Calcium Silicate Insulation Market by Temperature (High-Temperature & Mid-Temperature), End-use Industry (Metals, Industrial, Power Generation, Petrochemical, Transport), and Region (Europe, North America, APAC, MEA, South America) - Global Forecast to 2026

Updated on : April 16, 2024

Calcium Silicate Insulation Market

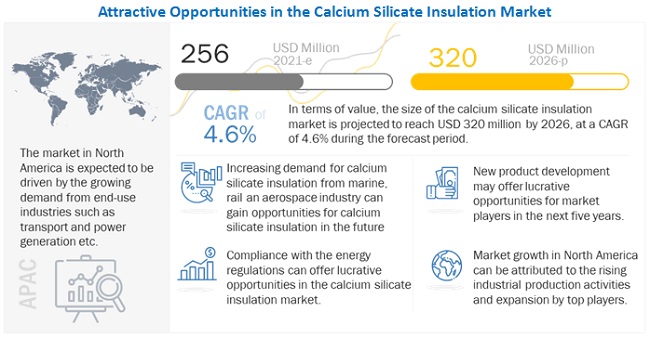

Calcium Silicate Insulation Market was valued at USD 256 million in 2021 and is projected to reach USD 320 million by 2026, growing at 4.6% cagr from 2021 to 2026. The growth of the calcium silicate insulation market is primarily triggered by its increasing use in the transport and power generation industries. Factors such as increasing capacity expansions and joint venture activities by end users in high-growth markets will drive the calcium silicate insulation market. APAC is the key market for calcium silicate insulation globally, followed by Europe and North America, in terms of value.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Calcium silicate insulation Market

The global pandemic has affected almost every sector in the world. The calcium silicate insulation market is negatively affected due to disruptions in the global supply chain and the hindrance in the building construction activities, which constitutes the majority share in the consumption of calcium silicate insulation. The market is highly dependent on the metal processing, power generation, chemical, and construction industries.

Covid-19 outbreak has severely impacted business and consumer sentiment across key global markets, leading to building & construction sectors recording significant decline. Though the market is slowly recovering, it will take a while before residential and commercial construction sectors return to a stable growth trajectory. Growth is expected in affordable housing segment to bounce back faster than mid-tier and luxury segments. Office and retail segments are expected to witness a slow recovery as collapsed demand will take 6-8 quarters to recover completely. Infrastructure construction sector is expected to maintain growth momentum, supported by public spending.

Calcium Silicate Insulation Market Dynamics

Driver: Rapid urbanization and infrastructure development

The global construction market has grown at a CAGR of 6.1% from 2015 to 2019. There was however a decline in the market in 2020 because of the pandemic which had hampered the growth of the construction industry. The growth decline is mainly due to lockdown and social distancing norms imposed by various countries and economic slowdown across countries owing to the COVID-19 outbreak and the measures to contain it. However, the reviving construction and infrastructure industry plays important role in consumption in calcium silicate insulation.

On the other hand, increasing investments in power generation capacities and urbanization is expected to drive the growth. Rising government expenditure for infrastructure development in emerging economies including India, China, and Brazil is expected to have a positive impact on the calcium silicate industry over the next few years.

Infrastructural development in economies, such as China, India, Brazil, and South Korea, are expected to boost industrial activities and increase the consumption of insulation materials during the forecast period. In 2019, countries, such as China, the US, Australia, the UK, and France spent 5.57%, 0.52%, 1.69%, 0.92%, and 0.84% of their GDP in construction and maintenance of infrastructure. India has also launched various infrastructure projects, such as the smart city initiative, urban transformation schemes, new industrial estates, and business parks, which are expected to boost sector growth during the forecast period. An increase in spending and industrial activities are thus expected to provide major opportunities for the growth of the calcium silicate insulation market as well.

Restraints: Low awareness regarding the use of insulation products

Energy conservation is a major focal point for all industries including power, food & beverage, and petrochemical. Insulation materials are simple yet significant requirement in any industry dealing with various heat transfer operations. Proper use of insulation materials results in reducing heat loss and, in turn, saves the cost. Lack of awareness for the usage of insulation materials, specifically in developing countries is a major restraint for the market.

Increasing demand of renewables sources for electricity generation is another factor restraining the growth of insulation materials including calcium silicate. Renewable energy sources do not require much insulation materials as there are less thermal energy-related operations involved, as compared to conventional counterparts. However, these technologies have their own limitations, such as dependency on weather, low capacity, and large area requirements for installation.

Opportunities: Rising demand for green building material

In response to increased pressure for environment safety, many infrastructure investors are strengthening their environmental, social and governance (ESG) focus and want to invest in environmentally sustainable assets. In addition, several standards and frameworks have emerged to integrate climate-related factors into investment decisions and redirect capital to environmentally sustainable projects. As ESG reporting becomes more mainstream and policy pressure increases, it is reasonable to anticipate further demand for such assets in the future. The pandemic and climate change are both global problems, and in responding to the former, there is an opportunity to build resilience for the latter.

