Middle Eastern Temporary Power and Cooling Market by Power Rating (Up To 500kVA, 5011,000 kVA, 1,0011,250 kVA, and Above 1,250 kVA), Equipment (Cooling Tower, AHU, Air Conditioner, Chiller), Application, and Region - Forecast to 2023

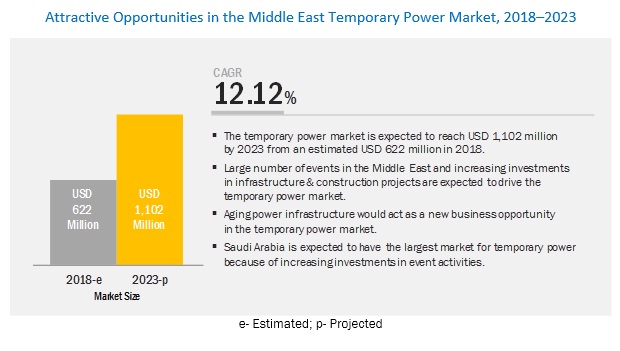

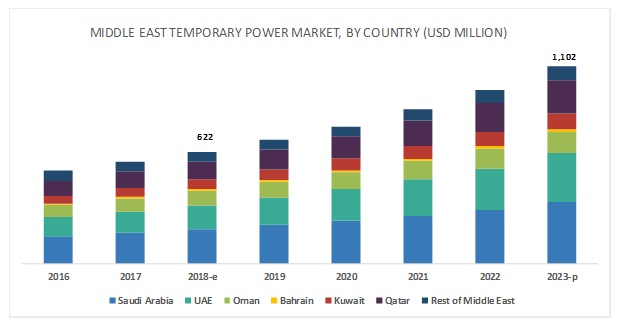

[149 Pages Report] The Middle Eastern temporary power market is projected to reach USD 1,102 million by 2023 at a CAGR of 12.12% from an estimated USD 622 million in 2018, whereas the Middle Eastern temporary cooling market is projected to reach a size of USD 305 million by 2023 at a CAGR of 5.78% from an estimated USD 230 million in 2018. This growth can be attributed to the lesser turnaround time, expansion of IT and data center projects, rise in GDP contribution from the non-oil sectors, and growing construction and infrastructure investments.

By power rating, the above 1,250 KVA segment is expected to be the largest contributor to the Middle Eastern temporary power and cooling market during the forecast period

The report segments the Middle Eastern temporary power market, by power rating, into-up to 500 kVA, 5011,000 kVA, 1,0011,250 kVA, and above 1,250 kVA. Above 1,250 kVA is expected to hold the largest market share by 2023. This range is mostly driven by the growth in heavy construction, oil & gas, utilities, and manufacturing. Saudi Arabia led the above 1,250 kVA segment in 2018. Saudi Arabia is one of the major countries for construction activities in the Middle East, with capital projects of about USD 1.2 trillion in the pre-execution stage, which is contributing directly to Saudi Vision 2030. These extensive infrastructure projects are expected to have a vital effect on the construction industry in the coming years, which is expected to grow about 56%. This will drive the above 1,250 kVA market during the forecast period.

Chillers accounted for the largest market share during the forecast period

The Middle Eastern temporary cooling market, by equipment, is segmented into-chiller, air handling unit (AHU), air conditioner, and cooling tower. The chiller segment is expected to dominate the Middle Eastern temporary power and cooling market by 2023 as it provides high energy efficiency, improved performance, easy maintenance, and space optimization. Moreover, increasing government measures over efficient energy use in industries are expected to drive the demand for chillers during the forecast period. As per the Middle East Data Centre 2017 to 2020 report, data center companies in Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE plan to expand their existing data center facilities. Companies like Microsoft also plan to open its first data center in the Middle East in 2019. All such factors would create the demand for temporary power and cooling during the forecast period.

By application, the events segment is expected to grow at the fastest rate during the forecast period

The events segment is expected to grow at the fastest rate during the forecast period. High disposable income and rising international tourism in the region has promoted a large number of events. Thus, rising event activities across the Middle East such as Expo 2020, Dubai Sports World, Gulf International Industry Fair, and ME Oil & Gas Show and Conference would create the demand for temporary power solutions to avoid blackouts and provide reliable and efficient performance. For instance, Dubai is hosting Expo 2020, which is expected to accommodate over 20 million visitors in the city. Also, other international events such as FIFA World Cup 2022, exhibitions, and expos are expected to grow at the highest rate in the entire Middle East. Such factors would create a demand for temporary power and cooling solutions in the region.

