CF & CFRP Market

CF & CFRP Market by Precursor Type (PAN, Pitch), Source, Resin Type, Manufacturing Process (Lay-Up, Compression Molding, Resin Transfer Molding, Filament Winding, Injection Molding, Pultrusion), End-use Industry, and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

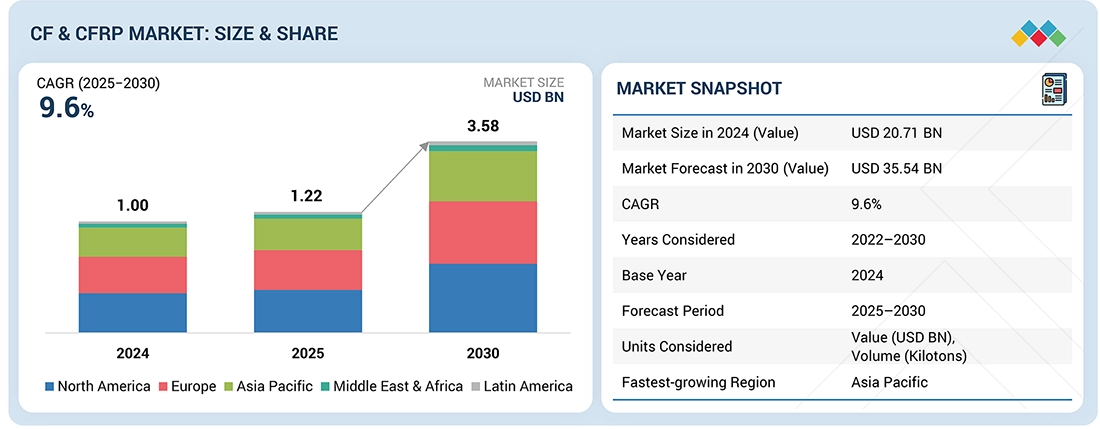

The CFRP market is projected to grow from USD 22.48 billion in 2025 to USD 35.55 billion by 2030, at a CAGR of 9.6% during the forecast period. CFRP is composed of two or more different materials, such as carbon fibers and matrix materials. In CFRP, carbon fibers serve as reinforcement materials, while resins like thermoset and thermoplastic act as matrix materials. These components provide excellent strength, a high stiffness-to-density ratio, and various other physical properties. The development of the CF & CFRP market is driven by advancements in manufacturing technologies and the rising demand from end-use industries such as aerospace & defense, wind energy, automotive, sporting goods, pipe & tank, marine, civil engineering, medical, and electrical & electronics. In sectors like aerospace & defense, companies such as Boeing and Airbus utilize CFRP to enhance fuel efficiency. In the automotive industry, carbon fiber is primarily used in electric vehicles and luxury cars due to its lightweight characteristics and impact strength. Sustainability concerns have led to a greater adoption of CF & CFRP because of their potential to reduce carbon emissions and improve energy efficiency, particularly in transportation. The wind energy sector also relies on CF & CFRP for producing efficient turbine blades, thereby supporting market expansion.

KEY TAKEAWAYS

-

BY RESIN TYPEThe CFRP market includes resin types like thermoset and thermoplastic. The thermoset segment accounted for the largest share of the CFRP market due to its superior mechanical properties, such as high strength, rigidity, dimensional stability, and excellent adhesion to carbon fibers. These characteristics make thermosetting resins like epoxy, polyester, and vinyl ester suitable for demanding applications in aerospace & defense, automotive, wind energy, sporting goods, where lightweight materials with exceptional durability and performance are essential.

-

BY MANUFACTURING PROCESSCFRP products are manufactured by various processes, like layup, compression molding, resin transfer molding, filament winding, injection molding, pultrusion, and other processes. Among them, the layup process accounted for the largest share due to its versatility, cost-effectiveness, and suitability for a wide range of applications. The lay-up process, which includes hand lay-up and spray-up techniques, allows manufacturers to control the orientation of fibers to maximize strength where needed, making it ideal for both simple and moderately complex composite parts. This flexibility is especially valuable in industries such as aerospace & defense, and automotive, where design requirements can vary significantly and customization is often necessary.