The trend of green buildings has brought about an increase in the demand of green materials. Calcium silicate insulation is used widely in the building and construction industry as wall facades, partitions, ceilings etc. With the growing demand for green building materials along with their excellent properties such as moisture resistance, fire resistance, and long shelf life, the demand for calcium silicate is also increasing. Furthermore, the European Calcium Silicate Producer Association (ECSPA) aims to facilitate the sustainable competitive growth of the European construction products industry by promoting efficient housing and infrastructure solutions.

“The high temperature is the largest calcium silicate insulation temperature for calcium silicate insulation market in 2020”

The growing aluminum, cement, glass, and petrochemical industries in developing economies and rebound in power generation and other industrial activities in developed economies are expected to drive the market for the high temperature range segment. The need for sustainable thermal insulation in high temperature processing industries and increased regulations supporting the same are driving the calcium silicate insulation market.

“Metals is estimated to be the largest end-use industry of calcium silicate insulation market between 2021 and 2026.”

Calcium silicate insulation is used in metal processing industries for steel, aluminium, and ferrous & non-ferrous casting application such as billet and ingot casting as transition plates, floats, spouts; head boxes for continuous casters; tips for continuous sheet casters; sprue bushes, tubes, nozzles and feeder box liner in low pressure die casting; hot face linings for dosing/holding furnaces and in launders & dams. It is also used for thermal insulation of liquid metals, for instance, it is used in direct contact with liquid aluminum alloys for transport, distribution and flow control of the metal. In order to achieve fire resistance rating, steel structures are cladded around with calcium silicate to provide thermal insulation. Other applications in the metal industry includes providing components for the manufacturing of bolts and ingots in horizontal and vertical casting, for example nozzles, floats, stoppers and hot top rings. It is also used as an insulating medium for metal cladding.

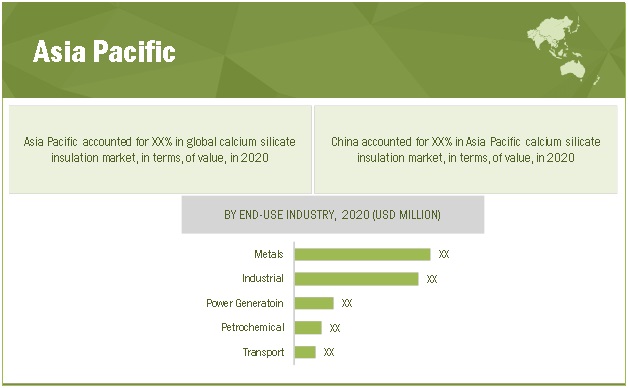

“APAC is expected to be the largest calcium silicate insulation market during the forecast period, in terms of value.”

APAC has dominated the global calcium silicate insulation market due to the growing investments in developing countries and manufacturing capacity additions across end-use industries, especially power generation, petrochemical, transport, metal processing and industrial infrastructure activities is increasing in developing economies such as China and India. This drives demand for thermal insulation, which has contributed significantly to the growth of the calcium silicate insulation market in APAC. China is the key market for calcium silicate insulation in the APAC due to its increasing industrialization and low-cost manufacturing technology. Most key players operating in the calcium silicate insulation market have their production capacities in APAC since the region’s production cost is lower than that in other regions. Some major players in APAC are A&A Material Corporation, Nichias Corporation, Sanle Group, Taisyou International Business Co. Ltd., Guangdong New Element Building Material Co. Ltd. and Beijing Hocreboard Building Material Co. Ltd. The demand for calcium silicate insulation is growing, especially in North America and the Europe. Thus, the markets in these regions are expected to register higher growth in comparison to other regions.

To know about the assumptions considered for the study, download the pdf brochure

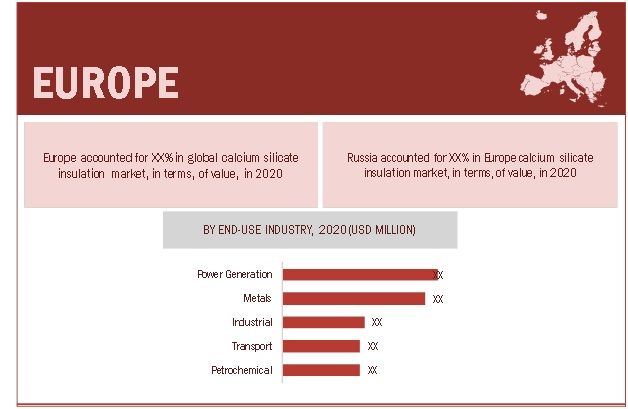

Europe is estimated to be the second-largest calcium silicate insulation market during the forecast period.