Saudi Arabia is expected to account for the largest market size during the forecast period

In this report, the Middle Eastern temporary power and cooling market has been analyzed with respect to 6 countriesKuwait, Qatar, Saudi Arabia, UAE, Oman, and Bahrain. The market in Saudi Arabia is estimated to be the largest from 2018 to 2023. Increasing focus on the non-oil sector is one of the major reasons behind the growth of temporary power and cooling market in Saudi Arabia. As per the Saudi Vision 2030, the country plans to increase its non-oil & gas sector exports from 16% to 50% by 2030. To accomplish this target, the country is primarily focused on construction and events activities to maintain its economy growth. Hence, it has initiated various plan such as the ESKAN Project to construct 500,000 affordable houses and strengthen its hospitality infrastructure to drive the tourism industry. Additionally, Saudi Arabia is also investing in national broadband projects. For instance, Google plans to open data centers in Saudi Arabia by partnering with Saudi Aramco, the state-owned oil company. All such factors will create a huge demand for temporary power and cooling solutions in the country.

The major players in the Middle Eastern temporary power and cooling market, are Aggreko (UK), RSS (UAE), Altaaqa (UAE), Cummins (Saudi Arabia), Byrne (UAE), Johnson Controls (Ireland), Geo Rental (UAE), and Argonaut (UAE).

Scope of the report

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Power Rating, Equipment, Application, and Region |

|

Geographies covered |

Middle East |

|

Companies covered |

Aggreko (UK), RSS (UAE), Altaaqa (UAE), Cummins (Saudi Arabia), and Byrne (UAE), Johnson Controls (Ireland), Geo Rental (UAE), and Argonaut (UAE). |

This research report categorizes the Middle East temporary power and cooling market based on power rating, equipment, application, and region

On the basis of power rating, the Middle East temporary power and cooling market has been segmented as follows:

- Up to 500 kVA

- 5011,000 kVA

- 1,0011,250 kVA

- Above 1,250 kVA

On the basis of equipment, the Middle East temporary power and cooling market has been segmented as follows:

- Cooling Tower

- Air Handling Unit (AHU)

- Air Conditioner

- Chiller

On the basis of application, the Middle East temporary power and cooling market has been segmented as follows:

- Construction

- Oil & gas

- Utilities

- Real estate & Data Center

- Events

- Marine

- Military

- Manufacturing

On the basis of country, the Middle East temporary power and cooling market has been segmented as follows:

- Saudi Arabia

- UAE

- Oman

- Bahrain

- Kuwait

- Qatar

- Rest of the Middle East

Key Questions addressed by the report

- The report identifies and addresses key segments of the Middle Eastern temporary power and cooling market, which would help manufacturers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.1.1 Ideal Demand Side Analysis

2.1.1.1 Assumptions

2.1.2 Supply Side Analysis

2.1.2.1 Calculation

2.1.3 Forecast

2.2 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Temporary Power and Cooling Market, 20182023

4.2 Temporary Power Market, By Power Rating

4.3 Temporary Cooling Market, By Equipment

4.4 Temporary Power Market, By Application

4.5 Temporary Cooling Market, By Application

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Policy Analysis

5.2.1 Saudi Arabia

5.2.2 UAE

5.2.3 OMAN

5.2.4 Bahrain

5.2.5 Kuwait

5.2.6 Qatar

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Large Number of Events in the Region

5.3.1.2 Lesser Turnaround Time

5.3.1.3 Power Shortage During High-Demand Periods

5.3.1.4 Growing Construction and Infrastructure Investments

5.3.1.5 Rise in GDP Contribution From the Non-Oil Sectors

5.3.1.6 Expansion of It and Data Center Projects

5.3.2 Restraints

5.3.2.1 Rise in T&D Investments

5.3.2.2 Rising Environmental Concerns

5.3.2.3 Rigorous Environmental Norms

5.3.3 Opportunities

5.3.3.1 Aging Power Infrastructure

5.3.3.2 Potential Implementation of Digital Technologies in Temporary Power & Cooling Solutions

5.3.4 Challenges

5.3.4.1 Intense Competition Within the Specialty Sector

6 Temporary Power Market, By Power Rating (Page No. - 47)

6.1 Introduction

6.2 Up to 500kVA

6.2.1 Increasing Events, Commercial Building and Facilities is Expected to Boost the Market in the Middle East Region

6.3 5011,000 Kva

6.3.1 Construction Adn Hvac Activites Will Boost the Temporary Power Market for 501 to 1,000 Kva Segment

6.4 1,0011,250 Kva

6.4.1 Heavy Construction, Manufacturing, and Utilities Would Drive the Demand for 1,001 to 1,250 Kva Segment

6.5 Above 1,250 Kva

6.5.1 Increasing Oil & Gas Activities and Heavy Construction Would Drive the Above 1,250 Kva Segment During the Forecast Period

