Management Decision Market by Offering, Vertical (BFSI, Retail & Consumer Goods, Telecom, IT & ITeS, Healthcare & Lifesciences, Manufacturing, Government, Transportation & Logistics, Energy & Utilities), Application and Region - Global Forecast to 2028

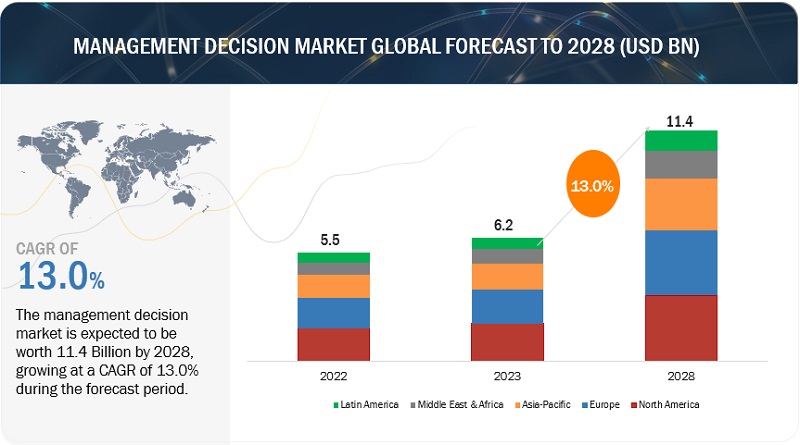

[290 Pages Report] MarketsandMarkets forecasts that the Management Decision market size is projected to grow from USD 6.2 billion in 2023 to USD 11.4 billion by 2028, at a CAGR of 13.0% during the forecast period. The rising need to enhance global presence will increase the adoption of Management Decisions. Key factors expected to drive the market’s growth are the compelling need to manage regulatory and compliance standards and the growing need for faster operational decisions and improved process efficiency. The rising customer expectations and competition among the leading market players increase the demand for cost-effective measures to enhance operational efficiencies. These factors are driving the demand for management decisions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Management Decision Market Dynamics

Driver: Increasing integration of AI to automate the decision-making process will drive market growth.

AI is transforming businesses, boosting innovation and productivity while facilitating organizational agility. It's widely implemented across industries, enhancing supply chains, transportation, education, marketing, and disaster management. AI's benefits include automation, anomaly detection, and accurate predictions, reducing manual work and improving decision-making. Organizations should strategically evaluate AI adoption to align with company goals and address ethical considerations. AI's impact on business operations is profound and continues to grow.

Restraint: Companies’ resistance to adopting modern technologies to reduce machine dependency, wrong information, and limited skills

Despite the numerous advantages of automation and cutting-edge technologies, such as time savings, decreased error rates, and cost efficiencies. Certain companies remain hesitant about integrating these advancements. This resistance often stems from apprehensions about the disruptions that new technological changes might bring to their established business environments. Consequently, some businesses confine themselves to a select group of vendors that offer familiar protocols and tools. In the present digital age, enterprises are exhibiting reluctance to adopt emerging technologies, largely due to the specialized skills and training these technologies demand.

Opportunity: Growing inclination of organizations toward decision-making with predictive analytics

There is a strong need for traditional methods to be changed, moving away from manual – arduous – planning processes to digital platforms that deliver digital transformation and build resiliency to disruption. Predictive modeling and What-If Scenario capabilities will help address this, providing insight into how different market changes and business strategies will impact the financial bottom line. This data will also offer more for operational teams and clarify how the organization achieves its overarching strategic goals.

Challenge: Lack of skilled workforce and poor management in creating user adoption process

The efficacy of technology relies heavily on the capabilities of the workforce utilizing it. The system's potential remains unrealized if employees fail to input accurate data or extract pertinent reports. This challenge is predominantly linked to training deficiencies, where numerous companies highlight the scarcity of competent candidates and proficient staff available for training. As a company embarks on a comprehensive digital transformation, the industrial landscape undergoes significant changes. Correspondingly, training initiatives must adapt to these shifts. Streamlining the complexity that has permeated company cultures within the industry will be pivotal in genuinely enhancing reliability and achieving successful digitization.

