Social Media Management Market Size, Share and Trends Report by Component (Solutions, Services), Deployment Mode, Organization Size, Application (Competitive Intelligence, Sales and Marketing Management), Vertical (BFSI, Retail and Consumer Goods) & Region - Global Forecast to 2027

Social Media Management Market Growth

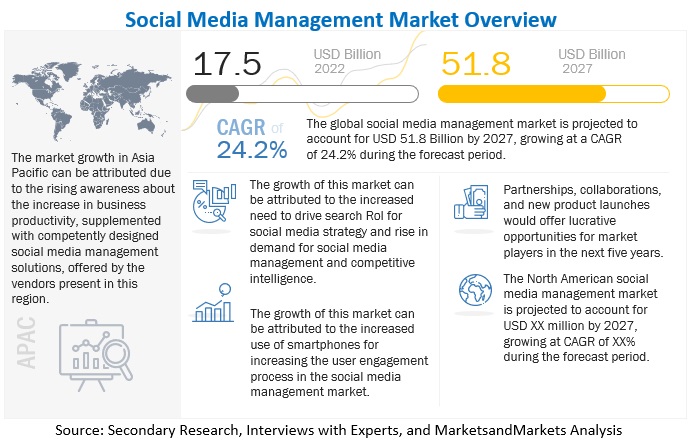

The global Social Media Management Market size was surpassed $17.5 billion in 2022 and is projected to reach over $51.8 billion by the end of 2027 at an effective CAGR of 24.2% during the forecast period.

Growth is driven by increasing digital engagement for brand visibility, customer loyalty, and return on investment through real-time insights, loyalty programs, and targeted marketing strategies.

Social Media Management Market Key Trends & Insights

- Competitive Intelligence Focus: Growing demand for advanced analytics to analyze unstructured social data, enhance market presence, and improve sales and profitability.

- Regulatory & Compliance Constraints: Data privacy regulations such as GDPR, PCI DSS, HIPAA, and GLBA impacting social media operations and requiring stringent compliance measures.

- Cloud Adoption Opportunity: Rising deployment of SaaS, IaaS, and PaaS models offering scalability, flexibility, and cost-efficiency in social media management solutions.

- Lack of Standard Measures: Absence of uniform validation metrics for social media management platforms impacting decision-making reliability.

- Solutions Segment Growth: Increased adoption of social media marketing, listening, monitoring, analytics, content management, and compliance management solutions.

- Cloud-based Deployment Mode: Highest CAGR expected due to low operational costs, remote accessibility, and vendor-managed IT infrastructure.

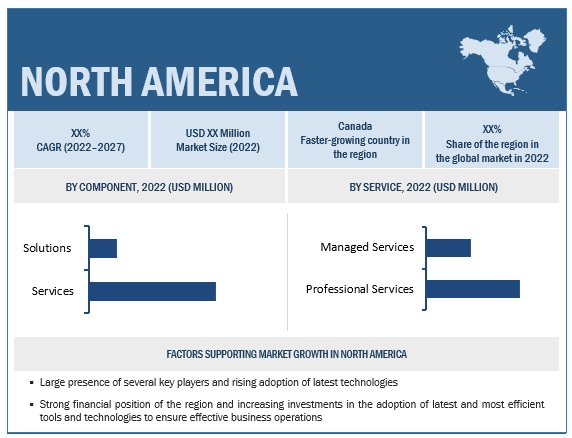

- North America Leadership: Largest market share driven by high internet penetration, strong social media adoption, and use of digital tools for branding, marketing, and customer engagement.

Social Media Management Market Size & Forecast

- 2022 Market Size: USD 17.5 Billion

- 2027 Projected Market Size: USD 51.8 Billion

- CAGR (2022–2027): 24.2%

- Largest Market in 2022: North America

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing focus on competitive intelligence

Global competition continues to affect profit margins, and companies are constantly looking for technological solutions to maximize their productivity and reduce costs while maintaining an edge in the competition. Companies need to integrate demographic, competitive, and business information, along with the customer’s data, to discover the intricacies of outperforming their competitors. Organizations are trying to focus on analyzing sales and various markets to identify gaps. Customers these days have become brand conscious. They demand better quality, lower prices, and faster delivery of products and services. Advanced analytics is being incorporated to help achieve market goals. Social media management solution helps to analyze unstructured social data to respond to dynamic market conditions and achieve high sales and operational profitability. Organizations can retrieve huge amounts of customer sentiments about their brands, then strategize their marketing and sales activities. Companies can use social media management solutions to improve their market presence and gain a competitive edge by effectively analyzing the competition and consumer behavior from social media platforms. Social media management solutions have various applications, such as engagement, CRM, publishing, advertisement, monitoring, and real-time analytics.

Restraints: Regulatory & compliance constraint

Data privacy issues have attracted global attention in recent years and have significantly affected the social media space with the formulation of data protection and privacy laws and regulations, such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), Health Insurance Portability and Accountability Act (HIPAA), and Gramm–Leach–Bliley Act (GLBA). GDPR specifies the requirement of enterprises to provide data breach notifications, secure data transfer, anonymize customer data, and process data with the consent of clients. According to the regulation, if any organization compromises the privacy of its customers or employees through its social media platforms or if an employee of the organization exposes confidential information about the stakeholders or customers of the organization, they are bound to pay hefty fines and legal actions and proceedings will be initiated against the concerned individuals or organizational entities.

