Cloud RAN Market by Component (Solution and Services), Network Type, Deployment (Cloud and Centralized), End User (Telecom Operators and Enterprises), and Region - Global Forecast to 2025

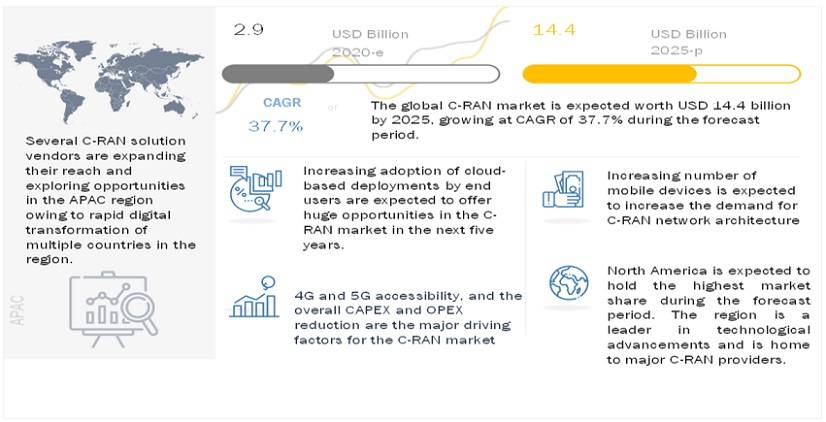

[229 Pages Report] The Cloud RAN Market size is projected to grow from USD 2.9 billion in 2020 to USD 14.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 37.7% during the forecast period. Cloud RAN helps in virtualizing networks. These virtual networks are then customized to meet the specific needs of applications, services, devices, customers, and operators. Cloud RAN also helps network operators provide dedicated virtual networks with functionalities specific to customer needs, over common network infrastructure. Additionally, it provides greater insights into network resource utilization with each customized network to match the level of delivery complexity required by supported services.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global Cloud RAN Market

The quick spread of the coronavirus has created a health crisis and triggered a massive financial crisis worldwide. During this difficult time, Communication Service Providers (CSPs) around the world are facing four operational challenges—securing their network data, maintaining operational continuity, adapting to new traffic patterns, and assuring the quality for key services—during the COVID-19 crisis. COVID-19 has pushed legacy processes well beyond peak capacity, exposing their inefficiencies and reliance on manual processing. Due to the pandemic, enterprises have focused more on understanding the exact role automation plays in digital transformation and, ultimately, how to measure its ROI as compared to other competing initiatives. This is expected to have a considerable effect on the Cloud RAN Market, which would drive and achieve momentum.

Market Dynamics

Driver: Increase in the demand for 5G network technologies

Many telecom companies are implementing 5G services for enhancing their service capabilities. Many regions are expected to rapidly adopt 5G services in the upcoming years. The present race of becoming the top leader in 5G delivery is expected to boost Cloud RAN investments. 5G is expected to deliver high bandwidth with less latency. 5G caters to various networking requirements, including enormous capacity users, which eventually lead to enormous connectivity concerns. There is also a concern over the efficient use of spectrum and network resources to reduce Total Cost of Ownership (TCO). The rising demand for 5G network technologies is expected to increase the demand for Cloud RAN network solutions and services in the coming years.

Restraint: Need for high fronthaul capacities restricts the market growth

A big challenge for Cloud RAN recognition is the fronthaul issue. Fronthaul connections are links between BBUs and RRUs. The widely used interface between BBUs and RRUs is Common Public Radio Interface (CPRI), which transfers digitized radio signals as input/output samples. Due to a rise in the demand for the CPRI data rate, the optical fibers are mostly used for the fronthaul technology. In the present situation, fronthaul solutions are CPRIs.

Opportunity: Increase in the number of internet users around the world

Increased internet connectivity around the world has created a new opportunity for telecom service providers to increase their revenue; however, there is a challenge for telecom players to meet the ever-increasing customer expectations such as low latency, high bandwidth, and more uptime to survive the competition in the market. Telecom players are investing heavily in capitalizing on this new opportunity. The increasing investment by telecom players in infrastructure is driving the growth of the Cloud RAN Market. As the number of internet users are increasing and expected to grow significantly in the upcoming years, the demand for Cloud RAN is also expected to rise.

