Cloud Gaming Market Size, Share and Industry Growth Analysis Report by Offering (Infrastructure, Gaming Platform Services), Device Type (Smartphones, Tablets, Gaming Consoles, PCs & Laptops, Smart TVs, HMDs), Solution (Video Streaming, File Streaming), Gamer Type, Region 2024-2031

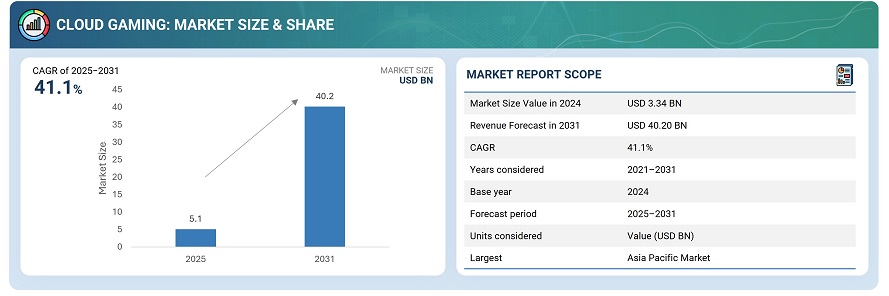

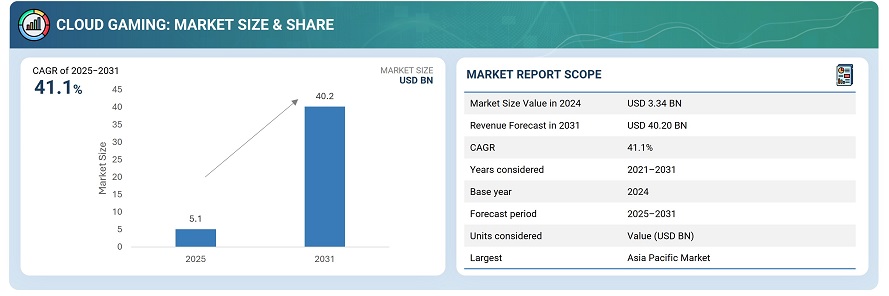

The global cloud gaming market was valued at USD 3.34 billion in 2024 and is estimated to reach USD 40.20 billion by 2031, at a CAGR of 41.1% between 2025 and 2031.

The global cloud gaming market is driven by the growing demand for accessible, high-quality gaming experiences without the need for dedicated hardware. Advances in high-speed internet connectivity, edge computing, and GPU virtualization are enabling seamless, low-latency gameplay across devices such as smartphones, PCs, and smart TVs. Integration with AI-based content optimization, 5G networks, and cross-platform game streaming is further enhancing user experience and expanding the addressable audience. Overall, the market is becoming increasingly dynamic, with technology providers, gaming studios, and cloud service vendors focusing on infrastructure scalability, content partnerships, and regional data center expansion to strengthen their competitive positioning.

Cloud gaming is an on-demand gaming service that enables users to stream and play video games directly on their devices, such as PCs, tablets, smartphones, head-mounted displays, or consoles, without needing to download or install the game locally. The games are hosted and executed on remote servers operated by third-party providers, who stream the gameplay video to the user over the internet. This model allows users to access high-performance gaming experiences regardless of their device’s hardware capabilities.

Market by Device Type

Smartphone

The smartphone segment is expected to account for the largest share of the cloud gaming market in 2024, driven by several key factors. The rapid expansion of high-speed mobile networks, particularly 5G, has significantly reduced latency and improved streaming quality, enabling seamless gameplay on mobile devices. In addition, the growing penetration of affordable smartphones with advanced GPUs and display capabilities has made mobile gaming more accessible to a broad user base across emerging and developed markets. Cloud gaming platforms are also increasingly optimized for mobile operating systems, offering cross-platform access, lightweight clients, and subscription-based models that appeal to casual and mid-core gamers.

Smart TV

The smart TV segment is rapidly emerging in the cloud gaming market as leading platforms like Xbox Cloud Gaming, NVIDIA GeForce Now, and Amazon Luna integrate directly into TVs from brands such as Samsung, LG, and Sony. This eliminates the need for consoles or PCs, allowing users to stream high-quality games instantly. Enhanced internet connectivity, 4K displays, and Bluetooth controller support are further improving the gaming experience. As a result, smart TVs are becoming a key access point for casual and living-room gamers, driving strong growth in this segment.