7 Temporary Cooling Market, By Equipment (Page No. - 53)

7.1 Introduction

7.2 Cooling Tower

7.2.1 Saudi Arabia Holds the Largest Market Share

7.3 Air Handling Unit (AHU)

7.3.1 Increasing Industrialization and Infrastructure Projects in the Middle East Region is the Major Key Factor for the AHU Market

7.4 Air Conditioner

7.4.1 Increasing It and Data Center is Expected to Boost the Air Conditioner Market

7.5 Chiller

7.5.1 Increasing Events Activities Across the Middle East Region Will Boost the Chiller Market

8 Temporary Power and Cooling Market, By Application (Page No. - 58)

8.1 Introduction

8.2 Construction

8.2.1 Qatar is Expected to Hold the Largest Market Share in the Construction

8.3 Oil & Gas

8.3.1 Increasing Demand for Oil & Gas From the Asia Pacific Region

8.4 Utilities

8.4.1 UAE is Expected to Grow at A Highest Cagr for Utilities Segment

8.5 Real Estate & Data Center

8.5.1 Increasing Data Center in the Middle East Region

8.6 Events

8.6.1 Increasing Number of Events in the Middle East Region Will Boost the Temporary Power and Cooling Market

8.7 Marine

8.7.1 Saudi Arabia is Holding the Largest Market Share for Marine Industry

8.8 Military

8.8.1 Qatar is Holding the Largest Market Share

8.9 Manufacturing

8.9.1 Infrastructural Transformation in the Country is Expected to Drive the Manufacturing Demand

9 Temporary Power and Cooling Market, By Country (Page No. - 71)

9.1 Introduction

9.2 Middle East

9.2.1 By Country

9.2.1.1 Saudi Arabia

9.2.1.1.1 Oil & Gas and Events Activities are Dominating the Temporary Power and Cooling Market in the Country

9.2.1.2 UAE

9.2.1.2.1 Increases Focuses on the Construction Sector is Expected to Boost the Demand for Temporary Power and Cooling Market in the Country

9.2.1.3 OMAN

9.2.1.3.1 Increasing Investment Towards the Oil & Gas and Utilities Sector is Likely to Drive the Temporary Power and Cooling Market

9.2.1.4 Bahrain

9.2.1.4.1 Increasing Number of Data Center in the Country Will Boost the Demand for the Market

9.2.1.5 Kuwait

9.2.1.5.1 Growth in the Construction and Real Estate Industries is Expected to Boost the Demand for Market

9.2.1.6 Qatar

9.2.1.6.1 Growing Construction and Event Activities Across the Country Will Boost the Market Growth

9.2.1.7 Rest of Middle East

10 Competitive Landscape (Page No. - 98)

10.1 Introduction

10.2 Ranking of Players & Market Structure

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 New Product Launches

10.3.3 Investments & Expansions

10.3.4 Others

11 Company Profiles (Page No. - 103)

11.1 Aggreko

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.2 Rental Solutions & Services

