Conversational AI Market by Offering ((Software by Technology, Modality, Deployment Mode), and Services), Business Function, Integration Mode, Conversational Agents Type (AI Chatbots, Generative AI Agents), Vertical and Region - Global Forecast to 2030

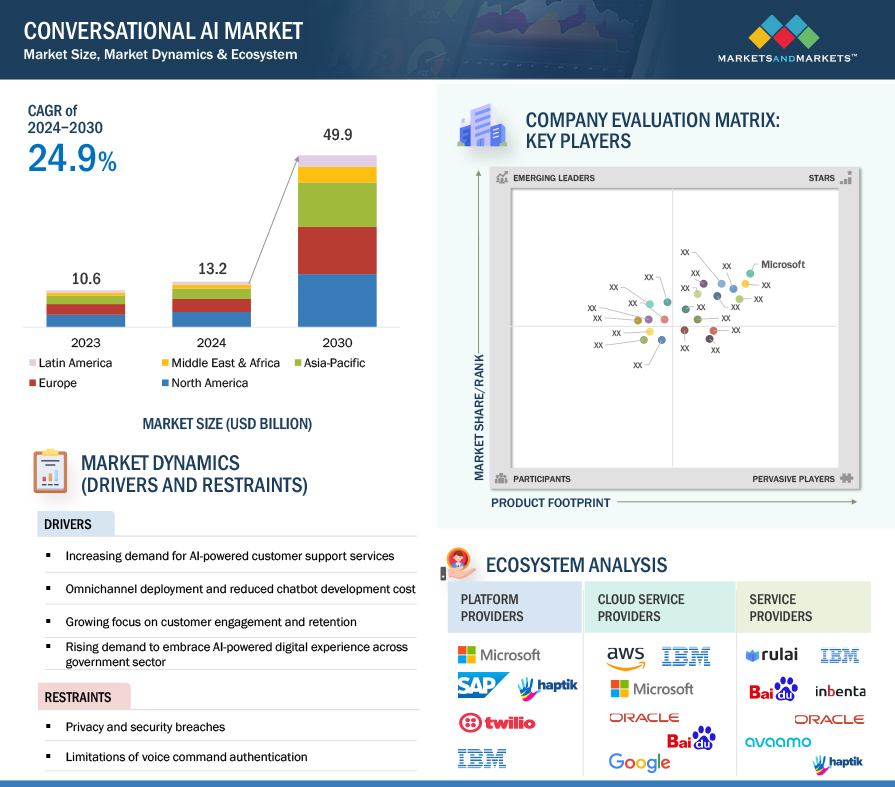

[384 Pages Rport] The conversational AI market is projected to grow from USD 13.2 billion in 2024 to USD 49.9 billion by 2030, at a compound annual growth rate (CAGR) of 24.9% during the forecast period. Due to various business drivers, the conversational AI market is expected to grow significantly during the forecast period. The market is experiencing significant growth due to the emergence of generative AI. Increasing integration of computer vision and voice recognition technology to facilitate more in-depth and personalized interactions is also responsible for driving the market’s growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increasing integration of AI chatbots in messaging services

The increasing integration of AI chatbots in messaging services is a significant driving factor in adopting conversational AI solutions in the market. As messaging platforms dominate communication channels worldwide, businesses recognize the immense potential of integrating AI-powered chatbots to engage with customers seamlessly. According to recent data, over 2.7 billion people globally use messaging apps, highlighting the vast reach and potential impact of leveraging these platforms for customer interactions. Furthermore, the integration of AI chatbots in messaging services enables businesses to meet customers where they are, providing immediate and personalized assistance directly within their preferred messaging apps. This convenience factor is paramount, as studies show that 64% of consumers prefer messaging over voice channels for customer service interactions.

