This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), American Society Nephrology (ASN), American Association of Kidney Patients (AAKP), European Renal Association (ERA) were referred to identify and collect information for the global hemodialysis and peritoneal dialysis market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the hemodialysis and peritoneal dialysis market. The primary sources from the demand side include hospitals, outpatient dialysis centers, home care setting among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

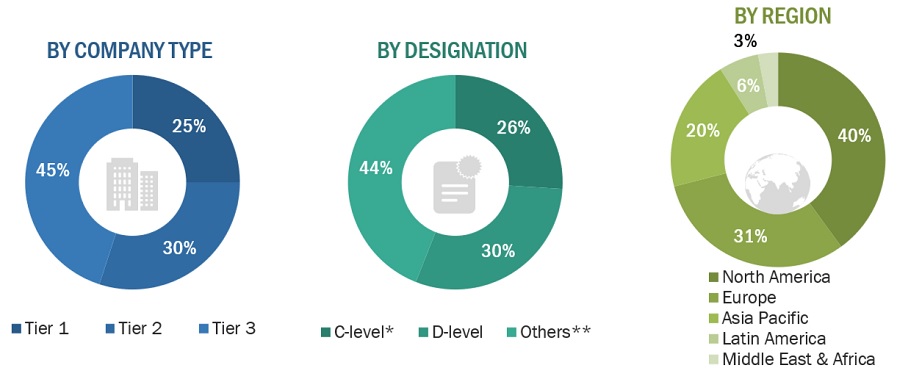

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

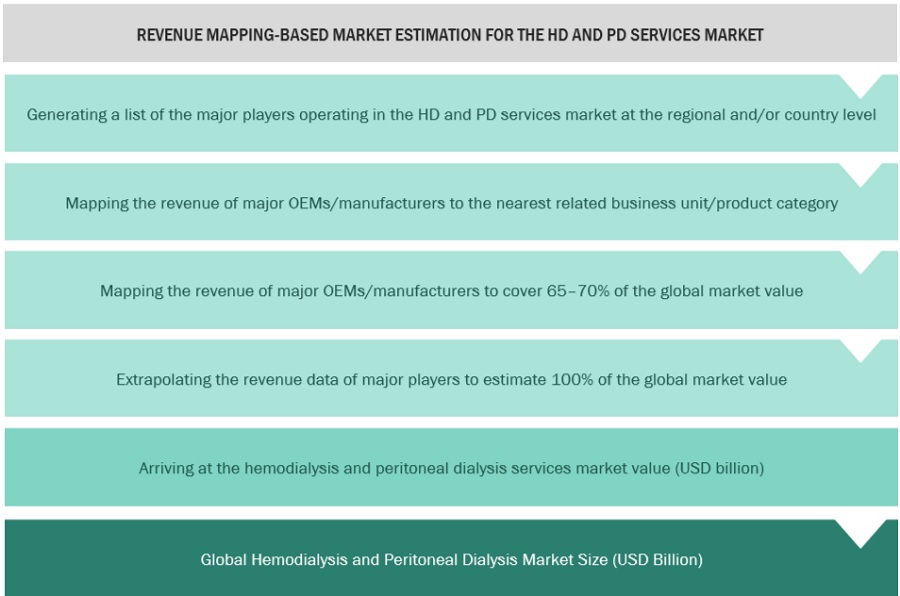

Market Estimation Methodology

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global hemodialysis and peritoneal dialysis market. All the major product manufacturers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players (who contribute at least 85–90% of the market share at the global level). Also, the global hemodialysis and peritoneal dialysis market was split into various segments and sub-segments based on:

-

list of major players operating in the hemodialysis and peritoneal dialysis products and services market at the regional and/or country level

-

Product mapping of various hemodialysis and Peritoneal dialysis manufacturers at the regional and/or country level

-

Mapping of annual revenue generated by listed major players from dialysis (or the nearest reported business unit/product category)

-

Revenue mapping of major players to cover at least 65-70% of the global market share as of 2023

-

Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

-

Summation of the market value of all segments/subsegments to arrive at the global hemodialysis and peritoneal dialysis market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation: Hemodialysis And Peritoneal Dialysis Market Based On Revenue Mapping Methodology

Data Triangulation

After arriving at the overall size of the global Hemodialysis and peritoneal dialysis market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Dialysis refers to a medical procedure essential individual suffering from chronic kidney diseases or impaired kidney function. It involves the removal of waste products and excess fluids from the blood, a function the kidneys normally perform. Dialysis can be of two main types: hemodialysis, where blood is filtered through a machine acting as an artificial kidney, and peritoneal dialysis, which uses the lining of the abdomen as a natural filter. By balancing electrolytes and fluid levels in the body.

Key Market Stakeholders

-

Hemodialysis and Peritoneal Dialysis Product Manufacturers

-

Hemodialysis and Peritoneal Dialysis Services Providers

-

Distributors, Channel Partners, and Third-party Suppliers

-

Hospitals, Independent Dialysis Centers, skilled Nursing Facilities

-

Nephrologist

-

Dialysis Nurses

-

R&D Companies

-

Business Research and Consulting Service Providers

Report Objectives

-

To define, describe, and forecast the global hemodialysis and peritoneal dialysis market on the basis of hemodialysis and peritoneal dialysis product and Services, disease indication, end user and region

-

To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

-

To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

-

To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

-

To profile the key market players and comprehensively analyze their market shares and core competencies2

-

To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global hemodialysis and peritoneal dialysis market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global hemodialysis and peritoneal dialysis market report.

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players.

Company Information

-

Detailed analysis and profiling of additional market players (up to 5 OEMs)

Geographic Analysis

-

Further breakdown of the Rest of Europe hemodialysis and peritoneal dialysis market into Belgium, Austria, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal, among other

-

Further breakdown of the Rest of Asia Pacific hemodialysis and peritoneal dialysis market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

-

Further breakdown of the Rest of Latin America hemodialysis and peritoneal dialysis market into Argentina, and Colombia, among other countries.

Alejandro

Jul, 2020

I would like to know opportunities for growth and adopción of peritoneal dialysis in Mexico.

Aaron

Mar, 2022

Looking forward to gain more insights on the global Hemodialysis Market.

Jose

Mar, 2022

Can you enlighten us on the end users in Hemodialysis Market?.