China Hemodialysis and Peritoneal Dialysis Market by Product & Services (HD, PD, Machine, Dialyzer, Concentrate, Dialysate, Catheter, Service), Modality (CAPD, APD, Nocturnal), End User (Hospital, Independent Center, Home Dialysis) - Forecast to 2024

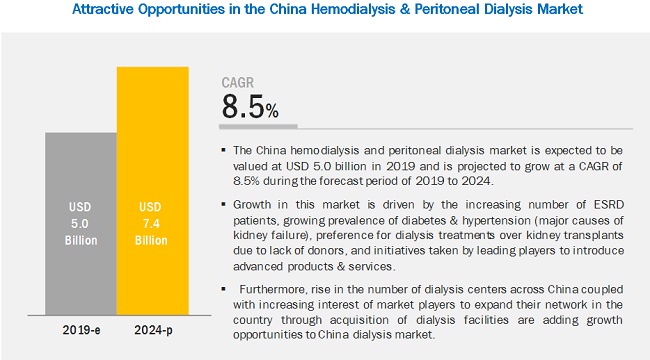

[144 Pages Report] The China hemodialysis and peritoneal dialysis market is projected to grow from an estimated USD 5.0 billion in 2019 to USD 7.4 billion by 2024, at a CAGR of 8.5% during the forecast period. Market growth is largely driven by factors such as increasing number of ESRD patients, growing prevalence of diabetes & hypertension (major causes of kidney failure), and preference for dialysis treatments over kidney transplants due to lack of donors. Furthermore, rise in the number of dialysis centers across China coupled with the increasing interest of market players to expand their network in the country through the acquisition of dialysis facilities is adding growth opportunities to market.

By type, the hemodialysis segment is expected to be the largest contributor during the forecast period

On the basis of type, the dialysis market is segmented into hemodialysis and peritoneal dialysis. The hemodialysis segment is further categorized into products (machines, & consumables/supplies) & services (in-center hemodialysis services and home hemodialysis (HHD) services). The peritoneal dialysis segment is further divided into products (machines & consumables) & services. The hemodialysis segment is expected to hold the largest share of the dialysis market in China as of 2019 mainly owing to greater accessibility of HD centers, growing number of community dialysis centers, higher physician expertise & awareness to administer HD, reimbursement coverage, and socio-demographic factors.

By end user, the in-center dialysis segment is expected to be the largest contributor to the China hemodialysis and peritoneal dialysis market

China dialysis market, by end user, is segmented into two categories—in-center dialysis and home dialysis. The in-center dialysis end-user segment is expected to hold the largest share of the dialysis end user market in China as of 2019; mainly due to the increasing number of dialysis centers across the globe, new product launches, and the availability of healthcare professionals in dialysis centers are propelling the growth of the in-center dialysis market.

Key Market Players

Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International, Inc. (US) and Shandong Weigao Group Medical Polymer Company Limited (China) dominated the market. Other players in this market include B. Braun Melsungen AG (Germany), Nikkiso Co. Ltd. (Japan), DaVita Healthcare Partners, Inc (US), Asahi Kasei Medical Co., Ltd (Japan), Bain Medical Equipment Co., Ltd. (China), Huaren Pharmaceutical (China), and Jiangsu Lengthen Life Science and Technology Co. Ltd (China).

Fresenius Medical Care AG & Co. KGaA (Germany) is one of the leading players in the market. Its broad portfolio of dialysis products is the key factor accounting for its large share in this market. The company has adopted both organic and inorganic growth strategies such as agreements, partnerships, collaborations, product launches, and contracts to maintain its top position. The company is also focused on providing training and conducting workshops to increase the adoption of its products.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, Product Type, Modality, and End User |

|

Geographies Covered |

China |

|

Companies Covered |

Fresenius Medical Care AG & Co. KGaA (Germany), Baxter International, Inc. (US), Shandong Weigao Group Medical Polymer Company Limited (China), B. Braun Melsungen AG (Germany), Nikkiso Co. Ltd. (Japan), and DaVita Healthcare Partners, Inc (US), Asahi Kasei Medical Co., Ltd (Japan), Bain Medical Equipment Co., Ltd. (China), Huaren Pharmaceutical (China), and Jiangsu Lengthen Life Science and Technology Co. Ltd (China). Major 10 players covered. |

This research report categorizes the China hemodialysis and peritoneal dialysis market based on type, product & services, modality, and end user.

