provide an overview of the value chain pertaining to the building information modeling ecosystem and the average selling prices of building information modeling solutions

- To strategically analyze the ecosystem, tariff and regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies about the market under study

- To strategically analyze micromarkets1 regarding individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide a competitive landscape for market leaders

- To analyze strategies adopted by players in the building information modeling market, such as product launches and developments, acquisitions, partnerships, agreements, expansions, and mergers

- To profile key players in the building information modeling market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Building Information Modeling Market

Hi, we need a sample brochure of this study and eagerly interested to have key insight discussion with your team.

We provides BIM services globally. we need some of clients so, we are looking for someone who will marketing our services in USA.

To understand the level of BIM development in the world and receive the real numbers of use in the market.

Software market valuations for construction commercial real estate, with a specific focus on warehouses, flex space, and offices.

In a construction project completed in 2025, multiple stake folders are considering using a common platform. We need an investigation for that.

What EMEA Emerging countries are included? Please respond including price to email, and methods to buy.

I am looking forward for developing a BIM based service provider company. I hope this brochure useful for me.

Good day! I am looking into figures on global acceptance and usage of BIM, forecasted global growth, percentage of growth it has brought to users and hindrances on adoption from consumers' perspective, all under the global area of focus.

I am seeking Data on the market size of Japan. Analysis regarding Japan is included on the Appendix, can you send me the sample data to confirm.

I am student from Brazil, doing a Master Degree in Project Management. As I am researching about BIM for my conclusion these, this study is very important to my work. Please, send me a free PDF, in order to support my research project.

I am participating as an invited speaker in a Master in BIM. During my speak, I will point to some BIM software in the market. It could be interesting to give pupils an insight of the market share of each software.

Interested in the global growth in key markets. Also, I Would like to see what the report contains on UK.

Hi, Does this report contain market share of Revit vs. other programs for Architects + AECs generally in the United States?

Role of BIM in improving and re-culturing the construction industry and the positive economics rewards and ROI's.

Learning more about the latest trends about BIM and how its making a big impact on todays modern world and what are the upcoming industry trends, which will drive this market?

I am requesting to get brochure for the BIM market.

Just trying to get a sense of the size of the BIM market

Which are the top players involved in this ecosystem.

What are the new upcoming trends for the growth of this market.

Which region along with country is dominating the BIM market and what are the major trends for the growth?

Please send us the sample brochure for the report.

Which application are will dominate the Bim market by 2024 or 2025, and what the driving factors for the same?

Total revenue share from BIM-software companies can generate revenue by targeting which customers?

Integration issue of BIM industry is the very important facts, we want to discuss many things related to Bim market and also will give me more information for the same. Before this, please send us the summary and scope of the report.

To track down the overview of BIM industry globally and find opportunities for it in india

I would like to know how much detailed information it contains for Building Information Modeling Market by Geography.

We are searching for the future market in BIM. We want to know that which are the dominant players present in this market and share captured by them in this market.

I am seeking access to this report as I am currently writing my thesis and would greatly benefit from the access to this report.

I'm developing a website to boost BIM negotiations around the world and I need the information of this article to measure the market that I'm getting into.

We are planning for a startup specializing in providing AEC services in the Asian Countries. Thus, we are interested in this report to have a better understanding of the market which would eventually help us in preparing an efficient business plan.

Hi, I would like to know what type of info is available for UK and also split for all industry/user types. Would you be able to provide some older data on UK as % of global and UK user group / industry split? Can the updated actuals + forecasts be purchased separately?

The geographic analysis is most important to me. I'm putting together an EU funding application and it would be good to be able to state what size the different markets were.

I would like to schedule a briefing with analysts of Building Information Modeling (BIM) report regarding ViZZ (https://www.vizz3d.com/), a transformative virtualization platform that brings to life data from various sources, creating immersive, experiential models that allow contractors, developers, prospective buyers, and investors to interact and walk-through them.