-

BY END-USE INDUSTRYCFRP products are widely used in industries like aerospace & defense, wind energy, automotive, sporting goods, civil engineering, pipes & tanks, marine, medical, electrical & electronics. The aerospace & defense segment held the largest market share in the CFRP market due to the demand for lightweight, high-strength materials that enhance fuel efficiency and performance. Carbon fiber reinforced plastics provide superior strength-to-weight ratios, crucial for manufacturing aircraft structures, including wings, fuselages, and control surfaces, as well as in military applications like rocket structures and protective gear, reducing fuel consumption and operational costs.

-

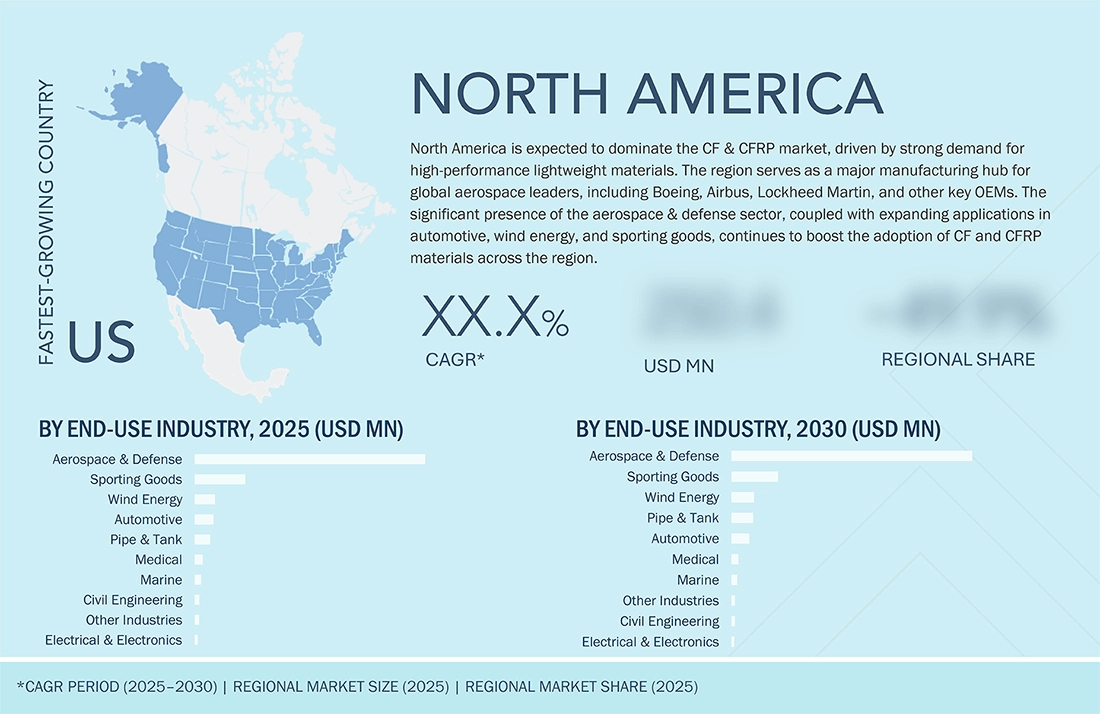

BY REGIONThe CF & CFRP market in North America accounted for the largest share due to several major factors such as government initiatives, increasing investment in renewable energy projects, growing adoption of electric vehicles, and increased focus on decarbonization in sectors. Overall, the US is positioning itself as a leader in high-performance carbon fiber innovation and sustainable composite manufacturing, driven by advancements in aerospace & defense, automotive, and wind energy. With the presence of major companies like Hexcel Corporation, the country is investing in cutting-edge CFRP technologies to enhance fuel-efficiency, structural strength, and sustainability.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Toray Industries, Teijin Limited, Mitsubishi Chemical Corporation, Hexcel Corporation, and Syensqo. These companies are deploying organic means to grow or leverage partnerships to increase their market presence and overall revenue.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, NanoXplore Inc, Global Graphene Group, and Graphenea S.A., are entered into number of agreements and partnerships to cater the growing demand for graphene across innovative applications.

The CF & CFRP market is poised for strong growth, driven by robust demand across erospace & defense, wind energy, automotive, sporting goods, civil engineering, pipes & tanks, marine, medical, electrical & electronics. Demand from the automotive and aerospace sectors is increasing as manufacturers adopt lightweight materials to improve fuel efficiency.

