Middle East Cloud Infrastructure Services Market by Service Type (PaaS, IaaS, CDN/ADN, Managed Hosting, Colocation Services, and DRaaS), Service Provider, Organization Size, Deployment Model, Industry Vertical, and Country - Forecast to 2022

[139 pages report] The Middle East Cloud Infrastructure Services Market size is expected to grow from USD 2.17 Billion in 2016 to USD 8.79 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 27.0% during the forecast period of 20172022. Major growth drivers of the market include initiatives by governments and corporates to promote technologies such as cloud and analytics, increasing use of cloud-dependent technologies such as Bring Your Own Device (BYOD) and Internet of Things (IoT), and business continuity requirements could drive demand for disaster recovery services. The base year considered for this report is 2016, and the market forecast period is 20172022.

Objectives of the Study

The main objective of the report is to define, describe, and forecast the Middle East cloud infrastructure services market by service types, service providers, deployment models, organization sizes, industry verticals, and countries. The report provides a detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report aims to strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market. The report attempts to forecast the market size with respect to countries, namely, Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Qatar, and other countries. The other countries include Bahrain, Egypt, Turkey, Israel, Oman, Kuwait, and Iran. The report strategically profiles key players and comprehensively analyzes their core competencies. It also tracks and analyzes competitive developments, such as partnerships, collaborations, and agreements; mergers and acquisitions; new product launches and new product developments; and Research and Development (R&D) activities in the Middle East cloud infrastructure services market.

Research Methodology

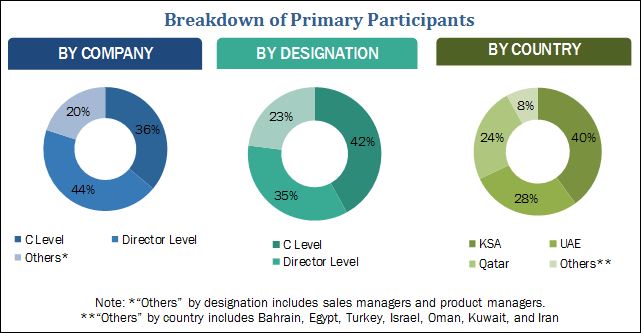

The research methodology used to estimate and forecast the Middle East cloud infrastructure services market began with capturing data on key vendor revenues through secondary research, which included directories and databases (D&B Hoovers, Bloomberg Businessweek, and Factiva). The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market that was derived from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The Middle East cloud infrastructure services ecosystem comprises vendors, such as IBM (US), Microsoft (US), Oracle (US), Amazon Web Services (US), HPE (US), Equinix (US), Cisco Systems (US), Etisalat (UAE), Injazat Data Systems (UAE), Malomatia (Qatar), Orixcom (UAE), eHosting Datafort (UAE), BIOS Middle East Group (UAE), Fujitsu (Japan), Cloud4c services (India), ez TECH (Oman), MK Enterprises (Qatar), iMED Solutions (UAE), Intertec Systems (UAE), JMR Infotech (India), Ooredoo (Qatar), STC Cloud (Saudi Arabia), Interkey Telecom & Technology (Saudi Arabia), Compro Information Technologies (Turkey), and DESistem (Istanbul). These Middle East Cloud Infrastructure Services Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Middle East Cloud Infrastructure Services.

Other stakeholders of the Middle East cloud infrastructure services market include cloud vendors, application design and development service providers, system integrators/migration service providers, consultancy firms/advisory firms, training and education service providers, data integration service providers, managed service providers, and data quality service providers.

Key Target Audience

- Service providers and distributors

- Middle East cloud infrastructure services application builders

- Analytics consulting companies

- Enterprises

- End-users

The study answers several questions for the stakeholders, primarily which market segments to focus on over the next 25 years for prioritizing efforts and investments.

