Nucleic Acid Isolation and Purification Market Size, Growth, Share & Trends Analysis

Nucleic Acid Isolation and Purification Market by Product (Kits, Reagents, Instruments), Method (Column, Magnetic Beads), Type (Genomic DNA, Plasmid DNA), Application (Diagnostics, Personalized Medicine), End User (CROs), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global nucleic acid isolation and purification market, valued at USD 6.67 billion in 2024, stood at USD 7.10 billion in 2025 and is projected to advance at a resilient CAGR of 9.1% from 2025 to 2030, culminating in a forecasted valuation of USD 10.99 billion by the end of the period. The global market for nucleic acid isolation and purification (NAIP) is expanding largely due to the increased use of PCR and NGS in clinical diagnostics and research. Laboratories globally require DNA/RNA of high purity and free of inhibitors in order to carry out reliable workflows for sequencing, oncology panels and routine molecular testing. Besides that, demand is rising for infectious disease testing, genetic screening and liquid biopsy/cfDNA applications.

KEY TAKEAWAYS

-

By RegionThe North America nucleic acid isolation and purification market accounted for a 42.0% revenue share in 2024.

-

By ProductBy product, the nucleic acid isolation and purification kits segment is expected to register the highest growth rate of 9.8%.

-

By TypeBy type, the plasmid DNA isolation and purification segment dominated the market in 2024, with a share of 22.2%.

-

By methodBy method, the magnetic bead-based isolation and purification segment dominated the market in 2024.

-

By ApplicationBy application, the personalized medicine segment is projected to grow at the fastest rate from 2025 to 2030.

-

By End userBy end user, the pharmaceutical & biotechnology companies segment is projected to grow at the fastest rate from 2025 to 2030.

-

Competitive Landscape - Key PlayersCompanies such as Thermo Fisher, Danaher, and QIAGEN were identified as some of the key players in the North America nucleic acid isolation and purification market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsCompanies such as Omega Bio-Tek, Inc., and TIANGEN Biotech Co., Ltd, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

Global demand for nucleic acid isolation and purification products and reagents has risen substantially with the broad application of PCR and NGS-based testing in both clinical and research settings. A clean, inhibitor-free nucleic acid is required for cancer panels, sequencing, and routine molecular diagnostics. This growth has also significantly increased demand for products used in infectious disease testing, genetic screening, microbiome studies, and liquid biopsy/cfDNA workflows, where sample quality directly impacts results. As testing volume increases, laboratories are moving from manual steps to automated, high-throughput extraction platforms to reduce hands-on time and improve result consistency.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ business in the global nucleic acid isolation and purification (NAIP) market is shaped by the wider shift toward molecular decision-making in healthcare and life sciences. As PCR, qPCR, and NGS become routine across infectious disease testing, oncology profiling, and genetic screening, labs need reliable, high-quality DNA/RNA extraction as a critical first step. Clinical labs, reference labs, and public health networks are major demand centers as they handle high sample volumes and require speed, consistency, and traceability. Biopharma and biotechnology companies also drive demand through bioanalytical studies, QC testing, and cell & gene therapy analytics, where purity and inhibitor removal directly affect downstream performance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Routine PCR/qPCR and NGS testing is scaling across care and research

-

Expanding public health genomic surveillance in more countries

Level

-

High cost and time required for high-volume testing

Level

-

Automation impacting throughput, traceability, and staffing resilience

-

Premium NAIP products for cfDNA, oncology, and low-input workflows

Level

-

Variability due to PCR inhibitors and matrix effects

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Routine PCR/qPCR and NGS testing is scaling across care and research

PCR and other NAAT workflows are standard for many infectious disease programs. Labs are adding new panels and handling higher sample volumes. NGS is also moving deeper into clinical use cases. This increases the need for clean DNA/RNA as the first step. When extraction is weak, downstream sensitivity drops quickly. So labs are investing in reliable NAIP workflows and reagents.

Restraint: High cost and time required for high-volume testing

Many common molecular tests still rely on extraction. But extraction adds hands-on steps and turnaround time. It also requires a steady supply of reagents and plastics. During high-demand periods, this step can limit overall testing capacity. That creates operational friction for labs with lean staffing models. It can slow expansion plans at some sites.

