Condensing Unit Market by Type (Air-cooled, Water-cooled), Application (Industrial, Commercial, Transportation), Function (Air Conditioning, Refrigeration, Heat Pumps), Refrigerant Type, Compressor Type and Region - Global Forecast to 2027

Updated on : August 06, 2024

Condensing Unit Market

The global condensing unit market was valued at USD 39.0 billion in 2022 and is projected to reach USD 57.1 billion by 2027, growing at 7.9% cagr from 2022 to 2027. The Asia Pacific region is one of the largest consumers of condensing units, with China leading the regional market.

To know about the assumptions considered for the study, Request for Free Sample Report

Condensing Unit Market Dynamics

Drivers: Growing retail sector in emerging economies

Steadily growing economies such as China, India, Thailand, and Malaysia are expected to register healthy industrial growth during the forecast period leading to the growth of the global condensing unit market as well. The growth of end-use sectors in these economies, such as supermarkets and retail chains, can be attributed to the increase in per capita disposable income of consumers and their changing lifestyles.

Opportunity: Technological advancements leading to the introduction of efficient condensing units

There is an increase in demand for condensing units due to technological advancements, for instance, the introduction of the latest models like the Copeland Scroll XJ Series for outdoor applications. The introduction of efficient condensing units will lead to a reduction in their replacement requirements, thus acting as a major contributor to the growth of the condensing unit market.

Based on type, the air-cooled segment is expected to lead the condensing unit market in terms of volume from 2022 to 2027.

Based on type, the air-cooled segment is projected to lead during the forecast period by volume. Air-cooled condensing units have easy installation and low maintenance features. Also, growing industrialization offers significant opportunities for the use of high-performance air-cooled condensing units in the Asia Pacific region.

Based on the application, the commercial segment is expected to lead the condensing unit market in terms of volume from 2022 to 2027.

Based on application, the commercial application is projected to lead during the forecast period by volume. The strategic developments undertaken by several players offering condensing units for commercial applications is propelling the demand for this segment. For instance, in April 2021, Panasonic installed five CO2 condensing units in Ireland. The condensing units can be used in walk-in freezers, cold rooms, and refrigerators.

Based on function, the air conditioning segment is expected to lead the condensing unit market in terms of volume from 2022 to 2027

Based on function, the air conditioning segment is projected to lead during the forecast period by volume, owing to the growth of cold storage sector. The cold storage sector is expected to increase its consumption of condensing units globally to meet the growing demand for frozen foods.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific condensing unit market is expected to lead during the forecast period in terms of value. This growth is expected due to an increase in sales of ready-to-eat or ready-to-cook food products such as ice creams and frozen desserts, frozen fruits & vegetables, seafood, and meat.

Condensing Unit Market Players

Emerson Electric Co. (US), Carrier Global Corporation (US), Danfoss (Denmark), GEA Group Aktiengesellschaft (Germany), Heatcraft Refrigeration Products LLC (US), BITZER SE (Germany), and SCM Frigo S.p.A. (Italy). These players have adopted the strategies of new product development, expansions, partnerships, acquisitions, contracts, joint ventures, and divestments to enhance their position in the market.

Condensing Unit Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 39.0 billion |

|

Revenue Forecast in 2027 |

USD 57.1 billion |

|

CAGR |

7.9% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD) and Volume (Thousand Unit) |

|

Segments Covered |

Type, Application, Function, Refrigerant Type, Compressor Type, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Emerson Electric Co. (US), Carrier (US), Danfoss (Denmark), GEA Group Aktiengesellschaft (Germany), BITZER (Germany), Heatcraft Worldwide Refrigeration (US), Baltimore Aircoil Company (BAC) (US), Dorin S.p.A. (Italy), SCM Frigo S.p.A. (Italy), Daikin Applied (US), EVAPCO, Inc. (US), Frascold S.p.A. (Italy), Howe Corporation (US), Hussmann Corporation (US), Blue Star Limited (India), MTA S.p.A. (Italy), Tecumseh Products Company LLC (US), Elgin S/A (Brazil), Embraco LLC (Brazil), Good Cold (Argentina), and Westric Multicontrol S.A. (Argentina), other players. |

This research report categorizes the condensing unit market based on type, compressor type, application, function, refrigerant type, and region.