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.3 Altaaqa

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.4 Cummins Arabia

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 SWOT Analysis

11.5 Atlas Copco

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.6 Byrne Equipment Rental

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.6.4 SWOT Analysis

11.7 Smart Energy Solutions

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Developments

11.7.4 SWOT Analysis

11.8 Al Faris Group

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 SWOT Analysis

11.9 Andrews Sykes Climate Rental

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.9.4 SWOT Analysis

11.10 Al Shola

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 SWOT Analysis

11.11 Argonaut

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Recent Developments

11.11.4 SWOT Analysis

11.12 Energyst Rental Solutions

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 SWOT Analysis

11.13 Trane Rental Services

11.13.1 Business Overview

11.13.2 Products Offered

11.13.3 Recent Developments

11.13.4 SWOT Analysis

11.14 Flow Air & Power Solution

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Recent Developments

11.14.4 SWOT Analysis

11.15 Johnson Controls

11.15.1 Business Overview

11.15.2 Products Offered

11.15.3 Recent Developments

11.15.4 SWOT Analysis

11.16 Geo Rental Solutions

11.16.1 Business Overview

11.16.2 Products Offered

11.16.3 SWOT Analysis

11.17 Jassim Transport & Stevedoring Co.

11.17.1 Business Overview

11.17.2 Products Offered

11.17.3 Recent Developments

11.17.4 SWOT Analysis

12 Appendix (Page No. - 141)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (69 Tables)

Table 1 Middle East Temporary Power Market Snapshot

Table 2 Middle East Temporary Cooling Market Snapshot

Table 3 Policy and Factors: Kingdom of Saudi Arabia

Table 4 Policy and Factors: UAE

Table 5 Policy and Factors: OMAN

Table 6 Policy and Factors: Bahrain

Table 7 Policy and Factors: Kuwait

Table 8 Policy and Factors: Qatar

Table 9 List of Few Upcoming Events in the Region

Table 10 List of Upcoming Data Center Projects in the Middle East, 2018

Table 11 Generator Emission

Table 12 Generator Power Rating Required By Different End-Users

Table 13 Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 14 Up to 500kVA: Temporary Power Market, By Country, 20162023 (USD Million)

Table 15 5011,000 Kva: Temporary Power Market, By Country, 20162023 (USD Million)

Table 16 1,0011,250 Kva: Temporary Power Market, By Country, 20162023 (USD Million)

Table 17 Above 1,250 Kva: Temporary Power Market, By Country, 20162023 (USD Million)

Table 18 Cooling Tower: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 19 AHU: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 20 Air Conditioner: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 21 Chiller: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 22 Temporary Power Market, By Application, 20162023 (USD Million)

Table 23 Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 24 Construction: Temporary Power Market, By Country, 20162023 (USD Million)

Table 25 Construction: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 26 Oil & Gas: Temporary Power Market, By Country, 20162023 (USD Million)

Table 27 Oil & Gas: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 28 Utilities: Temporary Power Market, By Country, 20162023 (USD Million)

Table 29 Real Estate & Data Center: Temporary Power Market, By Country, 20162023 (USD Million)

Table 30 Real Estate & Data Center: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 31 Events: Temporary Power Market, By Country, 20162023 (USD Million)

Table 32 Events: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 33 Marine: Temporary Power Market, By Country, 20162023 (USD Million)

Table 34 Marine: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 35 Military: Temporary Power Market, By Country, 20162023 (USD Million)

Table 36 Military: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 37 Manufacturing: Temporary Power Market, By Country, 20162023 (USD Million)

Table 38 Manufacturing: Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 39 Temporary Power Market, By Country, 20162023 (USD Million)

Table 40 Temporary Cooling Market, By Country, 20162023 (USD Million)

Table 41 Saudi Arabia: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 42 Saudi Arabia: Temporary Power Market, By Application, 20162023 (USD Million)

Table 43 Saudi Arabia: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 44 Saudi Arabia: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 45 UAE: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 46 UAE: Temporary Power Market, By Application, 20162023 (USD Million)

Table 47 UAE: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 48 UAE: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 49 OMAN: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 50 OMAN: Temporary Power Market, By Application, 20162023 (USD Million)

Table 51 OMAN: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 52 OMAN: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 53 Bahrain: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 54 Bahrain: Temporary Power Market, By Application, 20162023 (USD Million)

Table 55 Bahrain: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 56 Bahrain: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 57 Kuwait: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 58 Kuwait: Temporary Power Market, By Application, 20162023 (USD Million)

Table 59 Kuwait: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 60 Kuwait: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 61 Qatar: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 62 Qatar: Temporary Power Market, By Application, 20162023 (USD Million)

Table 63 Qatar: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 64 Qatar: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 65 Rest of Middle East: Temporary Power Market, By Power Rating, 20162023 (USD Million)

Table 66 Rest of Middle East: Temporary Power Market, By Application, 20162023 (USD Million)

Table 67 Rest of Middle East: Temporary Cooling Market, By Equipment, 20162023 (USD Million)

Table 68 Rest of Middle East: Temporary Cooling Market, By Application, 20162023 (USD Million)

Table 69 Argonaut, the Most Active Player in the Market Between the Years 2014 & 2018

List of Figures (53 Figures)

Figure 1 Temporary Power & Cooling Market Segmentation

Figure 1 Major Temporary Power and Cooling Projects Across Middle Eastern Countries is the Determining Factor for the Middle EaImplemetation

Figure 2 Largest Energy Project

Figure 3 GCC Total Construction Contract Awards Split By Country

Figure 4 Temporary Power Market

Figure 5 Temporary Cooling Market

Figure 6 Middle East Energy Generation Mix Comaprison, 2016 vs. 2035

Figure 7 Above 1,250 Kva Segment is Expected to Hold the Largest Temporary Power Market During the Forecast Period

