Data Center Solutions Market by Offering (Hardware, Software, Services), Data Center Type (Enterprise Data Center, Cloud Data Center, Colocation Data Center), Tier Type, Data Center Size, Vertical and Region - Global Forecast to 2028

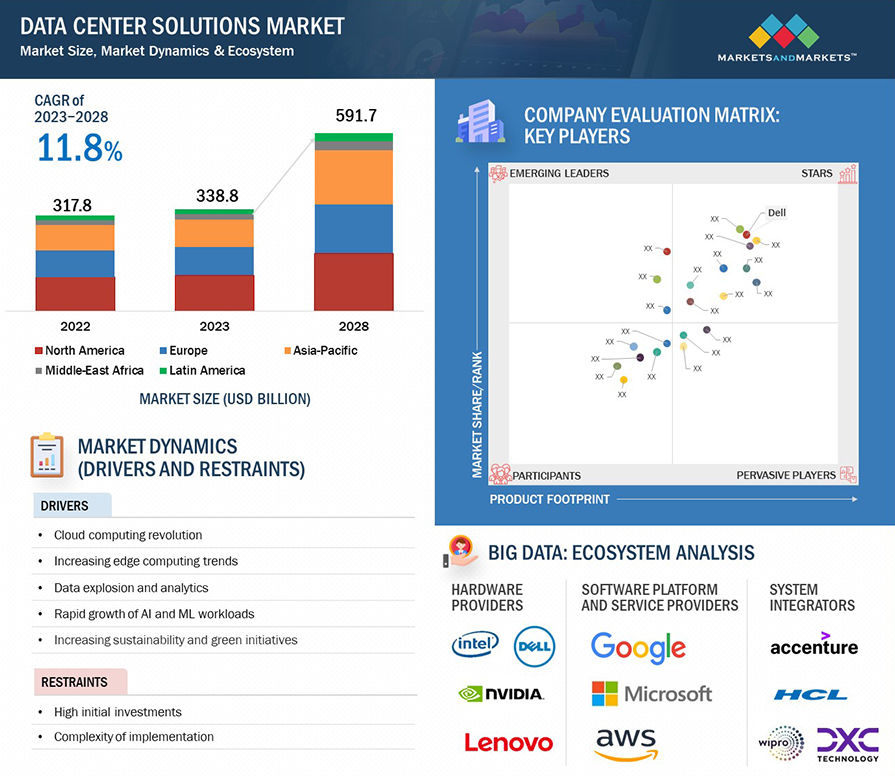

[260 Pages Report] The data center solutions market is expected to grow from USD 338.8 billion in 2023 to USD 591.7 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period. The data center solutions market is witnessing robust growth driven by the increasing demand for digital transformation, cloud services, and data-intensive technologies. Organizations across various industries are investing in advanced data center solutions to enhance their IT infrastructure's scalability, flexibility, and efficiency. The rise of edge computing, driven by IoT and real-time analytics applications, contributes to the need for localized processing capabilities. Key players in the market, including cloud service providers and colocation providers, focus on innovations such as AI and automation to optimize data center operations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Data Center Solutions Market

Various macroeconomic factors profoundly influence the global data center solutions market, including recessions, rising interest rates, geopolitical tensions such as the Russia-Ukraine war, and inflation. During economic recessions, businesses across industries often face budget constraints, leading to a technological investment slowdown, including data center solutions. Rising interest rates can further exacerbate this situation by increasing the cost of capital for businesses, making them more cautious about adopting new technologies. The Russia-Ukraine war introduces geopolitical uncertainty, disrupting global supply chains and impacting the business environment. This uncertainty may lead to delayed decision-making and reduced investments in data center-related technologies as organizations prioritize stability. Moreover, inflationary pressures can increase business operational costs, potentially limiting their capacity to invest in advanced data center solutions. In such a challenging economic landscape, the data center solutions market may experience a slowdown in growth as businesses navigate financial uncertainties and prioritize essential expenditures over technology upgrades.

Data Center Solutions Market Dynamics

Driver: Expansion of data center capacity

The driver of the "expansion of data center capacity" is a significant force influencing the data center solutions market. As organizations experience a growing need for digital services, handle increasing data volumes, and adopt emerging technologies, the demand for data center capacity has surged. Growth factors include the proliferation of data-intensive applications, the rise of cloud computing, the growth of IoT (Internet of Things) devices, and the increasing reliance on data-driven decision-making. Organizations seek data center solutions that provide scalable and efficient infrastructure to accommodate these expanding workloads; this involves adding physical space and hardware and implementing technologies and architectures that enhance data center performance, energy efficiency, and overall capacity management. The ongoing expansion of data center capacity reflects the continuous evolution of the digital landscape and the need for robust, scalable, and future-ready data center solutions. The importance of capacity planning in data centers has heightened due to the growing focus on environmental considerations.