Opportunity: Increase in cloud adoption trends

Cloud adoption is said to have increased recently because vendors are using Software-as-a-Service (SaaS) to deliver cloud computing solutions. Business users are always on the lookout to ensure they are providing the most effective social media management solutions. Cloud makes it possible to perform cloud computing, which allows outsourcing the operational IT work to another company. Cloud service providers take all the risks and burdens associated with it. As per industry experts and cloud vendors, cloud computing is expected to grow at an even higher rate during the upcoming years due to its range of features, such as flexibility, reliability, scalability, and low costs. Software-as-a-Service (SaaS), Infrastructure-as-a-Service (IaaS), and Platform-as-a-Service (PaaS) are all provided in the cloud Deployment mode.

Vendors are increasingly deploying the SaaS model to provide social media management solutions over the cloud. For instance, in March 2021, HCL partnered with Google Cloud; this partnership aims to expand their strategic partnership to provide HCL Software’s Digital Experience (DX) and Unica Marketing cloud-native platforms to Google Cloud.

Challenge: Lack of standard measures for a social media management platform

Previously, the content on social media was mostly limited to text, which was easy to analyze. With technology development, this unstructured data has expanded to include multimedia content in the form of images, videos, audio files, and GIFs. The analyzed data must be reliable and valid to generate value from social media channels. Otherwise, it would not be of much use and can be considered bad data, leading to wrong decision-making in organizations. Hence, it is necessary to validate all the analyses and algorithms used to rely on the results obtained. If the methodology and math cannot be verified, then foolproof decisions cannot be made. Most vendors validate the information themselves, which exposes a common problem with social media management for a management platform. Some provide validation with the help of customer metrics, such as Key Performance Indicators (KPIs); this method helps focus only on certain circumstances. Vendors are normally not keen on providing broad external validations. Part of the reason not to do so is the lack of standard measures for social media management solutions.

Solutions segment to account for larger market size during forecast period

The solutions segment of the social media management market has been divided into social media marketing; social media listening, monitoring, and analytics; social media asset and content management; and social media risk and compliance management. This section discusses each solution subsegment's market size and growth rate based on type (for selected subsegments) and region.

Social media plays an integral part in the business landscape. With 3.2 billion people using social media worldwide and 11 new users every second, the market is at an upsurge in the present and is to witness this in the future. Social media management solutions help reach a huge audience and simplify running a social media campaign. Social media management solutions refer to the platform, tools, and software, which provide end-to-end social media management solutions for social media data to numerous industry verticals. Social media management solutions help extract data from social media channels to track customer sentiments and their behavior toward brands. The increasing adoption of social media management by marketers and advertisers to understand customer preferences and analyze patterns for improving sales is fueling the demand for social media management solutions across various verticals.

Cloud-based deployment mode to register highest CAGR during forecast period

The cloud-based deployment mode provides a solution to access the data remotely from various servers or data centers. These include servers, networks, storage, databases, analytical tools, and software platforms to deliver and access services over the internet. Its low cost of Operating Expenditures (OPEX) helps users pay per usage and invest more time and energy in concentrating on core business goals. In the cloud deployment mode, the social media management solution is offered as SaaS, and all the social media management workloads are cloud-based. Social media management solution vendors handle IT infrastructure requirements of the customer, data redundancies, data availability, virtual private network setup (related to customer IT teams), setting security protocols and audits, configuration, and maintenance and updates.

North America to have largest market size during forecast period

North America is expected to have the largest social media management market share. The region is a mature and well-established market with a healthy risk appetite and inclination toward technological innovations, presenting many opportunities for social media management vendors and service providers. A widespread social media consumer base and the high prominence of social media management tools characterize the region. The adoption of social media networks as a key marketing and customer engagement tool for verticals will further drive market revenue generation across the region.

The presence of a growing tech-savvy population, high internet penetration, and better connectivity has resulted in an enormous usage of social media platforms. Such large-scale data generation through social media platforms has offered an opportunity for enterprises to gather meaningful insights about brand performance, product influence, product innovation, and campaign performance. Most of the customers in North America have been leveraging social media management for business activities that include, but are not limited to, campaign management, branding, marketing, advertising, and customer perception analysis. The rising popularity and higher reach of social media apps are further empowering SMEs and startups in the region to harness digital media as a cost-effective tool for building and promoting business, growing consumer base, and reaching out to a wider audience without substantial investment into sales and marketing channels. Several leading industry players, such as Bank of America, L'Oréal USA, and American Airlines, have successfully harnessed social media management as a rampant tool to tap consumer sentiment and formulate customer growth and retention strategies for North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The social media management solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the social media management market include Adobe (US), IBM (US), Google (US), Oracle (US), Salesforce (US), Sprout Social (US), Hootsuite (Canada), Meltwater (US), Sprinklr (US), Digimind (France), HubSpot (US), Qualtrics (US), Khoros (US), Cision (US), Zoho (India), Netbase (US), Talkwalker (Luxembourg), Buffer (US), Agorapulse (France), Sendible (UK), MavSocial (US), Emplifi (US), Synthesio (US), Eclincher (US), CreatorIQ (US), Slate Teams (US), Hunter Digital (US), AlchemyWorx (US), KAWO (China), Make Your Mark Digital (US), The Cirqle (Netherlands), Affable.ai (US), Loomly (US), Altorise (India), Socinova (India), and Promo Republic (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD (Billion) |

|

Segments covered |

Component, Organization Size, Deployment Mode, Application, Vertical, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East & Africa (EMEA), and Latin America |

|

Companies covered |

Adobe (US), IBM (US), Google (US), Oracle (US), Salesforce (US), Sprout Social (US), Hootsuite (Canada), Meltwater (US), Sprinklr (US), Digimind (France), HubSpot (US), Qualtrics (US), Khoros (US), Cision (US), Zoho (India), Netbase (US), Talkwalker (Luxembourg), Buffer (US), Agorapulse (France), Sendible (UK), MavSocial (US), Emplifi (US), Synthesio (US), Eclincher (US), CreatorIQ (US), Slate Teams (US), Hunter Digital (US), AlchemyWorx (US), KAWO (China), Make Your Mark Digital (US), The Cirqle (Netherlands), Affable.ai (US), Loomly (US), Altorise (India), Socinova (India), and Promo Republic (US) |

This research report categorizes the social media management market based on component, organization size, deployment mode, application, vertical, and region.

