Coordinate Measuring Machine Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Fixed CMM, Portable CMM), Industry (Automotive, Aerospace, Heavy Machinery, Energy & Power, Electronics, Medical), and Region (North America, APAC, Europe, and RoW) Global Growth Driver and Industry Forecast to 2026

Updated on : October 22, 2024

The Coordinate Measuring Machine (CMM) Market is witnessing significant demand as industries prioritize precision and quality control in their manufacturing processes. This demand is fueled by the increasing need for accurate measurements in sectors such as aerospace, automotive, electronics, and manufacturing. The market is expected to experience robust growth, driven by technological advancements in CMMs, including the integration of automation, artificial intelligence, and advanced software solutions that enhance measurement capabilities. Key trends shaping the market include the rising adoption of portable CMMs, which offer flexibility and ease of use, as well as the growing focus on Industry 4.0, leading to smarter, interconnected quality control systems. Looking to the future, the CMM market is poised for continued expansion, supported by innovations in sensor technology and data analytics, which will further improve measurement accuracy and efficiency, ensuring that manufacturers meet the increasing demands for quality and precision in their products.

Coordinate Measuring Machine Market Size

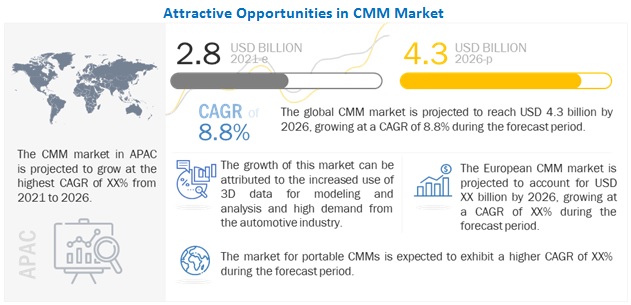

The global coordinate measuring machine market size is projected to reach USD 4.3 billion by 2026, growing at a CAGR of 8.8% during the forecast period

Growing use of 3D data in modeling and analytical applications, increasing R&D spending on developing metrology products, and thriving automotive sector are among the factors driving the growth of the coordinate measuring machine industry .

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global CMM Market

In 2020, COVID-19 had a negative effect on the CMM market, resulting in decreased shipments of CMM and the revenues generated from them. As a result, a drop was witnessed in the growth trend of the market during the first half of 2020. This trend is expected to discontinue in the latter half of the year as the demand is expected to increase due to the growing demand from automotive and aerospace industry.

The COVID-19 pandemic has substantially impacted the value chain of the coordinate measuring machine market. The US, China, India, and Japan, which have been adversely affected by the pandemic, account for a significant share of the global CMM manufacturing. The energy & power and aerospace industries are witnessing a low demand, which is expected to continue for the short term due to the global slowdown.

Coordinate Measuring Machine Market Dynamics

Driver : Growing use of 3D data in modeling and analytical applications

Rapid industrial development creates demand for advanced testing technologies and instruments to conduct R&D activities and manufacture a large number of complex mechanical parts that find applications in precision machinery, numerical machine control tools, auto parts, aerospace equipment, and so on. coordinate measuring machine is a precision instrument widely used to inspect and measure complex mechanical parts from 3 dimensions—length, width, and height. 3D modeling is used in key industries such as aerospace & defense, automotive, heavy machinery, medical, electronics, and energy & power. These intelligent models created from 3D objects collect data points via scanners or CMMs, which are then used for modeling.

The coordinate data measured by coordinate measuring machine, which is converted into measurement data such as position, diameter, distance, angle, is important in the manufacturing industry as this data directly impacts product quality and performance. This data is shared with plant operators to carry out the production schedule, design, and manufacturing functions and ensure the accuracy of manufactured products. CMMs can be used in measurement modeling to visualize product measurement during the production process, and its quality can be controlled through statistical sampling.

A large volume of 3D dimensional data is required for the precision inspection of product measurement. CMMs have become a viable and cost-effective method owing to advances in data-gathering sensor technology and improved measurement and inspection software solutions. Currently, 3D scanners are also used in conjunction with CMMs. 3D laser scanners, white-light scanners, and laser trackers are widely used as dimensional metrology solutions for faster and high-precision results. All these technologies have made data capturing easier and faster, resulting in accurate product measurements. Small laser trackers can accurately measure huge objects that find applications in automotive, aerospace, and heavy machinery industries.

Restraint: High cost of ownership

CMMs are cost-effective, but they are not cheap. A small manual unit of a coordinate measuring machine with a basic probe system, a computer, and software can be purchased for a minimum of USD 20,000. The automated solution can be bought for USD 50,000–60,000, depending on options and the measuring volume of the machine. Gantry-type CMMs are the costliest among all other types of CMMs, with the price ranging from USD 100 thousand to USD 1 million. Apart from this, the cost of software and other supporting hardware, such as computers and probes, makes the total cost of ownership very high, especially for product manufacturers with low production capacity. Hence, many manufacturers outsource their inspection or CMM needs, particularly during product development and production process chains. Moreover, the cost associated with setting up a metrology department makes it difficult to achieve a targeted return on investment (ROI) according to the business plan. Moreover, the prohibitive cost is incurred in maintaining and calibrating coordinate measuring machine tools and upgrading metrology software solutions, as well as hiring metrologists and providing them training at regular intervals.

Opportunity : Surging adoption of cloud computing and Industry 4.0

Every business aims to lower its operating costs and maximize its profit margins. Cloud storage evades the need for huge capital expenditure to buy servers and physical hard drives. Cloud service providers

generally have monthly tariffs and usually cost only a few cents per gigabyte of data storage. Moreover, cloud companies offer pay-as-you-go services for data storage space needed to serve their clients, which means they will only be charged for the space they need. For a manufacturing company, it becomes easy to share the data with the metrology equipment provider and get the results. This would help them reduce their operating costs both in terms of infrastructure and labor costs. In October 2020, ZEISS Group and Microsoft Corp. announced a multi-year strategic partnership to accelerate ZEISS transformation into a provider of digital services, embracing a cloud-first approach. By standardizing its equipment and processes in Microsoft Azure as its preferred cloud platform, ZEISS will be able to provide its customers with enhanced digital experiences, address changing market needs more quickly, and increase its productivity.