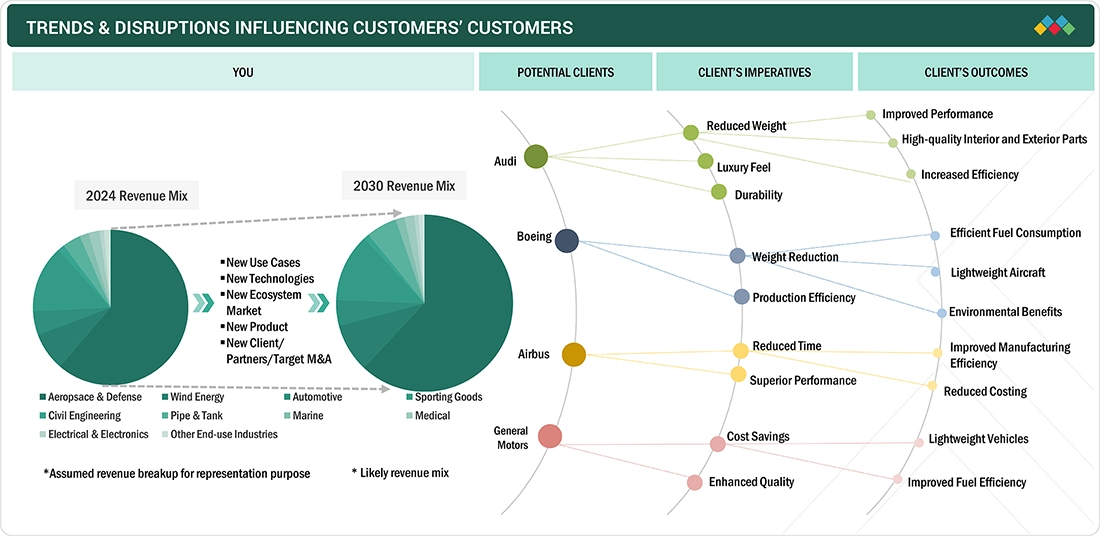

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The CF & CFRP market is being disrupted by several key trends, particularly in response to technological innovation, regulatory shifts, and sustainability demands. There is a strong industry focus on eco-friendly manufacturing, fully recyclable CFRP composites, circular economy approaches, and the development of bio-based resins and reinforcement fibers to reduce environmental impact.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in manufacturing of satellite parts.

-

High demand from aerospace & defense industry.

Level

-

High production cost

-

Lack of standardization in manufacturing technologies

Level

-

Increased investments in development of low-cost coal-based carbon fibers

-

Potential opportunities in new applications

Level

-

Production of low-cost carbon fiber

-

Capital-intensive production and complex manufacturing process

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in manufacturing of satellite parts

CF & CFRP products are used in telescope antennas, brake discs, airframe structures, and other satellite components. Due to high modulus and thermal conductivity in heat dissipation, carbon fibers are in high demand from satellite manufacturers in applications such as space radiators or electronic enclosures. Apart from this, CF & CFRP are highly demanded for prepregs used in satellite precision structures and heat sinks. Carbon fiber prepregs offer superior thermal conductivity to help channel heat from electrical components. Carbon fiber’s low coefficient of thermal expansion ensures that satellite parts maintain their integrity and dimensional stability despite the harsh thermal environment. This stability is vital for maintaining the precision of sensitive instruments and systems on board the satellite. In August 2024, ISRO launched Earth Observation Satellite (EOS-8) featuring integrated avionics, miniaturized antennas, and a flexible solar panel that uses a CFRP honeycomb rigid end panel to enhance the panel’s structural integrity and power generation, illustrating EOS-08’s focus on lightweight, robust, and efficient satellite design.

Restraint: High production cost

The high cost of carbon fiber is mostly associated with the cost of raw materials or precursors used in the production. The most commonly used precursor for carbon fiber manufacturing is the exceptionally costly precursor polyacrylonitrile (PAN), which necessitates a highly complex and detailed manufacturing process. Carbon fiber production requires specialized equipment and skilled personnel to ensure the material’s quality and consistency. Additionally, CFRP are essential in industries like aerospace, automotive, and renewable energy due to their strength, lightweight nature, and chemical resistance. However, their production is costly and highly energy-intensive up to 14 times more energy-demanding than steel.