Scope of the Report

The research report categorizes the Middle East cloud infrastructure services market to forecast the revenues and analyze the trends in each of the following subsegments:

By Service Type

- Colocation services

- Managed hosting

- Content Delivery Network/Application Delivery Network (CDN/ADN)

- Infrastructure as a Service (IaaS)

- Disaster Recovery as a Service (DRaaS)

- Platform as a Service (PaaS)

By Service Provider

- Cloud service provider

- Telecom service provider

- Managed service provider

By Deployment Model

- Public cloud

- Private cloud

- Hybrid cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Industry Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and IT

- Manufacturing

- Retail and eCommerce

- Government

- Travel and hospitality

- Media and entertainment

- Healthcare and Lifesciences

- Others (transportation and logistics, oil and gas, and education)

By Countries

- KSA

- UAE

- Qatar

- Others

- Egypt

- Turkey

- Israel

- Oman

- Kuwait

- Bahrain

- Iran

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of KSA cloud infrastructure services market

- Further breakdown of UAE cloud infrastructure services market

- Further breakdown of Qatar cloud infrastructure services market

- Further breakdown of other countries in the Middle East cloud infrastructure services market

Company Information

- Detailed analysis and profiling of additional market players up to 5.

Initiatives taken by governments and global cloud service providers to promote cloud and analytics technologies are driving the adoption of cloud infrastructure services in the Middle Eastern market.

The report provides detailed insights into the Middle East cloud infrastructure services market, which is segmented by service type, service provider, deployment model, organization size, industry vertical, and country. In the service type, the colocation services are expected to have the largest market share, followed by managed hosting services, during the forecast period. Vendors through cloud infrastructure services empower organizations to accomplish traditional enterprise workloads by offering an open private cloud deployment. The cloud infrastructure also enables users to develop an environment to embrace future-ready technologies with an advanced IT architecture.

The public cloud deployment model is expected to grow at a higher CAGR, owing to its increasing adoption. It can be attributed to the additional advantages offered by the public cloud over the private cloud offerings. However, the data security concerns are there in the public cloud.

In the organization size segment, the dominance of larger enterprises in terms of their market share is expected to continue during the forecast period. Despite the lower adoption to enable business continuity and embrace disaster recovery and backup services, the small and medium-sized enterprises (SMEs) are expected to grow at a higher CAGR than large enterprises.

The BFSI vertical is expected to have the largest market share, followed by the telecommunications and IT vertical, during the forecast period. However, the retail and wholesale vertical is expected expand at the highest CAGR during the forecast period.

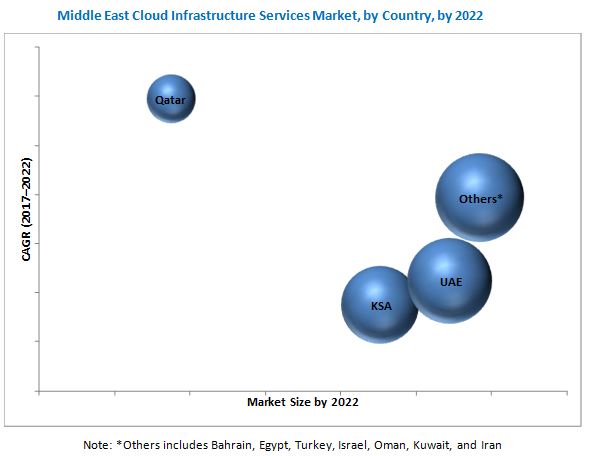

The report covers all the major aspects of the Middle East cloud infrastructure service market and provides an in-depth analysis for major countries such as Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Qatar, and other countries in the Middle Eastern region. KSA and UAE, being the early adopters of technologies along with the increasing presence of major industry players, are expected to continue their dominance in the Middle East cloud infrastructure services market during the forecast period. The other countries (Bahrain, Turkey, Egypt, Oman, Israel, and Iran) are gaining traction in terms of technology adoption. Qatar is expected to grow at the highest CAGR during the forecast period, owing to economic growth in the past few years.

Lack of high speed internet connectivity and increasing malware attacks in the connected infrastructure may affect the growth of Middle East cloud infrastructure services market.