Challenge: Security threats

The open broadcast nature of wireless architectures makes them vulnerable to new attacks, such as unauthorized or illegitimate access to sensitive information. From the perspective of Open Systems Interconnection (OSI) network protocol architecture, malicious attacks can take place in different layers. Cloud RAN is inherited from Cognitive Radio Networks (CRNs) and has a wire-less network at its core; therefore, it also faces many common security threats such as Primary User Emulation Attack (PUEA) and Spectrum Sensing Data Falsification (SSDF) attacks. As a comparatively new network architecture, due to its transmission and self-deploying nature, it faces more serious security threats and trust problems than traditional wireless networks and CRNs.

Solution segment is estimated to grow at higher growth rate during the forecast period

The Cloud RAN solution implements the Data Center Network technology to enable low-cost, high reliability, low latency, and high bandwidth interconnections between BBU pools. Cloud RAN requires less components, leading to low energy consumption, maintenance costs, and rental costs. It also optimizes the Capital Expenditure (CAPEX) and Operating Expenditure (OPEX) for network operators and improves network security as it is centralized. Enterprises have also benefited from enhanced capacity and coverage. Cloud RAN can be self-optimized, self-configured, and self-adaptable using Software-Defined Network (SDN) or Network Functions Virtualization (NFV).

Cloud segment to lead the Cloud RAN Market during the forecast period

Cloud-RAN is the evolution version of Centralized-RAN, wherein BBU are virtualized. It reduces the maintenance cost of virtual BBUs as they are stored in data center storages. These data centers possess efficient information exchange and can perform extensive computation that is difficult in current networks. As it is possible to virtualize after centralization is complete, cloud Cloud RAN exploits a combination of both virtualization and centralization. Thus, all organizations have already completed or started to centralize to make transition to Cloud RAN.

Enterprises segment to grow at a higher CAGR during the forecast period

Enterprises make the use of Cloud RAN to deploy in-building network solutions as it provides enhanced coverage and capacity. The centralization of BBUs greatly reduces TCO; however, it can be self-optimized, self-configured, and self-adaptable using SDN or NFV. This reduces power and maintenance costs and provides improved performance and efficiency. This also enables networks to be replaced or enhanced easily as per future requirements.

4G network type to lead the Cloud RAN Market during the forecast period

LTE or 4G was first introduced in 2009. It has brought several important changes, which include higher backhaul capacity to cells, the use of RRUs on towers, and centralized BBUs. It has introduced the use of Multiple Input Multiple Output (MIMO) antennas to increase the capacity of air interference between towers and User Equipment (UE). Cloud RAN architectures based on LTE systems can have a maximum distance of 20 km in fiber links between RRUs and BBUs.

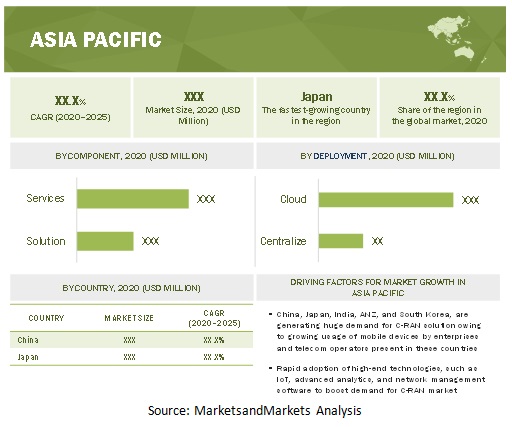

Asia Pacific to grow at highest CAGR during the forecast period

APAC is projected to grow at a higher rate during the forecast period. With the constant rise in mobile data traffic, APAC tends to hold significant potential in terms of Cloud RAN deployments as the region is witnessing major spending in the Cloud RAN Market. The transition of mindsets from traditional RAN architectures to Cloud RAN architectures has been leading to large-scale investments in the telecom industry, apparently spreading the scope of Cloud RAN. In the APAC region, the real opportunity for Cloud RAN deployments lies particularly in regions where there are ample amounts of fiber available for transportation. This, in turn, provides tremendous opportunities for Cloud RAN vendors as fiber availability is a critical requirement for Cloud RAN deployments.