Moreover, AI chatbots offer scalability and efficiency advantages, capable of handling large volumes of inquiries simultaneously without human intervention. This capability is crucial during peak times or for businesses with global customer bases. Research indicates that AI chatbots can reduce customer service costs by up to 30%, demonstrating the tangible economic benefits of adopting conversational AI solutions integrated with messaging services. Additionally, AI chatbots in messaging services empower businesses to provide round-the-clock support, delivering instant responses and resolutions to customer queries at any time of the day or night. This 24/7 availability enhances customer experience and fosters loyalty, as customers receive timely assistance whenever needed. As a result, businesses can gain a competitive edge in today's fast-paced market by leveraging the increasing integration of AI chatbots in messaging services to drive adoption and realize the full potential of conversational AI solutions.

Restraints: Lack of awareness regarding benefits of conversational AI

The lack of awareness is a significant restraining factor in adopting conversational AI solutions. Many businesses and consumers are unaware of the capabilities and benefits of conversational AI, leading to hesitancy in adopting these technologies. According to a survey, only 33% of consumers were familiar with the term "chatbot," indicating a significant gap in awareness regarding conversational AI solutions. Additionally, businesses may underestimate the potential of conversational AI to enhance customer experiences and drive operational efficiencies due to a lack of understanding of its capabilities. Moreover, misconceptions and myths surrounding conversational AI further contribute to the lack of awareness and adoption. For example, some businesses may believe that implementing conversational AI is too complex or costly, while others may fear job displacement or loss of human touch in customer interactions. These misconceptions hinder businesses from fully exploring the benefits of conversational AI solutions.

Furthermore, the rapid pace of technological advancements and evolving market trends make it challenging for businesses to stay informed about the latest developments in conversational AI, exacerbating the lack of awareness. To address this restraining factor, educational initiatives and awareness campaigns are crucial to informing businesses and consumers about the potential of conversational AI solutions. Providing case studies, demonstrations, and training programs can help illustrate the tangible benefits of conversational AI in improving customer engagement, streamlining operations, and driving business growth.

Opportunity: Emergence of generative AI

The rising advent of generative AI presents a significant opportunity for adopting conversational AI solutions in the market, enabling them to offer more personalized, efficient, and human-like interactions. Generative AI technologies, such as Generative Pre-trained Transformer (GPT) models, have demonstrated remarkable progress in understanding and generating natural language, enabling conversational AI systems to engage users in more contextually relevant and dynamic conversations. For instance, OpenAI's GPT-3 model, with 175 billion parameters, has shown the ability to generate human-like text across a wide range of topics and contexts. By leveraging generative AI, conversational AI systems can tailor responses to individual user preferences and behavior patterns, enhancing the overall user experience. Furthermore, the efficiency gains achieved through generative AI enable faster response times and reduced dependency on predefined scripts or templates, facilitating smoother and more fluid interactions. Human-like conversational capabilities also foster greater user engagement and satisfaction, increasing the adoption of conversational AI solutions across various industries. The market's growth is fueled by the demand for personalized customer experiences and the increasing integration of conversational AI across diverse applications, including customer service, virtual assistants, and healthcare. As generative AI advances, conversational AI systems are poised to play an increasingly prominent role in reshaping how businesses interact with customers and users, driving innovation and differentiation in the market landscape.

Challenge: Lack of accuracy in chatbots and virtual assistants

The lack of accuracy in chatbots and virtual assistants poses a significant challenge to the widespread adoption of conversational AI solutions. When these AI-powered systems fail to understand user queries or provide relevant responses accurately, it leads to frustration and dissatisfaction among users, ultimately undermining trust in the technology. Moreover, inaccurate responses can result in missed opportunities for businesses to address customer inquiries effectively or upsell products and services. Research indicates that 55% of US adults are likely to abandon their online purchases if they cannot find a quick answer to their questions. Therefore, the lack of accuracy impacts user experience and directly affects conversion rates and revenue generation for businesses leveraging conversational AI solutions. Furthermore, inaccuracies in chatbots and virtual assistants can lead to negative brand perceptions and damage reputation. Consequently, businesses must prioritize improving the accuracy of their conversational AI solutions through ongoing training, data refinement, and advanced natural language understanding algorithms to overcome this critical challenge and drive successful adoption in the market.

Conversational AI Market Ecosystem

By professional services, the Support & Maintenance segment registered the highest CAGR during the forecast period.