The Middle East cloud infrastructure services ecosystem encompasses vendors, such as IBM (US), Microsoft (US), Oracle (US), Amazon Web Services (US), HPE (US), Equinix (US), Cisco Systems (US), Etisalat (UAE), Injazat Data Systems (UAE), Malomatia (Qatar), Orixcom (UAE), eHosting Datafort (UAE), BIOS Middle East Group (UAE), Fujitsu (Japan), Cloud4c services (India), ez TECH (Oman), MK Enterprises (Qatar), iMED Solutions (UAE), Intertec Systems (UAE), JMR Infotech (India), Ooredoo (Qatar), STC Cloud (Saudi Arabia), Interkey Telecom & Technology (Saudi Arabia), Compro Information Technologies (Turkey), and DESistem (Istanbul). Other stakeholders of the Middle East cloud infrastructure services market include vendors, research organizations, network and system integrators, cloud service providers, managed service providers, third-party providers, and technology providers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities

4.2 Middle East Cloud Infrastructure Services Market By Country

4.3 Market By Service Type and Industry Vertical

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Initiatives By Governments and Corporates to Promote Technologies Such as Cloud and Analytics

5.2.1.2 Increasing Use of Cloud-Dependent Technologies Such as Byod and IoT

5.2.1.3 Business Continuity Requirements Resulting in High Demand for Disaster Recovery Services

5.2.2 Restraints

5.2.2.1 Malware Attacks on Data in Connected Infrastructure

5.2.3 Opportunities

5.2.3.1 Rise in Managed IT Services

5.2.3.2 Telecom Service Providers Leveraging Existing Infrastructure

5.2.4 Challenges

5.2.4.1 Lack of High-Speed Network Connectivity

5.2.4.2 Workload Complexities in Cloud Environment

5.3 Use Cases

5.3.1 Use Case 1: ABU Dhabi Finance

5.3.2 Use Case 2: Mediclinic International

5.3.3 Use Case 3: Waha Capital

5.4 Regulatory Framework

5.4.1 UAE

5.4.1.1 UAE Civil Code: Number 5 of 1985 Or Civil Transaction Law

5.4.1.2 UAE Federal Law on the Prevention of Information Technology Crimes Number 2 of 2006

5.4.1.3 Federal Law No. (1) of 2006, Concerning Electronic Transactions and Ecommerce

5.4.1.4 Dubai International Financial Centre (DIFC) Law Number 5 of 2012

5.4.1.5 Electronic Transactions Law, DIFC Law No. 2 of 2017

5.4.2 Kingdom of Saudi Arabia

5.4.2.1 Law Number 20 of 2014 Pertaining to Electronic Transactions

5.4.2.2 Anti-Cyber Crimes Law

5.4.2.3 Saudi Arabia Telecommunications Act

5.4.2.4 Shariah Principles

5.4.3 Qatar

5.4.3.1 The Penal Code (Law 11 of 2004)

5.4.3.2 Electronic Commerce and Transactions Law

5.4.3.3 Telecommunications Law

5.4.3.4 The Banking Law (Law 33 of 2006)

5.4.3.5 QCert

5.4.3.6 Data Protection and Privacy Law in Qatar

6 Middle East Cloud Infrastructure Services Market Analysis, By Service Type (Page No. - 43)

6.1 Introduction

6.2 Platform as A Service

6.3 Infrastructure as A Service

6.4 Content Delivery Network/Application Delivery Network

6.5 Managed Hosting

6.6 Colocation Services

6.7 Disaster Recovery as A Service

7 Market Analysis, By Service Provider (Page No. - 54)

7.1 Introduction

7.2 Cloud Service Provider

7.3 Telecom Service Provider

7.4 Managed Service Provider

8 Middle East Cloud Infrastructure Services Market Analysis, By Deployment Model (Page No. - 59)

8.1 Introduction

8.2 Public Cloud

8.3 Private Cloud

8.4 Hybrid Cloud

9 Market Analysis, By Organization Size (Page No. - 67)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.3 Large Enterprises