Key Market Players

The Cloud RAN Market comprises key solution and service providers, such as Nokia, Huawei, Ericsson, ZTE, NEC, Cisco, Samsung, Altiostar, Fujitsu, Intel, Mavenir, ASOCS, Radisys, CommScope, Artiza Networks, Anritsu, 6WIND, EXFO, Airspan, VIAVI, Infinera, Texas Instruments, Amphenol, Xilinx, Dali Wireless, and Casa Systems. These players have adopted various strategies to grow in the global Cloud RAN Market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, Deployment, End User, Network type |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Nokia, Huawei, Ericsson, ZTE, NEC, Cisco, Samsung, Altiostar, Fujitsu, Intel, Mavenir, ASOCS, Radisys, CommScope, Artiza Networks, Anritsu, 6WIND, EXFO, Airspan, VIAVI, Infinera, Texas Instruments, Amphenol, Xilinx, Dali Wireless, and Casa Systems |

This research report categorizes the Cloud RAN Market to forecast revenues and analyze trends in each of the following subsegments:

Based on components, the Cloud RAN Market has the following segments:

- Solution

-

Services

- Consulting Services

- Implementation Services

- Support Services

Based on deployment, the market has the following segments:

- Centralized

- Cloud

Based on end user, the Cloud RAN Market has the following segments:

- Telecom Operators

- Enterprises

Based on network type, the market has the following segments:

- 5G

- 4G

- 3G and 2G

Based on region, the Cloud RAN Market has the following segments:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of MEA

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

Recent Developments

- In November 2020, Ericsson in collaboration with Telia, a Swedish telecommunication service provider, announced the introduction of 5G in Estonia. Both companies would use resources from Ericsson Radio System and hardware produced locally. 5G rollouts were observed in three cities and are estimated to be available in 20 cities by the end of this year.

- In April 2020, ZTE collaborated with Red Hat, a leading global provider of open-source solutions, to deploy open 5G networks in China. This was accomplished by combining Red Hat’s OpenStack platform with ZTE’s hardware.

- In March 2020, Nokia acquired Elenion Technologies, a US-based company focusing on the photonics technology. The company aims at expanding by utilizing Elenion Technologies’ expertise and unique design platform to improve the optical connectivity of 5G, cloud, and enterprise networking.

- In October 2019, NEC announced the launch of FIWARE-based smart cities platform in India. The new product is based on FIWARE foundation’s open source platform, which supports Next Generation Service Interfaces (NGSIs). The platform is ideal for smooth integrations with smart city projects that accumulate data from a wide range of small city applications.

- In March 2019, Huawei announced the release of Telco Cloud Networking Solution. This solution aims at delivering the first end-to-end 400G DC network architecture and enables carriers to offer innovative services, enabling 5G, IoT, and VR over flexible network architectures.

Frequently Asked Questions (FAQ):

How is Cloud RAN Market expected to grow in next five years?

According to MarketsandMarkets, the global Cloud RAN Market size is projected to grow from USD 2.9 billion in 2020 to USD 14.4 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 37.7% during the forecast period.

What region holds the highest market share in the Cloud RAN Market?

North America has the highest market share in the Cloud RAN Market due to early adoption of technology and presence of various solution providers.

What are the major factors driving the growth of Cloud RAN Market?

The major drivers for the Cloud RAN Market include the rapid increase in bandwidth demand, increase in the demand for 5G network technologies, and the need for lower CAPEX and OPEX.

Who are the major vendors in the Cloud RAN Market?

The major vendors in the Cloud RAN Market include Nokia, Huawei, Ericsson, ZTE, and NEC. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECAST FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2016–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 6 CLOUD RAN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of Primary Profiles

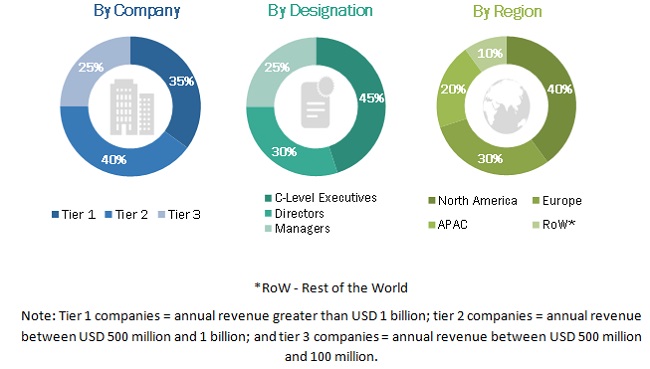

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key Industry Insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 CLOUD RAN MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES OF MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 TOP-DOWN (DEMAND SIDE): SHARE OF CLOUD RAN MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS FOR THE STUDY