Figure 8 Chiller Segment is Expected to Lead the Temporary Cooling Market During the Forecast Period

Figure 9 Oil & Gas Segment is Expected to Lead the Temporary Power Market, 20182023

Figure 10 Events Segment is Expected to Lead the Temporary Cooling Market, 20182023

Figure 11 Saudi Arabia is Expected to Dominate the Temporary Power Market During the Forecast Period

Figure 12 UAE is Expected to Be the Fastest Market During the Forecast Period

Figure 13 Increasing Construction and Event Activities are Driving the Temporary Power Market

Figure 14 Increasing Events and Real Estate Activities & Data Centers Across the Middle East Region are Driving the Temporary Cooling Market

Figure 15 Above 1,250 Kva Segment is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 16 Chiller Segment is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 17 Oil & Gas Segment Dominated the Temporary Power Market in 2017

Figure 18 Events Segment Dominated the Temporary Cooling Market in 2017

Figure 19 Temporary Power and Cooling Market: Drivers, Restraints, Opportunities, & Challenges

Figure 20 Travel Spending in UAE (Forecast)

Figure 21 Power Shortages Expected to Drive the Temporary Power Market During the Forecast Period in Saudi Arabia

Figure 22 Value of Active Projects in GCC

Figure 23 Global Oil Price Scenario, 20132017 (USD Per Barrel)

Figure 24 Saudi Arabia: Oil Sector vs Non-Oil Sector, 20132017

Figure 25 UAE Gross Domestic Product By Economic Activity, 20152016

Figure 26 Temporary Power Market, By Power Rating, 20182023 (USD Million)

Figure 27 Temporary Cooling Market, By Equipment, 2018-2023

Figure 28 Long-Term Oil Demand in the Middle East, 20162040

Figure 29 Electricity Production in the Middle East, 2017

Figure 30 Real Estate Activities, Middle East, 20122016

Figure 31 Middle East: Temporary Power and Cooling Market Snapshot

Figure 32 Saudi Arabia: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 33 Saudi Arabia: Above 1,250 Kva and Oil & Gas Segments Dominated the Temporary Power Segment in 2018

Figure 34 Saudi Arabia Contract By Sector, 20152018

Figure 35 UAE: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 36 UAE: Above 1,250 Kva and Oil & Gas Segments Dominated the Temporary Power Segment in 2018

Figure 37 OMAN: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 38 OMAN: Above 1,250 Kva and Utilities Segments Dominated the Temporary Power Segment in 2018

Figure 39 Bahrain: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 40 Bahrain: Above 1,250 Kva and Oil & Gas Segments Dominated the Temporary Power Segment in 2018

Figure 41 Kuwait: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 42 Kuwait: Above 1,250 Kva and Oil & Gas Segments Dominated the Temporary Power Segment in 2018

Figure 43 Qatar: Chiller and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 44 Qatar: 1,0011,250 Kva and Construction Segments Dominated the Temporary Power Segment in 2018

Figure 45 Rest of Middle East: Chillers and Events Segments Dominated the Temporary Cooling Segment in 2018

Figure 46 Rest of Middle East: Above 1,250 Kva and Oil & Gas Segments Dominated the Temporary Power Segment in 2018

Figure 47 Key Developments in the Temporary Power and Cooling Market, 20142018

Figure 48 Aggreko Led the Temporary Power Market in 2017

Figure 49 Aggreko Led the Temporary Cooling Market in 2017

Figure 50 Aggreko: Company Snapshot

Figure 51 Atlas Copco: Company Snapshot

Figure 52 Johnson Controls: Company Snapshot

Figure 53 Jassim Transport & Stevedoring: Company Snapshot

The study involved 4 major activities in estimating the current size for the Middle Eastern temporary power and cooling market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Middle Eastern temporary power and cooling market comprises several stakeholders such as energy utilities, government and industry associations, institutional investors, power and energy associations, and transmission & distribution (T&D) utilities in the supply chain. The demand side of this market is characterized by the development of the T&D networks, increasing renewables industry, and growth in power demand. The supply side is characterized by new product launches and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Middle Eastern temporary power and cooling market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying the various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define and segment the Middle Eastern temporary power and cooling market with respect to power rating, equipment, application, and country

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the Middle Eastern temporary power and cooling market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the Middle Eastern temporary power and cooling market with respect to the Middle East

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments such as new product developments, mergers & acquisitions, expansions & investments, partnership & collaboration, and contracts & agreements, in the Middle Eastern temporary power and cooling market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Middle Eastern Temporary Power and Cooling Market