By Component:

- Solutions

- Services

By Organization Size:

- Large Enterprises

- Medium-sized Enterprises

- Small-sized Enterprises

By Deployment Mode:

- On-premises

- Cloud

By Application:

- Sales & Marketing Management

- Customer Experience Management

- Competitive Intelligence

- Risk Management & Fraud Detection

- Others (social media account management and collaboration, social media content scheduling, and reporting)

By Vertical:

- BFSI

- Retail & Consumer Goods

- Government & Public Sector

- Healthcare & Life Sciences

- IT & Telecom

- Media & Entertainment

- Manufacturing

- Travel & Hospitality

- Other Verticals (education, real estate, and energy and utilities)

By Region:

-

North America

- US

- Canada

-

Europe, Middle East & Africa (EMEA)

- Germany

- UK & Ireland

- France

- Spain

- Saudi Arabia

- Italy

- Rest of Europe, Middle East & Africa

-

Asia Pacific

- China

- Japan

- ANZ

- India

- Singapore

- Rest of Asia Pacific

-

Latin America

- Mexico

- Colombia

- Brazil

- Rest of Latin America

Recent Developments:

- In January 2023, IBM announced IBM Partner Plus, a new program that reimagines how IBM engages with its business partners through unprecedented access to IBM resources, incentives, and tailored support to deepen the technical expertise and help speed time to market. The program is designed to fuel growth for new and existing partners, including resellers, hyperscalers, technology providers, independent software vendors and systems integrators, by putting them in control of the earning potential. IBM Partner Plus is central to the company’s Hybrid Cloud and AI strategy and aims to empower partners to help clients automate, secure, and modernize the businesses.

- In January 2023, Sprout Social announced the acquisition of Repustate, an innovative sentiment analysis and natural language processing company. Through this acquisition, Sprout will increase the power, breadth and automation of social listening, messaging and customer care capabilities with added sentiment analysis, natural language processing (NLP) and artificial intelligence (AI).

- In December 2022, Adobe and the State of Illinois announced that the Illinois Department of Innovation & Technology (DoIT) has entered a contract with Adobe for use of Adobe Experience Cloud and Adobe Document Cloud to modernize digital experiences for its residents. The state government is working alongside Adobe to create consistent, personalized experiences for residents, reflecting today’s digital-first economy.

- In November 2022, Sprinklr is the global leader in Unified-CXM – or managing how customers are engaging (experiencing) a brand via external channels. This includes listening to brand-relevant conversations across the internet and creating content and engaging on platforms like social media. Salesforce is the provider of CRM – or managing leads and interactions with the customer within a business. With the expanded partnership announced – and working with strategic go-to-market (GTM) partners like Accenture – the companies can help organizations unify CXM and CRM and provide a truly complete view of the customer.

- In September 2022, Salesforce unveiled Salesforce Genie, a hyperscale real-time data platform that powers the entire Salesforce Customer 360 platform. With Genie, every company can turn data into customer magic, delivering seamless, highly personalized experiences across sales, service, marketing, and commerce that continuously adapt to changing customer information and needs in real time.

Frequently Asked Questions (FAQ):

What is Social Media Management?

Social media management involves managing social media accounts, engaging audiences, and measuring the business results of social media activities. Effective social media management practices implemented at a scale across departments and regions allow everyone within the organization to collaborate and achieve measurable outcomes on social media.

Which countries are considered in the European, Middle Eastern & African region?

The report includes an analysis of the Germany, UK & Ireland, France, Spain, Saudi Arabia, Italy and other countries in the European, Middle Eastern & African region.

Which are the key drivers supporting the growth of the Social Media Management market?

Some factors driving the growth of the social media management market include the rising need to focus on competitive intelligence, the growing need to drive search RoI for social media strategy, enhancement of customer experience with social media management, the shift of people toward the virtual realm due to COVID-19 and the increase in user engagement of social media using smartphones.

Who are the key vendors in the Social Media Management market?

Some major players in the social media management market include Adobe (US), IBM (US), Google (US), Oracle (US), Salesforce (US), Sprout Social (US), Hootsuite (Canada), Meltwater (US), Sprinklr (US), Digimind (France), HubSpot (US), Qualtrics (US), Khoros (US), Cision (US), Zoho (India), Netbase (US), Talkwalker (Luxembourg), Buffer (US), Agorapulse (France), Sendible (UK), MavSocial (US), Emplifi (US), Synthesio (US), Eclincher (US), CreatorIQ (US), Slate Teams (US), Hunter Digital (US), AlchemyWorx (US), KAWO (China), Make Your Mark Digital (US), The Cirqle (Netherlands), Affable.ai (US), Loomly (US), Altorise (India), Socinova (India), and Promo Republic (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing focus on competitive intelligence- Growing need for search RoI for social media strategy- Enhancement of customer experience with social media management- Increase in user engagement with social media using smartphonesRESTRAINTS- Regulatory and compliance constraints- Lack of common standards and laws- Complexities in workflow managementOPPORTUNITIES- Voluminous data generation through social media platforms- Increase in cloud adoption- High adoption of social media management solutions among small and medium-sized enterprises (SMEs)CHALLENGES- Lack of standard measures for social media management platforms- Lack of single solution to manage unstructured data

