Dental Digital X-ray Market by Product (Digital, Analog), Type (Intraoral (Panoramic), Extraoral (Digital Sensor), Hybrid), Application (Diagnostic, Therapeutic), End User (Dental Hospitals, Forensic Laboratories), & Region - Global Forecasts to 2027

Updated on : March 14, 2023

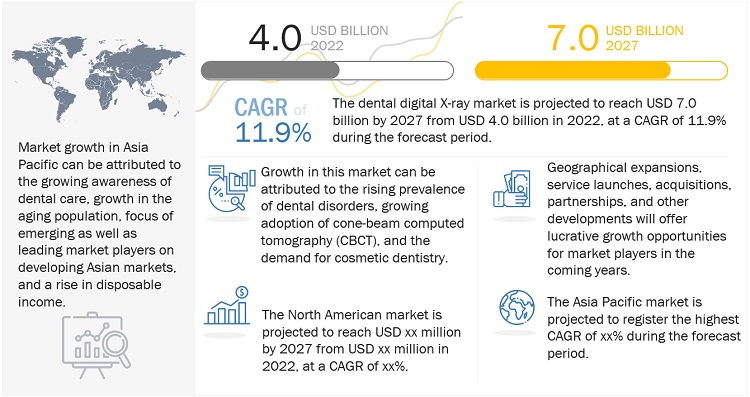

The global dental digital x-ray market in terms of revenue was estimated to be worth $4.0 billion in 2022 and is poised to reach $7.0 billion by 2027, growing at a CAGR of 11.9% from 2022 to 2027.

The increase in dental disorders, the ability of digital systems to reduce diagnosis time and provide improved image quality, and increasing adoption of CBCT as an imaging modality in dentistry, are some of the major drivers of the market.

Additionally, growing medical tourism, especially in emerging countries, provides significant growth opportunities for players in this market.

In this report, the market is segmented into –type, region, application, product, and end user.

Attractive Opportunities in the Dental Digital X-ray Market

To know about the assumptions considered for the study, Request for Free Sample Report

Dental digital x-ray market Dynamics

Drivers: Technological advancements

Technological innovation is one of the most important influencing factors for the growth of the market. Product innovation leads to the development of more economical, technologically advanced, and easy-to-use dental X-ray products. Conventional X-ray machines result in lead foils as a by-product, along with several other hazardous chemicals. 60% of dental offices in the US have eliminated the use of conventional X-ray materials from their practices by switching to dental digital X-ray diagnostic equipment. The frequent launch of new products is expected to increase the adoption of these devices due to the wide range of advantages they offer. This will, in turn, help the market grow.

Restraints: High cost of digital X-ray systems and potential risks associated with radiation exposure

Despite the benefits of digital systems, the high costs associated with them hinder their adoption, especially in developing countries. A digital X-ray system typically costs anywhere between USD 11,000 to USD 15,000 (excluding the cost of software, computers, and additional hardware such as servers) for a wired sensor system and between USD 20,000 to USD 50,000 (excluding the cost of maintenance and service repairs) for a wireless system. Dental CBCT systems cost anywhere between USD 150,000 to USD 300,000. Small and medium-sized hospitals cannot afford these systems due to budgetary constraints.

Also, frequent exposure to dental diagnostic X-rays, even with slight changes, increases health risks. These factors are expected to restrain the growth of the market.

Opportunities: Growing medical tourism

Countries such as India, Singapore, Thailand, Mexico, Hungary, Poland, and Turkey have emerged as the fastest-growing dental tourism destinations owing to the number of trained dental professionals and the development of strong healthcare infrastructure in these countries.

Price is another key factor influencing the growth of this market. The average cost of a dental treatment with implants in the US is around USD 4,000, whereas the same procedure costs USD 1,500 per implant in Thailand, USD 1,000 per implant in Turkey, USD 850 per implant in Mexico, and USD 750 per implant in India. Owing to such a major difference in the cost of dental services offered, patients in developed nations are increasingly opting for treatment in these emerging markets.

