Chelating Agents Market by Type (Non-biodegradable, Biodegradable), By Application (Pulp & Paper, Cleaning, Water Treatment, Agrochemicals, Personal Care), and Region (NA, Europe, APAC, SA, MEA) - Global Forecast to 2025

Updated on : June 18, 2024

Chelating Agents Market

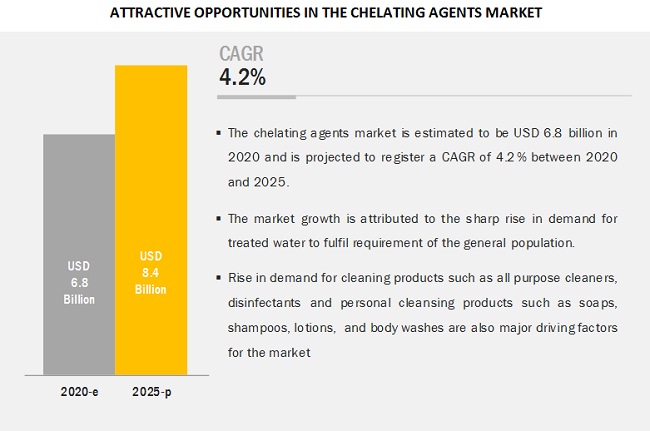

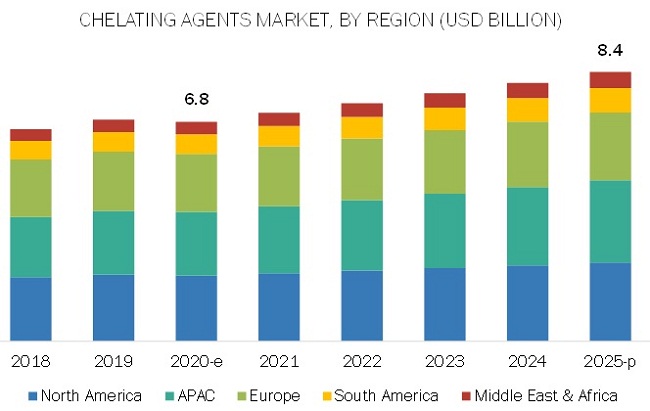

Chelating Agents Market was valued at USD 6.8 billion in 2020 and is projected to reach USD 8.4 billion by 2025, growing at 4.2% cagr from 2020 to 2025. The growth of this market can be attributed to the rising demand for cleaning formulations, such as surface cleaners, all-purpose cleaners, and disinfectants. Also, the rising demand for potable water is also anticipated to drive the growth of the chelating agents market.

Biodegradable chelating agents to register faster growth during the forecast period.

The objective of readily biodegradable chelating agents is to attain sustainability. The demand for cleaning products such as surface cleaners, detergents, and personal care products such as soaps, shampoos, and potable water is continuously on the rise. Growth in consumption of these personal care and cleaning products, the necessity of maintaining proper hygiene at workplaces, homes, and commercial spaces, and safety provided by the product are the major factors propelling the demand for biodegradable chelating agents.

Cleaning to be the fastest-growing application segment

Chelating agents are used in cleaning formulations for their effective functioning by preventing the minerals prevalent in hard water from meddling with the cleaning process. In addition, chelating agents also improve shelf-life, prevent allergies related to nickel or chromium, maintain color, provide antimicrobial effect, and help in scale removal. The use of chelating agents in cleaning products, such as surface cleaners, all-purpose cleaners, detergents, and disinfectants, is expected to rise owing to the need for maintaining proper personal and surrounding hygiene.

APAC to dominate the chelating agents market during the forecast period.

APAC is projected to lead the chelating agents market during the forecast period. Growing population, urbanization, and industrialization are the major drivers for the chelating agents market in the region. Industries, such as paper & pulp, industrial & institutional cleaning, water treatment, oil & gas, textile, pharmaceuticals, agriculture, and personal care, use chelating agents in many applications and also have a major presence in APAC, which is responsible for the large size of the market in the region.