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 12 SERVICES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 TELECOM OPERATORS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 CLOUD SEGMENT TO ACCOUNT FOR HIGHER MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN CLOUD RAN MARKET

FIGURE 15 NEED FOR REDUCTION IN CAPITAL EXPENDITURE AND OPERATIONAL EXPENDITURE TO DRIVE MARKET GROWTH

4.2 MARKET IN ASIA PACIFIC, BY COMPONENT AND COUNTRY

FIGURE 16 SOLUTION SEGMENT AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 17 MEXICO TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 62)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CLOUD RAN MARKET

5.2.1 DRIVERS

5.2.1.1 Rapid increase in bandwidth demand

5.2.1.2 Increase in the demand for 5G network technologies

FIGURE 19 GLOBAL MOBILE CONNECTIONS BY NETWORK TYPE–2023 REGIONAL (% SHARE)

5.2.1.3 Need for lower CAPEX and OPEX

5.2.2 RESTRAINT

5.2.2.1 Need for high fronthaul capacity restricts the market growth

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in the number of internet users around the world

FIGURE 20 INTERNET USERS BY REGION, 2018–2023 (%SHARE)

5.2.3.2 Rise in the demand for network connectivity to implement IoT

5.2.4 CHALLENGES

5.2.4.1 Security threats

5.2.4.2 Demand for diverse and challenging services

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 CUMULATIVE GROWTH ANALYSIS

5.4 CLOUD RAN MARKET: ECOSYSTEM

FIGURE 21 CLOUD RAN ECOSYSTEM

5.5 MARKET: VALUE CHAIN

FIGURE 22 CLOUD RAN VALUE CHAIN

5.6 TECHNOLOGY ANALYSIS

TABLE 3 TECHNOLOGY ENABLERS IN CLOUD RAN

5.7 CASE STUDIES

5.7.1 CASE STUDY 1: ARTIZA PROVIDED CLOUD RAN SOLUTIONS TO NTT DOCOMO

5.7.2 CASE STUDY 2: DISH CHOSE ALTIOSTAR’S CLOUD-NATIVE O-RAN COMPLIANT SOLUTION FOR COUNTRY-WIDE 5G NETWORK BUILDOUT

5.7.3 CASE STUDY 3: BHARTI AIRTEL DEPLOYED ALTIOSTAR’S OPEN VIRTUALIZED RADIO ACCESS NETWORK SOLUTION

5.8 REGULATORY LANDSCAPE

5.8.1 FEDERAL COMMUNICATIONS COMMISSION

5.8.2 OFFICE OF COMMUNICATIONS

5.8.3 MINISTRY OF INDUSTRY AND INFORMATION TECHNOLOGY

5.8.4 TELECOMMUNICATIONS REGULATORY AUTHORITY

5.8.5 FEDERAL TELECOMMUNICATIONS INSTITUTE

5.8.6 GENERAL DATA PROTECTION REGULATION

5.8.7 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

5.9 PATENT ANALYSIS

FIGURE 23 EUROPE PATENT APPLICATION, BY COUNTRY

FIGURE 24 EUROPE PATENT APPLICATION, BY TECHNOLOGY FIELD

FIGURE 25 EUROPE PATENT APPLICATION: DIGITAL TECHNOLOGY, BY APPLICANT

FIGURE 26 STANDARD ESSENTIAL PATENTS: 5G

FIGURE 27 4G- AND 5G-DECLARED PATENT PORTFOLIOS BY COMPANIES

6 CLOUD RAN MARKET, BY COMPONENT (Page No. - 75)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

6.1.2 COMPONENTS: MARKET DRIVERS

FIGURE 28 SERVICES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 4 CLOUD RAN MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 5 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTION

6.2.1 BASE BAND UNITS

6.2.2 REMOTE RADIO UNITS

TABLE 6 SOLUTION: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 SOLUTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 SERVICES

FIGURE 29 SUPPORT SERVICES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 8 SERVICES: CLOUD RAN MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 10 SERVICES: MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 11 SERVICES: CLOUD RAN MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

6.3.1 CONSULTING SERVICES

TABLE 12 CONSULTING SERVICES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 CONSULTING SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2 IMPLEMENTATION SERVICES

TABLE 14 IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.3 SUPPORT SERVICES