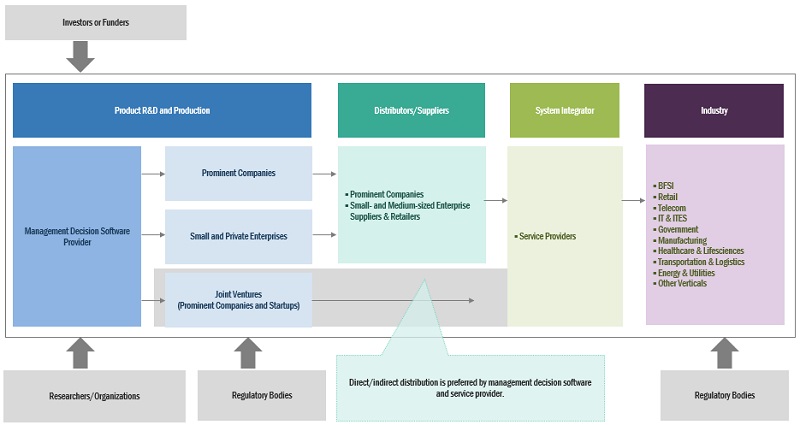

Management Decision Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the Management Decision market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), and Experian (Ireland).

By Service, the deployment & integration segment is expected to hold the largest market size during the forecast period.

Management decision vendors offer deployment and integration services to organizations for hassle-free implementation, installation, and deployment of management decision software. System integration services help organizations plan the integration layout as per the business requirement. Management decision software needs to be integrated with the existing systems; hence, they require the right connectors and back-end integration capabilities. System integration services are gaining wide acceptance by end users globally, as they ensure that systems communicate with each other efficiently to enhance the entire production process workflow

By Vertical, the BFSI segment is expected to hold the largest market size during the forecast period.

Today’s banking organizations face the pressing challenges of digital transformation, changing regulatory requirements, increased competition, and constrained margins. Banks are compelled to fundamentally change how they operate and govern their organizations to keep up with the rapid pace of change and create efficiencies for the bank and its customers. The BFSI industry provides extensive growth opportunities for management decisions due to the globalization of financial services and the growing IT investment. Management decision software empowers financial institutions to automate the decision-making process, thereby helping them to make informed decisions.

By application, the fraud detection management segment is expected to grow with the highest CAGR during the forecast period.

Numerous companies are showing keen interest in leveraging IoT (Internet of Things) technologies within the finance sector, primarily for fraud detection, as they anticipate impressive outcomes from their implementation. This approach facilitates the collection of data related to financial transactions, enabling the monitoring of accounts for fraudulent activities, scrutiny of applications for inconsistencies, and the creation of more accurate customer spending profiles. IoT tools have the capability to seamlessly identify customers across various digital devices and channels, thereby reducing instances of fraud while facilitating legitimate transactions. By integrating IoT into banking and financial services, institutions can effectively track the location of financial crimes, identify the specific devices implicated, and proactively address these issues in a timely manner. With the rise in fraud incidents globally, the demand for management decision software is gaining traction among enterprises for fraud detection management.

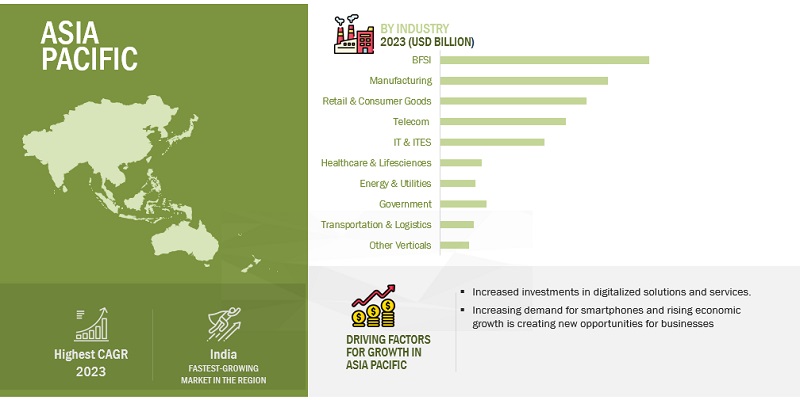

Based on region, Asia Pacific is expected to have the highest growth rate during the forecast period.

Asia Pacific exhibits a notable propensity for technology adoption and is poised to achieve the highest growth rate in the Management Decision market in the coming years. The management decision market within the Asia Pacific region encompasses China, Japan, India, and other countries in the region. Asia Pacific stands as a prominent global center for digital innovation, and enterprises here have promptly recognized the advantages of utilizing cloud technology to drive their digital transformation endeavors. The need for effective management decisions is experiencing swift expansion across the Asia Pacific area. This growth can be attributed to the escalating intricacies of businesses within the region, the heightened accessibility of data, and the amplified emphasis on regulatory compliance.