Chelating Agents Market Players

The chelating agents market comprises major players such BASF (Germany), Dow (US), Nouryon (Netherlands), Kemira Oyj (Finland), Mitsubishi Chemical Holdings Corporation (Japan), Hexion (US), ADM (US), Ascend Performance Materials (US), MilliporeSigma (US), and Nippon Shokubai Co., Ltd. (Japan). BASF is among the leading chelating agent manufacturers globally. New product launch and investment & expansion were the key strategies adopted by the company to penetrate the global chelating agents market.

Chelating Agents Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2018-2025 |

|

Base year |

2019 |

|

Forecast period |

2020-2025 |

|

Units considered |

Volume (Kiloton) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, South America, and Middle East & Africa |

|

Companies |

BASF (Germany), Dow (US), Nouryon (Netherlands), Kemira Oyj (Finland), and Mitsubishi Chemical Holdings Corporation (Japan) |

This research report categorizes the chelating agents market based on type, application, and region.

Based on type:

- Non-biodegradable Chelating Agents

- Biodegradable Chelating Agents

Based on application:

- Pulp & Paper

- Cleaning

- Water Treatment

- Agrochemicals

- Personal Care

- Others

Based on the region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

-

Recent Developments

- In 2019, BASF launched Trilon M Max EcoBalanced, a renewables-based Trilon M grade. This product launch has helped the company to satisfy the demand from home care and I&I cleaning industries with sustainable and high-quality ingredients.

- In 2020, Nouryon and INEOS Nitriles (London, UK) have invested in building a new facility in Cologne, Germany. The facility will produce raw material for Nouryon’s readily biodegradable green chelates. This agreement has helped Nouryon to serve the European market with a sustainable solution that replaces phosphates in many applications.

- In 2019, Ascend Performance Materials completed a multimillion-dollar investment in nitrilotriacetic acid production at its Chocolate Bayou facility in Alvin, Texas. The investment increased the production of the company’s biodegradable chelate, FlexaTrac NTA, by 10%. The capacity expansion has helped the company to meet the increasing demand for chelating agents, globally.

Key questions addressed by the report

- What are the upcoming hot bets for the chelating agents market?

- How are the market dynamics changing for different types of chelating agents?

- How are the market dynamics changing for different applications of chelating agents?

- Who are the major manufacturers of chelating agents?

- How are the market dynamics changing for different regions of chelating agents?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS/CONSIDERATIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 CHELATING AGENTS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

3.1 COVID IMPACT

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CHELATING AGENTS MARKET

4.2 CHELATING AGENTS MARKET SIZE, BY TYPE

4.3 CHELATING AGENTS MARKET SIZE, BY APPLICATION

4.4 CHELATING AGENTS MARKET, BY MAJOR COUNTRIES

4.5 APAC: CHELATING AGENTS MARKET, BY APPLICATION AND COUNTRY, 2019

5 MARKET OVERVIEW (Page No. - 35)

5.1 MARKET DYNAMICS

5.1.1 DRIVERS

5.1.1.1 Increase in demand for treated water

5.1.1.2 High growth potential in the cleaning segment

5.1.2 RESTRAINTS

5.1.2.1 Eco-toxicological risk of non-biodegradable chelating agents

5.1.3 OPPORTUNITIES

5.1.3.1 Increase in the use of environmentally-friendly chelating agents

5.1.3.2 Use of chelating agents for novel applications in the pharmaceutical industry

5.2 COVID-19 IMPACT ON MAJOR ECONOMIES

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN OF CHELATING AGENTS MARKET