Market by Solution Type

Video streaming

Video streaming dominates the cloud gaming market in terms of share. This is mainly because of its ability to remove the need for high-end local hardware, allowing users with low-spec devices to access console- or PC-quality games. Major platforms like Xbox Cloud Gaming and NVIDIA GeForce Now already leverage this model, providing instant access and broad device compatibility across smartphones, PCs, and smart TVs. The simplicity of streaming a video feed makes it easier for providers to scale quickly, driving mass adoption despite higher server-side compute and network bandwidth costs. Its proven reliability and subscription-based delivery model further consolidate its leading market position.

File streaming

File streaming is expected to grow rapidly as 5G, edge computing, and CDNs improve, reducing latency and letting some game processing happen on the client or nearby servers. Using progressive downloading, predictive loading, and compression, it delivers smoother gameplay, faster response times, and lower bandwidth use than video streaming. This makes it especially suited for fast-paced or competitive games, and its adoption is likely to increase as network infrastructure advances.

Market by Geography

Geographically, the cloud gaming market is witnessing widespread adoption across North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific leads the market, fueled by high smartphone penetration, rapid 5G network expansion, and growing interest in mobile and casual gaming. The region’s competitive market and affordable device availability also contribute to lower average subscription costs. North America follows closely, supported by strong investments in cloud infrastructure, high-speed internet penetration, and a mature gaming ecosystem. In Europe, growth is driven by robust broadband networks, cloud platform adoption, and cross-platform gaming initiatives. Meanwhile, South America, the Middle East & Africa are emerging markets, with increasing internet connectivity, rising interest in gaming, and expansion of cloud service infrastructure driving demand for cloud gaming solutions.

Market Dynamics

Driver: High-speed Internet and 5G Expansion

The growth of high-speed broadband and 5G networks is a major driver for cloud gaming, as it enables low-latency, high-resolution streaming across smartphones, PCs, and smart TVs. Improved connectivity allows users to play graphically demanding games without needing high-end local hardware, broadening the potential user base. Additionally, network advancements facilitate cross-platform gaming and smoother multiplayer experiences, further boosting adoption.

Restraint: Content Licensing and Game Availability

Cloud gaming platforms rely heavily on licensing agreements with game publishers to offer a broad catalog. Negotiating these rights can be costly and complex, limiting the number of titles available to users. Additionally, some popular games may be exclusive to certain platforms or regions, restricting content accessibility and potentially reducing user adoption. This dependence on third-party content is a notable restraint for cloud gaming providers seeking to scale globally.

Opportunity: Growth of Mobile and Casual Gaming

The rising penetration of smartphones and mobile internet availability in emerging markets is expanding the audience for cloud gaming. Casual gamers can access console-quality games without the need for expensive hardware, creating opportunities for subscription-based and cross-platform services. Providers can also leverage localized content and partnerships with mobile carriers to accelerate adoption.

Challenge: High Operational Costs

Operating cloud gaming platforms requires powerful GPUs, server infrastructure, and low-latency streaming systems, resulting in substantial capital and operational expenses. Providers must manage server scaling, energy consumption, and bandwidth costs while maintaining a smooth user experience. Achieving profitability while expanding to new regions and devices is a key challenge in this market.

Future Outlook

Between 2025 and 2036, the cloud gaming market is expected to grow substantially as gaming becomes increasingly device-agnostic and cloud-enabled. Advances in high-speed 5G networks, edge computing, and GPU virtualization will allow seamless, low-latency streaming of graphically intensive games across smartphones, PCs, smart TVs, and other connected devices. Expansion of cross-platform gaming, AI-driven personalization, and subscription-based models will enhance user engagement and broaden the audience. Increasing investments in cloud infrastructure, data centers, and gaming content partnerships will further accelerate adoption. As the market evolves, cloud gaming is poised to redefine traditional gaming ecosystems, enabling wider access, real-time multiplayer experiences, and data-driven insights into player behavior and preferences.