Market Players:

The major players in the Management Decision market are IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the Management Decision market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Software and Service), Application (Credit Risk Management, Collection Management, Customer Experience Management, Fraud Detection Management, Pricing Optimization, and Other Applications), Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK) |

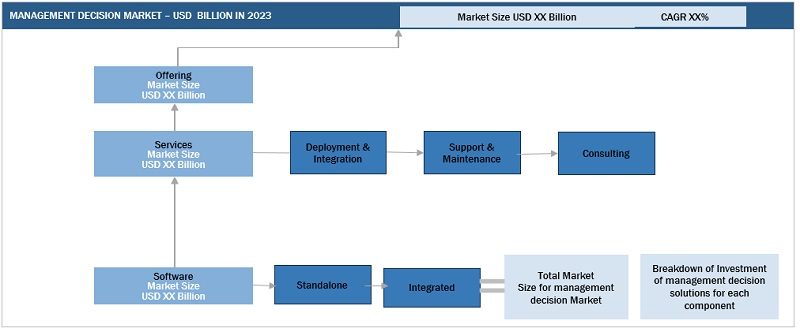

This research report categorizes the management decision market based on offering, functions, deployment model, organization size, vertical, and region.

Based on the Offering:

-

Software

- Standalone

- Integrated

-

Services

- Deployment and Integration

- Support and Maintenance

- Consulting

Based on the Application:

- Credit risk management

- Collection management

- Customer experience management

- Fraud detection management

- Pricing optimization

- Other Applications

Based on the vertical:

- BFSI

- Telecom

- IT & ITES

- Manufacturing

- Retail and Consumer Goods

- Government

- Healthcare and Life Sciences

- Energy and Utilities

- Transportation and Logistics

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2023, IBM added new features to Operational Decision Manager (ODM). The supported versions of key software components have been updated, enhancing ODM's compatibility and performance. Operational Decision Manager containers now have the RuntimeDefault seccomp profile enabled by default. This profile specifies a predefined list of system calls that can be executed within the container.

- In June 2023, FICO, a global analytic software company and recognized leader in AI decisioning platforms, and Belvo, the leading open finance data and payments platform in Latin America, announced a strategic partnership to expand credit access in Latin America. The two firms are developing an interpretable and explainable machine learning model that will provide a customer score based on consumer-permission transaction-level data aimed at increasing consumer credit access, improving banks’ risk management, and empowering lenders to create personalized financial experiences for their customers.

- In June 2023, the latest edition of the Pega Infinity™ software suite introduces new features to enhance low-code development, optimize existing processes, and deliver seamless experiences for employees and customers. These capabilities are designed to support organizations’ journey toward becoming autonomous enterprises. The software suite enables businesses to innovate rapidly, boost productivity, personalize customer interactions, and streamline operations, leading to cost reduction and decreased manual efforts. By leveraging these advancements, organizations can achieve greater efficiency and effectiveness in their operations while delivering enhanced customer experiences.

- In May 2023, FICO launched 19 major enhancements to the FICO Platform, the leading applied intelligence platform in the market, that helps clients drive critical and strategic business outcomes across their customer lifecycle.

- In February 2023, SAS Decision Manager 5.2, integrated with SAS Viya 3.4, introduced several new features and enhancements to enhance decision-making capabilities. Users can now utilize data grid variables within rules, providing greater flexibility in decision logic. Custom DS2 code files can be added and edited directly in decisions, enabling users to leverage custom code. The integration of analytic store models allows users to include them in decisions and publish them to various platforms like SAS Cloud Analytic Services, Apache Hadoop, SAS Micro Analytic Service, and Teradata.

Frequently Asked Questions (FAQ):

What is the definition of the Management Decision market?

Management decision software enables enterprises to make accurate and consistent business decisions throughout the enterprise. The software uses data analytics to control, manage, and automate business decisions, particularly operational decisions. The software is used for collection management, customer experience management, fraud detection management, pricing optimization, credit risk management, and decision automation.

What is the market size of the Management Decision market?

The Management Decision market size is projected to grow from USD 6.2 billion in 2023 to USD 11.4 billion by 2028, at a CAGR of 13.0% during the forecast period.

What are the major drivers in the Management Decision market?

The major driver of the Management Decision market is the need to improve the quality of decisions and achieve business agility with enhanced effectiveness, and the growing need for faster operational decisions and improved process efficiency. In every organization, decision-making has become increasingly intricate and multifaceted. It now encompasses broader considerations with far-reaching impacts across the entire enterprise. The traditional boundaries between strategic, tactical, and operational decisions are becoming less defined. To make effective decisions, business leaders must reevaluate what is crucial and who or what should be involved in the process.

Who are the key players operating in the Management Decision market?

The major players in the Management Decision market are The major players in the Management Decision market are IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK).

What are the opportunities for new market entrants in the Management Decision market?