- 5.3 SOCIAL MEDIA MANAGEMENT: EVOLUTION

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 CASE STUDY ANALYSISCASE STUDY 1: MET POLICE LEVERAGES SPRINKLR TO MEET GROWING DEMAND FOR SERVICES ON SOCIAL CHANNELSCASE STUDY 2: OCBC STREAMLINED CUSTOMER SERVICE AND ENGAGED CUSTOMERS USING HOOTSUITE TOOLCASE STUDY 3: MOMENTIVE DEPLOYED HUBSPOT CRM TO IMPROVE AND SIMPLIFY MARKETING PROCESSESCASE STUDY 4: KHOROS SUPPORTED TV 2’S SOCIAL MEDIA AWARENESS CAMPAIGN BY ENCOURAGING POSITIVE SOCIAL MEDIA DISCOURSECASE STUDY 5: SPRINKLR AND LINKEDIN ENABLED HIGHLY SCALABLE AND SEAMLESS CAMPAIGN MANAGEMENT EXPERIENCECASE STUDY 6: AIRFLUENCERS UNLEASHED INFLUENCER MARKETING WITH HELP OF ORACLECASE STUDY 7: LENOVO CREATED HOLISTIC SOCIAL MEDIA STRATEGY WITH SPRINKLR ADVOCACYCASE STUDY 8: ZOO ZURICH USED SOCIAL TO PROACTIVELY ENGAGE IN CONVERSATIONS WITH VISITORSCASE STUDY 9: OLIVE AND MILO TURNED TO SENDIBLE TO MANAGE THEIR GROWING CLIENT LISTCASE STUDY 10: SHELL CHOSE SPRINKLR’S INDUSTRY-LEADING UNIFIED CUSTOMER EXPERIENCE MANAGEMENT (UNIFIED-CXM) PLATFORM TO UNIFY SILOED TEAMS, PROCESSES, AND TOOLSCASE STUDY 11: SAGE RESTAURANT GROUP USED SENDIBLE TO PORTRAY BRAND IMAGE OF EVERY RESTAURANT ACCURATELYCASE STUDY 12: PHILIPS IMPLEMENTED SPRINKLR MODERN ADVERTISING TO WORK WITH 100 AGENCY PARTNERS GLOBALLYCASE STUDY 13: EURPAC INCREASED ITS SOCIAL MEDIA FOLLOWERS BY 47% USING HOOTSUITE PUBLISHER

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 REGULATORY ANALYSISGENERAL DATA PROTECTION REGULATIONHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI DSS)GRAMM-LEACH-BLILEY ACT (GLBA)

-

5.8 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATIONS AND PATENT APPLICATIONSTOP APPLICANTS

- 5.9 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.10 TECHNOLOGY ANALYSISSOCIAL MEDIA MANAGEMENT AND ARTIFICIAL INTELLIGENCE (AI)SOCIAL MEDIA MANAGEMENT AND MACHINE LEARNING (ML)SOCIAL MEDIA MANAGEMENT AND BIG DATASOCIAL MEDIA MANAGEMENT AND AUGMENTED REALITY (AR)SOCIAL MEDIA MANAGEMENT AND BLOCKCHAINSOCIAL MEDIA MANAGEMENT AND INTERNET OF THINGS (IOT)

- 5.11 PRICING ANALYSIS

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF SOCIAL MEDIA MANAGEMENT MARKET

-

6.1 INTRODUCTIONCOMPONENT: SOCIAL MEDIA MANAGEMENT MARKET DRIVERS

-

6.2 SOLUTIONSSOCIAL MEDIA MARKETING- Social media marketing targets audiences through social media channels and engages them effectivelySOCIAL MEDIA LISTENING, MONITORING, AND ANALYTICS- Social media listening, monitoring, and analytics impact success of organizationsSOCIAL MEDIA ASSET AND CONTENT MANAGEMENT- Social media asset and content management enables companies to optimize social media content effectivelySOCIAL MEDIA RISK AND COMPLIANCE MANAGEMENT- Risk and compliance management incorporates integrity and security of content published on social media

-

6.3 SERVICESPROFESSIONAL SERVICES- Implementation and consulting services- Training and support servicesMANAGED SERVICES

-

7.1 INTRODUCTIONDEPLOYMENT MODE: SOCIAL MEDIA MANAGEMENT MARKET DRIVERS

-

7.2 ON-PREMISESON-PREMISES DEPLOYMENT MODE CATERS TO BUSINESS NEEDS OF ORGANIZATIONS

-

7.3 CLOUDCLOUD-BASED SOLUTIONS PREFERRED BY SMALL AND MEDIUM-SIZED ENTERPRISES ATTRIBUTED TO LOW COSTS

-

8.1 INTRODUCTIONORGANIZATION SIZE: SOCIAL MEDIA MANAGEMENT MARKET DRIVERS

-

8.2 SMALL ENTERPRISESSOCIAL MEDIA ENABLES SMALL ENTERPRISES TO REACH GLOBAL AUDIENCES EASILY AND COST-EFFECTIVELY

-

8.3 MEDIUM-SIZED ENTERPRISESMEDIUM-SIZED ENTERPRISES INVEST IN SOCIAL MEDIA ADVERTISING AND MARKETING TO PROMOTE PRODUCTS AND SERVICES WITH RISING NEED FOR SOCIAL MARKETING

-

8.4 LARGE ENTERPRISESDEMAND FOR SOCIAL MEDIA MANAGEMENT TOOLS IN LARGE ENTERPRISES TO RISE DUE TO AFFORDABILITY AND HIGH ECONOMIES OF SCALE

