Dermatology Devices Market Size, Growth by Type (Diagnostic Devices (Dermatoscopes, Imaging Devices), Treatment Devices (Laser, Cryotherapy, Liposuction)), Application (Skin Cancer, Acne, Psoriasis, Skin Rejuvenation, Tattoo Removal) & Region - Global Forecast to 2027

The global dermatology devices market in terms of revenue was estimated to be worth $6.2 billion in 2022 and is poised to reach $11.3 billion by 2027, growing at a CAGR of 12.7% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market driven by the rising incidence of skin diseases and increasing awareness of aesthetic procedures. The expansion of healthcare infrastructure in developing regions is expected to provide growth opportunities to players operating in this market. However, reimbursement issues and stringent regulatory policies for medical devices are estimated to restrain the growth of this market.Dermatology devices help dermatologists and surgeons in diagnosing and treating skin disorders. These devices are used by various medical care providers, such as hospitals, dermatology clinics, physician offices, and academic research institutes.

To know about the assumptions considered for the study, Request for Free Sample Report

Dermatology Devices Market Dynamics

Driver: Rising adoption of aesthetic procedures among geriatric individuals

The process of aging is associated with progressive deterioration of the skin. Subsequently, the demand for aesthetic procedures, such as anti-wrinkle treatment and skin tightening, is expected to grow among the elderly.

Opportunity: Growing adoption of minimally invasive and non-invasive aesthetic procedures

In the past decade, there has been a significant increase in the preference for minimally invasive and non-invasive aesthetic procedures over traditional surgical procedures. Minimally invasive/non-surgical alternatives offer various advantages over traditional surgical procedures, such as less pain, reduced scarring, and quicker recovery. These procedures are also more economical than traditional surgical procedures.

The increasing demand for aesthetic procedures is driving the market for treatment devices as well as aesthetic lasers and cosmetic dermatology. These lasers are used in aesthetic procedures such as hair removal, skin rejuvenation, acne, psoriasis, tattoo removal, wrinkle removal, skin resurfacing, vascular lesions, and pigmented lesions, among other skin diseases. Lasers with longer wavelengths and better configurations have expanded the range of beauty treatments, making the aesthetic lasers industry a lucrative one. This market is being driven primarily by the more expensive CO2 and YAG laser systems, which can sell for more than USD 50,000 each and have gained tremendous popularity amongst users.

With the growth in the number of minimally invasive and non-invasive aesthetic procedures, the demand for several products, including botulinum toxin, chemical peels, and photo rejuvenation products, is expected to increase in the coming years.

Restraint: Clinical risks and complications associated with dermatology procedures

In the last two decades, dermatology procedures have become increasingly popular. The market has witnessed significant growth in the demand for aesthetic treatments owing to the rise in the number of doctors and surgeons providing safe and effective dermatology treatments and the launch of technologically advanced products for the same. However, dermatology procedures are associated with various possible side effects. Patients undergoing aesthetic treatments may face several risks and complications after or during the procedure. Some of these risks are listed below:

- Pigment changes: Laser hair removal might darken or lighten the affected skin. These changes might be temporary or permanent. Skin lightening primarily affects those who do not avoid sun exposure before or after treatment and those who have darker skin

- Skin irritation: Laser hair removal can cause temporary discomfort, redness, and edema. Any signs and symptoms usually go away after a few hours

Other issues related to aesthetic treatments include anesthesia-related complications, organ damage, and infections. Red light therapy is thought to be painless and safe. However, there have been complaints of RLT units causing burns and blisters. Burns were reported in a few people after they fell asleep with the unit on, while others were burned by damaged wires or gadget corrosion. Although less harmful to the eyes than typical lasers, red light therapy may necessitate the use of eye protection. These problems are expected to hamper the adoption of dermatology treatments.

The imaging devices are accounted to hold the highest CAGR of the dermatology devices industry, by type during forecast period.

Based on type, the dermatology devices market is segmented into imaging devices, dermatoscopes, and microscopes. During forecasted period, the imaging devices segment accounted for the highest CAGR of the dermatology diagnostic devices market. The highest CAGR of this segment can be attributed to technological advancements and the increasing incidence of skin diseases.

The skin cancer diagnosis are accounted to hold the highest CAGR of the dermatology devices industry, by application during forecasted period.

Based on application, the dermatology devices market is segmented into skin cancer diagnosis and other diagnostic applications. During forecasted period, the skin cancer diagnosis segment accounted for the highest CAGR of the market. The highest CAGR of this segment can be attributed to the rising incidence of skin cancer.