The rising trend of automation and intelligence decision-making creates new opportunities in the management decision market. Decision automation leverages artificial intelligence, data analytics, and predefined business rules to enable organizations to automate their decision-making processes across multiple domains. This adoption of automated decision-making yields heightened productivity and concurrently diminishes risks and errors associated with decision outcomes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing integration of AI to automate decision-making process- Rising need to improve quality of decisions and achieve business agility- Growing focus on nurturing faster operational decision-making and improved process efficiency- Demand for reduced dependency on IT teams- Rising need for companies to manage regulatory and compliance standardsRESTRAINTS- Resistance of middle management- Rising mistrust of companies regarding adoption of new technologiesOPPORTUNITIES- Growing trend of automation and intelligent decision-making- Focus of players on data-driven insights- Inclination of organizations toward decision-making with predictive analyticsCHALLENGES- Insufficient documentation- Lack of skilled workforce

-

5.3 HISTORY OF MANAGEMENT DECISION MARKETEARLY APPROACHSCIENTIFIC MANAGEMENTADMINISTRATIVE MANAGEMENTDECISION SUPPORT SYSTEMSMANAGEMENT INFORMATION SYSTEMSENTERPRISE RESOURCE PLANNINGINTEGRATED DECISION SUPPORT

-

5.4 ECOSYSTEM ANALYSISSOLUTION PROVIDERSSERVICE PROVIDERSSYSTEM INTEGRATORSDATA SOURCES AND PARTNERSTECHNOLOGY & CLOUD INFRASTRUCTURE PROVIDERSEND USERS

-

5.5 CASE STUDY ANALYSISMERCURY INSURANCE ADOPTED FICO’S MANAGEMENT DECISION SOLUTIONS TO ACCELERATE UNDERWRITING PROCESSABBVIE ADOPTED PEGASYSTEM’S MANAGEMENT DECISION SOLUTIONS TO ENHANCE CUSTOMER EXPERIENCESÜDLEASING USED ACTICO’S CREDIT RISK MANAGEMENT PLATFORM TO ACHIEVE EFFICIENT CREDIT DECISIONBAJAJ FINANCE EMPLOYED ACTICO’S RULES TO ACHIEVE SIGNIFICANT IMPROVEMENT IN BUSINESS PROCESSEST-MOBILE ADOPTED PEGASYSTEM’S SOLUTIONS TO ESTABLISH TEAM OF EXPERTS TO HANDLE CUSTOMER ISSUES

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 PATENT ANALYSIS

- 5.8 TRENDS AND DISRUPTIONS IMPACTING BUYERS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 REGULATORY LANDSCAPEGENERAL DATA PROTECTION REGULATIONINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)/INTERNATIONAL ELECTROTECHNICAL COMMISSION (IEC) 27000 STANDARDSCLOUD SECURITY ALLIANCE (CSA)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT, 1996FEDERAL FINANCIAL INSTITUTIONS EXAMINATION COUNCIL (FFIEC)

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 TECHNOLOGY ANALYSISCLOUD/SOFTWARE-AS-A-SERVICEARTIFICIAL INTELLIGENCEMACHINE LEARNINGROBOTIC PROCESS AUTOMATIONIOT

-

5.13 PRICING ANALYSISAVERAGE SELLING PRICE OF MAJOR OFFERINGS, BY KEY PLAYER

- 5.14 KEY CONFERENCES & EVENTS

- 5.15 BEST PRACTICES IN MANAGEMENT DECISION MARKET

-

5.16 FUTURE DIRECTION OF MANAGEMENT DECISION MARKETMANAGEMENT DECISION MARKET ROADMAP- Short-term (2023–2025)- Mid-term (2026–2028)- Long-term (2029–2030)

-

6.1 INTRODUCTIONOFFERINGS: MANAGEMENT DECISION MARKET DRIVERS

-

6.2 SOFTWAREGROWING DEMAND FOR COST-EFFECTIVE MANAGEMENT DECISION SOLUTIONS TO DRIVE MARKETSTANDALONEINTEGRATED

-

6.3 SERVICESFOCUS ON DEPLOYING RIGHT SOLUTIONS TO IMPROVE OPERATIONAL EFFICIENCY TO BOOST GROWTHDEPLOYMENT & INTEGRATIONSUPPORT & MAINTENANCECONSULTING

-

7.1 INTRODUCTIONAPPLICATIONS: MANAGEMENT DECISION MARKET DRIVERS

-

7.2 COLLECTION MANAGEMENTNEED FOR COMPANIES TO MANAGE AND TRACK CUSTOMER DEBT TO PROPEL GROWTH

-

7.3 CUSTOMER EXPERIENCE MANAGEMENTGROWING EMPHASIS ON UNDERSTANDING CUSTOMER EXPECTATIONS AND IMPROVING SERVICES TO PROPEL MARKET

-

7.4 FRAUD DETECTION MANAGEMENTGLOBAL RISE IN INCIDENTS OF FRAUD TO DRIVE USE OF FRAUD DETECTION MANAGEMENT SOLUTIONS

-

7.5 PRICING OPTIMIZATIONRISING FOCUS ON ENHANCING CROSS-BORDER SALES ACROSS MULTIPLE GEOGRAPHIES TO ENCOURAGE MARKET EXPANSION