Support and maintenance services play a crucial role in the conversational AI market, ensuring the smooth functioning and optimization of AI-powered chatbots and virtual assistants. These services encompass a range of activities aimed at addressing issues, improving performance, and enhancing user experience. Support services in conversational AI involve aiding users and clients in resolving technical issues, troubleshooting problems, and answering queries. This includes offering timely responses to inquiries, guiding users through troubleshooting steps, and resolving issues related to bot functionality, integration, or performance. Effective support services contribute significantly to customer satisfaction and retention by ensuring that users receive prompt and reliable assistance when needed.

By vertical, Healthcare & Life Sciences segment to register the highest CAGR during the forecast period.

The conversational AI market is experiencing exponential growth within the healthcare and life sciences industry, revolutionizing patient care and administrative processes alike. Conversational AI technologies offer unparalleled convenience and accessibility, enabling patients to interact with healthcare providers and access medical information seamlessly through natural language interfaces like chatbots and virtual assistants. Conversational AI solutions are increasingly adept at understanding medical terminology and interpreting complex queries, thereby facilitating accurate diagnosis, personalized treatment recommendations, and even remote monitoring of patient's health conditions.

By integration mode, Internal Enterprise Systems to register the largest market size during the forecast period.

The market for internal enterprise systems within the conversational AI sector is experiencing significant growth driven by several key factors. Businesses are increasingly recognizing the value of leveraging conversational AI technologies to streamline internal processes and improve operational efficiency. These systems offer a user-friendly interface that allows employees to interact with enterprise applications more intuitively, leading to faster task completion and reduced workload on IT departments. Additionally, the rise of remote work has highlighted the importance of effective communication and collaboration tools, and conversational AI platforms can facilitate seamless interactions among distributed teams.

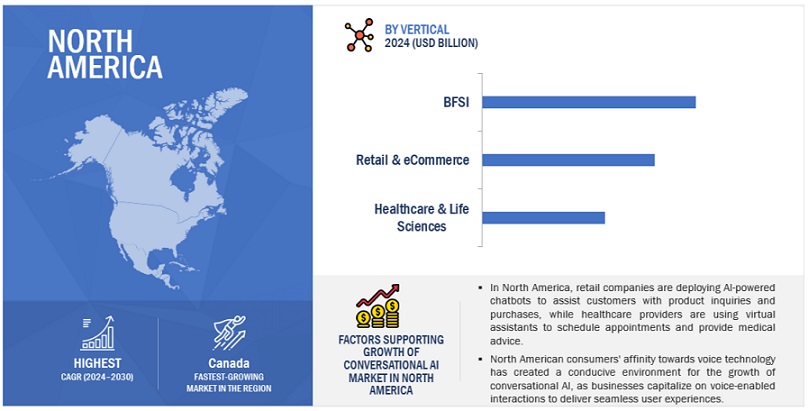

By region, North America to witness the largest & fastest market size during the forecast period.

The conversational AI market in North America is experiencing rapid growth, driven by several key factors. The increasing demand for seamless and personalized customer experiences across various industries, including retail, finance, healthcare, and telecommunications is influencing the growth of the market. Businesses are recognizing the value of leveraging conversational AI solutions to engage with their customers in more natural and efficient ways, leading to improved satisfaction and loyalty. Additionally, advancements in NLP, ML, and voice recognition technologies have significantly enhanced the capabilities of conversational AI systems, enabling them to understand and respond to user inquiries with greater accuracy and context sensitivity.