To know about the assumptions considered for the study, download the pdf brochure

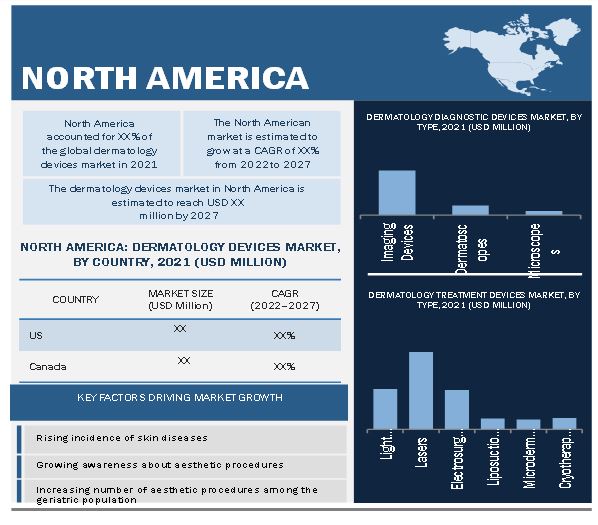

North America commanded the largest share of the dermatology devices industry.

Based on region, the dermatology devices market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. North America has the largest share of the global market. The large share of this regional segment can be attributed to factors such as the rising incidence of skin diseases, increased awareness about aesthetic procedures, rapid increase in healthcare expenditure, easy accessibility to advanced technologies, and the strong presence of market players in the region.

The major players operating in dermatology devices market are Alma Lasers, Ltd. (a subsidiary of Sisram Medical Ltd.) (Israel), Cutera, Inc. (US), Cynosure Inc. (US), El.En. S.p.A. (Italy), Lumenis, Ltd. (a subsidiary of Boston Scientific) (Israel), Solta Medical (a subsidiary of Bausch Health Companies Inc.) (US), Bruker Corporation (US), Carl Zeiss (Germany), Candela Corporation (US), Genesis Biosystems, Inc. (US), HEINE Optotechnik GmbH & Co. KG (Germany), Michelson Diagnostics Ltd. (UK), PhotoMedex, Inc. (US), Leica Microsystems (a subsidiary of Danaher Corporation) (US), Olympus Corporation (Japan), FotoFinder Systems GmbH (Germany), Canfield Scientific, Inc. (US), Beijing Toplaser Technology Co., Ltd. (China), DermLite (US), Syneron Medical Ltd. (a part of Apax Partners) (US), Aerolase (US), and Bovie (a subsidiary of Symmetry Surgical) (US).

Scope of the Dermatology Devices Industry

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$6.2 billion |

|

Projected Revenue by 2027 |

$11.3 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 12.7% |

|

Market Driver |

Rising adoption of aesthetic procedures among geriatric individuals |

|

Market Opportunity |

Growing adoption of minimally invasive and non-invasive aesthetic procedures |

This research report categorizes the dermatology devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Dermatology diagnostics devices, by Type

- Dermatoscopes

- Microscopes

- Imaging Devices

-

Dermatology treatment devices, by Type

- Light Therapy Devices

- Lasers

- Electrosurgical Equipment

- Liposuction Devices

- Microdermabrasion Devices

- Cryotherapy Devices

By Application

-

Dermatology diagnostics devices, by Application

- Skin Cancer Diagnosis

- Other Diagnostic Applications

-

Dermatology treatment devices, by Application

- Hair Removal

- Skin Rejuvenation

- Acne, Psoriasis, and Tattoo Removal

- Wrinkle Removal and Skin Resurfacing

- Body Contouring and Fat Removal

- Vascular and Pigmented Lesion Removal

- Warts, Skin Tags, and Weight Management

- Other Treatment Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

Recent Developments of Dermatology Devices Industry

- In 2022, Cynosure, Inc. collaborated with Clayton, Dubilier & Rice and announced a new investment of USD 60 million from lead investor Clayton, Dubilier & Rice

- In 2021, Lumenis entered into a definitive agreement to sell the Lumenis Surgical Business to Boston Scientific. The acquisition of Lumenis Surgical (including its robust product portfolio, global team, and the Israeli surgical laser center of excellence) represents a major milestone for the Lumenis team and will enable Boston Scientific to enhance the execution of its urology strategy.

- In 2022, Candela collaborated with The Vascular Birthmarks Foundation, Dr. Giacomo Colletti, Laserplast, this collaboration enabled more than 30 pre-qualified patients from 13 countries to receive free laser treatments in Milan

- In 2022, Canfield Scientific, Inc. acquired Medici Medical s.r.l. to create Canfield Scientific s.r.l., open a state-of-the-art facility near Modena, and launch a medical dermatology education program.

- In 2021, Alma launched Alma PrimeX, a non-invasive platform for body contouring and skin tightening.

- In 2021, Alma launched Alma Hybrid, which exclusively combines 3 powerful energy sources to deliver effective results.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global dermatology devices market?

The global dermatology devices market boasts a total revenue value of $11.3 billion by 2027.

What is the estimated growth rate (CAGR) of the global dermatology devices market?