China Hemodialysis Market

China Hemodialysis Market, by Products and Services

- Hemodialysis Products

- Hemodialysis Machines

- Center-use Hemodialysis Machines

- Home-use Hemodialysis Machines

- Hemodialysis Consumables/Supplies

- Dialyzers

- Dialyzers Market, by Material Type

- Cellulose-based Dialyzer

- Synthetic Dialyzer

- Dialyzers market, by Flux Type

- High Flux Dialyzer

- Low Flux Dialyzer

- Dialyzers Market, by Material Type

- Hemodialysis Access Products

- Bloodlines

- Hemodialysis Concentrates/Dialysates

- Dialyzers

- Hemodialysis Machines

- Hemodialysis Services

- In-center Hemodialysis Services

- Home Hemodialysis Services

Hemodialysis Market, by Modality

- Conventional Hemodialysis

- Short Daily Hemodialysis

- Nocturnal Hemodialysis

China Peritoneal Dialysis Market

China Peritoneal Dialysis Market, By Products and Services

- Peritoneal Dialysis Products

- Peritoneal Dialysis Concentrates/Dialysates

- Peritoneal Dialysis Machines

- Peritoneal Dialysis Catheters

- Peritoneal Dialysis Transfer Sets

- Peritoneal Dialysis Services

Peritoneal Dialysis Market, by Modality

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Ambulatory Peritoneal Dialysis (APD)

China Hemodialysis and Peritoneal Dialysis Market, by End User

- In-center Dialysis

- Hospitals

- Independent Dialysis Centers

- Home Dialysis

- Peritoneal Dialysis

- Home Hemodialysis

Recent Developments

- In 2018, Fresenius Medical Care acquired 70% shares of Guangzhou KangNiDaiSi Medical Investment Co., Ltd. company to expand its dialysis care network in China

- In 2017, Fresenius Medical Care opened an independent dialysis center in Quanzhou (China). This expansion is aimed to increase access to dialysis treatment in the country.

- In 2015, DaVita entered into a joint venture with Shunjing Renal Hospital (China) to establish DaVita (Shandong) Kidney Disease Hospital Co., Ltd. to increase its footprint in the China dialysis service market.

Key Questions Addressed by the Report:

- What are the growth opportunities related to the adoption of peritoneal dialysis across major areas of China in the future?

- The reimbursement coverage and breakdown of overall costs for hemodialysis and peritoneal dialysis procedures in China?

- Epidemiological trend, dialysis patient, and centers distribution across major regions of China?

- Information regarding the clinical care process from how patients are diagnosed with ESRD, who is the key decision maker for using HD/PD, and what factors are involved for such decision made?

- What are the new trends in the dialysis market of China?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Geographic Scope