Key Market Players

The conversational AI solution and service providers have implemented various types of organic and inorganic growth strategies, such as product upgrades, new product launches, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the conversational AI market include Microsoft (US), IBM (US), Google (US), OpenAI (US), Baidu (China), AWS (US), Artificial Solutions (Sweden), SAP (Germany), Oracle (US), Kore.ai (US), LivePerson (US), [24]7.ai (US), eGain (US), Amelia (US), Avaamo (US), Conversica (US), Haptik (India), Solvvy (US), Inbenta (US), Creative Virtual (UK), SoundHound (US), Kasisto (US), MindMeld (US), Gupshup (US), Twilio (US), Sprinklr (US), Boost.ai (Norway), Cognigy (Germany), Rasa (Germany), Saarthi.ai (India), Senseforth.ai (India), Yellow.ai (US), Exceed.ai (US), Clinc (US), Laiye (China), Rulai (US), Quiq (US), and Pypestream (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

USD (Billion) |

|

Segments Covered |

Offering, Deployment Mode, Business Function, Integration Mode, Conversational Agent Type, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Google (US), OpenAI (US), Baidu (China), AWS (US), Artificial Solutions (Sweden), SAP (Germany), Oracle (US), Kore.ai (US), LivePerson (US), [24]7.ai (US), eGain (US), Amelia (US), Avaamo (US), Conversica (US), Haptik (India), Solvvy (US), Inbenta (US), Creative Virtual (UK), SoundHound (US), Kasisto (US), MindMeld (US), Gupshup (US), Twilio (US), Sprinklr (US), Boost.ai (Norway), Cognigy (Germany), Rasa (Germany), Saarthi.ai (India), Senseforth.ai (India), Yellow.ai (US), Exceed.ai (US), Clinc (US), Laiye (China), Rulai (US), Quiq (US), and Pypestream (US). |

This research report categorizes the conversational AI market based on offering, deployment mode, business function, integration mode, conversational agent type, vertical, and region.

By Offering:

-

Software by Technology

- ML

- NLP

- ASR

- Data Mining

-

Software by Modality

- Text

- Speech

- Multimodal

-

Software by Deployment Mode

- Cloud

- On-premise

-

Services

- Consulting & Advisory

- Integration & Deployment

- Support & Maintenance

- Training & Education

By Business Function:

-

Sales & Marketing

- Contact Center Automation

- Branding & Advertisement

- Campaign Management

- Customer Engagement & Retention

- Others

-

Operations & Supply Chain

- Workflow Optimization

- Scheduling & Routing

- Inventory Management

- Vendor Management

- Others

-

Finance & Accounting

- Virtual Financial Advisors

- Expense Tracking & Reporting

- Data Privacy & Compliance Management

- Automated Invoice Processing

- Others

-

Human Resources (HR)

- Employee Engagement & Onboarding

- Performance Management

- Document Management

- Recruitment Assistants & Screening

- Others (Leave Management & Time-Off Requests)

-

IT Service Management (ITSM)

- Incident Management

- Cost Optimization

- Query Handling

- Knowledge Management

- Others

By Integration Mode:

- Internal Enterprise Systems

- External Communication Channels

By Conversational Agent Type:

- AI Chatbots

- Voice Bots

- Interactive Voice Assistants (IVA)

- Generative AI Agents

By Vertical:

-

BFSI

- Automated Customer Support

- Virtual Financial Assistants

- Portfolio Management

- Voice-Based Digital Banking

- Others

-

Retail & eCommerce

- Voice Commerce

- Personalized Recommendations

- In-Store Assistance

- Automated Surveys

- Automated Order Tracking & Updates

- Others

-

Education

- Admission Query Resolution

- Administrative Task Automation

- Virtual Learning/ Course Assistants

- Personalized Learning Support

- Conversational Campus

- Others

-

Media & Entertainment

- Content Personalization

- Personalized Content Delivery

- Immersive Conversational Gaming

- Advertising & Promotions

- Content Localization & Translation

- Others

-

Healthcare & Life Sciences

- Automated Appointment Booking

- Patient Engagement & Follow Up

- Self Health Management

- Health Tracking & Medication Management

- Symptom Assessment & Triage Management

- Others

-

Travel & Hospitality

- Virtual Travel Assistance

- Personalized Travel Planning

- Conversational Check-Ins

- Voice-Based Bookings/ Ordering

- Others

-

Automotive

- Virtual Car Showroom Assistants

- AI-Powered Navigation & Route Optimization

- Purchase Assistance

- AI-Driven Predictive Maintenance

- Vehicle Configuration & Customization

- Others

-

IT/ITeS

- IT Helpdesk Support & Troubleshooting

- Software & Application Support

- Project Management & Task Tracking

- Virtual IT Procurement Assistants

- IT Security Incident Response & Threat Intelligence Analysis

- Others

-

Government & Defense

- E-Governance Services

- Public Safety Information Dissemination

- Virtual Training Assistants for Defense Personnel

- Citizen Engagement Surveys & Feedback Collection

- Others

- Other Applications (Telecom, Transportation & Logistics, Utilities & Energy, and Manufacturing)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand (ANZ)