Restraint: Complexity of Implementation

The implementation complexity is a significant restraint in the data center solutions market, presenting challenges throughout the entire lifecycle of establishing and managing a data center. The initial phase involves designing a robust infrastructure that aligns with the organization's requirements, considering scalability, redundancy, and disaster recovery factors; this complexity is exacerbated by the need to integrate diverse technologies, including servers, storage systems, networking equipment, and security solutions. Ensuring seamless interoperability among these components demands specialized knowledge in various domains, and any misalignment or oversight during the integration phase can lead to operational inefficiencies and potential security vulnerabilities.

Opportunity: Increasing demand for hybrid and multi-cloud deployments

The opportunity in hybrid and multi-cloud deployments represents a transformative trend in the data center solutions market, driven by the evolving needs of modern organizations. Hybrid cloud solutions combine on-premises data centers with public and private cloud environments, while multi-cloud strategies involve leveraging services from multiple cloud providers. This approach offers businesses a versatile IT infrastructure, combining the control and security of on-premises solutions with the scalability and flexibility of the cloud. One key aspect of this opportunity lies in workload mobility. Organizations increasingly seek the ability to seamlessly move workloads and applications between on-premises data centers and various cloud platforms. This flexibility allows them to optimize performance, respond to changing demands, and avoid dependency on a single cloud provider. Data center solutions that facilitate efficient workload mobility by providing interoperability and compatibility across diverse environments are well-positioned to meet this demand. Data interoperability is another critical factor in this opportunity. Solutions enabling smooth data exchange and management between cloud providers and on-premises infrastructure play a crucial role; this includes robust data migration tools, synchronization mechanisms, and data governance features to ensure data integrity and security across the hybrid and multi-cloud landscape.

Challenge: Scalability and Flexibility complexities

Scalability and flexibility are fundamental challenges in the data center solutions market, driven by the dynamic nature of modern business environments and the evolving demands on IT infrastructures. Scalability refers to the ability of a data center solution to expand or contract its resources to accommodate changing workloads. At the same time, flexibility encompasses the agility to adapt to diverse and evolving requirements. Organizations today experience fluctuating workloads due to seasonal demand variations, product launches, or unexpected spikes in user activity. The challenge lies in designing data center solutions that can seamlessly scale resources up or down in response to these changes without compromising performance or incurring unnecessary costs.

Conversely, flexibility is about creating an infrastructure that can adapt to different business needs, technological shifts, and unforeseen challenges. The challenge here is to design scalable and versatile solutions to support diverse workloads, applications, and deployment models; this includes accommodating traditional applications, cloud-native architectures, and emerging technologies like edge computing.

Ecosystem

The tier 3 segment will grow at a higher CAGR during the forecast period based on tier type.

Large companies commonly utilize the advanced features provided by tier 3 data centers. According to the Uptime Institute, these data centers have a higher uptime and a guaranteed 99.982% availability, experiencing only 1.56 hours of downtime annually. They are distinguished by the N+1 redundancy level, ensuring that at least one backup equipment is available in case of system failure. Moreover, tier 3 data centers offer protection against power outages lasting up to 72 hours. Consequently, these data centers are ideal for large businesses that require extra fail-safes for their IT operations. Enterprises that host extensive customer-based data sets are among the primary users of this tier.

Based on vertical, the healthcare & life sciences segment is expected to grow at the highest CAGR during the forecast period.

In the Healthcare & Life Sciences sector, the data center solutions market serves as a cornerstone for advancing medical research, personalized healthcare, and the management of vast volumes of sensitive patient data. As the industry undergoes a digital transformation, data centers play a pivotal role in storing, processing, and analyzing diverse datasets, ranging from genomics and clinical records to medical imaging. These data centers comply with stringent regulatory standards, ensuring patient information privacy and security while facilitating seamless interoperability between healthcare systems.