The market in Europe is largely regulated with REACH (Registration, Evaluation, Authorization and Restriction of Chemical Substances) closely monitoring and issuing guidelines to ensure a high level of protection of environment and human health from the risks that can be posed by chemicals. The focus on sustainability is significant in Europe, which is why, it is the most regulated market, especially when it comes to certifying and commercializing insulation materials. This also provides a huge opportunity to the sustainable calcium silicate insulation market in the region. The metal, transport, and power generation industries provide a huge potential for the growth of the calcium silicate insulation market in the region.

Europe has a few of the largest calcium silicate insulation market players such as Skamol (Denmark), Promat (Etex Group) (Belgium), and Anglitemp (UK).

Calcium Silicate Insulation Market Players

The key market players profiled in the report include Skamol (Denmark), A&A Material Corporation (Japan), Promat (Etex Group) (Belgium), BNZ Materials (US), Johns Manville (US), Anglitemp (UK), NICHIAS Corporation (Japan), Calsitherm (Japan), SANLE Group (China), Taisyou International Business Co. Ltd. (Taiwan), Guangdong New Element Building Material Co. Ltd. (China) and Beijing Hocreboard Building Material Co. Ltd. (China).

Calcium Silicate Insulation Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 256 million |

|

Revenue Forecast in 2026 |

USD 320 million |

|

CAGR |

4.6% |

|

Years considered for the study |

2017-2026 |

|

Base Year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Thousand) |

|

Segments |

Temperature, End-use Industry, and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Skamol (Denmark), A&A Material Corporation (Japan), Promat (Etex Group) (Belgium), BNZ Materials (US), Johns Manville (US), Anglitemp (UK), NICHIAS Corporation (Japan), Calsitherm (Japan), SANLE Group (China), Taisyou International Business Co. Ltd. (Taiwan), Guangdong New Element Building Material Co. Ltd. (China) and Beijing Hocreboard Building Material Co. Ltd. (China) |

This report categorizes the global calcium silicate insulation market based on temperature, end-use industry, and region.

On the basis of Temperature, the calcium silicate insulation market has been segmented as follows:

- High Temperature

- Mid Temperature

On the basis of End-use industry, the calcium silicate insulation market has been segmented as follows:

- Metals

- Industrial

- Power Generation

- Petrochemical

- Transport

- Others

On the basis of region, the calcium silicate insulation market has been segmented as follows:

- Europe

- North America

- APAC

- Middle East & Africa

- South America

Recent Developments

- In November 2019, Johns Manville signed an agreement to acquire ITW Insulation Systems, a business owned by Illinois Tool Works Inc. and well known for its premium, low-temperature polyisocyanurate foam insulations and metal jacketing solutions. This deal can offer a strategical opportunity for the company to expand its insulation systems business.

- In July 2018, Calsitherm signed an agreement to acquire International Syalons (Newcastle) Ltd., a leading supplier of sialon and silicon nitride based advanced ceramics. International Syalons (Newcastle) Ltd. serves industries such as molten metal handling and metal forming, aerospace and automotive, industrial wear, oil and gas, welding, chemical processing, and high temperature sensing. With this acquisition Calsitherm will be able to solve attrition, corrosion and heat resistance problems in products used for variety of industrial applications.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of calcium silicate insulation?

Rising investments in infrastructure development and rapid growth in urbanization has boosted the demand for residential and commercial buildings which is likely to drive the calcium silicate market growth in construction industry. This chemical acts as a substitute to toxic building materials such as asbestos and phthalates as it provides effective sound insulation, light density and is immune to water damage. Calcium silicate materials are lighter than fiber cement board which makes them suitable for roofing, bricks and floor tiles applications. Growing building & construction industry along with increasing investment in infrastructure projects across the globe shall stimulate the product demand during the forecast period

What are different end-use industries of calcium silicate insulation?

The different end-use industries of calcium silicate insulation are classified as metals, industrial, power generation, petrochemical, transport, and others. Calcium silicate insulation are used in these end-use industries due to their high compressive strength, corrosion-inhibiting properties, and high-temperature structural integrity. Calcium silicate are used in these end-use industries as structural, technical and fireproofing insulation materials. Factors such as eco friendliness, non-combustibility, lightweight, frost resistant, minimum hygric expansion and contraction, thermal resistance and easy to machine & work makes calcium silicate an ideal material for thermal insulation in different end-use industries.

What is the biggest restraint for calcium silicate insulation?

The biggest restraint faced by calcium silicate insulation market is the low awareness regarding the use of insulation products. Energy conservation is a major focal point for all industries including power, food & beverage, and petrochemical. Insulation materials are simple yet significant requirement in any industry dealing with various heat transfer operations. Proper use of insulation materials results in reducing heat loss and, in turn, saves the cost. Lack of awareness for the usage of insulation materials, specifically in developing countries is a major restraint for the market.