The combination of CMM and IIoT helps manufacturers to exchange precise details of a workpiece between facilities, customers, or suppliers that are part of the supply chain through the cloud platform, thereby helping other manufacturers to reduce manufacturing waste and minimize production errors. Further, integration of coordinate measuring machine and Industry 4.0 enables manufacturers to track and optimize the supply chain and get real-time data regarding production and product performance, thereby enabling companies to offer enhanced services to customers and create new revenue streams.

Challenge: Bringing speed and accuracy improvement in CMM scanning

Aerospace applications, for example, engine blocks and jet engine turbine blades, require many data points for process control method validation and quality assurance. Computer numerical control (CNC) machine tools prove to be faster than CMMs in gathering metrology data. By the time, metrology data catches up with events on the shop floor, it may be too late to prevent the production of out-of-specification parts. In short, the low throughput of CMMs holds back the rest of the plant. Scanning done by a CMM, however, is quite slow, affecting measurement throughput.

Most CMMs are configured for three-axis motions. The mass of the machine’s structure creates inertia that causes dynamic errors when moving a CMM at a high rate of acceleration and deceleration. To avoid these inertial errors, scanning speed must be limited. (Most scanning is done between 5 mm and 15 mm per second.) Similarly, the three-axis motion limits the maneuverability of the probe stylus. It may not be able to reach some workpiece surfaces, such as those within a bladed disk. Many players in the coordinate measuring machine market, such as Renishaw (UK) and Machine Tools USA, are trying to overcome this challenge by inventing new probes and attending scanning times as high as 500 mm per second. High-speed scanning transforms the measurement process. It reduces measuring cycle time significantly and simultaneously increases the number of points that can be captured. Gathering more data in less time allows product manufacturers to measure dimensions, inspect more parts, meet tighter part specifications, and keep production processes under tight control.

Portable CMM segment is projected to register a higher CAGR from 2021 to 2026

Portable CMMs are easy to handle and give maximum flexibility to perform metrology activities, thereby are increasingly adopted in the automotive, heavy machinery, and energy & power industries. The working of an articulated arm is less complex, and this arm is highly flexible to carry out metrology activities. The articulated CMM is used in a point-cloud inspection or reverse-engineering applications owing to its ability to provide quick measurement with the help of laser scanners. The portable articulated arm CMM is user-friendly and provides quick and accurate measurements of any object within a specified range.

Heavy machinery segment is projected to register the highest CAGR from 2021 to 2026

The heavy machinery industry is expected to hold the largest share of the coordinate measuring machine market during the forecast period. As CMMs can provide an onsite dimensional measurement to manufacturers of heavy equipment including earthmoving, excavation, and agricultural machinery, the adoption of CMMs is expected to grow significantly during the forecast period. China is the largest market for heavy machinery, which poses increased demand for CMM solutions and is driving the growth of the market in APAC. China’s economic restructuring includes focusing on the development of advanced manufacturing and high-tech industries. Given this focus, sub-sectors that offer the most promising business opportunities are CNC machine tools, robotics, 3D printing equipment, and energy-efficient and environment protection equipment. Furthermore, Made in China 2025, a Chinese government initiative to upgrade China’s machinery industry to manufacture major machine goods with their own innovation and intellectual property rights is a huge opportunity for the coordinate measuring machine market.

To know about the assumptions considered for the study, download the pdf brochure

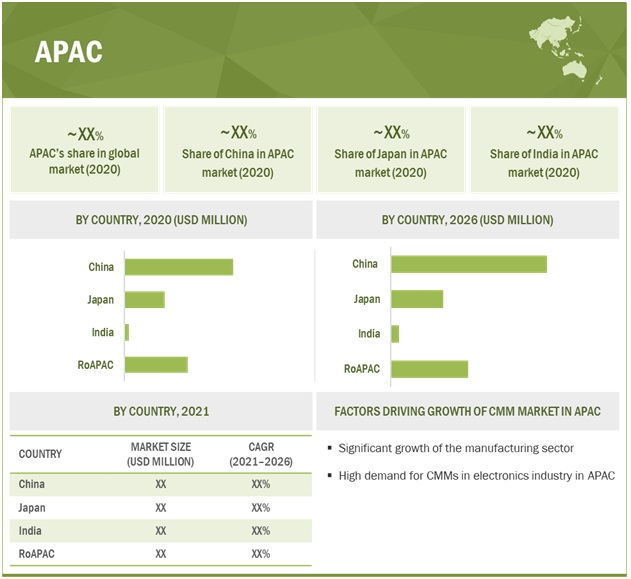

APAC to lead coordinate measuring machine market in 2020

Asia Pacific is the most rapidly growing market and offers a huge opportunity for the automotive industry, whose growth is driven by the growing population. The heavy machinery industry is booming rapidly, which, in turn, has driven the market for CMMs in India and China. The rising awareness related to automation, increasing emphasis of leading economies such as China and Japan on heavy machinery industries are some primary factors contributing to the largest market share of APAC.

The rapid growth of the automotive, heavy machinery, and aerospace industries in emerging economies, such as China and India, has contributed to the growth of the CMM market growth in APAC. Funding for R&D of heavy machinery and an extensive industrial base are the major factors that make APAC a dynamic region for CMMs, with China and Japan being the major contributors. The APAC region has already started recovering from the COVID-19 pandemic. With the fear of the new strain of COVID-19 and another wave of pandemics hitting this region, countries are opening their trade and businesses cautiously. The use of CMMs reduces the wastage of material due to inaccuracy and faulty manufacturing, which is one of the factors fueling the demand for CMMs in this region.

Coordinate Measuring Machines Market : The Key to Quality Control in Modern Manufacturing

The coordinate measuring machine market size is expanding significantly as a result of its broad use across numerous sectors. Automobile, aerospace, and electronics industries all depend on coordinate measuring equipment to give accurate measurements for quality control. Over time, the technology has developed tremendously, improving its usability and productivity for producers. The growing use of coordinate measuring machines is a result of the rising demand for high-quality goods and the requirement for more productive manufacturing techniques. Coordinate measuring machines are likely to become an essential tool in contemporary production as the market expands in response to rising demand and the emergence of new applications.