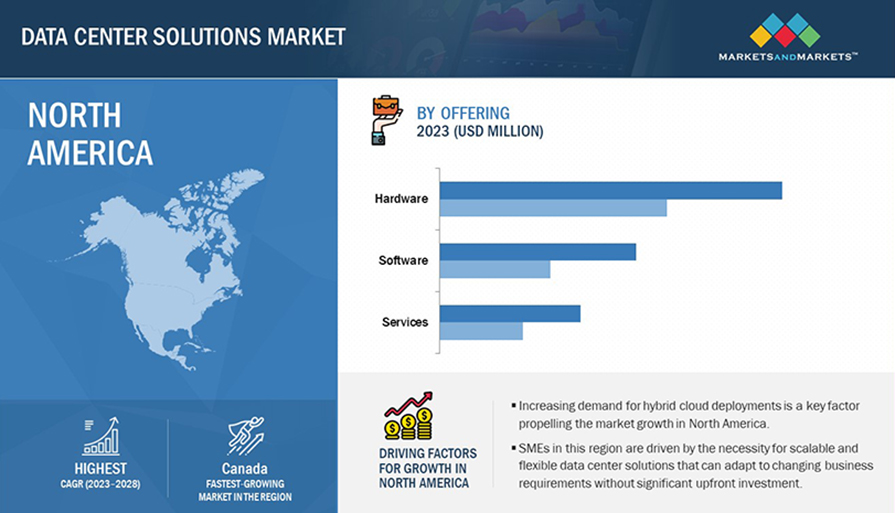

Based on Region, North America holds the largest market share during the forecast period.

The data center solutions market in North America is characterized by its maturity, technological innovation, and significant investments in data infrastructure. The region has been at the forefront of digital transformation, with a high concentration of established enterprises, technology giants, and a robust IT ecosystem. North America's data center market is driven by the increasing demand for cloud services, big data analytics, and the proliferation of connected devices. As businesses continue to adopt and scale digital technologies, there is a growing need for advanced data center solutions to ensure high performance, reliability, and scalability.

In recent years, several trends have shaped the data center landscape in North America. Edge computing has gained prominence, driven by the increasing need for low-latency processing in applications such as IoT, augmented reality, and autonomous vehicles; this has led to the development of edge data centers to bring computing resources closer to end-users. Sustainability and environmental considerations also influence the market, focusing on building energy-efficient and eco-friendly data centers.

Key Market Players

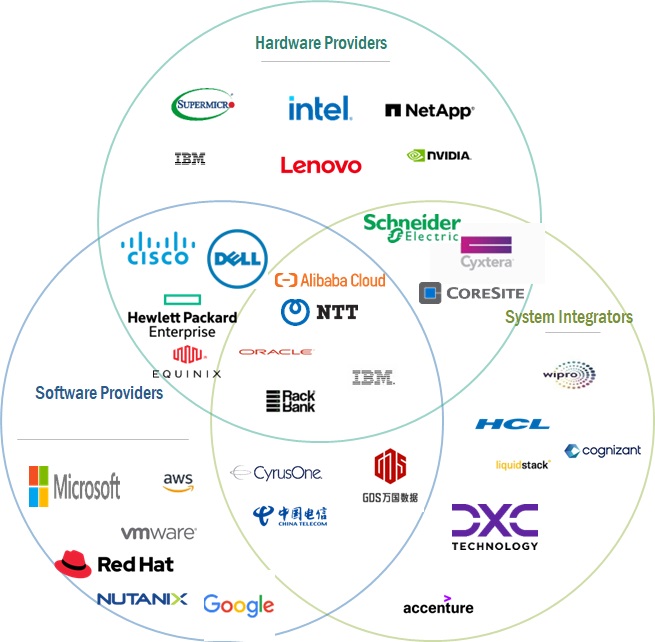

The data center solutions market is dominated by a few globally established players such as AWS (US), Microsoft (US), Google (US), Equinix (US), and Dell (US), among others, are the key vendors that secured data center solutions contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the data center solutions market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size Available For Years |

2018–2028 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering (Hardware, Software, Services), Tier Type, Data Center Type, Data Center Size, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

AWS (US), Microsoft (US), Google (US), Equinix (US), Dell (US), Huawei (China), Digital Realty (US), NTT (Japan), KDDI (Japan), HPE (US), CyrusOne (US), China Telecom (China), Cyxtera Technologies (US), GDS Holdings (China), CoreSite (US), and others. |

This research report categorizes the data center solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

-

Hardware

- IT Modules

- Power Modules

- Cooling Modules

-

Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery

- Security Software

- Virtualization Software

- Analytics Sofware

-

Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By Data Center Type:

- Cloud Data Center

- Colocation Data Center

- Enterprise Data Center

- Modular Data Center

- Edge Data Center

By Tier Type:

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Data Center Size:

- Small Data Centers

- Mid-Sized Data Centers

- Large Data Centers

By Vertical:

- BFSI

- IT & Telecom

- Government & Public Sector

- Healthcare & Life Sciences

- Transportation

- Retail

- Energy & Utilities

- Manufacturing

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2023, Equinix revealed its intentions to extend its backing for advanced liquid cooling technologies, including direct-to-chip solutions, to over 100 International Business Exchange (IBX) data centers across more than 45 cities globally. This initiative builds upon Equinix's current provision that facilitates liquid-to-air cooling, incorporating in-rack heat exchangers in nearly all IBX facilities. The expansion aims to empower a broader spectrum of businesses to leverage high-performance cooling technologies suitable for robust, high-density hardware crucial for compute-intensive workloads such as Artificial Intelligence (AI).