-

9.1 INTRODUCTIONAPPLICATION: SOCIAL MEDIA MANAGEMENT MARKET DRIVERS

-

9.2 SALES AND MARKETING MANAGEMENTSOCIAL MEDIA MANAGEMENT SOLUTIONS ENABLE SALES TEAMS TO UNDERSTAND TARGETED AUDIENCE

-

9.3 CUSTOMER EXPERIENCE MANAGEMENTSOCIAL MEDIA MANAGEMENT SOLUTIONS ENABLE COMPANIES TO IMPROVE CUSTOMER EXPERIENCESOCIAL CARE AND MESSAGINGCUSTOMER DATA PLATFORM

-

9.4 COMPETITIVE INTELLIGENCECOMPETITIVE INTELLIGENCE ENABLES BUSINESSES TO UNDERSTAND MARKET TRENDS AND QUICKLY ADAPT TO CHANGING MARKET CIRCUMSTANCES

-

9.5 RISK MANAGEMENT AND FRAUD DETECTIONRISK MANAGEMENT AND FRAUD DETECTION MINIMIZE RISKS ASSOCIATED WITH USING SOCIAL MEDIA

- 9.6 OTHERS

-

10.1 INTRODUCTIONVERTICAL: SOCIAL MEDIA MANAGEMENT MARKET DRIVERSSOCIAL MEDIA MANAGEMENT: ENTERPRISE USE CASES

-

10.2 BFSIBFSI SECTOR UNDERGOING DIGITAL TRANSFORMATION

-

10.3 RETAIL & CONSUMER GOODSSOCIAL MEDIA ANALYTICS HELPS ATTAIN RETAIL-SPECIFIC GOALS

-

10.4 GOVERNMENT & PUBLIC SECTORSOCIAL MEDIA HELPS IMPROVE REAL-TIME INTERACTIONS WITH CITIZENS, UNDERSTAND TRENDS, AND MODIFY DECISION-MAKING PATTERNS

-

10.5 HEALTHCARE & LIFE SCIENCESSOCIAL MEDIA DATA HELPS CONTROL EFFECTIVENESS OF PUBLIC HEALTH MONITORING AND REDUCE LATENCY

-

10.6 IT & TELECOMIT AND TELECOM COMPANIES IMPROVED QUALITY AND MINIMIZED COSTS IN BUSINESS FUNCTIONS BY IMPLEMENTING SOCIAL MEDIA MANAGEMENT SOLUTIONS

-

10.7 MEDIA & ENTERTAINMENTINTEGRATION OF SOCIAL MEDIA MANAGEMENT TOOLS HELPS MEDIA AND ENTERTAINMENT COMPANIES ATTRACT AND RETAIN CONSUMERS

-

10.8 MANUFACTURINGSOCIAL MEDIA MANAGEMENT SOLUTIONS HELP MANUFACTURING UNITS MAKE MAXIMUM USE OF SOCIAL MEDIA DATA

-

10.9 TRAVEL & HOSPITALITYSOCIAL MEDIA MANAGEMENT TOOLS IDENTIFY NEW PROSPECTS AND OFFER QUALITY SERVICES TO RETAIN EXISTING CUSTOMERS

- 10.10 OTHERS

-

11.1 INTRODUCTIONREGION: SOCIAL MEDIA MANAGEMENT MARKET DRIVERS

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rapid adoption of social media management tools and sustained business growth for market playersCANADA- Growing adoption of social media management solutions by enterprises

-

11.3 EUROPE, MIDDLE EAST, AND AFRICAEUROPE, MIDDLE EAST, AND AFRICA: RECESSION IMPACTGERMANY- Growing use of internet and social media platformsUK & IRELAND- Rising use of social media platforms to inform, educate, and influence usersFRANCE- Increasing adoption of social media management solutions to understand customer sentimentsSPAIN- Rising use of social media to promote businesses and stay in touch with customersSAUDI ARABIA- Presence of large digital-savvy consumer baseITALY- Growing adoption of AI technology in social media among retail, media and entertainment, and BFSI verticalsREST OF EUROPE, MIDDLE EAST, AND AFRICA

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Growing adoption of social media management software and associated services by companies to enhance customer experienceJAPAN- Increasing use of social media management solutions by enterprises to expand brand reachANZ- Rising investments by mid-sized businesses in social media advertising and video contentINDIA- Increasing focus on digitalizationSINGAPORE- Adoption of various growth strategies by social media management vendors to expand customer baseREST OF ASIA PACIFIC

-

11.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACT- MEXICO- COLOMBIA- BRAZIL- REST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

-

12.3 REVENUE ANALYSISHISTORIC REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 STARTUP/SME COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSADOBE- Business overview- Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Solutions/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Solutions/Services offered- Recent developments- MnM viewSPROUT SOCIAL- Business overview- Solutions/Services offered- Recent developmentsHOOTSUITE- Business overview- Solutions/Services offered- Recent developmentsMELTWATER- Business overview- Solutions/Services offered- Recent developmentsSPRINKLR- Business overview- Solutions/Services offered- Recent developmentsDIGIMIND- Business overview- Solutions/Services offered- Recent developmentsHUBSPOT- Business overview- Solutions/Services offered- Recent developmentsQUALTRICS- Business overview- Solutions/Services offered- Recent developmentsKHOROSCISIONZOHONETBASETALKWALKERBUFFERAGORAPULSESENDIBLEMAVSOCIALEMPLIFISYNTHESIOECLINCHER