Challenges: Survival of new entrants

The market is capital-intensive; it demands high capital and R&D investments for players to enter the market and develop new products and technologies. Additionally, in order to survive in the market, players are required to continue making investments to update their existing product portfolios and maintain competitive positioning.

Furthermore, lack of economies of scale and high manufacturing costs, technological improvement in the R&D segments within the company are some of the other challenges faced by new players in the market, especially in the initial years.

Among end users, dental hospitals & clinics segment of dental digital x-ray market is expected to grow at the highest CAGR from 2022 to 2027.

In addition to occupying the largest share of the market, by end user, the dental hospitals & clinics segment is also expected to be the fastest growing segment during the forecast period.

Favorable reimbursement scenarios for boosting the adoption of digital dental imaging systems in developed countries such as France and the US, high demand for cosmetic dentistry, and the increasing number of people opting for dental implants are expected to drive the demand for dental radiology and imaging systems in this end-user segment.

US was the largest segment in the world for dental digital x-ray market in 2021

In 2021, the US occupied the largest share in North America and globally, in the market. This can mainly be attributed to the presence of a large population with oral/dental disorders, significant availability of technologically advanced products, and a large number of key players based in the country.

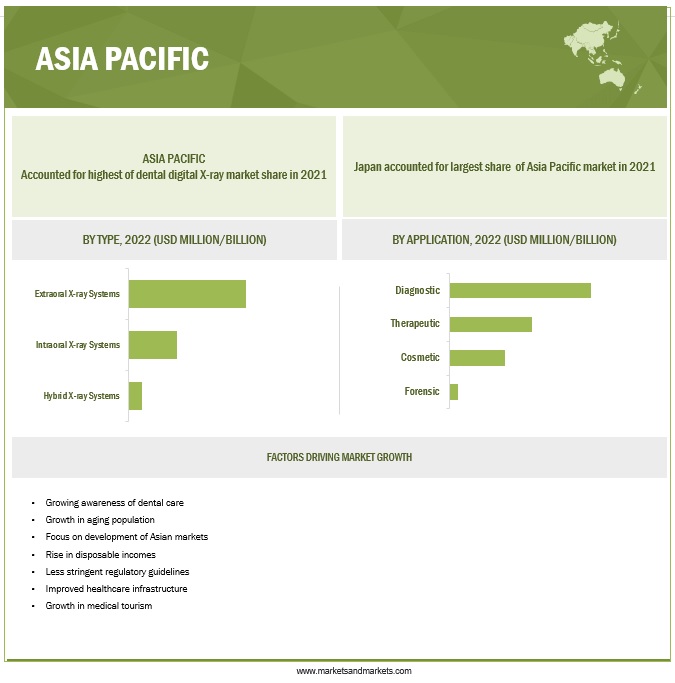

In Asia Pacific, China was expected to be the fastest growing country in the market during the forecast period. This can be attributed to the rise in disposable incomes, and an increase in the awareness about dental disorders, which has led to a significant increase in the demand for dental care services and the number of oral health clinics and dental hospitals.

To know about the assumptions considered for the study, download the pdf brochure

A few emerging and key players in the Dental digital x-ray market include Envista Holdings Corporation (US), VAREX IMAGING CORPORATION (US), Planmeca Oy (Finalnd), DENTSPLY SIRONA Inc. (US), VATECH CO. Ltd (South Korea), Acteon Group (France), Air Techniques, Inc. (US), The Yoshida Dental Mfg. Co. (Japan), and Hefei Meyer Optometric Technology Inc. (China).

These companies adopted strategies such as collaborations, product launches and enhancements, acquisitions, and partnerships, to strengthen their presence in the market.