The global dermatology devices market has an estimated compound annual growth rate (CAGR) of 12.7% and a revenue size in the region of $6.2 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 DERMATOLOGY DEVICES INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

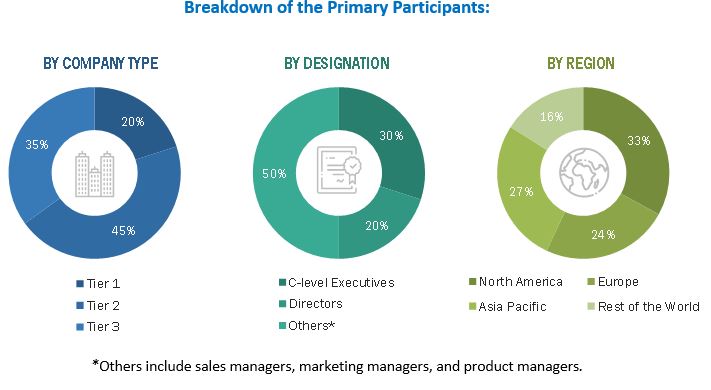

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 6 DERMATOLOGY DEVICES INDUSTRY SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF DERMATOLOGY TREATMENT DEVICES

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF DERMATOLOGY DIAGNOSTIC DEVICES

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 RISK ASSESSMENT/FACTOR ANALYSIS

TABLE 1 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 11 DERMATOLOGY DEVICES MARKET, BY TYPE, 2022 VS. 2027

FIGURE 12 DERMATOLOGY DIAGNOSTIC DEVICES MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 13 DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2022 VS. 2027

FIGURE 14 DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2022 VS. 2027

FIGURE 15 DERMATOLOGY DEVICES MARKET, BY REGION, 2022 VS. 2027

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 DERMATOLOGY DEVICES MARKET OVERVIEW

FIGURE 16 RISING INCIDENCE OF SKIN DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: DERMATOLOGY EQUIPMENT MARKET, BY TYPE (2021)

FIGURE 17 IMAGING DEVICES SEGMENT DOMINATED APAC MARKET IN 2021

4.3 GEOGRAPHICAL SNAPSHOT OF MARKET

FIGURE 18 JAPAN TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 DERMATOLOGY DEVICES INDUSTRY DYNAMICS

FIGURE 19 DERMATOLOGY DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising incidence of skin disorders

5.2.1.2 Availability of technologically advanced and user-friendly products

5.2.1.3 Growing adoption of minimally invasive and non-invasive aesthetic procedures

5.2.1.4 Rising adoption of aesthetic procedures among geriatric individuals

FIGURE 20 INCREASE IN GERIATRIC POPULATION, BY COUNTRY (2011 VS. 2015 VS. 2030)

FIGURE 21 INCREASE IN PROPORTION OF GERIATRIC INDIVIDUALS IN OVERALL POPULATION, BY COUNTRY (2011 VS. 2015 VS. 2030)

5.2.1.5 Increasing investments, funds, and grants by public-private organizations

TABLE 2 KEY INVESTMENTS BY GOVERNMENT BODIES IN THE DIAGNOSTIC IMAGING MARKET

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory policies for medical devices

5.2.2.2 Clinical risks and complications associated with dermatology procedures

5.2.2.3 High cost of diagnostic imaging systems

5.2.2.4 Declining reimbursements and increasing regulatory burden in the US

TABLE 3 MEDICARE REIMBURSEMENT TRENDS, BY IMAGING MODALITY, 2007–2019

5.2.3 OPPORTUNITIES

5.2.3.1 Growing medical devices industry in emerging economies

FIGURE 22 MEDICAL DEVICES MARKET, 2016–2020

5.2.3.2 Increasing disposable income and expanding middle-class population

5.2.4 CHALLENGES

5.2.4.1 Competitive pricing by low-cost manufacturers and availability of low-cost substitutes

5.2.4.2 Dearth of trained professionals

5.2.5 TRENDS

5.2.5.1 Importance of artificial intelligence and teleradiology in skin disorder diagnosis and treatment

5.3 COVID-19 IMPACT ANALYSIS

5.4 RANGES/SCENARIOS

5.4.1 MARKET

FIGURE 23 REALISTIC SCENARIO

FIGURE 24 PESSIMISTIC SCENARIO

FIGURE 25 OPTIMISTIC SCENARIO

5.5 REGULATORY ANALYSIS

TABLE 4 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING DERMATOLOGY DEVICES

5.5.1 NORTH AMERICA

5.5.1.1 US

TABLE 5 US FDA MEDICAL DEVICE CLASSIFICATION

TABLE 6 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.5.1.2 Canada

TABLE 7 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.3.1 Japan

TABLE 8 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

5.5.3.2 China

TABLE 9 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.5.3.3 India

5.6 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 26 DIRECT DISTRIBUTION—PREFERRED STRATEGY OF PROMINENT COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

5.8 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

5.9 ECOSYSTEM ANALYSIS

FIGURE 28 MARKET: ECOSYSTEM ANALYSIS

5.9.1 ROLE IN ECOSYSTEM

FIGURE 29 KEY PLAYERS IN MARKET ECOSYSTEM

5.10 TECHNOLOGY ANALYSIS

5.11 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 10 DERMATOLOGY DEVICES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.12 PATENT ANALYSIS