Based on Type, the condensing unit market has been segmented as follows:

- Air-cooled

- Water-cooled

Based on Function, the condensing unit market has been segmented as follows:

- Air Conditioning

- Refrigeration

- Heat Pumps

Based on Compressor Type, the condensing unit market has been segmented as follows:

- Reciprocating Compressors

- Screw Compressors

- Rotary Compressors

- Others

Based on Refrigerant Type, the condensing unit market has been segmented as follows:

-

Fluorocarbons

- HCFCs

- HFCs

- HFOs

-

Hydrocarbons

- Isobutane

- Propane

- Others (Butane, Propene, and Isopentane)

-

Inorganics

- Ammonia

- Carbon Dioxide

- Others (Water and Air)

Based on Application, the condensing unit market has been segmented as follows:

- Industrial

- Commercial

- Transportation

Based on Region, the condensing unit market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In September 2021, Emerson Electric Co. introduced new part of condensing unit named as Copeland CO2 scroll compressors with smart electronics and innovative integrated dynamic vapor Injection (DVI) technology. According to Emerson, the technology offered a new CO2 booster system solution that reduces system complexity and costs while maintaining high efficiency in any environment.

- In September 2019, BITZER SE expanded the production capacity of its Rottenburg-Hailfingen plant, located in Germany. The plant began the production of CRF, CXP, CXP, and McDEW condensers. It was expected to offer direct-expansion evaporators as of January 2020. The expansion helped the company meet the rising demand for condensing units in Europe.

Frequently Asked Questions (FAQs):

What is the current size of the global condensing unit market?

The condensing unit market is projected to grow from USD 39.0 billion in 2022 to USD 57.1 billion by 2027, at a CAGR of 7.9% from 2022 to 2027.

Who are the leading players in the global condensing unit market?

Some of the key players operating in the condensing unit market are Emerson Electric Co. (US), Carrier (US), Danfoss (Denmark), GEA Group Aktiengesellschaft (Germany), BITZER (Germany), Heatcraft Worldwide Refrigeration (US), Baltimore Aircoil Company (BAC) (US), Dorin S.p.A. (Italy), SCM Frigo S.p.A. (Italy), Daikin Applied (US), EVAPCO, Inc. (US), Frascold S.p.A. (Italy), Howe Corporation (US), Hussmann Corporation (US), Blue Star Limited (India), MTA S.p.A. (Italy), Tecumseh Products Company LLC (US), Elgin S/A (Brazil), Embraco LLC (Brazil), Good Cold (Argentina), and Westric Multicontrol S.A. (Argentina).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 CONDENSING UNIT MARKET: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 CONDENSING UNIT MARKET SEGMENTATION

FIGURE 2 REGIONAL SCOPE

FIGURE 3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNITS CONSIDERED

1.7 RESEARCH LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 4 CONDENSING UNIT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 DEMAND-SIDE MATRIX CONSIDERED

FIGURE 5 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR CONDENSING UNITS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CONDENSING UNIT MARKET (1/2)

FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF CONDENSING UNIT MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 10 CONDENSING UNIT MARKET: DATA TRIANGULATION

2.6 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.7 LIMITATIONS

2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 39)

TABLE 2 CONDENSING UNIT MARKET, 2022 VS. 2027

FIGURE 11 AIR-COOLED CONDENSING UNIT SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

FIGURE 12 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 13 AIR CONDITIONING SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

FIGURE 14 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN CONDENSING UNIT MARKET

FIGURE 15 CONDENSING UNIT MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 CONDENSING UNIT MARKET, BY REGION

FIGURE 16 MIDDLE EAST & AFRICA MARKET TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

4.3 ASIA PACIFIC CONDENSING UNIT MARKET, BY TYPE AND APPLICATION

FIGURE 17 COMMERCIAL APPLICATION AND AIR-COOLED SEGMENT DOMINATED ASIA PACIFIC CONDENSING UNIT MARKET IN 2021

4.4 CONDENSING UNIT MARKET, BY TYPE

FIGURE 18 AIR-COOLED SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

4.5 CONDENSING UNIT MARKET, BY FUNCTION

FIGURE 19 REFRIGERATION SEGMENT TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONDENSING UNIT MARKET

5.2.1 DRIVERS

5.2.1.1 Growing retail sector in emerging economies

5.2.1.2 Increasing demand for air conditioning units and refrigeration

5.2.1.3 Growth in the electronics and data center market

FIGURE 21 IMPACT OF DRIVERS ON CONDENSING UNIT MARKET

5.2.2 RESTRAINTS

5.2.2.1 Stringent environmental regulations on refrigerants used in condensing units

FIGURE 22 IMPACT OF RESTRAINTS ON CONDENSING UNIT MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements leading to the introduction of efficient condensing units