TABLE 16 SUPPORT SERVICES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SUPPORT SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 CLOUD RAN MARKET, BY NETWORK TYPE (Page No. - 85)

7.1 INTRODUCTION

7.1.1 NETWORK TYPES: COVID-19 IMPACT

7.1.2 NETWORK TYPES: MARKET DRIVERS

FIGURE 30 4G SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 18 MARKET SIZE, BY NETWORK TYPE, 2016–2019 (USD MILLION)

TABLE 19 MARKET SIZE, BY NETWORK TYPE, 2019–2025 (USD MILLION)

7.2 5G

TABLE 20 5G: CLOUD RAN MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 5G: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 4G

TABLE 22 4G: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 4G: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 3G AND 2G

TABLE 24 3G AND 2G: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 3G AND 2G: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 CLOUD RAN MARKET, BY DEPLOYMENT (Page No. - 91)

8.1 INTRODUCTION

8.1.1 DEPLOYMENTS: COVID-19 IMPACT

8.1.2 DEPLOYMENTS: MARKET DRIVERS

FIGURE 31 CLOUD SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 26 MARKET SIZE, BY DEPLOYMENT, 2016–2019 (USD MILLION)

TABLE 27 CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2019–2025 (USD MILLION)

8.2 CLOUD

TABLE 28 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 CENTRALIZED

TABLE 30 CENTRALIZED: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 CENTRALIZED: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 CLOUD RAN MARKET, BY END USER (Page No. - 96)

9.1 INTRODUCTION

9.1.1 END USERS: COVID-19 IMPACT

9.1.2 END USERS: MARKET DRIVERS

FIGURE 32 TELECOM OPERATORS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 32 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 33 CLOUD RAN MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

9.2 TELECOM OPERATORS

TABLE 34 TELECOM OPERATORS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 TELECOM OPERATORS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 ENTERPRISES

TABLE 36 ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 CLOUD RAN MARKET, BY REGION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: REGULATORY IMPLICATIONS

10.2.2 NORTH AMERICA: CLOUD RAN MARKET DRIVERS

10.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 38 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

TABLE 42 NORTH AMERICA: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019-2025 (USD MILLION)

10.2.4 UNITED STATES

TABLE 50 UNITED STATES: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 51 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 52 UNITED STATES: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 53 UNITED STATES: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 54 UNITED STATES: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 55 UNITED STATES: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 56 UNITED STATES: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 57 UNITED STATES: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.2.5 CANADA

TABLE 58 CANADA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 59 CANADA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 60 CANADA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 61 CANADA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 62 CANADA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 63 CANADA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 64 CANADA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 65 CANADA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: REGULATORY IMPLICATIONS

10.3.2 EUROPE: CLOUD RAN MARKET DRIVERS

10.3.3 EUROPE: COVID-19 IMPACT

TABLE 66 EUROPE: MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 71 EUROPE: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2019-2025 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 78 UNITED KINGDOM: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 79 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 80 UNITED KINGDOM: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 81 UNITED KINGDOM: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 82 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 83 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 84 UNITED KINGDOM: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.3.5 GERMANY

TABLE 86 GERMANY: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 88 GERMANY: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 90 GERMANY: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 91 GERMANY: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 92 GERMANY: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 93 GERMANY: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 94 REST OF EUROPE: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 96 REST OF EUROPE: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 97 REST OF EUROPE: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 98 REST OF EUROPE: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: REGULATORY IMPLICATIONS

10.4.2 ASIA PACIFIC: CLOUD RAN MARKET DRIVERS

10.4.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019-2025 (USD MILLION)

10.4.4 CHINA

TABLE 114 CHINA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 115 CHINA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 116 CHINA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 117 CHINA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 118 CHINA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 120 CHINA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.4.5 JAPAN

TABLE 122 JAPAN: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 123 JAPAN: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 124 JAPAN: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 125 JAPAN: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 126 JAPAN: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 127 JAPAN: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 128 JAPAN: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 129 JAPAN: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 130 REST OF ASIA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 131 REST OF ASIA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 132 REST OF ASIA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 133 REST OF ASIA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 134 REST OF ASIA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 135 REST OF ASIA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 136 REST OF ASIA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 137 REST OF ASIA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

10.5.2 MIDDLE EAST AND AFRICA: CLOUD RAN MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 138 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 139 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 140 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 141 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019-2025 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 150 KINGDOM OF SAUDI ARABIA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 151 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 152 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 153 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 154 KINGDOM OF SAUDI ARABIA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 155 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 156 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 157 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.5.5 UNITED ARAB EMIRATES