-

7.6 CREDIT RISK MANAGEMENTRISING DEMAND FOR ROBUST CREDIT RISK MANAGEMENT STRATEGIES TO DRIVE MARKET

- 7.7 OTHER APPLICATIONS

-

8.1 INTRODUCTIONVERTICALS: MANAGEMENT DECISION MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)RAPID DIGITAL TRANSFORMATION AND CHANGING REGULATORY REQUIREMENTS TO DRIVE POPULARITY OF MANAGEMENT DECISION SOLUTIONS IN BFSI SECTORBFSI: MANAGEMENT DECISION MARKET USE CASES- Banco de Crédito del Perú adopted FICO’s management decision solutions to achieve performance goals- BanReservas utilized FICO’s automation solutions to standardize credit evaluations, lower expenses, and enhance customer satisfaction

-

8.3 RETAIL & CONSUMER GOODSGROWING NEED TO MANAGE ENORMOUS VOLUME OF CUSTOMER DATA AND INVENTORY TO BOOST MARKETRETAIL & CONSUMER GOODS: MANAGEMENT DECISION MARKET USE CASES- Apero Solutions integrated its latest OpenEdge features into Latitude EFR to improve user interface

-

8.4 TELECOMINCREASING FOCUS ON ANALYZING CUSTOMER INTERACTIONS TO DRIVE MARKETTELECOM: MANAGEMENT DECISION MARKET USE CASES- Power & Telephone Supply Company adopted Telerik Platform to integrate mobile app development into its strategy- TELUS adopted FICO’s solutions to facilitate customer onboarding procedures

-

8.5 IT & ITESRAPID AUTOMATION AND RISING NEED TO ESTABLISH EFFECTIVE RISK MANAGEMENT SYSTEMS TO BOOST DEMAND FOR MANAGEMENT DECISION SOLUTIONSIT & ITES: MANAGEMENT DECISION MARKET USE CASES- Build.One adopted Progress’s OpenEdge to efficiently develop contemporary web applications

-

8.6 HEALTHCARE & LIFE SCIENCESGROWING EMPHASIS ON ENHANCING PATIENT EXPERIENCE TO DRIVE ADOPTION OF MANAGEMENT DECISION SOFTWARE AND SERVICESHEALTHCARE & LIFE SCIENCES: MANAGEMENT DECISION MARKET USE CASES- Bradesco Saúde partnered with Pega and Ernst & Young to digitally transform processes- Sked24 employed cutting-edge technology to transform patient-provider interactions into enduring relationships

-

8.7 MANUFACTURINGDEMAND TO IMPROVE OPERATIONAL EFFICIENCY AND MANAGE SUPPLY CHAIN TO PROPEL GROWTHMANUFACTURING: MANAGEMENT DECISION MARKET USE CASES- Kubota Tractor Corporation partnered with Team SI to establish consistent brand experience and streamline infrastructure management

-

8.8 GOVERNMENTINCREASING ADOPTION OF TECHNOLOGY IN GOVERNMENT ORGANIZATIONS TO DRIVE MARKETGOVERNMENT: MANAGEMENT DECISION MARKET USE CASES- California Department of Public Health adopted Pega’s licensing programs to enhance customer experience- Jungle Lasers adopted Progress Rollbase Development Platform to achieve expedited time-to-market and business growth- National Physiatry Academy adopted Sitefinity’s content organization solutions to enhance customer experience and workflow efficiency

-

8.9 TRANSPORTATION & LOGISTICSRISING DEMAND FOR MANAGEMENT DECISION SOLUTIONS TO OPTIMIZE OPERATIONS TO PROPEL MARKETTRANSFORMATION & LOGISTICS: MANAGEMENT DECISION MARKET USE CASES- SA Taxi adopted FICO’s Decision Modeler to incorporate automated decision-making into its loan origination processes

-

8.10 ENERGY & UTILITIESRISING NEED TO LEVERAGE ADVANCED DECISIONING CAPABILITIES TO DRIVE MARKETENERGY & UTILITIES: MANAGEMENT DECISION MARKET USE CASES- Cleco utilized Progress Sitefinity’s solutions to enhance its performance in various categories essential for measuring overall customer satisfaction

- 8.11 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: MANAGEMENT DECISION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Rising adoption of cloud-based services to boost demand for management decision solutionsCANADA- Rapid cloud adoption and digital transformation to propel market

