Defense Electronics Market Size, Share & Industry Growth Analysis Report by Vertical (Navigation, Communication, and Display (Avionics, Vetronics, Integrated Bridge Systems), C4ISR, Electronic Warfare, Radars, Optronics), Platform (Airborne, Marine, Land, Space) and Region - Global Forecast to 2028

Update: 10/22/2024

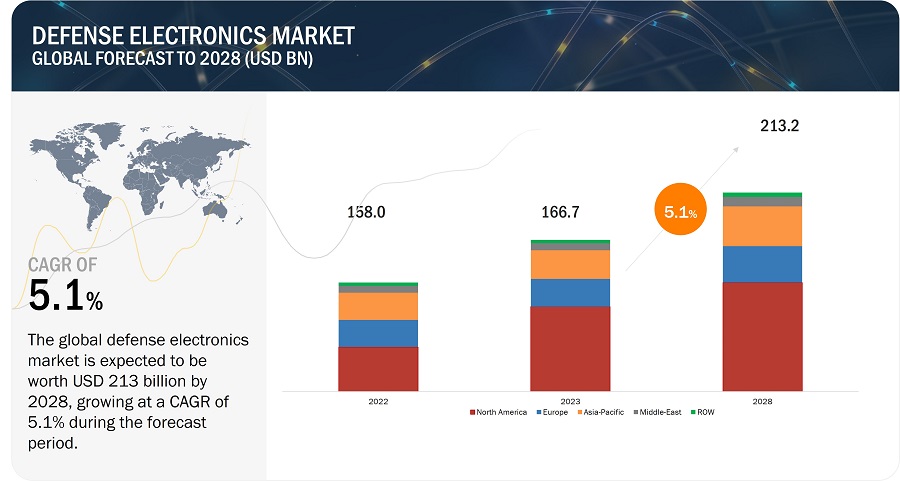

The Defense Electronics Market is estimated to be USD 166.7 Billion in 2023 and is projected to reach USD 213.2 Billion by 2028, at a CAGR of 5.1% from 2023 to 2028. The Defense Electronics Industry is driven by factors such as strengthening of joint forces by investing in defence electronic systems and increasing need for AI and IoT devices in military operations.

Defense Electronics Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Defense electronics Market Dynamics:

Drivers: Growing adoption of integrated defense electronics technologies

Ground units can dominate the modern battlefield due to new technological advancements, new weapon systems, and enhancements to existing weapon systems. In a time of constrained resources, the military primarily uses digital communications to enhance the informational components of existing weapon systems to maximize integration and sharing of information while denying a prospective adversary equivalent capability. Weapon systems must be converted from analog speech, video, and data transfers to digital coding to increase the amount of real-time information accessible to field commanders. A network connects weapon systems, aerial platforms, surveillance, and communication systems in the digitization of battlefield systems, enabling the exchange of massive volumes of data. Communication systems exchange information between the fighting, combat support, and combat service support functional areas of the battlefield.

Technological developments in military systems and equipment have resulted in significant improvements in defense electronics systems. The use of integrated defense electronics products provides multiple advantages, such as real-time decision-making, remote operations, and reprogramming of systems for defense against new and emerging threats. Defense electronics products, including integrated electronic warfare systems, enable communication with multiple other military defense systems, resulting in better-coordinated operations. Sensors and avionics can also be integrated with electronic warfare systems without undergoing technical changes. This reduces the system integration cost and ensures rapid deployment of the systems on various platforms.

Military aircraft need to be equipped with sophisticated electronic warfare integrated suites, such as anti-jamming devices since electronic jammers can cause the radar or electrical equipment of aircraft to malfunction. Since traditional countermeasure techniques are ineffective and obsolete, militaries are upgrading their aircraft with technologically advanced countermeasure techniques, such as anti-jammers, radar warning receivers (RWRs), laser warning receivers (LWRs), countermeasure dispenser systems (CMDS), and interference mitigation systems. Such benefits associated with the incorporation of integrated defense electronics products in the defense and military sectors contribute to the growth of the defense electronics market.

Restraints: Effect on execution of critical defense missions due to lack if proper communication technology

Defense electronic products include electronic warfare systems, avionics, optronics, communication systems and command & control systems, which collect and transfer high volumes of sensitive data from handheld, electro-optic, and radar. Communicating and distributing such high volumes of data affects processing speeds in real time and could result in delays in decision making, thus threatening the execution of critical defense missions. Sophisticated communication technology infrastructure based on big data and efficient data centers is required to make real-time communication more effective. Such infrastructure requires a substantial investment, which is a major restraint for the defense electronics market.

The current network infrastructure for military forces in various countries across the globe seems to lack the capability to transfer such high amounts of data in real time. A more sophisticated infrastructure is required to facilitate effective real-time communication. Such infrastructure requires high capital investment and will substantially restrict the growth of the defense electronics market. While the implementation of the 5G technology can help, the cost of setting up a communication network and essential infrastructure is considerably high in several countries worldwide.

Opportunities: Increasing need for AI and IOT devices in military operations

AI and IoT have emerged as complementary technologies that find significant applications in the defense electronics industry for military exercises and critical missions. The constantly expanding network infrastructure and the increasing usage of electronic military devices in the defense sector worldwide will invariably require AI for categorizing, processing, fusing, and analyzing the big data generated. The data produced from defense electronic devices are heterogeneous in nature and require artificial intelligence for analysis. When merged with IoT, AI systems would be especially useful in regulating defense electronic products, including electronic warfare and military devices, by analyzing their transmitted data and controlling their operations to match user requirements. They can also coordinate and synchronize defense electronic products with other devices used in combat operations and efficiently modify their outputs.