5.2.3.2 Increasing demand for natural refrigerants

TABLE 3 FACTORS INFLUENCING GROWTH OF NATURAL REFRIGERANTS

FIGURE 23 IMPACT OF OPPORTUNITIES ON CONDENSING UNIT MARKET

5.2.4 CHALLENGES

5.2.4.1 Supply chain disruption in the global HVAC systems market

FIGURE 24 IMPACT OF CHALLENGES ON CONDENSING UNIT MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 CONDENSING UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 CASE STUDY ANALYSIS

5.4.1 DANFOSS ASSISTED KRIOFROST IN INSTALLING THE COMPANY'S FIRST TRANSCRITICAL CO2 BOOSTER REFRIGERATION SYSTEM

5.5 POLICIES AND REGULATIONS

5.6 REVISED SECTION 608 OF REFRIGERANT MANAGEMENT REGULATIONS

5.7 FLAMMABILITY AND TOXICITY ISSUES

5.8 EUROPE

5.8.1 EU F-GAS REGULATIONS

5.8.2 MONTREAL PROTOCOL

5.8.3 DENMARK

5.9 NORTH AMERICA

5.9.1 SIGNIFICANT NEW ALTERNATIVE POLICY (SNAP) BY EPA

5.10 ASIA PACIFIC

5.10.1 JAPAN: REVISED F-GAS LAW

5.10.2 CHINA (FECO): FIRST CATALOGUE OF RECOMMENDED SUBSTITUTES FOR HCFCS

TABLE 5 RECOMMENDED SUBSTITUTES FOR R22 IN DIFFERENT SECTORS

5.10.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 ECOSYSTEM/MARKET MAP

FIGURE 26 CONDENSING UNIT MARKET: ECOSYSTEM/MARKET MAP

TABLE 10 CONDENSING UNIT MARKET: ECOSYSTEM

5.12 VALUE CHAIN ANALYSIS

FIGURE 27 COMPONENTS ACCOUNT FOR MAJOR VALUE ADDITION

5.12.1 HERMETIC CONDENSING UNIT

5.12.2 SCROLL CONDENSING UNIT

5.12.3 SEMI-HERMETIC CONDENSING UNIT

5.13 AVERAGE PRICE TREND

TABLE 11 AVERAGE PRICE OF CONDENSING UNIT IN KEY REGIONS, BY TYPE, 2021 (USD)

FIGURE 28 GLOBAL AVERAGE PRICE OF CONDENSING UNIT, BY TYPE

FIGURE 29 ASIA PACIFIC AVERAGE PRICE OF CONDENSING UNIT, BY TYPE

5.14 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 12 CONDENSING UNIT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.15.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.16 TRADE DATA

TABLE 15 CONDENSING UNIT EXPORT DATA

TABLE 16 CONDENSING UNIT IMPORT DATA

5.17 TECHNOLOGY ANALYSIS

5.18 PATENT ANALYSIS

FIGURE 32 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 33 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 34 LEGAL STATUS OF PATENTS

FIGURE 35 TOP JURISDICTION, BY DOCUMENT

FIGURE 36 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 17 LIST OF PATENTS BY MIDEA GROUP CO., LTD

TABLE 18 LIST OF PATENTS BY GREE ELECTRIC APPLIANCES INC. ZHUHAI

TABLE 19 LIST OF PATENTS BY AUX AIR CONDITIONING CO., LTD

TABLE 20 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 CONDENSING UNIT MARKET, BY COMPRESSOR TYPE (Page No. - 78)

6.1 INTRODUCTION

6.2 RECIPROCATING COMPRESSORS

6.2.1 LONG-TERM AND EFFECTIVE AIR COMPRESSION FEATURES TO FUEL DEMAND

6.3 SCREW COMPRESSORS

6.3.1 NOISE-FREE OPERATIONAL FEATURE TO INCREASE DEMAND

6.4 ROTARY COMPRESSORS

6.4.1 DEMAND FROM HOTELS AND HOSPITALS TO PROPEL MARKET

6.5 OTHERS

7 CONDENSING UNIT MARKET, BY TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 37 AIR-COOLED CONDENSING UNIT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 21 CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (USD BILLION)

TABLE 22 CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (USD BILLION)

TABLE 23 CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 24 CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