-

9.3 EUROPEEUROPE: MANAGEMENT DECISION MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Adoption of advanced IT infrastructure and continued transition toward online services to drive marketGERMANY- Government initiatives for technological developments in manufacturing sector to drive growthFRANCE- Stringent regulations to detect and prevent financial crimes to boost market expansionITALY- Increasing recognition of value of technology to boost adoption of management decision solutionsSPAIN- Growing demand for data-driven insights to drive growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: MANAGEMENT DECISION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Use of decision intelligence services for driving policy support and technological investments to fuel growthJAPAN- Need to facilitate growth of digital economy and cloud computing to drive marketINDIA- Focus on enhancing customer experience and driving profitability to boost marketAUSTRALIA & NEW ZEALAND- Surge in fraud-related attacks to fuel adoption of management decision solutionsREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTKSA- Rapidly changing business environment to drive need for management decision solutionsUAE- Growing inclination of people toward advanced technologies to propel marketSOUTH AFRICA- Rapid digitalization and adoption of cloud applications to propel marketREST OF MIDDLE EAST & AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: MANAGEMENT DECISION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing investments by government to boost mobile technologies to drive growthMEXICO- Availability of technical expertise and high adoption rate of IoT to encourage market expansionREST OF LATIN AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 10.4 RANKING OF KEY PLAYERS

-

10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 MANAGEMENT DECISION MARKET: PRODUCT BENCHMARKINGPROMINENT MANAGEMENT DECISION SOLUTION PROVIDERS- Parmenides- TIBCO- SEON

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY MANAGEMENT DECISION SOLUTION VENDORS

-

10.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

11.1 MAJOR PLAYERSIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFICO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPEGASYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTIBCO- Business overview- Products/Solutions/Services offered- Recent developmentsSAPIENS INTERNATIONAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsEXPERIAN- Business overview- Products/Solutions/Services offered- Recent developmentsEQUIFAX- Business overview- Products/Solutions/Services offered- Recent developmentsACTICO- Business overview- Products/Solutions/Services offered- Recent developmentsCRIFRAPIDGENPROGRESSDECISIONS

-

11.2 STARTUPS/SMESDECISION MANAGEMENT SOLUTIONSOPENRULESSPARKLING LOGICSCORTOENOVA DECISIONSFLEXRULERULEXSEONDECISIMOINRULEPARMENIDES

- 12.1 INTRODUCTION TO ADJACENT MARKETS

- 12.2 LIMITATIONS

- 12.3 BUSINESS RULE MANAGEMENT SYSTEMS MARKET

- 12.4 CUSTOMER EXPERIENCE MANAGEMENT MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 3 PATENTS FILED, 2018–2023

- TABLE 4 TOP 10 PATENT OWNERS IN MANAGEMENT DECISION MARKET, 2018–2023

- TABLE 5 LIST OF PATENTS GRANTED, 2018–2023

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 13 BUYING CRITERIA, BY KEY VERTICAL

- TABLE 14 PRICING MODELS AND INDICATIVE PRICE POINTS, 2022–2023

- TABLE 15 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 16 MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 17 MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 18 SOFTWARE: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 SOFTWARE: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 SERVICES: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 SERVICES: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 23 MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 24 MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 25 MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 COLLECTION MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 27 COLLECTION MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 CUSTOMER EXPERIENCE MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 CUSTOMER EXPERIENCE MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 FRAUD DETECTION MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 FRAUD DETECTION MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 PRICING OPTIMIZATION: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 PRICING OPTIMIZATION: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 CREDIT RISK MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 CREDIT RISK MANAGEMENT: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 OTHER APPLICATIONS: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 OTHER APPLICATIONS: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 39 MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 40 BFSI: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 BFSI: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 RETAIL & CONSUMER GOODS: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 RETAIL & CONSUMER GOODS: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 TELECOM: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 TELECOM: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 IT & ITES: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 IT & ITES: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 HEALTHCARE & LIFE SCIENCES: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 HEALTHCARE & LIFE SCIENCES: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 MANUFACTURING: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 MANUFACTURING: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 GOVERNMENT: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 GOVERNMENT: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 TRANSPORTATION & LOGISTICS: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 TRANSPORTATION & LOGISTICS: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 ENERGY & UTILITIES: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 ENERGY & UTILITIES: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 OTHER VERTICALS: MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 OTHER VERTICALS: MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MANAGEMENT DECISION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 MANAGEMENT DECISION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 US: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 73 US: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 74 US: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 75 US: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 US: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 77 US: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 79 CANADA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 81 CANADA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 83 CANADA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 85 EUROPE: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 87 EUROPE: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: MANAGEMENT DECISION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: MANAGEMENT DECISION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 UK: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 95 UK: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 UK: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 97 UK: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 UK: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 99 UK: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 100 GERMANY: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 101 GERMANY: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 GERMANY: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 103 GERMANY: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 105 GERMANY: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MANAGEMENT DECISION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 CHINA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 117 CHINA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 CHINA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 CHINA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 121 CHINA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 INDIA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 123 INDIA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 124 INDIA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 125 INDIA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 INDIA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 127 INDIA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 UAE: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 139 UAE: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 140 UAE: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 141 UAE: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 UAE: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 143 UAE: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 144 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 145 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 147 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 149 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 151 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 152 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 153 LATIN AMERICA: MANAGEMENT DECISION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 BRAZIL: MANAGEMENT DECISION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 155 BRAZIL: MANAGEMENT DECISION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 156 BRAZIL: MANAGEMENT DECISION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 157 BRAZIL: MANAGEMENT DECISION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 BRAZIL: MANAGEMENT DECISION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 159 BRAZIL: MANAGEMENT DECISION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 161 MANAGEMENT DECISION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 162 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 163 COMPETITIVE BENCHMARKING, BY OFFERING, APPLICATION, AND REGION