Top Coordinate Measuring Machine Companies - Key Market Players:

Zeiss Group (Germany), FARO Technologies (US), Hexagon (Sweden), Nikon Corporation (Japan), Mitutoyo (Japan), Tokyo Seimitsu (Japan), Keyence Corporation (Japan), Creaform (Canada), Perceptron (US), Wenzel Group (Germany), are among a few major Coordinate Measuring Machine Companies.

Coordinate Measuring Machine Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.8 Billion |

| Projected Market Size | USD 4.3 Billion |

| Growth Rate | 8.8% CAGR |

|

Years considered to provide market size |

2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Growing use of 3D data in modeling and analytical applications |

| Key Market Opportunity | Surging adoption of cloud computing and Industry 4.0 |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Heavy machinery segment |

| Highest CAGR Segment | Portable CMM segment |

This research report segments the CMM market based on type, industry, and geography.

Coordinate Measuring Machine Market , By Type:

-

Fixed CMM

- Bridge

- Cantilever

- Gantry

-

Portable CMM

- Articulated Arm

- Handheld

Coordinate Measuring Machine Market , By Industry

- Automotive

- Aerospace

- Heavy Machinery

- Energy & Power

- Electronics

- Medical

- Others

Coordinate Measuring Machine Market , By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Recent Developments In Coordinate Measuring Machine Industry :

- In June 2021, Nikon Corporation (Nikon) released the NEXIV CNC Video Measuring System model range that includes VMZ-S4540 and VMZS6555, suitable for inline, automated dimensional measurement.

- In June 2021, ZEISS CALYPSO 2021 reduces the time and effort needed to analyze workpieces. It has over 60 new functions and improvements, which will lead to significantly better performance in quality control. With improved mathematical algorithms and other innovations, the measurement results are now available 20 times faster than with ZEISS CALYPSO 2020.

- In May 2021, Mena3D and Nikon Metrology expanded their sales partnership and mutual approach in providing state-of-the-art metrology and optical inspection solutions in the Middle East and North Africa.Mena3D offers powerful 3D laser scanners specifically designed for both indoor and outdoor applications.

- In May 2021, ZEISS plans to expand its national coverage in the US for its Industrial Quality & Research segment by acquiring Capture 3D, a leading US partner for GOM‘s 3D non-contact measuring solutions. With this acquisition, customers will benefit from a seamless experience to get the best measuring solutions for their specific tasks.

- In May 2021, Hexagon’s Manufacturing Intelligence division opened a Technology Center in Montreal, Canada. The co-working space will be utilized in partnership with Leica eosystems, a part of Hexagon, a well-established geospatial technology provider in the greater Montreal area. The Technology Center provides a product showcase area where Québec manufacturers can get an in-person look at a wide range of advanced solutions for production, automation, metrology, and reality-capture applications under a single roof.

Frequently Asked Questions (FAQ):

Which are the major companies in the coordinate measuring machine market? What are their major strategies to strengthen their market presence?

The major companies in CMM market are – Hexagon (Sweden), Nikon Corporation (Japan), Keyence Corporation (Japan), Zeiss Group (Germany), Mitutoyo (Japan). The major strategies adopted by these players are acquisitions, product launches and partnerships.

Which is the potential market for CMM market in terms of region?

The APAC region is expected to dominate the CMM market owing to the increasing demand from automotive industry.

What are the opportunities for new market entrants?

There are significant opportunities in the CMM market which include surging adoption of cloud computing and Industry 4.0, escalating need for coordinate measuring machine services.

What are the drivers and opportunities for the CMM market?

Factors such as growing use of 3D data in modeling and analytical applications, increasing R&D spending on developing metrology products, and thriving automotive sector. Moreover, surging adoption of cloud computing and industry 4.0, escalating need for coordinate measuring machine services are expected to create lucrative opportunities in coordinate measuring machine market.

Who are the major consumers of CMM that are expected to drive the growth of the market in the next 5 years?

The major consumers of CMM for automotive, aerospace and heavy machinery industries are expected to have a significant share in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 COORDINATE MEASURING MACHINE MARKET : RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM PRODUCTS/SOLUTIONS/SERVICES OF CMM MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 COORDINATE MEASURING MACHINE MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTION FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 COVID-19 IMPACT ANALYSIS ON COORDINATE MEASURING MACHINE MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 FIXED CMM ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 9 QUALITY AND INSPECTION APPLICATION ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 10 HEAVY MACHINERY INDUSTRY TO REGISTER HIGHEST GROWTH RATE IN COORDINATE MEASURING MACHINE MARKET DURING FORECAST PERIOD

FIGURE 11 CMM MARKET IN APAC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN CMM MARKET

FIGURE 12 INCREASING DEMAND FROM AUTOMOTIVE INDUSTRY BOOSTS COORDINATE MEASURING MACHINE MARKET GROWTH

4.2 CMM MARKET, BY TYPE

FIGURE 13 FIXED CMM TO ACCOUNT FOR LARGER MARKET SIZE FROM 2021 TO 2026

4.3 CMM MARKET, BY INDUSTRY AND REGION

FIGURE 14 AUTOMOTIVE INDUSTRY AND APAC REGION ACCOUNTED FOR LARGEST SHARE OF CMM MARKET IN 2020

4.4 CMM MARKET, BY GEOGRAPHY

FIGURE 15 US HELD LARGEST SHARE OF COORDINATE MEASURING MACHINE MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 COORDINATE MEASURING MACHINE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing use of 3D data in modeling and analytical applications

5.2.1.2 Increasing R&D spending on developing metrology products

5.2.1.3 Thriving automotive sector

TABLE 1 CAR SOLD IN US, 2020

FIGURE 17 GLOBAL ELECTRIC VEHICLE (EV) STOCK, BY REGION

FIGURE 18 MARKET DRIVERS OF AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High cost of ownership

FIGURE 19 CMM MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Surging adoption of cloud computing and Industry 4.0