7.2 AIR-COOLED CONDENSING UNIT

7.2.1 LOW MAINTENANCE AND INSTALLATION COSTS TO DRIVE THIS SEGMENT

7.3 WATER-COOLED CONDENSING UNIT

7.3.1 ENERGY-EFFICIENT FEATURE TO FUEL DEMAND

8 CONDENSING UNIT MARKET, BY REFRIGERANT TYPE (Page No. - 85)

8.1 INTRODUCTION

8.2 FLUOROCARBONS

8.2.1 APPLICATION OF FLUOROCARBONS IN LARGE REFRIGERATORS TO BOOST DEMAND

8.2.1.1 Hydrochlorofluorocarbons (HCFCs)

TABLE 25 HCFC: APPLICATIONS AND GWP

8.2.1.2 Hydrofluorocarbons (HFCs)

TABLE 26 HFC: APPLICATIONS AND GWP

8.2.1.3 Hydrofluoroolefins (HFOs)

TABLE 27 HFO: APPLICATIONS AND GWP

8.3 HYDROCARBONS

8.3.1 NON-TOXIC FEATURE OF HYDROCARBONS TO FUEL GROWTH

8.3.1.1 Isobutane

TABLE 28 ISOBUTANE: APPLICATIONS AND GWP

8.3.1.2 Propane

TABLE 29 PROPANE: APPLICATIONS AND GWP

8.3.1.3 Others

8.4 INORGANICS

8.4.1 TRANSPORT AND INDUSTRIAL APPLICATIONS OF INORGANICS TO PROPEL DEMAND

8.4.1.1 Ammonia

TABLE 30 AMMONIA: APPLICATIONS AND GWP

8.4.1.2 CO2

TABLE 31 CO2: APPLICATIONS AND GWP

8.4.1.3 Others

TABLE 32 OTHERS: APPLICATIONS AND GWP

9 CONDENSING UNIT MARKET, BY FUNCTION (Page No. - 90)

9.1 INTRODUCTION

TABLE 33 CONDENSING UNIT MARKET: FUNCTION SEGMENT BREAKDOWN

FIGURE 38 AIR CONDITIONING SEGMENT TO DOMINATE CONDENSING UNIT MARKET DURING FORECAST PERIOD

TABLE 34 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (USD BILLION)

TABLE 35 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (USD BILLION)

TABLE 36 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 37 CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

9.2 AIR CONDITIONING

9.2.1 GROWING COLD STORAGE SECTOR TO PROPEL DEMAND

9.3 REFRIGERATION

9.3.1 DEMAND FROM HOTELS AND HOSPITALS TO DRIVE DEMAND

9.4 HEAT PUMPS

9.4.1 INCREASING INFRASTRUCTURAL PROJECTS TO FUEL DEMAND

10 CONDENSING UNIT MARKET, BY APPLICATION (Page No. - 94)

10.1 INTRODUCTION

FIGURE 39 INDUSTRIAL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 38 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 39 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 40 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 41 CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

10.2 COMMERCIAL

10.2.1 GROWING RETAIL SECTOR TO FUEL DEMAND

10.3 INDUSTRIAL

10.3.1 INCREASING DEMAND IN PETROCHEMICAL INDUSTRY TO PROPEL DEMAND

10.4 TRANSPORTATION

10.4.1 LOW OPERATIONAL COST AND HIGH EFFICIENCY TO DRIVE THIS SEGMENT

TABLE 42 TRANSPORT REFRIGERATION: KEY APPLICATIONS, END-USE INDUSTRIES, AND COMMON REFRIGERANTS

11 CONDENSING UNIT MARKET, BY REGION (Page No. - 99)

11.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC TO BE LARGEST CONDENSING UNIT MARKET DURING FORECAST PERIOD

TABLE 43 CONDENSING UNIT MARKET SIZE, BY REGION, 2018–2021 (USD BILLION)

TABLE 44 CONDENSING UNIT MARKET SIZE, BY REGION, 2022–2027 (USD BILLION)

TABLE 45 CONDENSING UNIT MARKET SIZE, BY REGION, 2018–2021 (THOUSAND UNIT)

TABLE 46 CONDENSING UNIT MARKET SIZE, BY REGION, 2022–2027 (THOUSAND UNIT)

11.2 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: CONDENSING UNIT MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 48 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 49 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (THOUSAND UNIT)

TABLE 50 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (THOUSAND UNIT)

TABLE 51 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 52 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 53 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 54 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

TABLE 55 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 56 ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

11.2.1 CHINA

11.2.1.1 Rapidly growing cooling energy sector to boost market

TABLE 57 CHINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 58 CHINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 59 CHINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 60 CHINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.2 INDIA