Increasing demand of renewables sources for electricity generation is another factor restraining the growth of insulation materials including calcium silicate. Renewable energy sources do not require much insulation materials as there are less thermal energy-related operations involved, as compared to conventional counterparts. However, these technologies have their own limitations, such as dependency on weather, low capacity, and large area requirement for installation .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 CALCIUM SILICATE INSULATION MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 CALCIUM SILICATE INSULATION MARKET DEFINITION AND INCLUSIONS, BY TEMPERATURE RANGE

1.2.3 CALCIUM SILICATE INSULATION MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 CALCIUM SILICATE INSULATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 6 CALCIUM SILICATE INSULATION MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS /GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTORS ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 CALCIUM SILICATE INSULATION MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 9 MID TEMPERATURE TO BE THE FASTER-GROWING SEGMENT OF THE CALCIUM SILICATE INSULATION MARKET DURING THE FORECAST PERIOD

FIGURE 10 TRANSPORT TO BE THE FASTEST-GROWING END-USE INDUSTRY OF CALCIUM SILICATE INSULATION

FIGURE 11 APAC ACCOUNTED FOR THE LARGEST SHARE OF CALCIUM SILICATE INSULATION MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CALCIUM SILICATE INSULATION MARKET

FIGURE 12 CALCIUM SILICATE INSULATION MARKET TO REGISTER MODERATE GROWTH DURING THE FORECAST PERIOD

4.2 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 13 US AND POWER GENERATION SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.3 CALCIUM SILICATE INSULATION MARKET, BY REGION

FIGURE 14 NORTH AMERICA TO BE THE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

4.4 CALCIUM SILICATE INSULATION MARKET, REGION VS. END-USE INDUSTRY

FIGURE 15 POWER GENERATION SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN MOST OF THE REGIONS IN 2020

4.5 CALCIUM SILICATE INSULATION MARKET ATTRACTIVENESS

FIGURE 16 CANADA TO BE THE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE CALCIUM SILICATE INSULATION MARKET

5.2.1 DRIVERS

5.2.1.1 Rapid urbanization and infrastructural development

FIGURE 18 INFRASTRUCTURE INVESTMENT AS PART OF GDP, 2019

5.2.1.2 Stringent regulations on conventional insulation products

TABLE 2 REGULATIONS AND STANDARD ON CONVENTIONAL INSULATION MATERIALS

5.2.1.3 Regulations mandating energy conservation and efficiency to drive the calcium silicate insulation market

5.2.2 RESTRAINTS

5.2.2.1 Low awareness regarding the use of insulation products

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for green building material

5.2.3.2 Innovation in end-use industries to drive the calcium silicate insulation market

5.2.4 CHALLENGES

5.2.4.1 High cost of installation and requirement of skilled workforce

5.2.4.2 Availability of substitute products

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS OF CALCIUM SILICATE INSULATION MARKET

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 CALCIUM SILICATE INSULATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 20 CALCIUM SILICATE INSULATION MARKET: SUPPLY CHAIN

TABLE 4 CALCIUM SILICATE INSULATION MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIAL

5.4.2 MANUFACTURING

5.4.3 DISTRIBUTION

5.4.4 END-USE INDUSTRIES

5.5 TECHNOLOGY ANALYSIS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 21 REVENUE SHIFT FOR CALCIUM SILICATE INSULATION MARKET

5.7 CONNECTED MARKETS: ECOSYSTEM

FIGURE 22 CALCIUM SILICATE INSULATION MARKET: ECOSYSTEM

5.8 CASE STUDIES

5.8.1 A CASE STUDY ON NEWARK ENERGY CENTER

5.8.2 A CASE STUDY ON PALM JUMEIRAH TUNNEL

5.8.3 A CASE STUDY ON CLYDE TUNNEL

5.8.4 A CASE STUDY ON MASTERBOARD BY PROMAT

5.9 MACROECONOMIC INDICATOR

5.9.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

TABLE 5 GDP TRENDS AND FORECAST BY MAJOR ECONOMY, 2018 – 2026 (USD BILLION)

5.10 CALCIUM SILICATE INSULATION MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

TABLE 6 CALCIUM SILICATE INSULATION MARKET IN REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

5.10.1 NON-COVID-19 SCENARIO

5.10.2 OPTIMISTIC SCENARIO

5.10.3 PESSIMISTIC SCENARIO

5.10.4 REALISTIC SCENARIO

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 US

5.11.2 EUROPE

5.11.3 INDIA

5.11.4 CHINA

5.11.5 TRADE DATA STATISTICS

5.11.5.1 IMPORT SCENARIO OF CALCIUM SILICATE INSULATION MARKET

FIGURE 24 CALCIUM SILICATE INSULATION MARKET, BY KEY COUNTRY, 2011–2020

TABLE 7 IMPORT OF CALCIUM SILICATE INSULATION MARKET, BY REGION, 2011–2020 (USD THOUSAND)

5.11.6 EXPORT SCENARIO OF CALCIUM SILICATE INSULATION MARKET

FIGURE 25 CALCIUM SILICATE INSULATION MARKET, BY KEY COUNTRY, 2011–2020

TABLE 8 EXPORT OF CALCIUM SILICATE INSULATION MARKET, BY REGION, 2011–2020 (USD THOUSAND)