5.12.1 PATENT TRENDS FOR DERMATOLOGY DEVICES

FIGURE 30 PATENT TRENDS FOR DERMATOSCOPES, JANUARY 2011–JUNE 2022

FIGURE 31 PATENT TRENDS FOR LIPOSUCTION DEVICES, JANUARY 2011–JUNE 2022

5.12.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 32 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR DERMATOSCOPE PATENTS, JANUARY 2011—JUNE 2022 (DERMATOLOGY MEDICAL DEVICE COMPANIES)

FIGURE 33 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR LIPOSUCTION DEVICE PATENTS, JANUARY 2011—JUNE 2022 (DERMATOLOGY MEDICAL DEVICE COMPANIES)

5.13 TRADE ANALYSIS

TABLE 11 IMPORT DATA FOR HS CODE 901320, BY COUNTRY, 2017–2021

TABLE 12 EXPORT DATA FOR HS CODE 901320, BY COUNTRY, 2017–2021

5.14 PRICING ANALYSIS

TABLE 13 AVERAGE SELLING PRICES OF DERMATOLOGY DEVICES

TABLE 14 COST OF DERMATOLOGY TREATMENT DEVICES

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DERMATOLOGY TREATMENT DEVICES

TABLE 15 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DERMATOLOGY TREATMENT DEVICES (%)

5.15.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR END USERS OF DERMATOLOGY TREATMENT DEVICES

TABLE 16 KEY BUYING CRITERIA FOR END USERS OF DERMATOLOGY TREATMENT DEVICES

5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.16.1 REVENUE SHIFT & REVENUE POCKETS FOR DERMATOLOGY DEVICE MANUFACTURERS

FIGURE 36 REVENUE SHIFT FOR DERMATOLOGY DEVICES

6 DERMATOLOGY DEVICES MARKET, BY TYPE (Page No. - 93)

6.1 INTRODUCTION

TABLE 17 DERMATOLOGY DEVICES MARKET, BY TYPE, 2020–2027

6.2 IMAGING DEVICES

6.2.1 MRI, ULTRASOUND, CT, AND OCT ARE WIDELY USED IN DERMATOLOGY DISEASE DIAGNOSIS

TABLE 18 DERMATOLOGY DIAGNOSTIC DEVICES MARKET FOR IMAGING DEVICES, BY REGION, 2020–2027

6.3 DERMATOSCOPES

6.3.1 INCREASING AWARENESS ABOUT SKIN HEALTH TO DRIVE SEGMENT GROWTH

TABLE 19 DERMATOLOGY MEDICAL EQUIPMENT MARKET FOR DERMATOSCOPES, BY REGION, 2020–2027

6.4 MICROSCOPES

6.4.1 AVAILABILITY OF TECHNOLOGICALLY ADVANCED MICROSCOPES — A KEY FACTOR DRIVING SEGMENT GROWTH

TABLE 20 DERMATOLOGY EQUIPMENT MARKET FOR MICROSCOPES, BY REGION, 2020–2027

7 DERMATOLOGY DEVICES MARKET, BY APPLICATION (Page No. - 98)

7.1 INTRODUCTION

TABLE 21 DERMATOLOGY DEVICES INDUSTRY, BY APPLICATION, 2020–2027

7.2 SKIN CANCER DIAGNOSIS

7.2.1 RISING PREVALENCE OF SKIN CANCER AND INCREASING AWARENESS ABOUT EARLY DIAGNOSIS TO DRIVE SEGMENT GROWTH

TABLE 22 NUMBER OF MELANOMA SKIN CANCER CASES, BY COUNTRY (2020)

TABLE 23 NUMBER OF NON-MELANOMA SKIN CANCER CASES, BY COUNTRY (2020)

TABLE 24 NUMBER OF MELANOMA SKIN CANCER DEATHS, BY COUNTRY (2020)

TABLE 25 NUMBER OF NON-MELANOMA SKIN CANCER DEATHS, BY COUNTRY (2020)

TABLE 26 DERMATOLOGY MEDICAL EQUIPMENT MARKET FOR SKIN CANCER DIAGNOSIS, BY REGION, 2020–2027

7.3 OTHER DIAGNOSTIC APPLICATIONS

TABLE 27 DERMATOLOGY DIAGNOSTIC DEVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027