11.2.2.1 Rise in income levels and growing food production to create high growth opportunities

TABLE 61 INDIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 62 INDIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 63 INDIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 64 INDIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.3 JAPAN

11.2.3.1 Growth in frozen food market to propel demand

TABLE 65 JAPAN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 66 JAPAN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 67 JAPAN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 68 JAPAN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.4 SOUTH KOREA

11.2.4.1 Growing investments in cold chain industry to drive market

TABLE 69 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 70 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 71 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 72 SOUTH KOREA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.5 THAILAND

11.2.5.1 Growing agricultural supply and other food products to drive market

TABLE 73 THAILAND: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 74 THAILAND: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 75 THAILAND: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 76 THAILAND: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.6 MALAYSIA

11.2.6.1 High penetration of refrigeration appliances to increase demand

TABLE 77 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 78 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 79 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 80 MALAYSIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.7 SINGAPORE

11.2.7.1 High spending of people on food to drive market

TABLE 81 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 82 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 83 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 84 SINGAPORE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.8 INDONESIA

11.2.8.1 Growing cold chain industry to propel market

TABLE 85 INDONESIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 86 INDONESIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 87 INDONESIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 88 INDONESIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.2.9 REST OF ASIA PACIFIC

TABLE 89 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 90 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 91 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 92 REST OF ASIA PACIFIC: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.3 NORTH AMERICA

FIGURE 42 NORTH AMERICA: CONDENSING UNIT MARKET SNAPSHOT

TABLE 93 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 94 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 95 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (THOUSAND UNIT)

TABLE 96 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (THOUSAND UNIT)

TABLE 97 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 98 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 99 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 100 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

TABLE 101 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 102 NORTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

11.3.1 US

11.3.1.1 Growing demand for food products to fuel demand

TABLE 103 US: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 104 US: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 105 US: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 106 US: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.3.2 CANADA

11.3.2.1 Regulations related to reduction in food spoilage and food loss to drive market

TABLE 107 CANADA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 108 CANADA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 109 CANADA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 110 CANADA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.3.3 MEXICO

11.3.3.1 Growing market for temperature-controlled storage and warehouse to fuel market

TABLE 111 MEXICO: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 112 MEXICO: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 113 MEXICO: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 114 MEXICO: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4 EUROPE

FIGURE 43 EUROPE: CONDENSING UNIT MARKET SNAPSHOT

TABLE 115 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 116 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 117 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (THOUSAND UNIT)

TABLE 118 EUROPE: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (THOUSAND UNIT)

TABLE 119 EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 120 EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 121 EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 122 EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

TABLE 123 EUROPE: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 124 EUROPE: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

11.4.1 GERMANY

11.4.1.1 Rising need for refrigerated storage and transportation to boost market

TABLE 125 GERMANY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 126 GERMANY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 127 GERMANY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 128 GERMANY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4.2 UK

11.4.2.1 Increasing efficient cold chain services by major companies to fuel growth

TABLE 129 UK: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 130 UK: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 131 UK: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 132 UK: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4.3 FRANCE

11.4.3.1 Presence of large supermarket chains to drive market

TABLE 133 FRANCE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 134 FRANCE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 135 FRANCE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 136 FRANCE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4.4 ITALY

11.4.4.1 Growing food retail industry and storage of ready-to-eat packed food products to propel demand

TABLE 137 ITALY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 138 ITALY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 139 ITALY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 140 ITALY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4.5 SPAIN

11.4.5.1 Increasing demand for air conditioners to fuel growth

TABLE 141 SPAIN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 142 SPAIN: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 143 SPAIN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 144 SPAIN: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.4.6 REST OF EUROPE

TABLE 145 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 146 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 147 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 148 REST OF EUROPE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.5 MIDDLE EAST & AFRICA

TABLE 149 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 150 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 151 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (THOUSAND UNIT)

TABLE 152 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (THOUSAND UNIT)

TABLE 153 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 154 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 155 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 156 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

TABLE 157 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 158 MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

11.5.1 SAUDI ARABIA

11.5.1.1 Rapid urbanization and presence of major players to drive demand

TABLE 159 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 160 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 161 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 162 SAUDI ARABIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.5.2 TURKEY

11.5.2.1 Growing HVAC&R industry to fuel growth

TABLE 163 TURKEY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 164 TURKEY: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 165 TURKEY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 166 TURKEY: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.5.3 UAE

11.5.3.1 Growing food & beverage industry to drive market

TABLE 167 UAE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 168 UAE: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 169 UAE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 170 UAE: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 171 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 172 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 173 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 174 REST OF MIDDLE EAST & AFRICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.6 SOUTH AMERICA