5.12 COVID-19 IMPACT

5.12.1 INTRODUCTION

5.12.2 COVID-19 HEALTH ASSESSMENT

FIGURE 26 COUNTRY-WISE SPREAD OF COVID-19

5.12.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 27 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.12.3.1 COVID-19 Impact on the Economy—Scenario Assessment

FIGURE 28 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 29 SCENARIOS OF COVID-19 IMPACT

5.13 IMPACT OF COVID-19: CUSTOMER ANALYSIS

5.14 PATENT ANALYSIS

5.14.1 APPROACH

5.14.2 DOCUMENT TYPE

FIGURE 30 PATENTS REGISTERED FOR CALCIUM SILICATE INSULATION, 2010–2020

FIGURE 31 PATENTS PUBLICATION TRENDS FOR CALCIUM SILICATE INSULATION, 2010–2020

5.14.3 JURISDICTION ANALYSIS

FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

FIGURE 33 SOURCE: SECONDARY RESEARCH, EXPERT INTERVIEWS, AND MARKETSANDMARKETS ANALYSIS

5.14.4 TOP APPLICANTS

FIGURE 34 CEEC SHANXI ELECTRIC POWER EXPLORATION & DESIGN INST. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2010 AND 2020

6 CALCIUM SILICATE INSULATION MARKET, BY TEMPERATURE RANGE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 35 MID TEMPERATURE SEGMENT TO RECORD THE HIGHER CAGR BETWEEN 2021 AND 2026

TABLE 9 CALCIUM SILICATE INSULATION MARKET SIZE, BY TEMPERATURE RANGE, 2017–2019 (USD THOUSAND)

TABLE 10 CALCIUM SILICATE INSULATION MARKET SIZE, BY TEMPERATURE RANGE, 2020–2026 (USD THOUSAND)

7 CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY (Page No. - 86)

7.1 INTRODUCTION

FIGURE 36 TRANSPORT TO BE THE FASTEST-GROWING INDUSTRY FOR CALCIUM SILICATE INSULATION MARKET DURING THE FORECAST PERIOD

TABLE 11 CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD THOUSAND)

TABLE 12 CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

7.2 POWER GENERATION

7.2.1 HIGH COMPRESSIVE STRENGTH OF CALCIUM SILICATE INSULATION TO DRIVE THE MARKET IN THIS INDUSTRY

TABLE 13 CALCIUM SILICATE INSULATION MARKET SIZE IN POWER GENERATION, BY REGION, 2017-2019 (USD THOUSAND)

TABLE 14 CALCIUM SILICATE INSULATION MARKET SIZE IN POWER GENERATION, BY REGION, 2020–2026 (USD THOUSAND)

7.3 PETROCHEMICAL

7.3.1 HIGH HEAT RESISTANCE AND LOW THERMAL SHRINKAGE TO PROPEL THE MARKET IN THE THIS INDUSTRY

TABLE 15 CALCIUM SILICATE INSULATION MARKET SIZE IN PETROCHEMICAL, BY REGION, 2017-2019 (USD THOUSAND)

TABLE 16 CALCIUM SILICATE INSULATION MARKET SIZE IN PETROCHEMICAL, BY REGION, 2020–2026 (USD THOUSAND)

7.4 METALS

7.4.1 NON-FERROUS CASTING APPLICATION TO POSITIVELY IMPACT THE MARKET IN THE INDUSTRY

TABLE 17 CALCIUM SILICATE INSULATION MARKET SIZE IN METALS, BY REGION, 2017-2019 (USD THOUSAND)

TABLE 18 CALCIUM SILICATE INSULATION MARKET SIZE IN METALS, BY REGION, 2020–2026 (USD THOUSAND)

7.5 INDUSTRIAL

7.5.1 CONSTRUCTION ACTIVITIES IN EMERGING ECONOMIES BOOSTING THE MARKET IN THE INDUSTRIAL SEGMENT

TABLE 19 CALCIUM SILICATE INSULATION MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2017-2019 (USD THOUSAND)

TABLE 20 CALCIUM SILICATE INSULATION MARKET SIZE IN INDUSTRIAL SECTOR, 2020–2026 (USD THOUSAND)

7.6 TRANSPORT

7.6.1 INCREASING APPLICATION IN THE MARINE INDUSTRY TO DRIVE THE MARKET

TABLE 21 CALCIUM SILICATE INSULATION MARKET SIZE IN TRANSPORT, 2017-2019 (USD THOUSAND)

TABLE 22 CALCIUM SILICATE INSULATION MARKET SIZE IN TRANSPORT, 2020–2026 (USD THOUSAND)

7.7 OTHERS

TABLE 23 CALCIUM SILICATE INSULATION MARKET SIZE IN OTHER END-USE INDUSTRIES, 2017-2019 (USD THOUSAND)