-

13.3 STARTUP/SME PROFILESCREATORIQSLATE TEAMSHUNTER DIGITALALCHEMY WORXKAWOMAKE YOUR MARK DIGITALTHE CIRQLEAFFABLE.AILOOMLYALTORISESOCINOVAPROMOREPUBLIC

-

14.1 SOCIAL MEDIA ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEW- Social media analytics market, by component- Social media analytics market, by application- Social media analytics market, by deployment mode- Social media analytics market, by organization size- Social media analytics market, by analytics type- Social media analytics market, by industry vertical- Social media analytics market, by region

-

14.2 WEB CONTENT MANAGEMENT MARKETMARKET DEFINITIONMARKET OVERVIEW- Web content management market, by component- Web content management market, by organization size- Web content management market, by deployment mode- Web content management market, by application- Web content management market, by vertical- Web content management market, by region

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 FACTOR ANALYSIS

- TABLE 2 SOCIAL MEDIA MANAGEMENT MARKET SIZE AND GROWTH RATE, 2018–2021 (USD MILLION, Y-O-Y %)

- TABLE 3 MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 4 MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 5 PATENTS FILED, 2019–2022

- TABLE 6 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 7 AVERAGE SELLING PRICING ANALYSIS, 2022

- TABLE 8 IMPACT OF EACH FORCE ON MARKET

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 11 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 13 SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 14 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 SOCIAL MEDIA MARKETING: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 16 SOCIAL MEDIA MARKETING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 17 SOCIAL MEDIA LISTENING, MONITORING, AND ANALYTICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 18 SOCIAL MEDIA LISTENING, MONITORING, AND ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 SOCIAL MEDIA ASSET AND CONTENT MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 20 SOCIAL MEDIA ASSET AND CONTENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 SOCIAL MEDIA RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 22 SOCIAL MEDIA RISK AND COMPLIANCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 MARKET, BY SERVICES, 2018–2021 (USD MILLION)

- TABLE 24 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

- TABLE 25 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 26 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

- TABLE 28 MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 29 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 30 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 IMPLEMENTATION AND CONSULTING SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 32 IMPLEMENTATION AND CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 TRAINING AND SUPPORT SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 34 TRAINING AND SUPPORT SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 MANAGED SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 36 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 38 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 39 ON-PREMISES: SOCIAL MEDIA MANAGEMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 40 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 CLOUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 42 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 SOCIAL MEDIA MARKET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 44 SOCIAL MEDIA MARKET MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 45 SMALL ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 46 SMALL ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 48 MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 LARGE ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 50 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 52 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 53 SALES AND MARKETING MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 54 SALES AND MARKETING MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 56 CUSTOMER EXPERIENCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 COMPETITIVE INTELLIGENCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 58 COMPETITIVE INTELLIGENCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 RISK MANAGEMENT AND FRAUD DETECTION: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 60 RISK MANAGEMENT AND FRAUD DETECTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 62 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 64 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 65 BFSI: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 66 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 68 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 GOVERNMENT & PUBLIC SECTOR: SOCIAL MEDIA MANAGEMENT MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 70 GOVERNMENT & PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 72 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 IT & TELECOM: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 74 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 76 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 MANUFACTURING: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 78 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 80 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 82 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 84 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 101 US: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 102 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 103 CANADA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 104 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 105 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 106 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 107 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 108 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 109 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

- TABLE 110 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 111 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 112 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 113 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 114 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 115 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 116 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 117 EUROPE, MIDDLE EAST, AND AFRICA: SOCIAL MEDIA MANAGEMENT MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 118 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 119 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 120 EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 121 GERMANY: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 122 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 123 UK & IRELAND: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 124 UK & IRELAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 125 FRANCE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 126 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 127 SPAIN: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 128 SPAIN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 129 SAUDI ARABIA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 130 SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 131 ITALY: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 132 ITALY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 133 REST OF EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 134 REST OF EUROPE, MIDDLE EAST, AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 138 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 151 CHINA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 152 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 153 JAPAN: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 154 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 155 ANZ: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 156 ANZ: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 157 INDIA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 158 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 159 SINGAPORE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 160 SINGAPORE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 163 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 164 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 165 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

- TABLE 166 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 167 LATIN AMERICA: SOCIAL MEDIA MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

- TABLE 168 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 171 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

- TABLE 172 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 173 LATIN AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 174 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 175 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

- TABLE 176 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 177 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 178 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 179 MEXICO: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 180 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 181 COLOMBIA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 182 COLOMBIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 183 BRAZIL: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 184 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 185 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 186 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 187 OVERVIEW OF STRATEGIES ADOPTED BY KEY SOCIAL MEDIA MANAGEMENT VENDORS

- TABLE 188 MARKET: DEGREE OF COMPETITION

- TABLE 189 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2022

- TABLE 190 MARKET: COMPETITIVE BENCHMARKING OF STARTUP/SMES, 2022

- TABLE 191 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 192 PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 193 DEALS, 2020–2023

- TABLE 194 ADOBE: BUSINESS OVERVIEW

- TABLE 195 ADOBE: SOLUTIONS/SERVICES OFFERED

- TABLE 196 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 197 ADOBE: DEALS

- TABLE 198 IBM: BUSINESS OVERVIEW

- TABLE 199 IBM: SOLUTIONS/SERVICES OFFERED

- TABLE 200 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 201 IBM: DEALS

- TABLE 202 GOOGLE: BUSINESS OVERVIEW

- TABLE 203 GOOGLE: SOLUTIONS/SERVICES OFFERED

- TABLE 204 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 205 GOOGLE: DEALS

- TABLE 206 ORACLE: BUSINESS OVERVIEW

- TABLE 207 ORACLE: SOLUTIONS/SERVICES OFFERED

- TABLE 208 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 209 ORACLE: DEALS