TABLE 175 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (THOUSAND UNIT)

TABLE 176 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (THOUSAND UNIT)

TABLE 177 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 178 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 179 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 180 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 181 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 182 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

TABLE 183 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2018–2021 (THOUSAND UNIT)

TABLE 184 SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY FUNCTION, 2022–2027 (THOUSAND UNIT)

11.6.1 BRAZIL

11.6.1.1 Growing population along with huge market potential for cold storage to enhance demand

TABLE 185 BRAZIL: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 186 BRAZIL: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 187 BRAZIL: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 188 BRAZIL: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.6.2 COLOMBIA

11.6.2.1 Increasing exports of consumer food products to create market opportunities

TABLE 189 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 190 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 191 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 192 COLOMBIA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.6.3 ARGENTINA

11.6.3.1 Increase in export of fruits to drive market

TABLE 193 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 194 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 195 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 196 ARGENTINA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

11.6.4 REST OF SOUTH AMERICA

TABLE 197 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2018–2021 (THOUSAND UNIT)

TABLE 198 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY APPLICATION, 2022–2027 (THOUSAND UNIT)

TABLE 199 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2018–2021 (THOUSAND UNIT)

TABLE 200 REST OF SOUTH AMERICA: CONDENSING UNIT MARKET SIZE, BY TYPE, 2022–2027 (THOUSAND UNIT)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 201 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

12.2 REVENUE ANALYSIS

FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES OVER LAST 5 YEARS

12.3 MARKET RANKING ANALYSIS, 2021

FIGURE 45 CONDENSING UNIT MARKET: RANKING ANALYSIS (2021)