- In November 2023, DXC Technology and AWS are expanding their collaboration to accelerate customers' transition to modern, cloud-centric it. The partnership aims to facilitate the migration from aging data center facilities to agile, secure, and sustainable cloud solutions provided by AWS, driving down operating costs for DXC and its customers. Additionally, DXC plans to divest some of its current data centers to interested parties.

- In November 2023, Microsoft announced that it is increasing its presence in Canada by establishing several new data centers in Quebec. The company recently revealed its plan to invest $500 million in expanding its cloud computing and artificial intelligence infrastructure in Quebec over the next two years.

- In November 2023, Google announced the building of its Teros data center project in Uruguay. The company has officially submitted applications for the required environmental permits for the development.

- In October 2023, Telehouse initiated construction for a second data center at its TH3 Paris Magny campus in France. This development aligns with Telehouse's strategic initiative to bolster European and national digital sovereignty. By enhancing hosting and connectivity capabilities at its existing European sites, the company aims to attract global Internet traffic to European grounds.

- In August 2023, Digital Realty introduced high-density colocation services on its global data center platform, PlatformDIGITAL. Featuring infrastructure configurations designed for high-performance computing (HPC), these services empower businesses to address challenges related to the rapid growth of unstructured data and leverage artificial intelligence (AI) with enhanced processing capabilities.

- In June 2023, Equinix revealed notable improvements to Equinix Fabric, including introducing virtual connections to cloud service providers at 25 and 50 gigabits per second (Gbps). These enhancements enable businesses to easily handle more extensive workloads, such as data-intensive AI training models or establishing scalable enterprise networks, by swiftly and seamlessly provisioning virtual connections to major cloud platforms.

- In June 2023, AWS is increasing its investment in Ohio data center operations, with plans to spend around $7.8 billion for expansion by 2030.

- In June 2023, NTT unveiled its most recent hyperscale data center campus, Chennai 2. Additionally, it introduced its subsea cable system, MIST, to the city. The Chennai 2 campus, situated in Ambattur and spanning 6 acres, represented a pioneering project with a planned total capacity of 34.8 MW for critical IT load across two data center buildings.

- In May 2023, Wipro announced that its FullStride Cloud Studio partnered with Google Cloud's Rapid Migration Program (RaMP) to help clients fast-track their journey to the cloud and pursue a migration strategy anchored in business outcomes.

- In March 2023, NYIIX, operated by TELEHOUSE America (a KDDI Group company), launched a neutral Point of Presence (PoP) at Equinix, Inc., expanding Internet peering options in the New York Metropolitan Area. Equinix customers at their NY2 International Business Exchange (IBX) data center and connected facilities within the Secaucus campus, including NY4, 5, 6, and 7, can now access NYIIX peering services.

- In February 2023, Microsoft and SAP partnered to launch RISE with SAP on Microsoft's hyperscale cloud data center region in Qatar. SAP customers in Qatar can now host RISE with SAP on Microsoft Azure, expanding the opportunities for building a cloud-first economy in Qatar, the GCC, and the MENA region.

- In January 2023, Google entered into a long-term lease agreement for a data center spanning approximately 381,000 square feet in Navi Mumbai, Idia. This strategic move is part of Google's expansion of its cloud infrastructure in India, addressing the increasing demand in one of its key growth markets.

Frequently Asked Questions (FAQ):

What is Data Center Solutions?

Considering the views of various sources and associations, a data center is a centralized facility that houses computing, storage, and networking equipment, along with the necessary infrastructure for managing and processing large volumes of data, supporting the IT requirements of organizations. Data center solutions are comprehensive products, services, and technologies designed to optimize, manage, and enhance data centers' efficiency, reliability, and security.

Which country was the early adopter of data center solutions?

The US was the early adopter of data center solutions.

Which are the key vendors exploring data center solutions?