Opportunity: Increased investment in development of low-cost coal-based carbon fibers

Due to the cost benefits, researchers are harnessing carbon in coal to create products such as carbon fiber and graphene. The price of carbon fiber lowers significantly when coal is used as feedstock. For instance, coal costs approximately USD 12/ton. On the other hand, an equivalent amount of petroleum (7 or 8 barrels) costs approximately USD 60/barrel. This means using coal as a precursor would be 30 or 35 times less expensive. Thus, companies and governments are investing in producing coal-based carbon fiber to achieve cost benefits. Ramaco Carbon is presently exploring various possibilities for using repurposed coal to make and use carbon fiber in the automotive industry. Ramaco has established a carbon ecosystem to achieve this and collaborated with the Wyoming Western Research Institute under the DOE project called Coal to Cars. The project has received funding of USD 5 million and focuses on using coal-based carbon fiber to decrease vehicle manufacturing costs. In addition, the University of Kentucky Research Foundation is also focusing on developing and scaling efficient processing technology for ultra-low quinoline insoluble (QI) coal tar pitch and subsequent mesophase pitch to simplify continuous fiber processing technologies toward the efficient production of high-performance carbon fiber products and demonstrate composite parts derived from the coal-to-carbon-fiber (C2CF) paradigm.

Challenge: Production of low-cost carbon fiber

The high cost of PAN and pitch carbon fibers is one of the major concerns associated with its growth. Carbon fiber still has low usage in large applications due to its high cost. Developing low-cost technologies is a major challenge for researchers and key manufacturers. The production process for carbon fiber is highly energy-intensive, involving several stages, such as polymerization, stabilization, carbonization, and surface treatment. The high energy demand adds significant cost to the final product, making it difficult to lower prices while maintaining performance standards. Carbon fibers are used in critical applications like aerospace, automobiles, and sports equipment, where material quality and consistency are paramount. Achieving a balance between lowering costs and maintaining the high strength-to-weight ratios, durability, and other performance characteristics of carbon fiber is difficult. Carbon fiber composites are only introduced in high-end and luxury cars in the automotive industry due to their high cost. With the increased availability of low-cost carbon fiber, its usage in the automotive industry is expected to surge.

CF & CFRP Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

CFRP used by Boeing and Airbus for aircraft bodies and wings, enabling significant weight reduction, increased fuel efficiency, and lower emissions. | CFRP is up to 60% lighter than aluminum alloys, which allows aircraft to reduce overall airframe weight by 20% or more. This leads directly to improved fuel efficiency, lower operating costs, and greater payload or passenger capacity. |

|

Tesla employs CFRP in components like carbon-wrapped rotors in electric motors, body panels in select models such as the Roadster, and structural elements to optimize vehicle performance and longevity. | High-end and electric vehicles (e.g., luxury cars, EVs) incorporate CFRP for lightweight structures, improving fuel economy, acceleration, and sustainability. |

|

LM Wind Power uses CFRP spar caps in ultra-long wind blades for onshore/offshore turbines. | CFRP turbine blades provide high strength and low weight, optimizing efficiency for large-scale turbines in Europe and Asia. |

|

McLaren Pioneered the full carbon fiber composite chassis in F1 (MP4/1 in 1981) and continues to innovate with recycled CFRP components | CF & CFRP are used in Formula 1 and racing for enhanced rigidity and safety. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