Key Market Players

Top cloud gaming companies include NVIDIA Corporation (US), Intel Corporation (US), Sony Group Corporation (Japan), Microsoft Corporation (US), and Advanced Micro Devices, Inc. (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Market Definition & Scope

1.3 Inclusions and Exclusions

1.4 Study Scope

1.4.1 Markets Covered

1.4.2 Years Considered

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in Cloud Gaming Market

4.2 Market, By Offering

4.3 Market, By Device Type

4.4 Market, By Solution Type

4.5 Market, By Gamer Type

4.6 Market, By Geography

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Commercialization of 5G Technology

5.2.1.2 Rise in Number of Gamers

5.2.1.3 Upsurge in Immersive and Competitive Gaming on Mobile Devices

5.2.1.4 Increase in Number of Internet Users

5.2.2 Restraints

5.2.2.1 Multiplayer Cloud Gaming Server Allocation Issues

5.2.3 Opportunities

5.2.3.1 Increased Popularity of Cloud Gaming in Multiplayer Scenarios

5.2.3.2 Greater Utilization of Cloud Gamification

5.2.3.3 Improved Cross-Platform Gaming Experience

5.2.4 Challenges

5.2.4.1 Limited Awareness Regarding Cloud Gaming Platforms

5.2.4.2 Fluctuating Internet Speed in Developing Countries

5.3 Cloud Gaming Use Cases

5.3.1 5G

5.3.2 AR/VR

5.4 Value Chain Analysis

6 Cloud Gaming Market, By Offering (Page No. - 44)

6.1 Introduction

6.2 Infrastructure

6.2.1 Compute

6.2.1.1 Gpus are Essential for Ultra Low-Latency and Streaming of Most Demanding Games

6.2.2 Memory

6.2.2.1 Advantages Such as High Density With Simplistic Architecture, Low Latency, and High Performance have Made DRAM core Memory Technology

6.2.3 Storage

6.2.3.1 Low Power Consumption Makes Ssds Ideal for Data Center Storage

6.3 Gaming Platform Services

6.3.1 Content Services

6.3.1.1 Content Services are Cloud Streaming Services That Connect Users to Powerful Gaming Servers

6.3.2 Pc Services

6.3.2.1 Pc Services Enable Streaming of Fully-Featured Virtual Gaming Pc to Users’ Device

7 Cloud Gaming Market, By Device Type (Page No. - 55)

7.1 Introduction

7.2 Smartphones

7.2.1 With Rapid Rise in Mobile Gaming, Cloud Gaming is Expected to Attain Significant Market Traction in Coming Years

7.3 Tablets

7.3.1 Owing to Better Computing Power Capabilities, Tablets Offer Enhanced Gaming Experience Than Other Devices

7.4 Gaming Consoles

7.4.1 Gaming Console Renders Favourable Opportunities to Cloud Gaming Providers By Enhancing Their Product Capabilities

7.5 Personal Computers & Laptops

7.5.1 Gamers Prefer Personal Computers Or Laptops to Explore Cloud Gaming as They Offer Immersive Gaming

7.6 Smart Televisions

7.6.1 Smart Television Manufacturers are Constantly Upgrading to Improve Product Features for Cloud Gaming

7.7 Head-Mounted Displays

7.7.1 AR & VR Devices are Rapidly Being Adopted in Gaming Landscape to Experience Immersive Gaming Experiences

8 Cloud Gaming Market, By Solution Type (Page No. - 67)

8.1 Introduction

8.2 Video Streaming

8.2.1 Video Streaming Eliminates Requirement for Any Additional Hardware Devices

8.3 File Streaming

8.3.1 File Streaming Enables Downloading of Game Content in Form of Bits

9 Cloud Gaming Market, By Gamer Type (Page No. - 77)

9.1 Introduction

9.2 Casual Gamers

9.2.1 Casual Gamers Actively Seek Free of Charge Games

9.3 Avid Gamers

9.3.1 Avid Gamers are Regular Players, But Not Professionals

9.4 Hardcore Gamers

9.4.1 Hardcore Gamers Tend to Invest Lot of Time and Money in Gaming

10 Geographic Analysis (Page No. - 82)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Video game companies based in US are making efforts to ensure uninterrupted video game streaming to users