Some of the significant vendors offering data center solutions across the globe include AWS (US), Microsoft (US), Google (US), Equinix (US), Dell (US), Huawei (China), Digital Realty (US), NTT (Japan), KDDI (Japan), and HPE (US), CyrusOne (US), China Telecom (China), Cyxtera Technologies (US), GDS Holdings (China), CoreSite (US), QTS Data Centers (US), 365 Data Centers (US), Alibaba Cloud (China), Oracle (US), Iron Mountain (US), IBM (US), Schneider Electric (France), RackBank Datacenters (India), Liquidstack (US), DartPoints (US), and Hyperview (US).

What is the total CAGR recorded for the data center solutions market during 2023-2028?

The data center solutions market will record a CAGR of 11.8% from 2023-2028

What is the projected market value of the data center solutions market?

The data center solutions market will grow from USD 338.8 billion in 2023 to USD 591.7 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 11.8% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

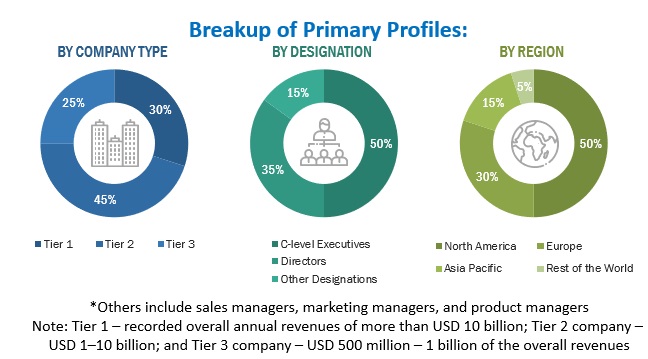

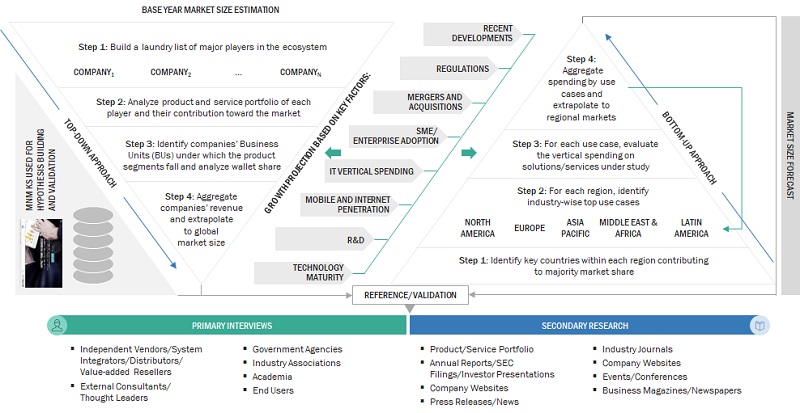

The study involved four major activities in estimating the current data center solutions market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the data center solutions market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, and various alliances. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial data center solutions market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using data center solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall data center solutions market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the data center solutions market and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the data center solutions market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data center solutions market: Top-down and bottom-up approaches

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides of the data center solutions market.

Market Definition

Considering the views of various sources and associations, a data center is a centralized facility that houses computing, storage, and networking equipment, along with the necessary infrastructure for managing and processing large volumes of data, supporting the IT requirements of organizations. Data center solutions are comprehensive products, services, and technologies designed to optimize, manage, and enhance data centers' efficiency, reliability, and security.

According to AWS, a data center is a physical location that stores computing machines and related hardware equipment. It contains the computing infrastructure that IT systems require, such as servers, data storage drives, and network equipment. It is the physical facility that stores any company's digital data. Data centers bring several benefits, such as:

- Backup power supplies to manage power outages

- Data replication across several machines for disaster recovery

- Temperature-controlled facilities to extend the life of the equipment

- Implementation of security measures for compliance with data laws

According to Schneider Electric, data center solutions are products and services required to create an operational data center. These products include IT equipment, storage systems, firewalls, routers, etc.

As per Nlyte Software, a data center is a facility of one or more buildings that house a centralized computing infrastructure, typically servers, storage, and networking equipment.

Key Stakeholders

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Software providers

- System integrators

- Network service providers

- Consulting service providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Colocation providers

- Enterprises

- Government and standardization bodies

- Telecom operators

- Healthcare organizations

Report Objectives

- To define, describe, and forecast the global data center solutions market based on offerings, data center type, data center size, verticals, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the market size concerning five central regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze competitive developments in the global data center solutions market, such as product enhancements, product launches, acquisitions, partnerships, and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Data Center Solutions Market