FIGURE 20 HISTORICAL AND ANTICIPATED SPENDING ON PUBLIC CLOUD SERVICES BY WORLDWIDE END USERS, 2019–2022

5.2.3.2 Escalating need for coordinate measuring machine services

FIGURE 21 CMM MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Bringing speed and accuracy improvement in CMM scanning

5.2.4.2 Lack of simplified software solutions

FIGURE 22 CHALLENGES FOR CMM MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS : COORDINATE MEASURING MACHINE MARKET

5.4 ECOSYSTEM

TABLE 2 COORDINATE MEASURING MACHINE MARKET : ECOSYSTEM

FIGURE 24 MARKET : ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CMM MANUFACTURERS

FIGURE 25 REVENUE SHIFT FOR MARKET PLAYERS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 IMPACT OF PORTERS 5 FORCES ON CMM MARKET

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: CMM MARKET

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 RIVALRY AMONG EXISTING COMPETITORS

5.7 CASE STUDY

5.7.1 HEAVY MACHINERY

5.7.1.1 Zeus engineering chooses FARO CAM2 software and FARoARM to support business growth plans

5.7.1.2 CMM is installed at express engineering

5.7.2 AUTOMOTIVE

5.7.2.1 ITM engineering opts for flexible and high-precision 3D measurement services

5.8 TECHNOLOGY TRENDS

5.8.1 CLOUD COMPUTING

5.8.2 PORTABLE METROLOGY

5.8.3 ROBOTIC LASER METROLOGY

5.9 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF CMM IN 2020 (USD)

TABLE 5 AVERAGE SELLING PRICE OF CMM, BY TYPE, IN 2020 (USD)

5.10 TRADE ANALYSIS

5.10.1 EXPORT SCENARIO

FIGURE 27 EXPORT DATA OF MEASURING INSTRUMENTS, APPLIANCES, AND MACHINES, BY COUNTRY, 2016–2020 (USD MILLION)

5.10.2 IMPORT SCENARIO

FIGURE 28 IMPORT DATA OF MEASURING INSTRUMENTS, APPLIANCES, AND MACHINES, BY COUNTRY, 2016–2020 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2020

TABLE 6 TOP 20 PATENT OWNERS IN US, 2011–2020

5.11.1 LIST OF MAJOR PATENTS

5.12 REGULATORY LANDSCAPE

5.12.1 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

5.12.2 REGISTRATION, EVALUATION, AUTHORIZATION, AND RESTRICTION OF CHEMICALS (REACH)

5.12.3 GENERAL DATA PROTECTION REGULATION (GDPR)

5.12.4 IMPORT–EXPORT LAWS

6 COMPONENTS OF COORDINATE MEASURING MACHINES (Page No. - 81)

6.1 INTRODUCTION

6.2 BRIDGE

6.3 TRIGGER PROBE

6.3.1 CONTACT PROBE

6.3.1.1 3D touch probe

6.3.1.2 2D spindle probe

6.3.1.3 Tool-length measuring probe

6.3.2 NON-CONTACT PROBE

6.3.2.1 Optical probe

6.3.2.2 Laser-line probe

6.4 STAGE

6.5 CONTROLLER

7 OFFERINGS RELATED TO COORDINATE MEASURING MACHINES (Page No. - 83)

7.1 INTRODUCTION

7.2 HARDWARE COMPONENTS

7.3 SWITCHES

7.4 SERVICES

7.4.1 AFTER-SALES SERVICES

7.4.2 SOFTWARE-AS-A-SERVICE

7.4.3 MEASUREMENT SERVICES

8 COORDINATE MEASURING MACHINE (CMM) MARKET, BY TYPE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 31 FIXED CMM TO ACCOUNT FOR LARGER MARKET SIZE THAN PORTABLE CMM DURING FORECAST PERIOD

TABLE 7 COORDINATE MEASURING MACHINE MARKET , BY TYPE, 2017–2020 (USD MILLION)

TABLE 8 MARKET , BY TYPE, 2021–2026 (USD MILLION)

8.2 FIXED CMM

TABLE 9 FIXED CMM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 FIXED COORDINATE MEASURING MACHINE MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.2.1 BRIDGE

8.2.1.1 Bridge design enables CMM to provide better rigidity and high accuracy

TABLE 11 BRIDGE CMM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 12 BRIDGE CMM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 32 APAC TO DOMINATE BRIDGE CMM MARKET FOR AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

TABLE 13 BRIDGE FOR AUTOMOTIVE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 BRIDGE MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 15 BRIDGE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 BRIDGE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 BRIDGE COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 BRIDGE MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 19 BRIDGE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 BRIDGE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 BRIDGE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 BRIDGE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

FIGURE 33 APAC TO LEAD FIXED CMM MARKET DURING FORECAST PERIOD

TABLE 23 COORDINATE MEASURING MACHINE MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 26 BRIDGE CMM MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD THOUSAND)

8.2.2 CANTILEVER

8.2.2.1 Fixed cantilever-type CMM captures significant market share owing to its ability to measure objects with high accuracy

TABLE 27 CANTILEVER CMM MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 28 CANTILEVER CMM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 29 CANTILEVER COORDINATE MEASURING MACHINE MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 CANTILEVER MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 31 CANTILEVER COORDINATE MEASURING MACHINE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 CANTILEVER CMM MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

FIGURE 34 APAC TO COMMAND CANTILEVER COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY DURING FORECAST PERIOD

TABLE 33 CANTILEVER MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 35 CANTILEVER CMM MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 CANTILEVER COORDINATE MEASURING MACHINE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 CANTILEVER MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 CANTILEVER CMM MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 39 COORDINATE MEASURING MACHINE MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 CANTILEVER CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 COORDINATE MEASURING MACHINE MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 CANTILEVER MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

8.2.3 GANTRY

8.2.3.1 Gantry-type CMM differentiates itself from bridge-type CMM with its ability to measure large objects such as cars and other vehicles

FIGURE 35 AUTOMOTIVE INDUSTRY TO ACCOUNT FOR LARGEST SIZE OF CMM MARKET IN 2026

TABLE 43 GANTRY COORDINATE MEASURING MACHINE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 44 GANTRY CMM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 45 GANTRY CMM MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 47 GANTRY CMM MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 COORDINATE MEASURING MACHINE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 49 GANTRY CMM MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 GANTRY COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