TABLE 202 CONDENSING UNIT MARKET: TYPE FOOTPRINT

TABLE 203 CONDENSING UNIT MARKET: APPLICATION FOOTPRINT

TABLE 204 CONDENSING UNIT MARKET: REGION FOOTPRINT

12.4 COMPANY EVALUATION MATRIX

12.4.1 STARS

12.4.2 EMERGING LEADERS

12.4.3 PERVASIVE PLAYERS

12.4.4 PARTICIPANTS

FIGURE 46 CONDENSING UNIT MARKET: COMPANY EVALUATION MATRIX, 2020

12.5 COMPETITIVE SCENARIO

TABLE 205 CONDENSING UNIT MARKET: PRODUCT LAUNCHES, 2018–2022

TABLE 206 CONDENSING UNIT MARKET: DEALS, 2018–2022

TABLE 207 CONDENSING UNIT MARKET: OTHER DEVELOPMENTS, 2018–2022

13 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)*

13.1 EMERSON ELECTRIC CO.

TABLE 208 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

FIGURE 47 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 209 EMERSON ELECTRIC CO: PRODUCT OFFERINGS

TABLE 210 EMERSON ELECTRIC CO.: PRODUCT LAUNCH

13.2 CARRIER

TABLE 211 CARRIER: COMPANY OVERVIEW

FIGURE 48 CARRIER: COMPANY SNAPSHOT

TABLE 212 CARRIER: PRODUCT OFFERINGS

TABLE 213 CARRIER: DEALS

13.3 DANFOSS

TABLE 214 DANFOSS: COMPANY OVERVIEW

FIGURE 49 DANFOSS: COMPANY SNAPSHOT

TABLE 215 DANFOSS: PRODUCT OFFERINGS

TABLE 216 DANFOSS: PRODUCT LAUNCH

TABLE 217 DANFOSS: DEALS

13.4 GEA GROUP AKTIENGESELLSCHAFT

TABLE 218 GEA GROUP AKTIENGESELLSCHAFT: COMPANY OVERVIEW

FIGURE 50 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

TABLE 219 GEA GROUP AKTIENGESELLSCHAFT: PRODUCT OFFERINGS

13.5 BITZER

TABLE 220 BITZER: COMPANY OVERVIEW

TABLE 221 BITZER: PRODUCTS OFFERED

TABLE 222 BITZER: PRODUCT LAUNCH

TABLE 223 BITZER: DEALS

TABLE 224 BITZER.: OTHERS

13.6 HEATCRAFT WORLDWIDE REFRIGERATION

TABLE 225 HEATCRAFT WORLDWIDE REFRIGERATION: COMPANY OVERVIEW

TABLE 226 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT OFFERINGS

TABLE 227 HEATCRAFT WORLDWIDE REFRIGERATION: PRODUCT LAUNCH

13.7 BALTIMORE AIRCOIL COMPANY

TABLE 228 BALTIMORE AIRCOIL COMPANY: COMPANY OVERVIEW

TABLE 229 BALTIMORE AIRCOIL COMPANY: PRODUCTS OFFERED

TABLE 230 BALTIMORE AIRCOIL COMPANY: PRODUCT LAUNCH

TABLE 231 BALTIMORE AIRCOIL COMPANY: DEALS

TABLE 232 BALTIMORE AIRCOIL COMPANY: OTHERS

13.8 DORIN S.P.A.

TABLE 233 DORIN S.P.A.: COMPANY OVERVIEW

TABLE 234 DORIN S.P.A: PRODUCTS OFFERED

TABLE 235 DORIN S.P.A.: PRODUCT LAUNCH

13.9 SCM FRIGO S.P.A.

TABLE 236 SCM FRIGO S.P.A.: COMPANY OVERVIEW

TABLE 237 SCM FRIGO S.P.A.: PRODUCTS OFFERED

TABLE 238 S.C.M FRIGO S.P.A.: OTHERS

13.10 DAIKIN APPLIED

TABLE 239 DAIKIN APPLIED: COMPANY OVERVIEW

FIGURE 51 DAIKIN APPLIED: COMPANY SNAPSHOT

TABLE 240 DAIKIN APPLIED: PRODUCTS OFFERED

TABLE 241 DAIKIN APPLIED: OTHERS

13.11 EVAPCO, INC.

TABLE 242 EVAPCO, INC.: COMPANY OVERVIEW

TABLE 243 EVAPCO, INC.: PRODUCTS OFFERED

TABLE 244 EVAPCO, INC.: DEALS

13.12 FRASCOLD S.P.A.

TABLE 245 FRASCOLD S.P.A.: COMPANY OVERVIEW

TABLE 246 FRASCOLD S.P.A.: PRODUCTS OFFERED

TABLE 247 FRASCOLD SPA: DEALS

TABLE 248 FRASCOLD SPA S.P.A.: OTHERS

13.13 HOWE CORPORATION

TABLE 249 HOWE CORPORATION: COMPANY OVERVIEW

TABLE 250 HOWE CORPORATION: PRODUCTS OFFERED

13.14 HUSSMANN CORPORATION

TABLE 251 HUSSMAN CORPORATION: COMPANY OVERVIEW

TABLE 252 HUSSMAN CORPORATION: PRODUCTS OFFERED

TABLE 253 HUSSMAN CORPORATION: PRODUCT LAUNCH

13.15 BLUE STAR LIMITED CORPORATION

TABLE 254 BLUE STAR LIMITED: COMPANY OVERVIEW

FIGURE 52 BLUE STAR LIMITED: COMPANY SNAPSHOT

TABLE 255 BLUE STAR LIMITED: PRODUCTS OFFERED

TABLE 256 BLUE STAR LIMITED: OTHERS

13.16 MTA S.P.A.

TABLE 257 MTA S.P.A: COMPANY OVERVIEW

TABLE 258 MTA S.P.A.: PRODUCTS OFFERED

13.17 TECUMSEH PRODUCTS COMPANY LLC

TABLE 259 TECUMSEH PRODUCTS COMPANY LLC: COMPANY OVERVIEW

TABLE 260 TECUMSEH PRODUCTS COMPANY LLC: PRODUCTS OFFERED

TABLE 261 TECUMSEH PRODUCTS COMPANY LLC: PRODUCT LAUNCH

13.18 ELGIN S/A

TABLE 262 ELGIN S/A: COMPANY OVERVIEW