8 DERMATOLOGY DEVICES MARKET, BY TYPE (Page No. - 103)

8.1 INTRODUCTION

TABLE 28 DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

8.2 LIGHT THERAPY DEVICES

8.2.1 INCREASING DEMAND FOR SKIN REJUVENATION PROCEDURES TO DRIVE SEGMENT GROWTH

TABLE 29 DERMATOLOGY TREATMENT DEVICES MARKET FOR LIGHT THERAPY DEVICES, BY REGION, 2020–2027

8.3 LASERS

8.3.1 IMPROVING LASER TECHNOLOGY HAS REVOLUTIONIZED TREATMENTS FOR SEVERAL SKIN CONDITIONS

TABLE 30 DERMATOLOGY TREATMENT DEVICES MARKET FOR LASERS, BY REGION, 2020–2027

8.4 ELECTROSURGICAL EQUIPMENT

8.4.1 RISK OF ELECTROSURGICAL BURNS IS EXPECTED TO HINDER SEGMENT GROWTH

TABLE 31 MARKET FOR ELECTROSURGICAL EQUIPMENT, BY REGION, 2020–2027

8.5 LIPOSUCTION DEVICES

8.5.1 INCREASING OBESITY RATES TO DRIVE SEGMENT GROWTH

TABLE 32 DERMATOLOGY TREATMENT DEVICES MARKET FOR LIPOSUCTION DEVICES, BY REGION, 2020–2027

8.6 MICRODERMABRASION DEVICES

8.6.1 INCREASING DEMAND FOR MINIMALLY INVASIVE PROCEDURES TO DRIVE SEGMENT GROWTH

TABLE 33 DERMATOLOGY TREATMENT DEVICES MARKET FOR MICRODERMABRASION DEVICES, BY REGION, 2020–2027

8.7 CRYOTHERAPY DEVICES

8.7.1 COST-EFFECTIVE NATURE OF CRYOTHERAPY TO DRIVE ITS ADOPTION

TABLE 34 DERMATOLOGY TREATMENT DEVICES MARKET FOR CRYOTHERAPY DEVICES, BY REGION, 2020–2027

9 DERMATOLOGY DEVICES MARKET, BY APPLICATION (Page No. - 110)

9.1 INTRODUCTION

TABLE 35 DERMATOLOGY DEVICES INDUSTRY, BY APPLICATION, 2020–2027

9.2 HAIR REMOVAL

9.2.1 IPL, DIODE, ND:YAG, AND RUBY LASERS ARE WIDELY USED IN HAIR REMOVAL PROCEDURES

TABLE 36 LASER HAIR REMOVAL PROCEDURES: REGIONAL DISTRIBUTION (2020)

TABLE 37 DERMATOLOGY TREATMENT DEVICES MARKET FOR HAIR REMOVAL, BY REGION, 2020–2027

9.3 SKIN REJUVENATION

9.3.1 GROWING DEMAND FOR SAFE AND EFFECTIVE SKIN REJUVENATION TREATMENTS TO PROPEL SEGMENT GROWTH

TABLE 38 DERMATOLOGY TREATMENT DEVICES MARKET FOR SKIN REJUVENATION, BY REGION, 2020–2027

9.4 ACNE, PSORIASIS, AND TATTOO REMOVAL

9.4.1 EMERGENCE OF LASER TECHNOLOGY FOR TATTOO REMOVAL TO DRIVE SEGMENT GROWTH

TABLE 39 LASER TATTOO REMOVAL PROCEDURES: REGIONAL DISTRIBUTION (2020)

TABLE 40 DERMATOLOGY TREATMENT DEVICES MARKET FOR ACNE, PSORIASIS, AND TATTOO REMOVAL, BY REGION, 2020–2027

9.5 WRINKLE REMOVAL AND SKIN RESURFACING

9.5.1 RAPIDLY GROWING AGING POPULATION TO DRIVE SEGMENT GROWTH

TABLE 41 SKIN RESURFACING PROCEDURES: REGIONAL DISTRIBUTION (2020)

TABLE 42 DERMATOLOGY TREATMENT DEVICES MARKET FOR WRINKLE REMOVAL AND SKIN RESURFACING, BY REGION, 2020–2027

9.6 BODY CONTOURING AND FAT REMOVAL

9.6.1 RISING AWARENESS OF RECONSTRUCTIVE SURGERY TO DRIVE SEGMENT GROWTH

TABLE 43 LIPOSUCTION PROCEDURES: REGIONAL DISTRIBUTION (2020)

TABLE 44 NON-INVASIVE FAT REDUCTION (COOLSCULPTING, LIPOSONIX, EMSCULPT, VANQUISH, AND ZERONA) PROCEDURES: REGIONAL DISTRIBUTION (2020)

TABLE 45 MARKET FOR BODY CONTOURING AND FAT REMOVAL, BY REGION, 2020–2027

9.7 VASCULAR AND PIGMENTED LESION REMOVAL

9.7.1 EMERGENCE OF LASER TECHNOLOGY FOR VASCULAR LESION REMOVAL TO DRIVE SEGMENT GROWTH

TABLE 46 DERMATOLOGY TREATMENT DEVICES MARKET FOR VASCULAR AND PIGMENTED LESION REMOVAL, BY REGION, 2020–2027

9.8 WARTS, SKIN TAGS, AND WEIGHT MANAGEMENT

9.8.1 CRYOTHERAPY IS WIDELY USED IN WART AND SKIN TAG TREATMENT

TABLE 47 DERMATOLOGY TREATMENT DEVICES MARKET FOR WARTS, SKIN TAGS, AND WEIGHT MANAGEMENT, BY REGION, 2020–2027

9.9 OTHER TREATMENT APPLICATIONS

TABLE 48 DERMATOLOGY TREATMENT DEVICES MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027