Opportunity: Automation impacting throughput, traceability, and staffing resilience

Labs are facing staffing pressures and rising volumes. Automation can reduce manual touches and variability. It also supports run logging and audit trails, which fit clinical and regulated environments well. Automated extraction platforms are improving for high-throughput biosamples, creating space for upgrades, replacements, and new installations.

Challenge: Variability due to PCR inhibitors and matrix effects

Blood, stool, soil, and FFPE can contain strong inhibitors. Some inhibitors co-extract with DNA/RNA, reducing amplification efficiency or causing failures. Labs then repeat runs, wasting time and reagents and creating a troubleshooting burden for QC teams. Designing a method that suits all samples remains challenging.

NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

MacroGenics’ cell line development team was evaluating a new cell line and expression system. They needed a reliable platform media and feed setup that could scale without compromising performance. They tested Gibco Efficient-Pro Medium and Feeds against their existing platform medium, then scaled the process from small studies to 500 L cGMP production. | Performance stayed consistent during scale-up, including at 500 L. The new platform process was also established in under one year, helping speed execution and reduce rework. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global nucleic acid isolation and purification market ecosystem comprises suppliers of extraction kits and reagents (lysis buffers, silica columns, magnetic beads, wash/elution chemistries) and automation platform providers offering manual-to-fully automated extraction systems. It also includes manufacturers of sample collection and stabilization products (swabs, transport media, blood tubes for cfDNA, RNA preservatives), as well as plasticware and contamination-control consumables that support clean workflows. A growing base of clinical diagnostic labs, reference labs, public health labs, and academic research centers drives routine demand for DNA/RNA prep. Biopharma and biotech companies use these solutions for bioanalytical testing, QC, and genomic workflows, while CROs/CDMOs scale extraction needs through multi-site studies and outsourced lab services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Global nucleic acid isolation and purification market, by product

As of 2024, kits dominated the global nucleic acid isolation and purification market. This is largely because nucleic acid extraction is consumables-led. Labs perform DNA/RNA prep on a routine basis, thus, they repeatedly purchase spin-column kits, magnetic bead kits, and buffer/reagent packs. Kits are preferred since they are validated, standardized and easy to run across different operators and sites.

Global nucleic acid isolation and purification market, by type

In 2024, plasmid DNA isolation and purification dominated the global nucleic acid isolation and purification market. Plasmid prep is a routine workflow in research labs and for biotech end users. Plasmids are necessary for cloning, vector construction and the production of transfection-ready DNA. The demand is further elevated by cell & gene therapy and vaccine workflows, where plasmid DNA acts as the primary starting material for viral vectors and other processes.

Global nucleic acid isolation and purification market, by method

As of 2024, magnetic bead-based isolation and purification dominated the global nucleic acid isolation and purification market. This is mainly because magnetic beads align well with the shift toward automation and high-throughput processing. Clinical labs and large reference labs prefer bead-based workflows as they reduce hands-on time and deliver consistent yields across batches. These methods also work well across diverse sample types, including blood, swabs, tissue and saliva, while maintaining strong performance.

Global nucleic acid isolation and purification market, by application

As of 2024, diagnostic applications dominated the global nucleic acid isolation and purification market. This is mainly because DNA/RNA extraction is a critical-first step for many routine molecular tests. Hospitals, reference labs and public health labs run large volumes of PCR and NAAT assays and each test starts with isolation. There is also growth in uptake of molecular diagnostics for respiratory infections, STI testing, transplant monitoring and oncology profiling.

Global nucleic acid isolation and purification market, by end user

In 2024, hospitals and diagnostic centers dominated the global nucleic acid isolation and purification market. This is mainly because these settings handle high routine volumes of molecular testing, where DNA/RNA extraction is a required first step. Hospitals and diagnostic centers process a mix of infectious disease panels, respiratory testing, STI screening and oncology-related assays. They also need consistent sample prep to reduce reruns and maintain turnaround times.