FIGURE 36 APAC TO DOMINATE GANTRY CMM MARKET FOR ENERGY & POWER INDUSTRY DURING FORECAST PERIOD

TABLE 51 GANTRY CMM MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 GANTRY MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 53 GANTRY CMM MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 GANTRY MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 GANTRY CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 56 GANTRY CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 57 GANTRY CMM MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 58 COORDINATE MEASURING MACHINE MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD THOUSAND)

8.3 PORTABLE CMM

FIGURE 37 ARTICULATED ARM TO CAPTURE LARGER SIZE OF PORTABLE CMM MARKET DURING FORECAST PERIOD

TABLE 59 PORTABLE CMM MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 60 PORTABLE COORDINATE MEASURING MACHINE MARKET, BY TYPE, 2021–2026 (USD MILLION)

8.3.1 ARTICULATED ARM

8.3.1.1 Articulated arm CMMs held larger market share of portable CMMs owing to their ability to allow probes to be placed in different directions during measurement process

TABLE 61 ARTICULATED ARM COORDINATE MEASURING MACHINE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 62 ARTICULATED ARM CMM MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 63 ARTICULATED ARM CMM MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 ARTICULATED ARM CMM MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 65 COORDINATE MEASURING MACHINE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 ARTICULATED ARM MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

FIGURE 38 ARTICULATED ARM CMM MARKET IN APAC FOR HEAVY MACHINERY INDUSTRY TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 67 ARTICULATED ARM COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 ARTICULATED ARM CMM MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 69 COORDINATE MEASURING MACHINE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 ARTICULATED ARM CMM MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 71 ARTICULATED ARM CMM MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 COORDINATE MEASURING MACHINE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 ARTICULATED ARM CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 ARTICULATED ARM CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 75 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 76 ARTICULATED ARM CMM FOR OTHER INDUSTRIES MARKET, BY REGION, 2021–2026 (USD THOUSAND)

8.3.2 HANDHELD

8.3.2.1 Automotive and medical industries boost demand for handheld CMMs

FIGURE 39 AUTOMOTIVE INDUSTRY TO RECORD LARGEST SHARE OF HANDHELD CMM MARKET DURING FORECAST PERIOD

TABLE 77 COORDINATE MEASURING MACHINE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 78 HANDHELD MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

TABLE 79 HANDHELD CMM MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 COORDINATE MEASURING MACHINE MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 HANDHELD CMM MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 HANDHELD CMM MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

TABLE 85 COORDINATE MEASURING MACHINE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 86 HANDHELD COORDINATE MEASURING MACHINE FOR ENERGY & POWER MARKET, BY REGION, 2021–2026 (USD THOUSAND)

FIGURE 40 APAC TO DOMINATE HANDHELD MARKET FOR ELECTRONICS INDUSTRY DURING FORECAST PERIOD

TABLE 87 HANDHELD CMM MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 88 COORDINATE MEASURING MACHINE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 89 HANDHELD CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 90 HANDHELD CMM MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 91 HANDHELD MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 92 MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD THOUSAND)

9 APPLICATIONS OF COORDINATE MEASURING MACHINES (Page No. - 122)

9.1 INTRODUCTION

FIGURE 41 APPLICATIONS OF CMM, 2020

9.2 QUALITY CONTROL AND INSPECTION

9.3 REVERSE ENGINEERING

9.4 VIRTUAL SIMULATION

9.5 PROFILING AND ASSESSMENT

10 COORDINATE MEASURING MACHINE (CMM) MARKET, BY INDUSTRY (Page No. - 125)

10.1 INTRODUCTION

FIGURE 42 AUTOMOTIVE INDUSTRY TO CAPTURE LARGEST SIZE OF CMM MARKET DURING FORECAST PERIOD

TABLE 93 COORDINATE MEASURING MACHINE MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 94 COORDINATE MEASURING MACHINE MARKET, BY INDUSTRY, 2021–2026 (USD MILLION)

10.2 AUTOMOTIVE

10.2.1 AUTOMOTIVE INDUSTRY TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 95 MARKET FOR AUTOMOTIVE INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 COORDINATE MEASURING MACHINE MARKET FOR AUTOMOTIVE INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 43 APAC TO DOMINATE CMM MARKET FOR AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

TABLE 97 COORDINATE MEASURING MACHINE MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 98 CMM MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.3 AEROSPACE

10.3.1 USE OF CMM TO MANUFACTURE PRECISION PARTS IN AEROSPACE TO FUEL ITS DEMAND

TABLE 99 COORDINATE MEASURING MACHINE MARKET FOR AEROSPACE INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 100 CMM MARKET FOR AEROSPACE INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 101 COORDINATE MEASURING MACHINE MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 CMM MARKET FOR AEROSPACE INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.4 HEAVY MACHINERY

10.4.1 ADOPTION OF CMM TO ACHIEVE ONSITE DIMENSIONAL MEASUREMENT BY MANUFACTURERS OF HEAVY EQUIPMENT TO ACCELERATE MARKET GROWTH

FIGURE 44 BRIDGE-TYPE CMM TO ACCOUNT FOR LARGEST MARKET SHARE FOR HEAVY MACHINERY INDUSTRY DURING FORECAST PERIOD

TABLE 103 COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 COORDINATE MEASURING MACHINE MARKET FOR HEAVY MACHINERY INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 CMM MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 106 MARKET FOR HEAVY MACHINERY INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.5 ENERGY & POWER

10.5.1 GROWING CLEAN ENERGY PORTFOLIOS IN APAC TO DRIVE DEMAND FOR CMM IN ENERGY & POWER INDUSTRY

TABLE 107 CMM MARKET FOR ENERGY & POWER INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 COORDINATE MEASURING MACHINE MARKET FOR ENERGY & POWER INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 109 CMM MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 110 COORDINATE MEASURING MACHINE MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.6 ELECTRONICS

10.6.1 ABILITY OF CMM TO MONITOR HIGH-PACED PRODUCTION OF VARIOUS ELECTRONIC PRODUCTS TO DRIVE MARKET FOR ELECTRONICS INDUSTRY