10 DERMATOLOGY DEVICES MARKET, BY REGION (Page No. - 120)

10.1 INTRODUCTION

TABLE 49 DERMATOLOGY DEVICES MARKET, BY REGION, 2020–2027

10.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: DERMATOLOGY DEVICES MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: DERMATOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027

TABLE 51 NORTH AMERICA: DERMATOLOGY DIAGNOSTIC DEVICES MARKET, BY TYPE, 2020–2027

TABLE 52 NORTH AMERICA: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 53 NORTH AMERICA: DERMATOLOGY MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2020–2027

TABLE 54 NORTH AMERICA: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.2.1 US

10.2.1.1 US dominated North American market in 2021

TABLE 55 US: KEY MACROINDICATORS

TABLE 56 US: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 57 US: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 58 US: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 59 US: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 60 US: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 61 US: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 62 US: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 63 US: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.2.2 CANADA

10.2.2.1 Technological advancements in dermatology devices to drive market growth in Canada

TABLE 64 CANADA: KEY MACROINDICATORS

TABLE 65 CANADA: DERMATOLOGY DEVICES MARKET, BY TYPE, 2020–2027

TABLE 66 CANADA: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 67 CANADA: DERMATOLOGY DEVICES INDUSTRY, BY APPLICATION, 2020–2027

TABLE 68 CANADA: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3 EUROPE

TABLE 69 EUROPE: DERMATOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027

TABLE 70 EUROPE: DERMATOLOGY EQUIPMENT MARKET, BY TYPE, 2020–2027

TABLE 71 EUROPE: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 72 EUROPE: DERMATOLOGY MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2020–2027

TABLE 73 EUROPE: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.1 FRANCE

10.3.1.1 Laws in France regarding cosmetic surgery are restrictive as compared with those in other countries

TABLE 74 FRANCE: KEY MACROINDICATORS

TABLE 75 FRANCE: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 76 FRANCE: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 77 FRANCE: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 78 FRANCE: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 79 FRANCE: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 80 FRANCE: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.2 GERMANY

10.3.2.1 Rising disposable income to drive dermatology device adoption in Germany

TABLE 81 GERMANY: KEY MACROINDICATORS

TABLE 82 GERMANY: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 83 GERMANY: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 84 GERMANY: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 85 GERMANY: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 86 GERMANY: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 87 GERMANY: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 88 GERMANY: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 89 GERMANY: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.3 UK

10.3.3.1 Increasing focus on facial dermatology to aid market growth

TABLE 90 UK: KEY MACROINDICATORS

TABLE 91 UK: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 92 UK: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 93 UK: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 94 UK: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 95 UK: DERMATOLOGY DIAGNOSTIC INDUSTRY, BY APPLICATION, 2020–2027

TABLE 96 UK: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.4 ITALY

10.3.4.1 Rising number of plastic surgeons to drive market growth

TABLE 97 ITALY: KEY MACROINDICATORS

TABLE 98 ITALY: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 99 ITALY: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 100 ITALY: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 101 ITALY: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 102 ITALY: DERMATOLOGY EQUIPMENT MARKET, BY TYPE, 2020–2027

TABLE 103 ITALY: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 104 ITALY: DERMATOLOGY DEVICES INDUSTRY, BY APPLICATION, 2020–2027

TABLE 105 ITALY: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.5 SPAIN

10.3.5.1 Growing demand for cosmetic procedures to drive market growth

TABLE 106 SPAIN: KEY MACROINDICATORS

TABLE 107 SPAIN: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 108 SPAIN: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 109 SPAIN: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 110 SPAIN: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 111 SPAIN: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 112 SPAIN: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 113 SPAIN: DERMATOLOGY MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2020–2027

TABLE 114 SPAIN: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.3.6 REST OF EUROPE

TABLE 115 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2020 (% OF GDP)

TABLE 116 RUSSIA: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 117 REST OF EUROPE: DERMATOLOGY DIAGNOSTIC DEVICES MARKET, BY TYPE, 2020–2027

TABLE 118 REST OF EUROPE: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 119 REST OF EUROPE: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 120 REST OF EUROPE: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: DERMATOLOGY DEVICES MARKET SNAPSHOT

TABLE 121 ASIA PACIFIC: DERMATOLOGY DEVICES MARKET, BY COUNTRY, 2020–2027

TABLE 122 ASIA PACIFIC: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 123 ASIA PACIFIC: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 124 ASIA PACIFIC: DERMATOLOGY EQUIPMENT MARKET, BY APPLICATION, 2020–2027

TABLE 125 ASIA PACIFIC: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.4.1 JAPAN