REGION

The Asia Pacific to be the fastest-growing region in the Global NAIP market during the forecast period

The global nucleic acid isolation and purification (NAIP) market is expected to grow fastest in the Asia Pacific region. This growth is driven by a substantial increase in PCR and NGS testing in hospitals and reference labs. Governments across the region are allocating funds to the molecular diagnostics sector, infectious disease preparedness, and genomics projects, which in turn is increasing the number of routine extractions. With oncology testing and companion diagnostics also growing, significant emphasis has been placed on producing stable, high-quality DNA/RNA workflows. The expansion of biopharma in the region is turning to QC testing, bioanalysis, and translational research to meet demand, where clean extraction is essential. Laboratories are rapidly transitioning to automated, high-throughput extraction platforms to reduce manual workload and enhance reproducibility. Concurrently, the need for affordable kits, local supply, and platform-compatible chemistries is becoming increasingly evident.

NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

In the global nucleic acid isolation and purification (NAIP) market matrix, Thermo Fisher Scientific (Star) is a dominant player, offering a range of products and services that serve clinical, research, and biopharma labs worldwide. The company provides a complete line of magnetic bead- and column-based extraction kits, automated sample preparation instruments, and the plastics and buffers that labs require for high-throughput, reproducible DNA/RNA workflows. PCR Biosystems (Emerging Leader) is strengthening its market position by focusing on PCR-based molecular workflows that require nucleic acid input of consistent quality.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Scientific, Inc. (US)

- Danaher Corporation (US)

- Qiagen (Germany)

- F. Hoffman-La Roche (Switzerland)

- Merck KGaA (Germany)

- Agilent Technologies, Inc. (US)

- Illumina, Inc. (US)

- Bio-Rad Laboratories Inc. (US)

- Promega Corporation (US)

- New England Biolabs (US)

- Takara Bio Inc. (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.67 Billion |

| Market Forecast in 2030 (Value) | USD 10.99 Billion |

| Growth Rate | CAGR of 9.1% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Related Segment & Geographic Reports |

North America Nucleic Acid Isolation and Purification Market Asia Pacific Nucleic Acid Isolation and Purification Market Europe Nucleic Acid Isolation and Purification Market Nucleic Acid Isolation and Purification Kits Market |

WHAT IS IN IT FOR YOU: NUCLEIC ACID ISOLATION AND PURIFICATION MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based diagnostics company |

|

|

RECENT DEVELOPMENTS

- July 2023 : INOVIQ and Promega Corporation announced a global joint marketing agreement for EXO-NET exosome isolation and nucleic acid purification solutions.

- October 2022 : Thermo Fisher Scientific Inc. (US) invested USD 97 million in expanding its clinical research operations in Richmond, Virginia. The facility will provide high-quality bioanalytical lab services to advance clinical research programs.

- May 2022 : Thermo Fisher Scientific Inc. (US) partnered with LabShares to provide instruments, lab equipment, and consumables to help early-stage life science companies accelerate their drug discovery efforts.

Table of Contents

Methodology

This research study relied extensively on secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global nucleic acid isolation and purification market. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess the market's growth prospects. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary sources for this research study include publications from government sources such as the World Health Organization (WHO), National Institutes of Health (NIH), Centers for Disease Control and Prevention (CDC), European Society of Human Genetics (ESHG), University Hospitals Southampton NHS Foundation Trust, Genomics England, Scottish Genome Partnership, Berlin Institute of Health, Max Delbrück Center for Molecular Medicine, and European Federation of Biotechnology (EFB). Secondary data was collected and analyzed to determine the overall size of the global nucleic acid isolation and purification market, which was then validated through primary research.