TABLE 158 UNITED ARAB EMIRATES: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 159 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 160 UNITED ARAB EMIRATES: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 161 UNITED ARAB EMIRATES: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 162 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 163 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 164 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 165 UNITED ARAB EMIRATES: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 166 REST OF MIDDLE EAST AND AFRICA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 167 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 169 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 170 REST OF MIDDLE EAST AND AFRICA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 171 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 172 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 173 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: REGULATORY IMPLICATIONS

10.6.2 LATIN AMERICA: CLOUD RAN MARKET DRIVERS

10.6.3 LATIN AMERICA: COVID-19 IMPACT

TABLE 174 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016-2019 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019-2025 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 179 LATIN AMERICA: CLOUD RAN MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016-2019 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019-2025 (USD MILLION)

10.6.4 BRAZIL

TABLE 186 BRAZIL: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 187 BRAZIL: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 188 BRAZIL: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 189 BRAZIL: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 190 BRAZIL: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 191 BRAZIL: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 192 BRAZIL: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 193 BRAZIL: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.6.5 MEXICO

TABLE 194 MEXICO: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 195 MEXICO: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 196 MEXICO: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 197 MEXICO: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 198 MEXICO: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 199 MEXICO: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 200 MEXICO: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 201 MEXICO: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 202 REST OF LATIN AMERICA: CLOUD RAN MARKET SIZE, BY COMPONENT, 2016-2019 (USD MILLION)

TABLE 203 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019-2025 (USD MILLION)

TABLE 204 REST OF LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2016-2019 (USD MILLION)

TABLE 205 REST OF LATIN AMERICA: MARKET SIZE, BY NETWORK TYPE, 2019-2025 (USD MILLION)

TABLE 206 REST OF LATIN AMERICA: CLOUD RAN MARKET SIZE, BY DEPLOYMENT, 2016-2019 (USD MILLION)

TABLE 207 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2019-2025 (USD MILLION)

TABLE 208 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2016-2019 (USD MILLION)

TABLE 209 REST OF LATIN AMERICA: MARKET SIZE, BY END USER, 2019-2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 159)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK, 2018-2020

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 37 REVENUE ANALYSIS OF CLOUD RAN MARKET

11.4 HISTORICAL REVENUE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 38 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

11.5 RANKING OF KEY PLAYERS IN MARKET, 2020

FIGURE 39 RANKING OF KEY PLAYERS, 2020

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 40 CLOUD-RADIO ACCESS MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 164)

12.1 INTRODUCTION

(Business Overview, Solutions and Products Offered, Recent Developments, and MnM View)*

12.2 CISCO

FIGURE 41 CISCO: COMPANY SNAPSHOT

12.3 NOKIA

FIGURE 42 NOKIA: COMPANY SNAPSHOT

12.4 HUAWEI

FIGURE 43 HUAWEI: COMPANY SNAPSHOT

12.5 NEC

FIGURE 44 NEC: COMPANY SNAPSHOT

12.6 SAMSUNG

FIGURE 45 SAMSUNG: COMPANY SNAPSHOT

12.7 ERICSSON

FIGURE 46 ERICSSON: COMPANY SNAPSHOT

12.8 ALTIOSTAR

12.9 ZTE

FIGURE 47 ZTE: COMPANY SNAPSHOT

12.10 FUJITSU

FIGURE 48 FUJITSU: COMPANY SNAPSHOT

12.11 INTEL

FIGURE 49 INTEL: COMPANY SNAPSHOT

* Business Overview, Solutions and Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.12 MAVENIR

12.13 ASOCS

12.14 RADISYS

12.15 COMMSCOPE

12.16 ARTIZA NETWORKS

12.17 ANRITSU

12.18 6WIND

12.19 EXFO

12.20 AIRSPAN

12.21 VIAVI

12.22 INFINERA

12.23 TEXAS INSTRUMENTS

12.24 AMPHENOL

12.25 XILINX

12.26 DALI WIRELESS

12.27 CASA SYSTEM

13 APPENDIX (Page No. - 209)

13.1 ADJACENT/RELATED MARKETS

13.1.1 5G INFRASTRUCTURE MARKET

13.1.1.1 Market definition

13.1.1.2 Limitations of the study

13.1.1.3 Market overview

13.1.1.4 5G infrastructure market, by communication infrastructure

TABLE 210 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 211 COMMUNICATION INFRASTRUCTURE: 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 212 5G COMMUNICATION INFRASTRUCTURE MARKET IN ROW, BY REGION, 2018–2027 (USD MILLION)