10.4.1.1 Japan accounted for largest share of APAC market in 2021

TABLE 126 JAPAN: KEY MACROINDICATORS

TABLE 127 JAPAN: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 128 JAPAN: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 129 JAPAN: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 130 JAPAN: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 131 JAPAN: DERMATOLOGY DEVICES INDUSTRY BY TYPE, 2020–2027

TABLE 132 JAPAN: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 133 JAPAN: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 134 JAPAN: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.4.2 CHINA

10.4.2.1 Rising healthcare expenditure to drive market growth in China

TABLE 135 CHINA: KEY MACROINDICATORS

TABLE 136 CHINA: DERMATOLOGY MEDICAL EQUIPMENT MARKET, BY TYPE, 2020–2027

TABLE 137 CHINA: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 138 CHINA: DERMATOLOGY DEVICES INDUSTRY, BY APPLICATION, 2020–2027

TABLE 139 CHINA: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.4.3 INDIA

10.4.3.1 Improving healthcare infrastructure to drive market growth in India

TABLE 140 INDIA: KEY MACROINDICATORS

TABLE 141 INDIA: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 142 INDIA: LEADING COSMETIC SURGICAL PROCEDURES IN 2019

TABLE 143 INDIA: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2020

TABLE 144 INDIA: LEADING COSMETIC NON-SURGICAL PROCEDURES IN 2019

TABLE 145 INDIA: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 146 INDIA: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 147 INDIA: DERMATOLOGY DIAGNOSTIC DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 148 INDIA: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.4.4 REST OF ASIA PACIFIC

TABLE 149 THAILAND: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 150 ROAPAC: DERMATOLOGY DEVICES INDUSTRY, BY TYPE, 2020–2027

TABLE 151 ROAPAC: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 152 ROAPAC: DERMATOLOGY EQUIPMENT MARKET, BY APPLICATION, 2020–2027

TABLE 153 ROAPAC: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

10.5 REST OF THE WORLD

TABLE 154 MEXICO: KEY MACROINDICATORS

TABLE 155 BRAZIL: KEY MACROINDICATORS

TABLE 156 BRAZIL: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 157 MEXICO: LEADING COSMETIC SURGICAL PROCEDURES IN 2020

TABLE 158 ROW: DERMATOLOGY DEVICES MARKET, BY REGION, 2020–2027

TABLE 159 ROW: DERMATOLOGY DIAGNOSTIC DEVICES MARKET, BY TYPE, 2020–2027

TABLE 160 ROW: DERMATOLOGY TREATMENT DEVICES MARKET, BY TYPE, 2020–2027

TABLE 161 ROW: DERMATOLOGY DEVICES MARKET, BY APPLICATION, 2020–2027

TABLE 162 ROW: DERMATOLOGY TREATMENT DEVICES MARKET, BY APPLICATION, 2020–2027

11 COMPETITIVE LANDSCAPE (Page No. - 168)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 163 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

11.3 REVENUE ANALYSIS

FIGURE 39 REVENUE ANALYSIS OF KEY PLAYERS IN DERMATOLOGY DEVICES MARKET

11.4 MARKET SHARE ANALYSIS

FIGURE 40 DERMATOLOGY DEVICES MARKET SHARE ANALYSIS, 2020

TABLE 164 DERMATOLOGY DEVICES MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION MATRIX (KEY PLAYERS)

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PARTICIPANTS

11.5.4 PERVASIVE PLAYERS

FIGURE 41 GLOBAL DERMATOLOGY DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS AND SMES)

11.6.1 PROGRESSIVE COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

11.6.4 DYNAMIC COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

FIGURE 42 DERMATOLOGY DEVICES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS, 2021

11.7 COMPETITIVE BENCHMARKING

TABLE 165 DERMATOLOGY DEVICES MARKET: DETAILED LIST OF KEY SMES/START-UPS

TABLE 166 DERMATOLOGY DEVICES MARKET: COMPETITIVE BENCHMARKING OF SMES/START-UPS

11.8 COMPANY FOOTPRINT

TABLE 167 OVERALL FOOTPRINT OF COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

TABLE 168 PRODUCT FOOTPRINT OF COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

TABLE 169 REGIONAL FOOTPRINT OF COMPANIES (DERMATOLOGY MEDICAL DEVICE COMPANIES)

11.9 COMPETITIVE SCENARIO AND TRENDS

11.9.1 DEALS

TABLE 170 DEALS, JANUARY 2019–MAY 2022

11.9.2 PRODUCT LAUNCHES & APPROVALS

TABLE 171 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019–MAY 2022

11.9.3 EXPANSIONS

TABLE 172 EXPANSIONS, JANUARY 2019–MAY 2022

12 COMPANY PROFILES (Page No. - 185)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 ALMA LASERS, LTD. (A SUBSIDIARY OF SISRAM MEDICAL LTD.)