TABLE 263 ELGIN S/A: PRODUCTS OFFERED

13.19 EMBRACO LLC

TABLE 264 EMBRACO LLC: COMPANY OVERVIEW

TABLE 265 EMBRACO LLC: PRODUCTS OFFERED

TABLE 266 EMBRACO LLC: PRODUCT LAUNCH

TABLE 267 EMBRACO LLC: OTHERS

13.20 GOOD COLD

TABLE 268 GOOD COLD: COMPANY OVERVIEW

TABLE 269 GOOD COLD: PRODUCTS OFFERED

13.21 MULTICONTROL SA

TABLE 270 MULTICONTROL SA: COMPANY OVERVIEW

TABLE 271 MULTICONTROL SA: PRODUCTS OFFERED

13.22 OTHER PLAYERS

13.22.1 FREEZEINDIA MANUFACTURING PRIVATE LIMITED

TABLE 272 FREEZEINDIA MANUFACTURING PRIVATE LIMITED: COMPANY OVERVIEW

13.22.2 NATIONAL COMFORT PRODUCTS

TABLE 273 NATIONAL COMFORT PRODUCTS: COMPANY OVERVIEW

13.22.3 PATTON LTD.

TABLE 274 PATTON LTD.: COMPANY OVERVIEW

13.22.4 SAFE AIR TECHNOLOGY

TABLE 275 SAFE AIR TECHNOLOGY: COMPANY OVERVIEW

13.22.5 SHANGHAI GENERAL FUSHI REFRIGERATION EQUIPMENT CO. LTD

TABLE 276 SHANGHAI GENERAL FUSHI REFRIGERATION EQUIPMENT CO. LTD: COMPANY OVERVIEW

13.22.6 SHREE REFRIGERATIONS

TABLE 277 SHREE REFRIGERATIONS: COMPANY OVERVIEW

13.22.7 SHANGHAI ZHAOXUE REFRIGERATION EQUIPMENT CO., LTD.

TABLE 278 SHANGHAI ZHAOXUE REFRIGERATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

13.22.8 ZHEJIANG BEIFENG REFRIGERATION EQUIPMENT CO., LTD

TABLE 279 ZHEJIANG BEIFENG REFRIGERATION EQUIPMENT CO., LTD: COMPANY OVERVIEW

13.22.9 ADVANSOR A/S

TABLE 280 ADVANSOR A/S: COMPANY OVERVIEW

*Details on Business Overview, Solutions, Products & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 234)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

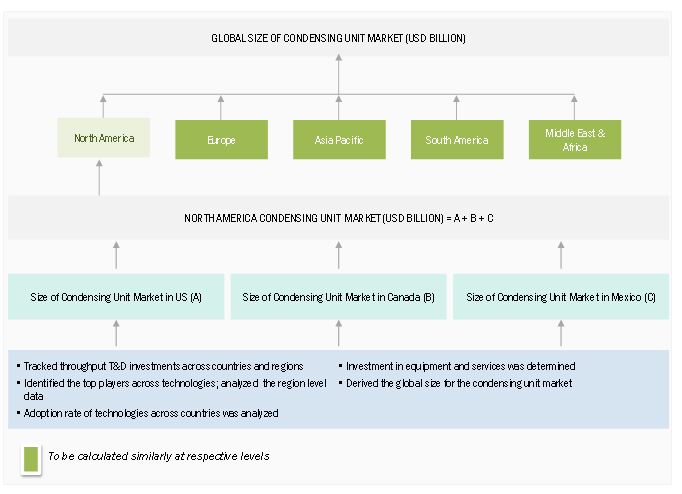

The study involved four major activities in estimating the current size of the condensing unit market. Exhaustive secondary research was done to collect information on the condensing unit market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the condensing unit value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments of the condensing unit market.

Secondary Research

As a part of the secondary research process, various secondary sources, such as Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain essential information about the supply chain of the industry, the monetary chain of the market, total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both the market and technology oriented perspectives.

Primary Research

The condensing unit market comprises several stakeholders, such as condensing unit manufacturers, manufacturers in end-use industries, traders, distributors, and suppliers of condensing units, regional manufacturer associations and condensing unit associations, and government and regional agencies, in the supply chain.

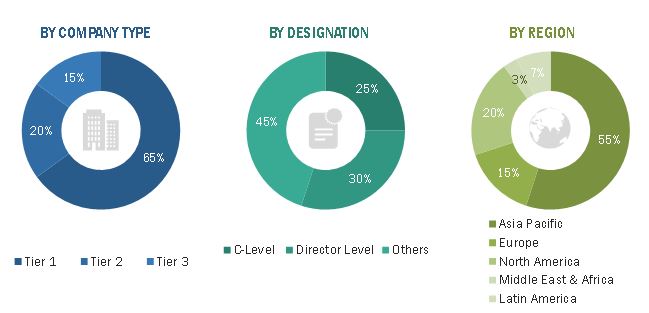

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the condensing unit market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the condensing unit market. Primary sources from the demand side included directors, marketing heads, and purchase managers from multiple end-use industries. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the condensing unit market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

Global Condensing Unit Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the condensing unit market, in terms of value and volume

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size of condensing units by type, application, function, and region

- To forecast the size of the market with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as new product launches, acquisitions, and expansions in the condensing unit market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Condensing Unit Market

Want project for study purpose

Information on number of commercial condensing units sold in Europe

University needs general information on Condensing units in Bolivia and Ivory Coast