AI-based projects deployed in the US defense forces include the Squad X Experimentation Program of Defense Advanced Research Projects Agency (DARPA), the OFFSET program, and Project Maven. Future and modern battlespace environments shaped by innovative technology will involve the growing use of defense electronic products and an integrated approach toward warfighting by combining land, air, space, and naval forces. Such environments will substantially require the implementation of AI and IoT technologies, which will support the growth of the defense electronics market over the projected timeframe. According to an article published in Shepard (UK) in November 2022, Future advancements could depend on cognitive electronic warfare (EW), which uses machine learning and AI to make decisions in microseconds to deal with combat circumstances.

In 2022, a Congressional Research Service publication on the Joint All-Domain Command and Control (JADC2) initiative claimed that crucial decisions in future conflicts must be made in hours, minutes, or seconds rather than over days. This will involve examining the operating environment and giving orders. The JADC2 program is a significant DoD endeavor to gather data streams from thousands of battlefield vehicles, environmental sensors, and other intelligent devices from every military branch. AI and ML provide pertinent data and enable speedy decision-making at the front lines.

Challenges: Increasing cyberattacks on trade secrets and defense-related data

Cyberattacks work best when combined with electronic warfare (EW), disinformation operations, antisatellite attacks, and precision-guided weapons in confrontations involving modern armies. The goal is to produce an operational advantage by deteriorating informational advantage, intangible assets (such as data), communications, intelligence assets, and weapon systems. The most harmful acts would combine cyberattacks and precision-guided bombs to disable or destroy crucial targets. Cyber operations can also be used to undermine decision making by defenders and stir up civil unrest by interfering with government, energy, transportation, and financial services.

Current cybersecurity solutions may fall short in terms of tackling advanced ransomware and spyware threats. Such incidents may affect the defense capabilities of different countries. The defense agencies of various countries across the globe constantly face the threat of cyberattacks. In July 2022, the Belgian government declared that three Chinese hacker gangs, a component of the well-known Chinese APT actors, had attacked Belgian military defense forces and civil services. Trade secrets and intelligence data were stolen by attackers supported by the Chinese government. In June 2022, Soft Cell (UK) released a brand-new remote access trojan (RAT) malware.

The Russia-Ukraine crisis, which started in February 2022, comprised physical combat that caused thousands of people to flee their homes and killed several civilians. According to FortiGuard Labs (US), new viper malware was used to attack Ukrainian targets, and the company found it installed on at least several hundred PCs there. Several Ukrainian organizations have also been the target of sophisticated operations that used the malware strands KillDisk and HermeticWiper, which seem to wipe data off of machines. It was discovered that bogus evacuation plan emails were used to spread Remote Manipulator System (RMS), a tool for remotely controlling devices in Ukraine. A wave of distributed denial-of-service (DDoS) attacks also hit Ukraine. These include interference with the networks of the Ministry of Defense and the military forces.

Industry players are launching new cyber security platforms and solutions to support the growth of the defense electronics market. AI-based cybersecurity solutions can independently gather data from various sources, analyze it, correlate it to the signals indicating cyberattacks, and take relevant actions. However, these solutions are under development, and cyberattacks continue to pose a threat to defense forces. While the innovative solutions and platforms provided by industry players will help reduce and tackle cyberattacks on military databases and devices in the future, the growing number of cyberattacks poses a major challenge to military agencies worldwide.

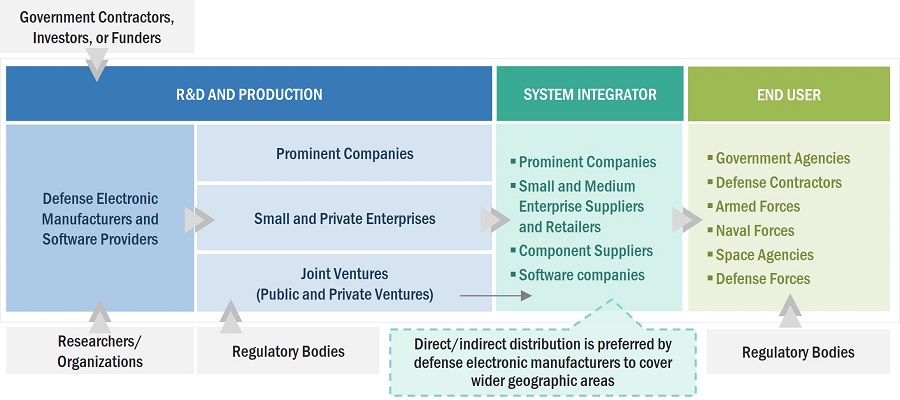

Defense Electronics Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of defense electronics components. These companies have been operating in the market for several years and offer a diverse product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Elbit Systems Ltd. (Israel), Safran SA (France), Cobham Limited (UK), L3 Harris Technologies Inc. (US) and Raytheon Technologies Corporation (US).

Based on vertical, the optronics segment is projected to grow at a second highest CAGR in the defense electronics market during the forecast period

Based on vertical, the defense electronics market has been segmented into navigation, communication, and display; C4ISR; electronic warfare; radar; optronics. The need to improve aims and intensify sights during operations is driving the optronics segment of defense electronics market.

Based on platform, the space segment is projected to grow at a second highest CAGR in the defense electronics market during the forecast period

Based on platform, the defense electronics market has been segmented into airborne, marine, land and space. The space segment is expected to grow at a second highest CAGR during the forecast period. The increasing need for fast and secure data transfer and need for assistance in weather monitoring, surveillance & reconnaissance, navigation and communication is driving this segment of the market.