TABLE 173 ALMA LASERS, LTD.: BUSINESS OVERVIEW

FIGURE 43 SISRAM MEDICAL LTD.: COMPANY SNAPSHOT (2021)

12.1.2 CUTERA, INC.

TABLE 174 CUTERA, INC.: BUSINESS OVERVIEW

FIGURE 44 CUTERA, INC.: COMPANY SNAPSHOT (2021)

12.1.3 CYNOSURE, INC.

TABLE 175 CYNOSURE, INC.: BUSINESS OVERVIEW

12.1.4 EL.EN. S.P.A.

TABLE 176 EL.EN. S.P.A.: BUSINESS OVERVIEW

FIGURE 45 EL.EN. S.P.A.: COMPANY SNAPSHOT (2021)

12.1.5 LUMENIS, LTD. (A SUBSIDIARY OF BOSTON SCIENTIFIC)

TABLE 177 LUMENIS, LTD.: BUSINESS OVERVIEW

FIGURE 46 BOSTON SCIENTIFIC: COMPANY SNAPSHOT (2021)

12.1.6 SOLTA MEDICAL (A SUBSIDIARY OF BAUSCH HEALTH COMPANIES INC.)

TABLE 178 SOLTA MEDICAL: BUSINESS OVERVIEW

FIGURE 47 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2021)

12.1.7 DERMLITE

TABLE 179 DERMLITE: BUSINESS OVERVIEW

12.1.8 BRUKER CORPORATION

TABLE 180 BRUKER CORPORATION: BUSINESS OVERVIEW

FIGURE 48 BRUKER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.9 CARL ZEISS

TABLE 181 CARL ZEISS: BUSINESS OVERVIEW

FIGURE 49 CARL ZEISS: COMPANY SNAPSHOT (2021)

12.1.10 GENESIS BIOSYSTEMS, INC.

TABLE 182 GENESIS BIOSYSTEMS, INC.: BUSINESS OVERVIEW

12.1.11 HEINE OPTOTECHNIK GMBH & CO. KG

TABLE 183 HEINE OPTOTECHNIK GMBH & CO. KG: BUSINESS OVERVIEW

12.1.12 MICHELSON DIAGNOSTICS, LTD.

TABLE 184 MICHELSON DIAGNOSTICS, LTD.: BUSINESS OVERVIEW

12.1.13 PHOTOMEDEX, INC. (A SUBSIDIARY OF DS HEALTHCARE GROUP)

TABLE 185 PHOTOMEDEX, INC.: BUSINESS OVERVIEW

12.1.14 FOTOFINDER SYSTEMS GMBH

TABLE 186 FOTOFINDER SYSTEMS GMBH: BUSINESS OVERVIEW

12.1.15 LEICA MICROSYSTEMS (A SUBSIDIARY OF DANAHER CORPORATION)

TABLE 187 LEICA MICROSYSTEMS: BUSINESS OVERVIEW

FIGURE 50 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.16 OLYMPUS CORPORATION

TABLE 188 OLYMPUS CORPORATION: BUSINESS OVERVIEW

FIGURE 51 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.17 CANDELA CORPORATION

TABLE 189 CANDELA CORPORATION: BUSINESS OVERVIEW

FIGURE 52 CANDELA CORPORATION: COMPANY SNAPSHOT (2020)

12.1.18 CANFIELD SCIENTIFIC, INC.

TABLE 190 CANFIELD SCIENTIFIC, INC.: BUSINESS OVERVIEW

12.1.19 BEIJING TOPLASER TECHNOLOGY CO., LTD.

TABLE 191 BEIJING TOPLASER TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 SYNERON MEDICAL LTD. (A PART OF APAX PARTNERS)

12.2.2 AEROLASE

12.2.3 BOVIE (A SUBSIDIARY OF SYMMETRY SURGICAL)

TABLE 192 SYMMETRY SURGICAL: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies. (DERMATOLOGY MEDICAL DEVICE COMPANIES)

13 APPENDIX (Page No. - 241)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities to estimate the current size of the dermatology devices market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Several stakeholders such as dermatology device manufacturers, vendors, distributors, and physicians from hospitals and clinics were consulted for this report. The demand side of this market is characterized by increasing preference for dermatology procedures, side effects of dermatology procedures, growing geriatric population and the subsequent increase of dermatology procedures, and increasing emphasis on improving technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Dermatology Devices Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the dermatology devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the dermatology devices industry.

Report Objectives

- To define, describe, and forecast the dermatology devices market based on product, end-user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, and opportunities, COVID-19 Impact Analysis)

- To strategically analyze micro markets for individual growth trends, prospects, and contributions to the overall dermatology devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments in four geographical regions, namely, North America, Europe, the Asia Pacific, and the Rest of the World.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches and approvals, deals, and expansions in the dermatology devices market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis:

- Further breakdown of the dermatology devices market into specific countries/regions in the Rest of Europe, Rest of Asia Pacific, Middle East & African, and Latin American countries

Company Information:

-

Detailed analysis and profiling of additional market players (up to 5) inclusive of:

- Business Overview

- Financial Information

- Product Portfolio

- Developments (last three years)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dermatology Devices Market