10 Middle East Cloud Infrastructure Services Market Analysis, By Industry Vertical (Page No. - 71)

10.1 Introduction

10.2 BFSI

10.3 Telecommunications and IT

10.4 Manufacturing

10.5 Retail and Ecommerce

10.6 Government

10.7 Travel and Hospitality

10.8 Media and Entertainment

10.9 Healthcare and Lifesciences

10.10 Others

11 Country-Wise Analysis (Page No. - 81)

11.1 Introduction

11.2 Kingdom of Saudi Arabia

11.3 United Arab Emirates

11.4 Qatar

11.5 Other Countries

12 Competitive Landscape (Page No. - 95)

12.1 Market Ranking, By Key Player

13 Company Profiles (Page No. - 96)

13.1 Equinix

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

13.2 Cisco Systems

13.3 Microsoft

13.4 IBM

13.5 HPE

13.6 Amazon Web Services

13.7 Etisalat

13.8 Oracle

13.9 BIOS Middle East Group

13.10 Fujitsu

13.11 Ehosting Datafort

13.12 Injazat Data System

13.13 STC Cloud

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 131)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (64 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Middle East Cloud Infrastructure Services Market Size and Growth Rate, 20152022 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Service Type, 20152022 (USD Million)

Table 4 Platform as A Service: Market Size, By Country, 20152022 (USD Million)

Table 5 Platform as A Service: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 6 Infrastructure as A Service: Market Size, By Country, 20152022 (USD Million)

Table 7 Infrastructure as A Service: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 8 Content Delivery Network/Application Delivery Network: Market Size, By Country, 20152022 (USD Million)

Table 9 Content Delivery Network/Application Delivery Network: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 10 Managed Hosting: Market Size, By Country, 20152022 (USD Million)

Table 11 Managed Hosting: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 12 Colocation Services: Market Size, By Country, 20152022 (USD Million)

Table 13 Colocation Services: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 14 Disaster Recovery as A Service: Market Size, By Country, 20152022 (USD Million)

Table 15 Disaster Recovery as A Service: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 16 Market Size, By Service Provider, 20152022 (USD Million)

Table 17 Cloud Service Provider: Market Size, By Country, 20152022 (USD Million)

Table 18 Telecom Service Provider: Market Size, By Country, 20152022 (USD Million)

Table 19 Managed Service Provider: Market Size, By Country, 20152022 (USD Million)

Table 20 Middle East Cloud Infrastructure Services Market Size, By Deployment Model, 20152022 (USD Million)

Table 21 Public Cloud: Market Size, By Service Type, 20152022 (USD Million)

Table 22 Public Cloud: Market Size, By Country, 20152022 (USD Million)

Table 23 Public Cloud: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 24 Private Cloud: Market Size, By Service Type, 20152022 (USD Million)

Table 25 Private Cloud: Market Size, By Country, 20152022 (USD Million)

Table 26 Private Cloud: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 27 Hybrid Cloud: Market Size, By Service Type, 20152022 (USD Million)

Table 28 Hybrid Cloud: Market Size, By Country, 20152022 (USD Million)

Table 29 Hybrid Cloud: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 30 Market Size, By Organization Size, 20152022 (USD Million)

Table 31 Small and Medium-Sized Enterprises: Market Size, By Country, 20152022 (USD Million)

Table 32 Large Enterprises: Market Size, By Country, 20152022 (USD Million)

Table 33 Middle East Cloud Infrastructure Services Market Size, By Industry Vertical, 20152022 (USD Million)

Table 34 Banking, Financial, Services, and Insurance: Market Size, By Country, 20152022 (USD Million)

Table 35 Telecommunications and IT: Market Size, By Country, 20152022 (USD Million)

Table 36 Manufacturing: Market Size, By Country, 20152022 (USD Million)

Table 37 Retail and Ecommerce: Market Size, By Country, 20152022 (USD Million)

Table 38 Government: Market Size, By Country, 20152022 (USD Million)

Table 39 Travel and Hospitality: Market Size, By Country, 20152022 (USD Million)

Table 40 Media and Entertainment: Market Size, By Country, 20152022 (USD Million)