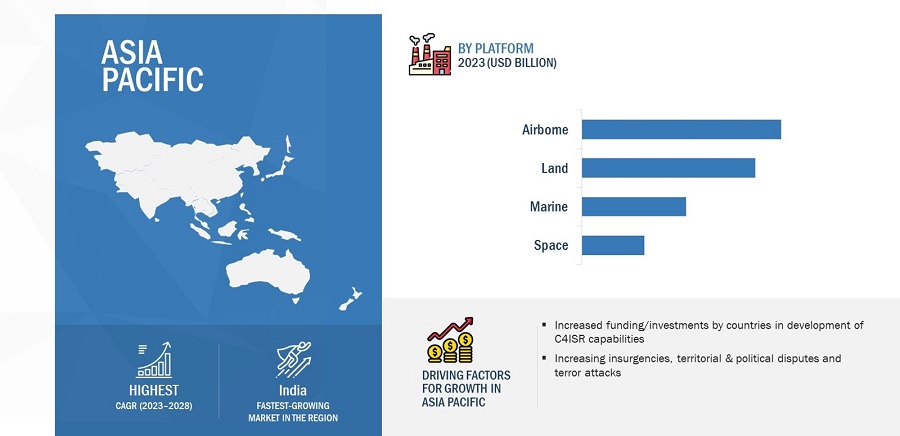

Asia Pacific is expected to account for the highest CAGR in the forecasted period and second largest share in 2023.

Asia Pacific is estimated to account for the highest CAGR in forecasted period and second largest share in 2023. The countries in Asia pacific region offer significant opportunities for defense electronics manufacturers as this region has been investing in development of modern technologies and procurement of new platforms. The increased demand for modern technologies and electronic warfare in countries such as Japan, India and China are driving the growth of this region.

Defense Electronics Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Defense Electronics Industry Companies: Top Key Market Players

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 166.7 Billion in 2023

|

|

Projected Market Size

|

USD 213.2 Billion by 2028

|

|

Growth Rate

|

CAGR of 5.1%

|

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Vertical, Platform |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and RoW |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Thales Group (France), and BAE Systems plc (UK) and others. Total 25 Market Players |

Defense Electronics Market Highlights

The study categorizes the Defense Electronics market based on Vertical, Platform and region.

|

Segment |

Subsegment |

|

By Vertical |

|

|

By Platform |

|

|

By Region |

|

Recent Developments

- In April 2023, The US Navy has given a contract to CAES, a top supplier of mission-critical advanced RF technology, for the AN/ALQ-99 Low Band Consolidation (LBC) transmitter's initial pre-production stage. The AN/ALQ-99 Low Band Transmitter has been modified to become the LBC.

- In March 2023, Raytheon Technologies received a contract from the Space Development Agency to design, develop and deliver a seven-vehicle missile tracking satellite constellation for missile warning and tracking.

- In March 2023, The Swedish Defence Materiel Administration has awarded a contract to Elbit Systems Sweden AB, a subsidiary of Elbit Systems Ltd., to provide the Swedish Army with Technological High Mobility Shelters (THMS). The deal contains opportunities for additional extensions, and it will be carried out over a three-year period.

- In February 2023, The US Marine Corps awarded Northrop Grumman Corporation the initial production and operations contract for the Next Generation Handheld Targeting System (NGHTS). The NGHTS is a portable targeting system that offers high-precision targeting and can function in locations without GPS.

- In February 2023, A Memorandum of Understanding was inked by Thales Group and Bharat Dynamics Limited (BDL), a government-owned company, to establish manufacturing facilities for precision-strike 70mm laser guided rockets (FZ275 LGR) in India. This arrangement will allow BDL to provide a Made in India solution for the Indian Government's current Advanced Light Helicopters (WSI) and Light Combat Helicopter fleet.

Frequently Asked Questions (FAQ):

What is the current size of the Defense Electronics Market?

The Defense Electronics Market is projected to grow from an estimated USD 166.7 Billion in 2023 to USD 213.2 Billion by 2028, at a CAGR of 5.1% from 2023 to 2028.

Who are the winners in the Defense Electronics Market?

Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), Northrop Grumman Corporation (US), and BAE Systems plc (UK)are some of the winners in the market.

What are some of the opportunities of the Defense Electronics Market?

Development of new-generation air and missile defense systems and incorporation of satellite-based geospatial analytical and GIS tools are few of the opportunities of the defense electronics market.

What are some of the technological advancements in the Defense Electronics Market?

5G networking for faster data transfer, quantum technologies, advanced materials, and cloud computing among others.

What are the factors driving the growth of the Defense Electronics Market?

Need for enhanced integrated situational awareness to support decision making and growing adoption of integrated defense electronics technologies are some of the key factors driving the growth in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing modernization of defense electronics capabilities- Need for enhanced integrated situational awareness to support decision-making- Strengthening of joint forces by investing in defense electronic systems- Growing adoption of integrated defense electronics technologiesRESTRAINTS- High investment in defense electronics in early phases- High installation and upgrade cost of avionic products- Effect on execution of critical defense missions due to lack of proper communication technology- Restraints related to technology transferOPPORTUNITIES- Growing need for new products for electronic warfare and C4ISR- Increasing use of UAVs as drone jammers- Increasing need for AI and IoT devices in military operations- Development of new-generation air and missile defense systems- Incorporation of satellite-based geospatial analytical and GIS toolsCHALLENGES- Stringent cross-border trading policies- Supply chain issues impacting defense electronics- High cost of deployment of electronic warfare systems- Inability to address threats by foe systems- Increasing cyberattacks on trade secrets and defense-related data

-

5.3 TRENDS/BUSINESSES IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR DEFENSE ELECTRONICS PRODUCT MANUFACTURERS

-

5.4 TECHNOLOGY ANALYSISDEVELOPMENT OF ELECTRONICALLY SCANNED ARRAY (AESA)3D PRINTINGHYPERSPECTRAL AND MULTISPECTRAL IMAGINGENHANCED VISION SYSTEM (EVS)

-

5.5 DEFENSE ELECTRONICS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 CASE STUDIESC5ISRC6ISREO/IR SYSTEMS IN MARITIME SECURITY AND SURVEILLANCEAI PROVIDES COMBATANTS WITH COGNITIVE EDGE OVER OPPONENTSEO/IR CAMERA FOR ISR IN UAVS