FIGURE 45 BRIDGE-TYPE CMM TO CAPTURE LARGEST MARKET SIZE FOR ELECTRONICS INDUSTRY DURING FORECAST PERIOD

TABLE 111 COORDINATE MEASURING MACHINE MARKET FOR ELECTRONICS INDUSTRY, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 CMM MARKET FOR ELECTRONICS INDUSTRY, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 COORDINATE MEASURING MACHINE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 114 COORDINATE MEASURING MACHINE MARKET FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2026 (USD MILLION)

10.7 MEDICAL

10.7.1 CMM PLAYS IMPORTANT ROLE IN DESIGNING AND MANUFACTURING OF MEDICAL EQUIPMENT FOR CUSTOM REQUIREMENTS

TABLE 115 COORDINATE MEASURING MACHINE MARKET FOR MEDICAL INDUSTRY, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 116 CMM MARKET FOR MEDICAL INDUSTRY, BY TYPE, 2021–2026 (USD THOUSAND)

FIGURE 46 APAC TO DOMINATE CMM MARKET FOR MEDICAL INDUSTRY DURING FORECAST PERIOD

TABLE 117 COORDINATE MEASURING MACHINE MARKET FOR MEDICAL INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 118 COORDINATE MEASURING MACHINE MARKET FOR MEDICAL INDUSTRY, BY REGION, 2021–2026 (USD THOUSAND)

10.8 OTHERS

TABLE 119 COORDINATE MEASURING MACHINE MARKET FOR OTHER INDUSTRIES, BY TYPE, 2017–2020 (USD THOUSAND)

TABLE 120 CMM MARKET FOR OTHER INDUSTRIES, BY TYPE, 2021–2026 (USD THOUSAND)

FIGURE 47 APAC TO BE FASTEST-GROWING MARKET AND LARGEST STAKEHOLDER OF CMM MARKET FOR OTHER INDUSTRIES DURING FORECAST PERIOD

TABLE 121 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 122 MARKET FOR OTHER INDUSTRIES, BY REGION, 2021–2026 (USD THOUSAND)

11 GEOGRAPHIC ANALYSIS (Page No. - 143)

11.1 INTRODUCTION

FIGURE 48 CMM MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 123 COORDINATE MEASURING MACHINE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 124 COORDINATE MEASURING MACHINE MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 49 NORTH AMERICA: COORDINATE MEASURING MACHINE MARKET SNAPSHOT

11.2.1 US

11.2.1.1 US to hold largest share of CMM market in North America from 2021 to 2026

11.2.2 CANADA

11.2.2.1 CMMs are expected to be implemented primarily in automotive industry in Canada

11.2.3 MEXICO

11.2.3.1 Mexican companies and associations are constantly striving to boost CMM market

TABLE 125 COORDINATE MEASURING MACHINE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN NORTH AMERICA, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN NORTH AMERICA, BY INDUSTRY, 2021–2026 (USD MILLION)

11.3 EUROPE

FIGURE 50 EUROPE: CMM MARKET SNAPSHOT

11.3.1 GERMANY

11.3.1.1 Germany is projected to account for largest share of European CMM market from 2021 to 2026

11.3.2 UK

11.3.2.1 UK is among major markets for heavy machinery globally

11.3.3 FRANCE

11.3.3.1 Flourishing automotive market projected to contribute to CMM market growth in France

11.3.4 ITALY

11.3.4.1 Booming automotive sector to accelerate demand for CMMs

11.3.5 REST OF EUROPE (ROE)

TABLE 129 COORDINATE MEASURING MACHINE MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 130 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 131 MARKET IN EUROPE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 132 MARKET IN EUROPE, BY INDUSTRY, 2021–2026 (USD MILLION)

11.4 APAC

FIGURE 51 APAC: CMM MARKET SNAPSHOT

11.4.1 CHINA

11.4.1.1 China to hold largest share of CMM market in APAC from 2021 to 2026

11.4.2 JAPAN

11.4.2.1 Significant growth in automotive and electronics industries drives CMM market growth in Japan

11.4.3 INDIA

11.4.3.1 Supporting government policies and FDI in automotive and electronics manufacturing boost CMM market growth

11.4.4 REST OF APAC (ROAPAC)

TABLE 133 COORDINATE MEASURING MACHINE MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 135 CMM MARKET IN APAC, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 136 COORDINATE MEASURING MACHINE MARKET IN APAC, BY INDUSTRY, 2021–2026 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

FIGURE 52 ROW: CMM MARKET SNAPSHOT

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Heavy government investments in aerospace industry to fuel market growth

11.5.2 SOUTH AMERICA

11.5.2.1 Growing automotive industry in South America propels CMM market growth

TABLE 137 COORDINATE MEASURING MACHINE MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 138 CMM MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 139 COORDINATE MEASURING MACHINE MARKET IN ROW, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 140 MARKET IN ROW, BY INDUSTRY, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 161)

12.1 INTRODUCTION

12.2 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 53 TOP PLAYERS DOMINATING MARKET IN 5 YEARS

12.3 MARKET SHARE ANALYSIS OF PLAYERS, 2020

TABLE 141 COORDINATE MEASURING MACHINE MARKET: CONSOLIDATED

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 54 CMM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 STARTUP/SME EVALUATION QUADRANT