TABLE 24 CALCIUM SILICATE INSULATION MARKET SIZE IN OTHER END-USE INDUSTRIES, 2020–2026 (USD THOUSAND)

8 CALCIUM SILICATE INSULATION MARKET, BY REGION (Page No. - 97)

8.1 INTRODUCTION

FIGURE 37 NORTH AMERICA TO BE THE FASTEST-GROWING CALCIUM SILICATE INSULATION MARKET DURING THE FORECAST PERIOD

TABLE 25 CALCIUM SILICATE INSULATION MARKET, BY REGION, 2017-2019 (USD THOUSAND)

TABLE 26 CALCIUM SILICATE INSULATION MARKET, BY REGION, 2020-2026 (USD THOUSAND)

8.2 APAC

FIGURE 38 APAC: CALCIUM SILICATE INSULATION MARKET SNAPSHOT

8.2.1 APAC: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY

TABLE 27 APAC: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 28 APAC: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.2.2 APAC: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY

TABLE 29 APAC: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 30 APAC: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY, 2020–2026 (USD THOUSAND)

8.2.2.1 China

8.2.2.1.1 Favorable market conditions to influence the market in the country

TABLE 31 CHINA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 32 CHINA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.2.2.2 India

8.2.2.2.1 Government initiatives for industrial development to drive the market

TABLE 33 INDIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 34 INDIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.2.2.3 Japan

8.2.2.3.1 Redevelopment projects to boost calcium silicate insulation demand

TABLE 35 JAPAN: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 36 JAPAN: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.2.2.4 South Korea

8.2.2.4.1 Growth in the nuclear power sector to propel the market

TABLE 37 SOUTH KOREA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 38 SOUTH KOREA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.2.2.5 Australia

8.2.2.5.1 Construction, infrastructure, and manufacturing sectors to govern the market growth

TABLE 39 AUSTRALIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 40 AUSTRALIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3 EUROPE

FIGURE 39 EUROPE: CALCIUM SILICATE INSULATION MARKET SNAPSHOT

8.3.1 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY

TABLE 41 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 42 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3.2 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY

TABLE 43 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY, 2017-2019 (USD THOUSAND)

TABLE 44 EUROPE: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY, 2020–2026 (USD THOUSAND)

8.3.2.1 Russia

8.3.2.1.1 Rising demand from the construction and oil & gas industries to drive the market

TABLE 45 RUSSIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 46 RUSSIA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3.2.2 Germany

8.3.2.2.1 Investments in the chemical & petrochemical industry favorable for the calcium silicate insulation market

TABLE 47 GERMANY: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 48 GERMANY: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3.2.3 France

8.3.2.3.1 Transition into clean economy using renewable sources of energy to boost the demand for calcium silicate insulation

TABLE 49 FRANCE: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 50 FRANCE: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3.2.4 Italy

8.3.2.4.1 Growing investments in the transportation industry governing the market growth

TABLE 51 ITALY: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 52 ITALY: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.3.2.5 UK

8.3.2.5.1 Growth in the automotive and construction industries to positively influence the market

TABLE 53 UK: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 54 UK: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.4 NORTH AMERICA

FIGURE 40 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET SNAPSHOT

8.4.1 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY

TABLE 55 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 56 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.4.2 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY

TABLE 57 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 58 NORTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

8.4.2.1 US

8.4.2.1.1 The petrochemical and power generation industries drive the market

TABLE 59 US: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 60 US: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.4.2.2 Canada

8.4.2.2.1 Abundant availability of feedstock is boosting the demand

TABLE 61 CANADA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 62 CANADA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.4.2.3 Mexico

8.4.2.3.1 Rising industrialization to propel market growth

TABLE 63 MEXICO: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD THOUSAND)

TABLE 64 MEXICO: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.5 SOUTH AMERICA

8.5.1 SOUTH AMERICA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY

TABLE 65 SOUTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 66 SOUTH AMERICA CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.5.2 SOUTH AMERICA: CALCIUM SILICATE INSULATION MARKET, BY COUNTRY

TABLE 67 SOUTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 68 SOUTH AMERICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

8.5.2.1 Brazil

8.5.2.1.1 Rising demand from petrochemical and transport industries to support market growth

TABLE 69 BRAZIL: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017-2019 (USD THOUSAND)

TABLE 70 BRAZIL: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.5.2.2 Argentina

8.5.2.2.1 Turmoil in the industrial sector to have a negative impact on the market growth

TABLE 71 ARGENTINA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 72 ARGENTINA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.6 MIDDLE EAST & AFRICA

8.6.1 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION MARKET, BY END-USE INDUSTRY

TABLE 73 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.6.2 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION, BY COUNTRY

TABLE 75 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2017–2019 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA: CALCIUM SILICATE INSULATION MARKET SIZE, BY COUNTRY, 2020–2026 (USD THOUSAND)