- 5.8 OPERATIONAL DATA

- 5.9 AVERAGE SELLING PRICE OF ELECTRONIC WARFARE SOLUTIONS

- 5.10 TRADE ANALYSIS

-

5.11 RECESSION IMPACT ANALYSISUNCERTAINTY ANALYSISFACTORS IMPACTING DEFENSE ELECTRONICS MARKET, 2022–2023

-

5.12 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 TARIFF AND REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFICMIDDLE EAST

- 5.15 KEY CONFERENCES AND EVENTS IN 2022–2023

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDS5G NETWORKING FOR FASTER DATA TRANSFERUSE OF SMART SENSORS FOR MILITARY APPLICATIONSCLOUD COMPUTINGINTERNET OF THINGS (IOT) IN MILITARYPLATFORM TELEMATICSRADAR TECHNOLOGIES- SOFTWARE DEFINED RADARS- 3D AND 4D RADARSADVANCED ANALYTICS (DATA PROCESSING AND ANALYTICS)ADVANCED MATERIALSSILICON (SI)GALLIUM NITRIDE (GAN)GALLIUM ARSENIDE (GAAS)QUANTUM TECHNOLOGIES IN DEFENSE ELECTRONICSMODERN ELECTRONIC WARFARE TECHNOLOGIES- Directed energy weapons- Next-generation jammers (NGJ)- Adaptive radar countermeasure (ARC) technologyLASER COMMUNICATIONHARDWARE: NEW WEAPONS TECHNOLOGYINTEGRATED PLATFORM THROUGH DIGITAL TWIN TECHNOLOGYOPEN ARCHITECTURE C4 SYSTEMSCYBER WARFARE

-

6.3 IMPACT OF MEGATRENDSDIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGS (IOT)SHIFT IN GLOBAL ECONOMIC POWERCOORDINATED MILITARY ACTIONS LEADS TO COOPERATIVE COMBATAI AND COGNITIVE APPLICATIONSMACHINE LEARNINGDEEP LEARNINGBIG DATA

- 6.4 INNOVATION AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 AIRBORNEMILITARY AIRCRAFT- Growing procurement and modernization programsMILITARY HELICOPTERS- Utilized in search & rescue, evacuation, and combat operationsUAV- Largescale adoption in combat applications

-

7.3 LANDARMORED VEHICLES (MFVS)- Rising demand for defense electronics to support MFVsUNMANNED GROUND VEHICLES (UGVS)- Used by NATO troops and advanced militariesCOMMAND CENTERS- Increasing need for cybersecurity to protect command centersDISMOUNTED SOLDIER SYSTEMS- Growing requirement for support systems for dismounted soldiers

-

7.4 NAVALAIRCRAFT CARRIERS- Upgraded with new componentsAMPHIBIOUS- Supports ground forcesDESTROYERS- Protects large vessels against small and powerful short-range attackersFRIGATES- Protects warships and merchant-marine shipsSUBMARINES- Increasing investments for refurbishmentUNMANNED MARINE VEHICLES (UMVS)- Deployed to enhance defense applications

-

7.5 SPACELEO SATELLITES- Used for fast and secure data transferMEO SATELLITES- Supports navigation systemsGEO SATELLITES- Assists in weather monitoring, surveillance & reconnaissance, navigation, and communication

- 8.1 INTRODUCTION

-

8.2 NAVIGATION, COMMUNICATION, AND DISPLAYAVIONICS- Communication- Navigation- Flight management- Electronic flight displays- Power and data management- Traffic and collision management- Payload and mission managementINTEGRATED BRIDGE SYSTEMS- Integrated navigation system- Automatic weather observation system- Voyage data recorder- Automatic identification systemVETRONICS- Navigation- Observation and display systems- Weapon control systems- Sensor and control systems- Vehicle protection systems- Power systems

-

8.3 C4ISRCOMMUNICATION AND NETWORK TECHNOLOGIESSENSOR SYSTEMSELECTRONIC WARFAREDISPLAYS AND PERIPHERALSSOFTWARE- Command & control software- Cybersecurity software- Computing software- Situational awareness software- Other software

-

8.4 ELECTRONIC WARFAREJAMMERS- Increasing demand to engage in modern warfareSELF-PROTECTION EW SUITE- Used to seek protection from external threatsDIRECTED ENERGY WEAPONS (DEW)- Protects components from energy radiationDIRECTION FINDERS (DF)- Detects direction of aircraft from originDIRECTIONAL INFRARED COUNTERMEASURES (DIRCM)- Counters sophisticated threatsANTI-RADIATION MISSILES (ARMS)- Increased investments in ARMS for military systemsANTENNAS- Provides innovative and high-power widebandIR MISSILE WARNING SYSTEMS (MWS)- Warns military aircraft against infrared-guided missile threatsIDENTIFICATION FRIEND OR FOE (IFF) SYSTEMS- Identifies military platforms as friendly or hostileLASER WARNING SYSTEMS (LWS)- Increasing use of laser targeting and guidance systemsELECTROMAGNETIC SHIELDING- Protects military assets and infrastructureRADAR WARNING RECEIVERS (RWRS)- Safeguards military platforms from radar-guided threatsCOUNTER UAVS- Used for counter-drone operationsINTERFERENCE MITIGATION SYSTEMS- Rising demand to protect RF systemsELECTROMAGNETIC PULSE (EMP) WEAPONS- Damages military platforms with conventional shielding