12.5.1 PROGRESSIVE COMPANY

12.5.2 RESPONSIVE COMPANY

12.5.3 DYNAMIC COMPANY

12.5.4 STARTING BLOCK

FIGURE 55 STARTUP/SME EVALUATION MATRIX

TABLE 142 COMPANY GEOGRAPHIC FOOTPRINT

TABLE 143 COMPANY INDUSTRY FOOTPRINT

TABLE 144 COMPANY FOOTPRINT ANALYSIS OF TOP PLAYERS IN CMM MARKET

12.6 COMPETITIVE SITUATIONS AND TRENDS

12.6.1 PRODUCT LAUNCHES

TABLE 145 COORDINATE MEASURING MACHINE MARKET : PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2018–JANUARY 2021

12.6.2 DEALS

TABLE 146 COORDINATE MEASURING MACHINE MARKET : DEALS, JANUARY 2018–JANUARY 2021

12.6.3 OTHERS

TABLE 147 COORDINATE MEASURING MACHINE MARKET : OTHERS, JANUARY 2018–JANUARY 2021

13 COMPANY PROFILES (Page No. - 174)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 ZEISS GROUP

TABLE 148 ZEISS GROUP: BUSINESS OVERVIEW

FIGURE 56 ZEISS GROUP: COMPANY SNAPSHOT

13.2.2 FARO TECHNOLOGIES

TABLE 149 FARO TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 57 FARO TECHNOLOGIES: COMPANY SNAPSHOT

13.2.3 HEXAGON

TABLE 150 HEXAGON: BUSINESS OVERVIEW

FIGURE 58 HEXAGON: COMPANY SNAPSHOT

13.2.4 NIKON CORPORATION

TABLE 151 NIKON CORPORATION: BUSINESS OVERVIEW

FIGURE 59 NIKON CORPORATION: COMPANY SNAPSHOT

13.2.5 MITUTOYO

TABLE 152 MITUTOYO: BUSINESS OVERVIEW

13.2.6 TOKYO SEIMITSU

TABLE 153 TOKYO SEIMITSU: BUSINESS OVERVIEW

FIGURE 60 TOKYO SEIMITSU: COMPANY SNAPSHOT

13.2.7 KEYENCE CORPORATION

TABLE 154 KEYENCE: BUSINESS OVERVIEW

FIGURE 61 KEYENCE: COMPANY SNAPSHOT

13.2.8 CREAFORM

TABLE 155 CREAFORM: BUSINESS OVERVIEW

13.2.9 PERCEPTRON

TABLE 156 PERCEPTRON: BUSINESS OVERVIEW

13.2.10 WENZEL GROUP

TABLE 157 WENZEL GROUP: BUSINESS OVERVIEW

13.3 OTHER PLAYERS

13.3.1 LK METROLOGY

13.3.2 MICRO-VU

13.3.3 ADCOLE

13.3.4 APPLIED AUTOMATION TECH (AAT)

13.3.5 METRONOR

13.3.6 TRIMEK

13.3.7 ELEY METROLOGY

13.3.8 ABERLINK

13.3.9 CHIEN WEI PRECISE TECHNOLOGY

13.3.10 HELMEL ENGINEERING

13.3.11 REDLUX

13.3.12 IMPACT METROLOGY SYSTEMS

13.3.13 SIPCON INSTRUMENT INDUSTRIES

13.3.14 FOWLER HIGH PRECISION

13.3.15 DUKIN

13.3.16 ALICONA IMAGING

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKET (Page No. - 215)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 NON-DESTRUCTIVE TESTING (NDT) AND INSPECTION

14.3.1 DEFINITION

14.3.2 MARKET OVERVIEW

14.3.3 NDT MARKET, BY VERTICAL

TABLE 158 NDT AND INSPECTION MARKET, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 159 NDT AND INSPECTION MARKET, BY VERTICAL, 2020–2025 (USD MILLION)

14.3.3.1 Manufacturing

TABLE 160 NDT AND INSPECTION MARKET FOR MANUFACTURING VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 161 NDT AND INSPECTION MARKET FOR MANUFACTURING VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 162 NDT AND INSPECTION MARKET FOR MANUFACTURING VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 163 NDT AND INSPECTION MARKET FOR MANUFACTURING VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 164 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR MANUFACTURING VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 165 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR MANUFACTURING VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 166 NDT AND INSPECTION MARKET IN EUROPE FOR MANUFACTURING VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 167 NDT AND INSPECTION MARKET IN EUROPE FOR MANUFACTURING VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 168 NDT AND INSPECTION MARKET IN APAC FOR MANUFACTURING VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 169 NDT AND INSPECTION MARKET IN APAC FOR MANUFACTURING VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 170 NDT AND INSPECTION MARKET IN ROW FOR MANUFACTURING VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 171 NDT AND INSPECTION MARKET IN ROW FOR MANUFACTURING VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.2 Oil and Gas

TABLE 172 NDT AND INSPECTION MARKET FOR OIL AND GAS VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 173 NDT AND INSPECTION MARKET FOR OIL AND GAS VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 174 NDT AND INSPECTION MARKET FOR OIL AND GAS VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 175 NDT AND INSPECTION MARKET FOR OIL AND GAS VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 176 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR OIL AND GAS VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 177 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR OIL AND GAS VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 178 NDT AND INSPECTION MARKET IN EUROPE FOR OIL AND GAS VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 179 NDT AND INSPECTION MARKET IN EUROPE FOR OIL AND GAS VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 180 NDT AND INSPECTION MARKET IN APAC FOR OIL AND GAS VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 181 NDT AND INSPECTION MARKET IN APAC FOR OIL AND GAS VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 182 NDT AND INSPECTION MARKET IN ROW FOR OIL AND GAS VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 183 NDT AND INSPECTION MARKET IN ROW FOR OIL AND GAS VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.3 Aerospace

TABLE 184 NDT AND INSPECTION MARKET FOR AEROSPACE VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 185 NDT AND INSPECTION MARKET FOR AEROSPACE VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 186 NDT AND INSPECTION MARKET FOR AEROSPACE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 187 NDT AND INSPECTION MARKET FOR AEROSPACE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 188 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR AEROSPACE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 189 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR AEROSPACE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 190 NDT AND INSPECTION MARKET IN EUROPE FOR AEROSPACE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 191 NDT AND INSPECTION MARKET IN EUROPE FOR AEROSPACE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 192 NDT AND INSPECTION MARKET IN APAC FOR AEROSPACE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 193 NDT AND INSPECTION MARKET IN APAC FOR AEROSPACE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 194 NDT AND INSPECTION MARKET IN ROW FOR AEROSPACE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 195 NDT AND INSPECTION MARKET IN ROW FOR AEROSPACE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.4 Public Infrastructure