8.6.2.1 Saudi Arabia

8.6.2.1.1 Growing investment in the expansion of the petrochemical industry supports the market growth

TABLE 77 SAUDI ARABIA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 78 SAUDI ARABIA: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.6.2.2 UAE

8.6.2.2.1 Growing transport industry to drive the calcium silicate insulation demand

TABLE 79 UAE: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 80 UAE: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.6.2.3 Iran

8.6.2.3.1 Growing investment in the domestic renewable power source to support the market growth

TABLE 81 IRAN: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 82 IRAN: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

8.6.2.4 Iraq

8.6.2.4.1 Expansion of its oil refineries can make a significant impact on the market

TABLE 83 IRAQ: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2019 (USD THOUSAND)

TABLE 84 IRAQ: CALCIUM SILICATE INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD THOUSAND)

9 COMPETITIVE LANDSCAPE (Page No. - 139)

9.1 INTRODUCTION

9.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 CALCIUM SILICATE INSULATION MARKET EVALUATION FRAMEWORK, 2018-2021

9.3 KEY PLAYERS’ STRATEGIES

9.3.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CALCIUM SILICATE INSULATION MANUFACTURERS

9.4 MARKET SHARE ANALYSIS

9.4.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 42 RANKING OF TOP FIVE PLAYERS IN THE CALCIUM SILICATE INSULATION MARKET, 2020

9.4.2 MARKET SHARE OF KEY PLAYERS

TABLE 85 CALCIUM SILICATE INSULATION MARKET: DEGREE OF COMPETITION

FIGURE 43 SKAMOL IS THE LEADING PLAYER IN THE CALCIUM SILICATE INSULATION MARKET

9.4.2.1 Skamol

9.4.2.2 A&A material corporation

9.4.2.3 Promat (Etex Group)

9.4.2.4 BNZ Materials

9.4.2.5 NICHIAS Corporation

9.5 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES, 2016–2020

9.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 86 CALCIUM SILICATE INSULATION MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 87 CALCIUM SILICATE INSULATION MARKET: TEMPERATURE FOOTPRINT

TABLE 88 CALCIUM SILICATE INSULATION MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 89 CALCIUM SILICATE INSULATION MARKET: COMPANY REGION FOOTPRINT

9.7 COMPANY EVALUATION MATRIX (TIER 1)

9.7.1 TERMINOLOGY/NOMENCLATURE

9.7.1.1 Stars

9.7.1.2 Emerging Leaders

FIGURE 45 COMPANY EVALUATION MATRIX FOR CALCIUM SILICATE INSULATION MARKET (TIER 1)