-

8.5 RADARSSURVEILLANCE AND AIRBORNE EARLY WARNING RADARS- Operates in any weather on any terrain- Airborne surveillance radars- Land-based surveillance radars- Naval surveillance radars- Space surveillance radarsTRACKING AND FIRE CONTROL RADARS- Finds Doppler frequency shift and detects targets- Airborne tracking and fire control radars- Land tracking and fire control radars- Naval tracking and fire control radars- Space tracking and fire control radarsMULTIFUNCTION RADARS- Land multifunction radars- Naval multifunction radarsWEAPON LOCATING AND C-RAM RADARS- Provides threat detection and countermeasure capabilitiesGROUND PENETRATING RADARS- Detects landmines and weapons buried undergroundWEATHER RADARS- Ensures mission effectiveness and safety- Airborne weather radars- Land weather radarsCOUNTER-DRONE RADARS- Detects hostile UASAIRCRAFT BIRDSTRIKE AVOIDANCE RADARS- Designed for monitoring of bird control zonesMILITARY AIR TRAFFIC CONTROL- Used for air traffic outside special airfield areasAIRBORNE MOVING TARGET INDICATOR RADARS- Distinguishes stationary and non-stationary targetsOTHER RADARS

-

8.6 OPTRONICSHANDHELD SYSTEMS- Designators- Rangefinders- Handheld thermal imagers- Weapon scopes and sightsEO/IR PAYLOADS- Airborne EO/IR- Maritime EO/IR- Vehicle EO/IR

- 9.1 INTRODUCTION

- 9.2 REGIONAL RECESSION IMPACT ANALYSIS

-

9.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISNORTH AMERICA: PESTLE ANALYSISUS- Huge spending to strengthen defense sectorCANADA- Government support for modernizing defense capabilities

-

9.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISEUROPE: PESTLE ANALYSISRUSSIA- Increasing investments in defense equipment and technologiesUK- Rapid market expansion through advanced and upgrading programsFRANCE- Strengthening defense forces by initiating programsGERMANY- Increasing contracts for advanced military capabilitiesITALY- Focus on integrating defense electronic systems in all defense platformsREST OF EUROPE- Geopolitical rifts encouraging adoption of defense electronics platforms

-

9.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISASIA PACIFIC: PESTLE ANALYSISCHINA- Increased adoption of defense electronic productsINDIA- Growing focus on developing advanced systems to increase defense capabilitiesJAPAN- Development of modern technologies and procurement of new platformsSOUTH KOREA- Improvement of surveillance and reconnaissance capabilitiesAUSTRALIA- Demand for modern technologies and electronic warfareREST OF ASIA PACIFIC- Growth of economies boosting defense spending

-

9.6 MIDDLE EASTMIDDLE EAST: RECESSION IMPACT ANALYSISMIDDLE EAST: PESTLE ANALYSISSAUDI ARABIA- Growing need for cyber defenseISRAEL- Hub of leading military system manufacturers and defense organizationsUAE- Investments in modernization programsTURKEY- Focus on strengthening electronic warfare capabilities

-

9.7 REST OF THE WORLDREST OF THE WORLD: REGIONAL RECESSION IMPACT ANALYSISLATIN AMERICAAFRICA- Growing economy and increasing trade activities

- 10.1 INTRODUCTION

-

10.2 COMPANY OVERVIEWKEY DEVELOPMENTS/STRATEGIES OF LEADING PLAYERS IN DEFENSE ELECTRONICS MARKET

- 10.3 RANKING ANALYSIS OF KEY PLAYERS IN DEFENSE ELECTRONICS MARKET, 2022

- 10.4 REVENUE ANALYSIS, 2022

- 10.5 MARKET SHARE ANALYSIS, 2022

-

10.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 10.8 COMPETITIVE BENCHMARKING

- 10.9 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.10 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORK

- 11.1 INTRODUCTION

-

11.2 KEY PLAYERSNORTHROP GRUMMAN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MNM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products/Services/Solutions offered- Recent developments- MNM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offered- Recent developmentsRHEINMETALL AG- Business overview- Products/Services/Solutions offered- Recent developmentsSAAB AB- Business overview- Products/Services/Solutions offered- Recent developmentsLEONARDO SPA- Business overview- Products/Services/Solutions offered- Recent developmentsISRAEL AEROSPACE INDUSTRIES (IAI)- Business overview- Products/Services/Solutions offered- Recent developmentsCURTISS-WRIGHT CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsELBIT SYSTEMS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsSAFRAN SA- Business Overview- Products/Services/Solutions offered- Recent developmentsCOBHAM LIMITED- Business overview- Products/Solutions/Services offeredHENSOLDT- Business overview- Products/Solutions/Services offered- Recent developmentsRAFAEL ADVANCED DEFENSE SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsINDRA SISTEMAS, SA- Business overview- Products/Services/Solutions offered- Recent developmentsASELSAN AS- Business overview- Products/Services/Solutions offered

-

11.3 OTHER PLAYERSRADIOELECTRONIC TECHNOLOGIES JSCSIERRA NEVADA CORPORATIONMAG AEROSPACETATA ADVANCED SYSTEMS LIMITEDL&T DEFENCEDATA PATTERNS (INDIA) LTD.MERCURY SYSTEMS, INC.SAMI ADVANCED ELECTRONICSLIG NEX1MISTRAL SOLUTIONS PVT. LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 MARKET ESTIMATION PROCEDURE

- TABLE 2 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 3 DEFENSE ELECTRONICS MARKET ECOSYSTEM

- TABLE 4 EO/IR SYSTEMS IN MARITIME SECURITY AND SURVEILLANCE

- TABLE 5 ARTIFICIAL INTELLIGENCE GIVES COGNITIVE EDGE OVER OPPONENTS

- TABLE 6 EO/IR CAMERA FOR ISR IN UAVS

- TABLE 7 MILITARY AIRCRAFT VOLUME, BY AIRCRAFT TYPE

- TABLE 8 RADAR APPARATUS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

- TABLE 9 RADAR APPARATUS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

- TABLE 10 DEFENSE ELECTRONICS SYSTEM MARKET: PORTER'S FIVE FORCE ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR PLATFORMS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP FOUR PLATFORMS

- TABLE 13 DEFENSE ELECTRONICS MARKET: CONFERENCES AND EVENTS, 2022–2023

- TABLE 14 INNOVATION AND PATENT REGISTRATIONS (2019–2022)