- TABLE 210 SALESFORCE: BUSINESS OVERVIEW

- TABLE 211 SALESFORCE: SOLUTIONS/SERVICES OFFERED

- TABLE 212 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 213 SALESFORCE: DEALS

- TABLE 214 SPROUT SOCIAL: BUSINESS OVERVIEW

- TABLE 215 SPROUT SOCIAL: SOLUTIONS/SERVICES OFFERED

- TABLE 216 SPROUT SOCIAL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 SPROUT SOCIAL: DEALS

- TABLE 218 HOOTSUITE: BUSINESS OVERVIEW

- TABLE 219 HOOTSUITE: SOLUTIONS/SERVICES OFFERED

- TABLE 220 HOOTSUITE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 HOOTSUITE: DEALS

- TABLE 222 MELTWATER: BUSINESS OVERVIEW

- TABLE 223 MELTWATER: SOLUTIONS/SERVICES OFFERED

- TABLE 224 MELTWATER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 MELTWATER: DEALS

- TABLE 226 SPRINKLR: BUSINESS OVERVIEW

- TABLE 227 SPRINKLR: SOLUTIONS/SERVICES OFFERED

- TABLE 228 SPRINKLR: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 SPRINKLR: DEALS

- TABLE 230 DIGIMIND: BUSINESS OVERVIEW

- TABLE 231 DIGIMIND: SOLUTIONS/SERVICES OFFERED

- TABLE 232 DIGIMIND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 233 DIGIMIND: DEALS

- TABLE 234 HUBSPOT: BUSINESS OVERVIEW

- TABLE 235 HUBSPOT: SOLUTIONS/SERVICES OFFERED

- TABLE 236 HUBSPOT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 237 HUBSPOT: DEALS

- TABLE 238 QUALTRICS: BUSINESS OVERVIEW

- TABLE 239 QUALTRICS: SOLUTIONS/SERVICES OFFERED

- TABLE 240 QUALTRICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 241 QUALTRICS: DEALS

- TABLE 242 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 243 SOCIAL MEDIA ANALYTICS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 244 SOCIAL MEDIA ANALYTICS MARKET, BY SERVICE, 2015–2020 (USD MILLION)

- TABLE 245 SOCIAL MEDIA ANALYTICS MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 246 SOCIAL MEDIA ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

- TABLE 247 SOCIAL MEDIA ANALYTICS MARKET, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

- TABLE 248 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

- TABLE 249 SOCIAL MEDIA ANALYTICS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 250 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 251 SOCIAL MEDIA ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 252 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 253 SOCIAL MEDIA ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 254 SOCIAL MEDIA ANALYTICS MARKET, BY ANALYTICS TYPE, 2015–2020 (USD MILLION)

- TABLE 255 SOCIAL MEDIA ANALYTICS MARKET, BY ANALYTICS TYPE, 2021–2026 (USD MILLION)

- TABLE 256 SOCIAL MEDIA ANALYTICS MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 257 SOCIAL MEDIA ANALYTICS MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 258 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 259 SOCIAL MEDIA ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 260 WEB CONTENT MANAGEMENT MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 261 WEB CONTENT MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 262 WEB CONTENT MANAGEMENT MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

- TABLE 263 WEB CONTENT MANAGEMENT MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 264 WEB CONTENT MANAGEMENT MARKET, BY SERVICE, 2016–2020 (USD MILLION)

- TABLE 265 WEB CONTENT MANAGEMENT MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 266 WEB CONTENT MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2016–2020 (USD MILLION)

- TABLE 267 WEB CONTENT MANAGEMENT MARKET, BY PROFESSIONAL SERVICES, 2021–2026 (USD MILLION)

- TABLE 268 WEB CONTENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 269 WEB CONTENT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 270 WEB CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 271 WEB CONTENT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 272 WEB CONTENT MANAGEMENT MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

- TABLE 273 WEB CONTENT MANAGEMENT MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- TABLE 274 WEB CONTENT MANAGEMENT MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 275 WEB CONTENT MANAGEMENT MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 276 WEB CONTENT MANAGEMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 277 WEB CONTENT MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 SOCIAL MEDIA MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE GENERATED BY OFFERING SOCIAL MEDIA MANAGEMENT SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE GENERATED BY OFFERING ALL SOCIAL MEDIA MANAGEMENT SOLUTIONS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE GENERATED BY OFFERING ALL SOCIAL MEDIA MANAGEMENT SOLUTIONS/SERVICES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF SOCIAL MEDIA MANAGEMENT THROUGH OVERALL SOCIAL MEDIA MANAGEMENT SPENDING

- FIGURE 8 SOLUTIONS SEGMENT TO DOMINATE SOCIAL MEDIA MANAGEMENT MARKET IN 2022

- FIGURE 9 SOCIAL MEDIA MARKETING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 10 PROFESSIONAL SERVICES SEGMENT TO DOMINATE SOCIAL MEDIA MANAGEMENT MARKET IN 2022

- FIGURE 11 TRAINING AND SUPPORT SERVICES SEGMENT TO LEAD SOCIAL MEDIA MANAGEMENT MARKET IN 2022

- FIGURE 12 SALES AND MARKETING SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 13 LARGE ENTERPRISES SEGMENT TO DOMINATE SOCIAL MEDIA MANAGEMENT MARKET IN 2022

- FIGURE 14 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2022

- FIGURE 15 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR IN 2022

- FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 17 GROWING NEED TO IMPROVE ROI AND OVERALL SOCIAL MEDIA STRATEGY