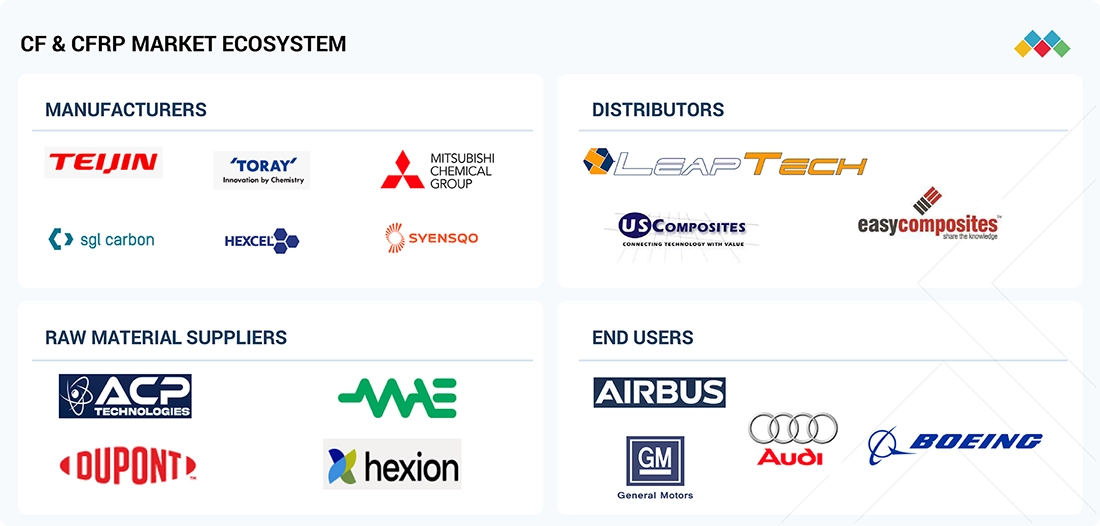

MARKET ECOSYSTEM

The CF & CFRP ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The raw material suppliers are the source of raw materials like PAN, Pitch, epoxy, polyester, additives, and fillers to the graphene manufacturers. The manufacturers use technologies such as layup and molding to produce CF & CFRP products. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CF & CFRP Market, By Resin

The CF & CFRP market has been subsegmented into thermosetting and thermoplastic resins under the segment resin type. Thermosetting resins are expected to dominate the overall CFRP market, in the forecast period. This dominance is attributed to its unique properties such as excellent resistance to solvents & corrosives, fatigue strength, tailored elasticity, excellent adhesion, and finishing.

CF & CFRP Market, By Source

The market has been studied for virgin carbon fiber and recycled carbon fiber under the source segment. The virgin carbon fiber segment is expected to dominate the overall CF & CFRP market in 2024, owing to its exceptional properties and wide acceptance in end-use industries such as aerospace & defense, wind energy, and sports goos.

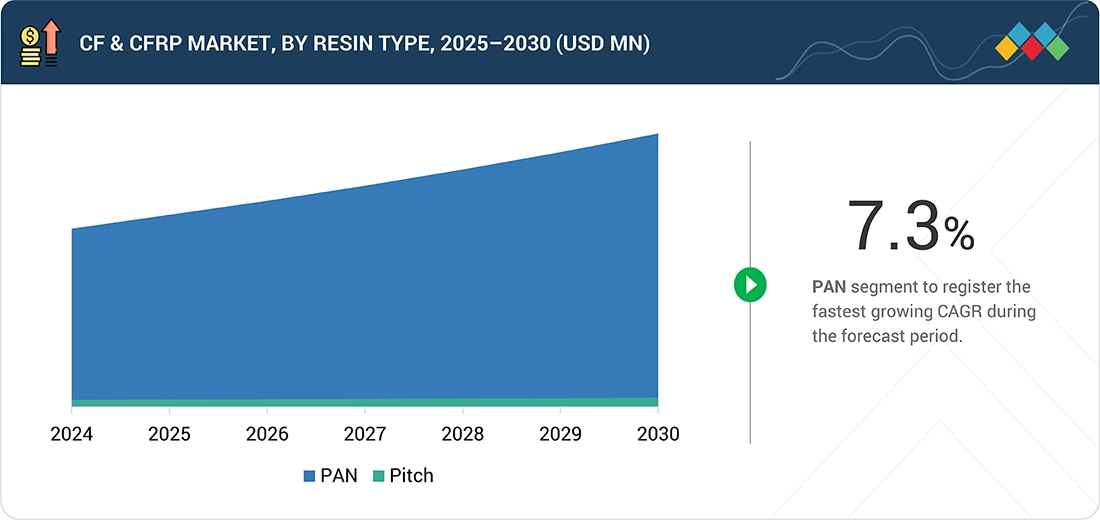

CF & CFRP Market, By Precursor Type

The CF & CFRP market is segmented on the basis of precursor type as polyacrylonitrile (PAN) - based and pitch-based carbon fibers. PAN-based carbon fiber dominated the overall market with a share of 96.0%, in terms of value, in 2024. PAN-based carbon fibers offer several advantages over pitch- and rayon-based carbon fibers, making them the most widely used type in high-performance applications. Compared to pitch-based fibers, PAN-based carbon fibers have superior tensile strength and are easier to produce with consistent quality, making them more reliable for structural uses in aerospace, automotive, and sporting goods.