- TABLE 164 LIST OF STARTUPS/SMES

- TABLE 165 COMPARATIVE ANALYSIS OF MANAGEMENT DECISION SOLUTION PROVIDERS

- TABLE 166 PRODUCT LAUNCHES, 2019–2023

- TABLE 167 DEALS, 2019–2023

- TABLE 168 IBM: BUSINESS OVERVIEW

- TABLE 169 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 IBM: PRODUCT LAUNCHES

- TABLE 171 IBM: DEALS

- TABLE 172 FICO: BUSINESS OVERVIEW

- TABLE 173 FICO: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 174 FICO: PRODUCT LAUNCHES

- TABLE 175 FICO: DEALS

- TABLE 176 SAS: BUSINESS OVERVIEW

- TABLE 177 SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SAS: PRODUCT LAUNCHES

- TABLE 179 SAS: DEALS

- TABLE 180 ORACLE: BUSINESS OVERVIEW

- TABLE 181 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 ORACLE: PRODUCT LAUNCHES

- TABLE 183 ORACLE: DEALS

- TABLE 184 PEGASYSTEMS: BUSINESS OVERVIEW

- TABLE 185 PEGASYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 PEGASYSTEMS: PRODUCT LAUNCHES

- TABLE 187 PEGASYSTEMS: DEALS

- TABLE 188 TIBCO: BUSINESS OVERVIEW

- TABLE 189 TIBCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 TIBCO: PRODUCT LAUNCHES

- TABLE 191 TIBCO: DEALS

- TABLE 192 SAPIENS INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 193 SAPIENS INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 194 SAPIENS INTERNATIONAL CORPORATION: PRODUCT LAUNCHES

- TABLE 195 SAPIENS INTERNATIONAL CORPORATION: DEALS

- TABLE 196 SAPIENS INTERNATIONAL CORPORATION: OTHERS

- TABLE 197 EXPERIAN: BUSINESS OVERVIEW

- TABLE 198 EXPERIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 EXPERIAN: PRODUCT LAUNCHES

- TABLE 200 EXPERIAN: DEALS

- TABLE 201 EQUIFAX: BUSINESS OVERVIEW

- TABLE 202 EQUIFAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 EQUIFAX: PRODUCT LAUNCHES

- TABLE 204 EQUIFAX: DEALS

- TABLE 205 ACTICO: BUSINESS OVERVIEW

- TABLE 206 ACTICO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ACTICO: PRODUCT LAUNCHES

- TABLE 208 ACTICO: DEALS

- TABLE 209 ADJACENT MARKETS AND FORECASTS

- TABLE 210 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2015–2019 (USD THOUSAND)

- TABLE 211 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY COMPONENT, 2020–2025 (USD THOUSAND)

- TABLE 212 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY ORGANIZATION SIZE, 2015–2019 (USD THOUSAND)

- TABLE 213 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY ORGANIZATION SIZE, 2020–2025 (USD THOUSAND)

- TABLE 214 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT TYPE, 2015–2019 (USD THOUSAND)

- TABLE 215 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT TYPE, 2020–2025 (USD THOUSAND)

- TABLE 216 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY VERTICAL, 2015–2019 (USD THOUSAND)

- TABLE 217 BUSINESS RULES MANAGEMENT SYSTEMS MARKET, BY VERTICAL, 2020–2025 (USD THOUSAND)

- TABLE 218 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 219 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 220 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2015–2020 (USD MILLION)

- TABLE 221 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2021–2026 (USD MILLION)

- TABLE 222 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 223 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 224 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 225 CUSTOMER EXPERIENCE MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MANAGEMENT DECISION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES OFFERED BY VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY VENDORS FROM SOFTWARE AND SERVICES

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED BY KEY VENDORS

- FIGURE 10 MANAGEMENT DECISION MARKET, 2023–2028 (USD MILLION)