Primary Research

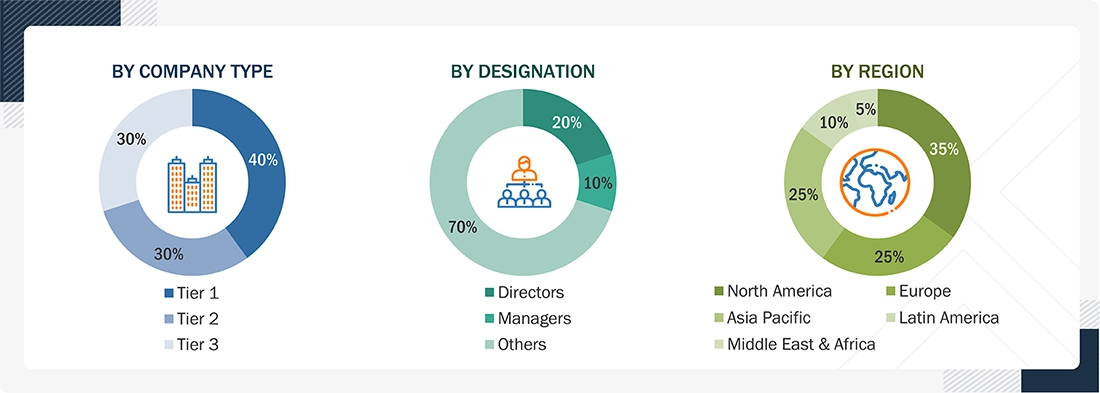

Extensive primary research was conducted after obtaining information of the global market through secondary research. Several primary interviews were conducted with market experts from the demand side (hospitals and diagnostic centers, academic institutes and government organizations, pharmaceutical and biotechnology companies, and others) and the supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, from Tier 1 and Tier 2 companies engaged in offering products) across five major regions, namely, North America, Europe, the Asia-Pacific, Latin America, and the Middle East & Africa. Approximately 80% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. Primary data was collected through questionnaires, emails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

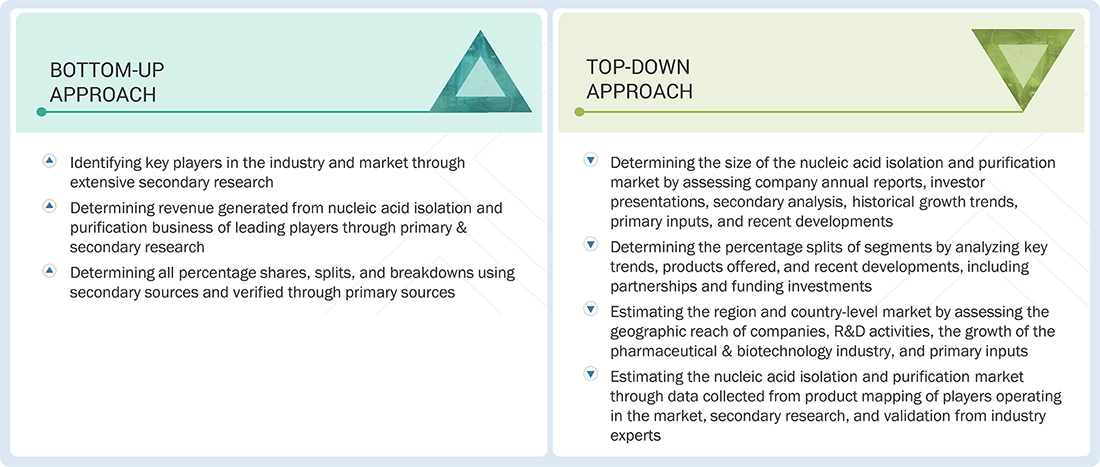

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the nucleic acid isolation and purification market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

Nucleic Acid Isolation and Purification Market : Top-Down and Bottom-Up Approach

Data Triangulation

To complete the overall market engineering process and determine the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by analyzing various factors and trends from both the demand and supply sides

Market Definition

Nucleic acid isolation and purification are molecular biology techniques used to extract DNA and RNA for downstream applications, such as sequencing, cloning, and polymerase chain reaction. These downstream applications are important in life science research, molecular diagnostics, forensics, and genetic engineering.

- Manufacturers and vendors of nucleic acid isolation and purification kits and instruments

- Research associations related to genomics

- Hospitals & diagnostic centers

- Contract research organizations

- Healthcare institutions

- Research institutes

- Pharmaceutical & biotechnology companies

- Government & academic institutes

- Community centers

Report Objectives

- To define, describe, and forecast the nucleic acid isolation and purification market by product, method, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations, in the global nucleic acid isolation and purification market

- To benchmark players within the nucleic acid isolation and purification market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business and product strategy

Available customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:Geographical Analysis

- Further breakdown of the Rest of Europe nucleic acid isolation and purification market, by country

- Further breakdown of the Rest of Asia Pacific nucleic acid isolation and purification market, by country

- Further breakdown of the Rest of Latin America nucleic acid isolation and purification market, by country

-

Detailed analysis and profiling of additional market players (up to five)

- Cross-segment analysis

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nucleic Acid Isolation and Purification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Nucleic Acid Isolation and Purification Market