1.3 Markets Covered

2 Research Methodology

2.1 Secondary Data

2.2 Primary Data

2.3 Survey Methodology

2.4 Market Size Estimation

2.5 HD and PD Dialysis Services Market Estimation

2.6 Research Coverage & Limitations

2.7 Research Assumptions

3 Executive Summary

4 Number of Dialysis Centers Across China

4.1 Overview of Dialysis Centers in China

4.2 Major Dialysis Centers in Beijing

4.3 Major Dialysis Centers in Shanghai

4.4 Major Dialysis Centers in Shenzhen

5 Number of Dialysis Patients Across China

5.1 Number of Dialysis Patients in the Three Major Cities of China

5.2 Epidemiology of Dialysis in China

5.3 Risk Factors and Outcomes of Kidney Diseases in China

6 Reimbursement Scenario for Dialysis in China, 2017

6.1 Reimbursement Scenario for Dialysis in China, 2017

6.2 Basic Differences Between Umi and Rmi

6.3 Treatment & Overall Cost Breakdown for HD and PD

6.4 Comparison of Expenses Under Different Medical Insurance Policies for HD & PD Patients

7 First-Level Data on the Clinical Care Process for Dialysis in China

7.1 Overview

7.2 Factors Associated With the Selection of A Dialysis Modality

7.3 Critical Care Process for Implementing Assisted Peritoneal Dialysis

7.4 Factors That Can Influence the Recruitment and Retention of PD Patients

8 Local Government Policy in China Promoting Peritoneal Dialysis

9 China Pricing Analysis Dialysis

10 Market Overview

10.1 Drivers

10.2 Restraints

10.3 Opportunities

10.4 Challenges

11 China Hemodialysis and Peritoneal Dialysis Market, By Type

11.1 Introduction

11.2 Hemodialysis Market

11.2.1 Hemodialysis Products

11.2.1.1 Hemodialysis Machines

11.2.1.1.1 Center-Use Hemodialysis Machines

11.2.1.1.2 Home-Use Hemodialysis Machines

11.2.1.2 Hemodialysis Consumables/Supplies

11.2.1.2.1 Dialyzers

11.2.1.2.2 Dialyzers Market, By Material Type

11.2.1.2.2.1 Cellulose Based Dialyzer

11.2.1.2.2.2 Synthetic Dialyzer

11.2.1.2.3 Dialyzers Market, By Flux Type

11.2.1.2.3.1 High Flux Dialyzer

11.2.1.2.3.2 Low Flux Dialyzer

11.2.1.2.4 Hemodialysis Access Products

11.2.1.2.5 Bloodlines

11.2.1.2.6 Hemodialysis Concentrates/Dialysates

11.2.1.2.7 Others

11.2.2 Hemodialysis Services

11.2.3 Hemodialysis Market, By Modality

11.2.3.1 Conventional Hemodialysis

11.2.3.2 Short Daily Hemodialysis

11.2.3.3 Nocturnal Hemodialysis

11.3 Peritoneal Dialysis Market

11.3.1 Peritoneal Dialysis Products

11.3.1.1 Peritoneal Dialysis Concentrates/Dialysates

11.3.1.2 Peritoneal Dialysis Machines

11.3.1.3 Peritoneal Dialysis Catheters

11.3.1.4 Peritoneal Dialysis Transfer Sets

11.3.1.5 Others

11.3.2 Peritoneal Dialysis Services

11.3.3 Peritoneal Dialysis Market, By Modality

11.3.3.1 Continuous Ambulatory Peritoneal Dialysis (CAPD)

11.3.3.2 Ambulatory Peritoneal Dialysis (APD)

12 China Hemodialysis and Peritoneal Dialysis Market, By End User

12.1 Hemodialysis and Peritoneal Dialysis Market, By End User

12.1.1 In-Center Dialysis Market, By Type

12.1.2 Home Dialysis Market, By Type

13 Company Profiles

(Business Overview, Product & Services, Recent Developments Financial Snapshots)*

13.1 Asahi Kasei Medical Co., Ltd. (A Subsidiary of Asahi Kasei Corporation)

13.2 Baxter International Inc.

13.3 B. Braun Melsungen AG

13.4 Bain Medical Equipment Co., Ltd. (China)

13.5 Davita Healthcare Partners Inc.

13.6 Fresenius Medical Care AG & Co. KGaA

13.7 Huaren Pharmaceutical (China)

13.8 Jiangsu Lengthen Life Science and Technology Co.,Ltd (China)

13.9 Nikkiso Co., Ltd

13.10 Shandong Weigao Group Medical Polymer Company Limited.

*Details on Business Overview, Product & Services, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Competitive Analysis

14.1 List of Global and Local Players Operating in the Dialysis Products & Services Market in China

14.2 China: Dialysis Products & Services Market Share Analysis (2017)

15 Appendix

15.1 Discussion Guide

15.2 Knowledge Store

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Authors Details

16 References

List of Tables (30 Tables)

Table 1 Number of Dialysis Centers, By City, 2018

Table 2 Number of Dialysis Patients , By City, 2018

Table 3 Major Causes of Esrd in China (%)

Table 4 Prevalence of Dialysis Patients, By Geographic Region and Modality

Table 5 Basic Differences Between Umi and Rmi, as of 2017

Table 6 1-Year Treatment Cost Difference for HD and PD Across China, as of 2017

Table 7 Breakdown of Overall Costs of Dialysis Patients, By Modality, as of 2017

Table 8 Pattern of Payment (%) for Insurance Type By Modality, as of 2017

Table 9 Expenses Under Different Medical Insurance Policies for PD Patients (USD) , as of 2017

Table 10 Expenses Under Different Medical Insurance Policies for HD Patients (USD) , as of 2017

Table 11 Average Selling Prices of Dialysis Products in China (USD) , as of 2018

Table 12 Average Selling Prices of Dialysis Disposables in China (USD) , as of 2018

Table 13 Prevalence of Diabetes (% of Population in the 20–79 Age Group) in China

Table 14 China: Population Aged 65 Years and Above (% of Total Population)

Table 15 China: Population Aged 60 Years and Above (% of Total Population)

Table 16 China Hemodialysis Market, By Type, 2017–2024 (USD Million)

Table 17 China Hemodialysis Market, By Product & Service, 2017–2024 (USD Million)