10.2.2 Canada

10.2.2.1 Growth of Gaming Market is Expected to Boost Market Growth Cloud Gaming in Canada

10.2.3 Mexico

10.2.3.1 Mexico is Expected to Witness Highest Growth Rate in Market in North America

10.3 Europe

10.3.1 Germany

10.3.1.1 France is highly competitive market as it is coming up with varied start-ups for cloud gaming

10.3.2 UK

10.3.2.1 UK is Internationally Prominent Start-Up Hub for Innovative Games and Entrepreneurial Developers

10.3.3 France

10.3.3.1 France is Highly Competitive Market as It is Coming Up With Varied Start-Ups for Cloud Gaming

10.3.4 Italy

10.3.4.1 Italian Market is Excepted Be Propelled By Heavy Investments in Establishing High-Speed and Robust Networks

10.3.5 Rest of Europe

10.3.5.1 Spain and Sweden have Captured Huge Market Share and Created Immersive Gaming Experiences for Players Worldwide

10.4 APAC

10.4.1 China

10.4.1.1 China is Expected to Witness Highest CAGR in Coming Years

10.4.2 Japan

10.4.2.1 Japan Held Largest Market Size of Cloud Gaming in 2019

10.4.3 South Korea

10.4.3.1 Commercialization of 5G is Expected to Boost Market

10.4.4 Australia

10.4.4.1 Australia is an Early Adopter of Cloud Gaming

10.4.5 Rest of APAC

10.4.5.1 Gaming Market is Propelled By Rising Younger Population, Higher Disposable Incomes, and Increasing Number of Smartphone Users

10.5 RoW

10.5.1 Middle East & Africa

10.5.1.1 Middle East & Africa have high potential of adopting cloud gaming

10.5.2 South America

10.5.2.1 Rise in Number of Smartphones is Expected to Fuel Growth of Market

11 Competitive Landscape (Page No. - 111)

11.1 Overview

11.2 Market Ranking Analysis, 2019

11.3 Competitive Leadership Mapping

11.3.1 Visionary Leaders

11.3.2 Innovators

11.3.3 Dynamic Differentiators

11.3.4 Emerging Companies

11.4 Strength of Product Portfolio (25 Companies)

11.5 Business Strategy Excellence (25 Companies)

11.6 Competitive Situation and Trends

11.6.1 Partnerships, Collaborations, and Agreements

11.6.2 Product Launches

11.6.3 Expansions

11.6.4 Acquisitions

12 Company Profiles (Page No. - 122)

12.1 Key Players

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1.1 NVIDIA

12.1.2 Intel Corporation

12.1.3 Google

12.1.4 Microsoft

12.1.5 Amazon

12.1.6 Advanced Micro Devices

12.1.7 Sony

12.1.8 IBM

12.1.9 Tencent

12.1.10 Alibaba

* Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12.2 Right-To-Win

12.3 Other Key Players

12.3.1 Blade

12.3.2 Blacknut

12.3.3 Paperspace

12.3.4 Vortex

12.3.5 Playgiga

12.3.6 Activision

12.3.7 Ubitus

12.3.8 Playkey

12.3.9 Loudplay

12.3.10 Electronic Arts

12.3.11 Hatch Entertainment

12.3.12 Jump Gaming

13 Appendix (Page No. - 160)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Report

13.5 Author Details

List of Tables (108 Tables)

Table 1 Cloud Gaming Market, By Offering, 2017–2024 (USD Million)

Table 2 Cloud Gaming Infrastructure Market, By Type, 2017–2024 (USD Million)

Table 3 Cloud Gaming Infrastructure Market, By Solution Type, 2017–2024 (USD Million)

Table 4 Cloud Gaming Infrastructure Market, By Region, 2017–2024 (USD Million)

Table 5 Cloud Gaming Infrastructure Market in North America, By Country, 2017–2024 (USD Thousand)

Table 6 Cloud Gaming Infrastructure Market in Europe, By Country, 2017–2024 (USD Thousand)

Table 7 Cloud Gaming Infrastructure Market in APAC, By Country, 2017–2024 (USD Thousand)

Table 8 Cloud Gaming Infrastructure Market in RoW, By Region, 2017–2024 (USD Thousand)