- TABLE 15 DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 16 DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 17 AIRBORNE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 18 AIRBORNE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 19 LAND: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022(USD BILLION)

- TABLE 20 LAND: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 21 NAVAL: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 22 NAVAL: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 23 SPACE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022(USD BILLION)

- TABLE 24 SPACE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 25 DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 26 DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 27 DEFENSE ELECTRONICS MARKET, BY NAVIGATION, COMMUNICATION, AND DISPLAY, 2020–2022 (USD BILLION)

- TABLE 28 DEFENSE ELECTRONICS MARKET, BY NAVIGATION, COMMUNICATION, AND DISPLAY, 2023–2028 (USD BILLION)

- TABLE 29 AVIONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 30 AVIONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 31 INTEGRATED BRIDGE SYSTEMS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 32 INTEGRATED BRIDGE SYSTEMS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 33 TOP FIVE INTEGRATED BRIDGE SYSTEM SOFTWARE PROVIDERS

- TABLE 34 VETRONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 35 VETRONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 36 C4ISR: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 37 C4ISR: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 38 C4ISR SOFTWARE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 39 C4ISR SOFTWARE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 40 ELECTRONIC WARFARE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 41 ELECTRONIC WARFARE: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 42 RADAR WARNING RECEIVERS IN SERVICE ACROSS COUNTRIES

- TABLE 43 RADARS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 44 RADARS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 45 OPTRONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022(USD BILLION)

- TABLE 46 OPTRONICS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 47 HANDHELD SYSTEM: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022(USD BILLION)

- TABLE 48 HANDHELD SYSTEMS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 49 EO/IR PAYLOADS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2020–2022 (USD BILLION)

- TABLE 50 EO/IR PAYLOADS: DEFENSE ELECTRONICS MARKET, BY TYPE, 2023–2028 (USD BILLION)

- TABLE 51 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 52 DEFENSE ELECTRONICS MARKET, BY REGION, 2020–2022 (USD BILLION)

- TABLE 53 DEFENSE ELECTRONICS MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 54 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 55 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 56 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 57 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 58 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2020–2022 (USD BILLION)

- TABLE 59 NORTH AMERICA: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 60 US: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 61 US: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 62 US: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 63 US: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 64 CANADA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 65 CANADA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 66 CANADA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 67 CANADA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 68 EUROPE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 69 EUROPE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 70 EUROPE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 71 EUROPE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 72 EUROPE: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2020–2022 (USD BILLION)

- TABLE 73 EUROPE: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 74 RUSSIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 75 RUSSIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 76 RUSSIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 77 RUSSIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 78 UK: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 79 UK: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 80 UK: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 81 UK: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 82 FRANCE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 83 FRANCE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 84 FRANCE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 85 FRANCE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 86 GERMANY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 87 GERMANY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 88 GERMANY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 89 GERMANY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 90 ITALY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 91 ITALY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 92 ITALY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 93 ITALY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 94 REST OF EUROPE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 95 REST OF EUROPE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 96 REST OF EUROPE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 97 REST OF EUROPE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 98 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 99 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 100 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 101 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 102 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2020–2022 (USD BILLION)

- TABLE 103 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 104 CHINA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 105 CHINA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 106 CHINA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 107 CHINA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 108 INDIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 109 INDIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 110 INDIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 111 INDIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 112 JAPAN: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 113 JAPAN: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 114 JAPAN: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 115 JAPAN: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 116 SOUTH KOREA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 117 SOUTH KOREA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 118 SOUTH KOREA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 119 SOUTH KOREA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 120 AUSTRALIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 121 AUSTRALIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 122 AUSTRALIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 123 AUSTRALIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 124 REST OF ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 125 REST OF ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 126 REST OF ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 127 REST OF ASIA PACIFIC: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 128 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 129 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 130 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 131 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 132 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2020–2022 (USD BILLION)

- TABLE 133 MIDDLE EAST: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 134 SAUDI ARABIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 135 SAUDI ARABIA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 136 SAUDI ARABIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 137 SAUDI ARABIA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 138 ISRAEL: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 139 ISRAEL: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 140 ISRAEL: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 141 ISRAEL: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 142 UAE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 143 UAE: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 144 UAE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 145 UAE: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 146 TURKEY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 147 TURKEY: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 148 TURKEY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 149 TURKEY: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 150 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 151 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 152 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 153 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 154 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2020–2022 (USD BILLION)

- TABLE 155 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET, BY COUNTRY, 2023–2028 (USD BILLION)

- TABLE 156 LATIN AMERICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 157 LATIN AMERICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 158 LATIN AMERICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 159 LATIN AMERICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 160 AFRICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2020–2022 (USD BILLION)

- TABLE 161 AFRICA: DEFENSE ELECTRONICS MARKET, BY PLATFORM, 2023–2028 (USD BILLION)

- TABLE 162 AFRICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2020–2022 (USD BILLION)

- TABLE 163 AFRICA: DEFENSE ELECTRONICS MARKET, BY VERTICAL, 2023–2028 (USD BILLION)

- TABLE 164 DEFENSE ELECTRONICS MARKET: DEGREE OF COMPETITION

- TABLE 165 DEFENSE ELECTRONICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 166 DEFENSE ELECTRONICS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 167 COMPANY FOOTPRINT

- TABLE 168 COMPANY TYPE FOOTPRINT

- TABLE 169 PRODUCT LAUNCHES, 2020–2023

- TABLE 170 DEALS, 2020–2023

- TABLE 171 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 172 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 173 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 174 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 175 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 176 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 177 THALES GROUP: BUSINESS OVERVIEW

- TABLE 178 THALES GROUP: PRODUCT LAUNCHES

- TABLE 179 THALES GROUP: DEALS

- TABLE 180 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 181 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 182 BAE SYSTEMS PLC: DEALS