TABLE 213 5G COMMUNICATION INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

13.1.1.5 5G infrastructure market, by region

TABLE 214 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 215 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 216 5G INFRASTRUCTURE MARKET IN CANADA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 217 5G INFRASTRUCTURE MARKET IN MEXICO, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 218 5G INFRASTRUCTURE MARKET IN EUROPE, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 219 5G INFRASTRUCTURE MARKET IN GERMANY, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 220 5G INFRASTRUCTURE MARKET IN ITALY, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 221 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 222 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 223 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 224 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 225 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY END USER, 2018–2027 (USD MILLION)

TABLE 226 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 227 5G INFRASTRUCTURE MARKET IN JAPAN, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 228 5G INFRASTRUCTURE MARKET IN JAPAN, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 229 5G INFRASTRUCTURE MARKET IN REST OF ASIA PACIFIC, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 230 5G INFRASTRUCTURE MARKET IN REST OF THE WORLD, BY REGION, 2018–2027 (USD MILLION)

TABLE 231 5G INFRASTRUCTURE MARKET IN REST OF THE WORLD, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 232 5G INFRASTRUCTURE MARKET IN REST OF THE WORLD, BY END USER, 2018–2027 (USD MILLION)

TABLE 233 5G INFRASTRUCTURE MARKET IN REST OF THE WORLD, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 234 5G INFRASTRUCTURE MARKET IN MIDDLE EAST AND AFRICA, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 235 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 236 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

13.1.2 LTE AND 5G BROADCAST MARKET

13.1.2.1 Market definition

13.1.2.2 Limitations of the study

13.1.2.3 Market overview

13.1.2.4 LTE and 5G broadcast market, by technology

TABLE 237 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 238 5G BROADCAST: LTE AND 5G BROADCAST MARKET, BY END USER, 2015–2024 (USD MILLION)

13.1.2.5 LTE and 5G broadcast market, by region

TABLE 239 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 240 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 241 EUROPEAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 242 EUROPEAN LTE AND 5G BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 243 ASIA PACIFIC LTE AND 5G BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 244 REST OF THE WORLD LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities to estimate the current market size for the Cloud RAN market. An exhaustive secondary research was done to collect information on the Cloud RAN market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Cloud RAN market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Business Week, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard, and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Cloud RAN market comprises several stakeholders, such as Cloud RAN operators, Cloud RAN service providers, venture capitalists, government organizations, regulatory authorities, policy makers and financial organizations, consulting firms, research organizations, academic institutions, resellers and distributors, and training providers. The demand side of the Cloud RAN market consists of all the firms operating in several industry verticals. The supply side includes Cloud RAN providers, offering Cloud RAN solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top Down Approach

In the top-down approach, an exhaustive list of all the vendors who offer solutions and services in the Cloud RAN market was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their offerings by solution and service. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Further, each sub segment was studied and analyzed for its global market size and regional penetration.

Bottom Up Approach

The bottom-up procedure was employed to arrive at the overall market size of the Cloud RAN market from the revenues of the key players (companies) and their market shares. The calculation was done based on estimations and by verifying their revenues through extensive primary interviews. Calculations based on the revenues of the key companies identified in the market led to the overall market size. The overall market size was used in the top-down procedure to estimate the size of the other individual segments (offering, deployment mode, organization size, vertical, and region) via percentage splits of market segments from the secondary and primary research. The bottom-up procedure was also implemented for the data extracted from the secondary research to validate the market segment revenues obtained.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the size of the Cloud RAN market, by component, deployment, end user, network type, and region, in terms of value

- To describe and forecast the size of the market segments with respect to 5 main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Cloud RAN market

- To analyze the impact of COVID-19 on segments of the Cloud RAN market

- To analyze each subsegment with respect to the individual growth trends, prospects, and contributions to the overall Cloud RAN market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To analyze competitive developments such as mergers and acquisitions (M&A); product launches and product enhancements; agreements, partnerships, and collaborations; business expansions; and research and development (R&D) activities in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Company Analysis

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Cloud RAN Market