Table 41 Healthcare and Lifesciences: Market Size, By Country, 20152022 (USD Million)

Table 42 Others: Market Size, By Country, 20152022 (USD Million)

Table 43 Middle East Cloud Infrastructure Services Market Size, By Country, 20152022 (USD Million)

Table 44 Kingdom of Saudi Arabia: Market Size, By Service Type, 20152022 (USD Million)

Table 45 Kingdom of Saudi Arabia: Market Size, By Service Provider, 20152022 (USD Million)

Table 46 Kingdom of Saudi Arabia: Market Size, By Deployment Model, 20152022 (USD Million)

Table 47 Kingdom of Saudi Arabia: Market Size, By Organization Size, 20152022 (USD Million)

Table 48 Kingdom of Saudi Arabia: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 49 United Arab Emirates: Middle East Cloud Infrastructure Services Market Size, By Service Type, 20152022 (USD Million)

Table 50 United Arab Emirates: Market Size, By Service Provider, 20152022 (USD Million)

Table 51 United Arab Emirates: Market Size, By Deployment Model, 20152022 (USD Million)

Table 52 United Arab Emirates: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 United Arab Emirates: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 54 Qatar: Middle East Cloud Infrastructure Services Market Size, By Service Type, 20152022 (USD Million)

Table 55 Qatar: Market Size, By Service Provider, 20152022 (USD Million)

Table 56 Qatar: Market Size, By Deployment Model, 20152022 (USD Million)

Table 57 Qatar: Market Size, By Organization Size, 20152022 (USD Million)

Table 58 Qatar: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 59 Others: Middle East Cloud Infrastructure Services Market Size, By Service Type, 20152022 (USD Million)

Table 60 Others: Market Size, By Service Provider, 20152022 (USD Million)

Table 61 Others: Market Size, By Deployment Model, 20152022 (USD Million)

Table 62 Others: Market Size, By Organization Size, 20152022 (USD Million)

Table 63 Others: Market Size, By Industry Vertical, 20152022 (USD Million)

Table 64 Market Ranking of the Key Players in the Market, 2017

List of Figures (34 Figures)

Figure 1 Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Assumptions

Figure 8 Middle East Cloud Infrastructure Services Market (2015-2022)

Figure 9 Market Snapshot, By Service Type (2017 vs 2022)

Figure 10 Market Snapshot, By Deployment Model (2017)

Figure 11 Market Snapshot, By Organization Size (2017 vs 2022)

Figure 12 Market Snapshot, By Industry Vertical (2017 vs 2022)

Figure 13 Rise in Managed IT Services is Expected to Create Attractive Opportunities for the Market During the Forecast Period

Figure 14 Qatar is Estimated to Grow at the Highest CAGR in the Middle East Cloud Infrastructure Services Market During the Forecast Period

Figure 15 Colocation Service Type and BFSI Vertical are Estimated to Have the Largest Market Shares in 2017

Figure 16 Middle East Cloud Infrastructure Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Disaster Recovery as A Service Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 18 Managed Service Providers Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 19 Public Cloud Deployment Model is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 20 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Retail and Wholesale is Expected to Have the Highest Growth Rate During the Forecast Period

Figure 22 Qatar is Expected to Grow at the Highest CAGR in the Middle East Cloud Infrastructure Services Market During the Forecast Period

Figure 23 Kingdom of Saudi Arabia: Market Snapshot

Figure 24 Qatar: Market Snapshot

Figure 25 Equinix: Company Snapshot

Figure 26 Cisco Systems: Company Snapshot

Figure 27 Microsoft: Company Snapshot

Figure 28 IBM: Company Snapshot

Figure 29 HPE: Company Snapshot

Figure 30 Amazon Web Services: Company Snapshot

Figure 31 Etisalat: Company Snapshot

Figure 32 Oracle: Company Snapshot

Figure 33 Fujitsu: Company Snapshot

Figure 34 STC Cloud: Company Snapshot

Growth opportunities and latent adjacency in Middle East Cloud Infrastructure Services Market