- FIGURE 11 MANAGEMENT DECISION MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 MANAGEMENT DECISION MARKET, BY VERTICAL, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 MANAGEMENT DECISION MARKET: REGIONAL SHARE

- FIGURE 14 RISING GLOBAL TREND OF AUTOMATION AND INTELLIGENT DECISIONING ACROSS GLOBE TO DRIVE MARKET

- FIGURE 15 SOFTWARE AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 16 SOFTWARE AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 17 SOFTWARE AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 18 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 MANAGEMENT DECISION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 MAJOR BENEFITS DRIVING MANAGEMENT DECISION MARKET

- FIGURE 21 CHALLENGES IN ADOPTING AI AND ML TECHNOLOGIES INTO EXISTING BANKING OPERATIONS

- FIGURE 22 BENEFITS ACHIEVED FROM ADOPTING AI AND ML TECHNOLOGIES

- FIGURE 23 EVOLUTION OF MANAGEMENT DECISION MARKET

- FIGURE 24 ECOSYSTEM MAP

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 TOTAL NUMBER OF PATENTS GRANTED ANNUALLY, 2018–2023

- FIGURE 27 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 31 KEY BUYING CRITERIA

- FIGURE 32 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 33 CONSULTING SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 34 FRAUD DETECTION MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 ENERGY & UTILITIES SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 36 MANAGEMENT DECISION MARKET: REGIONAL SNAPSHOT

- FIGURE 37 ASIA PACIFIC TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MANAGEMENT DECISION MARKET SNAPSHOT

- FIGURE 39 NORTH AMERICA: COUNTRY-WISE ANALYSIS

- FIGURE 40 EUROPE: COUNTRY-WISE ANALYSIS

- FIGURE 41 ASIA PACIFIC: MANAGEMENT DECISION MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: COUNTRY-WISE ANALYSIS

- FIGURE 43 RANKING OF KEY PLAYERS, 2023

- FIGURE 44 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 45 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 46 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 47 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 48 VALUATION AND FINANCIAL METRICS OF KEY MANAGEMENT DECISION SOLUTION VENDORS

- FIGURE 49 IBM: COMPANY SNAPSHOT

- FIGURE 50 FICO: COMPANY SNAPSHOT

- FIGURE 51 ORACLE: COMPANY SNAPSHOT

- FIGURE 52 PEGASYSTEMS: COMPANY SNAPSHOT

- FIGURE 53 SAPIENS INTERNATIONAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 EXPERIAN: COMPANY SNAPSHOT

- FIGURE 55 EQUIFAX: COMPANY SNAPSHOT

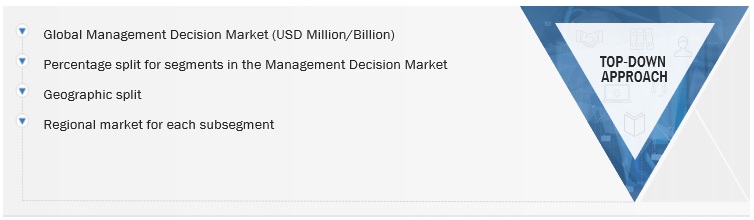

The study involved four major activities in estimating the current size of the global Management decision market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total management decision market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

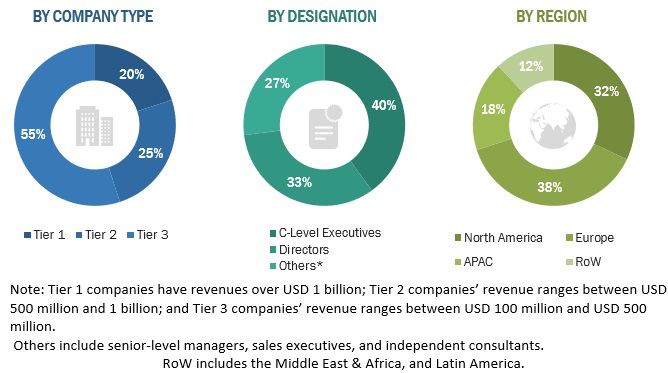

Various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the management decision market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

FICO |

Senior Manager |

|

IBM |

Senior Analyst |

|

SAS |

Sales Executive |

Market Size Estimation

For making market estimates and forecasting the management decision market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global management decision market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the management decision market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Management Decision Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Management Decision Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Management decision software enables enterprises to make accurate and consistent business decisions throughout the enterprise. The software uses data analytics to control, manage, and automate business decisions, particularly operational decisions. The software is used for collection management, customer experience management, fraud detection management, pricing optimization, credit risk management, and decision automation.

Key Stakeholders

- Management Software and Service Providers

- Technology Vendors

- Telecom Providers

- System Integrators (SIs)

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

Report Objectives

- To determine, segment, and forecast the global Management Decision market by offering, application, vertical, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Management Decision market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Management Decision Market