- South Korea

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Qatar

- Egypt

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In January 2024, IBM Consulting is rolling out IBM Consulting Advantage, an AI services platform designed to support IBM consultants in delivering consistency, repeatability, and speed to their clients. It includes a portfolio of proprietary methods, assets, and assistants that leverage technology from IBM and strategic partners. When using aspects of IBM Consulting Advantage in an application design, development, and testing client pilot, early adopter teams saw productivity improvements of up to 50%.

- In January 2024, Google Cloud's new conversational commerce solution, announced, can enable retailers to easily embed generative AI-powered virtual agents on their websites and mobile apps. Retailers can build virtual agents with helpful and nuanced conversations with shoppers using natural language and provide product options based on a shopper's preferences.

- In January 2024, IBM announced its collaboration with SAP to develop solutions to help clients in the consumer packaged goods and retail industries enhance their supply chain, finance operations, sales, and services using generative AI. With a shared legacy of technology expertise and the completed work of embedding IBM Watsonx, an enterprise-ready AI and data platform and AI assistants, into SAP solutions, IBM is working with SAP to create new generative and traditional AI solutions to be focused on addressing the complexities of the direct store delivery business process and product portfolio management.

- In January 2024, Open AI introduced ChatGPT Teams. ChatGPT Team offers access to advanced models like GPT-4 and DALL·E 3 and tools like Advanced Data Analysis. It includes a dedicated collaborative workspace for any team and admin tools for team management.

- In February 2023, Microsoft released an upgraded version of Microsoft Teams Premium. The upgrade includes the most recent technologies, such as Large Language Models powered by OpenAI’s GPT-3.5, to make meetings more intelligent, personalized, and secure.

Frequently Asked Questions (FAQ):

What is Conversational AI?

Conversational AI is a type of artificial intelligence (AI) that can simulate human conversation. It is made possible by natural language processing (NLP), a field of AI that allows computers to understand and process human language and Google's foundation models that power new generative AI capabilities.

What is the total CAGR expected to be recorded for the Conversational AI market during the forecast period?

The market is expected to record a CAGR of 24.9% during the forecast period.

Which are the key drivers supporting the growth of the Conversational AI market?

Some factors driving the growth of the retail analytics market are integration of AI chatbots in messaging services, increasing integration of computer vision and voice recognition technology to facilitate more in-depth and personalized interactions, emergence of generative AI and exponential growth of focus on customer engagement and retention.

Which are the key verticals prevailing in the Conversational AI market?

The key verticals gaining a foothold in the conversational AI market are BFSI, retail & e-commerce, education, healthcare & life sciences, media & entertainment, travel & hospitality, automotive, government & defense, IT/ITeS, and others.

Who are the key vendors in the Conversational AI market?

Some major players in the conversational AI market include Microsoft (US), IBM (US), Google (US), OpenAI (US), Baidu (China), AWS (US), Artificial Solutions (Sweden), SAP (Germany), Oracle (US), Kore.ai (US), LivePerson (US), [24]7.ai (US), eGain (US), Amelia (US), Avaamo (US), Conversica (US), Haptik (India), Solvvy (US), Inbenta (US), Creative Virtual (UK), SoundHound (US), Kasisto (US), MindMeld (US), Gupshup (US), Twilio (US), Sprinklr (US), Boost.ai (Norway), Cognigy (Germany), Rasa (Germany), Saarthi.ai (India), Senseforth.ai (India), Yellow.ai (US), Exceed.ai (US), Clinc (US), Laiye (China), Rulai (US), Quiq (US), and Pypestream (US) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