- TABLE 183 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 184 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 185 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 186 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 187 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 188 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 189 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 190 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 191 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 192 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 193 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 194 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 195 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 196 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 197 RHEINMETALL AG: DEALS

- TABLE 198 SAAB AB: BUSINESS OVERVIEW

- TABLE 199 SAAB AB: PRODUCT LAUNCHES

- TABLE 200 SAAB AB: DEALS

- TABLE 201 LEONARDO SPA: BUSINESS OVERVIEW

- TABLE 202 LEONARDO SPA: PRODUCT LAUNCHES

- TABLE 203 LEONARDO SPA: DEALS

- TABLE 204 ISRAEL AEROSPACE INDUSTRIES (IAI): BUSINESS OVERVIEW

- TABLE 205 ISRAEL AEROSPACE INDUSTRIES (IAI): PRODUCT LAUNCHES

- TABLE 206 ISRAEL AEROSPACE INDUSTRIES (IAI): DEALS

- TABLE 207 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

- TABLE 208 CURTISS-WRIGHT CORPORATION: PRODUCT LAUNCHES

- TABLE 209 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 210 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 211 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 212 ELBIT SYSTEMS LTD.: DEALS

- TABLE 213 SAFRAN SA: BUSINESS OVERVIEW

- TABLE 214 SAFRAN SA: PRODUCT LAUNCHES

- TABLE 215 SAFRAN SA: DEALS

- TABLE 216 COBHAM LIMITED: BUSINESS OVERVIEW

- TABLE 217 COBHAM LIMITED: DEALS

- TABLE 218 HENSOLDT: BUSINESS OVERVIEW

- TABLE 219 HENSOLDT: DEALS

- TABLE 220 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 221 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

- TABLE 222 INDRA SISTEMAS, SA: BUSINESS OVERVIEW

- TABLE 223 INDRA SISTEMAS, SA: PRODUCT LAUNCHES

- TABLE 224 INDRA SISTEMAS, SA: DEALS

- TABLE 225 ASELSAN AS: BUSINESS OVERVIEW

- TABLE 226 ASELSAN AS: PRODUCTS/SERVICES/SOLUTIONS

- TABLE 227 RADIOELECTRONIC TECHNOLOGIES JSC: COMPANY OVERVIEW

- TABLE 228 SIERRA NEVADA CORPORATION: COMPANY OVERVIEW

- TABLE 229 MAG AEROSPACE: COMPANY OVERVIEW

- TABLE 230 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 231 L&T DEFENCE: COMPANY OVERVIEW

- TABLE 232 DATA PATTERNS (INDIA) LTD.: COMPANY OVERVIEW

- TABLE 233 MERCURY SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 234 SAMI ADVANCED ELECTRONICS: COMPANY OVERVIEW

- TABLE 235 LIG NEX1: COMPANY OVERVIEW

- TABLE 236 MISTRAL SOLUTIONS PVT. LTD: COMPANY OVERVIEW

- FIGURE 1 DEFENSE ELECTRONICS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 DEFENSE ELECTRONICS MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY ON DEFENSE ELECTRONICS MARKET

- FIGURE 9 C4ISR SEGMENT TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 AIRBORNE SEGMENT TO LEAD MARKET IN 2023

- FIGURE 11 INCREASING GEOPOLITICAL DISPUTES, TERROR ATTACKS, AND BORDER DISPUTES TO DRIVE MARKET

- FIGURE 12 C4ISR SEGMENT TO CONTRIBUTE HIGHEST MARKET SHARE IN 2023

- FIGURE 13 MARINE SEGMENT TO GAIN HIGHEST MARKET SHARE FROM 2023 TO 2028

- FIGURE 14 EO/IR PAYLOADS TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2023

- FIGURE 15 NORTH AMERICA TO LEAD MARKET IN 2023

- FIGURE 16 DEFENSE ELECTRONICS MARKET DYNAMICS

- FIGURE 17 REVENUE SHIFT IN DEFENSE ELECTRONICS MARKET

- FIGURE 18 DEFENSE ELECTRONICS: MARKET ECOSYSTEM MAP

- FIGURE 19 DEFENSE ELECTRONICS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE OF ELECTRONIC WARFARE SOLUTIONS (2022)

- FIGURE 21 PROBABLE SCENARIO IMPACT OF DEFENSE ELECTRONICS MARKET

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP FOUR PLATFORMS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP FOUR PLATFORMS

- FIGURE 25 IMPLEMENTATION OF IOT IN MILITARY

- FIGURE 26 QUANTUM WARFARE UTILIZING QUANTUM TECHNOLOGY SYSTEMS

- FIGURE 27 AIRBORNE SEGMENT TO LEAD DEFENSE ELECTRONICS MARKET DURING FORECAST PERIOD

- FIGURE 28 C4ISR SEGMENT TO LEAD DEFENSE ELECTRONICS MARKET DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA TO DOMINATE DEFENSE ELECTRONICS MARKET FROM 2023 TO 2028

- FIGURE 30 NORTH AMERICA: DEFENSE ELECTRONICS MARKET SNAPSHOT

- FIGURE 31 EUROPE: DEFENSE ELECTRONICS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: DEFENSE ELECTRONICS MARKET SNAPSHOT

- FIGURE 33 MIDDLE EAST: DEFENSE ELECTRONICS MARKET SNAPSHOT

- FIGURE 34 REST OF THE WORLD: DEFENSE ELECTRONICS MARKET SNAPSHOT

- FIGURE 35 RANKING OF KEY PLAYERS IN DEFENSE ELECTRONICS MARKET, 2022

- FIGURE 36 REVENUE ANALYSIS OF KEY COMPANIES IN DEFENSE ELECTRONICS MARKET, 2020–2022

- FIGURE 37 DEFENSE ELECTRONICS MARKET SHARE ANALYSIS OF KEY COMPANIES, 2022

- FIGURE 38 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 39 DEFENSE ELECTRONICS MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 40 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 43 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 44 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 47 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 48 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- FIGURE 50 LEONARDO SPA: COMPANY SNAPSHOT