Dental Digital X-ray Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Type, End User, Application, Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and the Rest of the World |

|

Companies covered |

|

The research report categorizes the dental digital x-ray market into the following segments and sub-segments:

By Product

- Digital X-ray Systems

- Analog X-ray Systems

By Type

-

Extraoral X-ray Systems

- Panoramic/Cephalometric Systems

- Cone-Beam Computed Tomography (CBCT) Systems

-

Intraoral X-ray Systems

- Digital Sensors

- Photostimulable Phosphor (PSP) Systems

- Hybrid X-ray Systems

By Application

- Diagnostic

- Therapeutic

- Cosmetic

- Forensic

By End User

- Dental Hospitals & Clinics

- Dental Academic & Research Institutes

- Forensic Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments

- In April 2022, Envista Holdings Corporation (US) acquired Carestream Dental's Intra-Oral Scanner (US) in line with its long-term strategy to focus on its fastest-growing Specialty Products & Technologies segment to digitalize dental workflows

- In February 2022, DENTSPLY SIRONA Inc. (US) announced its collaboration with Google Cloud (US) and the launch of its medical-grade 3D printing solution to drive its leadership in Digital Dentistry.

- In September 2021, Planmeca Oy (Finland) acquired KaVo Treatment Unit & Instrument business from Envista Holdings Corporation (US) to strengthen companies' product portfolio and dental solutions.

- In March 2021, Air Techniques, Inc. (US) announced its partnership with DENTSPLY SIRONA (US)'s SICAT software. This Integration of SICAT software with ProVecta 3D Prime allows dentists to provide patients with an ideal experience.

Frequently Asked Questions (FAQ):

What is the projected market value of the global dental digital x-ray market?

The global market of dental digital x-ray is projected to reach USD 7.0 billion.

What is the estimated growth rate (CAGR) of the global dental digital x-ray market for the next five years?

The global dental digital x-ray market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.9% from 2022 to 2027.

What are the major revenue pockets in the dental digital x-ray market currently?

The dental digital x-ray market is segmented into four major regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). North America accounted for the largest share of the dental digital x-ray market in 2021. The high prevalence of dental diseases, rising healthcare expenditure, and presence of major players in the US is driving the growth of the dental digital x-ray market in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the dental digital x-ray market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

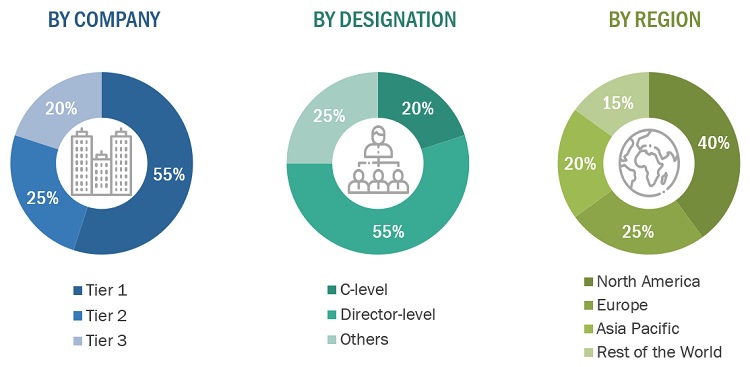

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the dental digital x-ray market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the dental digital x-ray market is provided below:

Tiers are defined based on a company’s total revenue. As of 2021: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the dental digital x-ray market was arrived at after data triangulation as mentioned below.

Approach to calculating the revenue of different players in the ultrasound probe covers market

The size of the global dental digital x-ray market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global dental digital x-ray market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the dental digital x-ray market by application, type, product, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the dental digital x-ray market with respect to five major regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the dental digital x-ray market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches and enhancements, collaborations, partnerships, and acquisitions of the leading players in the dental digital x-ray market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific dental digital x-ray market into New Zealand, South Korea, Malaysia, Singapore, Indonesia, and other countries

- Further breakdown of the Rest of Europe dental digital x-ray market into Belgium, Russia, the Netherlands, Switzerland, and other countries

- Further breakdown of the Rest of the World dental digital x-ray market into Latin America and Middle East and Africa

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Digital X-ray Market