CF & CFRP Market, By Manufacturing Process

The market for CFRP is segmented based on manufacturing process into lay-up, filament winding, injection molding, resin transfer molding, and other processes. The lay-up process is the most widely used process in the market. The lay-up process includes hand lay-up, spray-up, and automated lay-up, which are widely used for carbon fiber composites for manufacturing components for the aerospace & defense and marine industries for a wide range of products. The growth of the layup process in CFRP manufacturing is closely tied to the rising demand across high-performance end-use applications such as aerospace, automotive, wind energy, and sporting goods.

CF & CFRP Market, By End-use Industry

The aerospace & defense segment accounted for the largest share of the overall CFRP market, in terms of value, in 2024. This is due to the high demand for carbon fiber composites in commercial passenger aircraft and fighter planes. The market for CFRP composites is rising due to the increasing demand for A380 and Boeing 787 aircraft from Boeing and Airbus.

REGION

North America to dominate the global CF & CFRP market during forecast period

North America led the CF & CFRP market due to its robust aerospace & defense and automotive industries, which have a high demand for lightweight, high-strength materials to improve fuel efficiency and performance. The aerospace industry has been a major driver, as CFRP's exceptional strength- to-weight ratio is critical for manufacturing aircraft components, enabling reduced weight without compromising structural integrity.

CF & CFRP Market: COMPANY EVALUATION MATRIX

In the CF & CFRP market matrix, Toray Industries, Inc. (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries like automotive and aerospace. Zhongfu Shenying Carbon Fiber Co., Ltd. (Emerging Leader) is gaining traction with sustainable CF & CFRP solutions in automotive, electronics, and automotive applications. While Toray dominates with scale, Directa Zhongfu Shenying shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.71 Billion |

| Market Forecast in 2030 (Value) | USD 35.55 Billion |

| Growth Rate | CAGR of 9.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (Billion), Volume (kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

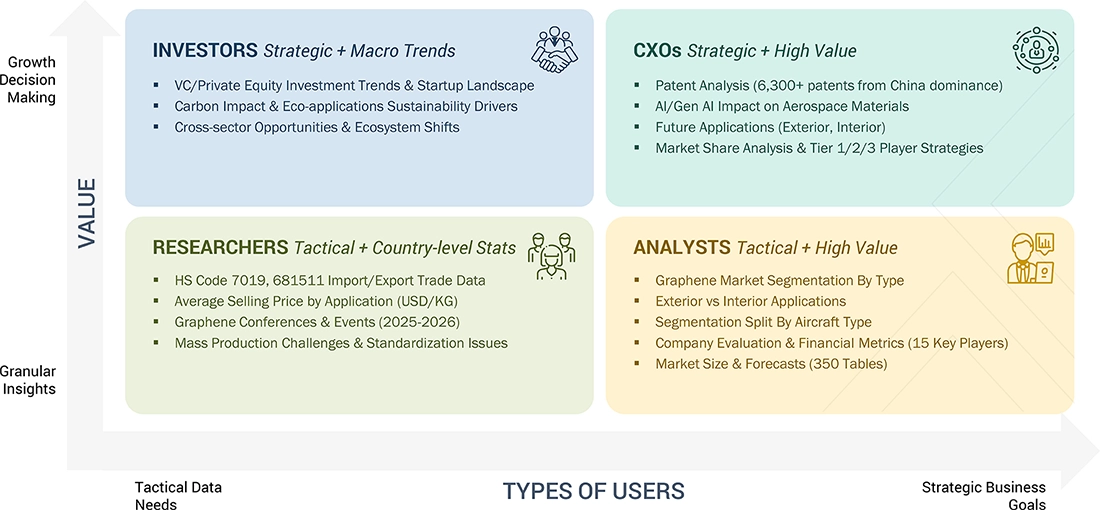

WHAT IS IN IT FOR YOU: CF & CFRP Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based CF & CFRP Manufacturer |

|

|

| Composites Structures Manufacturer |

|

|

| Automotive OEM/EV Manufacturer |

|

|

| Global/ Regional CF Raw Material Producer |

|

|

| Advanced Materials & Technology Investor/OEM |

|

|

RECENT DEVELOPMENTS

- September 2024 : Toray Advanced Composites, a subsidiary of Toray Industries, Inc., launched a high-performance thermoplastic composite material specifically engineered to address the growing need for lightweight and environmentally sustainable materials in aircraft interior applications, offering significant benefits to the aerospace industry.