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 MANUFACTURERS

5.4.3 DISTRIBUTORS

5.4.4 END-USERS

6 CHELATING AGENTS MARKET, BY TYPE (Page No. - 43)

6.1 INTRODUCTION

6.2 NON-BIODEGRADABLE

6.2.1 EASY AVAILABILITY AND LOW COST TO DRIVE THE MARKET

6.2.2 EDTA

6.2.3 DTPA

6.2.4 PHOSPHATES & PHOSPHONATES

6.2.5 OTHERS

6.3 BIODEGRADABLE

6.3.1 COMPARABLE EFFECTIVENESS AND ENVIRONMENTALLY-FRIENDLY PROPERTIES TO DRIVE THE GROWTH

6.3.2 EDDS

6.3.3 NTA

6.3.4 IDS

6.3.5 GLDA

6.3.6 MGDA

6.3.7 SODIUM GLUCONATE

6.3.8 OTHERS

6.4 COVID IMPACT

7 CHELATING AGENTS MARKET, BY APPLICATION (Page No. - 49)

7.1 INTRODUCTION

7.2 PULP & PAPER

7.2.1 DECLINE EXPECTED AS A RESULT OF THE ONGOING PANDEMIC

7.2.1.1 COVID-19 Impact

7.3 CLEANING

7.3.1 INCREASED DEMAND FOR SURFACE CLEANING AND MAINTAINING PROPER HYGIENE TO DRIVE THE MARKET

7.3.1.1 COVID-19 Impact

7.4 WATER TREATMENT

7.4.1 INCREASED USE IN WASTEWATER TREATMENT TO DRIVE THE MARKET

7.4.1.1 COVID-19 Impact

7.5 AGROCHEMICALS

7.5.1 INCREASED REQUIREMENT AS FERTILIZER ADDITIVES TO DRIVE THE DEMAND

7.5.1.1 COVID-19 Impact

7.6 PERSONAL CARE

7.6.1 INCREASING USE OF PERSONAL CLEANSING PRODUCTS TO DRIVE THE MARKET

7.6.1.1 COVID-19 Impact

7.7 OTHERS

7.7.1 COVID-19 IMPACT

8 CHELATING AGENTS MARKET, BY REGION (Page No. - 56)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Robust expansion of the chemical industry to fuel the market

8.2.2 CANADA

8.2.2.1 Changing landscape of the chemical industry to drive the chelating agents market

8.2.3 MEXICO

8.2.3.1 Growth in industrial investments to drive the market

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 Extensive use of recycled paper to drive the consumption

8.3.2 FRANCE

8.3.2.1 The country is a key producer of paper for specialty applications

8.3.3 UK

8.3.3.1 High consumer spending on hygiene and personal care products to be the major market driver

8.3.4 ITALY

8.3.4.1 Increasing emphasis on green cleaners to drive the consumption of chelating agents

8.3.5 RUSSIA

8.3.5.1 Growth potential of the chemical sector to drive the demand for chelating agents

8.3.6 REST OF EUROPE

8.4 APAC

8.4.1 CHINA

8.4.1.1 China accounted for the largest share in the APAC chelating agents market

8.4.2 JAPAN

8.4.2.1 Increasing consumer spending on home and personal care products to propel the demand

8.4.3 SOUTH KOREA

8.4.3.1 Market restructuring activities in the pulp & paper industry to boost the demand

8.4.4 INDIA

8.4.4.1 Growth of the industrial and agricultural sectors to propel the market

8.4.5 REST OF APAC

8.5 MIDDLE EAST & AFRICA

8.5.1 SOUTH AFRICA

8.5.1.1 Modernization of the pulp & paper industry to boost the consumption

8.5.2 SAUDI ARABIA

8.5.2.1 Domestication of pulp & paper production to propel the demand

8.5.3 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.1.1 Growth in consumption of cleaning products to drive the market

8.6.2 ARGENTINA

8.6.2.1 Growing need for maintaining proper hygiene to drive the market

8.6.3 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 95)

9.1 OVERVIEW

9.2 COMPETITIVE LEADERSHIP MAPPING, 2019

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

9.3 COMPETITIVE BENCHMARKING

9.3.1 STRENGTH OF PRODUCT PORTFOLIO

9.3.2 BUSINESS STRATEGY EXCELLENCE

9.4 MARKET RANKING OF KEY PLAYERS

9.5 COMPETITIVE SITUATION & TRENDS

9.5.1 INVESTMENT & EXPANSION

9.5.2 NEW PRODUCT DEVELOPMENT

9.5.3 AGREEMENT & COLLABORATION

10 COMPANY PROFILES (Page No. - 103)

(Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current focus and strategies, Threat from competition & Right to win)*

10.1 BASF

10.2 THE DOW CHEMICAL COMPANY

10.3 NOURYON

10.4 KEMIRA OYJ

10.5 MITSUBISHI CHEMICAL HOLDINGS CORPORATION

10.6 ADM

10.7 NIPPON SHOKUBAI CO., LTD.

10.8 MILLIPORESIGMA

10.9 ASCEND PERFORMANCE MATERIALS

10.10 HEXION

*Details on Business overview, Products offered, Recent developments, SWOT analysis, Winning imperatives, Current focus and strategies, Threat from competition & Right to win might not be captured in case of unlisted companies.