Table 9 Cloud Gaming Platform Services Market, By Type, 2017–2024 (USD Million)

Table 10 Cloud Gaming Platform Services Market, By Solution Type, 2017–2024 (USD Million)

Table 11 Cloud Gaming Platform Services Market, By Region, 2017–2024 (USD Million)

Table 12 Cloud Gaming Platform Services Market in North America, By Country, 2017–2024 (USD Thousand)

Table 13 Cloud Gaming Platform Services Market in Europe, By Country, 2017–2024 (USD Thousand)

Table 14 Cloud Gaming Platform Services Market in APAC, By Country, 2017–2024 (USD Thousand)

Table 15 Cloud Gaming Platform Services Market in RoW, By Region, 2017–2024 (USD Thousand)

Table 16 Cloud Gaming Market, By Device Type, 2017–2024 (USD Million)

Table 17 Market for Smartphones, By Region, 2017–2024 (USD Million)

Table 18 Market for Smartphones, By Solution Type, 2017–2024 (USD Million)

Table 19 Market for Smartphones, By Gamer Type, 2017–2024 (USD Million)

Table 20 Market for Tablets, By Region, 2017–2024 (USD Thousand)

Table 21 Market for Tablets, By Solution Type, 2017–2024 (USD Million)

Table 22 Market for Tablets, By Gamer Type, 2017–2024 (USD Million)

Table 23 Market for Gaming Consoles, By Region, 2017–2024 (USD Million)

Table 24 Market for Gaming Consoles, By Solution Type, 2017–2024 (USD Million)

Table 25 Market for Gaming Consoles, By Gamer Type, 2017–2024 (USD Million)

Table 26 Market for Personal Computers & Laptops, By Region, 2017–2024 (USD Million)

Table 27 Market for Personal Computers & Laptops, By Solution Type, 2017–2024 (USD Million)

Table 28 Market for Personal Computers & Laptops, By Gamer Type, 2017–2024 (USD Million)

Table 29 Market for Smart Televisions, By Region, 2017–2024 (USD Thousand)

Table 30 Market for Smart Televisions, By Solution Type, 2017–2024 (USD Thousand)

Table 31 Market for Smart Televisions, By Gamer Type, 2017–2024 (USD Thousand)

Table 32 Market for Head-Mounted Displays, By Region, 2017–2024 (USD Thousand)

Table 33 Market for Head-Mounted Displays, By Solution Type, 2017–2024 (USD Thousand)

Table 34 Market for Head-Mounted Displays, By Gamer Type, 2017–2024 (USD Thousand)

Table 35 Market, By Solution Type, 2017–2024 (USD Million)

Table 36 Market for Video Streaming, By Offering, 2017–2024 (USD Million)

Table 37 Market for Video Streaming, By Device Type, 2017–2024 (USD Thousand)

Table 38 Market for Video Streaming, By Region, 2017–2024 (USD Million)

Table 39 Market for Video Streaming in North America, By Country, 2017–2024 (USD Thousand)

Table 40 Market for Video Streaming in Europe, By Country, 2017–2024 (USD Thousand)

Table 41 Market for Video Streaming in APAC, By Country, 2017–2024 (USD Thousand)

Table 42 Market for Video Streaming in RoW, By Region, 2017–2024 (USD Thousand)

Table 43 Market for File Streaming, By Offering, 2017–2024 (USD Million)

Table 44 Market for File Streaming, By Device Type, 2017–2024 (USD Thousand)

Table 45 Market for File Streaming, By Region, 2017–2024 (USD Million)

Table 46 Market for File Streaming in North America, By Country, 2017–2024 (USD Thousand)

Table 47 Market for File Streaming in Europe, By Country, 2017–2024 (USD Thousand)

Table 48 Market for File Streaming in APAC, By Country, 2017–2024 (USD Thousand)

Table 49 Market for File Streaming in RoW, By Region, 2017–2024 (USD Thousand)

Table 50 Cloud Gaming Market, By Gamer Type, 2017–2024 (USD Million)

Table 51 Market for Casual Gamers, By Region, 2017–2024 (USD Million)

Table 52 Market for Avid Gamers, By Region, 2017–2024 (USD Million)