- October 2023 : Mitsubishi Chemical Group acquired CPC SRL, a renowned Italian company specializing in the manufacturing and distribution of automobile components crafted from carbon fiber reinforced plastic (CFRP). This pivotal acquisition, which began with minority ownership in 2017, aligns with MCG Group’s long-term strategic vision to further expand and enhance its vertically integrated carbon fiber supply chain.

- February 2022 : Teijin Limited announced that it has agreed to form a business alliance with Fuji Design Co., Ltd., a Japanese manufacturer of recycled carbon fibers, to establish a business structure for the production, supply, and commercialization of carbon fiber reinforced plastic (CFRP) products made from recycled carbon fibers using a low environmental impact process.

- December 2021 : Hexcel Corporation partnered with METYX. This partnership aimed to manufacture high-performance carbon pultruded profiles. These profiles are of unidirectional carbon fiber and polyurethane, especially for the wind energy market.

Table of Contents

Methodology

The study involves two major activities to estimate the current market size for the CF & CFRP market. Extensive secondary research was conducted to gather information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts throughout the value chain via primary research. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Following that, market breakdown and data triangulation were applied to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering CF & CFRP and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the CF & CFRP market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after gathering information about the CF & CFRP market scenario through secondary research. Several primary interviews were held with market experts from both the demand and supply sides across major regions, including North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and phone interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development or marketing directors, product development or innovation teams, relevant key executives from the CF & CFRP industry, system integrators, component providers, distributors, and key opinion leaders. Primary interviews aimed to gather insights such as market statistics, revenue data from products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also provided an understanding of the various trends related to precursor type, source, resin type, manufacturing process, end-use industry, and region. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams of customers or end users seeking CF & CFRP services, were interviewed to gain insight into the buyer’s perspective on suppliers, products, component providers, and their current usage of CF & CFRP, as well as the future outlook of their business that will impact the overall market.

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the CF & CFRP market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for CF & CFRP in different end-use industries at the regional level. Such procurements provide information on the demand aspects of CF & CFRP for each end-use industry. For each end-use industry, all possible segments of the CF & CFRP market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

CFRP materials are made from two or more different materials (such as carbon fibers and matrix materials). In CFRP, carbon fibers are used as reinforcement materials, and resins such as thermoset and thermoplastic are used as matrix materials. These materials offer an excellent strength and stiffness-to-density ratio and have other physical properties. They are used in various end-use industries, such as aerospace and defense, wind energy, sports goods, and pipes and tanks.

Stakeholders

- CF & CFRP Manufacturers

- CF & CFRP Distributors and Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the CF & CFRP market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global CF & CFRP market by precursor type, source, resin type, manufacturing process, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the CF & CFRP market? What key strategies have market players adopted to strengthen their market presence?

Major companies include Toray Industries, Teijin Limited, Mitsubishi Chemical Corporation, Hexcel Corporation, Syensqo, SGL Carbon, HS Hyosung Advanced Materials, Zhongfu Shenying, Kureha Corporation, DowAksa, Weihai Guangwei, UMATEX, Jilin Chemical Fiber Group, Jiangsu Hengshen, and China National Bluestar. Key strategies adopted by these players include product launches, acquisitions, and capacity expansions to strengthen their market position.

What are the drivers and opportunities for the CF & CFRP market?

Drivers: Rising demand from the aerospace & defense industry and increased use in electric vehicles (EVs).

Which region is expected to hold the largest market share?

North America is expected to hold the largest share due to the presence of strict environmental regulations, strong aerospace industry, and high investment in CF & CFRP technologies.

What is the projected growth rate of the CFRP market over the next five years?

The CFRP market is projected to grow at a CAGR of 9.6% during the forecast period (in terms of value).

How is the CF & CFRP market aligned for future growth?

The market is rapidly growing and consolidated, with a mix of global and regional players. It is driven by technological advancements, industry-specific regulations, and expanding applications in automotive, aerospace, construction, and more.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the CF & CFRP Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in CF & CFRP Market

Nicolas

Apr, 2018

Carbon Fiber market with automotive as key application.

Toshi

Feb, 2018

Sepcific information on Carbon Fiber Reinforced Plastic market for aircraft components applications.

Anucha

Nov, 2017

Require report arounf CF,a CFRRP, 3D prinitng, 4D printing in energy storage and IT material.

Nikita

Jun, 2018

General information on CFRP (thermosetting) in Prosthetics.

Prabal

Feb, 2018

Carbon Fiber Pricing.