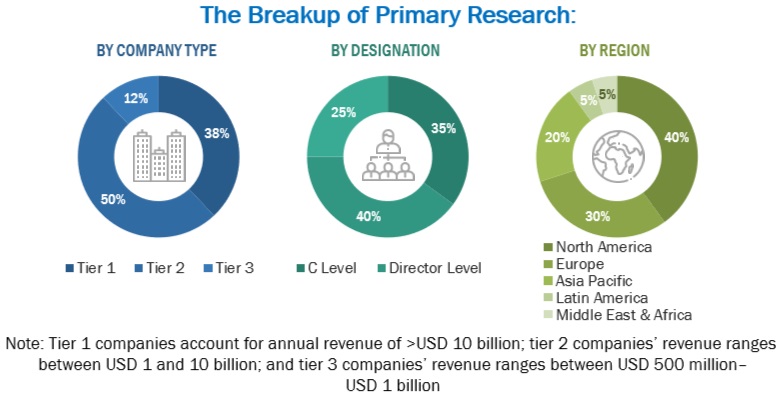

The conversational AI market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred conversational AI providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, conversational AI spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on software, services, market classification, and segmentation according to offerings of major players, industry trends related to software, services, deployment modes, business function, integration mode, conversational agent type, vertical, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and conversational AI expertise; related key executives from conversational AI solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from software and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using conversational AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of conversational AI software and services, which would impact the overall conversational AI market.

To know about the assumptions considered for the study, download the pdf brochure

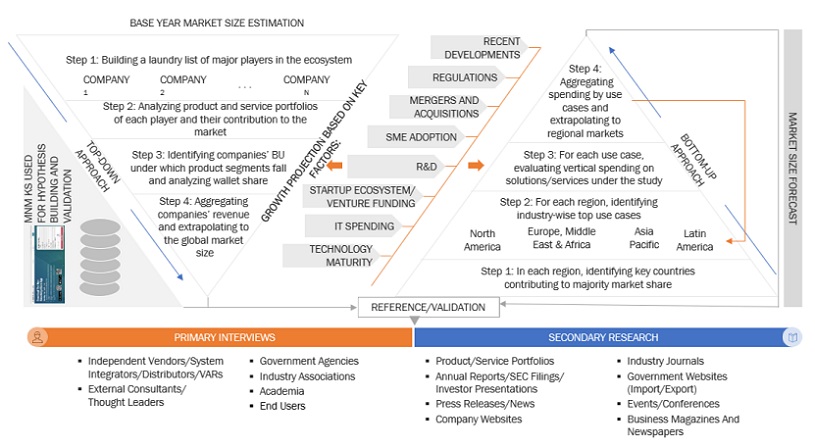

Market Size Estimation

In the bottom-up approach, the adoption rate of conversational AI solutions and services among different end users in key countries concerning their regions contributing the most to the market share was identified. For cross-validation, the adoption of conversational AI solutions and services among industries and different use cases concerning their regions was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the conversational AI market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major conversational AI providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall conversational AI market size and segments’ size were determined and confirmed using the study.

Global Conversational AI Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the conversational AI market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major conversational AI providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall conversational AI market size and segments’ size were determined and confirmed using the study.

Market Definition

Conversational AI is technology that uses natural language processing and machine learning to take automated conversations to the next level. Conversational AI can better understand and process human language and power more intelligent conversations that don't follow a rigid structure, making them feel more natural and more human. From basic Natural Language Processing (NLP) to advanced machine learning models, conversational AI facilitates diverse conversations. Common applications include chatbots, virtual assistants, and customer service bots.

Stakeholders

- Application design and software developers

- Conversational AI vendors

- Business analysts

- Cloud service providers

- Consulting service providers

- Data scientists

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Market research and consulting firms

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Technology providers

- Value-added resellers (VARs)

Report Objectives

- To define, describe, and predict the conversational AI market by offering (software and services), deployment mode, business function, integration mode, conversational agent type, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the conversational AI market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the conversational AI market

- To analyze the impact of recession across all the regions across the conversational AI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American conversational AI market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America conversational AI market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Conversational AI Market