Table 53 Market for Hardcore Gamers, By Region, 2017–2024 (USD Thousand)

Table 54 Market, By Region, 2017–2024 (USD Million)

Table 55 Market in North America, By Country, 2017–2024 (USD Million)

Table 56 Market in North America, By Offering, 2017–2024 (USD Million)

Table 57 Market in North America, By Device Type, 2017–2024 (USD Thousand)

Table 58 Market in North America, By Solution Type, 2017–2024 (USD Million)

Table 59 Infrastructure Market in North America, By Gamer Type, 2017–2024 (USD Million)

Table 60 Market in US, By Offering, 2017–2024 (USD Million)

Table 61 Market in US, By Solution Type, 2017–2024 (USD Million)

Table 62 Market in Canada, By Offering, 2017–2024 (USD Thousand)

Table 63 Market in Canada, By Solution Type, 2017–2024 (USD Thousand)

Table 64 Market in Mexico, By Offering, 2017–2024 (USD Thousand)

Table 65 Market in Mexico, By Solution Type, 2017–2024 (USD Thousand)

Table 66 Market in Europe, By Country, 2017–2024 (USD Million)

Table 67 Market in Europe, By Offering, 2017–2024 (USD Million)

Table 68 Market in Europe, By Device Type, 2017–2024 (USD Thousand)

Table 69 Market in Europe, By Solution Type, 2017–2024 (USD Million)

Table 70 Market in Europe, By Gamer Type, 2017–2024 (USD Million)

Table 71 Market in Germany, By Offering, 2017–2024 (USD Million)

Table 72 Market in Germany, By Solution Type, 2017–2024 (USD Million)

Table 73 Market in UK, By Offering, 2017–2024 (USD Million)

Table 74 Market in UK, By Solution Type, 2017–2024 (USD Million)

Table 75 Market in France, By Offering, 2017–2024 (USD Million)

Table 76 Market in France, By Solution Type, 2017–2024 (USD Million)

Table 77 Market in Italy, By Offering, 2017–2024 (USD Thousand)

Table 78 Market in Italy, By Solution Type, 2017–2024 (USD Thousand)

Table 79 Market in Rest of Europe, By Offering, 2017–2024 (USD Million)

Table 80 Market in Rest of Europe, By Solution Type, 2017–2024 (USD Million)

Table 81 Market in APAC, By Country, 2017–2024 (USD Million)

Table 82 Market in APAC, By Offering, 2017–2024 (USD Million)

Table 83 Market in APAC, By Device Type, 2017–2024 (USD Thousand)

Table 84 Market in APAC, By Solution Type, 2017–2024 (USD Million)

Table 85 Market in APAC, By Gamer Type, 2017–2024 (USD Million)

Table 86 Market in China, By Offering, 2017–2024 (USD Million)

Table 87 Market in China, By Solution Type, 2017–2024 (USD Million)

Table 88 Market in Japan, By Offering, 2017–2024 (USD Million)

Table 89 Market in Japan, By Solution Type, 2017–2024 (USD Million)

Table 90 Market in South Korea, By Offering, 2017–2024 (USD Million)

Table 91 Market in South Korea, By Solution Type, 2017–2024 (USD Million)

Table 92 Market in Australia, By Offering, 2017–2024 (USD Thousand)

Table 93 Market in Australia, By Solution Type, 2017–2024 (USD Thousand)

Table 94 Market in Rest of APAC, By Offering, 2017–2024 (USD Thousand)

Table 95 Market in Rest of APAC, By Solution Type, 2017–2024 (USD Thousand)

Table 96 Market in RoW, By Region, 2017–2024 (USD Million)

Table 97 Market in RoW, By Offering, 2017–2024 (USD Million)

Table 98 Market in RoW, By Device Type, 2017–2024 (USD Thousand)

Table 99 Market in RoW, By Solution Type, 2017–2024 (USD Million)

Table 100 Market in RoW, By Gamer Type, 2017–2024 (USD Million)

Table 101 Market in Middle East & Africa, By Offering, 2017–2024 (USD Million)

Table 102 Market in Middle East & Africa, By Solution Type, 2017–2024 (USD Million)

Table 103 Market in South America, By Offering, 2017–2024 (USD Thousand)