Table 18 China Hemodialysis Products Market, By Type, 2017–2024 (USD Million)

Table 19 China Hemodialysis Machines Market, By Type, 2017–2024 (USD Million)

Table 20 China Hemodialysis Consumables/Supplies Market, By Type, 2017–2024 (USD Million)

Table 21 China Hemodialysis Dialyzers Market, By Material Type, 2017–2024 (USD Million

Table 22 China Hemodialysis Dialyzers Market, By Flux Type, 2017–2024 (USD Million)

Table 23 China Hemodialysis Services Market, By Type, 2017–2024 (USD Million)

Table 24 China Hemodialysis Market, By Modality, 2017–2024 (USD Million)

Table 25 China Peritoneal Dialysis Market, By Type, 2017–2024 (USD Million)

Table 26 China Peritoneal Dialysis Products Market, By Type, 2017–2024 (USD Million)

Table 27 China Peritoneal Dialysis Market, By Modality, 2017–2024 (USD Million)

Table 28 China Hemodialysis Market, By End User, 2017–2024 (USD Million)

Table 29 China In-Center Dialysis Market, By Type, 2017–2024 (USD Million)

Table 30 China Home Dialysis Market, By Type, 2017–2024 (USD Million)

List of Figures (17 Figures)

Figure 1 Peritoneal Dialysis Segment to Register the Highest CAGR in the Market During the Forecast Period

Figure 2 In-Center Dialysis Segment to Dominate the China Hemodialysis and Peritoneal Dialysis Market, By End User, During the Forecast Period

Figure 3 Number of HD & PD Patients in China, 2012–2018

Figure 4 Distribution of HD and PD Patients Among Different Hospital Grades in China

Figure 5 Breakup of Factors Influencing Choice of RRT Among Physicians in China

Figure 6 Major Dialysis Fluid Manufacturers in China

Figure 7 China: Hemodialysis and Peritoneal Dialysis Market: Drivers, Restraints, Opportunities, and Challenges

Figure 8 Asahi Kasei Corporation: Company Snapshot (2017)

Figure 9 Baxter International Inc. : Company Snapshot (2018)

Figure 10 B. Braun Melsungen AG : Company Snapshot (2018)

Figure 11 Davita Healthcare Partners Inc. : Company Snapshot (2018)

Figure 12 Fresenius Medical Care AG & Co. KGaA : Company Snapshot (2018)

Figure 13 Nikkiso Co., Ltd : Company Snapshot (2018)

Figure 14 Nikkiso Co., Ltd : Company Snapshot (2017)

Figure 15 Market Share of Local and Global Manufacturers in the China Dialysis (2017)

Figure 16 China Hemodialysis Market Share in China (2017

Figure 17 China Peritoneal Dialysis Market Share in China (2017)

The study involved four major activities to estimate the current market size for hemodialysis and peritoneal dialysis. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

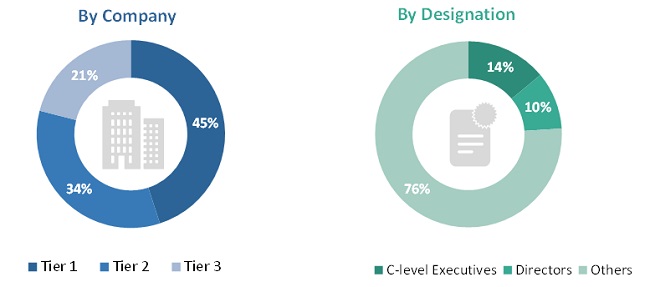

The China hemodialysis and peritoneal dialysis market comprises several stakeholders such as dialysis equipment and consumables manufacturing companies, dialysis service providers, nephrologists, dialysis & critical care nurses, hospitals, clinics, and dialysis centers. The demand side of this market is characterized by the increasing awareness about dialysis treatment options and the rise in the prevalence of ESRD. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the dialysis (hemodialysis & peritoneal dialysis) market in China. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the dialysis industry.

Report Objectives

- To define, describe, and forecast the China hemodialysis and peritoneal dialysis market on the basis of type, product & services, modality, and end user

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, challenges, and trends) influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the China hemodialysis and peritoneal dialysis market

- To analyze the opportunities in the China hemodialysis and peritoneal dialysis market for key stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches, agreements, partnerships, collaborations, and acquisitions in the China hemodialysis and peritoneal dialysis market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the current China hemodialysis and peritoneal dialysis market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in China Hemodialysis and Peritoneal Dialysis Market