TABLE 196 NDT AND INSPECTION MARKET FOR PUBLIC INFRASTRUCTURE VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 197 NDT AND INSPECTION MARKET FOR PUBLIC INFRASTRUCTURE VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 198 NDT AND INSPECTION MARKET FOR PUBLIC INFRASTRUCTURE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 199 NDT AND INSPECTION MARKET FOR PUBLIC INFRASTRUCTURE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 200 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 201 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 202 NDT AND INSPECTION MARKET IN EUROPE FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 203 NDT AND INSPECTION MARKET IN EUROPE FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 204 NDT AND INSPECTION MARKET IN APAC FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 205 NDT AND INSPECTION MARKET IN APAC FOR PUBLIC INFRASTRUCTURE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 206 NDT AND INSPECTION MARKET IN ROW FOR PUBLIC INFRASTRUCTURE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 207 NDT AND INSPECTION MARKET IN ROW FOR PUBLIC INFRASTRUCTURE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.5 Automotive

TABLE 208 NDT AND INSPECTION MARKET FOR AUTOMOTIVE VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 209 NDT AND INSPECTION MARKET FOR AUTOMOTIVE VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 210 NDT AND INSPECTION MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 211 NDT AND INSPECTION MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 212 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 213 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 214 NDT AND INSPECTION MARKET IN EUROPE FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 215 NDT AND INSPECTION MARKET IN EUROPE FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 216 NDT AND INSPECTION MARKET IN APAC FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 217 NDT AND INSPECTION MARKET IN APAC FOR AUTOMOTIVE VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 218 NDT AND INSPECTION MARKET IN ROW FOR AUTOMOTIVE VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 219 NDT AND INSPECTION MARKET IN ROW FOR AUTOMOTIVE VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.6 Power Generation

TABLE 220 NDT AND INSPECTION MARKET FOR POWER GENERATION VERTICAL, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 221 NDT AND INSPECTION MARKET FOR POWER GENERATION VERTICAL, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 222 NDT AND INSPECTION MARKET FOR POWER GENERATION VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 223 NDT AND INSPECTION MARKET FOR POWER GENERATION VERTICAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 224 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR POWER GENERATION VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 225 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR POWER GENERATION VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 226 NDT AND INSPECTION MARKET IN EUROPE FOR POWER GENERATION VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 227 NDT AND INSPECTION MARKET IN EUROPE FOR POWER GENERATION VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 228 NDT AND INSPECTION MARKET IN APAC FOR POWER GENERATION VERTICAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 229 NDT AND INSPECTION MARKET IN APAC FOR POWER GENERATION VERTICAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 230 NDT AND INSPECTION MARKET IN ROW FOR POWER GENERATION VERTICAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 231 NDT AND INSPECTION MARKET IN ROW FOR POWER GENERATION VERTICAL, BY REGION, 2020–2025 (USD MILLION)

14.3.3.7 Others

TABLE 232 NDT AND INSPECTION MARKET FOR OTHER VERTICALS, BY TECHNIQUE AND SERVICE, 2017–2019 (USD MILLION)

TABLE 233 NDT AND INSPECTION MARKET FOR OTHER VERTICALS, BY TECHNIQUE AND SERVICE, 2020–2025 (USD MILLION)

TABLE 234 NDT AND INSPECTION MARKET FOR OTHER VERTICALS, BY REGION, 2017–2019 (USD MILLION)

TABLE 235 NDT AND INSPECTION MARKET FOR OTHER VERTICALS, BY REGION, 2020–2025 (USD MILLION)

TABLE 236 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 237 NDT AND INSPECTION MARKET IN NORTH AMERICA FOR OTHER VERTICALS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 238 NDT AND INSPECTION MARKET IN EUROPE FOR OTHER VERTICALS, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 239 NDT AND INSPECTION MARKET IN EUROPE FOR OTHER VERTICALS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 240 NDT AND INSPECTION MARKET IN APAC FOR OTHER VERTICALS, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 241 NDT AND INSPECTION MARKET IN APAC FOR OTHER VERTICALS, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 242 NDT AND INSPECTION IN ROW MARKET FOR OTHER VERTICALS, BY REGION, 2017–2019 (USD MILLION)

TABLE 243 NDT AND INSPECTION IN ROW MARKET FOR OTHER VERTICALS, BY REGION, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 249)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

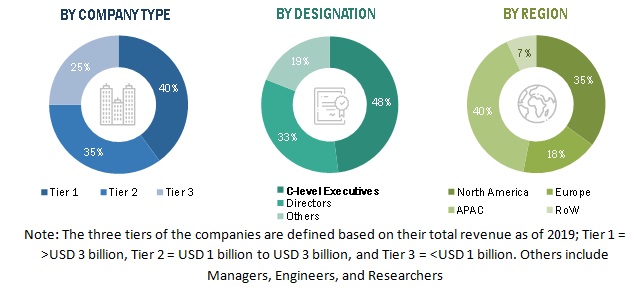

This study involved four major activities in estimating the size of the coordinate measuring machine (CMM) market. Exhaustive secondary research has been conducted to collect information on the CMM market. In the next step, these findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. Following that, the market breakdown and data triangulation methods have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for the CMM market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, associations (such as International Organization of Legal Metrology, Asia Pacific Legal Metrology Forum (APLMF), European Association of National Metrology Institutes (EURAMET), and Coordinate Metrology Society (CMS)), and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the CMM market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall CMM market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Key players expected operating in the CMM market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall expected CMM market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the CMM market.

Report Objectives:

Available Customizas:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the CMM market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Coordinate Measuring Machine Market

Knowledge about usage of linear and torque motors in CMM and hi precision metrology measuring machines. Have you included these motors in the CMM scope?

We are trying to do analysis of the CMM market and looking for CMM sales data by industry, location, type etc. Has it been included in the scope?

I would like to have the CMM Forecast. What is the scope and the forecasted year for the report? Which are the major drivers affecting the growth of this market?

What are the various types and applications you have considered? Also has the data about the type by application and application by type included in the scope? Also how is IoT or IIoT associated with CMM? Has it been included?

want to download Coordinate Measuring Machine (CMM) Market by Type (Bridge, Cantilever, Articulated Arm, Handheld), Application (Quality Control & Inspection, Reverse Engineering), Industry (Automotive, Heavy Machinery), and Geography - Global Forecast to 2023. How could IIoT impact the CMM market?