10.11 OTHER PLAYERS

10.11.1 AVA CHEMICALS

10.11.2 CHEMTEX SPECIALITY LIMITED

10.11.3 OSAM SPECIALTY CHEMICALS PVT. LTD.

10.11.4 TOSOH CORPORATION

10.11.5 BOZZETTO GROUP

10.11.6 CARGILL

10.11.7 ZHONGLAN INDUSTRY CO., LTD.

10.11.8 MACROCYCLICS

10.11.9 SAANVI CORP

10.11.10 TATE & LYLE

10.11.11 SHANDONG IRO CHELATING CHEMICAL CO., LTD.

10.11.12 ZSCHIMMER & SCHWARZ

11 APPENDIX (Page No. - 130)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (81 Tables)

TABLE 1 CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 2 CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 3 CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 4 CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 5 CHELATING AGENTS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 6 CHELATING AGENTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 8 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 10 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 11 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 12 NORTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 13 US: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 14 US: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 15 CANADA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 16 CANADA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 17 MEXICO: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 18 MEXICO: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 19 EUROPE: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 20 EUROPE: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 21 EUROPE: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 22 EUROPE: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 23 EUROPE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 24 EUROPE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 25 GERMANY: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 26 GERMANY: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 27 FRANCE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 28 FRANCE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 UK: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 30 UK: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 31 ITALY: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 32 ITALY: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 33 RUSSIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 34 RUSSIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 35 REST OF EUROPE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 36 REST OF EUROPE: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 37 APAC: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 38 APAC: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 APAC: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 40 APAC: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 APAC: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 42 APAC: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 43 CHINA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 44 CHINA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 JAPAN: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 46 JAPAN: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 47 SOUTH KOREA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 48 SOUTH KOREA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 49 INDIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 50 INDIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 REST OF APAC: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 52 REST OF APAC: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 54 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 56 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 58 MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 SOUTH AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 60 SOUTH AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 SAUDI ARABIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 62 SAUDI ARABIA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 REST OF MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 64 REST OF MIDDLE EAST & AFRICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 65 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 66 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 68 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 70 SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 BRAZIL: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 72 BRAZIL: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 ARGENTINA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 74 ARGENTINA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 REST OF SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 76 REST OF SOUTH AMERICA: CHELATING AGENTS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 INVESTMENT & EXPANSION (2015–2020)

TABLE 78 NEW PRODUCT DEVELOPMENT (2015–2020)

TABLE 79 AGREEMENT & COLLABORATION (2015–2020)

TABLE 80 WALLET SHARE OF DIRECT CUSTOMER INDUSTRY FOR CARE CHEMICALS DIVISION OF BASF

TABLE 81 WALLET SHARE OF PULP & PAPER DIVISION OF KEMIRA OYJ FROM MAJOR CUSTOMERS

LIST OF FIGURES (39 Figures)