Table 104 Cloud Gaming Market in South America, By Solution Type, 2017–2024 (USD Thousand)

Table 105 Partnerships, Collaborations, and Agreements, 2018–2019

Table 106 Product Launches, 2018–2019

Table 107 Expansions, 2018–2019

Table 108 Acquisitions, 2018–2019

List of Figures (50 Figures)

Figure 1 Cloud Gaming Market Segmentation

Figure 2 Cloud Gaming Market: Research Design

Figure 3 Cloud Gaming: Bottom-Up Approach

Figure 4 Cloud Gaming: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Market, By Offering, 2019 vs 2024 (USD Million)

Figure 7 Market, By Device Type, 2019 vs 2024 (USD Million)

Figure 8 Market, By Solution Type, 2019 vs 2024 (USD Million)

Figure 9 Market, By Gamer Type, 2019 vs 2024 (USD Million)

Figure 10 Market in APAC to Grow at Highest CAGR During Forecast Period

Figure 11 Commercialization of 5G to Drive Growth of Market

Figure 12 Gaming Platform Services to Account for Larger Market Size of Cloud Gaming in 2019

Figure 13 Market for Smartphones is Expected to Witness Highest CAGR During Forecast Period

Figure 14 Market for Video Streaming to Hold Larger Size in 2019

Figure 15 Market for Casual Gamers to Witness Highest Growth During Forecast Period

Figure 16 Market in China to Witness Highest CAGR During Forecast Period

Figure 17 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Market Drivers and Their Impact

Figure 19 Internet Users Traffic, 2010–2017

Figure 20 Market Restraint and Its Impact

Figure 21 Market Opportunities and Their Impact

Figure 22 Market Challenges and Their Impact

Figure 23 Market, By Offering

Figure 24 APAC is Expected to Account for Largest Market Size of Cloud Gaming Platform Services in 2019

Figure 25 Market, By Device Type

Figure 26 Video Streaming to Witness Higher Growth in Market for Gaming Consoles During Forecast Period

Figure 27 APAC to Hold Largest Size of Market for Smart Televisions in 2024

Figure 28 Market, By Solution Type

Figure 29 Market for Gaming Platform Services to Witness Higher CAGR During Forecast Period

Figure 30 Cloud Gaming Market, By Gamer Type

Figure 31 APAC is Expected to Lead Market for Hardcore Gamers in Coming Years

Figure 32 China is Expected to Witness Highest CAGR in Coming Years

Figure 33 North America: Snapshot of Cloud Gaming Market

Figure 34 Europe: Snapshot of Cloud Gaming Market

Figure 35 APAC: Snapshot of Cloud Gaming Market

Figure 36 RoW: Snapshot of Cloud Gaming Market

Figure 37 Companies Adopted Product Launches and Partnerships & Acquisitions as Key Growth Strategies From 2018 to 2019

Figure 38 Ranking of Key Players in Market, 2019

Figure 39 Market (Global) Competitive Leadership Mapping, 2018

Figure 40 Market Evaluation Framework: Expansions, Partnerships, and Acquisitions have Fueled Growth of Market From 2018 to 2019

Figure 41 NVIDIA: Company Snapshot

Figure 42 Intel Corporation: Company Snapshot

Figure 43 Google: Company Snapshot

Figure 44 Microsoft: Company Snapshot

Figure 45 Amazon: Company Snapshot

Figure 46 Advanced Micro Devices (AMD): Company Snapshot

Figure 47 Sony: Company Snapshot

Figure 48 IBM: Company Snapshot

Figure 49 Tencent: Company Snapshot

Figure 50 Alibaba: Company Snapshot

The study involved 4 major activities in estimating the current size of the cloud gaming market. Exhaustive secondary research has been conducted to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the cloud gaming market begins with capturing data on revenues of the key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical and commercial study of the cloud gaming market. Moreover, secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research has been mainly done to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to the cloud gaming market. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the ecosystem of the cloud gaming market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the overall size of the cloud gaming market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the cloud gaming market, in terms of value, by offering, devices, solution type, and gamer type

- To describe and forecast the market size, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the cloud gaming market for stakeholders and detail the competitive landscape for market players

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product launches, expansions, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cloud Gaming Market