- FIGURE 18 SOCIAL MEDIA MANAGEMENT MARKET TO WITNESS DECLINE IN Y-O-Y GROWTH IN 2022

- FIGURE 19 RISK MANAGEMENT AND FRAUD DETECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 SOLUTIONS AND BFSI SEGMENTS TO HOLD LARGEST SHARES OF NORTH AMERICAN SOCIAL MEDIA MANAGEMENT MARKET IN 2022

- FIGURE 21 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

- FIGURE 22 SOCIAL MEDIA MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 REGION-WISE SOCIAL MEDIA PENETRATION

- FIGURE 24 TOTAL NUMBER OF SOCIAL MEDIA USERS WORLDWIDE, 2017–2020 (BILLION)

- FIGURE 25 EVOLUTION OF SOCIAL MEDIA MANAGEMENT MARKET

- FIGURE 26 SOCIAL MEDIA MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 SOCIAL MEDIA MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 ANNUAL NUMBER OF PATENTS GRANTED, 2019–2022

- FIGURE 29 TOP 10 PATENT APPLICANTS, 2019–2022

- FIGURE 30 SOCIAL MEDIA MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 33 SOCIAL MEDIA MANAGEMENT MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 34 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 35 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 TRAINING AND SUPPORT SERVICES SUB-SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 COMPETITIVE INTELLIGENCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 TRAVEL AND HOSPITALITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC SOCIAL MEDIA MANAGEMENT MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 CHINA TO REGISTER HIGHEST CAGR IN SOCIAL MEDIA MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: SNAPSHOT OF SOCIAL MEDIA MANAGEMENT MARKET

- FIGURE 44 ASIA PACIFIC: SNAPSHOT OF SOCIAL MEDIA MANAGEMENT MARKET

- FIGURE 45 HISTORIC REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 46 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN 2021

- FIGURE 47 SOCIAL MEDIA MANAGEMENT MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 48 STARTUP/SME SOCIAL MEDIA MANAGEMENT PLAYERS: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 49 ADOBE: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT

- FIGURE 51 GOOGLE: COMPANY SNAPSHOT

- FIGURE 52 ORACLE: COMPANY SNAPSHOT

- FIGURE 53 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 54 SPROUT SOCIAL: COMPANY SNAPSHOT

- FIGURE 55 MELTWATER: COMPANY SNAPSHOT

- FIGURE 56 SPRINKLR: COMPANY SNAPSHOT

- FIGURE 57 HUBSPOT: COMPANY SNAPSHOT

- FIGURE 58 QUALTRICS: COMPANY SNAPSHOT

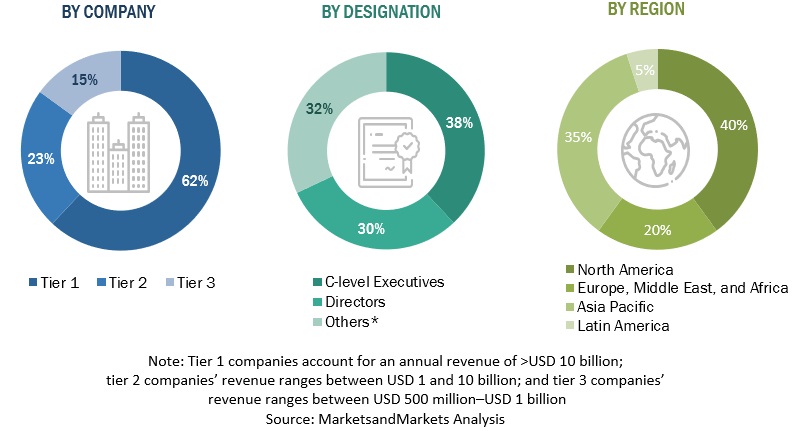

The research study for the social media management market involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly Interviews with Experts from the core and related industries, preferred social media management providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, Social media management spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to solutions, services, deployment modes, functionality, applications, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various Interviews with Experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and social media management expertise; related key executives from social media management solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using social media management solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of social media management solutions and services, which would impact the overall social media management market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this approach for market estimation, we identified the key companies offering solutions and services in the social media management market, such as Adobe, IBM, Google, Oracle, Salesforce, Sprout Social, Hootsuite, Meltwater, Sprinklr, Digimind, Hubspot, Clarabridge, Khoros, Falcon.Io, Zoho, NetBase, Brandwatch, Talkwalker, Buffer, Agora Pulse, Sendible, MavSocial, Socialbakers, Synthesio, and eClincher, which have the major contribution in the market. After finalizing these companies, validation of the data was done from Interviews with Experts through primary interviews related to the market’s leading vendors. US Securities and Exchange Commission (SEC) filings and paid databases estimated total revenue through annual reports. Companies’ revenue pertaining to the Business Units (BUs) that offer the managed network services would be identified through similar sources. Through primaries, revenue data generated through solutions and services of social media management was collected. The collective revenue of key companies that offer the social media management solutions comprised 80–85% of the market, which was again confirmed through primary interviews with experts. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (70–75%) and unorganized players (25–30%) collectively was assumed to be the market size of the global social media management market for FY 2021.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on social media management based on some of the key use cases. These factors for the social media management industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the social media management market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major social media management providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall market size and segments’ size were determined and confirmed using the study.

Report Objectives

- To define, describe, and predict the global social media management market by component (solutions and services), application, deployment mode, organization size, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the size of the market segments with respect to four major regions: North America; Europe, Middle East, and Africa (EMEA); Asia Pacific; and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the impact of recession across all the regions across the social media management market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American social media management market

- Further breakup of the European, Middle Eastern & African market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Social Media Management Market