FIGURE 1 CHELATING AGENTS: MARKET SEGMENTATION

FIGURE 2 CHELATING AGENTS MARKET: RESEARCH DESIGN

FIGURE 3 CHELATING AGENTS MARKET: BOTTOM-UP APPROACH

FIGURE 4 CHELATING AGENTS MARKET: TOP-DOWN APPROACH

FIGURE 5 CHELATING AGENTS MARKET: DATA TRIANGULATION

FIGURE 6 CHELATING AGENTS MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 7 CHELATING AGENTS MARKET ANALYSIS

FIGURE 8 NON-BIODEGRADABLE SEGMENT LEADS THE OVERALL CHELATING AGENTS MARKET

FIGURE 9 PULP & PAPER WAS THE LARGEST APPLICATION OF CHELATING AGENTS IN 2019

FIGURE 10 APAC TO BE THE FASTEST-GROWING CHELATING AGENTS MARKET

FIGURE 11 GROWTH OF THE CLEANING SECTOR TO DRIVE THE CHELATING AGENTS MARKET

FIGURE 12 NON-BIODEGRADABLE CHELATING AGENTS TO BE THE LARGER TYPE

FIGURE 13 CLEANING TO BE THE LARGEST APPLICATION OF CHELATING AGENTS

FIGURE 14 INDIA TO REGISTER THE HIGHEST CAGR BETWEEN 2020 AND 2025

FIGURE 15 CHINA AND PULP & PAPER SEGMENT ACCOUNTED FOR THE LARGEST SHARES

FIGURE 16 DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN THE CHELATING AGENTS MARKET

FIGURE 17 CHELATING AGENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 OVERVIEW OF CHELATING AGENTS VALUE CHAIN

FIGURE 19 NON-BIODEGRADABLE SEGMENT TO ACCOUNT FOR THE LARGER MARKET SHARE

FIGURE 20 CLEANING APPLICATION TO LEAD THE MARKET

FIGURE 21 CHELATING AGENTS MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

FIGURE 22 NORTH AMERICA: CHELATING AGENTS MARKET SNAPSHOT

FIGURE 23 EUROPE: CHELATING AGENTS MARKET SNAPSHOT

FIGURE 24 APAC: CHELATING AGENTS MARKET SNAPSHOT

FIGURE 25 COMPANIES ADOPTED INVESTMENT & EXPANSION AS THE KEY STRATEGY BETWEEN 2015 AND 2020

FIGURE 26 CHELATING AGENTS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 27 BASF: COMPANY SNAPSHOT

FIGURE 28 BASF: SWOT ANALYSIS

FIGURE 29 DOW: COMPANY SNAPSHOT

FIGURE 30 DOW: SWOT ANALYSIS

FIGURE 31 NOURYON: COMPANY SNAPSHOT

FIGURE 32 NOURYON: SWOT ANALYSIS

FIGURE 33 KEMIRA OYJ: COMPANY SNAPSHOT

FIGURE 34 KEMIRA OYJ: SWOT ANALYSIS

FIGURE 35 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: COMPANY SNAPSHOT

FIGURE 36 MITSUBISHI CHEMICAL HOLDINGS CORPORATION: SWOT ANALYSIS

FIGURE 37 ADM: COMPANY SNAPSHOT

FIGURE 38 NIPPON SHOKUBAI CO., LTD.: COMPANY SNAPSHOT

FIGURE 39 HEXION: COMPANY SNAPSHOT

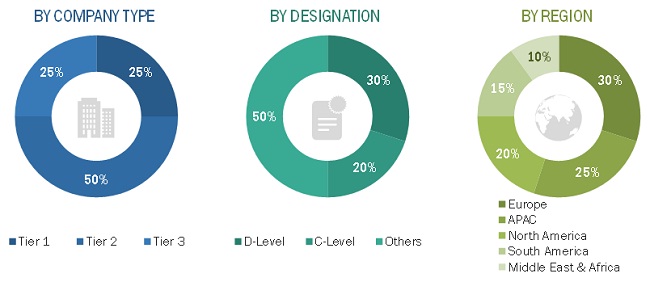

The study involved four major activities in estimating the current size of the chelating agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, Food & Agriculture Organization of the United Nations’ database, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The chelating agents market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The supply side of this market includes lab technicians, technologists, and sales managers from the chelating agents industry. The demand side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the chelating agents market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- Market sizes, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the chelating agents market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in various end-use industries.

Report Objectives:

- To define, describe, and forecast the chelating agents market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, and opportunities) influencing the market growth

- To analyze and forecast the market by type and application

- To forecast the size of the market with respect to five regions: Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically analyze the markets with respect to ongoing trends in various industries during this COVID-19 pandemic

- To analyze the competitive developments in the market such as investment & expansion, new product launch, and agreement & collaboration

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC, Rest of Europe, Rest of South America, and Rest of Middle East & Africa for chelating agents market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Chelating Agents Market

Green chelates technology overview, capacities in Europe.

Sample related to the pulp and paper Industry for EMEA and or Asia