9.8 START-UP/SMES EVALUATION MATRIX

9.8.1 TERMINOLOGY/NOMENCLATURE

9.8.1.1 Responsive companies

9.8.1.2 Dynamic companies

9.8.1.3 Starting blocks

FIGURE 46 STARTUP/SMES EVALUATION MATRIX FOR CALCIUM SILICATE INSULATION MARKET

9.9 COMPETITIVE SITUATIONS AND TRENDS

9.9.1 PRODUCT LAUNCHES

TABLE 90 CALCIUM SILICATE INSULATION MARKET: PRODUCT LAUNCHES, JANUARY 2018–DECEMBER 2021

9.9.2 DEALS

TABLE 91 CALCIUM SILICATE INSULATION MARKET: DEALS, JANUARY 2018–JANUARY 2021

9.9.3 OTHER DEVELOPMENTS

TABLE 92 CALCIUM SILICATE INSULATION MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS, JANUARY 2016–JANUARY 2021

10 COMPANY PROFILES (Page No. - 156)

10.1 MAJOR PLAYERS

10.1.1 SKAMOL

10.1.2 PROMAT (ETEX GROUP)

FIGURE 47 PROMAT (ETEX GROUP): COMPANY SNAPSHOT

FIGURE 48 PROMAT (ETEX GROUP): WINNING IMPERATIVES

10.1.3 A&A MATERIAL CORPORATION

FIGURE 49 A&A MATERIAL CORPORATION: COMPANY SNAPSHOT

FIGURE 50 A&A MATERIAL CORPORATION: WINNING IMPERATIVES

10.1.4 BNZ MATERIALS

10.1.5 JOHNS MANVILLE

10.1.6 ANGLITEMP

10.1.7 NICHIAS CORPORATION

FIGURE 51 NICHIAS CORPORATION: COMPANY SNAPSHOT

FIGURE 52 NICHIAS CORPORATION: WINNING IMPERATIVES

10.1.8 CALSITHERM

10.1.9 SANLE GROUP

10.1.10 TAISYOU INTERNATIONAL BUSINESS CO. LTD.

10.1.11 GUANGDONG NEW ELEMENT BUILDING MATERIAL CO. LTD.

10.1.12 BEIJING HOCREBOARD BUILDING MATERIALS CO. LTD.

10.2 OTHER KEY MARKET PLAYERS

10.2.1 RAMCO INDUSTRIES

TABLE 93 RAMCO INDUSTRIES.: COMPANY OVERVIEW

10.2.2 RCM ROOFING & CLADDING MATERIAL

TABLE 94 RCM ROOFING & CLADDING MATERIAL: COMPANY OVERVIEW

10.2.3 LAIZHOU MINGGUANG THERMAL INSULATION MATERIALS CO. LTD.

TABLE 95 LAIZHOU MINGGUANG THERMAL INSULATION MATERIALS CO LTD.: COMPANY OVERVIEW

10.2.4 LITECORE A/S

TABLE 96 LITECORE A/S.: COMPANY OVERVIEW

10.2.5 EPASIT

TABLE 97 EPASIT: COMPANY OVERVIEW

10.2.6 INSULCON

TABLE 98 INSULCON: COMPANY OVERVIEW

10.2.7 NIPPON KEICAL

TABLE 99 NIPPON KEICAL: COMPANY OVERVIEW

10.2.8 SOBEN INTERNATIONAL

TABLE 100 SOBEN INTERNATIONAL: COMPANY OVERVIEW

10.2.9 NINGBO YIHE GREEN BOARD CO. LTD.

TABLE 101 NINGBO YIHE GREEN BOARD CO. LTD.: COMPANY OVERVIEW

10.2.10 KINGTEC BUILDING MATERIALS INDUSTRIAL CO. LTD.

TABLE 102 KINGTEC BUILDING MATERIALS INDUSTRIAL CO. LTD.: COMPANY OVERVIEW

10.2.11 ZHEIJIANG HAILONG NEW BUILDING MATERIAL CO. LTD.

TABLE 103 ZHEIJIANG HAILONG NEW BUILDING MATERIAL CO. LTD.: COMPANY OVERVIEW

10.2.12 AMERICAN ELEMENTS

TABLE 104 AMERICAN ELEMENTS: COMPANY OVERVIEW

10.2.13 SHINE TECHNOLOGY CO. LTD.

TABLE 105 SHINE TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

10.2.14 MOWCO PRODUCTS

TABLE 106 MOWCO PRODUCTS: COMPANY OVERVIEW

10.2.15 LUOYANG WANHAO NEW MATERIAL CO. LTD.

TABLE 107 LUOYANG WANHAO NEW MATERIAL CO. LTD.: COMPANY OVERVIEW

11 ADJACENT & RELATED MARKETS (Page No. - 196)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 PIPE INSULATION MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.4 PIPE INSULATION MARKET, BY REGION

TABLE 108 PIPE INSULATION MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

11.4.1 APAC

TABLE 109 APAC: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 110 APAC: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 111 APAC: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

11.4.2 WESTERN EUROPE

TABLE 112 WESTERN EUROPE: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 113 WESTERN EUROPE: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 114 WESTERN EUROPE: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

11.4.3 CENTRAL AND EASTERN EUROPE

TABLE 115 CENTRAL & EASTERN EUROPE: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 116 CENTRAL & EASTERN EUROPE: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 117 CENTRAL & EASTERN EUROPE: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

11.4.4 NORTH AMERICA

TABLE 118 NORTH AMERICA: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 119 NORTH AMERICA: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 120 NORTH AMERICA: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

11.4.5 SOUTH AMERICA

TABLE 121 SOUTH AMERICA: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 122 SOUTH AMERICA: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 123 SOUTH AMERICA: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

11.4.6 MIDDLE EAST & AFRICA

TABLE 124 MIDDLE EAST & AFRICA: PIPE INSULATION MARKET SIZE, BY COUNTRY, 2016–2023 (USD MILLION)

TABLE 125 MIDDLE EAST & AFRICA: PIPE INSULATION MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: PIPE INSULATION MARKET SIZE, BY MATERIAL TYPE, 2016–2023 (USD MILLION)

12 APPENDIX (Page No. - 206)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size for calcium silicate insulation. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

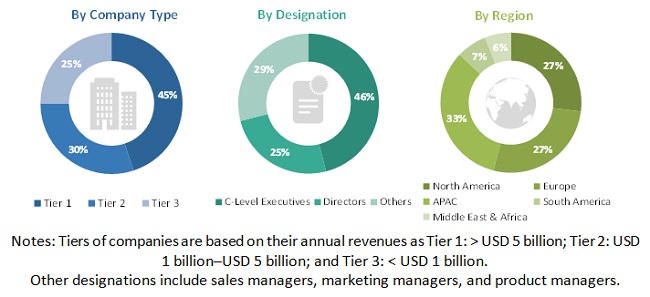

Primary Research

The calcium silicate insulation market comprises several stakeholders such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as metals, industrial, power generation, petrochemical, transport, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the calcium silicate insulation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the calcium silicate insulation market, in terms of value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the calcium silicate insulation market on the basis of temperature and end-use industry

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as expansion, new product launch, merger & acquisition, and agreement in the calcium silicate insulation market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Calcium Silicate Insulation Market