- FIGURE 51 ISRAEL AEROSPACE INDUSTRIES (IAI): COMPANY SNAPSHOT

- FIGURE 52 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 54 SAFRAN SA: COMPANY SNAPSHOT

- FIGURE 55 COBHAM LIMITED: COMPANY SNAPSHOT

- FIGURE 56 HENSOLDT: COMPANY SNAPSHOT

- FIGURE 57 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 58 INDRA SISTEMAS, SA: COMPANY SNAPSHOT

- FIGURE 59 ASELSAN AS: COMPANY SNAPSHOT

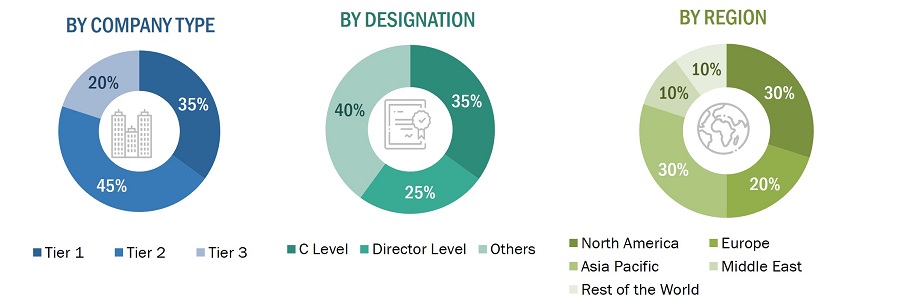

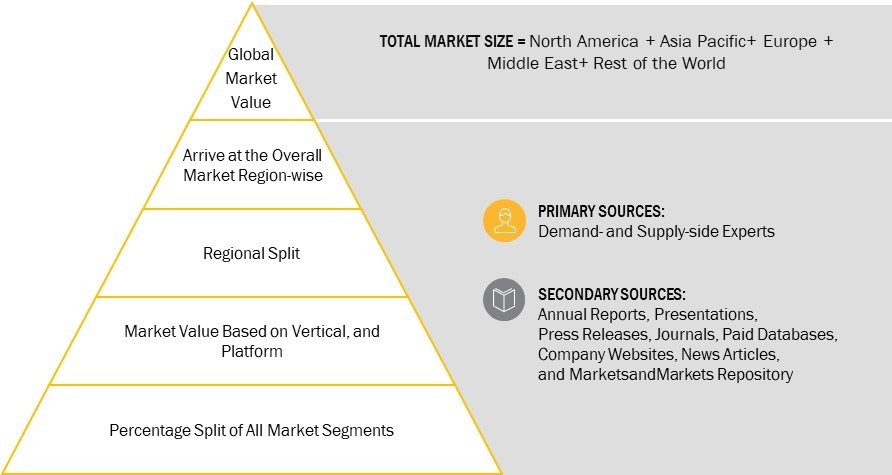

This research study on the defense electronics market involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva, to identify and collect information relevant to the market. The primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain in this industry. In-depth interviews with various primary respondents, including key industry participants, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the degaussing system market and to assess its growth prospects.

Secondary Research

The ranking analysis of companies in the defense electronics market was determined using secondary data from paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and diversification of their products. Primary sources further validated these data points.

Secondary sources referred for this research study on the defense electronics market included government sources such as the US Department of Defense (DoD); defense budgets; military modernization program documents; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the defense electronics market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the defense electronics market through secondary research. Several primary interviews were conducted through questionnaires, emails, and telephonic interviews with market experts from the demand and supply sides across North America, Europe, Asia Pacific, Middle East, and Rest of the World.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the defense electronics market. The research methodology used to evaluate the market size also includes the following:

- Key players in the market were identified through secondary research, and their market values were determined through primary and secondary research. These included a study of annual and financial reports of top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were considered, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, added with detailed inputs, and analyzed and presented in this report.

Bottom Up Approach

The bottom-up approach was employed to arrive at the overall size of the defense electronics market by estimating the revenue of key players and their market shares. Calculations based on the revenue of key players identified in the market were used to determine the size of the defense electronics market.

Top Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual segments through percentage splits from secondary and primary research. The immediate parent market size was used to implement the top-down approach for evaluating specific market segments. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were estimated for each company to verify the revenue shares used in the bottom-up approach. With the data triangulation procedure and data validation through primaries, the overall size of the parent market and each segment was determined and confirmed in this study.

Market Definition

The term defense electronics refers to electronic parts and systems that are created for technological superiority for the defense of a country. To assist mission accomplishment and reduce deaths, systems made from defense electronics offer strong, high-performance electronic detection, electronic protection, and electronic attack capabilities. Defense contractors create greater capability microprocessors, transceivers, power management, photonics, and other component functions to attain cutting-edge capabilities. Some of these parts are designed specifically for use in harsh temperature and vibration conditions in military settings. Various military platforms, such as large and small aircraft, ships, submarines, satellites, handheld gadgets, and land vehicles, can be equipped with these cutting-edge systems.

Key Stakeholders

- Defense Electronics Manufacturers

- Defense Electroic Software Providers

- Technology Support Providers

- System Integrators

- Defense Electronic Componenet Suppliers

Objectives of the Report

- To define, describe, segment, and forecast the size of the defense electronics market based on platform, vertical, and region

- To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, Middle East, and Rest of the World along with key countries in each of these regions

- To identify and analyze key drivers, opportunities, restraints, and challenges influencing the growth of the defense electronics market

- To identify technology trends currently prevailing in the defense electronics market

- To provide an overview of the tariff and regulatory landscape with respect to the defense electronics regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as new product launches, contracts, partnerships, collaborations, expansions, and agreements, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the defense electronics market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Defense Electronics market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Defense Electronics market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Defense Electronics Market